International teams functioned in

survival mode for the last three years.

Most remained anchored to the home

office solving supply shortages

and executing price increases via

impersonal Teams meetings. A fresh

approach is required as the survival

strategies of 2019-2022 do not serve

as an acceleration platform moving

forward. 2023 signals the time to shift

from “maintain to gain” by getting on

the plane. Export Solutions shares our

ten tactics for a warm welcome back.

Strategy Renewal

A new Lessons Learned exercise is

critical at this pivot point. New

consumer habits and retail prices

may cause us to shuffle our country

prioritization ranking. Countries and

distributors that were leaders prior to

the pandemic may be categorized as

laggards now. Resource allocation

between mature and emerging markets

must be calibrated. Digital strategies

are for today, not the future.

FaceTime

How can you build a relationship and

a partnership with an international

distributor without seeing each other?

It’s tough to conceive a new brand

strategy if you have not been in the

same room for three years! A major

theme for 2023 is to reconnect

with your distributor teams in their

home markets.

Insights to Accelerate International Expansion

Winter 2023

Volume 15 Issue 1

Our Mission: Help Manufacturers “Spend time Selling to Distributors versus Searching for Distributors”

In This Issue

Database covers

2,845 Retailers

Export Solutions retailer database now

reaches 96 countries. Our point of

difference is coverage of an average of

25 customers per country, not just the

4 or 5 everyone already knows. Features

include one click access to retailers’ web

shops for online price checks and weekly

special offer fliers. Examples: UAE

coverage extends to 35 retailers, 126 in

Canada, 58 in the UK, and 47 retailers in

Australia. For free sample access and

subscription information, please visit

www.exportsolutions.com.

Welcome Back

Page 2

Real FaceTime

Page 3

Introducing USA Food Export Group

Page 4

Why Distributors?

Page 5

Can We Help You?

Page 6

Road Map to the World

Page 8

Ex-Selling at E-Commerce

Page 10

Getting a Distributor

to Love Your Brand

Page 11

Export Manager Report Card

continued on page 7

2

International development evolved into

a business management process defined

by a packed calendar of Teams and Zoom

meetings. Export managers adjusted to lower

tier frequent flier status and the short

commute from your bedroom office to a

home cooked dinner. Surviving the Covid era

deserves a badge of honor. However, it’s a

mistake to adapt remote-based export as the New Normal strategy.

Intimacy is a requirement to thrive in 2023. I remind my clients that some of the best deals

are closed after 9:00 pm. There are few bonding activities in business more important

than a lively dinner at a nice restaurant with a distributor or customer. In the last few

months, I have resumed globe-trotting with a buoyant outcome. Distributor dinners are

celebrations, the resumption of treasured relationships. Distributor conferences resemble

a loud family reunion with everyone genuinely happy to see each other after a gap.

Looking to rekindle your international relationships? Here are five strategies to reignite

the flame of distributor passion for your company.

1. Distributor Visits to All Core Countries

Revert to the trusted practice of “showing up.” Conduct store visits with the sales team

and dinner with the distributor CEO. Walk around the distributor office and warehouse,

handing out small gifts with your company logo. Shaking hands and “kissing babies” is

all part of the job of securing distributor focus on your priorities.

2. Regional Distributor Meetings

Distributors love these events in first-class locations. For the brand owner, it’s an

efficient tactic to secure the undivided attention of your sales team for two to three days.

The key is a mix of distributor sharing of case studies mixed with fun social events.

Everyone loves to win awards. Make new memories!

3. Form a Distributor Advisory Council

It is an honor to serve on a distributor advisory council. Linking top distributors with

exposure to your senior management team creates a special bond between the two

companies. Members of your advisory council always achieve their sales objectives.

4. Training

Many companies have invested in new brand portals, digital marketing content, and

product innovation. Conduct a training session as part of a distributor group meeting

to increase your visibility. Make the training fun and you will win their loyalty.

5. Connect With Every Distributor CEO

A first quarter must is to speak with every distributor CEO. Inquire about their outlook

for the year and planned investments and changes. Use the opportunity to reinforce

your priorities for the year and to confirm your visit dates.

Many export managers will remain glued to their desks and show up only for the

global trade fairs and still perform adequately. Leaders will return to the road for REAL

FaceTime with core stakeholders. This engagement will allow us to experience the

warmth of our relationships and distinguish between Zoom promises and retail reality.

Good luck!

Strategic Services

Contact Us for

Export Solutions

1. Identify Best in Class

Distributors: 96 Countries

2. Best Practices

Export Strategy

3. Distributor Management

Workshops

4. Export 101:

Let’s Get Started

5. New Market

Prioritization

and Launch Plan

6. Personal Distributor

Introductions:

96 Countries

7. Walmart International

8. Distributor Contracts,

Margins, and Fees

9. Meeting Speaker

10. International

Strategy Expert

Strategic Services

Contact Us for

Export Solutions

1. Identify Best in Class

Distributors: 96 Countries

2. Best Practices

Export Strategy

3. Distributor Management

Workshops

4. Export 101:

Let’s Get Started

5. New Market

Prioritization

and Launch Plan

6. Personal Distributor

Introductions:

96 Countries

7. Walmart International

8. Distributor Contracts,

Margins, and Fees

9. Meeting Speaker

10. International

Strategy Expert

www.exportsolutions.com

Greg Seminara

“Spend Time Selling to Distributors versus Searching for Distributors”

Real FaceTime

3

19 Companies | 200+ Top Brands | $85 Billion Combined

Connect | Learn | Share | Grow

View our activities for export managers – www.usafoodexport.com

America’s Favorite Brands

Introducing

Executive Board

Export Solutions Smucker’s Tabasco

Greg Seminara, CEO Danny Berrios, President Emeritus Megan Lopez, President

General Mills Sun-Maid

Eric Saint-Marc, Vice-President Carsten Tietjen, Vice-President Elect

Blue Diamond Campbells Church & Dwight

Dale Tipple Julio Gomez Arun Hiranandani

Program Directors (*also members of the Advisory Board)

Ferarra Candy Kao USA

Daniel Michelena, Latin America – Florida Chapter Julie Toole, Women in Export

Advisory Board

Bazooka Candy Bush Beans Duracell Heartland

Santiago Ricaurte Dave Bauman William Vera Tom Theobald

Idahoan Johnsonville Sausage KDRP –Motts

Ryan Ellis Cory Bouck Billy Menendez

Mizkan Reynolds Welch’s

Noel David Brent Flavo Marc Rosen

4

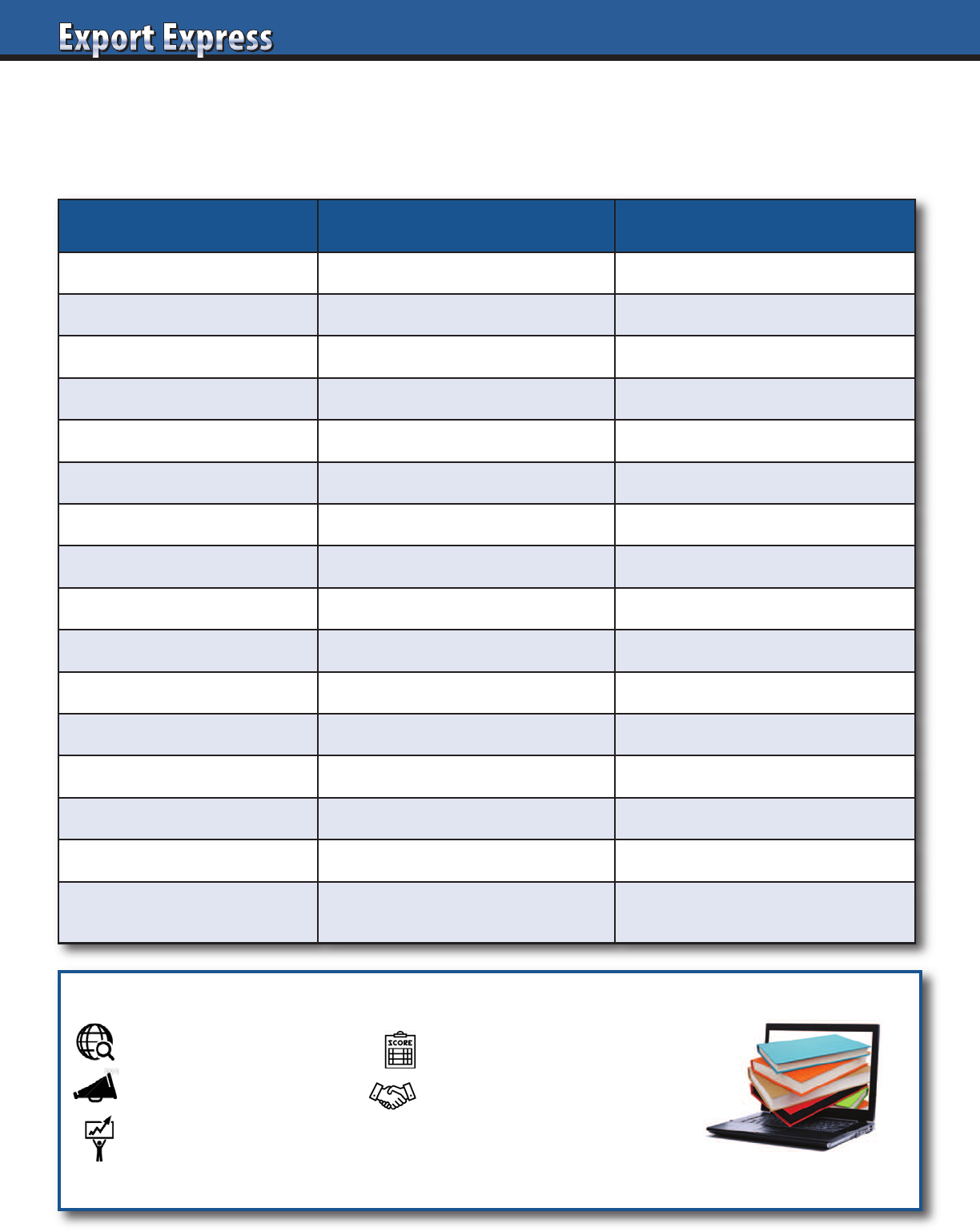

Why Distributors?

Distributors offer an integrated, local solution versus selling direct to customers via an offshore subsidiary. Export Solutions

database covers 9,400 distributors, an average of 87 per country, validating their essential role in every country.

Distributor Subsidiary

Cost Variable cost model Fixed Cost Model

Critical Mass Scale = Revenue Costly for one company

Local “Native” presence Short-term expats?

Entrepreneurship Owners Employees

Focus Serves multiple brands Dedicated

Geographic Coverage National Major cities only

Customer Relationships Long standing, cross functional Frequent turnover

Omni Channel All channel opportunities Costly for one company

Specialization Local category experts Global category experts

Compliance Masters local laws/practices Requires outside counsel

Complexity Handles through scale Costly to manage

Category Habits “Lives” local habits Research-based understanding

Continuity Dedicated to one country Dedicated to “home” country

Marketing Local activation Global activation

Retail Servicing Invests in core service Frequently outsourced

Results

Delivers annual results.

Long-term focus.

Delivers annual results.

Short-term focus.

Distributor Search Guide

Export Strategy Guide

Selling to USA Handbook

All guides available free at www.exportsolutions.com in the Export Tips section.

Export Scorecard Guide

New Distributor Cooperation

Model Guide

“From First Meeting to First Order”

Create Your Own Export Library

5

Distributor Search Helper for:

Your

Logo

Here

Can We Help You?

Recent Distributor Search Projects

Asia Europe Middle East Latin America

Australia Germany Israel Argentina

China Ireland Kuwait Brazil

Indonesia Netherlands Qatar Colombia

Japan Nordics Saudi Arabia Costa Rica

Malaysia Spain UAE Ecuador

Philippines United Kingdom North America Mexico

Singapore Africa Canada Panama

South Korea South Africa United States Peru

Call the Export Accelerator!

Contact Greg Seminara at greg@exportsolutions.com

to discuss your business development project.

www.exportsolutions.com

6

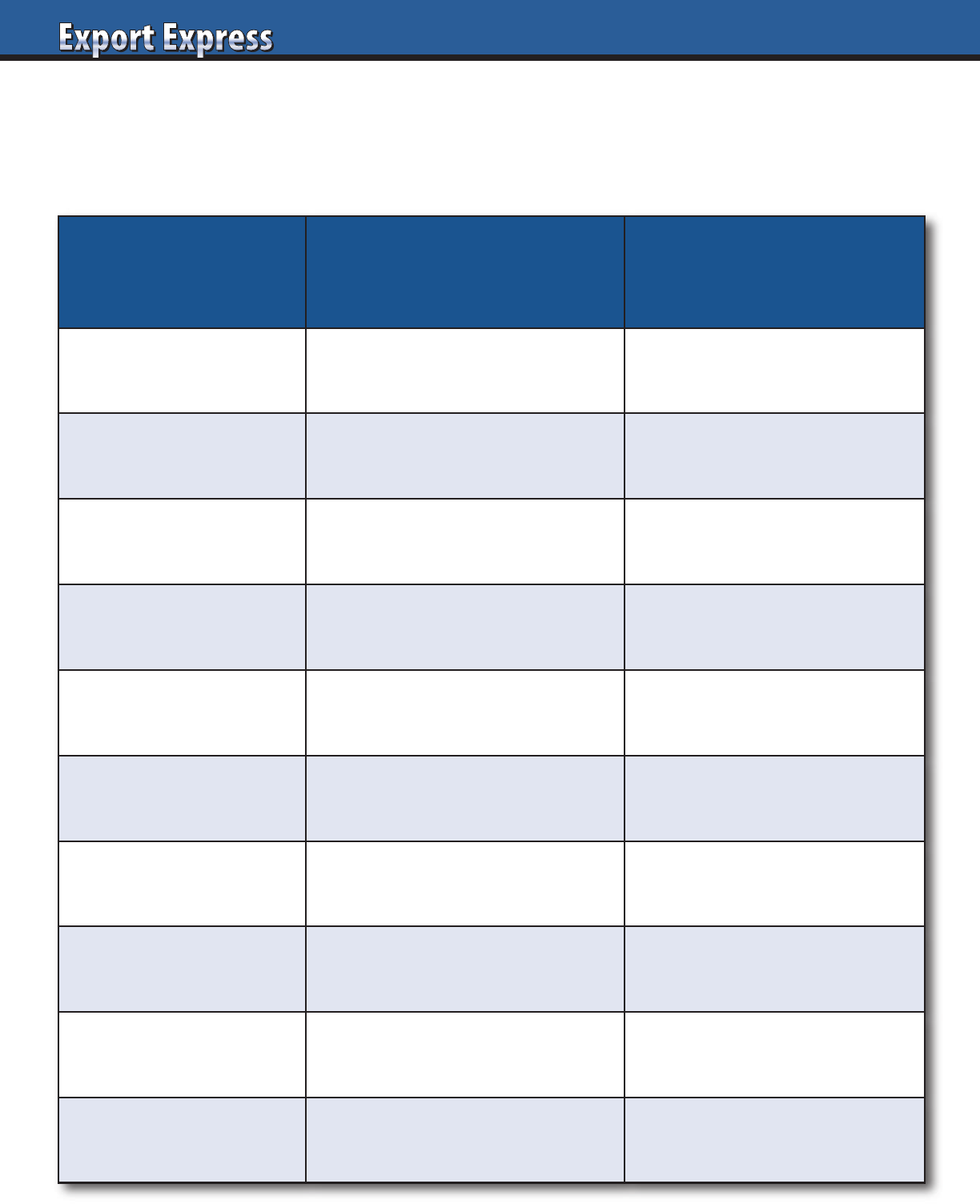

Road Map to the World

What is the profile of your best performing export countries? Most companies sell to a mix of markets from neighboring

countries to places with high GDP or category development. An essential task is to segment countries by type and allocate

resources according to the size of the prize. What is your export sales split by market type today? Future?

Type Description Examples

Neighbor

Adjacent country with

similar lifestyle habits.

USA & Canada

Germany & Austria

Homesick

International destinations

for your countries’ expats.

Australia: UK & Italian brands

Brasil: Portugal & Japan

Island

Island countries dependent

on overseas suppliers.

Caribbean, Malta,

Iceland, Cyprus

Customer

Follow Global Partner to

overseas countries.

Walmart, Amazon, Costco,

Carrefour, Ahold, Metro

Continent

Region where your brand

enjoys visibility and scale.

South America, Middle East,

Eastern Europe, SE Asia

E-Commerce

Universal platform. Unlimited

assortment in cyber space.

Coupang: S Korea

Mercado Libre: Latam

Category Champion

Countries with high

category development.

Tea: UK & Ireland

Cereal: Mexico

Money Markets

Countries with high GDP and

per capita spending.

USA, Western Europe,

Saudi Arabia, Singapore

Big Bets-Many Mouths

Large population countries

requiring strategic investment.

USA, China, India, Indonesia,

Brasil, Mexico

Opportunistic

Trading. Sell at net price.

Avoid diverting.

Anywhere. Ship to destination.

E-Commerce Excellence

E-commerce has reached critical mass in

many countries. It is crystal clear that this

powerful channel will only become more

significant. In Asian countries like China

and South Korea, e-commerce is rapidly

becoming the primary outlet for imported

brands. Create an e-commerce business

plan for each country with activities,

budget, and monthly reporting metrics.

Treat Amazon as a global customer like

Carrefour or Walmart. Share best practices

from your corporate headquarters.

Big Bet

There is a difference between strategic

brand building and tactical exports. All

companies should identify one “Big Bet”

country with a significant size of the

prize. Attractive targets include highly

populated countries, with healthy category

development. Exporters must “walk the

talk” in a challenging big bet country by

investing in brand marketing activities,

local manager, and product innovations

aligned with consumer habits.

Asia Rebound

Asia emerged from lockdown in late 2022,

at least one year behind other regions.

Drivers such as young populations and

new middle class have resumed their

upward trajectory. Southeast Asian

countries like Vietnam, Thailand, and

the Philippines are future stars. Japan,

South Korea, and Taiwan are rich

countries with large stores and good

potential, especially for USA companies.

Distributor Change

Many distributors thrived during the

pandemic, benefitting from the shift to

meals prepared at home. Others suffered,

as core channels and gourmet-priced

brands lost relevancy. Distributor change

is a last resort, but every team has at least

one partner that is a chronic under

performer and not a good fit for the

future. Begin today, as the transition

period to a new distributor may require

one year to implement.

Is the Store a 10?

The supermarket is a product showroom

where export dreams are translated to

financial reality. How do you determine a

good store presence for your brand versus

a bad one? Each member of your distributor

sales force should maintain a clear

understanding of your in-store placement

and off-shelf merchandising objectives.

Export Solutions has designed a program

called Is the Store a 10? to allow all the

capability to evaluate store conditions for

any brand based upon a simple 1 to 10

scoring system.

Beyond the Brand Promotions

Exporters repeat the same boring price

discount trade promotions year after

year. The world has changed, with

supermarkets looking for unique special

offers tailored to their customers, not

the general market. Challenge your

distributors to create fresh promotional

offerings around meal solutions, country

of origin, or a retailer’s favorite charity.

Try something new!

Selling to the USA

All international brands claim sales to

the USA, but struggle to gain scale in this

attractive country of 335 million people.

Our retailer database tracks 418 USA

customers, all looking for unique new

food items. The path forward requires

that overseas brands play by USA rules

with brokers’ slotting fees supported by a

USA-based country manager.

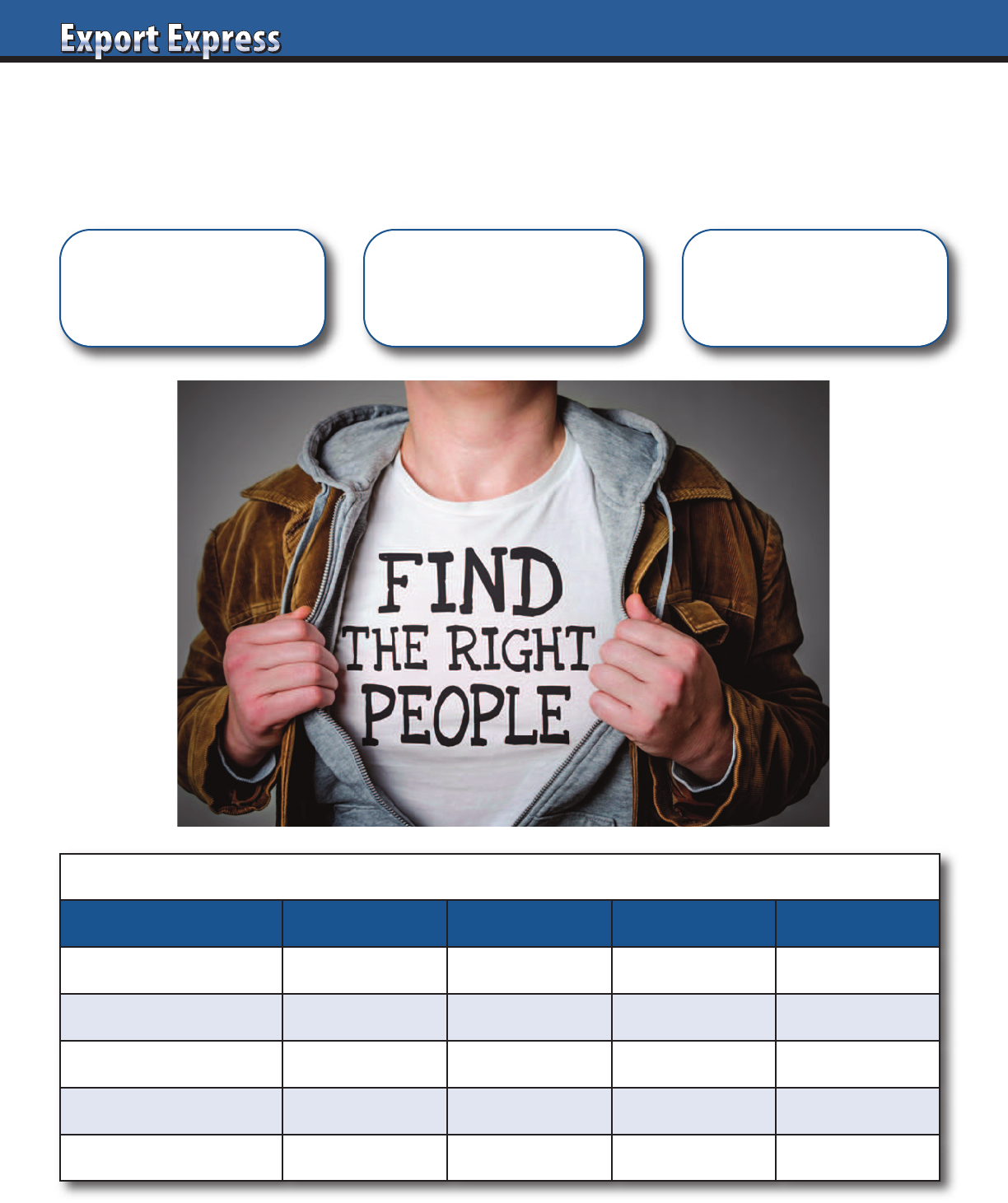

People Power

Human resource allocation may equal

marketing investment as a tool to drive

export development. “Distributors

respect what the brand owners inspect.”

Consider strategies such as appointing

a manager dedicated to launching new

markets or global e-commerce. Hire

people in growth hubs like Bangkok,

Jeddah, or Mexico City versus expensive

expatriate destinations such as Singapore.

Increased headquarter-based supply-

chain support is critical as managers

return to the road.

Can We Help You?

Why do companies use Export Solutions

consulting services? Export Solutions

serves as a “hands on”accelerator,

quickly helping companies find

distributor solutions worldwide.

We are able to help, through the world’s

leading global distributor rolodex,

with relationships created through

300+ projects on five continents.

Export Solutions maintains a single-

minded focus on the distributor search

process “from first meeting to first order.”

Recent projects ranged from Thailand

and Taiwan to Saudi Arabia and Kuwait.

Europe and the Americas represent core

areas too, with projects in Italy and the

UK as well as Argentina, Peru and, of

course, the USA and Canada. Consider

subscribing to our popular database

covering 9,400 category specific distributors

and 2,845 retailers in 96 countries.

Welcome Back

continued from page 1

2023 Winning Strategies

Geographic • Big Bet: Choose Focus Country

• Accelerate USA Development for Overseas Brands

• Asia Rebound: Vietnam, Thailand, Philippines

• Saudi Arabia & the Gulf

Sales

Execution

• E-Commerce KPIs

• In-Store Visibility: Is This Store a 10?

• Listing Maps – Every Country

Team • Reconnect: Increase Market Visits

• Upgrade Underperforming Distributors

• People Power: Shift Resources to New Business Development

7

8

E-commerce now accounts for five percent of USA omnichannel

sales, up 40% in the last year according to Nielsen. This includes

almost $12 billion sold through online grocers. No one can

accurately gauge how big e-commerce will become, but it is safe

to predict that it will be much, much bigger in the next five years.

Billion-dollar multinationals and scrappy start-ups are attacking

this channel with vigor, widening the performance gap versus

successful national brands. In China and India, e-commerce

accounts for a majority of the sales for many imported products.

Read Export Solutions’ ten tips for capturing your fair share of

the growth in this strategic channel.

1. Conduct E-Commerce Survey for Core Countries

Create a one-page template capturing local e-commerce

customers, online grocery trends and current distributor

engagement. Calibrate where each country is on a development

curve. Source best practices from distributors in China, India,

United Kingdom, and the USA where e-commerce maintains

highest acceptance levels.

2. Speak to Millennials

Spend time with young people, learning how they shop and

blaze through digital marketing messages. Learn why millennials

avoid “their mothers brands” and how many rarely make a

“stock-up shop” at a neighborhood supermarket. Another

revelation is the trust they place in online reviews and

key influencer recommendations.

3. Create a Global E-Commerce Strategy

Align with your company’s overall e-commerce strategy.

Establish benchmarks and toolkits to share with your

distributors. Acknowledge the fast pace of development,

allowing flexibility to pivot fast.

4. Distributors: E-Commerce Business Plan

Request each distributor create a 2023 e-commerce business plan.

Include new distribution targets, marketing plans, and shipment

objectives for e-commerce customers. Challenge distributors

to hire a young person to serve as a dedicated e-commerce

key account manager. Review each distributor’s e-commerce

marketing plan early and often in 2023. “A distributor respects,

what the brand owner inspects.”

5. Learn Online Marketing Tactics

Goodbye end caps and slotting allowances. Hello “pay per click”

and first-page search results. Unlimited shelf space exists in

cyberspace, with room for every SKU that you (and your

competitors) produce. Face-to-face buyer meetings are replaced

by online marketing menu programs and transparent sales

ranking information. Learn the new rules or you will fail the

e-commerce test.

6. Treat Amazon and Alibaba as Global Customers

Amazon revenue will exceed $500 billion in 2023, including

more than $400 billion sourced from sales of goods. Amazon

will comfortably rank as the world’s number two retailer, far

exceeding sales by Carrefour or Costco. Multinational category

leaders have established customer teams to service Amazon.

Many place their best, young talent against this high growth

customer. Multifunctional team roles may share the same titles

in Finance, Supply Chain and Marketing, but the “work” is much

different. What dedicated resources are assigned to Amazon and

Alibaba today at your company?

7. Consider a Web Shop

Direct to consumer represented a complex route to market in the

past. Today, new brands and leading companies are jumping at

the opportunity to showcase their innovation and share in-depth

product knowledge through their own proprietary web shop.

Outsourced supply chain experts exist to provide fulfillment

solutions. Tangible profits may be elusive today, but there is

valuable, inexpensive learning to be gained from pioneering

in this area.

8. Hire an International E-Commerce Expert

Appear as a preferred supplier to your distributors by providing

leadership insights into this new trade channel. Distributors in

emerging markets are hungry for best practices in establishing

e-commerce brand building models. Send your e-commerce

expert to core markets to conduct workshop training sessions.

Your investment in an e-commerce strategy and guru positions

your company as a preferred partner helping to build the

distributor’s entire business.

9. Appoint E-Commerce Distributors – Asia

Selling through the e-commerce channel requires different routes

to market capabilities and skill sets than marketing through

brick-and-mortar supermarkets. Consider appointing a separate

e-commerce distributor in advanced countries like China and

South Korea. A key issue is managing pricing equilibrium

between your conventional distributor and e-commerce partner.

10. Track E-Commerce Results

Establish KPIs and measure performance at key customers such

as Amazon. Are you getting your fair share of the growth?

E-commerce development is a top 2023 priority for every brand

and distributor. Some may say that e-commerce is evolving

slowly in their country or too complex and unprofitable to

allocate resources. These are the same people whose parents

were probably in the horse-and-buggy or fax businesses.

Enhanced focus on e-commerce will position you as a leader

(or survivor) for 2025.

Ten Tips: Ex-Selling at E-Commerce

9

418 USA Customers

How many are you selling to?

Export Solutions Retail Database Covers 418 Customers

284 Supermarket Chains 31 Natural Foods

46 Convenience Chains 28 Wholesalers

Features

3

Up-to-date store counts

3

Direct link to retailers’ web sites

3

Financial information for publicly traded retailers

3

126 Canadian retailers plus 2,300 retailers in 94 other countries

3

Free sample access

Order now: www.exportsolutions.com

10

The classic industry question is: “How do you maintain

distributor focus on your company’s priorities once you leave

the market?” There is no easy answer, but a solution is to

encourage a distributor to “fall in love” with your brand and

company. Falling in love is based upon an attraction to a person

and enjoyment of spending time with them. The same feelings

can apply to a brand. I regularly witness super-human efforts

by distributors for small- and medium-sized brands just because

of “Brand Love.” Listed below are Ten Tips to romance your

distributors to superior results.

1. Master Chef Endorsement

The first step is convince the distributor team to be passionate

consumers of your product and enthusiastic brand ambassadors.

For food products, invite all of the group to lunch at a popular

local restaurant. Pay a well-known chef to prepare a meal

featuring your products. Or cook lunch for them yourself.

For candy and snack brands, provide samples to share with

the distributor’s children’s sports clubs. Provide frequent

and generous samples to all of the distributor team.

2. Fun Sales Meetings

Every distributor has sales meetings for their entire company.

These are usually a repetitive drone of Powerpoint slides.

Why not hire an agency to create a fun presentation module

which may include audience participation, games, or costumes?

Or sponsor a local motivational speaker or training workshop

using your products as the case studies. Break the mold of

boring meetings!

3. Provide Great Customer Service

Respond to requests quickly. Ship complete containers to keep

the pipeline filled. Pay all bill-backs promptly.

4. Distributor Awards

Recognize your high performing distributors with an award.

This could be Distributor of the Year or for $1 million in sales

or for 15 years of partnership. Some companies sponsor smaller

awards for key account manager of the year in each market and

retail representative of the year. Publicize the event by awarding

a plaque, hold an awards luncheon, take photos and share a

press release of the celebration.

5. VIP Visit to Corporate Headquarters

Treat your distributors as VIPs at your corporate office.

This trip creates a memorable bonding experience and a chance

for you to serve as a good host. Take the distributor to a product

development lab and organize a meal with your CEO or

executive officers. Make him feel like part of the family.

6. Support Local Events and Charities

Creative distributors drive incremental sales through local

marketing events. Display a willingness to support their

ideas and invest in new programs. Events that sync with the

distributors (or retailers) special charity build substantial

goodwill and appreciation.

7. Annual Incentive Trip

Many companies sponsor trips for distributor executives who

attain their annual sales quota. Mid-size brands source added

focus by sharing the benefits of a good year by inviting achievers

(and spouses?) to trips in resort locations like Hawaii or

international cities such as Rome. Everyone works hard

to qualify and vow to return “year after year.”

8. Holiday Baskets

Send baskets or gift packs to distributor employees that include

your product and other adjacent holiday items. The idea is to

extend your brand’s relationship to your partner’s homes.

9. Distributor Advisory Council

Form a small elite group of distributors to advise your company

on international development. Meet twice a year with access to

your company’s senior management. All members of the

Distributor Advisory Council will meet their sales target.

10. Treat Distributors as Your Best Customers

Be nice. Say “thank you” frequently. Send handwritten notes

to people to recognize a nice display or a fixed problem.

Have fun while you work.

Distributors may work with twenty brands or more, each

shouting for attention. Distributors support all their brands, but

there is no magic science to allocate time equally. Naturally, we

all spend more time and effort for the brands and people we like.

What can you do to make your distributors “Fall in Love?”

Ten Tips: Getting a Distributor to Love Your Brand

Need more information? Visit www.exportsolutions.com.

11

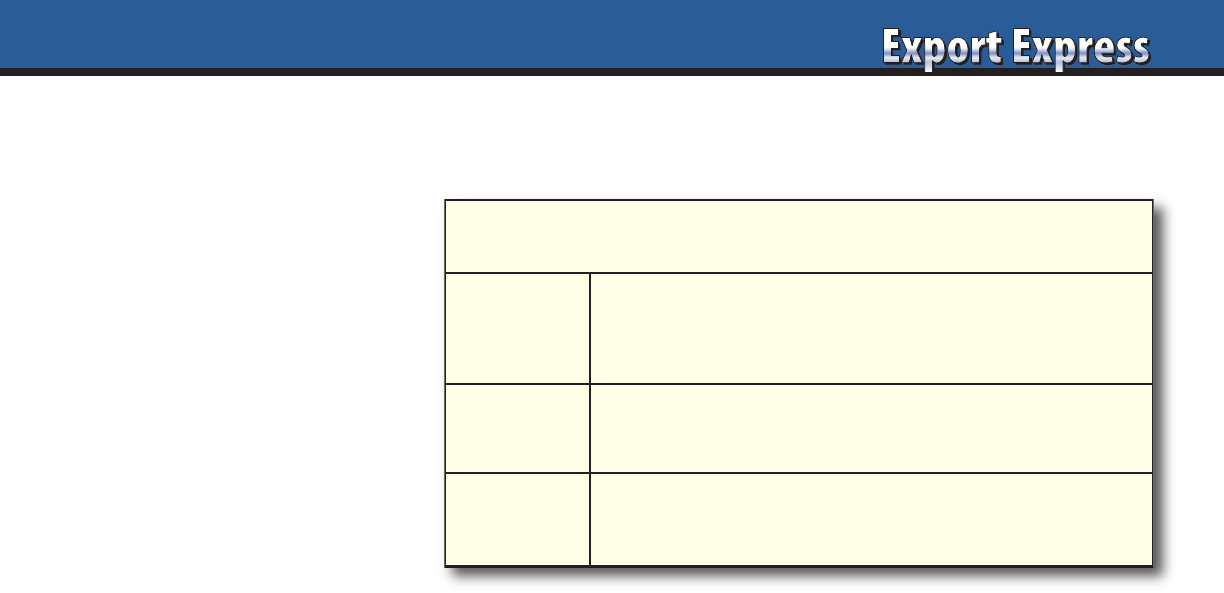

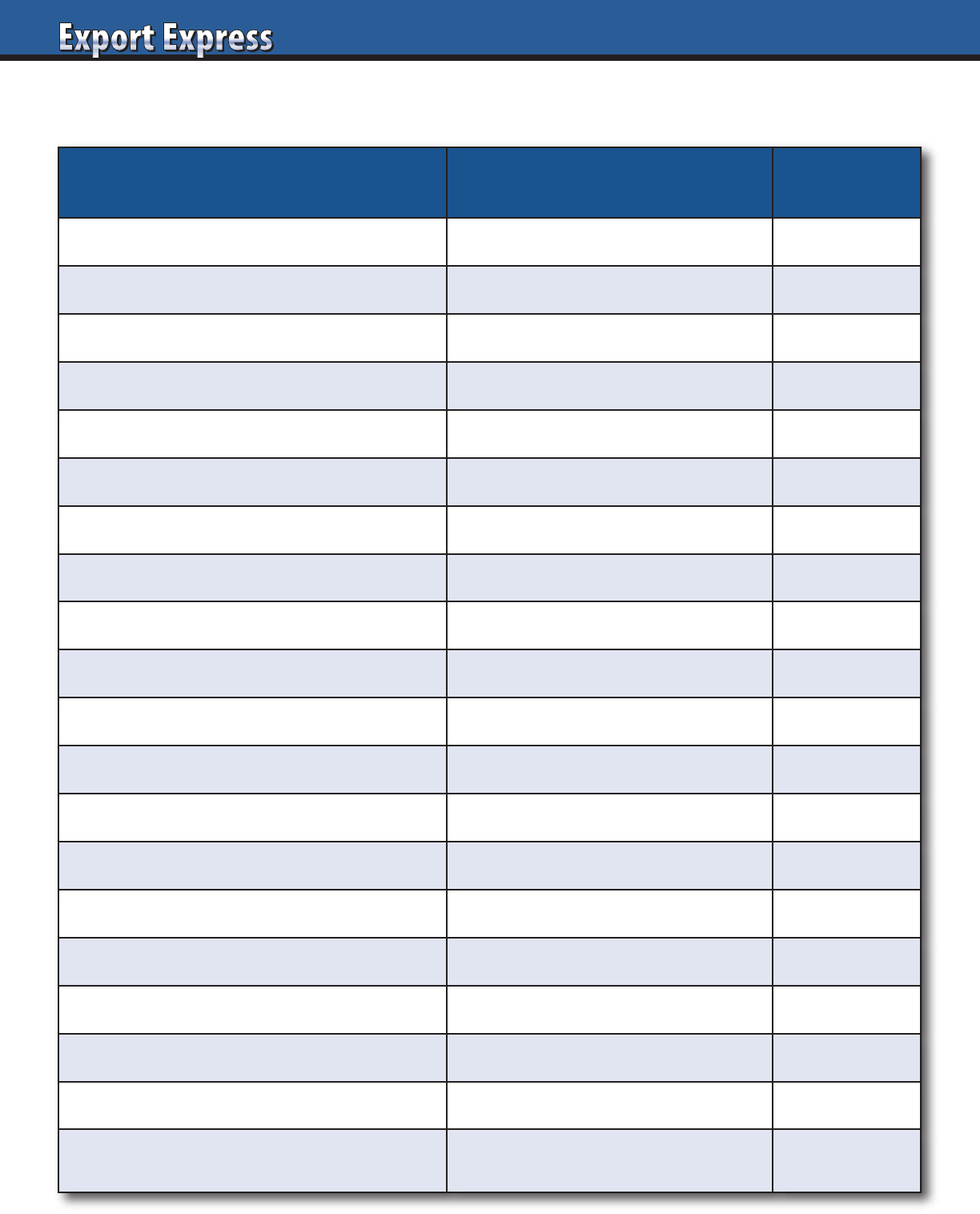

Export Manager Report Card

Assessment Criteria Considerations

Rating:

(10 = Best)

Annual Plan Development, Execution, Delivery • Aligned, reliable, committed

Export Experience – Food/Consumer Products • New to 20 years +

Ability to Influence Distributors • Focus on your priorities

Pioneers New Business • From concept to containers

Work Ethic • Office time vs. overseas trips?

International Citizenship • Language skills, cultural alignment

Category Knowledge • Viewed as expert: buyers, distributors

Business Leadership • Partners with internal functions

Distributor Relationships • From sales reps. to owner

Thought Leadership • Creates and shares best practices

Export Strategy • Logical vision and road map

Profitable, Sustainable Exports • Sells profitable cases

Retail Store Conditions • Brand presence vs. market share?

Brand Building – Promotions • Creativity, effectiveness, efficiency

Problem Solving – Response Time • Same day to one week?

Customer Relations • Senior access at top retailers

Analytical Skills: Shipments, Nielsen • Trends, opportunities, plan

Digital Savvy • E-commerce, social media

Supply Chain Management & Forecasting • Accuracy and efficiency

Results vs Budget, Market,

Category (CY, PY, 3 Years)

• Flat to 10% +

12

Searching for Distributors?

Export Solutions Distributor Database Covers 96 Countries

Europe

3,161 Distributors

34 Countries

Asia

2,038 Distributors

17 Countries

Latin America

1,593 Distributors

29 Countries

Subscribe now at www.exportsolutions.com

Middle East Database Coverage, by Distributor Specialty

Saudi Arabia Egypt Qatar Kuwait

International Food 81 38 42 61

Beverage 18 11 15 22

Sweets & Snacks 29 20 15 33

Italian Food 22 8 13 16

Total Distributors 116 61 74 93