Insights to Accelerate International Expansion

Trade Show Planning Guide

Our Mission: Help Manufacturers “Spend time Selling to Distributors versus Searching for Distributors”

I love trade shows! Where else can you

host crowds of overseas distributors

interested in speaking about your brand?

International exhibitions represent an

efficient approach to meet existing

partners, evaluate new distributors,

launch new products, check out the

competition, and network. The challenge

is to “find the right people” who are

serious brand builders, not pretenders.

Scheduled meetings with pre-screened

distributor candidates are a proven

success strategy.

Big Investment

Brand owner participation at global

trade shows like SIAL or ISM represents

a significant commitment. There is the

financial investment in booth space plus

travel and entertainment. A greater cost

is associated with investment in the

team’s time. Normally, it takes one week

to get ready for a major show, another

week for the show and as much as two

weeks for follow ups. Some companies

roll the dice and elect to make a big

splash at only one trade show per year.

Under any scenario, there is significant

pressure from senior management to

make trade show investment pay

out in the form of profitable new

business relationships.

Make “Hope and Pray” Go Away

Many exhibitors create a beautiful booth,

and then “hope and pray” that a strong

distributor from a target country passes

by. Export Solutions’ Trade Show

Planning Guide is a resource to help you

maximize productivity from your

international trade show participation.

This guide is packed with insights,

templates, and best practices to help you

“find the right people” to build your

export sales. Export Solutions’

distributor database is an “accelerator,”

supplying information on 9,200

distributors in 96 countries. “Spend time

selling to distributors versus searching

for distributors.”

Greg’s Guidance: Trade Show Tips

3 New Expansion Countries: invite qualified distributors

to scheduled meetings

3 Distributors Wanted: post sign listing key expansion countries

3 Distributor Data Sheet for all visitors to complete

3 Company Credentials Brochure, export manager contacts on back

3 Find the Right People: Select your distributors, do not let your

distributors select you

In This Issue

Sell to 96 Countries

Looking for qualified international

distributors? Export Solutions’ leading

distributor database supplies information

on more than 9,200 distributors in 96

countries. The database features filters

that allows you to screen distributors by

categories such as Confectionery, Natural

Food, Beverage, or Made in the USA (or

Italy, UK, or Germany). New! Export

Solutions’ retailer database now tracks

2,700 retailers in 96 countries. Free

samples at www.exportsolutions.com.

Page 2

Ten Tips –

Maximizing Trade Show Productivity

Page 6-7

Select Your Distributors, Do Not Let

Your Distributors Select You!

Page 14

10 Questions for Every

Distributor Interview

Page 23

What is the Plan?

Page 28

Export Trade Promotion Funding

Page 33

Pioneering: A Gamble, Not

a Guaranteed Gold Mine

Find the Right People

2

Everyone loves a trade show.

Where else can you rent a booth

and witness lines of customers

and distributors waiting to see

you to talk about your brands?

Trade shows represent sizable

investments and valuable booth

time can be wasted with non-

productive meetings.

Read our Ten Tips to maximize

your trade show productivity.

1. Create Sign:

Distributors/Customers Wanted

List countries where you are

searching for a distributor or

retailer partner. This serves as

an invitation to distributors from

those countries to stop by. This

strategy also acts as a deterrent

to discourage distributors from

visiting from countries where

you already have a partner or

maintain limited interest.

2. Use Export Solutions Database

to Pre-Screen Distributors

Over 3,000 companies have used our proprietary database to

find qualified distributors. Quickly. A common technique is

for distributors to list the countries where they hope to expand

one month in advance of a major trade show. They then use the

Export Solutions’ database to pre-screen candidates and identify

the five candidates per country with the highest potential.

Then, they email these distributors in advance of the trade fair

to request a meeting. This approach works better than sitting

at your booth with a “hope and wait” strategy to meet

qualified distributors.

3. Create a Template to Recap Capabilities of Potential Distributors

Request that prospective distributors complete the template

in advance of a meeting. Think of the template as a distributor

CV or resume. How long has the distributor candidate been in

business, sales, employees, key brands, length of service for key

brands, and most importantly references from other brand

owners and in country retailers.

4. Prepare a One Page Recap of your Company Credentials

This should include product “beauty shot,” current export

countries, and unique product characteristics. List export

manager contacts and a photo on the back with a space for

notes. Professionally print this on a one glossy page handout.

This will serve as an important reminder for the meeting when

the retailer or distributor returns home with hundreds of

business cards.

5. Participate in Show Sponsored Matchmaking Events

Most trade fairs organize matchmaking events. The formats can

vary, but basically they can arrange meetings with interested

buyers or distributors. As always there is a mix of good meetings

and bad, but the approach is worth consideration.

6. Take Photos of Potential Distributor Candidates

First take a picture of the distributors business card. Then take

a photo of the potential new distributor. After hundreds of short

meetings, this will help you remember the candidate once you

begin serious due diligence after the trade show.

7. Bring at least 500 Business Cards

I am serious. We have all run out of cards at a trade show. Better

yet, bring 1000 business cards.

8. Schedule a Group Event for Current Distributors

This event is an efficient way to launch a new product or

announce “Distributor of the Year.” You must schedule the

event before or after show opening times. Best bet is a breakfast

or a dinner, if you schedule it four months in advance to avoid

conflicts with other events.

9. Get to the Show Early and Leave Late

As a trade show visitor, it is normally much easier to reach senior

decision makers of a supplier before 10:00 am or after 4:00 pm.

They are often less distracted and have more time to spend with

you. Similarly, Brand Owners are always more accessible on

Sunday of a trade show or the last day. Normally, the retail

buyers don’t attend trade shows on the weekends or “last day”

of the trade show.

10. Create a Trade Show Exhibit Planner

Trade Shows post a listing of all exhibitors on their web site in

advance of the show. Many also have a routing software that will

allow you to add exhibitors of interest to your private list and plot

a route based upon your selected exhibitors. Exhibitors that

maximize trade shows schedule most of their meetings in advance.

Ten Tips – Maximizing Trade Show Productivity

3

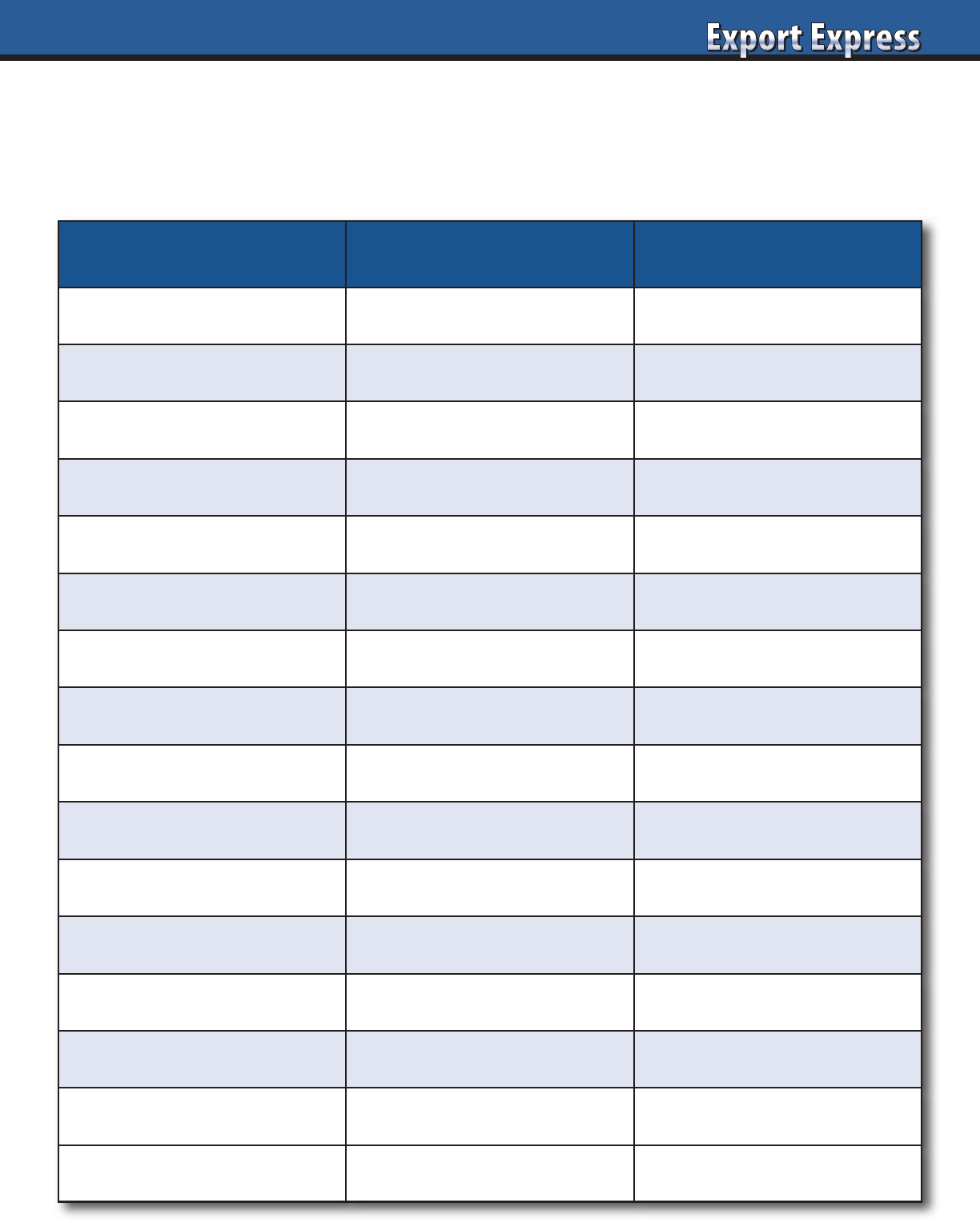

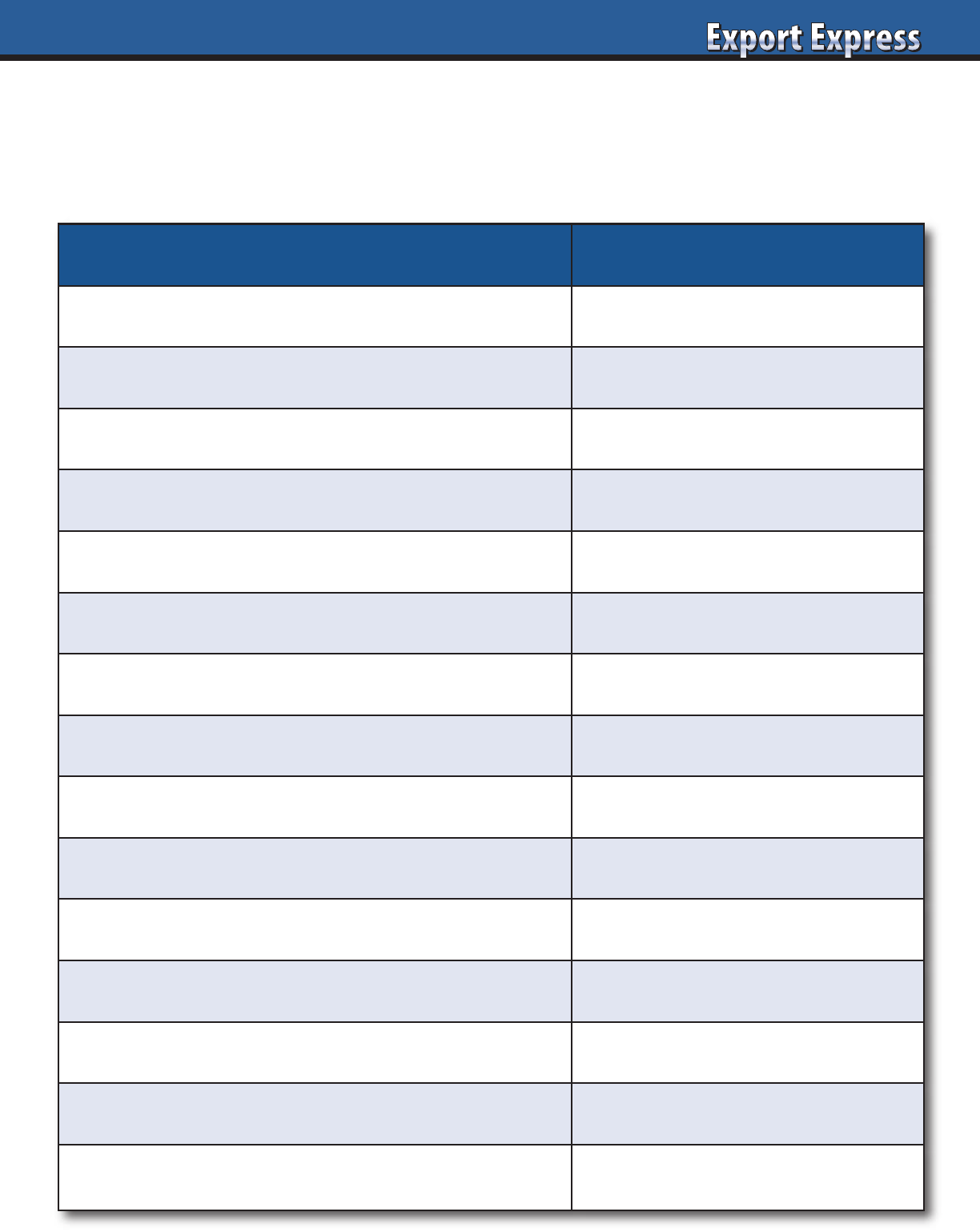

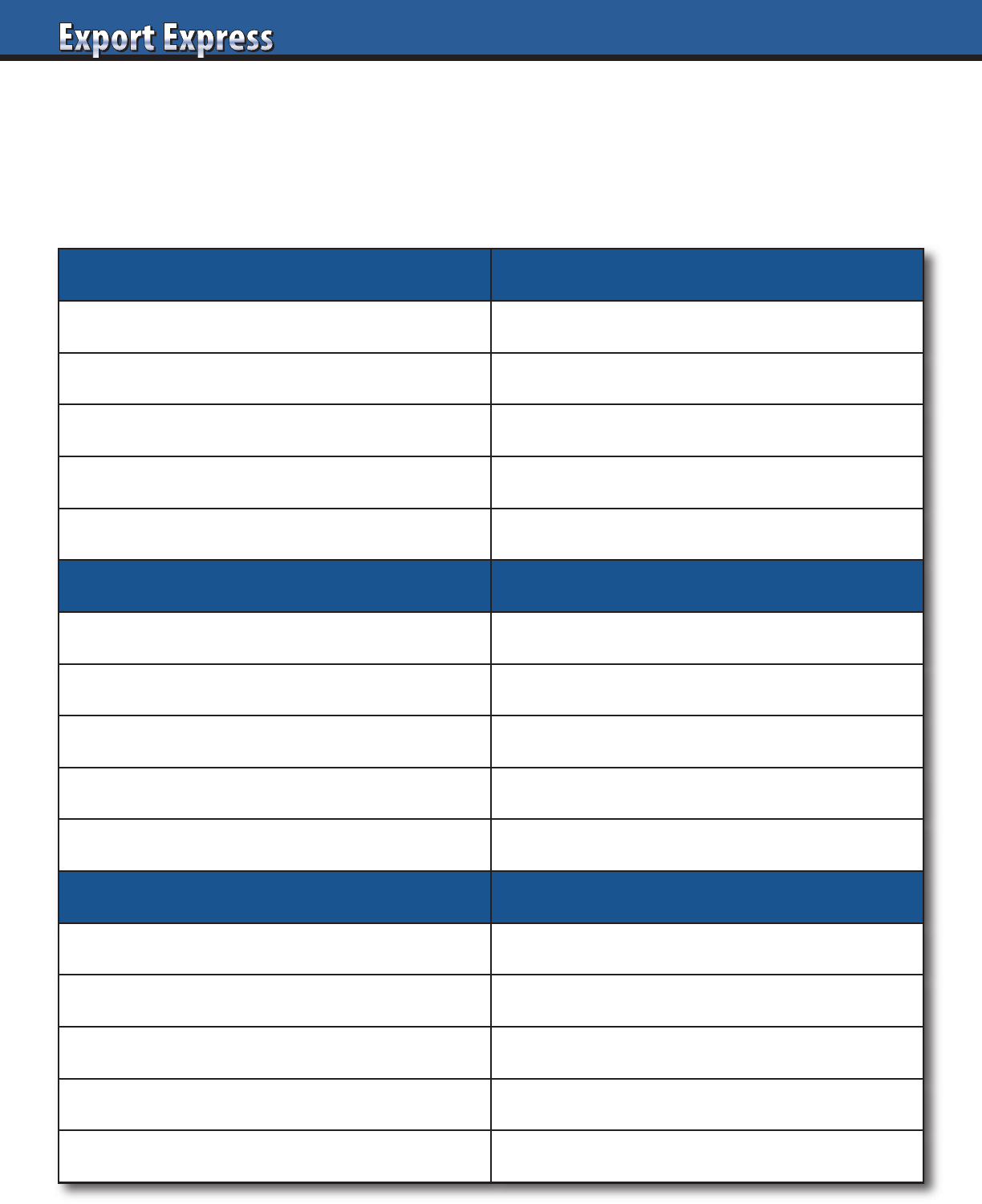

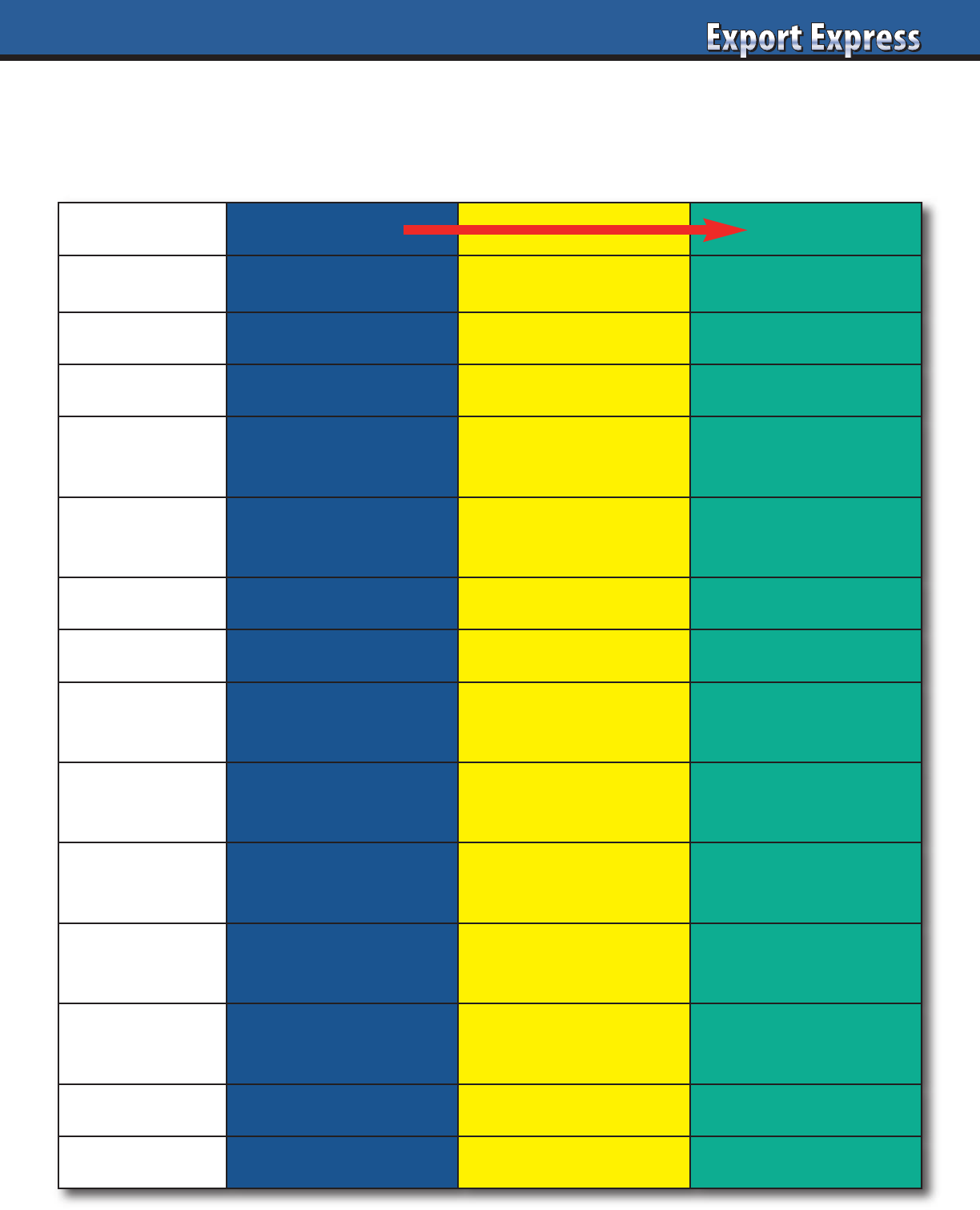

Are Distributors Interested in Your Brand?

High Interest Low Interest

Email Response

Immediate reply Delayed or no reply

CEO Engagement

Active participation Delegated to middle management

Scheduling Meeting

Flexible and easy Difficult. Conflicts.

Airport/Hotel Pick-Up

Offers to pick you up Take a taxi!

Meeting Presentation

Tailored. Prepared for you. Standard presentation

Category Research

Obtains data None

Competitive Review

Shares photos: store sets Informal comments

Store Visits

Organized/led by CEO Office meeting only

Samples

Obtains and tries samples Waits for you

Team Participation

3-6 people at meeting One person

Cell Phone

Shares private number Email address only

Questions

Addresses key issues No questions

Timeline

Meets due dates Delays

Post Meeting Follow-up

Immediate and frequent None

Proposed Plan

Detailed and fact based Brief topline

Results Winner Second place?

I have conducted hundreds of distributor interviews for multinational companies: P&G, Nestle, General Mills, Duracell, Lindt, Tabasco,

Barilla, J&J, etc. Distributor candidates all claim enthusiasm and high interest in your brand. See Export Solutions’ checklist of clues to

measure true distributor interest level.

4

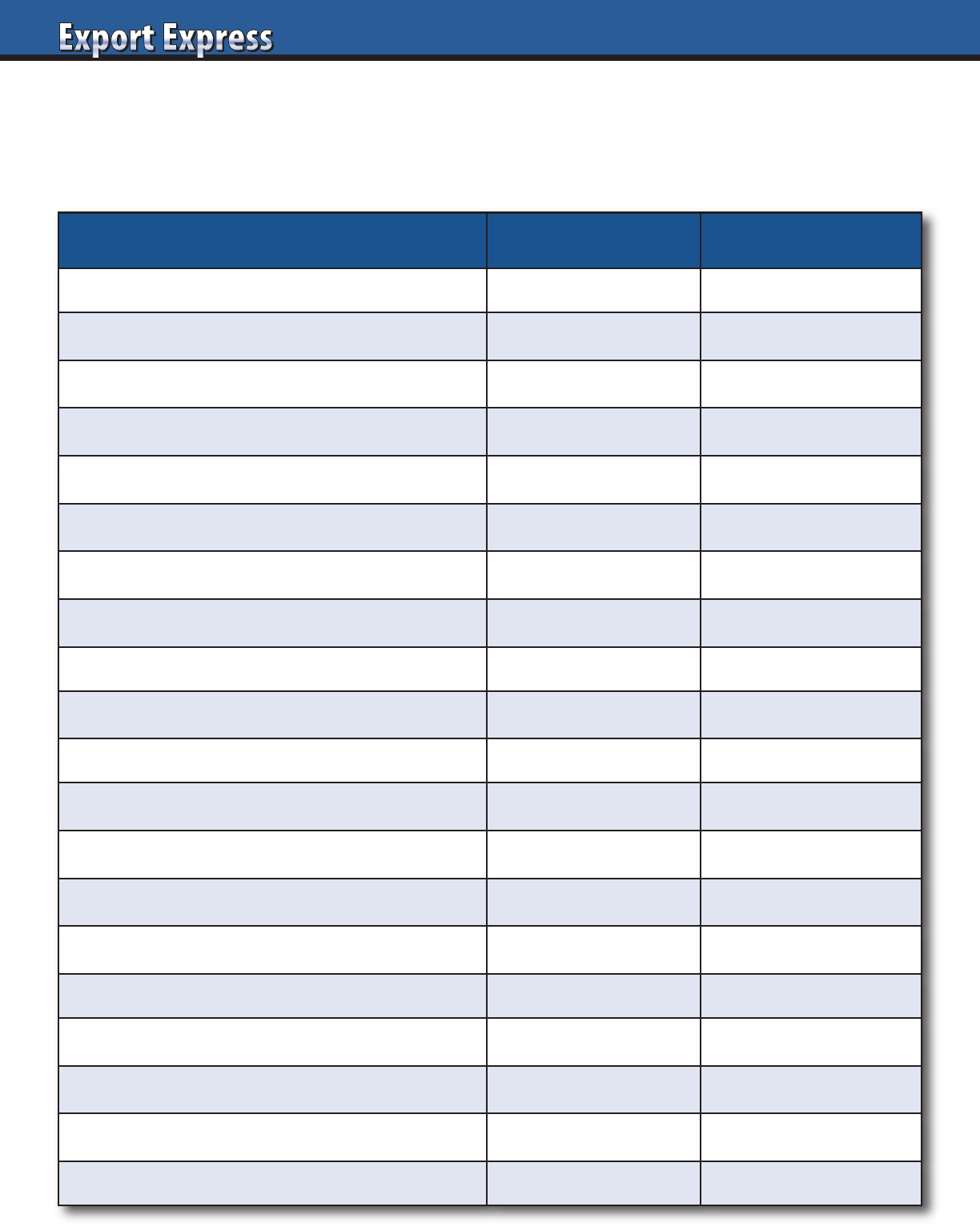

What Distributors Want to Know ?

Strong distributors are overwhelmed by calls from brand owners looking for new partners. Distributors assess

each opportunity carefully, as any new brand must add incremental sales and profits and not distract from

priorities from existing brands handled. What is the “size of the prize” for the distributor?

Assessment Criteria Facts Rating (10 = Best)

Your company: size/reputation

Existing business: sales in distributors country?

If zero “current sales,” what is realistic expectation?

Brand’s USP…your point of difference/innovation?

Size of investment plan: Marketing and Trade?

Potential distributor revenues?margin?

How does the product taste? (or peform)

How attractive/compliant is the packaging?

Pricing relative to category?

Brand success story in an adjacent country?

Competition intensity in category?

Brand range complexity?Product shelf life?

Local market research? Syndicated data?

Will brand invest in marketing and social media?

Will this be a tough product to launch?

Can we grow with the brand owner?

Your brand: core distributor category or adjacency?

Will the export manager be good to work with?

Will we be proud/excited to represent this brand?

What is the “size of the prize?”

5

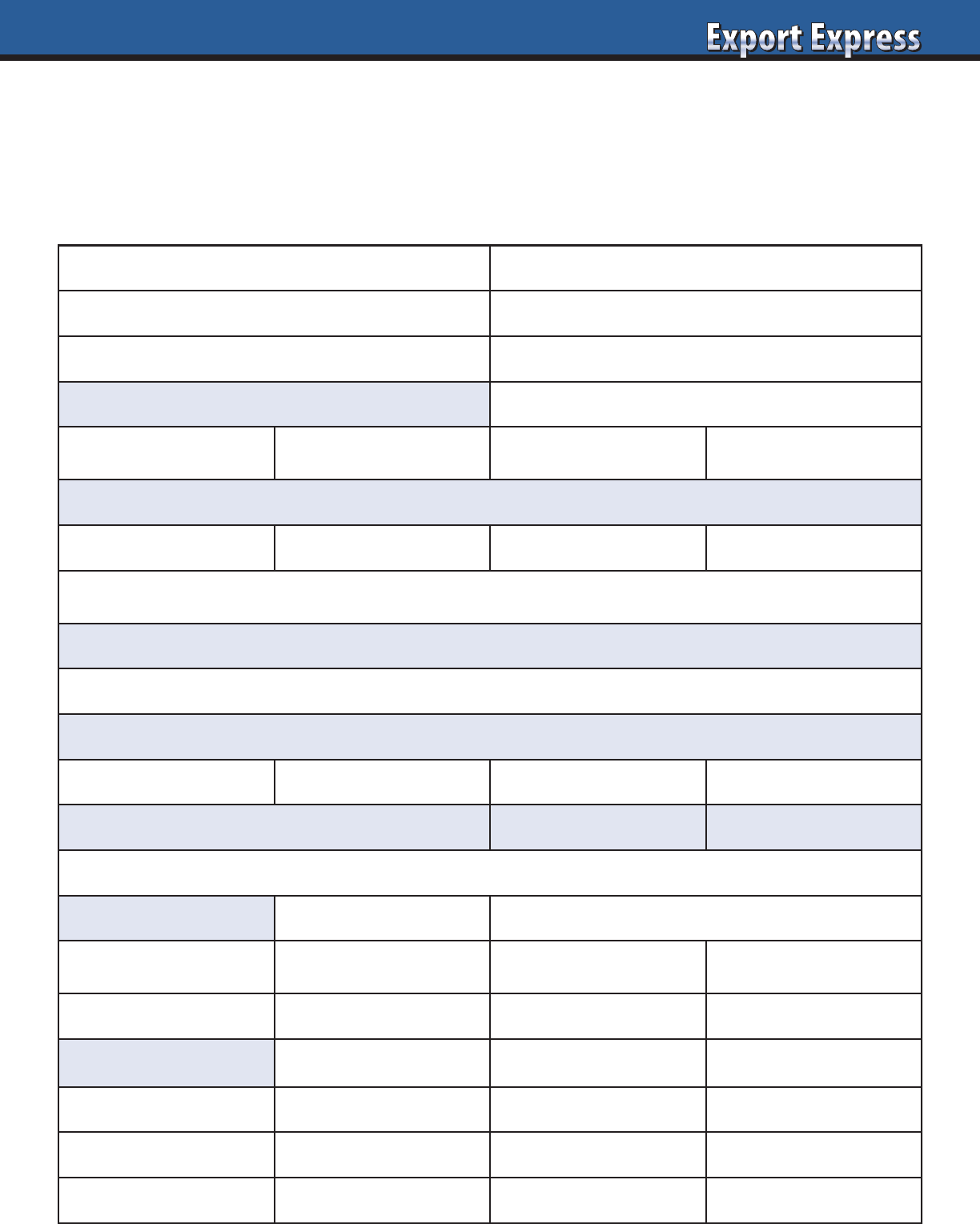

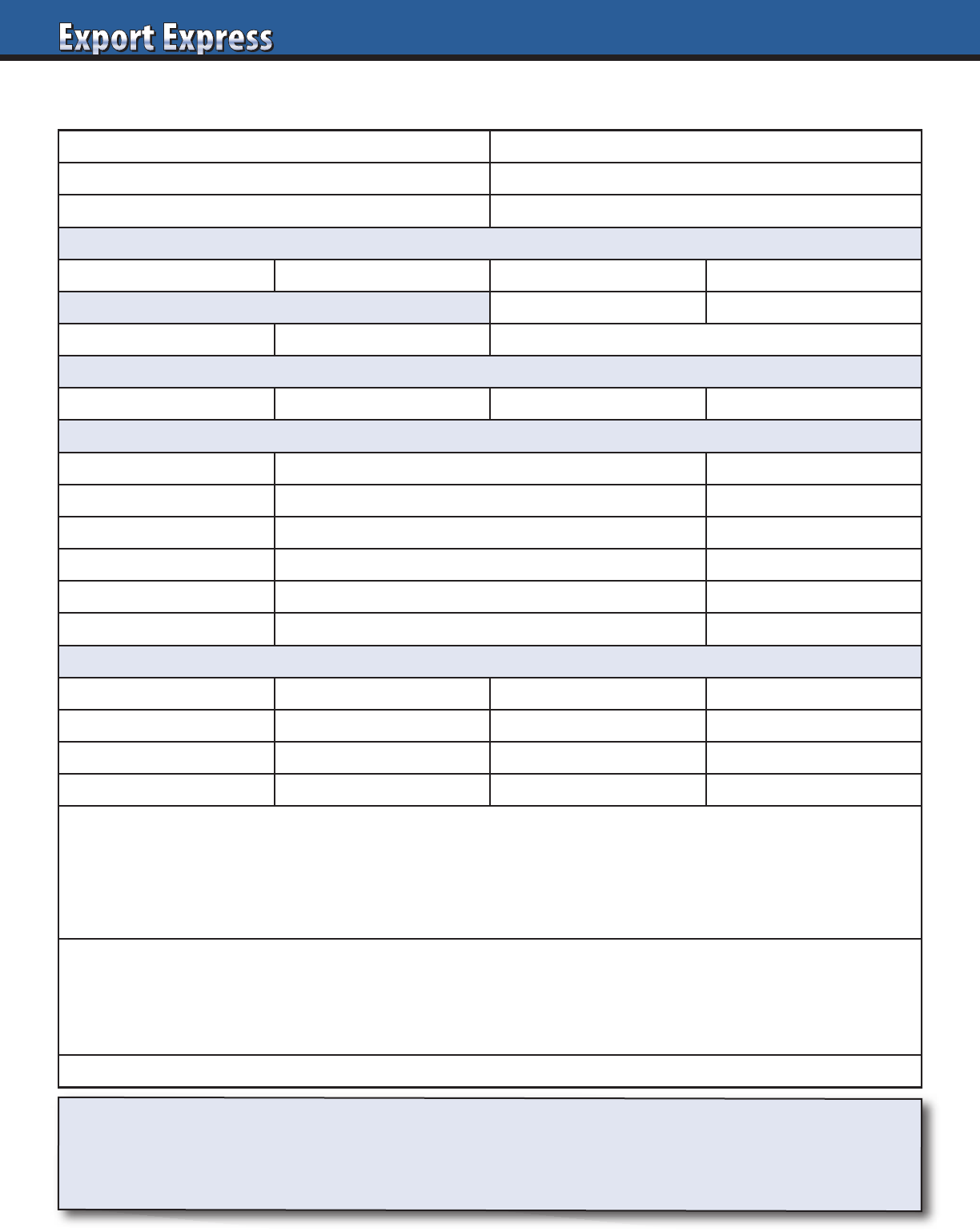

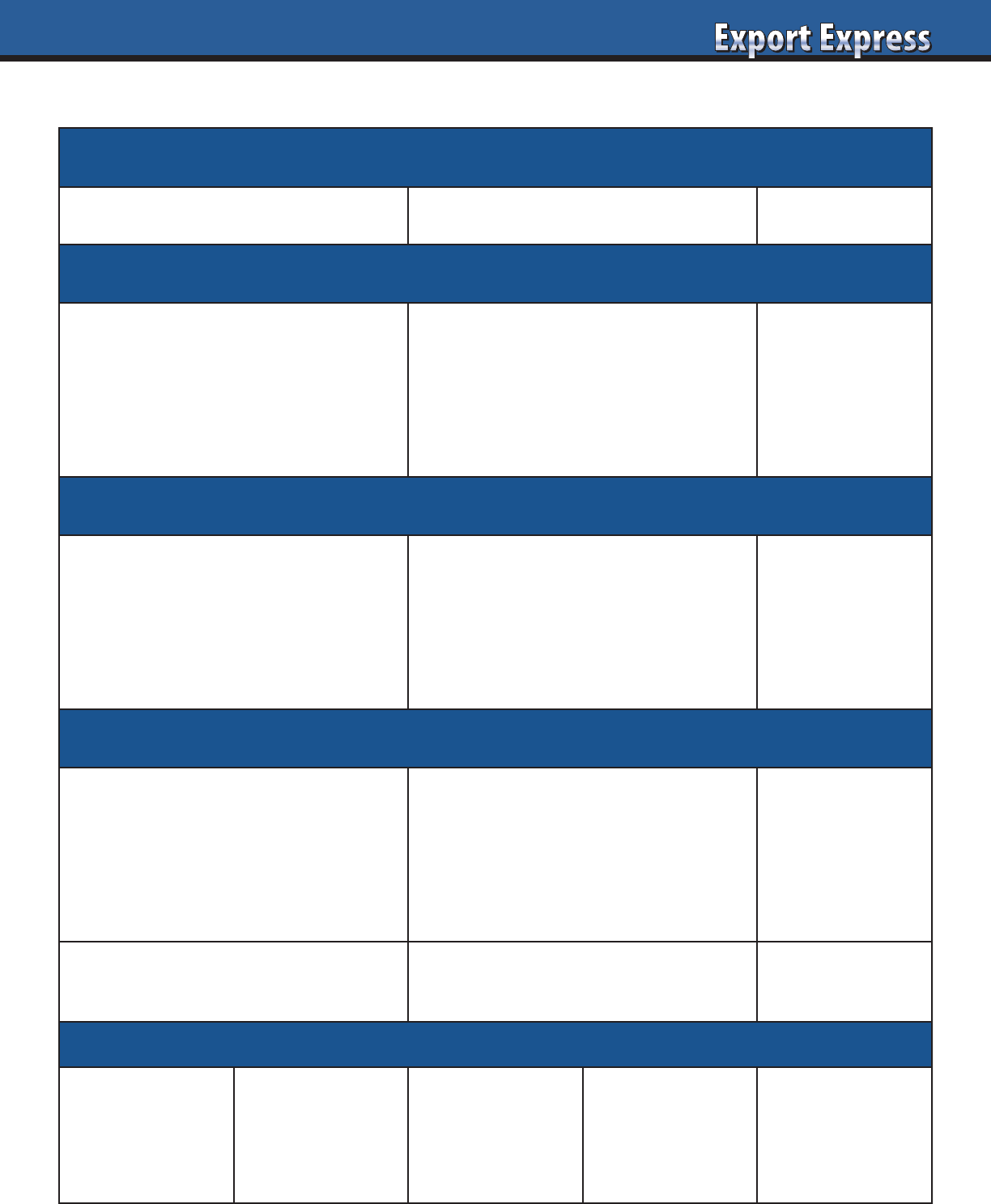

Exporter Data Sheet

What Distributors want to Know about Your Company

New Business Opportunity: _____________________________________

(Company Name/Country)

Key Contact: Telephone:

Web Site: Email:

Founding Date: Ownership:

Annual Sales: Total Employees:

0-$50 million $50 million - $250 million $250 million- $1 billion $1 billion +

% Sales International:

0-10% 10-25% 26-50% 50% +

Exporter Classification/Description:_________________________ (#1-10, based upon Export Solutions’ scale)

Core Product Range:

Unique Selling Point:

Market Share:

Home Country: Country A: Country B: Country C:

Current Business in Distributor’s Country: Yes/No: Size $:

Current Customers (Distributor’s Country):

Investment Model: Listing Fees*: Yes/No *average $35 per item,per store

Trade Promotion Budget: Dead net price: 10% of sales: Mass:

Marketing: Digital: Sampling: 360 degree:

Ambition/Size of Prize: Sales: Market Share:

Year 1

Year 2

Year 3

6

Identifying strong distributors is a critical step in developing

your export business. There is a “science” to partner selection.

In some cases, manufacturers choose the easy way out, electing

to work with small, undercapitalized companies that approach

them randomly at a trade show or via email. Many company’s

distributor networks contain these small, enthusiastic

distributors who aggressively pursued your popular brand, but

rarely deliver. Give them an “A” for effort, but distributor search

must include proper due diligence of all potential candidates,

not just the small one chasing you.

Do you believe that the best distributors are waiting in line

at trade shows or speed dialing export managers? The most

powerful distributors are busy building brands for their existing

partners. However, all distributors are open to representation of

new suppliers. In fact, many of the more strategic distributors

assign a brand manager to new business development. This

senior person is dedicated to evaluating new company

representation inquiries like yours.

Export Solutions ten step distributor search process is a proven

method for identifying and selecting distributors that are the

right fit for your brand’s marketplace ambitions. Listed below

are some practical tips on selecting the right company to

optimize your business in a new country.

Establish Partner Selection Criteria

What are the key attributes of your most successful distributors?

Category specialization? Multichannel coverage? Synergy with

related brands? Choosing a large, “best in class” partner versus

a “small, hungry” company willing to pioneer a new brand is

an important preference.

Evaluate Multiple Candidates

Create a large group of potential candidates. This could include

distributors or local producers of related products. Include

qualified candidates that have emailed or visited at a trade fair.

Highlight companies that are specialists in the market sector that

you are aiming at. Export Solutions streamlines this process with

our leading distributor database containing an average of 85

distributors per country.

What is Your Story?

Manufacturers need to supply a compelling story on why the

distributor needs to invest his money and team resources into

your brand. Distributors search for companies with innovative

products back by marketing support. How much money can

the distributor make representing your brand?

Determine Candidates’ Preliminary Interest Level

Send a brief summary of your product proposition and company

credentials to the 5-10 most promising candidates. A follow-up

phone call to your top candidates is an essential personal

connection. Distributors expressing an interest should complete

a brief company overview recapping their corporate capabilities:

annual sales, organizational model, coverage, key principals, etc.

Interview 3-5 Candidates

Normally, we recommend interviewing at least three candidates

depending on the size and complexity of a country. Schedule the

meeting 4-6 weeks in advance. Provide a specific agenda at least

three weeks in advance, including pre-work such as category

market analysis. Meet the distributor’s team that would work

on your business, as well as senior management. Always meet

at the distributor’s office for clues on company culture, scale,

and capabilities.

Select Your Distributors,

Do Not Let Your Distributors Select You!

continued on next page

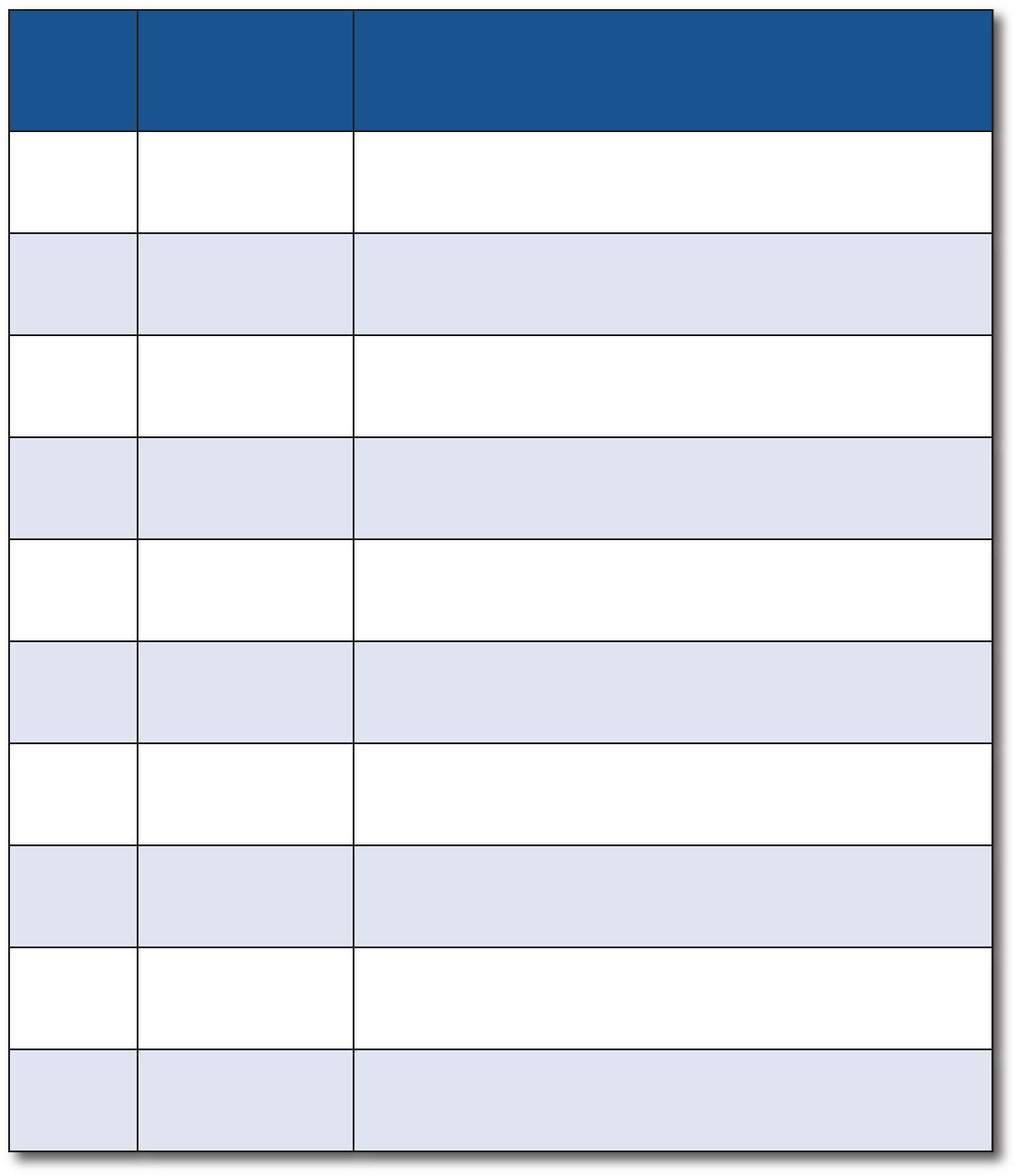

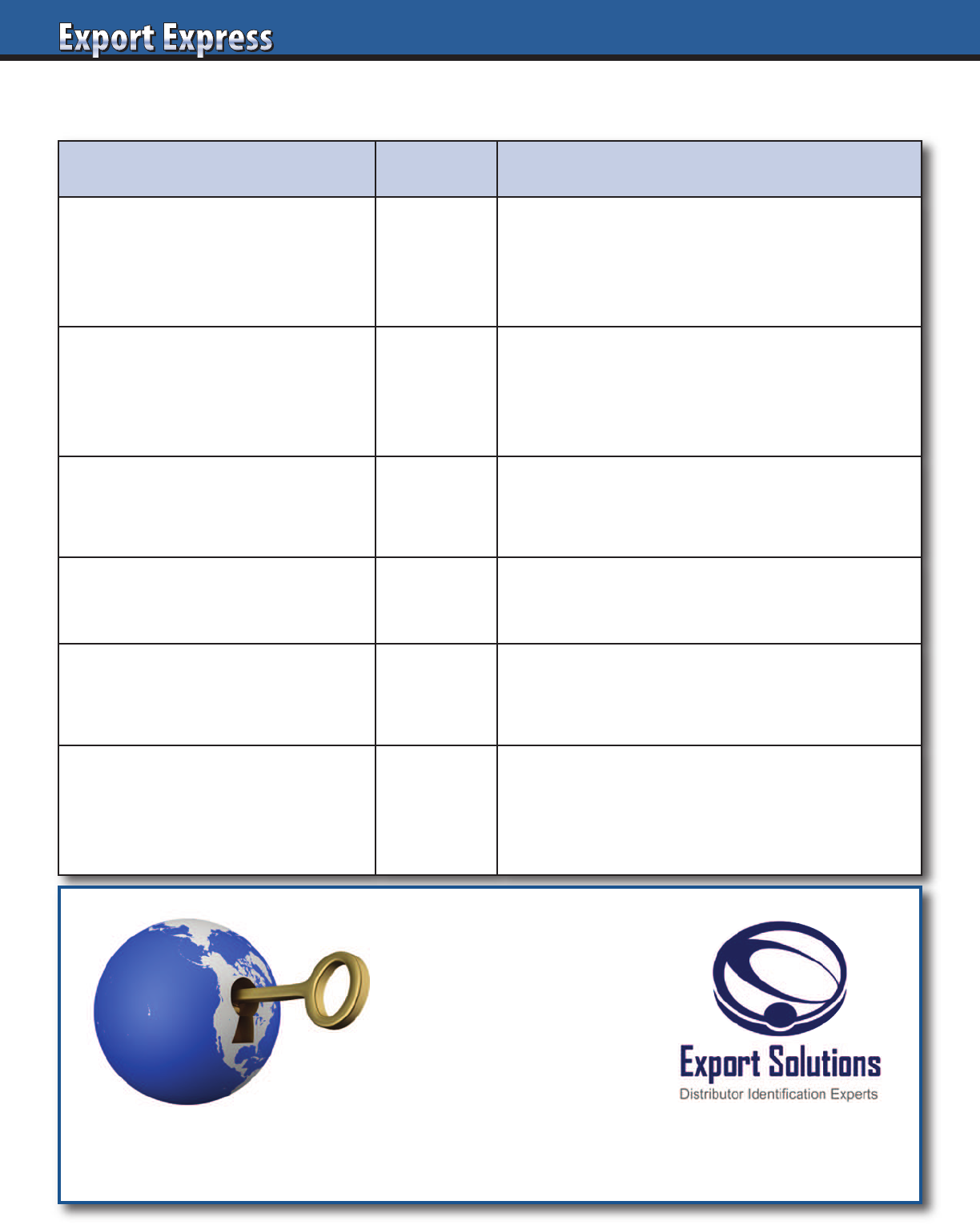

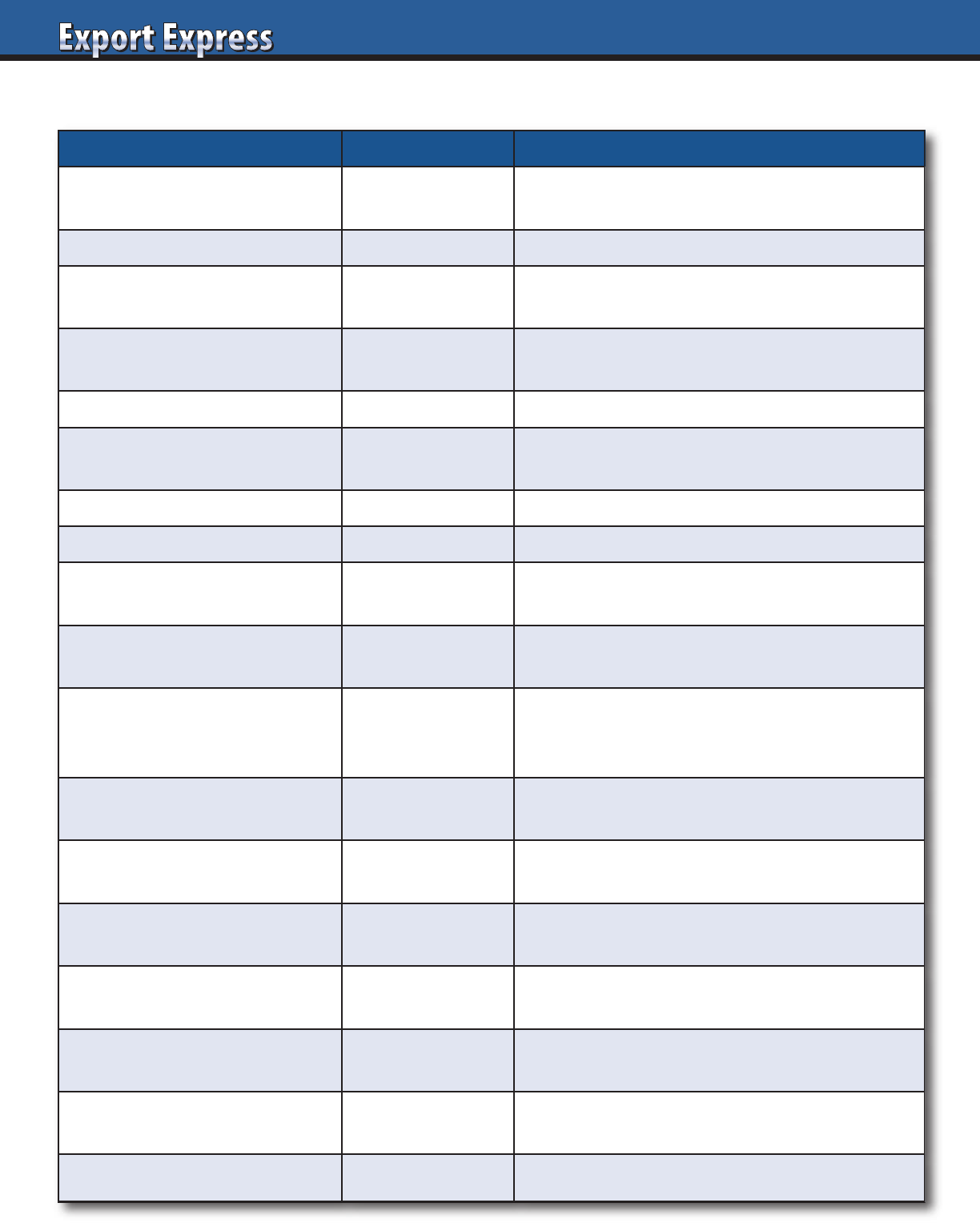

Distributor Search Best Practices

Activity Bad Practice Best Practice

Distributor Profile No portfolio synergies.

Representing similar size,

premium brands from your

aisle/country.

First Contact

Random solicitation

by unknown company.

Trade show or formal

phone meeting with

respected distributor.

Market Visit

Start partnership without

market visit.

Local assessment: office, store

checks, warehouse inspection.

Year I Plan No plan. “Buy and ReSell.”

Logical plan with targets,

activities, timelines, costs.

Price Calculation

Sell at dead net price.

Arbitrary mark-up.

Transparent price calculation

from factory to store shelf.

7

Independent Assessment of Performance for Existing Brands

Visit supermarkets and other retailers to observe category

conditions. At the same time, evaluate each candidate’s performance

for his existing clients. Do his current brands maintain a strong

presence in the market? Or are his brands hard to find on the

shelf? Complete these visits to leading retailers independently,

as an accompanied trip may lead you to check stores which may

not be representative of marketplace reality.

Prepare Distributor Assessment Grid

Create a list of key questions to ask each candidate. Topics

could include local category dynamics, cost of entry, and

distributor success stories. Create a standard grid to evaluate

and compare all candidates on a common platform. Contact

us for our free Distributor Search Guide with assessment grids,

agendas, sample questions and templates for every aspect of

the distributor search process.

What is the Distributor’s Plan?

If selected, what is the distributor’s plan? Customer targets, price

calculation, marketing plan, volume expectations? Timeline and

benchmarks? Key issues? Resources required? Does the plan

align with your vision and the size of the market opportunity?

See Export Solutions’ 10 C Cooperation Model.

Future

Companies conduct rigorous assessments before hiring new

employees. A higher level of intensity must be displayed during

the distributor search process When you choose a distributor,

you are selecting a whole team to represent your company in

a country, not just one individual.

Export Solutions motto:

Select your distributors, do not let your distributors select you.

Select Your Distributors,

Do Not Let Your Distributors Select You!

continued from previous page

Strategic Export

Development Program

Export Passport

Export Passport

8

Distributor Search Challenge

• Some distributors are too big…

• Other distributors are too small!

3

Export Passport identifies

Prime Prospect distributors

that represent the Right Fit

9

10

Exporter Classification*

Type Description

Export Profile

10 Multinational Strong market share everywhere across multiple categories.

9 Global Multinational. Mix of leading countries and niche participation.

8 Category Champion One core mass category. Strong performance globally.

7 Icon Well known, niche leader. Global availability. Example: Tabasco.

6 Regional Leader Strong share across one continent/region. Some export success.

5 National Hero National treasure, #1 brand. Exports to homesick expats, tourists.

4 Player Respectable share in home country. Opportunistic exports.

3 Participant “Me too” product. Opportunistic exports. “Trader”/private label.

2 Challenger Innovator. Some listings in home country. New to export.

1 Start-up Trying to get traction in home country. Export “dreamer.”

*Export Solutions’ classification system

11

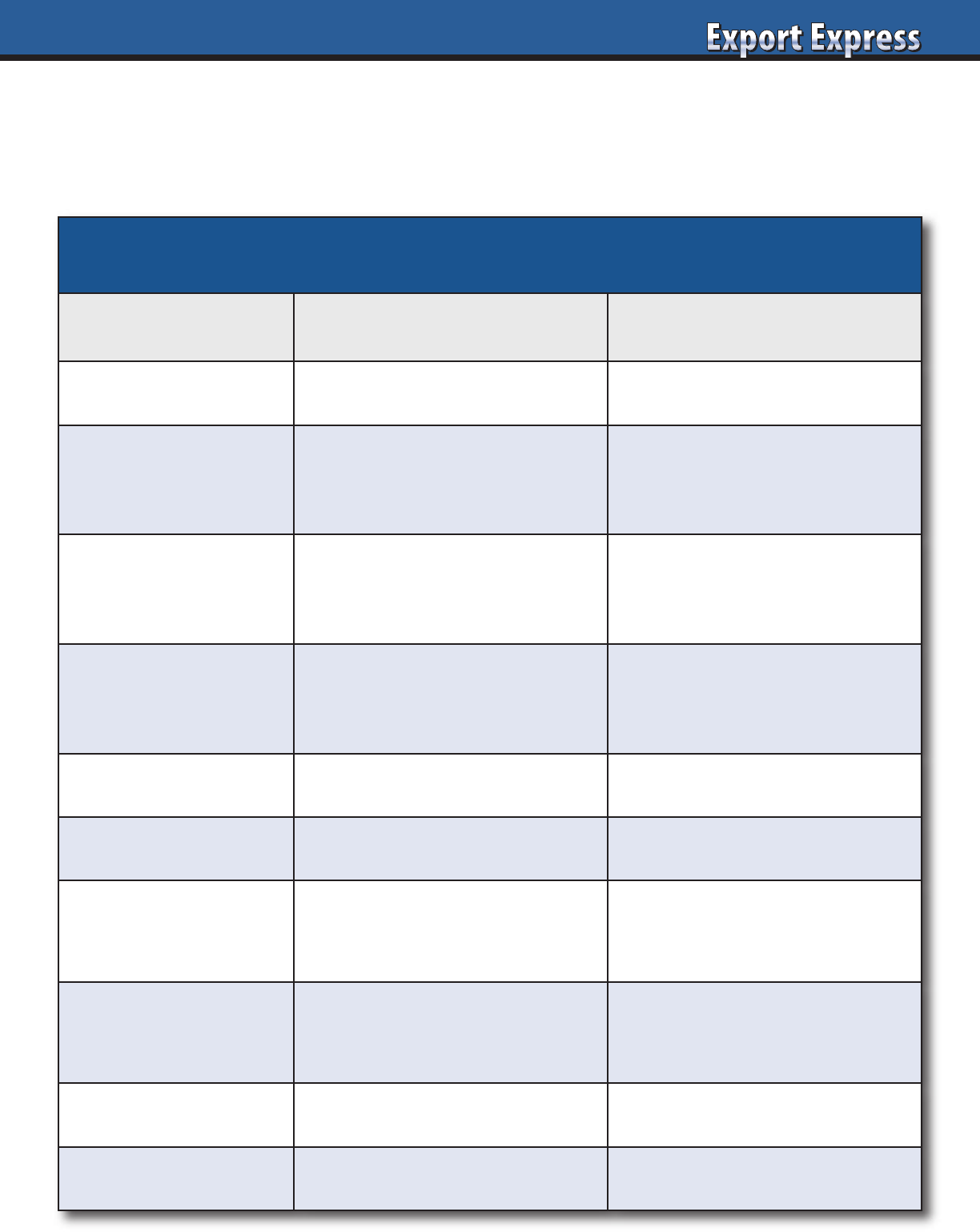

Distributor Classification*

Stars

Title

Description

Prime Prospects

HHHHH

Champion

Massive distributor.

Handles multinational/#1

brands across many

categories.

Brand leaders.

$$$ marketing budgets.

Exporter types: 6-10

HHHH

Captain

Category Captain.

Handles leading brands in

one segment.

Category

innovators/leaders.

$$ marketing budgets.

Exporter types: 5-9

HHH

Player

Mid-size distributor.

Handles #2/3 brands or

niche leaders across many

categories.

Differentiated,

premium brands.

$-$$ marketing budgets.

Exporter types: 4-7

HH

Participant

Respected local.

Diversified product

portfolio.

Results equal to investment.

Flexible, challenger brands.

$ marketing budget.

Exporter types: 2-4

H

Pioneer

Small distributor.

Entrepreneurial, open to

innovative new companies.

Start-up brands.

“Pay as you go” marketing.

Exporter types: 1-3

Need more information? Visit www.exportsolutions.com.

*Export Solutions’ classification system

12

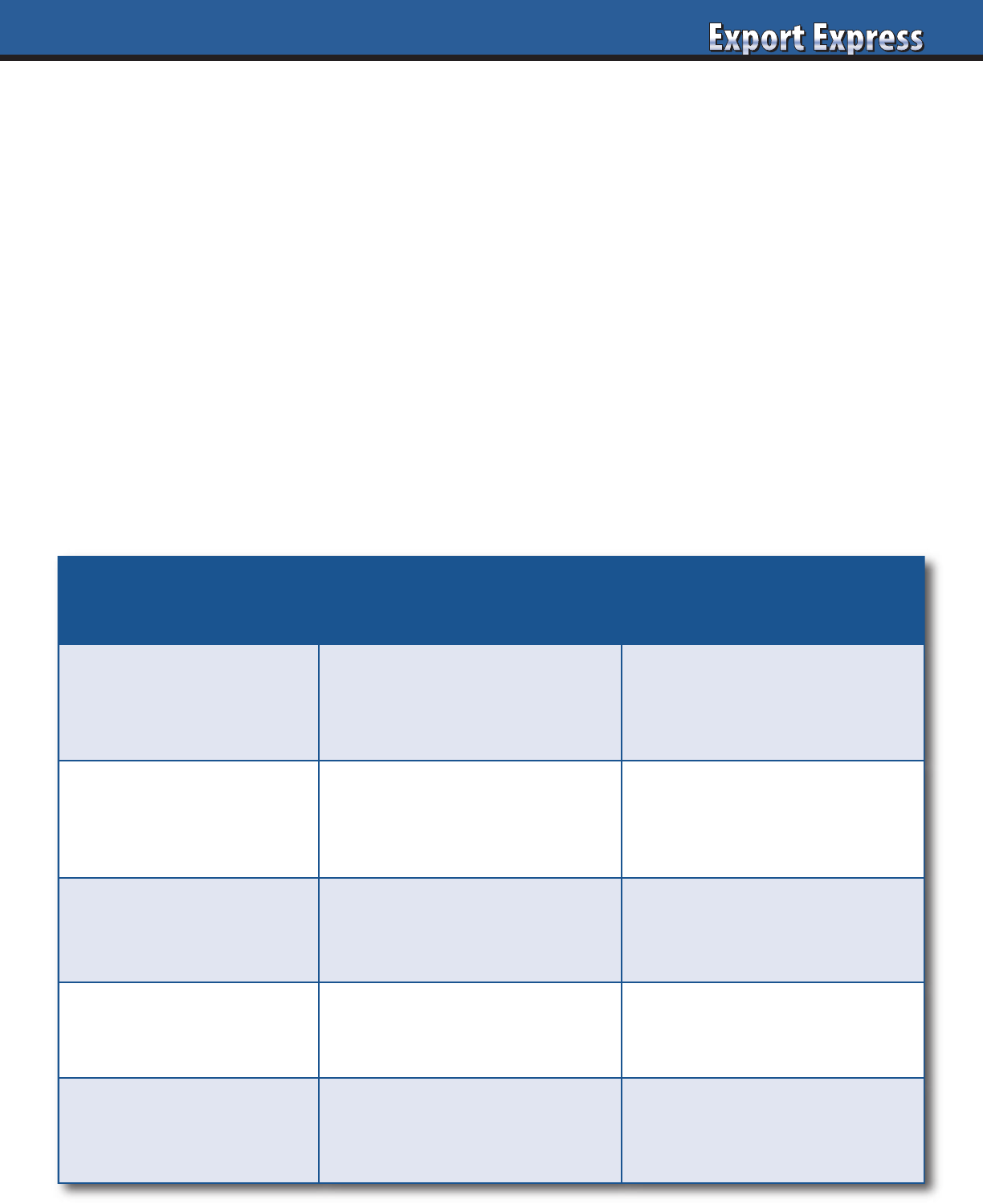

Export Solutions recommends creating your own one page Export Distributor fact sheet template. Insist that all candidates

complete the template 100 percent prior to a phone interview or trade show meeting. Pay particular attention to the annual

sales number, brands represented and manufacturer references. Qualified candidates will enthusiastically complete these

sections. “Pretenders” or time wasters will leave these sections blank or disappear saving you time and money!

Export Distributor Data Sheet:___________________________________

Key Contact: Telephone:

Web Site: Email:

Annual Sales: Total Employees:

Employees, by Function:

Key Account Sales Logistics Marketing Merchandising

Company Owned Warehouse: Yes No

If Yes Warehouse Size: Location:

Channel Coverage (percent sales by channel):

Supermarket Convenience Foodservice Other

Top Five Manufacturer Clients:

Company Name Brands Represented Years Service

1

2

3

4

5

Manufacturer references:

Company Name Contact Name Contact Telephone Contact Email

1

2

3

Why are you interested in distributing our brand?

Why is your company the best candidate to represent our brand in the market?

Feel free to attach your company credentials presentation.

(Distributor Name)

13

Distributor Search Helper for:

Your

Logo

Here

Can We Help You?

Recent Distributor Search Projects

Asia Europe Middle East Latin America

Australia Germany Israel Argentina

China Ireland Kuwait Brazil

Indonesia Netherlands Qatar Colombia

Japan Nordics Saudi Arabia Costa Rica

Malaysia Spain UAE Ecuador

Philippines United Kingdom North America Mexico

Singapore Africa Canada Panama

South Korea South Africa United States Peru

Call the Export Accelerator!

Contact Greg Seminara at greg@exportsolutions.com

to discuss your business development project.

www.exportsolutions.com

14

10 Questions for Every Distributor Interview

1.Company History

How long have you been in business? Who are the owners?

How many direct, “payrolled” employees do you have?

Approximate annual sales volume?

2. Company Brand Portfolio

What are your top 10 companies/brands represented?

For which channels do you represent each brand?

How long have you represented each brand?

Can you provide senior level references at each “brand owner”?

3. Key Account Buyers

Who is the buyer for our category at the largest retailers in

your market? What other brands do you sell to our buyer?

How frequently do you visit each major customer?

4. New Product Launch Success Story

Provide a recent example of a new brand launch success story.

Key retailer acceptance? Cost of entry? How long did it take?

Key elements of the success strategy?

5. Creative Selling

Provide an example where you took an assigned

marketing/brand support budget and created a successful

local program. How do you measure success?

6. Retail Servicing

How many full time employees do you have visiting retail

stores? Are they located countrywide or just in the capital city?

How do you measure a “good store” in terms of brand presence

versus a “bad store”? Describe your retail reporting system.

7. People

Who would be our point of first contact? Would our contact also

“sell” our brands to major accounts? What other brands is our

contact responsible for? How do we insure that we get our fair

share of attention from your sales force?

8. Business Planning Model

What would your action plan be if we made an agreement to

start with your company? First steps? 90 Day Plan? Reporting?

9. Cost to Serve

How do you model your distributor margin? Range of margin

for our brands? Are you open to promotional spending split

(50/50)?

10. Enthusiasm for our Company

Why is our brand a good match for your company?

Why are you the best partner in the market for our brand?

What commitment are you willing to make?

Talk to an Expert

• International Strategy Road Map

• Fix Problem Markets

• Entry Plans

• Find Distributors in 96 Countries

• Export Workshops

• Motivational Meeting Speaker

Contact Greg Seminara at (001)-404-255-8387 to discuss your business development project.

www.exportsolutions.com

15

Retail buyers are challenged to maximize profits and sales from every available inch of shelf space. Every new item accepted must

improve on the performance of the brand currently occupying that space. Buyers are overwhelmed by new product offerings, all with

ambitious promises. Improve your chances of success by incorporating Export Solutions’ 10 point check list on how to excite your

category buyer about your new product.

How to Excite Buyers – New Product Checklist

Buyers: New Product Assessment

High Interest Low Interest

Category Opportunity Large or high growth Declining or niche

Brand Owner

Multinational or proven local.

Category expert

New foreign supplier

or start-up

Innovation

Something new, supported

by consumer research

“Me too” product

Profit Margin

Enhance current

category margin

Equal to or less than

current category margin

Sales Generates incremental sales Cannibalizes existing sales

Marketing Investment Sampling, social media, PR None

Trade Programs Invests in retailer “push” programs Periodic discounts/rebates

Brand Track Record

Successful at other

local retailers

Unproven in the country

Terms/Conditions Attractive deal structure Typical terms/conditions

Representation Dependable local distributor Small, niche entrepreneur

Criteria (weighting) Rating Evaluation Factors

Corporate Credentials 30%

Size, sales force, logistics, # employees.

Reputation (reference check existing brands).

National coverage.

Multi-channel coverage.

Category Expertise 20%

Sells brands in my category.

Shelf space for existing brands.

Current brands selling to target retailer.

Category analysis and insights.

Brand Building 15%

Ideas to build or launch my brand?

Marketing plan, cost, timing.

Success stories.

Cost to Serve 15%

Fair, transparent model relative to size

of business, brand investment, and

work required.

Enthusiasm for

My Brand 20%

Advance preparation, CEO involvement.

Follow-up on commitments.

Alignment with your vision.

X Factors: People, Admin.,

Professionalism, etc.

+/-

CPG/FMCG background for leaders.

Efficiency of scheduling meeting.

Office environment.

Do you enjoy the people?

Rating System

Rating Score

Excellent 5

Very Good 4

Average 3

Fair 2

Poor 1

Contact Greg Seminara at (001)-404-255-8387 to discuss your distributor search project.

www.exportsolutions.com

New Distributor Assessment Grid

16

17

Distributor Capability Assessment

Export Solutions established 15 assessment criteria to identify “Best in Class” performers as well as “under

achievers.” Many distributor relationships extend 10 years or more. Is your distributor network still a “good fit”

for your current business requirements? Template can also be used as New Distributor Reference Check form.

Assessment Criteria Rating: (10 = Best)

Category Expertise/Critical Mass

Focus/Time Dedicated to your Business

Joint Business Plan Development, Execution, Delivery

Alignment with Brand Owners Vision. Relationship.

Cost to Serve (fair margin, extra costs)

Assortment/Shelf Space

Promotion Creativity, Effectiveness, and Efficiency

Key Account Relations (Senior level, buyer)

Leadership/Owner (engaged & committed to us?)

Brand Manager (seniority, clout,creativity)

Multi Channel, Multi Regional Coverage

Financial Stability, Payment Record

Supply Chain Management & Forecasting

Problem Solving: rapid response?

Sales Results versus Budget, Market, Category (CY, PY, 3 Years)

18

Introducing

America’s Favorite Brands

Executive Board

Export Solutions Smucker’s Tabasco

Greg Seminara, CEO Danny Berrios, President Megan Lopez, Vice-President

General Mills Sun-Maid

Eric Saint-Marc Carsten Tietjen

Advisory Board

Bazooka Candy Blue Diamond Bob’s Red Mill

Santiago Ricaurte Dale Tipple Jan Chernus

Bush Beans Campbells Church & Dwight

Dave Bauman Julio Gomez Arun Hiranandani

Ferarra Candy Heartland Idahoan

Daniel Michelena Tom Theobald Ryan Ellis

Johnsonville Sausage Kao USA Keurig Dr. Pepper

Cory Bouck Julie Toole Billy Menendez

Mizkan Reynolds Welch’s

Noel David Chris Corey Marc Rosen

19 Companies | 200+ Top Brands | $80 Billion Combined

View our activities for export managers – www.usafoodexport.com

19

Have you ever experienced an incredible

first meeting with a distributor? Strong

alignment, good fit, everyone smiling,

timelines agreed. Then, nothing happens!

The export manager may take up to six

months to translate his outlook from

“done deal” to “dead deal.” There are

two reasons why this occurs.

First, distributors are positive,

competitive athletes, always striving

to win new business. However, in some

cases, the distributors wake up after time

to reflect and decide they really weren’t

that interested in the brand after all.

Failure also results when a strong

first personal meeting at a trade show

or distributors office is followed by

a relationship buried in email

communication, with no personal touch.

Below are Export Solutions’ Ten Tips on

converting promising new business leads

into tangible business partnerships.

1. Zoom/Teams – Don’t Depend on Email

Motivated distributors still return phone

calls, but frequently receive up to 200

emails a day, many from existing brand

partners. Top distributors’ business days

are captured by a continuous flow of

meetings with customers, principals,

and their own employees. Best bet is to

call a potential partner or set up Zoom

meetings. Email is okay for routine

correspondence, but too easy to ignore

or delete.

2. Follow Up Immediately & Frequently

Time slips away, as Export Managers

focus on existing businesses and

“problems of the day.” One tip is to

put regular follow up reminders on

your computer calendar.

3. Focus on 5 C’s: Category Review, Calculation,

Cost of Plan, Compliance, Contract

There are 5 critical elements to translate

a “lead” into shipments.

Category Review: How does your

category look in target country? Category

size, competition,pricing,margins, and

merchandising activity.

Calculation: What is the distributor’s

proposed calculation from your factory

gate to the store shelf? What are standard

costs like duties and taxes? What are

flexible or negotiable like trade discounts

and distributor margin?

Cost of Plan: Each brand needs a plan

to gain market entry. This includes key

account “sell in,”

followed by consumer

and trade promotion

activities. Look at the

distributor’s proposed

plan, as well as several

options with different

price tags.

Compliance: Many

countries feature a

product registration

process and labeling

requirements. In some

countries, this step is

easy with automatic

compliance for a USA

or European brand. Or a

simple solution with a small distributor

applied sticker. In other countries like

Japan or Indonesia, plan on one year or

more to navigate the complex process.

Contract: “Ready, Set, Go” can be delayed

by 3-6 months due to contract negotiations.

Company lawyers demand 20 page

agreements in English that even the

Brits can’t understand. Distributors

prefer two page letters of understanding

or a handshake deal. Do what is right

for your business, but expect delays

and frustration.

4. Request References

A good idea is to quickly request

distributor references from other brands

they handle. Motivated distributors will

send impressive references right away.

Also, have your credit department run

a Dun and Bradstreet or Equifax report

as soon as possible. Many trade show

meetings are with “pretenders” who state

exaggerated claims and are ultimately too

small to handle your brand. Better to

discover this sooner versus later.

5. Move Beyond the Distributor Owner/MD

The distributor owner “writes the

checks,” but frequently serves as a

“bottleneck.” The key is to quickly get

your brand assigned to a “worker” whose

task is to move your project through the

system and produce an order!

6. Establish Realistic Timelines

Sync with category review dates and avoid

holiday periods. Update timelines

frequently. New distributor relationships

always take longer. Plan on six months

from first meeting to first shipment. Be

pleasantly surprised if things move quicker.

7. Distributor Response Time

Signals Interest Level

How often do you check your emails?

Probably every hour. When I work

on distributor search projects for well

known brands like Pringles, Tabasco,

or Barilla, distributor response is

lightening fast. Motivated distributors

will chase you if they are interested

because they are anxious to start selling

your brand!

8. Establish Regular Checkpoint Calls

I suggest every two weeks at a

minimum. Use a common document of

priorities, action steps, and due dates.

9. Visit the Distributor

It’s amazing the amount of progress

that will be made during a meeting

at the distributor’s office. Also, the

distributor will work hard in advance of

your visit as your project moves up the

priority list and they want to guarantee

a favorable impression. A visit to the

distributor’s market signals your

commitment. Beware if the distributor

is reluctant to schedule your visit. Either

he has changed his mind about a

partnership or his office and capabilities

do not match the bold promises made at

the initial trade show meeting.

10. Parallel Path Two Candidates per Country

A favorable first meeting represents an

excellent start. However, there are still

many steps (think 5 C’s in point 3)

before you sign a contract and receive

your first order. Always keep two

candidates in the process, in case your

top choice disappoints. This can be

tough, but represents a better option

than needing to start the entire process

over again.

Ten Tips: Converting Promising Leads to New Partnerships

Searching for New Distributors?

Export Solutions makes life a little easier for more than 3,000 export managers.

Our time saving distributor database serves as a “helper” for identifying more

than 9,200 qualified, local brand builders in 96 countries.

“Select Your Distributors,

Do Not Let Your Distributors Select You”

www.exportsolutions.com

Search by Country, Category, or Country of Origin

20

Local Experts

Distributor Coverage

Asia: 2,030

Europe: 3,139

Latin America: 1,574

Middle East: 937

USA/Canada: 1,464

Category Experts

Distributor Coverage

Beverage: 1,691

Candy/Snack: 2,713

International Food: 3,276

Health & Beauty: 1,800

Natural Food: 837

Country Experts

Distributor Coverage

German Brands: 648

Italian Brands: 1,397

UK Brands: 682

USA Brands: 1,189

21

1. Case

Manufacturer supplies a business case

confirming brand “aspirations” for the

country: Key items in portfolio, estimated

base pricing, volume/market share

expectations, and investment model.

2. Category Review

Distributor supplies a local review

of category competitors, pricing,

and merchandising practices.

3. Capabilities

Distributor shares detailed organizational

capability and customer coverage.

Could include references from existing

suppliers represented. An important step

when there are two or more candidates

under consideration.

4. Commitment and Costs

What is the Year 1 Plan and Forecast?

Targeted listings, marketing activities,

launch budget and volume estimate

associated with the spending plan.

5. Calculation – Value Chain

Line by line, build up from port to retail store

shelf. Include currency assumptions.

6. Compliance

Highlight product registration and

label requirements. Typical timelines

for compliance?

7. Captain of Team

Who will be our day-to-day brand manager or

first point of contact? Which senior executive

will serve as our “Brand Champion?”

8. Contract

Options include formal contract, letter

of understanding, or handshake deal.

Begin this process early!

9. Consumer Marketing

What are planned activities to generate

consumer trial and repeat purchases?

Trade marketing, consumer marketing,

social media, etc.

10.Calendar /Close

Distributor supplies a detailed timeline of

all activities. When can we expect first order

and delivery to support launch?

Frequent checkpoint calls or meetings.

10 C’s – Cooperation Model

Looking for Good Distributors?

Export Solutions’ database covers

9,200 distributors in 96 countries.

www.exportsolutions.com

Ten Questions: Developing your Cooperation Model

1. Size of the Prize

What are the distributor’s year one and year three

volume estimates? How big is the category? Is the

category growing?

2. Key Account Listings

What listings can we achieve in year one? Who will

be our biggest customers? Will there be differences

in retailer acceptance by region or channel?

3. Trade Reaction

What will retailers like about our brand? Any potential

barriers? Which retailers will be most challenging?

4. Brand Manager

Who will be our primary point of contact?

Experience level? Workload?

5. Marketing Investment

What budget is requested to achieve our mutual

shipment objectives? Who pays for marketing costs?

Which costs are split?

6. Currency Fluctuation

What assumptions are made in your price calculation?

What happens if the currency fluctuates more than

5 percent in either direction? How do you handle

price increases?

7. Distributor Margin

What is your distributor margin? What services are included?

Any other fees or regular costs if we work together?

8. Trial and Repeat

What strategies are required to generate consumer trial

and repeat purchase? What works? How do you conduct

post-promotion analysis and measure payout and success?

9.Focus

Where will our company rank in terms of volume contribution

to your overall business? How will we secure share of mind

during our critical first year?

10. Issues

What are the biggest issues we will face? Barriers to success?

What must happen to win?

5 Critical Questions to Thrive in 2025

1. Are we willing to pursue international acquisitions?

2. Would your company consider overseas contract packing (versus export)?

3. Can we test a high spend investment plan (“The Right Way”) in a strategic country?

4. Would your company invest aggressively in offshore head count in advance of sales?

5. Europeans: can we develop the USA market implementing the USA playbook? USA factory,

broker network, competitive pricing, USA team, channel strategy, 30-50% trade promotions?

22

23

Picking the right distributor is not an exact

science. I know that each of us experiences

moments of frustration when we question,

“why did we ever pick that distributor?”

Believe me, an equal number of examples

exist where a distributor may share the same

emotion about your company! Frequently,

a partnership is christened by a positive

distributor interview or enthusiastic meeting

at a trade show. Everyone is always in a

hurry to negotiate prices and a contract and

secure the first order. However, in many cases the decision to work together is cemented

without a formal business plan where expectations, road map, and KPI’s are established.

Unfortunately, one year later both parties may find themselves pointing fingers at each

other due to disappointing results.

I recently completed a distributor search project in the Middle East. We interviewed a

number of good candidates and identified two with high potential. Last month, I was

notified by the export manager that he selected one of the candidates. I supported his

decision, but questioned how the plan proposals for the two distributors compared?

The vague response confirmed no plans, just that he liked one distributor better.

This year, another project brought me to a country where a new distributor had been

appointed less than one year earlier. Initial results were severely below expectations.

The first question I asked the brand owner related to the reconciliation versus the

original one-year business plan. What happened? In this case, there was general

understanding about the direction of the partnership, but never alignment around

a one-page scorecard with KPIs and a logical road map.

Launching a new distributor relationship is like the birth of a child. A mother rarely

leaves the side of a baby, providing comfort, safety, and nutrition until the infant is

healthy and able to survive without constant oversight. The same philosophy must

apply to a distributor partnership. During the first few months, there must be frequent

communication, care and visibility from the supplier with the new “brand parents.”

This approach results in a healthy brand. Too many times, I see a new distributor

appointed without anyone from the manufacturer committed to visit the country

for the sales launch meeting or conduct a retail sales audit within the first sixty days.

Parents bring their newborn to the doctor frequently for checkups.

Listed below are Export Solutions’ tips on creating a clear annual plan for each country

and distributor partner.

1. Select new distributors based upon the quality of their year one plan:

targeted listings, volume forecast, and retail penetration.

What is their written commitment and timeline for achievement?

2. Current distributors should also have a confirmed one page plan.

Merchandising events, new listing targets, spending, and shipment targets.

Many brand owners treat distributors as good customers which is a smart approach.

The distributor is paying your invoice, not a retailer. Successful distributor partnerships

thrive when both parties are aligned and committed to a simple, one-page plan.

Looking for a sample format? I’ve prepared a one-page business plan template that

is freely available in the Export Tips section of my web site or simply email me.

What is your annual plan for each country?

www.exportsolutions.com

Greg Seminara

404-255-8387

“Spend Time Selling to Distributors versus Searching for Distributors”

What is the Plan?

Strategic Services

Contact Us for

Export Solutions

1. Identify Best in Class

Distributors: 96 Countries

2. Best Practices

Export Strategy

3. Distributor Management

Workshops

4. Export 101:

Let’s Get Started

5. New Market

Prioritization

and Launch Plan

6. Personal Distributor

Introductions:

96 Countries

7. Walmart International

8. Distributor Contracts,

Margins, and Fees

9. Meeting Speaker

10. International

Strategy Expert

Strategic Services

Contact Us for

Export Solutions

1. Identify Best in Class

Distributors: 96 Countries

2. Best Practices

Export Strategy

3. Distributor Management

Workshops

4. Export 101:

Let’s Get Started

5. New Market

Prioritization

and Launch Plan

6. Personal Distributor

Introductions:

96 Countries

7. Walmart International

8. Distributor Contracts,

Margins, and Fees

9. Meeting Speaker

10. International

Strategy Expert

24

“The Right Way

”

– New Country Launch

Retail buyers and distributors are receptive to brand launches from multinationals. Why?

Multinationals succeed, as they introduce new products “The Right Way.” Export Solutions recaps

30 components of launching “The Right Way.” Exporters create magic with limited budgets!

Winners check as many boxes as possible on “The Right Way” scorecard.

Product Retailer

o Meaningful innovation – not “me too” o Boost category sales, margin, and profit

o Consumer market research insights o Syndicated data (Nielsen) – category facts

o Technical confirmation of product differentiation o Invest in retailer “push” programs

o Reasonable retail price – premium (not sky high) o 4-6 high value promotional events per year

o Test market results – similar country or retailer o Retailer VP, distributor CEO at intro call

Marketing Excitement

o 360 marketing plan: TV, in-store, social, PR o Launch party – memorable location

o Sampling o PR, social media, trade press

o Social media o Celebrity endorsement

o Displays: end of aisle and shelf blocks o Distributor sales contest

o Special offers – retailer fliers o Donation to local charity

Team Scorecard

o Distributor – best in class, category expert o Year 1: invest; year 2: break even; year 3: profit

o Local manager – launch oversight o Sales volume (retail sell-out)

o Marketing, social media, PR agencies o Market share

o Brand/technical resource from headquarters o Retail availability (weighted distribution)

o Total distributor engagement: reps. to CEO o Year 2 commitment and enthusiasm

25

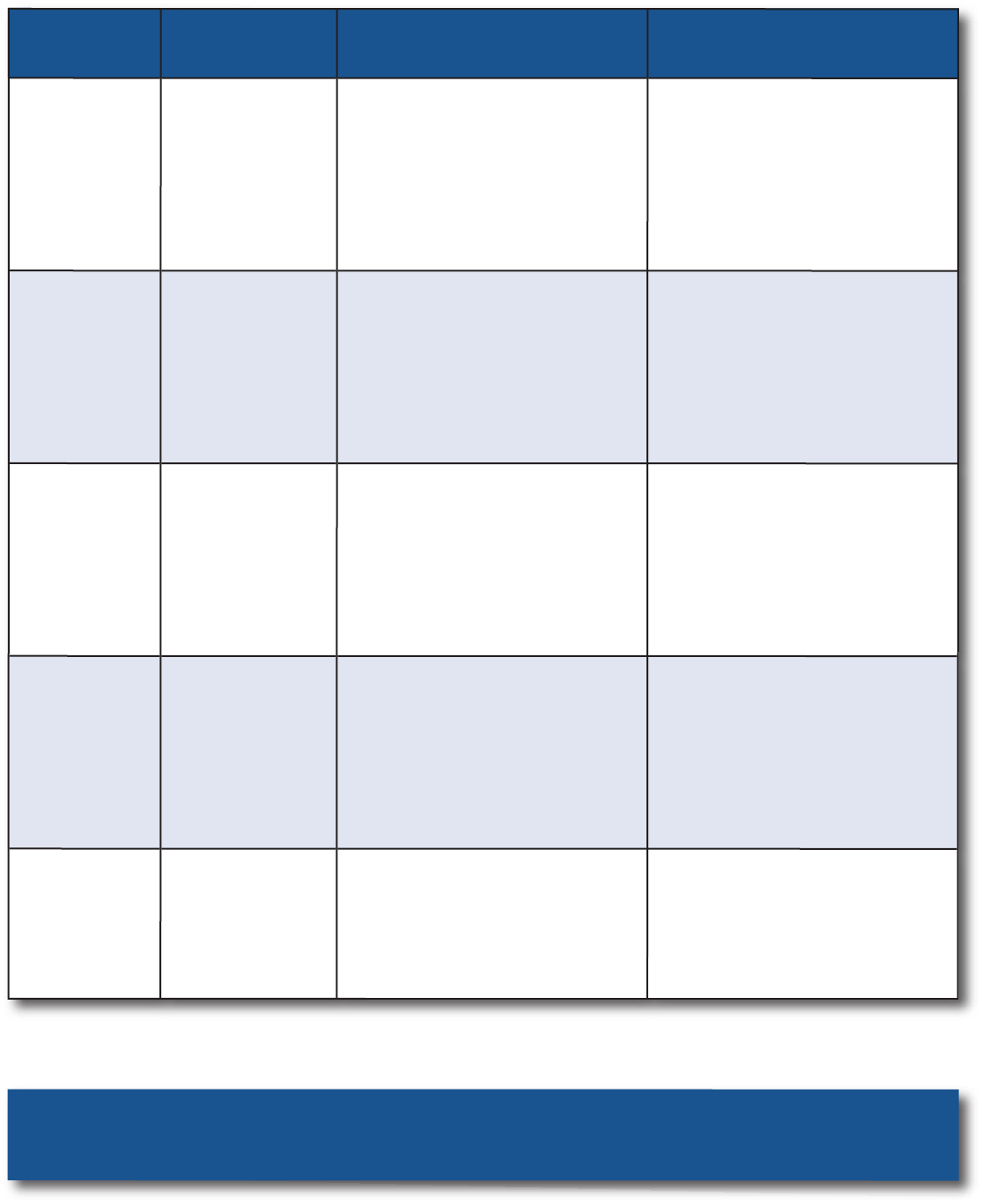

Launch Plan Proposal – Year One*

Brand Objective

Volume: _______________ Wtd. Distribution: _______________ Share: ________

Consumer Marketing Activities

Activity

1.

2.

3.

Rationale Cost

Trade Marketing Activities

Activity

1.

2

3.

Volume Cost

Listing Fees

Customer

1.

2.

3.

# SKUs, Space, Promotion Support Cost

Total Year One Volume Total Year One Cost Wtd. Distribution

Distribution Achieved with Above Spend Level

Customer

1.

2.

3.

Stores % Country # SKUs Volume (annual)

*Feel free to attach other pages to support your recommended launch plan.

26

Price Calculation Worksheet

Item Amount Comments

List Price (factory or port)

Compare to your domestic list price?

Avoid diverting risk.

Exchange rate Watch bank rate vs. distributor rate.

Freight (sea, truck or rail)

Target full containers.

Consolidation is costly.

Duties

Apply correct Harmonized (HS) code.

Confirm Free Trade Agreements.

Customs clearance, insurance Money and time!

Inland freight: port to distributor

Translate actual costs to case rate.

Avoid flat percentage rates.

Landed Cost

Product Stickering Select countries.

Listing Fees

Flat fee. One time only.

Usually not in calculation.

Marketing fund accrual

Typically, 10-20% of list price.

Part of calculation or manufacturers price.

Distributor Margin

Normal range: 15-35%.

Depends on size, complexity of brand, services,

and “what trade spend is included.”

Other Distributor Fees

Should be part of distributor margin.

Avoid hidden profit centers.

Price to Retailer

Fair and transparent model.

Incentives for large customers, extra performance.

Retailer promotions, incentives,

rebates

10 – 20% depending on the country.

Other Retailer Fees

At times for merchandising or central distribution.

Should be allocated from distributor margin.

Retailer Margin

Global average: 28%

Range: 15% -45% based upon category, brand.

Sales Tax/VAT

Included in price in many countries.

USA sales tax is on top of shelf price.

Consumer shelf price Everyday prices and promotional prices.

27

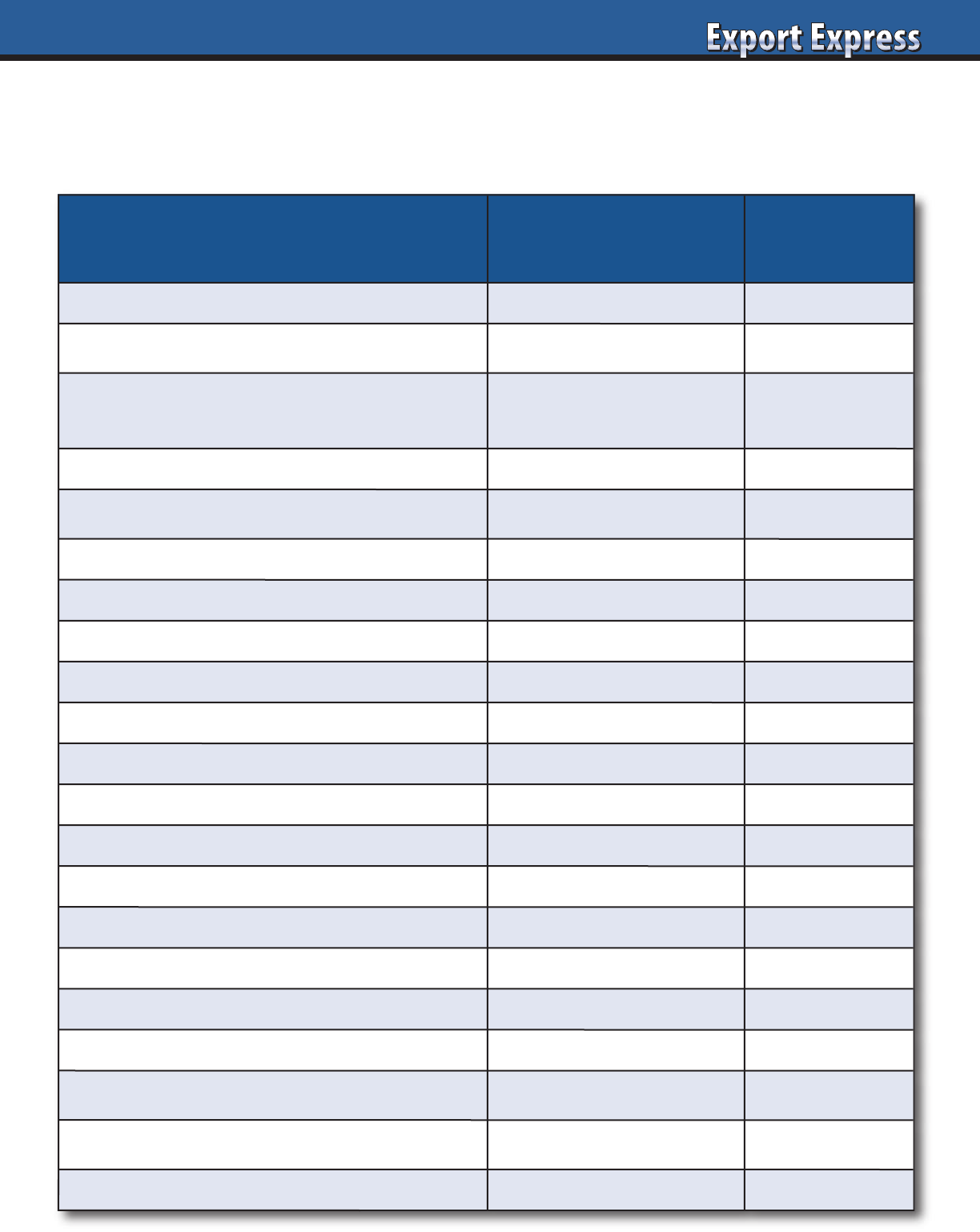

Cost Calculation Assessment*

*Ambient grocery example: Higher margins – Chilled and Health & Beauty products

Assessment Criteria

Global

Benchmark

Actual

Retailer: Everyday margin

20-35%

Retailer: Back margin (rebates,discounts)

0-10%

Retailer: Other margin

(Damage, merchandising, central warehouse)

0-5%

Total Retailer Gross Margin

25-40%

Trade Promotion (Manufacturer)

5-20% of net sales

Total Distributor Margin

15-35%

Warehouse/Stickering

2-4%

Delivery

2-5%

Total Distributor Logistics

3-7%

Key Account Sales

1-3%

Brand Management

1-2%

Merchandisers/Field Force

0-4%

Total Distributor Sales Team

4-6%

Administration

1-2%

Finance and Collections

2-5%

Overheads (office, IT, corporate)

2-5%

Distributor Promotion Investment

0-10%

Distributor Net Profit

2-5%

28

How much do you pay for a display or special promotion at

your top customer? Retailers from Argentina to Vietnam capture

manufacturers’ promotion money to drive sales and profits.

Brand development and market share are frequently

proportional to investment level. In the world of export, you

must “pay to play.” However, different models exist to fund

trade activities. Leading distributors confirm that they work

with a variety of different structures. “It’s all money” and the

key question remains: under which cost line do you want this

investment to sit in your price calculation?

Manufacturer Funded Promotion Budget

The classic approach is for the brand owner to develop a joint

business promotion plan with the distributor. A spending budget

is developed, funded 100% by the manufacturer. The overseas

distributor pays the local retailer and sends a billback to the

producer, with proof of performance. The rationale for this

practice is that the supplier owns the brand equity and can

change distributors. Distributors are reluctant to invest their

own margin into another companies brand.

Split Fund – “Skin in the Game”

In some cases, the brand owner and distributor split the

marketing plan costs, usually “50-50.” A further variation exists

where the brand owner covers the cost of consumer marketing

and the distributor pays for the periodic trade promotion

discounts. The philosophy is that the distributor will benefit

from higher sales and will also be motivated to execute

successful promotions if their own money is invested. This

structure appears most frequently with an existing brand,

with a minimum three year history of shipments. In reality, the

distributor calculates the expected investment and builds it into

his cost structure. A “50-50” shared model will usually not be

accepted with a new brand pioneered for the first time.

Best Price – Dead Net

Dead net pricing is the third model. In this scenario, a

manufacturer provides a distributor with his very best price.

The distributor builds in all promotional support and his margin

into his calculation. In this case, the manufacturer does not

receive a constant stream of requests for more promotion

funding. However, the brand may lose control of their pricing

model or be under supported if the distributor fails to promote

at adequate levels.

10% of Sales – $1/Case

Another common model is for a manufacturer to establish a fixed

funding rate per case sold which the distributor invests to build

the brand. Normal funding begins at 10% of case cost, but can

accelerate to 20% or more for a competitive category. Some

manufacturers offer a flat rate per case or amount per container.

As mentioned before, it ultimately converts to a pile of money

to invest in brand building. This approach functions best with

a brand with a current sales history, as percentages don’t mean

much when the brand has zero sales.

Listing Fees

These one time payments are primarily covered by the brand

owner as part of upfront launch costs. Sometimes these fees can

be rolled into introductory promotions, spread out over twelve

months, or paid via free goods. Please check out Export

Solutions’ article Ten Tips: How to Minimize Listing Fee Payments

for more ideas on how to reduce these payments.

Most Effective Promotion Vehicles

Every key account manager should know the best promotion

vehicles to drive incremental sales at their customer. At some

supermarkets, promotional leaflets drive tonnage. At others,

deep discounts (30% +) or displays are winners. Distributor sales

teams are market experts and can source best practices from their

other brands.

Post Promotion Analysis

Tools are available to measure promotion effectiveness. These

evaluate sales lift, boost in baseline consumption, and cost per

incremental case. A good idea is to analyze mutiple scenarios

such as different price points, seasonality, and display support.

Creativity Counts

Many of the best trade promotion success stories involve field

activated promotions. This allows a brand to break through

the clutter of too many “me too” events. The sales team

maintains ownership and enthusiasm to drive support. Another

positive strategy is aligning with a retailer’s favorite charity

to contribute to the community while building your brand.

Manufacturers must avoid the dull routine of repetitive

15% trade promotions. Boring!

Key Issue – Distributor Underspends

Distributors are businesses, aimed at achieving a fair profit, just

like your company. A risk occurs whenever distributors claim

responsibility for managing the trade discount plan for their

country. At times, these trade discounts can be under spent

versus category and brand requirements. For example: when a

distributor says that he will fund four promotions per year, does

that mean at a 10% level or 30% level? Will the distributor funded

promotions be for all channels and retailers or just a few

customers? How do you know?

Compliance and Audit

Most distributor contracts include provisions for audit of trade

promotion payments. Larger suppliers include trade promotion

payment software. Good practices are complex and require piles

of paperwork. A core message is that the “distributor respects

what the manufacturer inspects.”

Export Trade Promotion Funding

29

Create Your Own Export Library

Looking for a fresh point of view for your

next event or training workshop?

Contact Greg Seminara at

greg@exportsolutions.com

All guides available free at www.exportsolutions.com.

Export Strategy Guide

Distributor Search Guide

Export Handbook

Selling to USA Handbook

Distributor Management Guide

Finance & Logistics

300 Tips for

Export Managers

Idea Guide:

New World – New Business

Export Treasure Chest

My Favorite Templates & Forms

People Power

Strong Teams Build Great Brands

New Distributor

Cooperation Model

30

Is it time for a fresh look for the new year?

The 2020 pandemic redefined business

practices. We witnessed a global surge in

e-commerce and spent our days locked

down in our home offices on Teams

or Zoom meetings. Despite the new

dynamics, many companies remained

glued to the old marketing playbook. The

first quarter of 2022 delivers a gift of time to brandscape. Below are five

areas to consider as you refresh your export strategy and credentials.

Web Site

When was the last time that you updated your web site? Does your site maintain

a modern, inviting, look and feel? Are your products updated? Is there a page dedicated

to your international presence and export team? Add your bio and photo to create

a personal connection. Update your contact us template to make it easy for potential

distributors (or brand owners) to share their company information. Your web site is

the first place that a prospective distributor or supplier will look when evaluating

your company.

E-Commerce

E-commerce sales grew by 40% and will only become larger. However, many companies

do not fully address their e-commerce capabilities and game plans in their presentations.

Managers should evaluate each element of their business model to highlight the impact

of e-commerce. Adapt your presentations to discuss Amazon success stories, special

e-commerce packs, and digital marketing skills.

2022 Company Credentials

Distributors and brand owners regularly participate in new business “pitches.”

The typical move is to dust off the old presentation and swap logos without a proper

refresh. Consider revising your presentation to a modern 15 page deck. For suppliers,

start with a one page fact sheet, listing sales, history, employees, etc. Follow with

pages on your product portfolio, export success, and most importantly, strategy and

investment plans for the new country. Distributors should also concentrate on basic

company facts, organization chart, channel and customer coverage, and approach to

brand building.

Training

Many export managers and distributors delivered a new commitment to training

facilitated by web based platforms. It is now easy to conduct web training remotely, even

adding resources and experts from your company headquarters. Why not create a new

training module to share with your distributors? Add excitement, entertainment, and

engagement to supplement the learning. Don’t forget to send product samples, even if

the training is virtual.

LinkedIn

Brandscaping includes “brand you.” Over 800 million business people are registered on

LinkedIn and I assume that includes you. When was the last time that you updated your

photo, background, or profile? Or shared an article of interest or “liked” a post from a

colleague? LinkedIn is an important marketing tool, not just a site for job search.

Most expect another four to six months before regular business travel resumes.

This presents a perfect window to brandscape your marketing toolkit before the race

back to the airport. I followed my own advice and launched a new web site which makes

it easier for readers to access my 15 free Export Guides and more than 200 articles and

templates on export development. Please visit www.exportsolutions.com and let me

know if you like our new look.

www.exportsolutions.com

Greg Seminara

“Spend Time Selling to Distributors versus Searching for Distributors”

Brandscaping

Strategic Services

Contact Us for

Export Solutions

1. Identify Best in Class

Distributors: 96 Countries

2. Best Practices

Export Strategy

3. Distributor Management

Workshops

4. Export 101:

Let’s Get Started

5. New Market

Prioritization

and Launch Plan

6. Personal Distributor

Introductions:

96 Countries

7. Walmart International

8. Distributor Contracts,

Margins, and Fees

9. Meeting Speaker

10. International

Strategy Expert

Strategic Services

Contact Us for

Export Solutions

1. Identify Best in Class

Distributors: 96 Countries

2. Best Practices

Export Strategy

3. Distributor Management

Workshops

4. Export 101:

Let’s Get Started

5. New Market

Prioritization

and Launch Plan

6. Personal Distributor

Introductions:

96 Countries

7. Walmart International

8. Distributor Contracts,

Margins, and Fees

9. Meeting Speaker

10. International

Strategy Expert

31

A big difference exists in export strategy for SMCG (Slow Moving Consumer Goods) and companies committed

to FMCG Brand Building (Fast Moving Consumer Goods). Either model is okay. Many companies are en route

between SMCG and FMCG. Alignment between aspiration, investment, and perspiration drives realistic outcomes.

Export Journey: SMCG to FMCG

SMCG FMCG

Aspirations Niche Participant Mass/Leader

Consumer

Homesick Upscale Local

Research

None Nielsen Consumer

Portfolio

Best sellers from

home market

Best sellers from

home market

Tailored to region

or country

Packaging

Standard packs stickered Multilingual

Local language label

and pack size

Factory

Corporate HQ Corporate HQ Offshore

Pricing

Super Premium Premium Competitive

Marketing

None Sampling, Digital

360 Plans

TV, Digital

Trade Spend

None 10-20% Discount

Ad, Display

20-30% Discount

Route to Market

Niche distributor Mid -size distributor

Mass distributor or

subsidiary

Country Focus

Adjacent

Homesick Expats

Mid-size countries

plus USA

All countries

USA, China, Brasil

Channels

E-Commerce

Homesick Expats

Supermarket

E-Commerce

All channels

Oversight

1 visit/year from HQ Regional manager Dedicated country manager

Complexity

Low Moderate High

32

Brand owners express frustration at the

lack of response from distributors to

their representation inquiries. Qualified

distributors are flooded with emails from

companies looking for new distributors

to handle their unknown brands. It’s

difficult to convince massive retailers

to take a chance on a new brand without

a proven track record. It’s even tougher

to persuade the owner of a mid-size

distributor to write a check for the first

order of your product, particularly if

you are not committed to a significant

marketing campaign. Brand building

from ground zero requires one-two years.

Research reveals that approximately 20

percent of new products are still on the

shelves two years later. Listed below are

Export Solutions’ tips on increasing your

chances that your new brand will be a

“Gold Mine” for a successful distributor.

Distributors: Always Looking for New Brands

Every distributor is looking for new

brands. Distributor profitability rises

exponentially when they add new

business. New business allows them

to leverage their fixed costs of warehouse

space and sales teams. Most distributors

search for adjacent brands that

complement their existing portfolio.

For example, confectionery specialists

look for other snack items that may be

purchased by the same buyer and are

located in the same aisle as their current

brands. Distributors need new

companies, as all distributors (even

the good ones), lose brands due to

acquisition, performance, or direct

models. The key is to position your

new brand opportunity as an attractive

addition to the distributor’s portfolio.

What Every Distributor Wants to Know

While you rave about your brands

superior taste, the distributor has

three thoughts on his mind :

1. How much money can he make

representing your brand?

2. Will it be tough to secure

market acceptance?

3. What will the brand owner commit

to in marketing investment?

Manufacturers that position their

proposition in these terms have a better

chance of gaining market acceptance.

Review Export Solutions’ article “How

to Excite Buyers, New Product Checklist”

for an independent product assessment.

Resistance to Pioneering

New product launch cycles require up

to one year from time of first distributor

meeting until he receives retailer payment

for his first order. During this incubation

period, the distributor must allocate his

sales and marketing resources to your

company without compensation. This

time dedicated to your company is

sourced from their other brands that are

currently generating income. Access to

the shelf does not guarantee consumer

trial and repeat purchase. A distributor

may buy your brand, capture shelf space,

and suffer disappointment when the

product does not sell. Unfortunately,

these pessimistic comments reflect reality

and provide insights on why best in class

distributors are hesitant to pioneer.

On the Road to Gold Mine

How can brand owners overcome

distributor resistance to pioneering?

Distributors are impressed by large

companies and brands that have been

successful in adjacent countries. Some

distributors will accept a product that

offers some existing market penetration

with the belief that their stronger team

can drive the business to the next level.

Manufacturer commitment to a powerful

marketing program sends a loud message

that you are serious. For mid-size

manufacturers, offering a small monthly

pioneering fee ($3,000 - $7,000)

demonstrates that you are a patient

partner, willing to co-fund the launch

preparation until distributor sales begin.

At the end of the day, distributors look for

a strong partner, with a good track record,

and a firm financial commitment to

support youir mutual marketing efforts.

How to Find an Enthusiastic Partner?

Export Solutions compiled an extensive

Distributor Search guide covering all

aspects of the distributor search process.

In pioneering scenarios, it is critical to

consider a wide variety of potential

partners. Schedule a one week trip to a

country. Plan to visit at least 5

distributors. Most distributors will be

open to an introductory meeting with an

overseas principal if you are professional

in your approach. Referrals from your

local government trade support contact

or another one of their current brand

owners helps pave the way. Trade shows

also generate leads from interested

distributors. Post a large sign saying:

Distributors Wanted, listing countries

of interest. This will encourage visitors

to stop and chat.

Pioneering is tough but not impossible.

In reality, creating new brand sales from

a zero base is the essence of the Export

Manager’s job responsibility. Fortunately,

Export Solutions’ database covers more

than 9,200 distributors looking for

opportunities. Good luck!

Pioneering: A Gamble, Not a Guaranteed Gold Mine

33

Your new product launch is a big deal, comparable to the birth of

a child. The first days are critical if you want to raise a “healthy

brand.” Listed below are Export Solutions’ ten tips for launching

your company for the first time to a new distributor or

expanding through a new product introduction.

Firm Calendar

Distributor and brand owner should align on a “firm calendar.”

This includes dates for sales materials development, launch

meeting and key account calls. All dates are dependent on arrival

and customs clearance of the first order. No product, no meeting!

Get Ready

Allow adequate time for printing of point of sale materials

and development of key account presentation. In some cases,

translation or local adaptation of brand owner supplied tools

may be required.

Memorable Meetings

I still remember motivational meetings with themes around

boxing and magic. Create new memories with a special theme or

an external speaker. Off-site meetings contribute to making your

launch special, with an added sense of commitment. Have fun!

Mandatory Attendance

The distributor CEO, brand manager, and export manager must

all attend and have speaking roles. Best is to have one meeting

with sales and merchandising teams together. However, in some

cases, a follow up meeting may be required. Invite logistics,

finance, and customer service people to make it a “team effort.”

In-Store Objectives

Establish clear measures for in-store presence. This includes

shelf positioning, space allocation, pricing, and off-shelf

merchandising. Share a photo. What qualifies as a “good store”

versus a “bad store?”

Frequently Asked Questions

Prepare a list of potential questions and logical responses.

Role play with the team. Share a printed one pager with

sample answers to tough questions.

Samples, Samples, Samples

Provide generous quantities of samples for all distributor

employees to enjoy and take home. Prepare recipes if your

brand is a food product. Samples are your best advertisement.

Personal Goals

Each team member should have personal goals for your launch.

For a key account sales person, this could be acceptance of the

core product lineup. A retail merchandiser could be assigned

a target of a specific number of stores with displays or eye level

shelf placement. For the launch, focus on implementation goals

versus case shipments.

Key Account Calls

In many countries, large supermarket chains dominate sales.

Develop a personal strategy for each key account. What are

the buyers internal goals? How do we fit with the chains

consumer base and plans? Which chain “push” programs can

we participate in? Schedule a “lead call” with an easier key

account to get feedback that will help you with a tougher buyer.

Invite the export manager or distributor MD to participate in the

sales call if it will help.

Audit

Schedule a retail audit of stores to coincide with the expected

retail availability of product. Bring other people from the brand

owner’s company and have 2-3 teams auditing the market

against a specific set of goals. Visit secondary cities, not just the

stores around the distributor’s office. Recognize that conditions

will not be perfect and celebrate progress to date.

New Product Launch: Ready, Set, Grow – Ten Tips

Need more information? Visit www.exportsolutions.com.

34

Export Solutions’ New Distributor Checklist

____ Contract/Agreement

____ Price Calculation Model

____ Business Plan: objectives, marketing,

spending, key dates

____ Category Review: Pricing, Shelf,

Assortment, Merchandising

____ Label Compliance

____ Shelf Life

____ Order Lead Time

____ Minimum Order

____ Pick up Point

____ Payment Terms

____ Payment Currency

____ Damage Policy

____ Product Registration

____ Forecast: Year 1

____ Pipeline Order & Inventory

____ Brand Facts

____ Product Samples

____ Appointment Letter

____ Brand Specifications in System:

Distributor & Customers

____ Training: Key Account Managers,

Retail, Administrative Staff, Warehouse

____ In Store Standards: Pricing, Shelf

Management, Merchandising

____ FAQ’s/Handling Common Objections

____ Key Account Presentation

____ Customer Appointment Dates

____ Category/Business Review:

Tailored to Each Key Account

____ Retail Sales Contest

____ Checkpoint Calls

____ Market Audit Date

____ Reporting: Track Distribution, Pricing,

Shelf Positioning, Merchandising, etc.

3 History of Success pioneering other international brands

3 Strong retail presence for current brands handled

3 Logical launch plan, category analysis, and cost structure

3 Positive references from existing brands and Dun & Bradstreet

3 Enthusiastic about your brand and the business

Greg's Guidance: Distributor Assessment Criteria

35

Distributors are flooded with requests

for representation of brands from

around the world. Normally, these

presentations are jammed with pretty

photos and long stories about the

company’s history. Brands will receive

better response with a fact based,

company credentials presentation

focused on “what distributors and

buyers really want to know.” Export

Solutions recommends that brands

create two versions of your credentials

presentation: a ten page detailed

presentation and a one page summary.

Recapped below are our ten tips

on developing a strong company

credentials presentation to attract

interest from distributors and

buyers anywhere.

1. Just the Facts:

Page 1 should include basic company

facts. Annual sales, ownership, number

of employees, and key categories

and brands.

2. History

Tell the story of when and how the

company was founded. This is your

chance to seduce the audience with a

captivating story. Learn to tell the story

in one page with no company videos

or DVDs (boring!). Provide a longer

version of your history and milestones

on your company web site for those

who want more information.

3. Brand USP

This is the place for pretty pictures

of your brand and the opportunity to

demonstrate your category expertise.

Why is your brand different? How do

you compare with current category

assortment? List any awards or

recognition for your company.

4. Current Export Markets

Share countries where your brand is

currently available. Segment between

core markets where your brand is

strong and others where you maintain

niche status. What is the rationale for

entering the distributor’s country?

5. Distributor and Retailer Partners

Highlight well known distributors

currently serving as your partners. List

retailers who currently sell your brand.

Logos work well.

6. Success Stories

Focus on recent examples of your brand

building results. Mention specific retailers

or distributors if examples are well

known retailers or in adjacent countries.

7. Investment Strategy

Distributors and buyers demand critical

information on how you plan to generate

consumer awareness, trial, and repeat

purchase of your product. Their

interest will match your level of

financial commitment.

8. Team Resources

Publish photos of your export team.

This includes marketing, finance,

customer service, and logistics experts.

List years of service for each team

member to demonstrate that you have

a strong support organization to build

the business.

9. Sync With Web Site

Your credentials presentation should sync

with information on your web site. In

reality, your web site is the first place that