Frustrated by international shipping

issues? Look next door to Canada.

Canada purchased $25 billion of USA

agricultural products in 2021, a 12%

increase versus 2020. Ninety percent

of Canada’s population lives within

100 miles of the USA border, less

than a one-day truck delivery from

northern USA distribution centers.

The USMCA was approved in 2020

to replace NAFTA and facilitate trade

between USA, Canada, and Mexico.

Canada’s GDP ranks tenth in the world,

larger than Russia, Spain, or Australia.

Companies looking to expand their

international business should consider

Canada a friendly neighbor and

a growing country approaching

39 million people.

Opportunity Gap

Most USA and European companies

market their brands to Canada today.

A simple benchmark is the 10% rule.

USA brands should measure their

Canadian success in terms of sales per

capita versus the USA. Companies

achieving results in Canada at 10% of

the USA are performing in line with

market potential. However, a deep

analysis typically reveals that the

Canadian business is underdeveloped,

with Canada sales penetration at

30-50% of the USA. Asian and

European brands also perform well, as

Canadian newcomers are often “first

generation,” still homesick for their

favorite brands.

Insights to Accelerate International Expansion

Summer 2022

Volume 14 Issue 3

Our Mission: Help Manufacturers “Spend time Selling to Distributors versus Searching for Distributors”

In This Issue

Looking for New

Distributors?

How about 9,300? Export Solutions’

distributor database has helped 3,000

brand owners in 14 years speed up the

process of finding qualified distributors.

Our database covers an average of 85

distributors per country of supermarket

type products for 96 countries. Search by

country, category, brand name, or country

of origin. Experts for Europe, Middle

East, Latin America, and Asia with

complete regional coverage. “Spend

time

selling

to distributors versus

searching

for distributors.”

Good Neighbor, Great Customer

Page 2

Elevate & Activate

Page 4

Export Today: Tackling 5 Tough Issues

Page 5

Are You a Distributor Helper?

Page 8

FAQ’s

– Distributor Database

Page 10

Export Manager Report Card

Page 11

Export Journey: SMCG to FMCG

continued on page 7

2

Many export managers are dedicated to

market expansion in far flung lands. We

celebrate new listings at international

retailers, sometimes forgetting that the

real development work has just begun.

True success is measured by the “second”

order at any customer.

Recently, I spent the day checking stores

with a leading European brand owner.

Fortunately, my client enjoyed presence at a handful of high-profile chains

visited. Most of our initial discussions focused on securing placement at the “next”

group of supermarkets. Yet, brand placement at current customers was frequently

towards the bottom of the shelf, with limited facings and no promotion. Ultimately, we

concluded that there was probably a bigger business opportunity improving our shelf

presence and in-store visibility at current customers versus chasing new ones.

Export Solutions’ “Elevate and Activate” strategy challenges brands to focus on the

fundamentals of store level execution to enjoy incremental volume gains.

1. How do you determine a “good” store vs. a “bad” store?

Each company should publish in-store presence guidelines for each of their brands.

These objectives should be shared at a distributor merchandising training session so

your team is clear on in-store goals. Adjust expectations to reflect local conditions.

2. Eye Level is the gold standard.

Most brands battle for placement on the desirable eye-level shelf. International brands

tend to be premium, delivering higher “penny profit” per unit sold. Normally, retailers

prefer to allocate eye-level space to their most profitable brands. Where is the most

common shelf location for your brand?

3. Activate excitement at the point of purchase.

Each store offers an opportunity to improve and offer the consumer a reason

to buy. High impact price promotions are a reliable but costly tactic. Other options

include point-of-sale placement or taking shelf stock to create a co-promotion with

an adjacent brand already on display.

4. Spend a day at retail with your distributor.

Improving shelf conditions is not an office activity. Schedule a day in the field with your

distributor retail manager and brand manager to discuss practical solutions “store by

store.” Request that the store visits reflect reality, not just the best outlets that have been

spruced up for your VIP “red carpet” visit.

5. What’s measured is treasured!

Implement a universal methodology for store evaluation. Export Solutions created

an “Is this store a 10” program, which can be adapted for any company in any country.

Consider a retail sales contest to motivate store level representatives.

Each year presents tough challenges for incremental volume growth. Focusing on

creating more retail “elevation and activation” at existing customers represents a proven

strategy for brand-building success.

Good Luck!

Strategic Services

Contact Us for

Export Solutions

1. Identify Best in Class

Distributors: 96 Countries

2. Best Practices

Export Strategy

3. Distributor Management

Workshops

4. Export 101:

Let’s Get Started

5. New Market

Prioritization

and Launch Plan

6. Personal Distributor

Introductions:

96 Countries

7. Walmart International

8. Distributor Contracts,

Margins, and Fees

9. Meeting Speaker

10. International

Strategy Expert

Strategic Services

Contact Us for

Export Solutions

1. Identify Best in Class

Distributors: 96 Countries

2. Best Practices

Export Strategy

3. Distributor Management

Workshops

4. Export 101:

Let’s Get Started

5. New Market

Prioritization

and Launch Plan

6. Personal Distributor

Introductions:

96 Countries

7. Walmart International

8. Distributor Contracts,

Margins, and Fees

9. Meeting Speaker

10. International

Strategy Expert

www.exportsolutions.com

Greg Seminara

“Spend Time Selling to Distributors versus Searching for Distributors”

Elevate & Activate

3

Introducing

America’s Favorite Brands

Executive Board

Export Solutions Smucker’s Tabasco

Greg Seminara, CEO Danny Berrios, President Megan Lopez, Vice-President

General Mills Sun-Maid

Eric Saint-Marc Carsten Tietjen

Advisory Board

Bazooka Candy Blue Diamond Bob’s Red Mill Bush Beans

Santiago Ricaurte Dale Tipple Jan Chernus Dave Bauman

Campbells Church & Dwight Duracell Ferarra Candy

Julio Gomez Arun Hiranandani William Vera Daniel Michelena

Heartland Idahoan Johnsonville Sausage Kao USA

Tom Theobald Ryan Ellis Cory Bouck Julie Toole

KDRP –Motts Mizkan Reynolds Welch’s

Billy Menendez Noel David Chris Corey Marc Rosen

20 Companies | 200+ Top Brands | $85 Billion Combined

Connect | Learn | Share | Grow

View our activities for export managers – www.usafoodexport.com

Export Today: Tackling 5 Tough Issues

4

The Covid pandemic sparked

generational lifestyle changes impacting

how we live, work, eat, and shop. Volume

remains stable for now, yet all companies

face unprecedented inflationary pressures

redefining our pricing and margin

framework. Businesses thrive with

innovation, but ultimately cash flow

determines the health and direction

of our business.

Export Solutions explores the 5 key

issues impacting international

development today.

1. Supply Chain

Retailers can’t sell what is not in stock.

Six weeks is no longer considered “safety

stock” for overseas distributors. Most

export success strategies involve

distributors taking longer inventory

positions, up to sixteen weeks in some

cases. This allows distributors to serve

as “super suppliers” with inventory

when others are out of stock. The strategy

can function if all stakeholders closely

watch product expiration dates, weekly

“sell out,” and the cost of financing the

extra inventory.

2. Pricing

What will your shelf price be on January 1?

As discussed, there is a delicate balance

required for managing the four margins

between factory and shelf: brand owner,

distributor, retailer, and promotion. All

participants have a vested interest in

offering consumers a “fair value” price

that reflects market reality, but avoids

the sticker shock of a 20-30% increase

versus last year. Distributors point to a

solution where each participant displays

flexibility. This could

include a scenario

where a manufacturer

delays a price increase

several months, a

distributor sacrifices

some gross margin,

and the trade agrees

to protect penny profit,

but take a lower

margin. Promotion

spending is a key

variable, as many

distributors deploy

promotion funds to

offset or delay the

price increase.

3. Who is Your Team?

Tough discussions require managers to

abandon their comfortable home office for

life at the airport again. I advocate that an

investment in a locally based manger may

represent a higher investment priority

than an increased marketing budget. To

succeed in the USA (European brands),

Saudi Arabia, and China you must hire an

in-country representative glued to market

issues. Additionally, please select a local

expert as your manager, not someone

from your country living abroad on

a three-year adventure.

4. Elevate & Activate

Bigger opportunities appear through

improved in-store execution in existing

markets than chasing dreams in China,

Indonesia, or Brasil. Our page 2 column

shares practical strategies to elevate and

activate your brand’s presence at current

supermarket and e-commerce customers.

5. 2023 Plans

How will you budget for 2023? First

half 2022 results may inspire a false

confidence for 2023 plans. Conservative

thinking forecasts a 2023 recession, as

price increases finally translate to shelf

tags. Cash-starved consumers retreat

to the basics, burdened by higher living

costs everywhere. Fortunately, everyone

still eats and appreciates an affordable

food luxury. I appear optimistic for the

Middle East and Asia, neutral on Europe,

and pessimistic for Latin America

(outside Mexico). An upside exists if the

war in Ukraine ends and oil prices return

to historical levels closer to $75 per barrel.

No year is easy, and 2023 could feel the

deep pain from inflation. A bright note

emerges signaling that the dramatic

limitations caused by the pandemic

are slowly diminishing. Our lives are

changed forever, but at least we can

travel to resume the critical face-to-face

discussions of business development.

Talk to an Expert

• Find Distributors in 96 Countries

• International Strategy Road Map

• Fix Problem Markets

• Entry Plans

• Online Export Workshops

• Motivational Meeting Speaker

Contact Greg Seminara at (001)-404-255-8387 to discuss your business development project.

www.exportsolutions.com

5

Are You a Distributor Helper?

Successful distributors represent 20 companies or more. A challenge is the battle for distributor resources.

How do you motivate a distributor to focus on your priorities? A leading European Distributor CEO (thanks William)

reported that "they invest in companies that invest in them." What's important to the distributor?

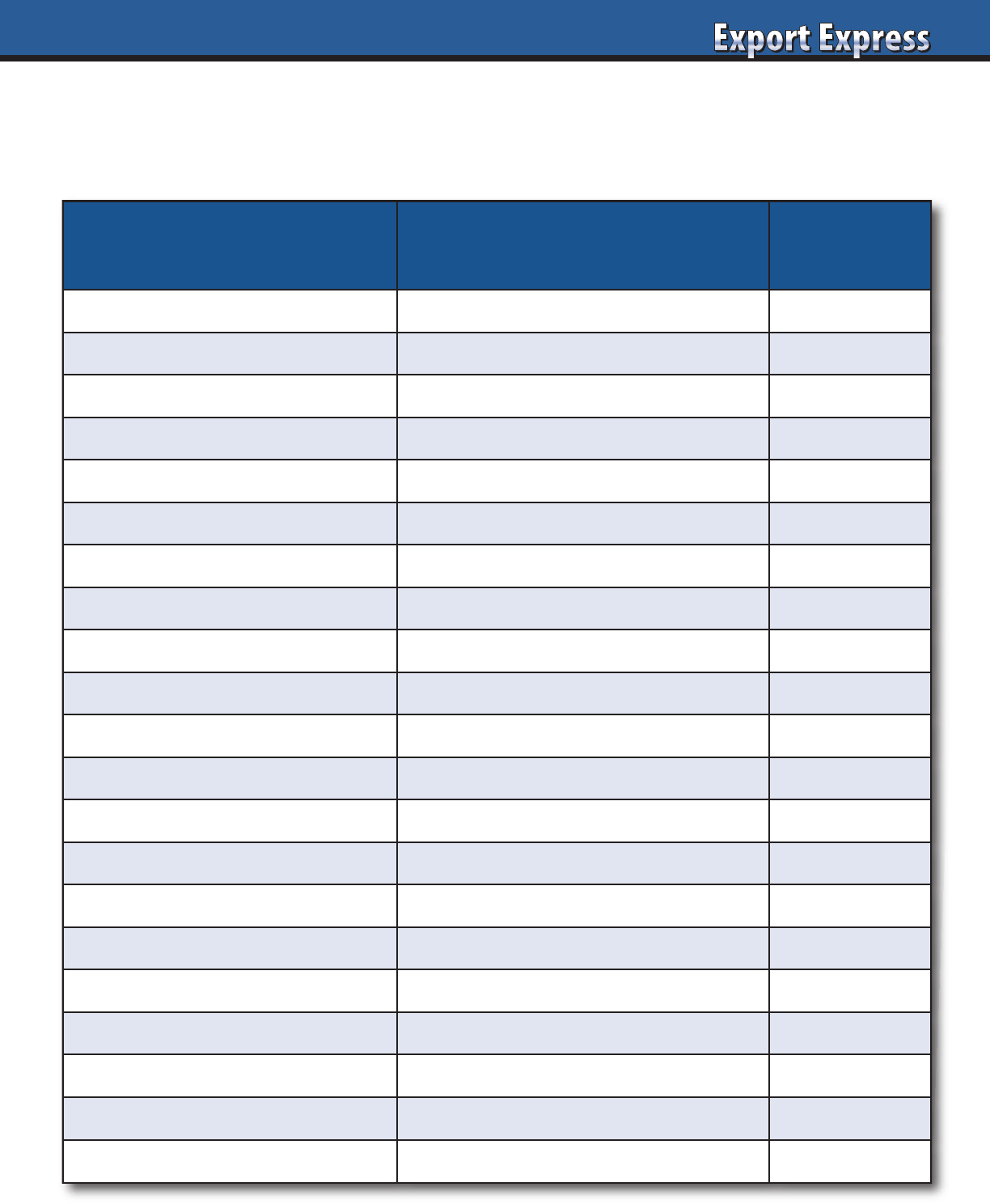

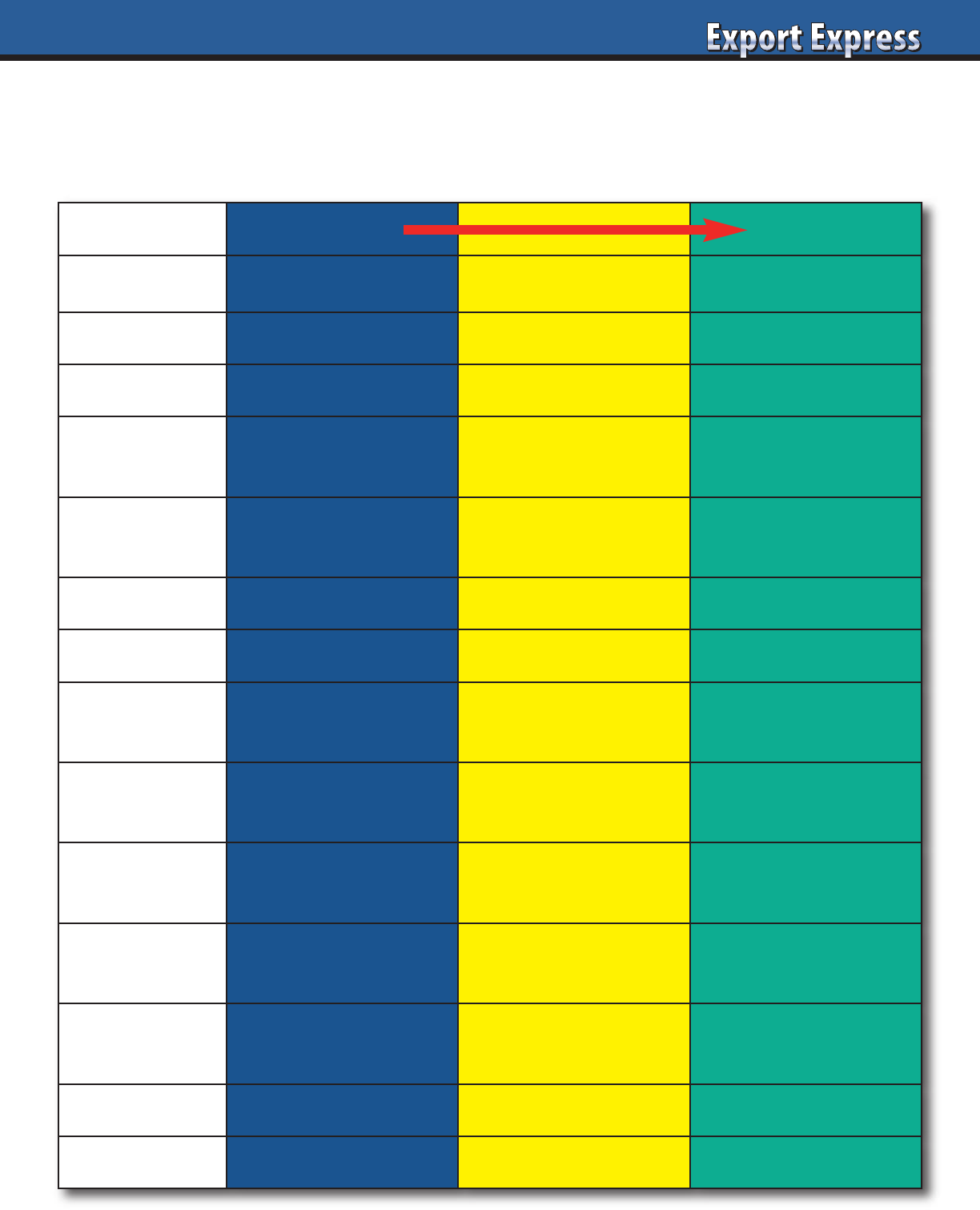

Supplier Assessment Considerations

Rating:

(10 = Best)

Market Research Local consumer research, syndicated data.

Supplier Visit Frequency Weekly, quarterly, annually?

Marketing Spend Zero to 25% of sales.

Total Team Relationship

Knows entire team, not just CEO/BM.

Export Manager Experience New hire to 10 years or more.

Logistics Service Level Target 98% on time, complete orders.

Customer Service Same day response to one month reply.

Product Innovation Delivers breakthrough new products.

Company Functional Experts

Supplies access: IT, supply chain, marketing.

Awards/Thank You Celebrates success with whole team.

Local Marketing Events

Invests in local ideas. "Shows up."

Supplier Portal

Brand facts, presentations, insights.

Customer Relations

Key customer favorite to avoid calls.

Sales Contest

Motivates/links with sales team.

Invitation to Headquarters VIP HQ invite or regional meeting.

Category Expertise

Shares best practices from other countries.

Social Media Content

Supplies quality, user-ready content.

Currency/Terms/Billbacks Two-way street. Open book.

Senior Management Relationship

CEO establishes distributor relationship.

Respects Distributor Margin Healthy distributor is profitable.

Achieves Results Culture of mutual growth, partnership.

6

Distributor Search Helper for:

Your

Logo

Here

Can We Help You?

Recent Distributor Search Projects

Asia Europe Middle East Latin America

Australia Germany Israel Argentina

China Ireland Kuwait Brazil

Indonesia Netherlands Qatar Colombia

Japan Nordics Saudi Arabia Costa Rica

Malaysia Spain UAE Ecuador

Philippines United Kingdom North America Mexico

Singapore Africa Canada Panama

South Korea South Africa United States Peru

Call the Export Accelerator!

Contact Greg Seminara at greg@exportsolutions.com

to discuss your business development project.

www.exportsolutions.com

One Country: Five Regions

Canada is the world’s second largest

country, stretching almost 4,700 miles.

Ontario is a multicultural province.

Toronto is a global city, like New York,

hosting citizens with roots in Italy, the

UK, and Asia. Quebec maintains strong

cultural ties to France. On the west coast,

Vancouver is an energetic gateway with

many Asians and sharing similarities

with the USA’s Pacific Northwest region.

The Prairie provinces of oil-rich Alberta

plus Manitoba and Saskatchewan feature

similar characteristics to the Great Plains

states of the USA. All are proudly

Canadian, but maintain regional lifestyle

and food habits impacting our industry.

3 Chains: 39 Banners

Loblaws, Sobey’s, and Metro dominate

the supermarket channel. All three serve

as retailers and wholesalers serving

multiple banners, channels, and formats.

For example, the Loblaws banner covers

only 59 stores, primarily in the Toronto

area, while their No Frills price-impact

format features 274 stores across multiple

provinces. Costco and Walmart dominate

their channels featuring a mix of Canadian

brands and international favorites.

Success Stories

Many companies look to Canada as a top

country for export sales. This includes

multinationals such as General Mills,

Campbell’s, and Smuckers, as well

as other icons such as Bob’s Red Mill,

Tabasco, and Bush Beans. The common

ingredients are strong key account

management, winning the shelf battle

at regional banners and investment in

retailer activation programs.

Distributor vs. Broker

There are several route to market models

available in Canada. There are a wide

variety of specialist importer/distributors

plus North American style food brokers.

Other hybrid models include formation

of a small direct key account sales team,

with financial and logistics services

provided by an expert like Thomas, Large

& Singer. All models can succeed, but

best practices involve having at least

one employee on the ground in Toronto

(or Montreal) to manage the business

from the Canadian side of the border.

Currency & Compliance

Today, one Canadian dollar is valued

at US 77 cents. This falls within a

historical range. However, all must pay

close attention as the exchange rates have

fluctuated between .69 to Canadian 1.03.

There have been examples of companies

suffering when not aligning pricing with

currency movement. Canada requires

bi-lingual labels. The US FDA and

the Canadian CFIA and Health Canada

recognize that each organization

maintains comparable health safety

systems. Labeling requirements are not

identical, but most companies are able

to align to Canada standards.

Export Solutions Can Help!

Our distributor database supplies

information on 205 Canadian distributors

across all category specialties and core

provinces. We also track 76 retail and

foodservice brokers. As noted, there are

many customers beyond the top five.

Our retailer database covers 95 Canadian

retail banners, including 17 supplied by

Loblaws, 13 from Sobeys, and 9 Metro

banners. We have completed more

than ten route to market and business

development consultancy projects, making

Canada an area of core competency.

Canada: Export Hero

Many companies are frustrated by

the surging costs of containers and

challenges of marketing premium

products to emerging countries.

We all market to Canada, but many

companies may generate a higher

return on resource investment here

versus chasing far flung markets.

Canada is not easy, but represents a

growing country, with a diverse food

culture, open to innovative brands from

the USA, Asia, and Europe. Plus a visit

to Canada allows you to meet nice

people, visit Niagara Falls, and enjoy a

doughnut at Tim Horton’s. Good luck!

Good Neighbor, Great Customer

continued from page 1

7

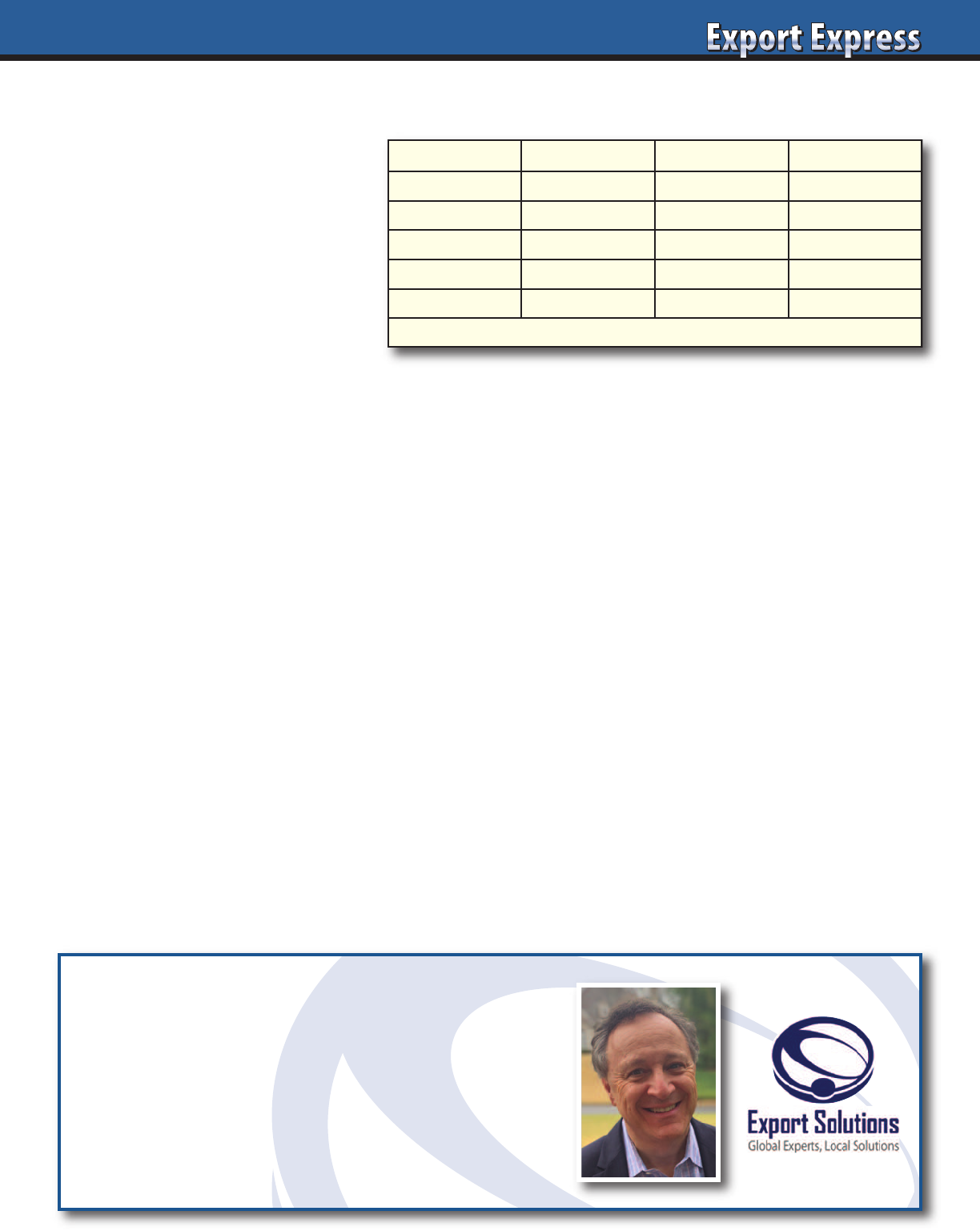

Sales* Banners Stores

Loblaws 41 17 2,439

Sobeys 23 13 1,970

Metro 14 9 1,612

Costco 30 1 106

Walmart 23 1 408

*billions of US$, includes drug stores

Export Solutions Can Help!

• Distributor Search helper in 96 countries

Contact Greg Seminara at

greg@exportsolutions.com

or (001)-404-255-8387

www.exportsolutions.com

8

Why did you create the distributor database?

Export Managers dedicate a lot of time

to networking, always searching for good

distributor recommendations. We waste

precious time at trade shows speaking to

“pretenders” with no hope of adequately

representing our brands. I thought that

the supermarket industry could benefit

from a global distributor database to

instantly find the leading distributors

in any country.

How did you compile the distributor database?

Export Solutions sources distributor

candidates using six specific strategies.

This includes having access to the global

distributor lists of more than 300 brands

and store checks in at least 25 countries

per year.

How accurate is the contact data?

Export Solutions’ distributor database is

updated every day! Distributor company

names, web sites, and specialization

rarely change. This makes the database

98% accurate at the company level. The

distributors’ key contact for new product

inquiries and their email addresses

may change as a result of job moves.

Email address accuracy ranges from

80-90% depending on the country. We

employ three separate mechanisms

to keep up to date with changes.

What’s new?

Our database has expanded to 96 countries

and 9,300 distributors. It’s now searchable,

supplying country and category filter

inputs or brand names! We also offer

90-day access if you purchase a country

or category list. This allows you to work

online and enjoy “one click access” to

distributors’ web sites. Naturally, we

prefer that you purchase an annual

subscription with unlimited access to

the entire database for one year.

What is the difference between

Export Solutions’ distributor database

and other “lists”?

1. Created by industry export professionals,

not directory aggregators or other online

companies with no relevant food/consumer

goods industry experience.

2. Each distributor is personally validated

by Greg Seminara. Distributors can not

self register or pay to be in our database.

We know the difference between a

“best in class” distributor and a “one

man show.”

3. Our distributor database is designed

for manufacturers of branded products

normally sold through supermarkets,

pharmacies, and food service channels.

We do not include distributors of

commodities or ingredients.

4. Call us! Our specialization is

distributor search, with 300+ projects

completed. Contact us for a free copy

of our Distributor Search Guide.

5. Our database is searchable by country,

category specialization, brand name, or

a combination of all three filters.

Which type of companies use our database?

Database clients range from small start-

ups to the largest companies in food

and consumer goods. Export Solutions’

database has had more than 3,000 clients,

including brand owners from all over

the world. Leading government trade

organizations from USA, Italy, Germany,

and Brasil also develop special

agreements to gain access.

What product categories are covered?

Distributors include specialists for branded

food products, confectionery and snacks,

beverage, natural foods, gourmet products,

ethnic food, health and beauty care products,

household products, and general

merchandise. We offer oustanding coverage

of Italian, German, Spanish and UK food

distributors. Many distributors can handle

any product that is normally sold through

supermarkets, convenience, foodservice/

catering, or pharmacy trade channels.

What are best practices in getting the most

productivity from the database?

Successful companies use the database

to screen companies to develop a top five

list of high-potential candidates. They

send a short introductory email with

a web link to their company site. Then,

the export manager follows up with a

phone call within 48 hours. The database

is an excellent tool to invite potential

candidates to an international trade

show like Sial, Anuga, ISM or Sweets

and Snacks. Note: mass mailing

distributors usually generates less

than desirable results.

Does Export Solutions provide any additional

information on the distributors?

Export Solutions knows many of the

distributors in our database. Clients

of our Premium Subscription or Talk

to An Export Expert Services can gain

access to our insights via phone on the

best distributor candidates in any of

the 96 countries we cover.

How do I access the distributor database?

Visit www.exportsolutions.com and

click the distributor database page.

You can place a subscription or country

or category access into a shopping cart.

Register and check out via credit card.

The process takes two minutes and we

automatically send you an invoice.

FAQ’s – Distributor Database

9

Search by Country

Coverage: 96 countries and 9,300 distributors

Search By Category

Confectionery & Snack

Gourmet/Ethnic Foods

Beverage (Ambient & Hot)

Italian Food

Natural Food

Health & Beauty

Search by Brand Name

Tracking distributors for more than 500

of the world’s most famous brands.

Combo Search

Enter multiple factors:

Example 1: Who are confectionary/snack

distributors in Japan?

Example 2: Who is the Barilla distributor

in Mexico?

www.exportsolutions.com

NEW!

Distributor Search Made Simple

10101010

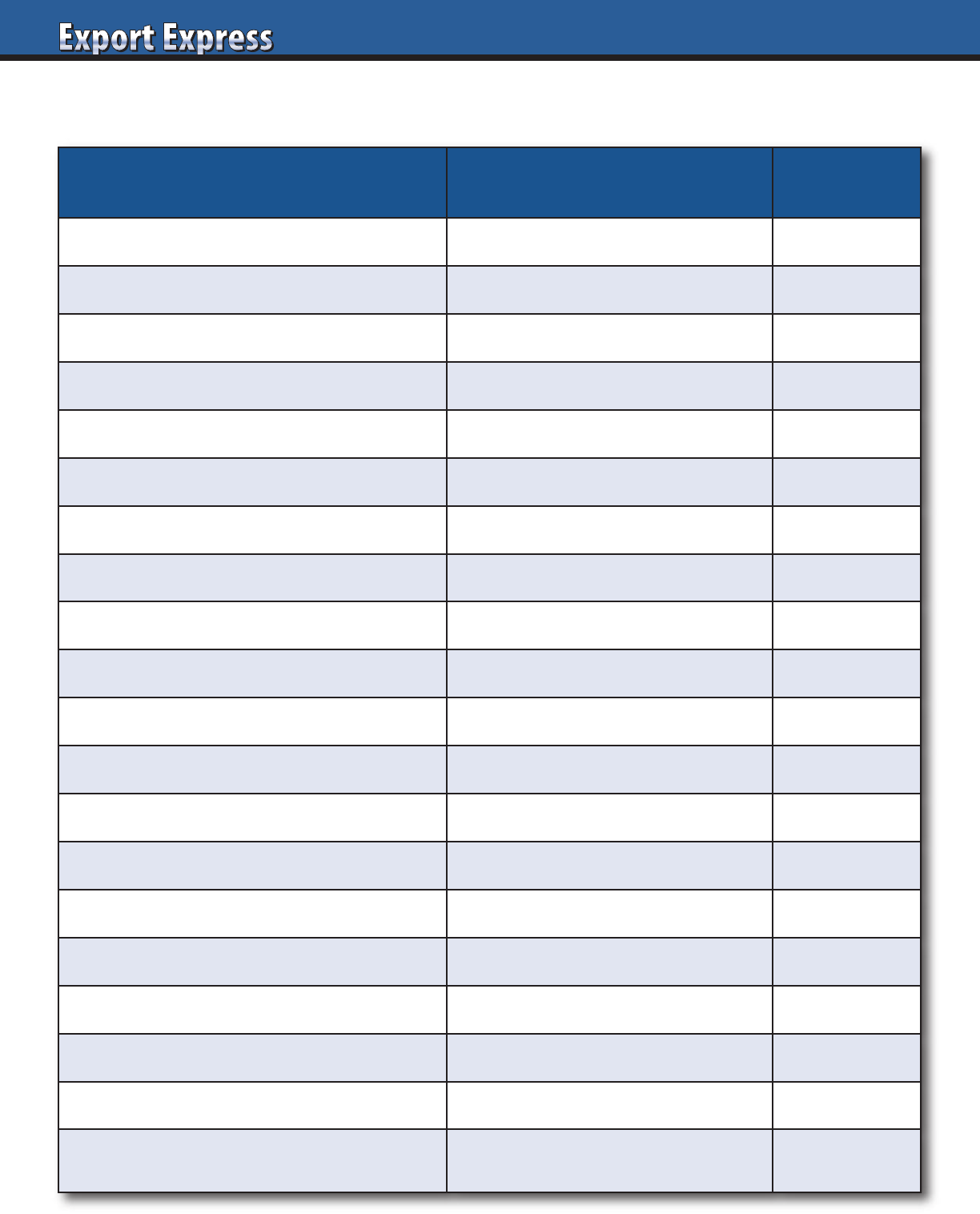

Export Manager Report Card

Assessment Criteria Considerations

Rating:

(10 = Best)

Annual Plan Development, Execution, Delivery • Aligned, reliable, committed

Export Experience – Food/Consumer Products • New to 20 years +

Ability to Influence Distributors • Focused on your priorities

Pioneers New Business • From concept to containers

Work Ethic • Office time vs. overseas trips?

International Citizenship • Language skills, cultural alignment

Category Knowledge • Viewed as expert: buyers, distributors

Business Leadership • Partners with internal functions

Distributor Relationships • From sales reps. to owner

Thought Leadership • Creates and shares best practices

Export Strategy • Logical vision and road map

Profitable, Sustainable, Exports • Sells profitable cases

Retail Store Conditions • Brand presence vs. market share?

Brand Building – Promotions • Creativity, effectiveness, efficiency

Problem Solving – Response Time • Same day to one week?

Customer Relations • Senior access at top retailers

Analytical Skills: Shipments, Nielsen • Trends, opportunities, plan

Digital Savvy • E-commerce, social media

Supply Chain Management & Forecasting • Accuracy and efficiency

Results vs Budget, Market,

Category (CY, PY, 3 Years)

• Flat to 10% +

11

A big difference exists in export strategy for SMCG (Slow Moving Consumer Goods) and companies committed

to FMCG (Fast Moving Consumer Goods) brand building. Either model is okay. Many companies are en route

between SMCG and FMCG. Alignment between aspiration, investment, and perspiration drives realistic outcomes.

Export Journey: SMCG to FMCG

SMCG FMCG

Aspirations Niche Participant Mass/Leader

Consumer

Homesick Upscale Local

Research

None Nielsen Consumer

Portfolio

Best sellers from

home market

Best sellers from

home market

Tailored to region

or country

Packaging

Standard packs stickered Multilingual

Local language label

and pack size

Factory

Corporate HQ Corporate HQ Offshore

Pricing

Super Premium Premium Competitive

Marketing

None Sampling, Digital

360 Plans

TV, Digital

Trade Spend

None 10-20% Discount

Ad, Display

20-30% Discount

Route to Market

Niche distributor Mid -size distributor

Mass distributor or

subsidiary

Country Focus

Adjacent

Homesick Expats

Mid-size countries

plus USA

All countries

USA, China, Brasil

Channels

E-Commerce

Homesick Expats

Supermarket

E-Commerce

All channels

Oversight

1 visit/year from HQ Regional manager Dedicated country manager

Complexity

Low Moderate High

12

We’ve Got You Covered!

Distributor Database Coverage

Confectionery & Snack

2,737 Distributors

Ambient Beverage

1,716 Distributors

International Foods

3,316 Distributors

USA Importer/Distributor

608 Distributors

Middle East

940 Distributors

12 Countries

Asia

2,036 Distributors

17 Countries

Latin America

1,591 Distributors

Europe

3,155 Distributors

9,300 distributors – 96 Countries

Subscribe now at www.exportsolutions.com

“Spend time Selling to Distributors versus Searching for Distributors”