Insights to Accelerate International Expansion

Finance & Logistics

Our Mission: Help Manufacturers “Spend time Selling to Distributors versus Searching for Distributors”

In This Issue

Sell to 96 Countries

Looking for new customers and

distributors in international markets?

Export Solutions’ distributor database

covers more than 9,200 distributors

in 96 countries. Our database features

extensive coverage of leading food,

confectionery, and beverage distributors.

New! Export Solutions’ retailer database

now tracks 2,700 retailers in 96 countries.

Order now at www.exportsolutions.com.

“Turnover is Vanity, Profit is Sanity,

but Cash Flow is Reality!”

The purpose of an export program is to

deliver incremental, profitable sales for

our companies. Too many times, this

fundamental fact is blurred in pursuit

of sticking more pins in our export

coverage map. Our activities focus on

the glamorous aspects of export: new

country entry, distributor selection,

and marketing plans. However, the

real work is in the details. This involves

creating a realistic price calculation and

financing marketing investment. Many

underestimate the complexity of

effectively managing a global supply

chain. 2021 currency fluctuations

reminded us of the need not to just

sell more, but to sell more profitably.

The goal of our Money Matters Guide is

to share practical insights on financial

and logistics aspects of managing an

export business. Export Solutions

desires to add more value to your

company than just providing lists of

distributors in 96 countries. Export

Solutions’ goal is to share strategies,

ideas, and best practices that have

helped other brands succeed in

building export sales. Delivering and

invoicing the requested order to our

distributors and customers represents

the critical point where export dreams

translate to a tangible sale.

Export Solutions can help!

Money Matters: Finance and Logistics Tips

3 Maintain copies of each distributor’s price calculation.

Rough margin estimate: Retail price minus your delivered

price. Split balance between retailer and distributor.

3 Ship directly to distributors, avoid diverting risk!

3 Monthy (quarterly?) retail price surveys

and warehouse inventory reports

3 Track currency fluctuations in Top 20 Countries

3 Distributors need to make money too!

Greg's Guidance – Finance & Logistics

Page 3

Price is Right?

Page 5

Money Matters 2022

Page 7

Let’s Talk About Salaries

Page 14

FAQ’s – Retailer Database

Page 19

Pioneering: A Gamble, Not a

Guaranteed Gold Mine

Page 24

Currency Exchange –

Tough Tactics for Tumultuous Times

Page 30

10 Tips: Mandatory Distributor

Warehouse Visit

Page 36

Incoterms

2

Do you speak the same language as

your distributors? I am not talking

about English, Italian, Arabic, or

Chinese linguistic skills. I am speaking

the language of money. Most export

managers discuss business with their

distributors in terms of cases and

containers. Many distributors are

entrepreneurs that measure their business in terms of profit contribution and

cash flow, just like your company CFO. Understanding distributor economics

can position you and your company as preferred suppliers.

1. Distributors deserve a reasonable profit for their efforts.

Many achieve a net profit margin of only 3-5 percent plus various owner benefits.

A financially stable partner invests in people and technology to advance your mutual

business. A solid balance sheet allows the distributor to weather the storm in a political

or financial crisis.

2. What is the “salary” you pay your distributors?

Calculate cash flow generated by your company by analyzing distributor net sales

to customers multiplied by the distributor margin excluding any promotional bill

backs. Margin is one metric, but cash generated pays the bills. How does the distributor

salary compare to the work required to service your business or the cost of maintaining

a local subsidiary?

3. New Business = Bonus

Distributors are constantly searching for new brands. The next piece of new business

entering a distributor generates incremental sales while better utilizing fixed assets like

the sales team and warehouse. Brands with existing sales in a country are very attractive

as they contribute immediately to the distributor, even if they require a lot of effort

during the initial transition.

4. Pioneering is tough!

Would you work for a company for one year without salary? That is the scenario when

a distributor is challenged to pioneer a brand in a country for the first time. The cycle

of distributor selection, business plan, new product launch, marketing activation and

customer repayment may take one year or more before the distributor receives his first

“paycheck” for his efforts for your company. Of course, there is a long term pay out

for the distributor when the brand works. This is one of the primary reasons that

distributors are reluctant to start to represent a new company without a strong USP

and investment program.

5. What is the “size of the prize?”

Distributors appreciate export managers that frame their partnership in terms of mutual

profit development. Brand owners that understand the intricacies of distributor cost to

serve will be rewarded. Measure your profit contribution to a distributor and request

that a fair share of their resources be invested in your brand development. A profitable

distributor is a healthy distributor!

Good luck!

www.exportsolutions.com

Greg Seminara

“Spend Time Selling to Distributors versus Searching for Distributors”

Distributor Economics

Strategic Services

Contact Us for

Export Solutions

1. Identify Best in Class Dis-

tributors: 96 Countries

2. Best Practices

Export Strategy

3. Distributor Management

Workshops

4. Export 101:

Let’s Get Started

5. New Market Prioritiza-

tion

and Launch Plan

6. Personal Distributor In-

troductions:

96 Countries

7. Walmart International

8. Distributor Contracts,

Margins, and Fees

9. Meeting Speaker

10. International

Strategy Expert

Strategic Services

Contact Us for

Export Solutions

1. Identify Best in Class Dis-

tributors: 96 Countries

2. Best Practices

Export Strategy

3. Distributor Management

Workshops

4. Export 101:

Let’s Get Started

5. New Market Prioritiza-

tion

and Launch Plan

6. Personal Distributor In-

troductions:

96 Countries

7. Walmart International

8. Distributor Contracts,

Margins, and Fees

9. Meeting Speaker

10. International

Strategy Expert

3

Consumer pricing is one of the famous

“Four P’s” of product marketing. Many

export managers spend countless hours

negotiating wholesale price lists with

distributors and retailers. However, this

intensity frequently disappears when the

discussion shifts to the point of pricing to

the consumer. This is unfortunate, because

retail pricing is at the critical point where

our marketing dreams and distributor

inventory are translated to tangible sales.

I recently conducted a seminar where I presented a full day program on Export Strategy,

Distributor Economics, and Getting More Than Your Fair Share of Your Distributors

Attention. In the Distributor Economics module, I surveyed the group on how many

maintained copies of each distributor’s price calculation. This is the fundamental formula

that tracks each brands pricing inputs from factory gate to supermarket shelf. None of the

participants had copies of their distributor’s actual price calculation or requested a market

wide retail price survey. As the norm, busy export managers focus attention on the myriads

of details required to process orders such as importation paperwork and product

registration. However, retail pricing is a critical element to add to your “to-do” list.

Listed below are Export Solution’s Tips for managing your retail price guidelines.

1. Review Suggested Retail Price by Market.

Is your pricing realistic based upon 2022 market dynamics and your cost calculation?

2. Conduct Market Wide Retail Price Survey

How do your prices compare versus your suggested retail price and competitive set?

3. Obtain Distributor Price Calculations

Most distributors openly share this information with their brand partners. If a distributor

is hesitant, it’s usually easy to figure out if you have retail prices.

Retail price - distributor cost - sales taxes and import duties = gross margin.

This gross margin is divided by the retailer and distributor.

4. Examine Each Line Item of a Price Calculation

Distributors and Retailers are entitled to a fair return for their work on your brand. They

maintain profit targets just like your company. In some cases, price calculation transparency

leads to breakthrough changes in business development. I remember a situation where the

distributor established an 8% currency benefit at the start of a price calculation to hedge

against fluctuation. The export manager agreed to sell in the common currency, absorbing

the risk, but translating to an 8% positive benefit to the brand price. In some cases,

distributors may place “average” numbers in a calculation for logistics services or trade

discounts which may not be representative for your brand.

5. Evaluate Relationship Between Everyday Pricing and Promotional Pricing

Price analysis should reveal typical price paid by the consumer. For example “everyday”

prices are not as relevant if the consumer habit is to wait until product is on promotional

discount to purchase and “stock up.”

6. Supermarket E-Commerce Sites Offer Instant Desktop Price Surveys

Lately, I have checked online web sites for retailers in the UK, Australia, Panama and the

USA to get an immediate snapshot of market prices and assortment. It’s not perfect, but

a free and easy way to begin to understand market pricing dynamics.

Pricing is a cornerstone of your brand proposition. A little emphasis and investigation will

determine if your “Price is Right” to optimize sales in a country.

www.exportsolutions.com

“Spend Time Selling to Distributors versus Searching for Distributors”

Price is Right?

Greg Seminara

404-255-8387

Strategic Services

Contact Us for

Export Solutions

1. Identify Best in Class Dis-

tributors: 96 Countries

2. Best Practices

Export Strategy

3. Distributor Management

Workshops

4. Export 101:

Let’s Get Started

5. New Market Prioritiza-

tion

and Launch Plan

6. Personal Distributor In-

troductions:

96 Countries

7. Walmart International

8. Distributor Contracts,

Margins, and Fees

9. Meeting Speaker

10. International

Strategy Expert

Strategic Services

Contact Us for

Export Solutions

1. Identify Best in Class Dis-

tributors: 96 Countries

2. Best Practices

Export Strategy

3. Distributor Management

Workshops

4. Export 101:

Let’s Get Started

5. New Market Prioritiza-

tion

and Launch Plan

6. Personal Distributor In-

troductions:

96 Countries

7. Walmart International

8. Distributor Contracts,

Margins, and Fees

9. Meeting Speaker

10. International

Strategy Expert

4

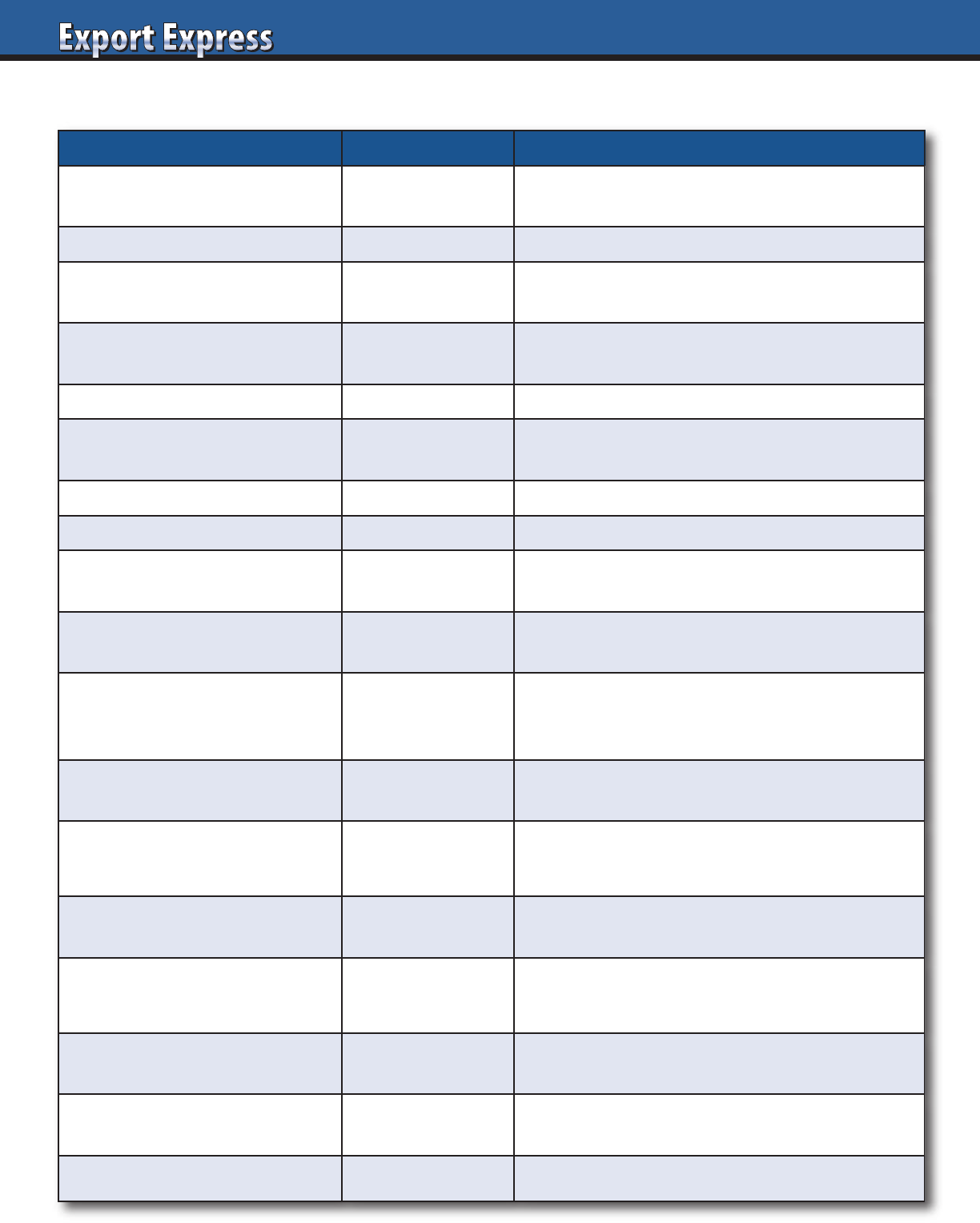

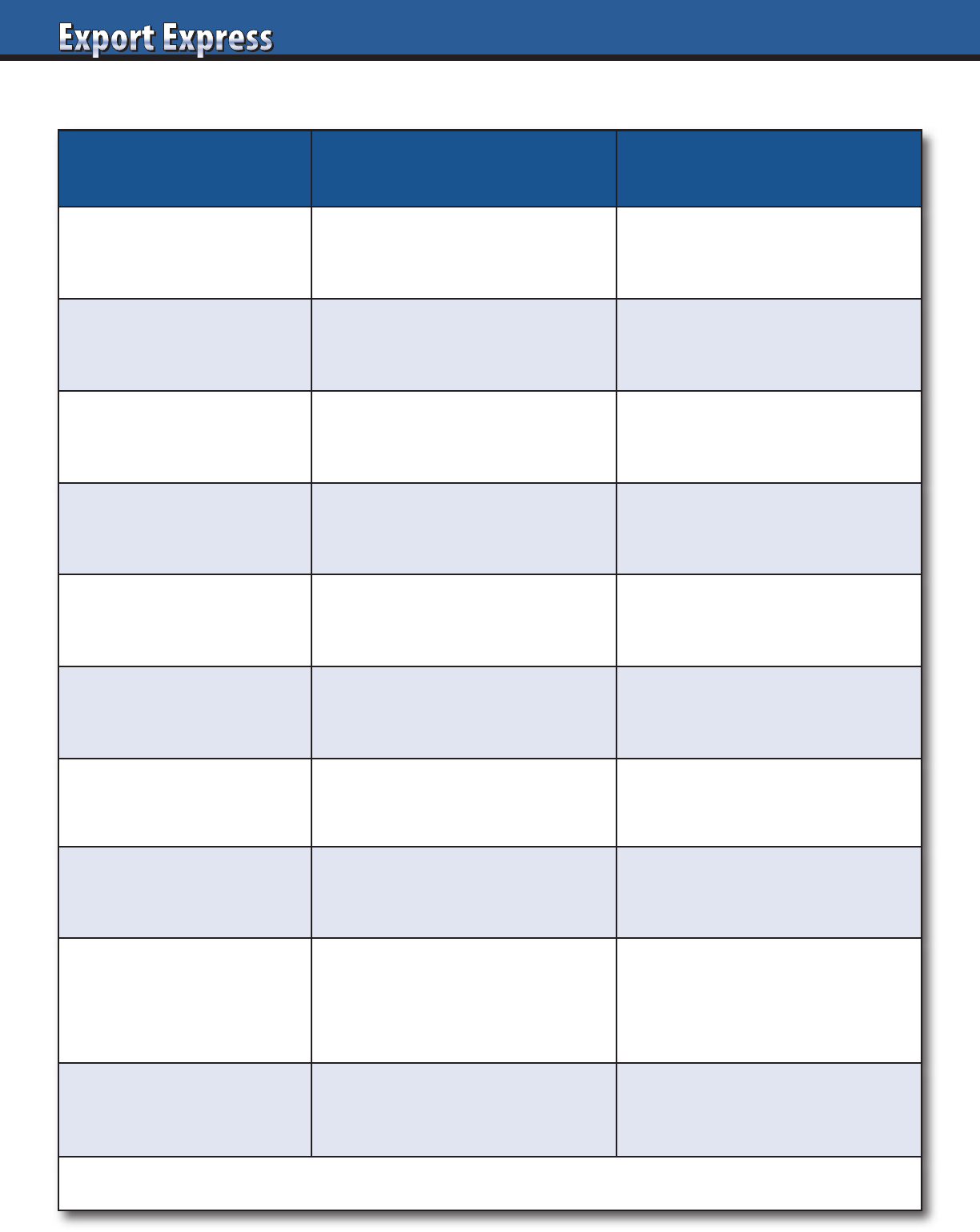

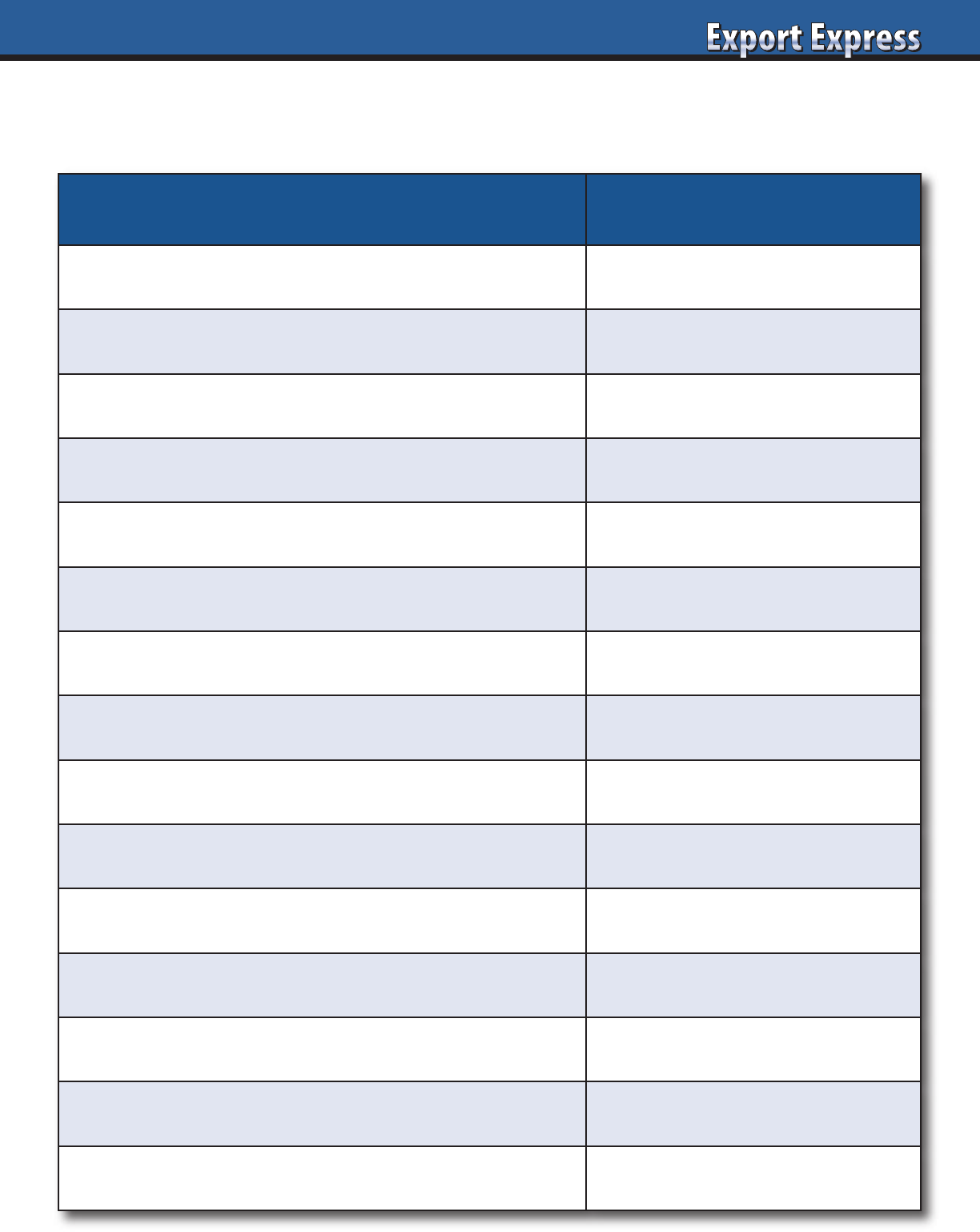

Price Calculation Worksheet

Item Amount Comments

List Price (factory or port)

Compare to your domestic list price?

Avoid diverting risk.

Exchange rate Watch bank rate vs. distributor rate.

Freight (sea, truck or rail)

Target full containers.

Consolidation is costly.

Duties

Apply correct Harmonized (HS) code.

Confirm Free Trade Agreements.

Customs clearance, insurance Money and time!

Inland freight: port to distributor

Translate actual costs to case rate.

Avoid flat percentage rates.

Landed Cost

Product Stickering Select countries.

Listing Fees

Flat fee. One time only.

Usually not in calculation.

Marketing fund accrual

Typically, 10-20% of list price.

Part of calculation or manufacturers price.

Distributor Margin

Normal range: 15-35%.

Depends on size, complexity of brand, services,

and “what trade spend is included.”

Other Distributor Fees

Should be part of distributor margin.

Avoid hidden profit centers.

Price to Retailer

Fair and transparent model.

Incentives for large customers, extra performance.

Retailer promotions, incentives,

rebates

10 – 20% depending on the country.

Other Retailer Fees

At times for merchandising or central distribution.

Should be allocated from distributor margin.

Retailer Margin

Global average: 28%

Range: 15% -45% based upon category, brand.

Sales Tax/VAT

Included in price in many countries.

USA sales tax is on top of shelf price.

Consumer shelf price Everyday prices and promotional prices.

5

Money Matters 2022

Today’s export managers devote more time to finance issues

than their historical role as international brand builders. Global

managers are turning grey from problems in Russia, Ukraine,

and Venezuela. It’s virtually guaranteed that this month a new

crisis will evolve somewhere.

Few money issues should come as a complete surprise. Watch

for clues in distributors’ operations and organization. Study

country benchmarks published by The Economist or other

financial tracking services. Listed below are a few tangible steps

to consider to minimize risk and optimize your financial results

in 2022.

Update Credit History

2021 financial reporting should be completed by all distributors.

Now is a good time to request an updated credit history for all

partners. Recommend that your group finance manager handle

the request to create joint ownership of the issue and to avoid

sensitivity. Run a Dun & Bradstreet report for all distributors.

Track days outstanding trends for the last 24 months.

Review Pricing Calculation

Brand owners and distributors dedicate significant time to

wrestling over the pricing calculation prior to establishing

a relationship. As the years go by, the calculation may “drift,”

although input costs usually shift significantly. Why not take

a fresh look at your pricing model?

Time for a Price Increase?

Raw material prices and transportation costs have surged in

recent months. Many brand owners have taken cost justified

price increases. Retailers may complain, but they understand

the reality of changes based upon their own private label and

transportation costs. In many cases, the retailer may benefit from

a price increase if consumption remains stable and competition

follows the price hike.

Inventory Levels: Important Benchmark

Measurement of inventory through the supply chain is an

important indicator. The key metrics should always be in terms

of number of weeks supply on hand at the distributor and

retailer’s warehouses. Evaluation should be based upon trailing

12 week sales velocity or seasonal trends. Low inventory levels

could indicate cash flow problems. High inventory levels could

suggest sell through issues. Look at trends versus historical levels

and contractual agreements.

Retail Pricing Survey

When was the last time that you requested a market wide audit

of retail prices? Your competition may have adjusted their pricing

higher or lower without your notification. A price survey is also

valuable in advance of a price increase to measure “pre” and

“post” prices for your brand and category.

10% Challenge

Trade spending may be a wise investment if it drives profitable,

incremental sales. This is a good time of year to challenge

distributors with the question: “What type of spend levels

would be necessary to secure a 10% increase in shipments

(consumption) in the next 90 days?” Of course, in emerging

markets you may want to challenge the distributor for a 20-40%

increase or higher.

Distributors Need to Make Money Too

Distributors are squeezed, dealing with increased transportation

costs and demanding retailers. Calculate the gross dollars earned

by the distributor to represent your product. Consider the

financial implications of your requested activity to build your

brand. A healthy relationship is when both the brand owner and

distributor are making money.

Evaluating Distributors?

We can help!

Export Solutions performs

Distributor Search in 96 countries.

6

Distributor Search Helper for:

Your

Logo

Here

Can We Help You?

Recent Distributor Search Projects

Asia Europe Middle East Latin America

Australia Germany Israel Argentina

China Ireland Kuwait Brazil

Indonesia Netherlands Qatar Colombia

Japan Nordics Saudi Arabia Costa Rica

Malaysia Spain UAE Ecuador

Philippines United Kingdom North America Mexico

Singapore Africa Canada Panama

South Korea South Africa United States Peru

Call the Export Accelerator!

Contact Greg Seminara at greg@exportsolutions.com

to discuss your business development project.

www.exportsolutions.com

7

Shhhhh. Salary discussions are taboo.

Not here! I am actually opening the door to

a conversation on distributor compensation

or “salaries.” All business people are

focused on their personal salary and

attainment of available bonuses. Discussions

with our distributors measure movement of

containers or cases, without a whisper of

distributor profit implications or “salary.”

Many brand calculations were created in a

different era, with details now buried under

an unexamined grey cloud of secrecy. Exporters may be surprised at distributor

sophistication in understanding the cost to serve details of their supply chain.

A natural and necessary cultural change must occur from brand owners and distributors

to bring compensation discussions to the forefront. This advancement will position

producers to accelerate their business to the next level as “profitable preferred partners.”

Distributors will benefit too. Financial transparency should sustain the distributor

model, validating the fundamental right to earn a reasonable return for their efforts.

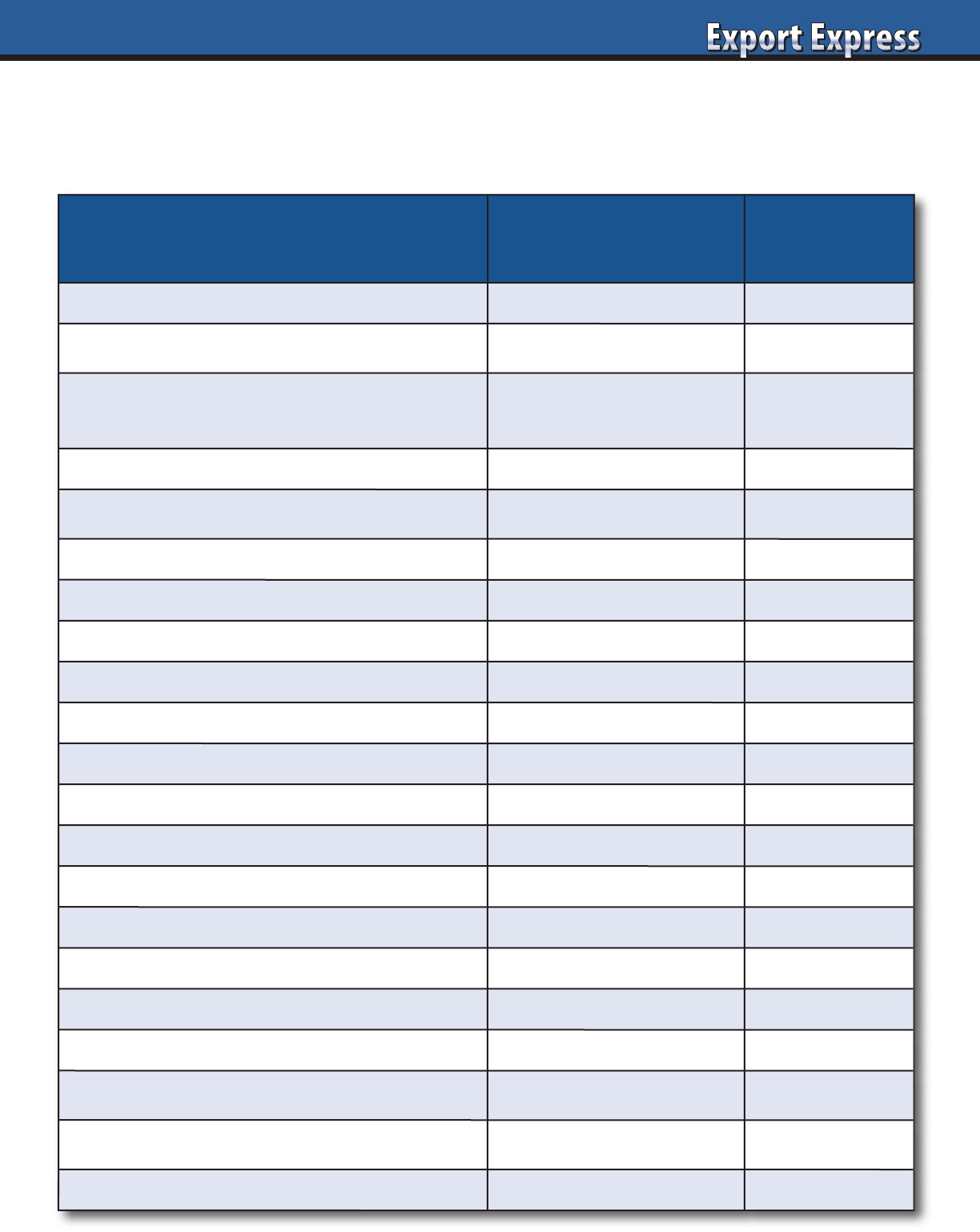

1. Analyze Your Profit Contribution to Each Distributor

Export Solutions identified 20 factors for consideration. A good idea is to complete

our template that helps you evaluate your company contribution to distributor profit.

How profitable is your company for your distributors?

2. Distributor Salary: Beyond Profit Margin

Distributors maintain multiple profit centers, just like manufacturers. Each supplier

maintains a unique cost to serve. Brands that deliver high sales and profits with a

limited range of SKUs are most attractive to a distributor.

3. Compare Outsourcing to Distributor Versus Direct Employees

The distributor model is an integrated solution, capable of serving as your “outsourced

subsidiary” in a country. Larger companies should compare the model versus the cost of

direct employees. Include backroom functions like HR and IT, as well as overheads such

as offices and telecommunications. Distributors are usually a “bargain.”

4. Is Your Distributor Compensation Model Relevant for 2022?

Global customers, online shopping, central delivery, field teams, currency swings,

and a hundred other factors have changed since original agreements were created.

When was that the last time that you reviewed your distributor pricing calculations?

5. Calibrate Distributor Work Demands to Compensation

Big company profit contributions may warrant dedicated resources. Smaller brands

may need to think twice about mountains of paperwork requests.

Brand owners must adopt 2022 strategies for investing in the continued financial health

of their top performing distributors. In other cases, lagging distributors may not be

delivering value for your compensation. Most salary discussions can be difficult, with

one party always feeling that they are “under paid.” The reality is that distributor

organizations generate positive cash flow for their owners. Brand owners that dedicate

the time to understand their contributions to a distributor’s profitability can reach a new

level of partnership alignment and business development.

www.exportsolutions.com

Greg Seminara

404-255-8387

“Spend Time Selling to Distributors versus Searching for Distributors”

Let’s Talk About Salaries

Strategic Services

Contact Us for

Export Solutions

1. Identify Best in Class Dis-

tributors: 96 Countries

2. Best Practices

Export Strategy

3. Distributor Management

Workshops

4. Export 101:

Let’s Get Started

5. New Market Prioritiza-

tion

and Launch Plan

6. Personal Distributor In-

troductions:

96 Countries

7. Walmart International

8. Distributor Contracts,

Margins, and Fees

9. Meeting Speaker

10. International

Strategy Expert

Strategic Services

Contact Us for

Export Solutions

1. Identify Best in Class Dis-

tributors: 96 Countries

2. Best Practices

Export Strategy

3. Distributor Management

Workshops

4. Export 101:

Let’s Get Started

5. New Market Prioritiza-

tion

and Launch Plan

6. Personal Distributor In-

troductions:

96 Countries

7. Walmart International

8. Distributor Contracts,

Margins, and Fees

9. Meeting Speaker

10. International

Strategy Expert

8

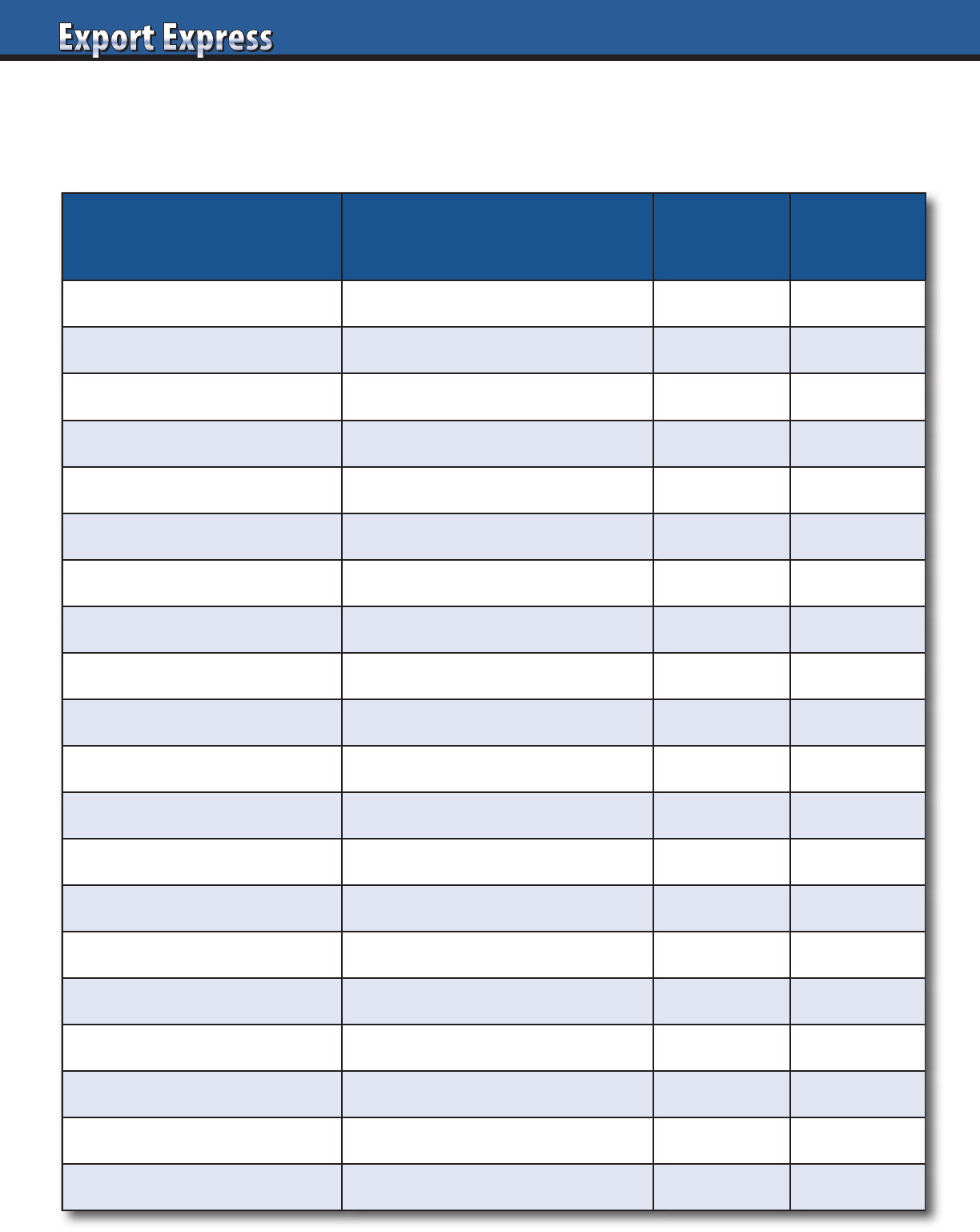

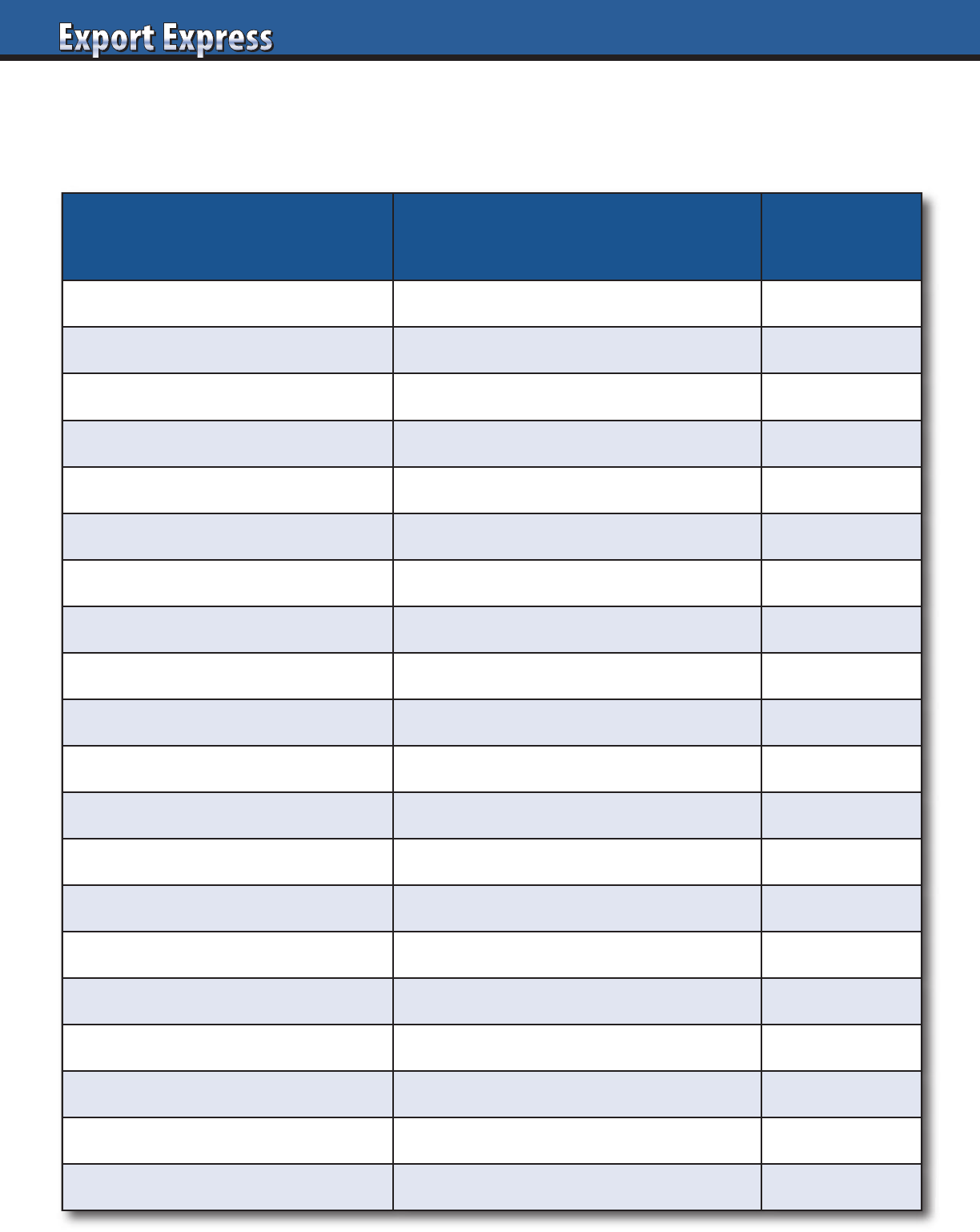

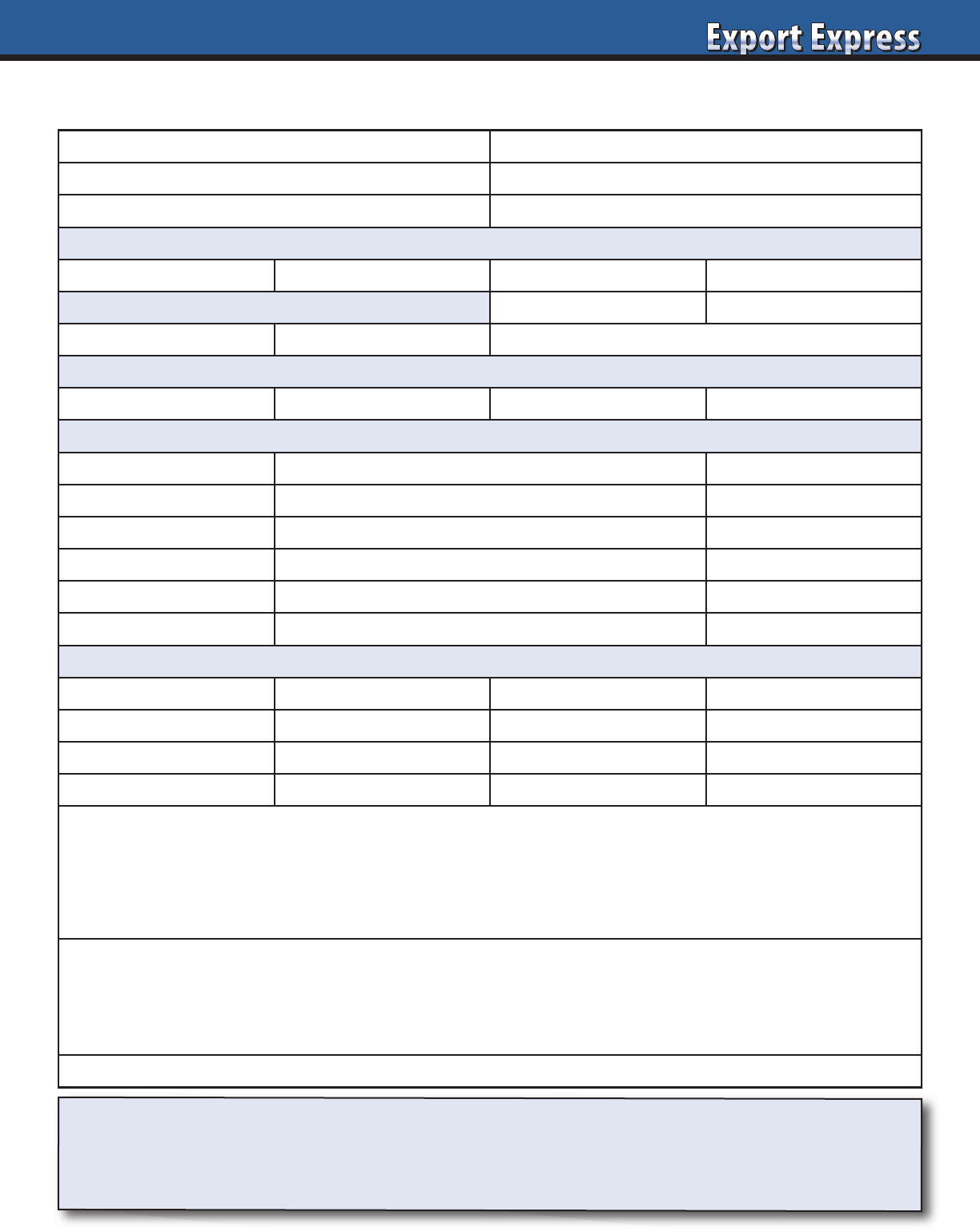

Analyze: Your Contribution to Distributor Profit

Export Solutions: 20 Factors Driving Distributor Profitability

Assessment Criteria

Considerations

Result

Rating:

(10 = Best)

Annual Sales Revenue • Percent total distributor sales

Annual Margin Generated ($) • Net sales times gross margin

Distributor Percent Margin

• 10 percent to 50 percent

Brand Owner Investment Level

• Percent of distributor purchases

Distributor Margin Re-Investment

• Distributor promotion spending

Category Adjacency • Distributor portfolio synergies

Brand Market Share

• Niche versus market leader

Payment Terms

• Pre-pay versus 120 day terms

Safety Stock Requirements • Two weeks to four months

Typical Customer Order • One case to full truck

Shelf Life • Two weeks to five years

Case Cube/Case Cost • “Low cube, high case cost best”

# Brands/Items in Range

• “High sales, fewer items valued”

Logistics/Storage: Temp?

• Ambient versus chilled

Damage/Expired Goods • None to 20% of sales

Category Competition

• Niche to highly competitive

Labor: Battle for Shelf Space

• None to intense fight

Brand Manager

• Shared or dedicated

Admin Requirements • Orders only to multiple reports

Manufacturer Visit Frequency

• Never to weekly

Pricing is a critical element of our marketing strategy.

The “calculation” defines all pricing inputs from a designated

port to the retail store shelves. Brand owners and distributors

invest significant energy developing a pricing model during

initial negotiations. My experience reveals that the calculation

tends to drift over time, fluctuating from the original guidelines.

This is natural, given changes in cost to serve inputs. However,

the calculation represents a fundamental ingredient to brand

success. Brand owners should review current models to ensure

an understanding of pricing for each country.

1. Do you possess your current pricing calculation from each market?

Many brand owners do not have current price calculations.

In some cases, distributors are reluctant to share them. The price

calculation, with suggested retail price, should be matched with

a retail price survey. This will allow you to compare (not control!)

the official model with “retail reality.”

2. What inputs are included in the price calculation? Any extra costs?

There are no standard price calculation models, even within

the same country. All distributors employ unique methodologies.

The key is to understand what is included and what inputs are not

included. You will also need to request definitions for some line

items. For example, financing in one model could be based upon

a Bill of Lading date in one scenario and delivery date in another.

3. What services are included in the Distributor Margin?

A financially healthy distributor is a good partner. Distributors

are entitled to fair compensation for their work on your brand.

It’s critical to understand what services are included in a

distributor margin. For example, in some scenarios, a distributor

offers a flat, “all inclusive” margin. In others, they may offer

a lower margin, but add an “admin” fee or profit allocation in

addition to the distributor margin. Are distributor margins the

same for all products in your portfolio? Does the distributor

margin change if you double or triple your sales?

4. Who pays for Trade Discounts and Promotions?

In many cases, the manufacturer covers 100% of these brand

specific investments. In other models, the costs are covered by

the distributor or split. The key is to understand who is

responsible and what is the planned investment. There is a big

difference in a distributor funding 1-2 small promotions per year

and funding monthly, high value, deep discount promotions.

5. How are price increases managed?

Price increases are a common activity in our business.

Manufacturers need to adjust prices to reflect fluctuations

in raw material costs, promotional support, and competitive

activity. Manufacturers should understand that some distributors

act as “single vendors” to a retailer. In some cases, distributors

can only implement pricing actions once per year. In other cases,

distributors may apply price increases (or decreases) against all

the brands in their portfolio.

6. How do you handle Currency Fluctuation?

This represents a critical point in certain countries and at times

emerges as an issue with worldwide implications. For example,

the euro/dollar exchange rate has fluctuated from .83 to 1.60,

settling around 1.12 as of today.

Six Questions Regarding your Distributor Pricing Calculation

9

Create Your Own Export Library

Distributor Search Guide

Export Handbook

Selling to USA Handbook

Distributor Management Guide

Finance & Logistics

All guides available free at www.exportsolutions.com in the Export Tips section.

Idea Guide:

New World – New Business

Export Treasure Chest

My Favorite Templates & Forms

People Power

Strong Teams Build Great Brands

10

Cost to Serve: 5 Factors to Consider

Manufacturers must perform self analysis

to understand the costs required to service

their business:

1. How complex is your product line?

One category with 3-5 items is relatively

simple to manage. Or is your company in

many categories with 50-100 items to sell,

inventory, deliver, and merchandise in-store?

2. Logistics: Single largest cost for a distributor.

Freight and warehouse handling complexity

can vary widely by manufacturer. Key

factors include product cube, shelf life, sales

turnover, and typical order. Temperature

controlled logistics usually adds 5-10 points

of margin.

3. Retail Intensiveness. Certain brands

compete in large categories (confectionery/

drinks) with fierce competition for shelf

space. This demands constant attention

by the distributors/brokers sales force on

every store visit. Other brands require little

ongoing retail attention. In these cases,

distributor personnel must simply verify

that authorized brand sizes are available

at each store.

4. Seasonal Brand versus Year-Round Sales?

Naturally, it is easier for a distributor to

service a brand that has a narrow selling

season (Christmas Holiday) than a brand

requiring year-round focus.

5. Manufacturer Involvement and Visibility.

Does the brand require a dedicated brand

manager in the distributor to handle day-

to-day activities? How involved is the

brand owner? Do you speak to him daily

or several times per year? What is the

frequency of brand owners request for

information/reports and market visits?

Pioneering New Brands is Expensive

Brands new to a country bring no

immediate income and are risky for a

distributor. As a result, brands requiring

pioneering frequently experience higher

margins for distributor services. This

surcharge is driven by the fact it may take

up to a year from start until the distributor

derives a meaningful sales level and is paid

for his shipments of your new product.

Market entry planning can take 3 months,

followed by another 3-4 months to sell in

to retail availability. Marketing activities

begin and may take 2-3 months to generate

meaningful sales levels followed by retailer

payment 30-90 days later. Thus, a distributor

may be investing his organization’s

resources for one year before he gets paid!

In some cases, a manufacturer will offer

the distributor or broker a small, monthly

fixed retainer fee during the launch

planning period. This supplies income for

resources allocated before your partner

receives payment.

Marketing Investment:

How Much and Who Pays?

Brands with a strong financial

commitment to marketing should

generate higher sales for the distributor.

Marketing investments include spending

for consumer awareness activities such as

advertising and sampling, as well as trade

development events such as listing fees,

special displays, and in-store campaigns.

Brands with strong marketing budgets

typically enjoy lower margin structures.

In some cases, the distributors agree to

share the marketing costs as part of their

margin calculation. This practice may

apply to large brands or new products.

Distributor sharing of marketing

expenses may result in a slightly

higher margin, but also in increased

accountability, efficiency and a unique

sense of partnership.

What is the Size of the Prize?

Margins and commissions represent your

partner’s "salary." Brands with existing

business deliver immediate and reliable

cash flow. Most distributors’ costs

are fixed: sales force, warehouse,

management, administration, etc. Brands

with current sales deliver incremental

profits for the distributor by leveraging

the distributors’ existing infrastructure.

The distributor must offer a competitive

margin to attract these brands to deliver

a cost savings versus the brands current

organizational strategy. Manufacturers

with significant existing business are in

a strong negotiating position.

Bonus Incentives Versus Scale Discounts

Supplemental compensation schemes

may be used to incent distributors/

brokers or to obtain cost savings once

certain volume thresholds are reached.

One approach is to pay a bonus based

upon reaching critical annual sales

targets. In other situations, manufacturers

may structure margin calculations to

receive rebates/margin reductions once

business reaches a certain sales level. For

example, reduction of margin from 25%

to 23% once 3 million in sales are reached,

20% once 5 million in sales are reached.

Other plans call for a reduced margin

only on levels exceeding the thresholds.

For example 25% margin on first one

million in sales, 22% margin on sales

above one million.

Distributor Margins & USA Broker Commissions: What’s Fair?

Short Answer – Prevailing Rates*

12-20% Distributor Margin Leading companies with sizable budgets:

consumer marketing and trade promotion

20-30% Distributor Margin Mid-size companies with some investment:

marketing and trade promotion

30-50% Distributor Margin Niche brands or start-ups with little or no

upfront marketing investment

2% USA Broker Commission Leading companies/brands – full service

(HQ sales + retail)

3-5% USA Broker Commission Average size brands – full service

(HQ sales + retail)

5- 10% USA Broker Commission Niche brands or “start-ups” requiring

full service

Distributor margins do not include optional distributor contributor to trade promotion

*Distributor margins and broker commissions can vary based upon local factors such

as retail requirements, logistics costs, financing fees, and complexity of servicing a

manufacturers business. Contact Export Solutions to discuss typical margins/com-

missions for a specific country or brand.

11

Cost Calculation Assessment*

*Ambient grocery example: Higher margins – Chilled and Health & Beauty products

Assessment Criteria

Global

Benchmark

Actual

Retailer: Everyday margin

20-35%

Retailer: Back margin (rebates,discounts)

0-10%

Retailer: Other margin

(Damage, merchandising, central warehouse)

0-5%

Total Retailer Gross Margin

25-40%

Trade Promotion (Manufacturer)

5-20% of net sales

Total Distributor Margin

15-35%

Warehouse/Stickering

2-4%

Delivery

2-5%

Total Distributor Logistics

3-7%

Key Account Sales

1-3%

Brand Management

1-2%

Merchandisers/Field Force

0-4%

Total Distributor Sales Team

4-6%

Administration

1-2%

Finance and Collections

2-5%

Overheads (office, IT, corporate)

2-5%

Distributor Promotion Investment

0-10%

Distributor Net Profit

2-5%

Export Accelerator

Contact Us for Distributor Search Help in 96 Countries

Greg Seminara • greg@exportsolutions.com

“Spend time Selling to Distributors versus

Searching for Distributors”

12

Why have Barilla, Pringles, Nature Valley, Starbucks, Duracell,

Nestlé, Tabasco, Pepperidge Farm, and other leaders used

Export Solutions as a distributor search consultant?

• Powerful distributor network: owner of industry database

9,200 distributors – 96 countries

• Professional 10 step due diligence process

• Results! We make Export Managers’ lives easier!

Coverage: 96 countries and 2,700 retailers

Supermarket

Convenience

Drug Store

Natural Food

Club, Cash & Carry

Supplying profiles, store counts, formats,

news and info for Top 100 international

retailers plus all overseas branches

Example 1: Who are supermarket

retailers in Canada?

Example 2: How many stores does Loblaws

operate by banner, in Canada?

NEW!

ORDER NOW!

13

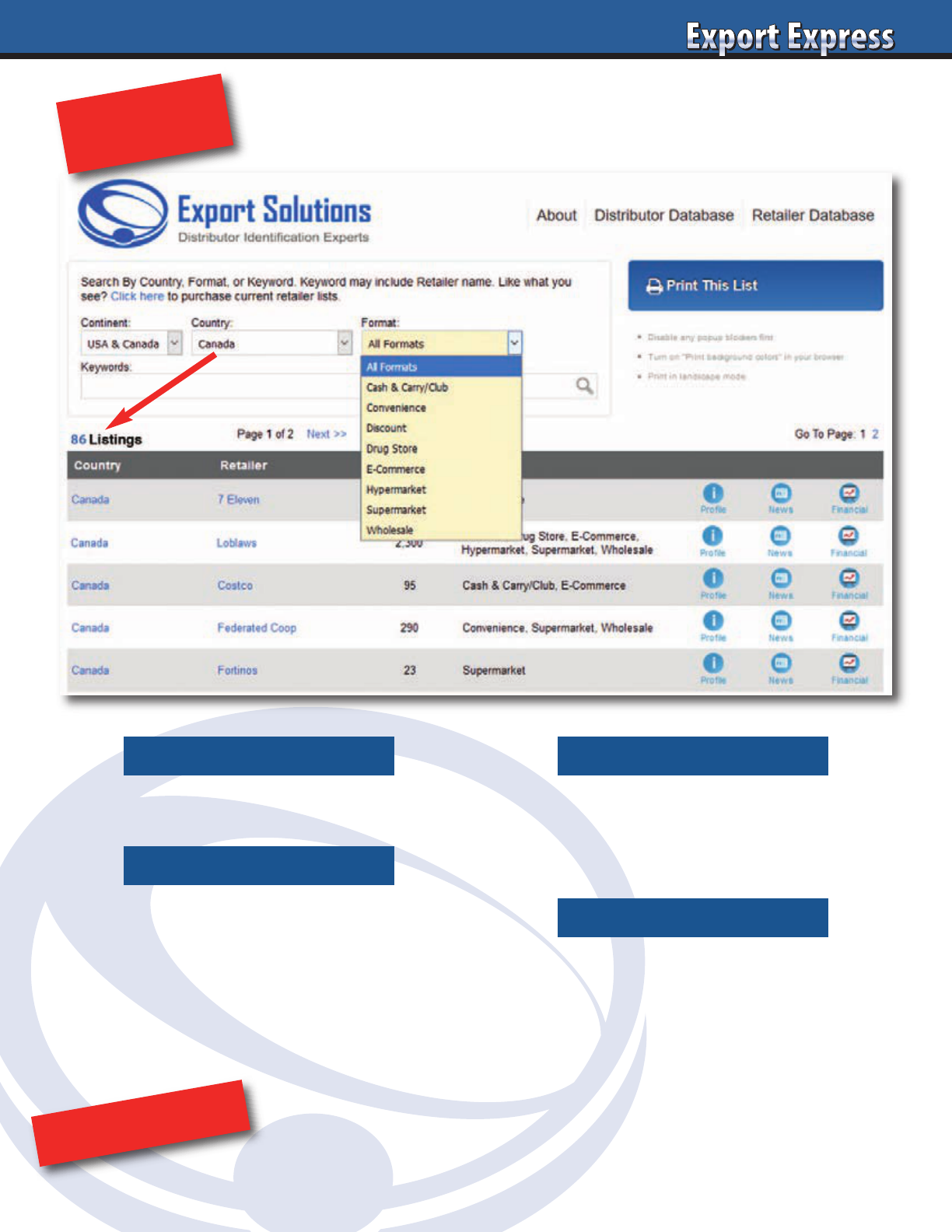

Search by Retailer NameSearch by Country

Combo Search

www.exportsolutions.com

Search By Format

Retailer Search Made Simple

Canada Example

14

Why did you create the retailer database?

Export managers dedicate a lot of time

to researching countries, retailers and

preparing business plans. A standard

KPI measure is tracking product listings

for key customers. I believe that our

industry could benefit from a global

retailer database to instantly locate

retailers and their store counts in

96 countries. The retailer database

is a logical extension of our leading

distributor database which has helped

more than 3,000 companies build export

sales during the last 10 years.

What is your geographic coverage?

96 of top 100 GDP countries worldwide.

This includes most Asian, Middle Eastern,

and European countries. Our database

covers every country in the Americas.

In Africa, we cover South Africa.

What is your format coverage?

Excellent coverage of chain supermarkets,

hypermarkets, clubs, cash and carry,

and convenience formats. Solid initial

coverage of drug stores, natural food

stores, and e-commerce channels.

Our database does not cover

DIY/hardware, toy, office, liquor,

or sporting goods channels.

Retailer database: featured info

Profile – Retailers profile and link

to their internet home page.

Formats – Retailer’s stores segmented

by format and banner.

We track supermarkets, hypermarkets,

cash and carry, convenience stores,

discounters, drug stores, natural food

stores, and e-commerce retailers.

News – Latest retailers’ news. In some

cases (Asia), we substitute a link to the

retailer’s latest promotional flyer.

Financial – Many leading retailers are

publicly traded. A link is provided to

their latest financial results. We do not

offer estimated financial information for

privately held or family owned retailers.

How is your coverage of global retailers?

We offer total coverage for top 100 global

retailers. This includes all of their

branches and banners. Searchable!

Use filters to research Walmart, Costco,

Carrefour, Tesco, Metro, Casino presence

by country. Database covers retailer’s

total store outlets as well as a breakout

by banner and format.

What can I use the retailer database info for?

• Obtain an instant snapshot of an

average of 24 retailers per country

for 96 countries.

• Track presence of global retailers like

Walmart, Carrefour, and Metro AG.

• Create country specific listing maps

where distributors measure brand

authorization by retailer.

• Conduct home office based

international category reviews

and price checks from retailers’

e-commerce sites (not all retailers).

• Prepare annual reviews and reports

with up-to-date information on

leading retailers and channels.

Searchable

The database offers filters allowing you

to search by country, format, or retailer

name. You can also use a combination

of filters for your research.

Can I get a free sample

of the retailer database?

Sure! Check www.exportsolutions.com for a

complete profile of United Kingdom retailers.

Do you provide retailer’s annual sales

or market share information?

Accurate annual sales information is

available through the financial link for

publicly traded companies. We do not

provide estimated financial information

for privately held and family owned

retailers. Channel blurring occurs

between supermarket, convenience,

e-commerce, and even natural food

operators. We do not provide market

share due to difficulty to accurately

isolate and define channel market share

information, particularly with so many

privately held retailers.

How accurate is the retailer data?

Export Solutions’ retailer database is

updated weekly, so information is highly

accurate. Retailer names, web sites, and

formats rarely change. This makes the

database 99% accurate at the company

level. New stores open every day,

resulting in store counts that may be 95%

accurate. We intend to update store

counts on a regular basis.

How much does retailer database access cost?

An annual subscription to the retailer

database is $975. This supplies one year,

unlimited access to more than 2,700

retailers in 96 countries. Special offers

available for our distributor database

customers. Note: special pricing for

government trade organizations.

How do I access the retailer database?

Visit www.exportsolutions.com and click

the retailer database page. You can place

a subscription or individual continent

(i.e., Europe) into a shopping cart.

Register and check out via credit card.

The process takes two minutes and we

automatically send you an invoice.

About Export Solutions

Export Solutions was founded in 2004

and is based in Atlanta, Georgia in the

USA. Export Solutions serves as a leading

provider of business intelligence to the

food and consumer goods industries.

Our distributor database covers 9,200

distributors in 96 countries and has been

used by more than 3,000 clients. Our

Export Express newsletter has a circulation

of 9,900 and is viewed as an important

source of insights, strategies, and

templates for international development.

www.exportsolutions.com.

FAQ’s – Retailer Database

15

I just returned from Central America where retailers such as

Walmart, Auto Mercado (Costa Rica), and Super 99 (Panama)

suffer from out of stock conditions due to direct import practices.

A retailer’s primary objective is to maximize sales, which is

tough to achieve if there are gaps on your shelf as you await

the next container from the USA. “Service” defines best-in-class

manufacturers like Coca Cola and distributors which maintain

local inventory and strong commitments to keeping in store

product showrooms “looking good.” Listed below are Export

Solutions’ Ten Tips why an international retailer should source

your brand from a local distributor versus waiting for a direct

shipment from your central factory.

1. Local Inventory: 24-48 Hour Delivery

Local distributors promise 24-48 hour delivery, instantly

correcting costly out of stocks. Direct import supply chains may

take up to six weeks for inventory replenishment. We have all

witnessed situations where a retailer allows 1-2 items to run out

of stock for weeks to wait to place a consolidated order or to

encourage sales of a size where they are overstocked.

2. Brand Building vs. Availability

Direct import brands look lonely on the shelf, without any

activation or promotion. I remember the case of Hidden Valley

Ranch, the leading USA salad dressing from Clorox. I was

thrilled when it showed up on the shelf of my Walmart in Buenos

Aires. However, I was one of a few homesick expats who knew

about Hidden Valley. Without support, the brand gathered dust

and was discontinued.

3. In-Store Merchandisers: Emerging Markets

In-store merchandisers or distributor appointed “shelf stockers”

represent an essential function across Latin America, Asia,

and the Middle East. Large distributors maintain armies of

merchandisers to fight for shelf space and brand presence for the

brands that they represent. Retailers typically offer “prefunctory”

stocking for direct import brands, with low level of compliance

versus agreed to terms. I recall a situation in Mexico for a leading

USA beverage brand. The retailer had complained about slow

rotation of the direct import brand. We checked stores and saw

that only 2 of 4 sizes were typically cut in on the shelf, with

items relegated to the bottom or top shelf, nowhere near

“planogram promises.”

4. Distributors: Local Category Advisors

Distributors understand local taste preferences and share trends

from other market customers. In emerging countries, normally

there is a preference for smaller sizes than the family packs

offered in USA or European supermarkets.

5. Problem Solving: Pricing, Shelf Tags and More

Success in the consumer goods industry requires focus on the

myriad of details from the factory to the store shelf. Without a

distributor, difficult to identify and correct routine problems like

incorrect pricing, missing shelf tags , and misshelved goods.

6. Promotions Drive Trial and Tonnage

Local distributors offer periodic promotions to stimulate sales.

Typically, this translates to price discounts, but can also include

sampling, banded packs, and joint displays. Direct import brands

usually sit on the shelf without the benefit of local activation.

7. Point of Sale Material and Stock Rotation

Emerging markets permit point of sale materials which

encourage sales. Distributors provide special display pieces

or trial size shippers. Merchandisers rotate stock regularly

to facilitate “first in, first out” movement.

8. Damaged, Expired Goods or Product Recall

Local distributors provide a valuable service on returned goods.

This allows a retailer to remove out of date or damaged products

for a credit. With direct imports, the sub-prime product lags

unattractively on the shelf, with no one focused on replacement.

9. Payment Terms

Distributors offer retailers 30-60 day payment terms. Smart

retailers fund their inventory from the “float,” buying and selling

goods before the payment is due. On direct imports, retailer

needs to tie up his money in inventory, in some cases paying in

advance and then storing goods until the unsupported brands

sell. Is this the best use of capital?

10. Retailers: Support Your Local Distributor Community

Distributors represent small/mid-size local businesses

which provide jobs to members of the community. Distributor

employees are shoppers too, likely to shop at customers that

are supporting their company.

Success: Create Total Country Customer Strategy

Export Solutions recommends dealing with a local partner

(distributor) who is capable of serving all market customers.

This allows you to optimize sales and maintain pricing

equilibrium. Retailers attempting to buy direct offer the

temptation of short term volume, but rarely translate to

long term brand building for the supplier.

Retailer Benefits: Purchase from Local Distributors

Reduce Export Diverting

Activity Bad Practice Best Practice

Logistics

Allow factory pickup or

delivery to USA* port

Ship directly to distributor

Label USA* pack, 100% English

Translated to distributor’s

language

Distributor Profile

Small company with no

web site or brand references

Well known local distributor

handling other global brands

Pricing

Low price combined with

USA* port pickup

Export pricing model,

ship directly to distributor

Partner Due Diligence Start partnership without visit

Extensive evaluation,

including in market visit

Pack Size Standard USA* package

Special “multi language” pack,

labeled “Export Only”

Store Check No trip to check stores

Annual visit to document store

conditions and warehouse stock

Listing Map No customer level information

Report local product

authorization, by retailer

Syndicated Data No data

Obtain data to compare

purchase levels with

market consumption

Reference Check

No financial

or commercial checks

Check current principals plus

financial institutions (D & B)

* For Made in USA brands

16

Coverage: 96 countries and 2,700 retailers

Supermarket

Convenience

Drug Store

Natural Food

Club, Cash & Carry

Supplying profiles, store counts, formats,

news and info for Top 100 international

retailers plus all overseas branches

Example 1: Who are supermarket

retailers in the

Netherlands?

Example 2: How many stores does

Albert Heijn operate by banner,

in the Netherlands?

NEW!

ORDER NOW!

17

Search by Retailer NameSearch by Country

Combo Search

www.exportsolutions.com

Search By Format

Netherlands

32 Retailers

18

Everyone knows their own salary.

But have you given much thought

to the compensation structure for

your distributor partners? Distributor

compensation is often a “murky” issue,

buried in a calculation created years ago

focused on a combination of distributor

margin plus other income for services

rendered. Brand leaders periodically

review their distributor compensation

structure and compare it to the

requirements to service their business

in 2022. Listed below are Export Solutions

“Ten Tips” for analyzing your distributor

compensation model.

1. Convert Distributor Margin

to Gross Dollars Earned

Margin percentages are important,

but another critical measure is absolute

income derived from representing your

brand. This simple calculation of gross

margin multiplied by invoiced sales

provides a baseline number. If applicable,

manufacturers should add bonuses or

subtract retailer rebates.This is the first

step to understanding your true

distributor compensation.

2. Shared Service Model

Typical distributor services may include

importation, warehousing, delivery,

selling, merchandising, invoicing, and

collections. In some cases distributors

reinvest a portion of their margin in trade

discounts or in store marketing activities.

Another major distributor expense is

people, including senior management and

a brand management team. Income from

your brand margin buys your company

a share of total distributor resources.

3. Value Equation:

Distributor vs. Local Subsidiary

An important exercise is to evaluate the

services received from the distributor

relative to what they would cost if you

needed to create your own independent

subsidiary in a country. Your analysis

should include subsidiary allocations

for buildings, information technology,

telecommunications, travel, and

entertainment. Normally, the result

demonstrates that the distributor model

is an efficient outsourcing alternative.

The key is to balance your many company

objectives versus the requirement to

function in a “shared services”

environment where you are “buying”

only part of the distributors time.

4. Pay For Performance

Most food and consumer

goods industry executives

operate in a compensation

structure which includes a

bonus incentive for achieving

and exceeding assigned goals.

Some brand owners have

extended this approach to

distributors so that the entire

team is aligned on a common

plan. All distributor bonus

schemes should reward cases

moved into consumption

versus warehouse inventory.

5. Price Increases mean

Distributor Pay Raise

Many suppliers were fortunate

enough to execute price

increases. In a margin driven

structure, this often translates

to a pay raise for the

distributor, with little

incremental effort other

than implementing the price

increase. On the other hand,

a price decline means a

reduction in distributor

compensation and the

distributor needs to execute

his own “salary” reduction!

6. Contracts and Margins from the 1990’s

Many distributor contracts and margin

calculations date back to the 1990’s or

many years earlier. These agreements are

rarely revised or reviewed based upon

the realities of competing in today’s

marketplace. When was the last time that

you reviewed your Distributor contract,

margin, and service requirements? Does

it still make sense?

7. I don’t know my distributor’s margin

This happens more frequently than you

might imagine. In many arrangements,

the distributor buys your brand at a dead

net price and applies their own internal

methodology for margin development.

Some distributors are protective of this

practice with a rationale that manufacturers

should not “pry” as long as shipments

maintain a positive trajectory.

8. Best in Class Distributor Compensation

Leading Distributors offer an open book

approach based upon a cost to serve

model. Financially astute distributors

provide new suppliers a detailed

template identifying key services and

manufacturers requirements to operate

the business. Smart manufacturers will

benchmark their distributor margin

versus similar brands in the market.

Key inputs include complexity of your

product line, logistics inputs (temperature

requirements, case weight) and size of

your business.

9. Total Compensation:

More than Gross Margin

Examine every line item in your market

price calculation to understand total

distributor revenue sourced from your

brand. Distributors may increase their

income through promotional funds,

added margin for logistics services,

or periodic bill-backs.

10. Distributors have Profit Targets Too!

Distributors are in business to make

money too! It is quite reasonable to

expect that the distributor should

realize a net profit of 3-5 percent.

Everyone hopes to grow their salary

base and receive bonuses for excellent

performance. Winning long term

relationships exist when both parties

profit from business success.

Ten Tips – Distributor Compensation Analysis

19

Brand owners express frustration at

the lack of response from distributors to

their representation inquiries. Qualified

distributors are flooded with emails from

companies looking for new distributors

to handle their unknown brands. It’s

difficult to convince massive retailers

to take a chance on a new brand without

a proven track record. It’s even tougher

to persuade the owner of a mid-size

distributor to write a check for the first

order of your product, particularly if

you are not committed to a significant

marketing campaign. Brand building

from ground zero requires one-two years.

Research reveals that approximately

20 percent of new products are still on the

shelves two years later. Listed below are

Export Solutions’ tips on increasing your

chances that your new brand will be a

“Gold Mine” for a successful distributor.

Distributors: Always Looking for New Brands

Every distributor is looking for new

brands. Distributor profitability rises

exponentially when they add new

business. New business allows them

to leverage their fixed costs of warehouse

space and sales teams. Most distributors

search for adjacent brands that

complement their existing portfolio.

For example, confectionery specialists

look for other snack items that may be

purchased by the same buyer and are

located in the same aisle as their current

brands. Distributors need new

companies, as all distributors (even

the good ones), lose brands due to

acquisition, performance, or direct

models. The key is to position your

new brand opportunity as an attractive

addition to the distributor’s portfolio.

What Every Distributor Wants to Know

While you rave about your brands

superior taste, the distributor has

three thoughts on his mind :

1. How much money can he

make representing your brand?

2. Will it be tough to secure

market acceptance?

3. What will the brand owner commit

to in marketing investment?

Manufacturers that position their

proposition in these terms have a better

chance of gaining market acceptance.

Review Export Solutions’ article “How to

Excite Buyers, New Product Checklist”

for an independent product assessment.

Resistance to Pioneering

New product launch cycles require up

to one year from time of first distributor

meeting until he receives retailer payment

for his first order. During this incubation

period, the distributor must allocate his

sales and marketing resources to your

company without compensation. This

time dedicated to your company is

sourced from their other brands that are

currently generating income. Access to

the shelf does not guarantee consumer

trial and repeat purchase. A distributor

may buy your brand, capture shelf space,

and suffer disappointment when the

product does not sell. Unfortunately,

these pessimistic comments reflect reality

and provide insights on why best in class

distributors are hesitant to pioneer.

On the Road to Gold Mine

How can brand owners overcome

distributor resistance to pioneering?

Distributors are impressed by large

companies and brands that have been

successful in adjacent countries. Some

distributors will accept a product that

offers some existing market penetration

with the belief that their stronger team

can drive the business to the next level.

Manufacturer commitment to a powerful

marketing program sends a loud message

that you are serious. For mid-size

manufacturers, offering a small monthly

pioneering fee ($3,000 - $7,000)

demonstrates that you are a patient

partner, willing to co-fund the launch

preparation until distributor sales begin.

At the end of the day, distributors look for

a strong partner, with a good track record,

and a firm financial commitment to

support youir mutual marketing efforts.

How to Find an Enthusiastic Partner?

Export Solutions compiled an extensive

Distributor Search guide covering all

aspects of the distributor search process.

In pioneering scenarios, it is critical to

consider a wide variety of potential

partners. Schedule a one week trip

to a country. Plan to visit at least 5

distributors. Most distributors will be

open to an introductory meeting with an

overseas principal if you are professional

in your approach. Referrals from your

local government trade support contact

or another one of their current brand

owners helps pave the way. Trade Shows

also generate leads from interested

distributors. Post a large sign saying:

Distributors Wanted, listing countries

of interest. This will encourage visitors

to stop and chat.

Pioneering is tough but not impossible.

In reality, creating new brand sales from

a zero base is the essence of the Export

Manager’s job responsibility. Fortunately,

Export Solutions’ database covers more

than 9,200 distributors looking for

opportunities. Good luck!

Pioneering: A Gamble, Not a Guaranteed Gold Mine

20

Introducing

America’s Favorite Brands

Executive Board

Export Solutions Smucker’s Tabasco

Greg Seminara, CEO Danny Berrios, President Megan Lopez, Vice-President

General Mills Sun-Maid

Eric Saint-Marc Carsten Tietjen

Advisory Board

Bazooka Candy Blue Diamond Bob’s Red Mill

Santiago Ricaurte Dale Tipple Jan Chernus

Bush Beans Campbells Church & Dwight

Dave Bauman Julio Gomez Arun Hiranandani

Ferarra Candy Heartland Idahoan

Daniel Michelena Tom Theobald Ryan Ellis

Johnsonville Sausage Kao USA Keurig Dr. Pepper

Cory Bouck Julie Toole Billy Menendez

Mizkan Reynolds Welch’s

Noel David Chris Corey Marc Rosen

19 Companies | 200+ Top Brands | $80 Billion Combined

View our activities for export managers – www.usafoodexport.com

21

Stretching thin marketing budgets is a job

requirement for most Export Managers.

Listed below are “Ten Tips” for brand

building on a “Shoestring Budget.”

1. Tap into Government Export Programs

Many countries sponsor strong trade

organizations that can aid your export

development program. Exports translate

to jobs and most countries have well

established programs to facilitate the

sale of locally produced products. For

example, the USA Foreign Agricultural

Service will co-fund marketing

investments for small-mid size USA food

producers through their MAP programs.

German Sweets and GEFA, UBI France,

ICE (Italy), ICEX (Spain), Austrade

(Australia), and AG Canada serve as

valuable resources for local exporters.

These organizations often sponsor local

“Food Events” at leading supermarkets

in international countries. For example,

Austrade sponsored G’Day USA to

showcase Australian food producers to

USA consumers. These events are highly

publicized and normally feature a

relatively modest participation fee.

2. Leverage Relationships

with Global Retailers

Wal*Mart, Carrefour, Tesco & Costco

all maintain programs to ease the export

process for their current suppliers. This

usually involves direct consolidated

shipments with other local producers,

labeling assistance, and placement in a

special section in the international aisle

of their stores, i.e., USA Foods, France

Foods, UK Foods etc. The immediate

benefit is the streamlined route to market

without payment of upfront local

marketing fees. This allows you to “Test

the Market” prior to a traditional market

entry with a local distributor and heavy

marketing support.

3. Joint Venture with Local Manufacturer

Another idea is to locate a local player

in your category in a country targeted

for expansion. You may be able to

offer a potential partner innovation

in taste/flavor or packaging to

complement his local expertise. A joint

venture or Co-Branding agreement can

produce revenues without significant

start-up funds.

4. Build Marketing

Costs into

Distributor Margin

Many

manufacturers

build an accrual

fund into their

distributor

margin

calculation.

Normally the

funding level is

around 10% of

sales, but can

range from 5 -

20% depending

on the category.

This creates a

fund for the

local distributor

to manage. The

accrual fund is created on a “pay as you

go” basis, with fund levels proportionate

to shipments. In this scenario, the

manufacturer usually provides a small

fixed sum to create a launch budget prior

to initial shipments

5. Free Goods May Fund Trade Marketing

Free goods may be used to offset the cost

of trade marketing programs, particularly

for established brands. This can be in

form of a 1 free with 10 purchase or

similar type of promotional events.

The benefit is that your budget can be

stretched as your cost of goods produced

is less than the wholesale cost.

6. Private Label

Retailers source quality products for their

private label at the lowest possible price.

This eliminates the need for marketing

investments. However, private label is

difficult if freight expenses are too high.

7. Foodservice Channel

Foodservice/Catering offers a “low

investment” route to market versus

the supermarket channel. Foodservice

usually requires less traditional brand

marketing support. Foodservice operators

look for tailored solutions with rebates

based upon purchase levels. A small

budget for SPIF’s (SPIF- special incentive

fund) can generate purchases from

independent restaurants.

8. Specialty Retailers

Each country has specialty retailers that

serve as alternate channels for your

brands. This could include diverse

customers such as Cost Plus World

Market, Trader Joes, Big Lots or Dollar

Tree in the USA. These retailers maintain

different approaches not dependent on

heavy manufacturer spending.

Their strategy is to offer different brands

(or sizes) versus traditional supermarkets

or mass merchandisers.

9. Co-promotion with Other Brands

Retailers generate excitement through

Theme events around a group of

complimentary items or common

cause. This could involve participating

in Barbecue event with other Barbecue

related products :

Charcoal, Meat, Picnic Supplies, Drinks,

Pickles etc. Another example is a retailer

promotion celebrating their anniversary

or support of their favorite Charity

(Juvenile Diabetes etc.). In many

countries, leading distributors sponsor

an annual event for all the brands they

represent. Don’t forget the country

specific promotions (G’Day USA)

mentioned earlier. In each case,

manufacturers pay for a portion of

the event as costs are spread out among

all brand participants.

10. “In & Out” Packs/Gift Baskets

These special packs can generate

incremental business without investment

in listing fees or shelf space. Examples

could include modular displays, trail size

shippers, or bonus packs with free product

or gift. Gift Baskets are very popular

during the Christmas Holidays. This is a

good vehicle for “Fine Foods” brands to

gain exposure with gourmet consumers.

International Expansion – Shoestring Budget

Coverage: 96 countries and 9,200 distributors

Confectionery & Snack

Gourmet/International Foods

Beverage (Ambient & Hot)

USA, German, UK, Italian Food

Health & Beauty

Tracking Distributors for more than 300

of the world’s most famous brands.

Example 1: Who are Beverage Distributors

in Germany?

Example 2: Who is the Pringles Distributor

in Saudi Arabia?

NEW!

ORDER NOW!

Distributor Search Made Simple

22

Search by Brand NameSearch by Country

Search By Category

Combo Search

www.exportsolutions.com

23

There are 196 countries in the world

and there is always a financial crisis

somewhere. Recently, Western European

countries have suffered issues. Emerging

markets display a history of “boom-bust”

cycles. A friend from Argentina explained

this story. “I do not worry when things

are bad and the country is suffering. At

least, I can face my problems directly and

I know that recovery is ahead of me. I am

more afraid in good times, when business

has been growing for a few years. In these

cases, I know that a new crisis is around

the corner and surprises are tougher

to deal with.” Recapped below are

Export Solutions’ Ten Tips for

dealing with countries experiencing

financial instability.

1. Assume every market will be affected.

Naturally, certain emerging markets carry

a higher degree of risk versus others.

However, even large countries such as the

USA and the United Kingdom have been

burned through the bankruptcies of

Bruno’s and Woolworth’s. Total risk

should be measured by the amount

of credit outstanding as well as each

countries risk factor.

2. CFO to CFO discussions make sense.

Bring in the financial experts. Let your

company CFO or financial manager speak

with your Distributors ( or Key Retailers)

financial manager. These financial experts

speak the same language and will

allow your financial team to accurately

gauge the situation. It also spreads

out the responsibility beyond the

sales and marketing department

for potential problems.

3. Request New Distributor/Retailer

Credit Information – Most of this

information was submitted years ago

in advance of the credit crisis. It is timely

to request new information every year.

2021 year end financial reports should

be available from every distributor.

4. Watch Distributor/Retailer Inventories

Shipments to retailers may not correlate

to consumer demand. Inventory levels

measured in terms of weeks supply

on hand should be monitored at both

distributors and retailers. Higher

inventory levels signal slowing

consumer demand. Reduced inventory

levels may indicate a cash flow/potential

credit problem.

5. Connect with Peer Non-Compete

Suppliers – Every retailer and distributor

trades with a myriad of suppliers. I

recommend setting up formal or informal

groups of peer, non compete, suppliers.

These valuable contacts facilitate the

exchange of benchmarking information

on shared retailers and distributors.

6. Track Leading Indicators – Most of

us are not economists, but it is still easy

to develop a simple tracking form of

leading metrics for distributors in key

countries. We suggest measuring trends

in shipments, accounts receivable,

inventory, as well as country level data

on GDP, stock market, unemployment,

and currency exchange rates.

7. Payment Terms – Some suppliers are

implementing additional safeguards to

protect themselves. This includes moving

towards “brokerage style” arrangements

where the manufacturer still maintains

ownership of the goods. Other strategies

include offering discounts for early

payment or requesting cash on delivery.

8. Run a Dun & Bradstreet Report on

Partners – On the surface, business may

appear normal. A Dun & Bradstreet

Report (or similar) creates a rating based

upon a thorough examination of financial

records, statements and dealings of the

business with its customers, clients,

investors and shareholders.

9. Beware of Unusual Shipments or

Billback’s – Unfortunately, there are

too few examples of unusual, “best

ever” promotional success stories. Look

carefully at order patterns or promotional

allowance reimbursement (billback)

requests that appear out of sequence

or abnormal.

10. Commit to Open Dialogue with Long

Term Partners – Many exporters enjoy

relationships with their international

distributors that extend 20, 30, 40 years

or more. Current financial issues likely

reflect overall country level financial

status versus poor decisions taken by

a long term distributor. Distributors need

to understand that manufacturers hate

“surprises”. Best bet is to create an

environment that facilitates open

communication supported by data

to solve any credit issues.

Ten Tips – Managing a Credit Crisis

24

Dramatic currency gyrations wreak

havoc with retail pricing around the globe.

Strong USA dollar, weaker Euro, devalued

China RMB, and cratering pound.

These lightning fast moves on currency

exchange may require six months or more

to wind their way through the supply

chain. Some distributors devote more time

to serving as f/x traders versus brand

builders. Unfortunately, most export

managers are distanced from the problem

until receiving an urgent call from a

distributor who faces passing on a 10-20

percent price increase to his customers.

Listed below are Export Solutions’ “tough

tactics for tumultuous times.”

Higher Prices Mean Lower Volume

Emerging market currencies usually

move in a weaker direction. This

translates to higher shelf prices. Citizens

in these economies rarely experience wage

increases in parallel with inflation. Most

consumers tend to reduce purchases of

overseas products as they become luxury

items. Exporters need to calibrate “how

much pain” they are willing to endure

in terms of lower volume.

Prices Only Go Up, Never Down

Permanent price declines or rollbacks

are extraordinarily difficult to execute.

If your currency weakens, retailers and

distributors don’t pass on lower net cost.

It is common practice for them to try to

maintain retail shelf prices and capture

extra margin. Savvy brand owners skip

the price rollback and invest in heavier

promotion levels or enjoy higher profits.

Conduct Monthly Price Surveys

In countries of extreme price fluctuation,

best to schedule monthly price surveys of

your brand and the competition. Request

that distributors use the same store base

every month to avoid regional differences.

Online grocers allow us to monitor

country pricing from our desktops,

miles away from overseas markets.

Retailers: Once Per Year Price Increases

Many retailers accept price increases

only one time per year. This may occur

in conjunction with annual negotiations.

Other retailers demand ninety days

advance notice. Sometimes “borderline”

brands encounter customers who

simply refuse to accept price increases.

Ultimately, this puts tremendous pressure

on distributors who may be facing price

increases from multiple suppliers

What’s Fair? – Peg Rate

I advocate a model where currency

is pegged to an exchange rate at the

beginning of the year. Distributor and

brand owner agree to “swallow” price

swings of the five percent in either direction

of the peg. If the currency breaches five

percent threshold, then both parties review

the formula and assess options.

Bank Rate Versus Distributor Rate

A key metric to investigate is the

distributor exchange rate in his

calculation versus the actual bank

rate. Many distributors seek to insulate

themselves by building in a five to ten

percent protective cushion. Guess

what? If the currency doesn’t move,

the distributor just made an extra five

to ten percent on your brand, starting

from the landed cost line!

Sell in Local Currency

This forces large manufacturers to accept

the risk or benefit. This insulates smaller

distributors who may not enjoy similar

capital reserves as their larger principals.

This approach works especially well

with European brands selling to the

USA or vice versa.

Competitive Activity

Frequently, all category players

experience similar input cost increases

such as raw materials. Competitors may

use the window to hold prices low to

gain market share. Others may eliminate

promotional spending. Ultimately brands

elect a certain price positioning in

a country and should strive to stay

within the desired range.

Document Price Change Rationale

Retailers provide strict challenges to those

requesting price increases. Supply them

with hard facts on costs of raw material,

currency exchange, transportation and

other factors. Retailers with substantial

private label programs face similar

pressures on their own private label,

so they are not blind to the situation.

Watch Credit/Receivables

Distributors pay their suppliers in

advance of receiving payment from local

customers. Distributors invoice in local

currency and wait for repayment.

During periods of currency fluctuation,

the typical sixty day float could result in

a five percent reduction in receivables.

Across a broad portfolio of brands, this

could spell trouble for a distributor.