The UN projects that the world

population will reach eight billion

in November. This milestone reflects

one billion new citizens gained since

2011. Sixty percent of the world’s

population resides in Asia, almost

five times the combined total of

Europe, USA, Canada, and Australia.

The west still maintains a sizable

advantage with purchasing power.

However, an enormous opportunity

exists targeting the top 20% of Asia’s

population, a market exceeding one

billion people. “Mouths plus money

equals opportunity.”

Lessons Learned

Why does it surprise us that Chinese

people prefer Chinese food and Indians

opt for Indian food? How popular is

authentic Chinese food in Italy? Italian

food has had some success pioneering

across Asia. However, the clear

conclusion is that western food has

struggled to attain popular acceptance

in the high-growth, emerging market

countries. Our brands remain niche,

Insights to Accelerate International Expansion

Fall 2022

Volume 14 Issue 4

Our Mission: Help Manufacturers “Spend time Selling to Distributors versus Searching for Distributors”

In This Issue

Looking for New

Distributors?

How about 9,300? Export Solutions’

distributor database has helped 3,000

brand owners in 14 years speed up the

process of finding qualified distributors.

Our database covers an average of 85

distributors per country of supermarket

type products for 96 countries. Search by

country, category, brand name, or country

of origin. Experts for Europe, Middle

East, Latin America, and Asia with

complete regional coverage. “Spend

time

selling

to distributors versus

searching

for distributors.”

Now Serving: 8 Billion

Page 2

What Is the Size of the Prize?

Page 3

Euro-USD Exchange Rate:

Money Matters

Page 4

Food Diversity Quotient:

Export Potential Indicator

Page 5

What Distributors Like

Page 8

Exporter Classification

Page 9

Distributor Classification

Page 10

FAQ’s

– Distributor Database

continued on page 7

2023 Hot Markets

1. USA

(International Brands)

2. Saudi Arabia

3. VIP’s: VN, ID, PI

4. Poland

5. Mexico

2

Every job seeker is trained to quickly

gauge the salary range before dedicating

energy to the interview process.

Then why do companies searching for

international distributors and new retail

placements ignore the question on every

buyer’s mind? What is the size of the prize? As export managers tout product

benefits and overseas success, the distributor “customer” is quickly calculating how

much revenue and profit your product line can generate in his country. Distributors

are motivated by a big prize, just like you would be tempted by a new job offer with

a lucrative compensation package.

1. All distributors are scouting for new business opportunities.

I help multinational companies like Barilla, Tabasco, Lindt, and General Mills on

distributor projects. Leading distributors receive at least ten new representation

opportunities per month. They make a quick initial assessment and respond with

urgency for an attractive prize from a strategic brand owner.

2. Is your size of the prize estimate real?

Distributors appreciate companies with existing business in their country. This provides

more accurate guidance on market potential. Pioneering from zero sales is tough!

Distributors respect fact-based sales forecasts based upon category size, market share,

pricing, and unique product benefits.

3. Sales performance is directly related to brand support investment levels.

Distributors may be more impressed by a company with a strong marketing support

campaign commitment versus another brand with a breakthrough positioning, but

limited investment in brand building. A brand’s marketing budget commitment offers

critical clues on the size of the prize.

4. Is it worth the effort?

Distributors are magicians at allocating limited team resources. Your product range may

be tempting, but how difficult will the task be to launch your brand, gain traction and

repeat sales? Most distributors select a maximum of two or three new companies each

year from the mountain of inquiries received.

5. Apply the same discipline to distributor inquiries.

Export managers may be overwhelmed by inquiries from small traders or distributors

from remote countries. Standardize your process to avoid speaking with “time wasters.”

Our motto “Select your distributors, do not let your distributors select you!”

Distributors maintain sales growth and profit objectives just like your company. Most

distributors are independent, family-owned companies. Logically, they elect to invest

their own money and team resources when a lucrative prize appears. Brands that remain

focused on distributor benefits will be successful at attracting a strong network of best-

in-class distributors.

Good Luck!

Strategic Services

Contact Us for

Export Solutions

1. Identify Best in Class

Distributors: 96 Countries

2. Best Practices

Export Strategy

3. Distributor Management

Workshops

4. Export 101:

Let’s Get Started

5. New Market

Prioritization

and Launch Plan

6. Personal Distributor

Introductions:

96 Countries

7. Walmart International

8. Distributor Contracts,

Margins, and Fees

9. Meeting Speaker

10. International

Strategy Expert

Strategic Services

Contact Us for

Export Solutions

1. Identify Best in Class

Distributors: 96 Countries

2. Best Practices

Export Strategy

3. Distributor Management

Workshops

4. Export 101:

Let’s Get Started

5. New Market

Prioritization

and Launch Plan

6. Personal Distributor

Introductions:

96 Countries

7. Walmart International

8. Distributor Contracts,

Margins, and Fees

9. Meeting Speaker

10. International

Strategy Expert

www.exportsolutions.com

Greg Seminara

“Spend Time Selling to Distributors versus Searching for Distributors”

What is the Size

of the Prize?

The euro and USD trade at parity for

the first time since July 2002. The recent

euro devaluation is a direct result of

instability created by the Russian invasion

of the Ukraine. The euro has declined

16% versus last year and historic levels

ranging from 1.13-1.20. Other benchmark

currencies such as the UK pound and

Japanese yen trade at multi-year lows.

This signals some pain for USA

multinationals such as P&G, Mondelez,

and Kraft Heinz, with sizable European

businesses. On the other hand, European

exporters may discover a unique window

of opportunity to develop their USA

business due to a more competitive

pricing framework.

USA: Retail Business Remains Strong

There is a permanent shift to food

consumed at home in the USA. Most food

brands are tracking 5-10% ahead of last

year through a combination of steady

volume and price increases. Home-based

workers now purchase food from

supermarkets for breakfast and lunch.

Dinners feature more inspired meals, as

people do not suffer through the evening

commute. Restaurant prices have

skyrocketed, especially in the fine dining

segment, making eating out a special

occasion event versus a regular habit. As

a result, USA consumers are searching for

new options and open to spending a little

more for innovative brands from Europe,

Asia, and the Americas.

415 USA Retailers

Export Solutions’ retailer database tracks

415 USA customers, segmented by state

and by channel. There are plenty of

small- to mid-size chains willing to

try an international brand to offer a

differentiated assortment versus national

players such as Walmart and Kroger.

International brands should offer a

compelling story, category innovation,

and a commitment to brand support.

A difference versus Europe is that the

average USA store sizes exceeds 40,000

square feet (4,000 sq. meters) with plenty

of space. Hard discount is not a factor,

with Aldi, Lidl and others accounting

for 2% market share. Private label market

share is only 18.8% according to Nielsen.

A proven strategy is to build a presence

at high-profile premium retailers before

gradually expanding to mass operators.

Three-Tier Model

Most overseas brands partner with

one of the 614 "importer"distributors in

our USA distributor database. In the USA

“distributors” usually refers to wholesale

distributors such as UNFI or Kehe.

International brands must consider

three margins in their value chain:

importer distributor, wholesale

distributor and retailer. However,

with a lower cost basis due to currency

and elimination of Trump-era tariffs,

many European producers are more

competitive today than at any time

in their recent history.

Saudi Arabia, UAE, Panama, HK, & Ecuador

Many countries peg their currency to the

USA dollar. This includes the Gulf nations

and the Caribbean islands. Panama is an

attractive growth market, a hub for Latin

America. Ecuador features a population

of 18 million and the USA dollar is legal

tender. Hong Kong features high

acceptance of international brands. All

of these countries are worthy of renewed

consideration due to the current euro

exchange rate.

USA Brands: More Marketing

Made in the USA brands will experience

higher price points in Europe. However,

a strong dollar also translates to more

marketing muscle for overseas investments

due to the elevated purchasing power of

the dollar. Next year may be the time to

stretch your investments in social media,

sampling, and promotion to build long-

term brand equity.

Revisit your Price Calculation

Successful distributors are brand builders

versus currency traders. Value-chain

calculations should be examined to

ensure that all partners maintain a fair

mix of profit and investment, without

currency fluctuation shifts falling to

the bottom line. Online price checks of

retailer web shops allows you to instantly

check the current assortment and pricing

of most leading USA retailers including

Walmart, Kroger, and Costco.

Retail Safari

One option to accelerate your North

America growth strategy is to participate

in a Retail Safari program from Export

Solutions. This “hands on”, commercial

approach allows companies interested

in USA development to benefit from

an intensive look at the USA and your

category. Participants in this one-week

program visit three or four benchmark

cities like Atlanta, Metro New York,

Los Angeles, and Toronto. Atlanta is

critical as the commercial capital of the

populated south (38% of USA) as well

as an opportunity to check all national

retailers in one suburb to see the real

USA market: Walmart, Costco, Kroger,

Publix, Whole Foods, Trader Joe’s,

Target, Sam’s Club, Fresh Market, etc.

Metro NY (or Boston) allows you to

observe more regional chains, with lower

cost-of-entry requirements. The Retail

Safari includes daily briefings on core

topics such as USA broker models, trade

promotion strategies, and value chain

calculation. Contact Greg Seminara for

more information.

3

Euro-USD Exchange Rate: Money Matters

Food Diversity Quotient:

Export Potential Indicator

4

Why are some countries more receptive

to international foods than others? My

informal analysis reveals that certain

countries have adopted world foods as

a regular part of their diet. For example,

a typical USA family consumes Italian

food, Mexican food, and Asian food

multiple times per month. Other

countries maintain deep appreciation

of their own traditional recipes, with few

citizens venturing to explore dishes from

foreign lands. This is a factor why China

and India are difficult to enter and why

the UK, UAE, and Singapore are open.

Examining the Food Diversity Quotient

of a country may serve as an indicator of

receptiveness to your product portfolio.

5 Stages

Every country maintains a mix of

consumers who eat primarily local foods

to world travelers regularly enjoying

a diverse mix of international menu

options. Credit the Italians and Chinese

for years of hard work pioneering their

delicious cuisines to the mainstream

in many countries. Now Mexican and

Japanese are gaining traction. The leading

ethnic food distributor in France stated

“during Covid, people could not travel

overseas on airplanes, so they began

traveling in their kitchens instead.”

Mass Versus Gourmet

An important data point is the percentage

of the population regularly consuming

food at different stages. Is it just a few

high-income gourmets, travelers, and

homesick expatriates? Or do most people

in a country periodically enjoy pasta,

tacos, and sushi? Understanding the

country-level Food Diversity Quotient

requires an assessment of whether the

consumption of international food is a

regular habit practiced by the masses,

or niche.

Retail/Foodservice Clues

One way to determine acceptance is

to track the size of international food

sections in supermarkets. Is there a big

section of Italian food brands? How many

Mexican or Thai food items are stocked?

Another method is to check the popularity

of restaurants specializing in food from

that country. Are there many Spanish or

Japanese restaurants? Are the restaurants

only in the capital city or countrywide?

Do restaurants exist at multiple price

points appealing to the “hungry student”

and the executive gourmet?

Future

A positive development is the surge

in acceptance of international foods.

There are many factors in country

segmentation and allocation of export

resources. Assessing a country’s Food

Diversity Quotient serves as another

worthy consideration. Export Solutions’

distributor database maintains filters

that allows subscribers to identify

distributors in 96 countries specializing

in food from Italy (1,417), Spain (414),

Germany (653), Latin America (561),

UK (688), Asia (466), and USA (1,205).

For more information, visit

www.exportsolutions.com.

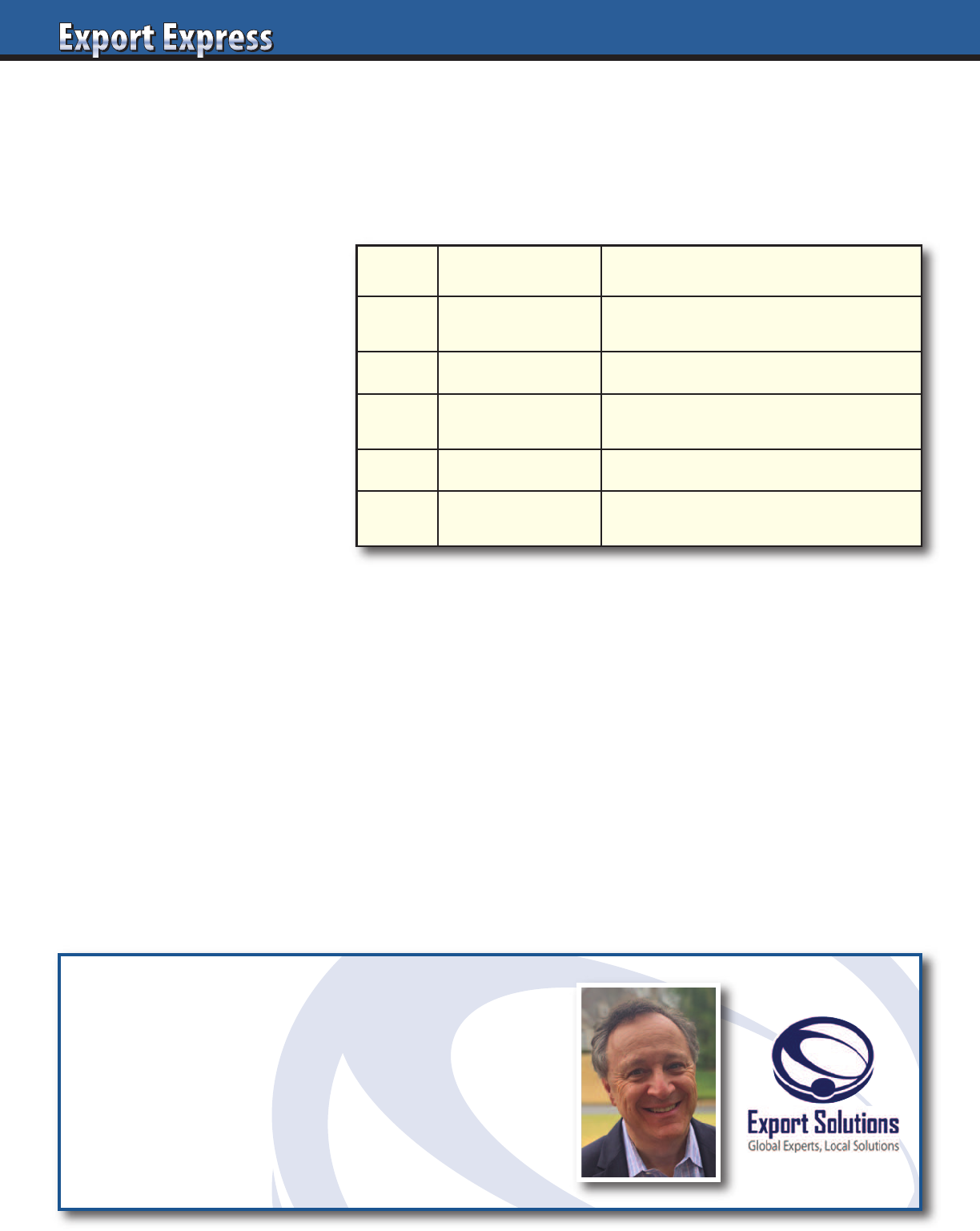

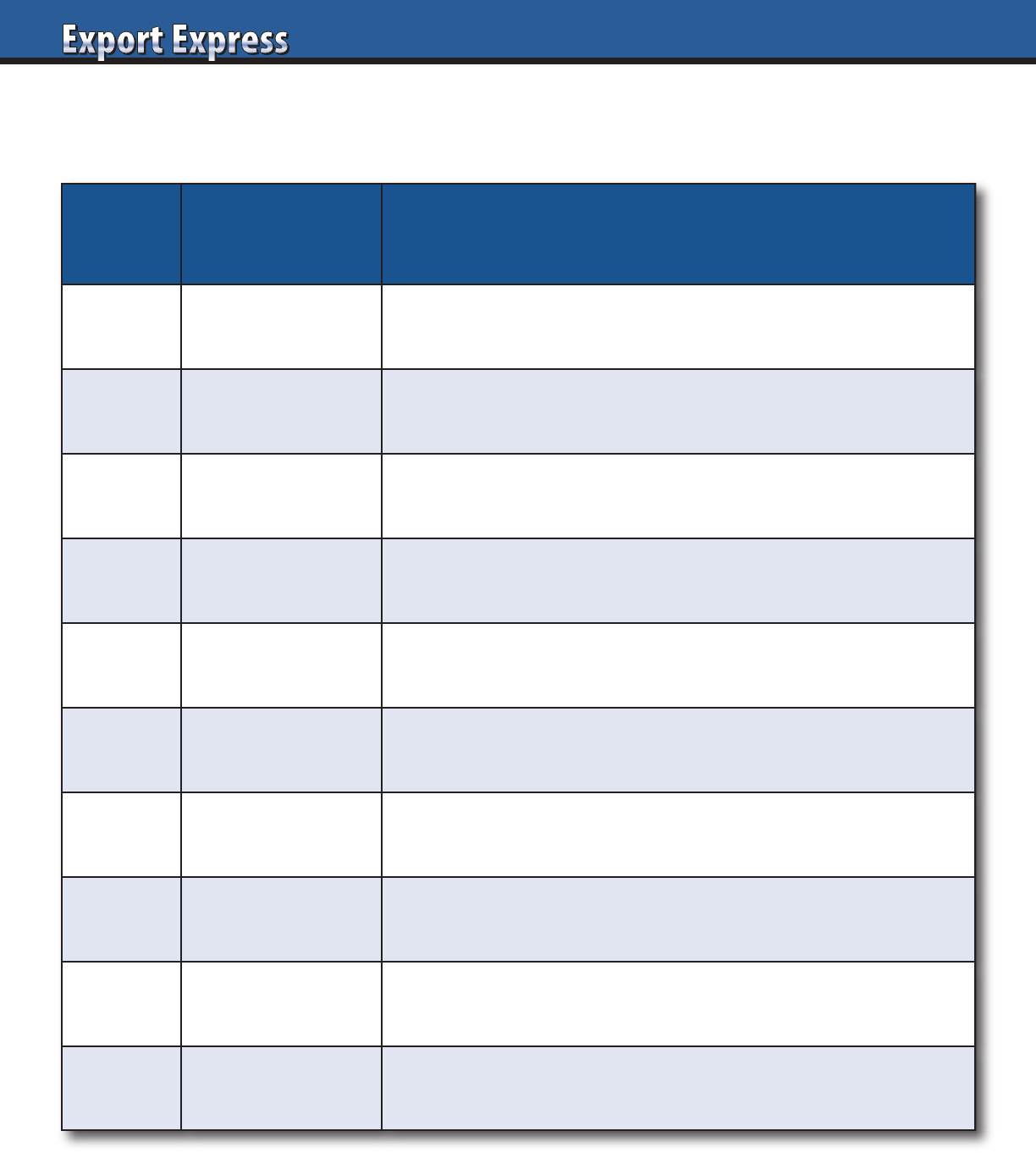

Stage Type Description

1 Local

Traditional Foods

Meat & Potatoes, Noodles

2 Popular Italian, Chinese Food

3 Trendy

Mexican ,Thai, Japanese,

Spanish Tapas

4 Explorers Middle Eastern, Indian, Vietnamese

5 World Travelers

Open to All Types of Cuisine:

African, Korean, Greek, Brasilian

Export Solutions Can Help!

• Distributor Search helper in 96 countries

Contact Greg Seminara at

greg@exportsolutions.com

or (001)-404-255-8387

www.exportsolutions.com

Food Diversity Quotient

5

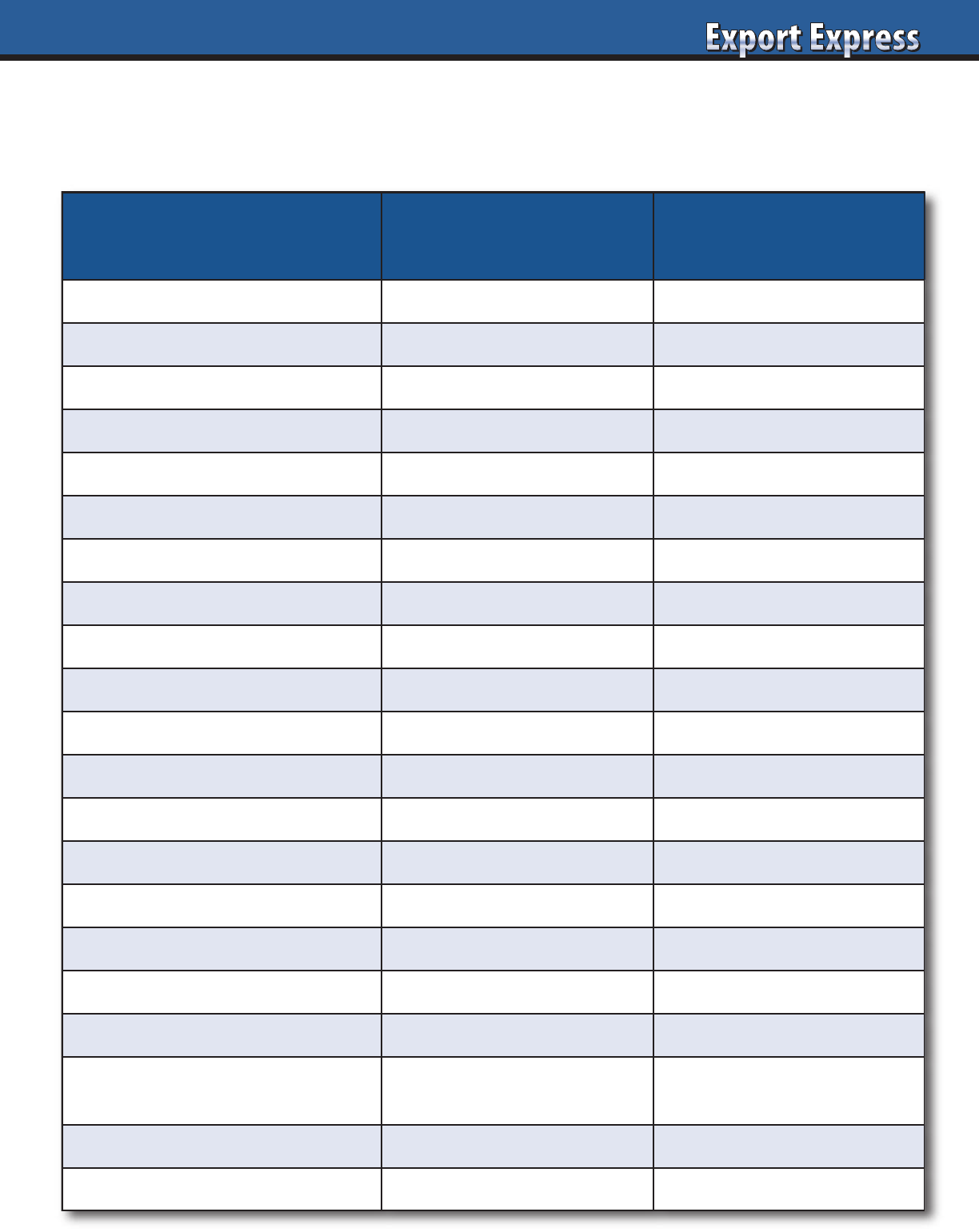

What Distributors Like

Distributors deserve respect as they are our customers for an entire country. They serve as "buyers" of our products and pay

our invoices. Distributors allocate more focus to companies that treat them well. Learn what distributors like (and don't like).

Like

Don't Like

Business Scale Category Leaders

Niche

Marketing Spend 15–25% of Sales Dead Net Pricing

New Brands Existing Business Pioneering from Zero

Syndicated Data Nielsen No Data

Consumer Research Local Insights

No Research

Service Level 98% +

Less Than 90%

Innovation Breakthrough

"Me Too"

Export Manager Veteran, 5 Years +

New

Customer Contact With Distributor

Direct

Reporting Basic Dashboard

Non-Essential Reports

Marketing Budget Local Events No Budget

Billback Repayment

30 Days or Less 60-90 Days +

Brand Facts/Content

Online Portal None

Customer Service

Same-Day Reply Same-Month Reply

Regional Meetings

Popular. Also HQ Invite. Never

Sales Contest

During Peak Season None

Company Visits

Quarterly Weekly or Never

Awards/Thank You

Celebrates Success No Recognition

Senior Management Relationship

Your CEO Maintains

Distributor Relationship

No Relationship

Distributor Margin Respects Healthy Margin

Low Margin

Growth Expectation

5–10%

0% or 20% +

6

Distributor Search Helper for:

Your

Logo

Here

Can We Help You?

Recent Distributor Search Projects

Asia Europe Middle East Latin America

Australia Germany Israel Argentina

China Ireland Kuwait Brazil

Indonesia Netherlands Qatar Colombia

Japan Nordics Saudi Arabia Costa Rica

Malaysia Spain UAE Ecuador

Philippines United Kingdom North America Mexico

Singapore Africa Canada Panama

South Korea South Africa United States Peru

Call the Export Accelerator!

Contact Greg Seminara at greg@exportsolutions.com

to discuss your business development project.

www.exportsolutions.com

as Asian consumers stick to their

traditional dishes, with European and

USA favorites appreciated by a small

group of upscale culinary explorers.

Confectionery and snack categories

remain exceptions, as everyone enjoys

a sweet treat. Starbucks and Coca Cola

should be recognized for converting

tea drinkers, but these leaders operate

with massive resources, far beyond

most exporters.

Food Diversity Quotient

Examination of a country’s Food

Diversity Quotient (see page 4 article)

supplies important clues on market

prioritization. This may increase the

attractiveness of global cities like Tokyo,

Seoul, and Singapore versus New Delhi

or Jakarta. Another option is to pair your

product with local dishes to create new

recipe ideas. Partner with a local chef

and food technologist for ideas. The

foodservice channel serves as an important

showcase in Asia for Western food.

M & A – Accelerator

Acquisition is an effective strategy to gain

critical mass, particularly in Southeast

Asia. Many consumers appreciate food

from an adjacent Asian country that may

be more similar to their own cuisine.

Large European and USA companies may

“buy local scale” and establish a platform

to produce their core brand locally and

export to nearby countries. Acquisitions

are not “risk free” and frequently require

overseas expatriates to share best

practices and manage the money.

High Class to Mass

Each country features a gourmet

supermarket chain catering to high

income consumers. A success strategy

is focusing trade promotion resources at

these upscale retailers before expanding

availability to mass retailers. For example,

the top ten percent of Indonesia’s

population represents a market of twenty-

eight million people, similar to Benelux.

The middle class totals about fifty million

Indonesians, larger than Spain.

E-commerce

E-commerce appears as a primary source

of revenue for many overseas brands,

particularly in China and South Korea.

This requires a unique go-to market and

investment strategy. Brands targeting

e-commerce may

consider aligning with

a distributor specializing

in this channel. Volume-

oriented companies

should also calculate

brick-and-mortar retail

costs when developing

a total-country pricing

strategy. A streamlined

value-chain model may

succeed for e-commerce

but not function when

competing in the

costly battle for shelf-

space game.

Right Fit Distributors

There are many

powerful distributors

in Asia. A key is to align

your aspirations and

marketing investment

with your distributor

profile. Companies

committed to brand-

building activation

should partner with

massive distributors

with omni-channel capabilities.

However, if you are operating with

a limited budget, consider a smaller,

hungry pioneer willing to dedicate

more resources to launching innovative,

premium products.

Meet the VIP’s

Vietnam, Indonesia, and the

Philippines feature a combined

population approaching 500 million

people. All of these countries are at early

stages of development, so cost of entry

remains low relative to the giant

populations and mid- to long-term size of

the prize. Indonesia features a labyrinth

of registration requirements, patiently

handled by the local distributors.

Vietnam is the new outsourcing star,

as manufacturing companies seek an

alternative to China. Both Philippines

and Vietnam maintain positive

acceptance of “made in the USA”

consumer products.

Where is Your Team?

In the past, export managers serviced

Asia with a few grueling two-week trips

per year. Advanced companies created

regional headquarters in expat-friendly

hubs like Hong Kong and Singapore.

Today, winners are shifting emphasis

to local hires in the VIP’s, Malaysia or

Thailand. These emerging countries

feature talented executives trained

by multinationals at an affordable

compensation package when paid in local

currency. These managers wake up in the

market, speak the language, and dominate

the attention of leading distributors.

Export Solutions Can Help

Export Solutions has executed more

than 50 projects across Asia. This includes

multiple distributor search projects across

India, Japan, South Korea, Indonesia,

Philippines, Taiwan, and even Mongolia

and Myanmar. Export Solutions’ Asia-

Pacific distributor database is extensive,

supplying information on more than

2,000 distributors across 17 countries.

This translates to an average of 120

distributors of all types of branded

products covering every aisle of the store.

Looking to accelerate your business in

Asia? Export Solutions can help!

Now Serving: 8 Billion

continued from page 1

7

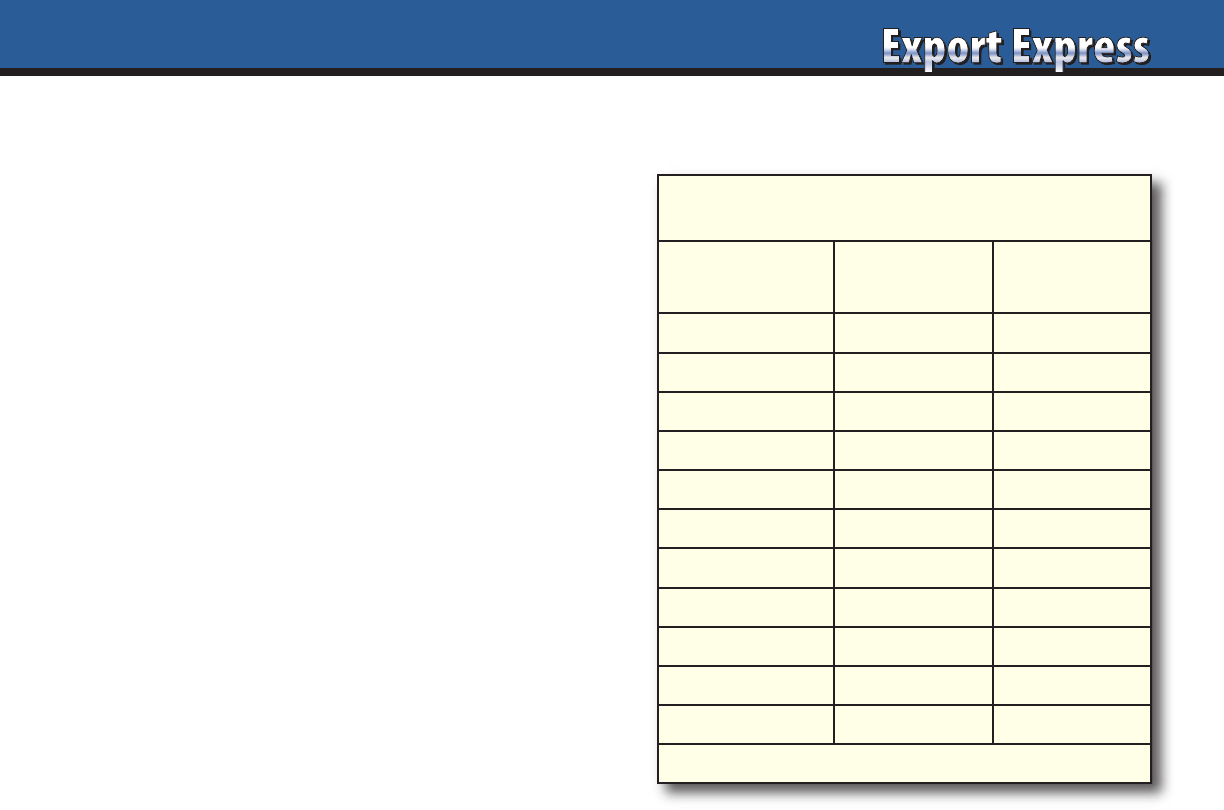

Population

(millions)

Top 20%*

(income)

China 1,426 285

India 1,417 283

Indonesia 280 56

Japan (80%) 126 100

Philippines 113 22

Vietnam 100 20

Thailand 72 14

South Korea (80%) 52 40

Malaysia 33 7

Taiwan (80%) 24 19

Total 3,643 846

*Top 80%: Japan, South Korea, Taiwan

Asia’s Next Billion

8

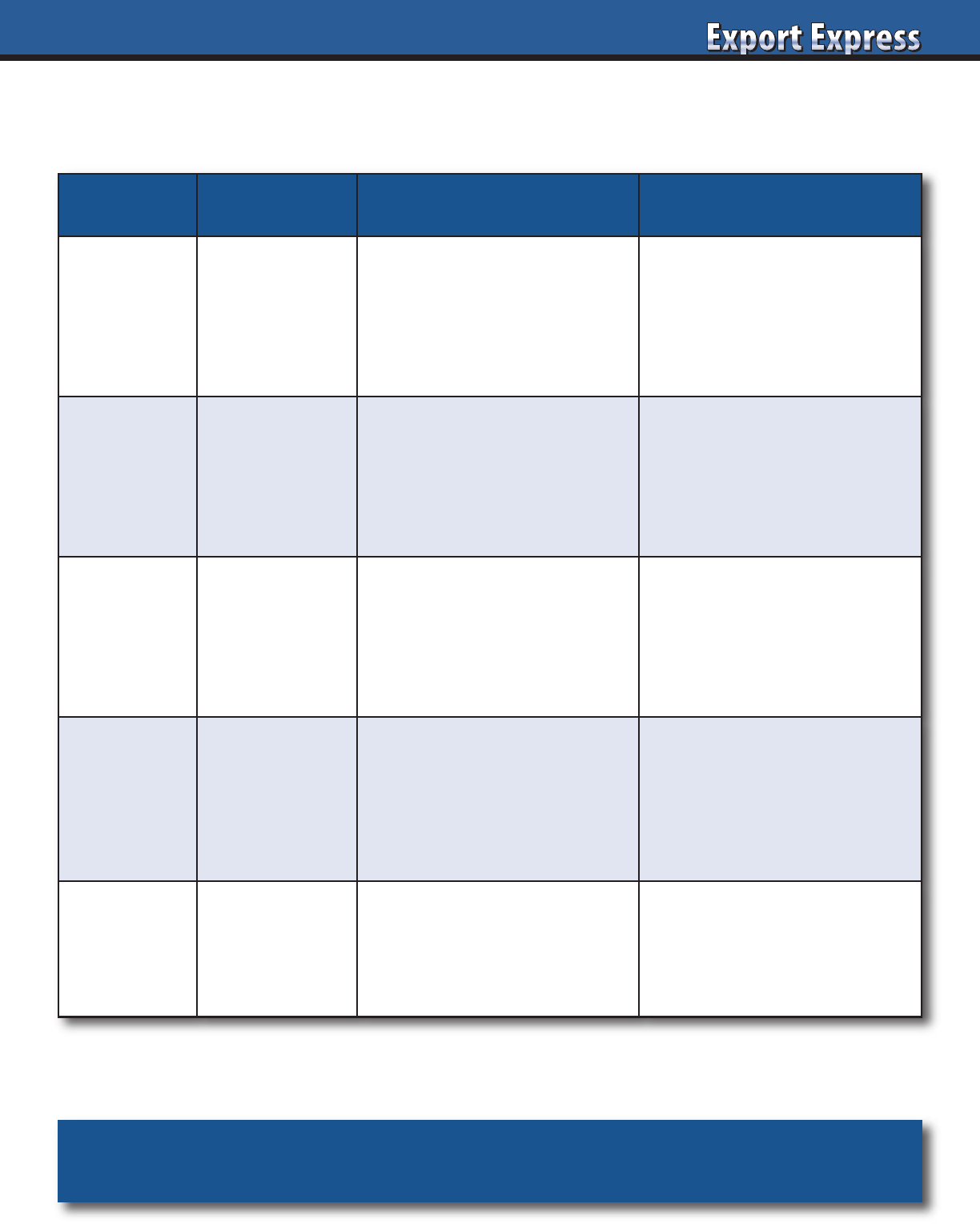

Exporter Classication

*

Type Description Export Profile

10 Multinational Strong market share everywhere across multiple categories.

9 Global Multinational. Mix of leading countries and niche participation.

8 Category Champion One core mass category. Strong performance globally.

7 Icon Well known, niche leader. Global availability. Example: Tabasco.

6 Regional Leader Strong share across one continent/region. Some export success.

5 National Hero National treasure, #1 brand. Exports to homesick expats, tourists.

4 Player Respectable share in home country. Opportunistic exports.

3 Participant “Me too” product. Opportunistic exports. “Trader”/private label.

2 Challenger Innovator. Some listings in home country. New to export.

1 Start-up Trying to get traction in home country. Export “dreamer.”

*Export Solutions’ classification system

9

Distributor Classication

*

Stars Title Description Prime Prospects

HHHHH

Champion

Massive distributor

Handles multinational/

#1 brands across

many categories

Brand leaders

$$$ marketing budgets

Exporter types: 6-10

HHHH

Captain

Category captain

Handles leading brands

in one segment

Category

innovators/leaders

$$ marketing budgets

Exporter types: 5-9

HHH

Player

Mid-size distributor

Handles #2/3 brands

or niche leaders across

many categories

Differentiated,

premium brands

$-$$ marketing budgets

Exporter types: 4-7

HH

Participant

Respected local

Diversified

product portfolio

Results equal

to investment

Flexible, challenger brands

$ marketing budget

Exporter types: 2-4

H

Pioneer

Small distributor

Entrepreneurial, open to

innovative new companies

Start-up brands

“Pay as you go” marketing

Exporter types: 1-3

Need more information? Visit www.exportsolutions.com.

*Export Solutions’ classification system

10101010

Why did you create the distributor database?

Export Managers dedicate a lot of time

to networking, always searching for good

distributor recommendations. We waste

precious time at trade shows speaking to

“pretenders” with no hope of adequately

representing our brands. I thought that

the supermarket industry could benefit

from a global distributor database to

instantly find the leading distributors

in any country.

How did you compile the distributor database?

Export Solutions sources distributor

candidates using six specific strategies.

This includes having access to the global

distributor lists of more than 300 brands

and store checks in at least 25 countries

per year.

How accurate is the contact data?

Export Solutions’ distributor database is

updated every day! Distributor company

names, web sites, and specialization

rarely change. This makes the database

98% accurate at the company level. The

distributors’ key contact for new product

inquiries and their email addresses

may change as a result of job moves.

Email address accuracy ranges from

80-90% depending on the country. We

employ three separate mechanisms

to keep up to date with changes.

What’s new?

Our database has expanded to 96 countries

and 9,300 distributors. It’s now searchable,

supplying country and category filter

inputs or brand names! We also offer

90-day access if you purchase a country

or category list. This allows you to work

online and enjoy “one click access” to

distributors’ web sites. Naturally, we

prefer that you purchase an annual

subscription with unlimited access to

the entire database for one year.

What is the difference between

Export Solutions’ distributor database

and other “lists”?

1. Created by industry export professionals,

not directory aggregators or other online

companies with no relevant food/consumer

goods industry experience.

2. Each distributor is personally validated

by Greg Seminara. Distributors can not

self register or pay to be in our database.

We know the difference between a

“best in class” distributor and a “one

man show.”

3. Our distributor database is designed

for manufacturers of branded products

normally sold through supermarkets,

pharmacies, and food service channels.

We do not include distributors of

commodities or ingredients.

4. Call us! Our specialization is

distributor search, with 300+ projects

completed. Contact us for a free copy

of our Distributor Search Guide.

5. Our database is searchable by country,

category specialization, brand name, or

a combination of all three filters.

Which type of companies use our database?

Database clients range from small start-

ups to the largest companies in food

and consumer goods. Export Solutions’

database has had more than 3,000 clients,

including brand owners from all over

the world. Leading government trade

organizations from USA, Italy, Germany,

and Brasil also develop special

agreements to gain access.

What product categories are covered?

Distributors include specialists for branded

food products, confectionery and snacks,

beverage, natural foods, gourmet products,

ethnic food, health and beauty care products,

household products, and general

merchandise. We offer oustanding coverage

of Italian, German, Spanish and UK food

distributors. Many distributors can handle

any product that is normally sold through

supermarkets, convenience, foodservice/

catering, or pharmacy trade channels.

What are best practices in getting the most

productivity from the database?

Successful companies use the database

to screen companies to develop a top five

list of high-potential candidates. They

send a short introductory email with

a web link to their company site. Then,

the export manager follows up with a

phone call within 48 hours. The database

is an excellent tool to invite potential

candidates to an international trade

show like Sial, Anuga, ISM or Sweets

and Snacks. Note: mass mailing

distributors usually generates less

than desirable results.

Does Export Solutions provide any additional

information on the distributors?

Export Solutions knows many of the

distributors in our database. Clients

of our Premium Subscription or Talk

to An Export Expert Services can gain

access to our insights via phone on the

best distributor candidates in any of

the 96 countries we cover.

How do I access the distributor database?

Visit www.exportsolutions.com and

click the distributor database page.

You can place a subscription or country

or category access into a shopping cart.

Register and check out via credit card.

The process takes two minutes and we

automatically send you an invoice.

FAQ’s – Distributor Database

11

Search by Country

Coverage: 96 countries and 9,300 distributors

Search By Category

Confectionery & Snack

Gourmet/Ethnic Foods

Beverage (Ambient & Hot)

Italian Food

Natural Food

Health & Beauty

Search by Brand Name

Tracking distributors for more than 500

of the world’s most famous brands.

Combo Search

Enter multiple factors:

Example 1: Who are confectionary/snack

distributors in Japan?

Example 2: Who is the Barilla distributor

in Mexico?

www.exportsolutions.com

NEW!

Distributor Search Made Simple

12

We’ve Got You Covered!

Distributor Database Coverage

International Foods

3,345 Distributors

Confectionery & Snack

2,751Distributors

Italian Food

1,417 Distributors

USA Importer/Distributor

614 Distributors

Europe

3,161 Distributors

34 Countries

Asia

2,038 Distributors

17 Countries

Latin America

1,593 Distributors

29 Countries

Middle East

942 Distributors

12 Countries

9,300 distributors – 96 Countries

Subscribe now at www.exportsolutions.com

“Spend time Selling to Distributors versus Searching for Distributors”