Insights to Accelerate International Expansion

Distributor Search Guide

Our Mission: Help Manufacturers “Spend time Selling to Distributors versus Searching for Distributors”

In This Issue

Sell to 96 Countries

Looking for new customers and

distributors in international markets?

Export Solutions’ distributor database

covers more than 9,200 distributors in

96 countries. Our database features

extensive coverage of leading food,

confectionery, and beverage distributors.

New! Export Solutions’ retailer database

now tracks 2,700 retailers in 96 countries.

Order now at www.exportsolutions.com.

Locating a strong local partner to

sell your brand is never easy. Export

Solutions has worked on more than

300 distributor identification projects

in 96 countries. We share every brand

owner’s frustration on the lack of

responsiveness to email and phone

inquiries. The reality is that pioneering

a new brand today is difficult for the

distributor too. As a result, distributors

are searching for unique brands,

supported by investment in marketing

and trade development activities. Your

professional first approach to a potential

distributor makes a big difference in a

creating a positive environment to

conduct business.

The objective of this guide is to share

practical tips for international distributor

identification projects. Export Solutions

desires to add more value to your

company than simply providing you

the lists of distributors for each country

or category. Export Solutions’ goal is to

share strategies, ideas, and best practices

that have helped other brands succeed

in building export sales. Ultimately, the

potential of your brand must attract

the distributor. Our Distributor Search

Guide helps enhance your “Export

Readiness” to target the right type

of distributor to build your brand.

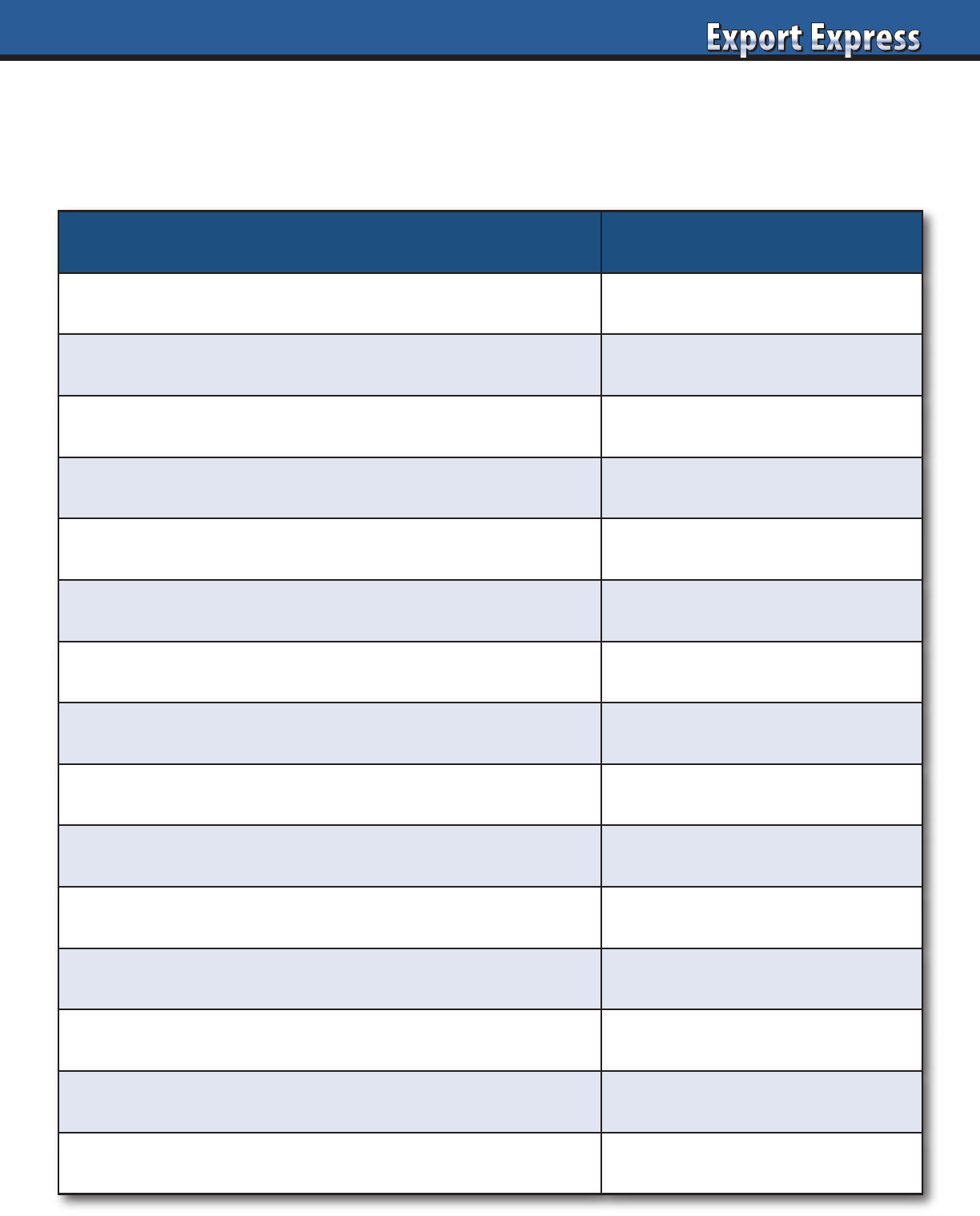

Distributor Search Guide from Export Solutions

3 History of Success pioneering other

international brands

3 Strong retail presence for current brands handled

3 Logical launch plan, category analysis,

and cost structure

3 Positive references from existing brands

and Dun & Bradstreet

3 Enthusiastic about your brand and the business

Greg's Guidance:

Distributor Assessment Criteria

Page 4

Select Your Distributors, Do Not Let Your

Distributors Select You!

Page 17

FAQ’s – Distributor Database

Page 26

10 Questions for Every Distributor Interview

Page 32

Ten Tips: Getting Better Results

with Big Distributors

Page 43

Export Solutions Celebrates 16 Years!

Page 55

How to Excite Buyers –

New Product Checklist

Page 63

Six Questions Regarding your

Distributor Pricing Calculation

Page 80

Big Distributors vs. Small Distributors:

Your Best Bet

2

2022 marks the fifteen year anniversary of

the launch of Export Solutions’ distributor

database. Many of my friends from export

will recall the story behind the birth. I was

faced with the challenge of identifying

distributor candidates in Italy for a large

multinational. I attacked the project the

“old way”: sorting through business cards,

checking the Embassy, calling colleagues, searching the internet, and after one

month finding five acceptable distributor candidates. Frustrated by the process,

I took six months off and pioneered the first industry database created from the

standpoint of an export manager. Today, brand owners locate names, web sites,

brands represented, and contact information for 105 distributors in Italy and

9,200 distributors across 96 countries in about 10 seconds on my web site.

Below are some important “lessons learned” about finding distributors.

1. 85 Distributors Per Country

Each country offers more distributor options than you think. Every government trade

officer and export manager knows the names of 3-5 distributors per country. Often, we

stick with an underperforming distributor because of the misconception that “there are

no other choices” in a market. Our country lists track an average of 85 distributors of all

sizes and specialties per country. The revelation is that you can instantly find several

qualified distributor options in every country by using our database.

2. Consider Small/Mid Size Distributors

Mega distributors representing 20 or more brands are not usually interested in

pioneering new brands with zero sales. These large distributors are excellent, but are

busy enough with their current portfolio. Many new brands focus their energies on these

“name brand” distributors, but are frustrated with the lack of response. Better approach

is to pursue small to mid size distributors that are hungrier and more entrepreneurial to

launch a new brand. Big distributors are a good choice when you are outsourcing sales

of a brand with measurable existing business.

3. Email Plus Telephone Call

No one speaks these days. We email 100 messages a day and wonder about the lack of

response. Email is a great to tool to communicate news. However, when you need action,

pick up the phone and call. Executives still return phone calls, but will frequently ignore

or delete email messages just to clear the inbox.

4. Rethink Your Trade Show Strategy

Trade shows like Sial, Anuga, Cibus, and ISM are outstanding places to gain visibility for your

brand and contacts with potential new distributors. However, too many brands use the “Hope

and Wait” approach at their booth. Unfortunately, many of the spontaneous visitors at a trade

show are from “time wasters”, incapable of building your brand. Some of our best success

stories come from companies who leverage Export Solutions’ database to create productive

meetings at trade shows. Basically, they pre-screen candidates from the database in advance

of a trade show and invite the most promising ones to scheduled meetings at the show.

5. Avoid Disappointment – Visit Each Market At Least Once

There are too many disappointments in the world of export. Frequently, I’ll witness a

distributor meeting a brand owner for the first time at a trade show. Within five minutes

they are discussing pricing, followed by exaggerated projections of market potential. Our

business is fairly straight forward to figure out. Visit each market at least one time. Meet

your distributor candidates at their office. Visit a few stores. Then create your plan. Export

is tough, but you increase your chances for success when you complete fundamental in

market due diligence.

www.exportsolutions.com

Distributor Search 2022

Greg Seminara

404-255-8387

“Spend Time Selling to Distributors versus Searching for Distributors”

Strategic Services

Contact Us for

Export Solutions

1. Identify Best in Class

Distributors: 96 Countries

2. Best Practices

Export Strategy

3. Distributor Management

Workshops

4. Export 101:

Let’s Get Started

5. New Market

Prioritization

and Launch Plan

6. Personal Distributor

Introductions:

96 Countries

7. Walmart International

8. Distributor Contracts,

Margins, and Fees

9. Meeting Speaker

10. International

Strategy Expert

Strategic Services

Contact Us for

Export Solutions

1. Identify Best in Class

Distributors: 96 Countries

2. Best Practices

Export Strategy

3. Distributor Management

Workshops

4. Export 101:

Let’s Get Started

5. New Market

Prioritization

and Launch Plan

6. Personal Distributor

Introductions:

96 Countries

7. Walmart International

8. Distributor Contracts,

Margins, and Fees

9. Meeting Speaker

10. International

Strategy Expert

1. Determine Brand Ambition for Country

Will your brand be a category leader,

player, or niche participant?

2. Establish Distributor Selection Criteria

Big brand distributor, category specialist,

or smaller entrepreneur?

3. Create a Pool of Candidates

Export Solutions’ database tracks 9,200

distributors in 96 countries.

4. Determine Candidate’s Preliminary

Interest Level

Send introductory email, followed by

phone call within 48 hours.

5. Introductory Web Interview

One hour meeting to share credentials

and confirm interest.

6. Local Interview at Distributor’s Office

4-6 weeks lead time. 2 hour meetings.

Send advance agenda and samples.

7. Independent Store Checks

Provides category insights and real distributor

performance for current brands handled.

8. Interview Preparation: Scorecard, Samples,

Your Presentation, Key Questions

Export Solutions’ templates: Assessment

Scorecard & Ten Questions for Every Interview

9. Distributor Interviews – Target 3 Candidates

Review capabilities, warehouse and interest

in your brand.

10. Cooperation Model

What is the plan? Year one plan, pricing

calculation, and timeline.

10 Step Distributor Search Process

Looking for Good Distributors?

Export Solutions’ database covers

9,200 distributors in 96 countries.

www.exportsolutions.com

3

4

How many emails do you receive a week from “distributors”

wishing to represent your brand? How much of your trade

show time is wasted on impromptu meetings with enthusiastic

“traders” who make bold promises, but never order? Why are

we surprised when you search these companies on the internet

to discover there is no information or a web site “under

construction?” Many companies’ distributor networks contain

these small, anonymous distributors who aggressively pursued

a famous brand, but rarely deliver. Give them an “A” for effort,

but distributor search must include proper due diligence of all

potential candidates, not just the small one chasing you.

Do you believe that the best distributors are waiting in line

at trade shows or speed dialing export managers? The most

powerful distributors are busy building brands for their existing

partners. However, all distributors are open to representation of

new companies. In fact, many of the more strategic distributors

assign a brand manager to new business development. This

senior person is dedicated to evaluating new company

representation inquiries like yours.

Hiring the right local partner is the third most important step

in optimizing your sales. This follows creating a differentiated

product and willingness to invest in marketing support. Listed

below are some practical tips on selecting the right company

to optimize your business in a new country.

Identify a Pool of Preliminary Candidates

Create a large group of potential candidates. This could include

distributors or local producers of related products. Include

qualified candidates that have emailed or visited at a trade fair.

Highlight companies that are specialists in the market sector that

you are aiming at. Export Solutions streamlines this process with

our industry leading distributor database containing an average

of 85 distributors (large and small) per country.

Establish Partner Selection Criteria

What are the key attributes of your most successful distributors?

Category specialization? Multi channel coverage? Synergy with

related brands? Choosing a large “Best in Class” partner versus

a “Small, Hungry” company willing to pioneer a new brand is

an important preference.

Determine Candidates Preliminary Interest Level

Send a brief summary of your product proposition and company

credentials to the 5-10 most promising candidates. An immediate

follow-up phone call to your top candidates is an appropriate

personal connection. Distributors expressing an interest should

complete a brief company overview recapping their corporate

capabilities: Sales, Coverage, Key Principals, etc.

Schedule a Meeting in the Candidate’s Office

Interview at least three candidates depending on the size

and scope of a project. Schedule the meeting 4-6 weeks in

advance. Provide a specific agenda at least 3 weeks in advance,

including pre-work such as category market analysis. Meet the

distributor’s team that would work on your business, as well

as senior management. A distributor’s office provides clues

on company culture, scale, and capabilities.

Prepare Distributor Assessment Grid

Create a list of key questions to ask each candidate. Topics could

include local category dynamics, cost of entry, and distributor

success stories. Create a standard grid to evaluate and compare

all candidates on a common platform. Contact us for our free

Distributor Search Guide with assessment grids, agendas,

sample questions and templates for every aspect of the

distributor search process.

Independent Evaluation of Candidates Performance for Existing Brands

Visit supermarkets and other retailers to observe category

conditions. At the same time, evaluate each candidate’s

performance for his existing clients. Do his current brands

maintain a strong presence in the market? Or are his brands hard

to find on the shelf? Complete these visits to leading retailers

independently, as an accompanied trip may lead you to check

stores which may not be representative of marketplace reality.

What is the Distributor’s Plan?

If selected, what is the distributors Year One plan? Customer

targets, price calculation, marketing plan, volume expectations?

Timeline and benchmarks? Key issues? Resources required?

Does their plan align with your vision and the size of the

market opportunity?

Reference Checks Represent an Important Next Step

Request references of 5 of the distributors top 10 clients. Call at

least three references and request insights into performance and

capabilities. Acknowledge that these are likely to be positive

references, but they always provide significant value. Run a Dun

& Bradstreet or other type of credit report on leading candidates.

See Distributor Assessment template on page 31.

Future

Companies conduct rigorous assessments before hiring new

employees. A higher level of intensity must be displayed during

the distributor search process When you choose a distributor,

you are selecting a whole team to represent your company in

a country, not just one individual.

Export Solutions’ Motto: Select your distributors, do not let

your distributors select you.

Select Your Distributors, Do Not Let Your Distributors Select You!

5

Export Solutions’ New Distributor Checklist

____ Contract/Agreement

____ Price Calculation Model

____ Business Plan: objectives, marketing,

spending, key dates

____ Category Review: Pricing, Shelf,

Assortment, Merchandising

____ Label Compliance

____ Shelf Life

____ Order Lead Time

____ Minimum Order

____ Pick up Point

____ Payment Terms

____ Payment Currency

____ Damage Policy

____ Product Registration

____ Forecast: Year 1

____ Pipeline Order & Inventory

____ Brand Facts

____ Product Samples

____ Appointment Letter

____ Brand Specifications in System:

Distributor & Customers

____ Training: Key Account Managers,

Retail, Administrative Staff, Warehouse

____ In Store Standards: Pricing, Shelf

Management, Merchandising

____ FAQ’s/Handling Common Objections

____ Key Account Presentation

____ Customer Appointment Dates

____ Category/Business Review:

Tailored to Each Key Account

____ Retail Sales Contest

____ Checkpoint Calls

____ Market Audit Date

____ Reporting: Track Distribution, Pricing,

Shelf Positioning, Merchandising, etc.

Talk to an Expert

• Find Distributors in 96 Countries

• International Strategy Road Map

• Fix Problem Markets

• Entry Plans

• Export Workshops

• Motivational Meeting Speaker

Contact Greg Seminara at (001)-404-255-8387 to discuss your business development project.

www.exportsolutions.com

6

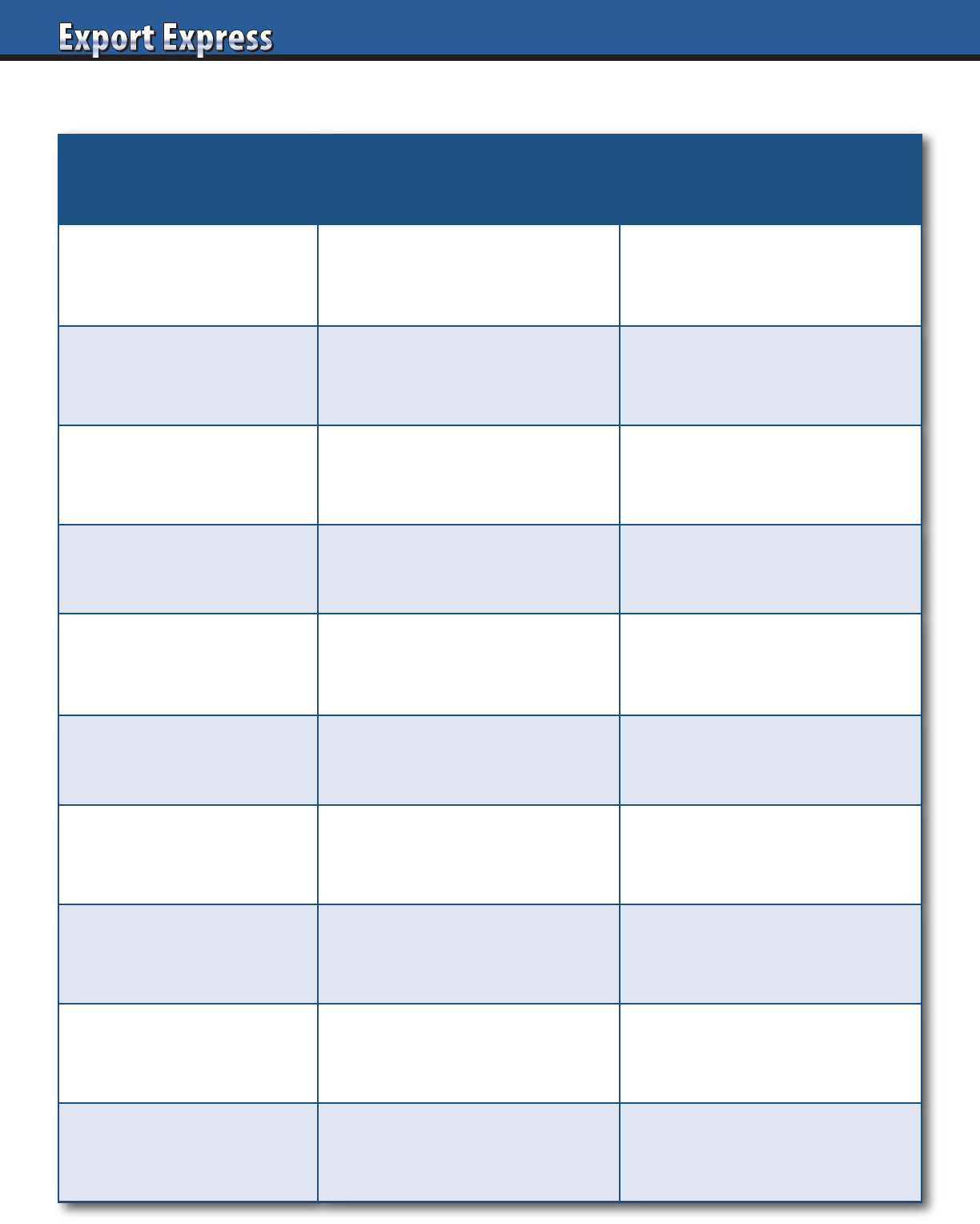

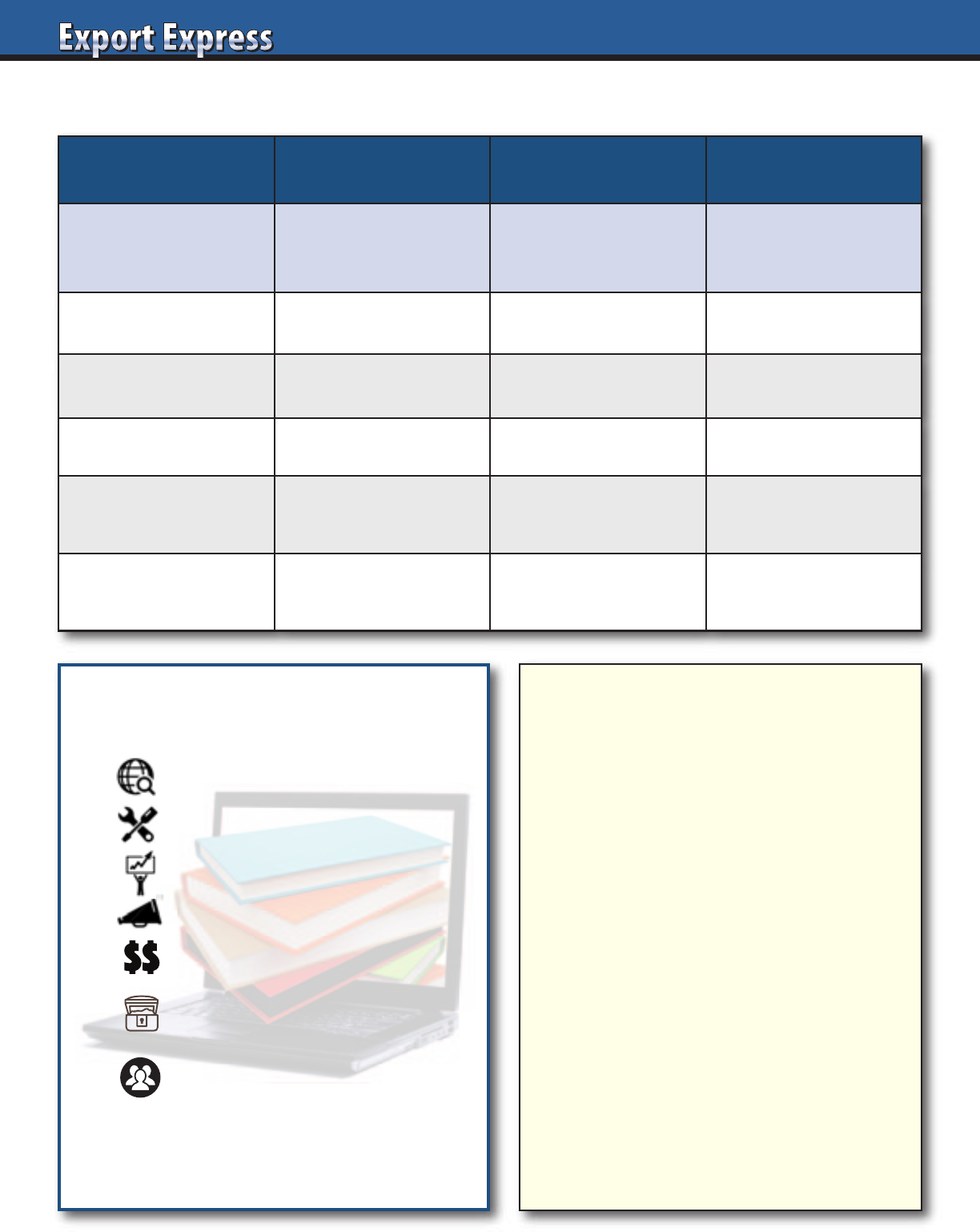

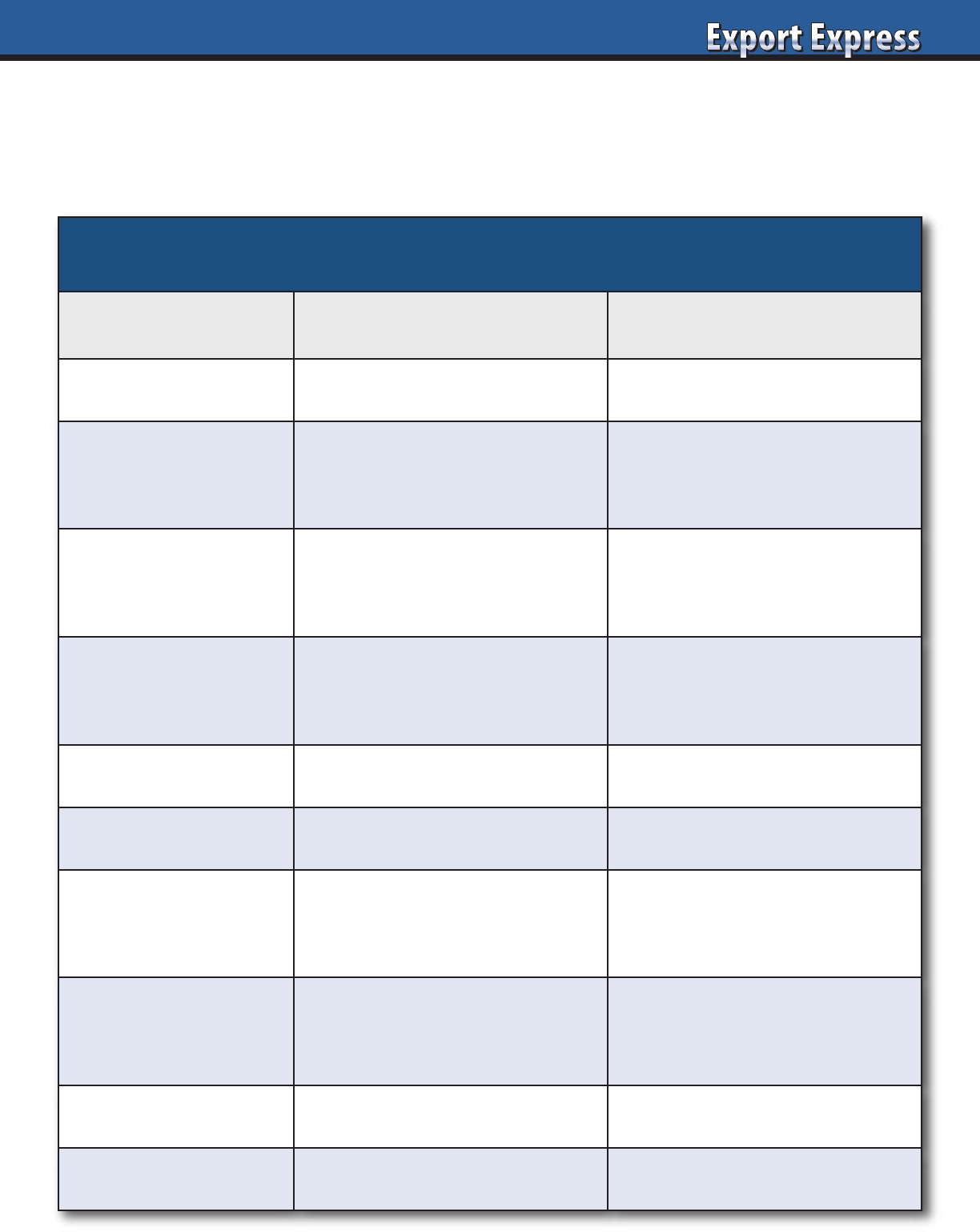

Distributor Search Best Practices

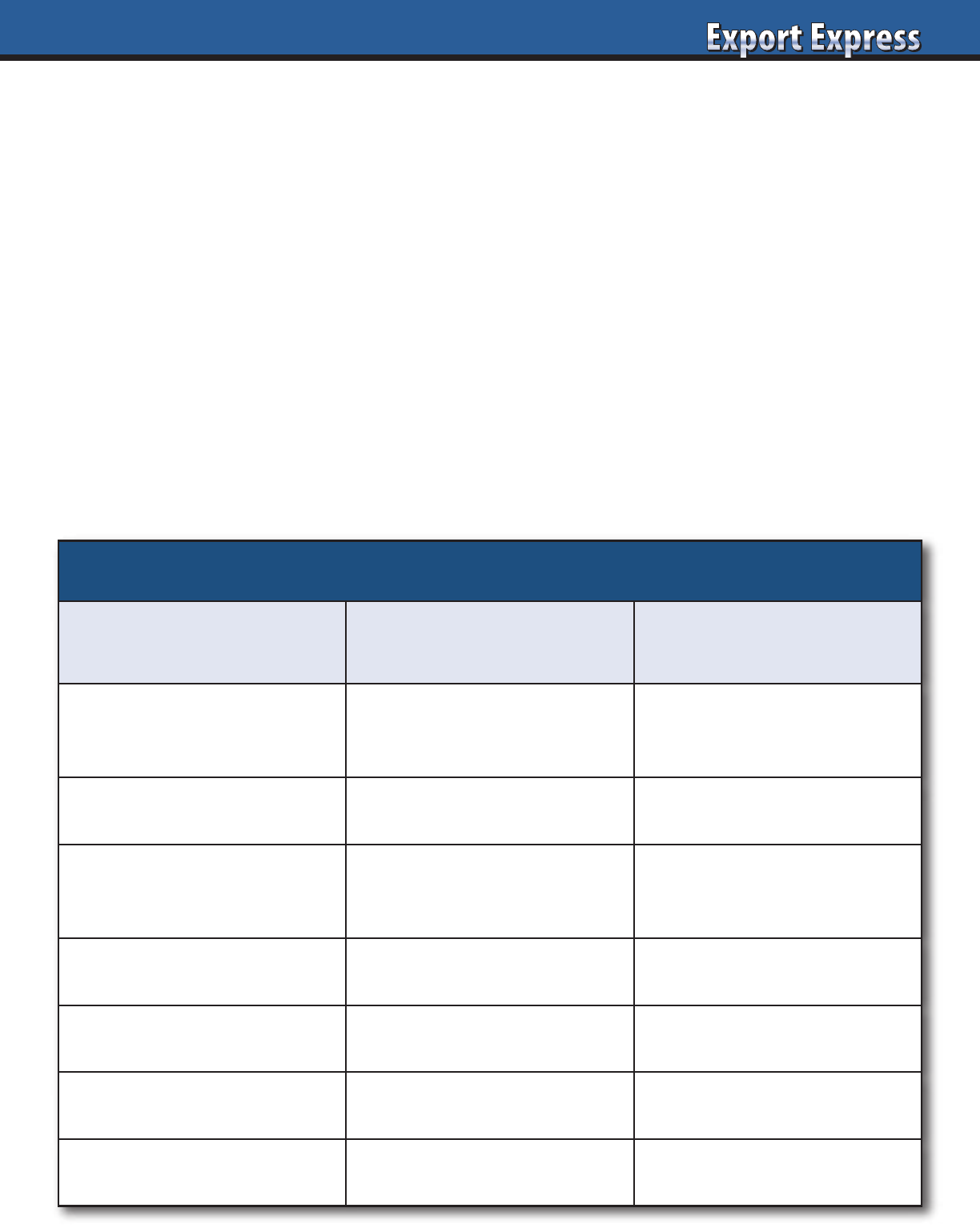

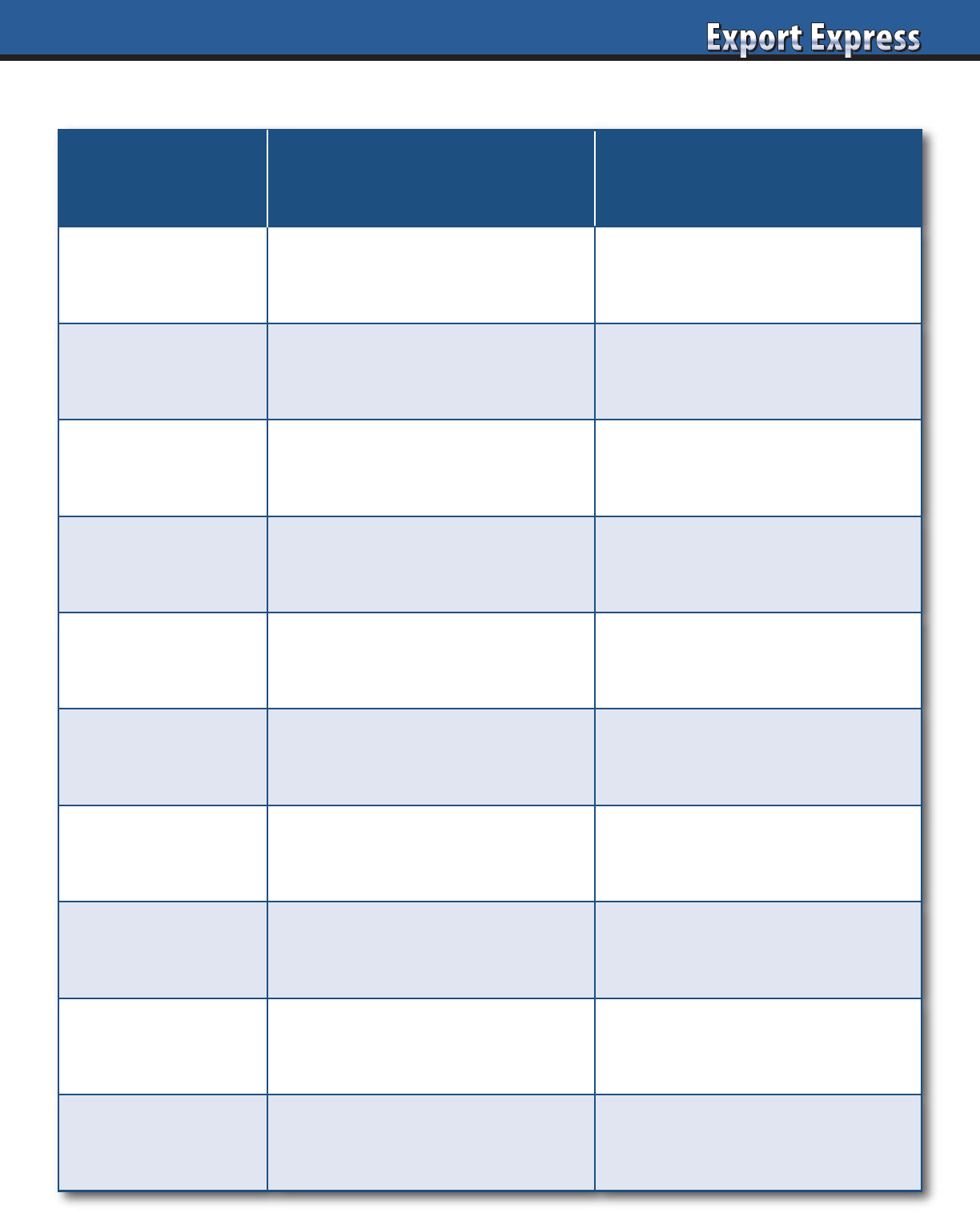

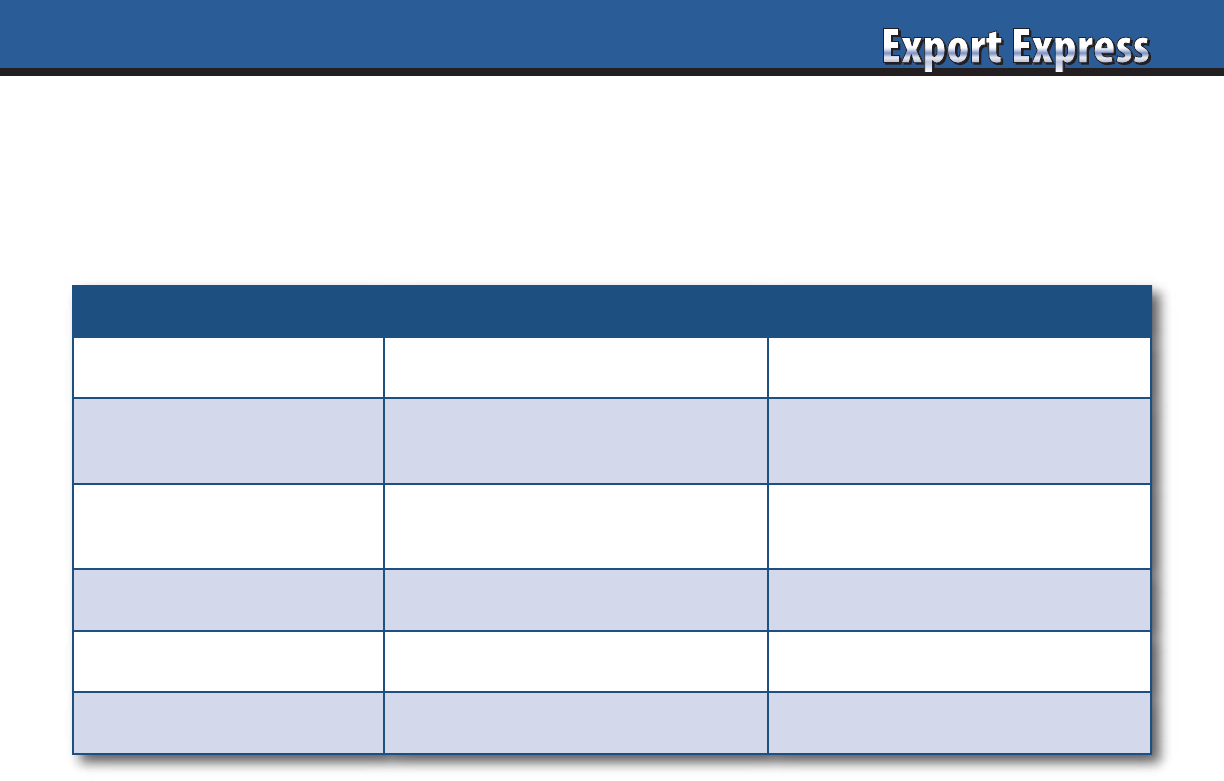

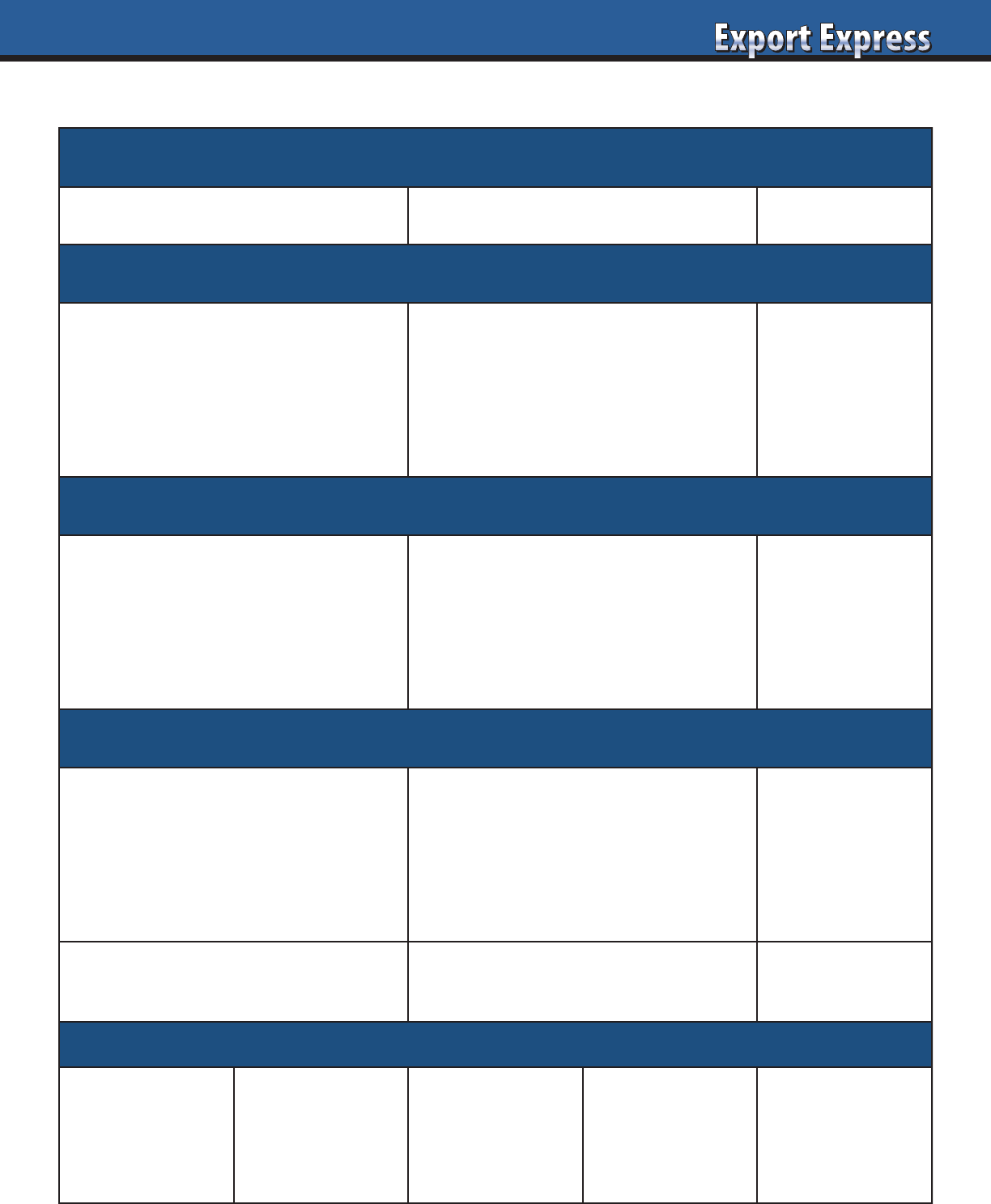

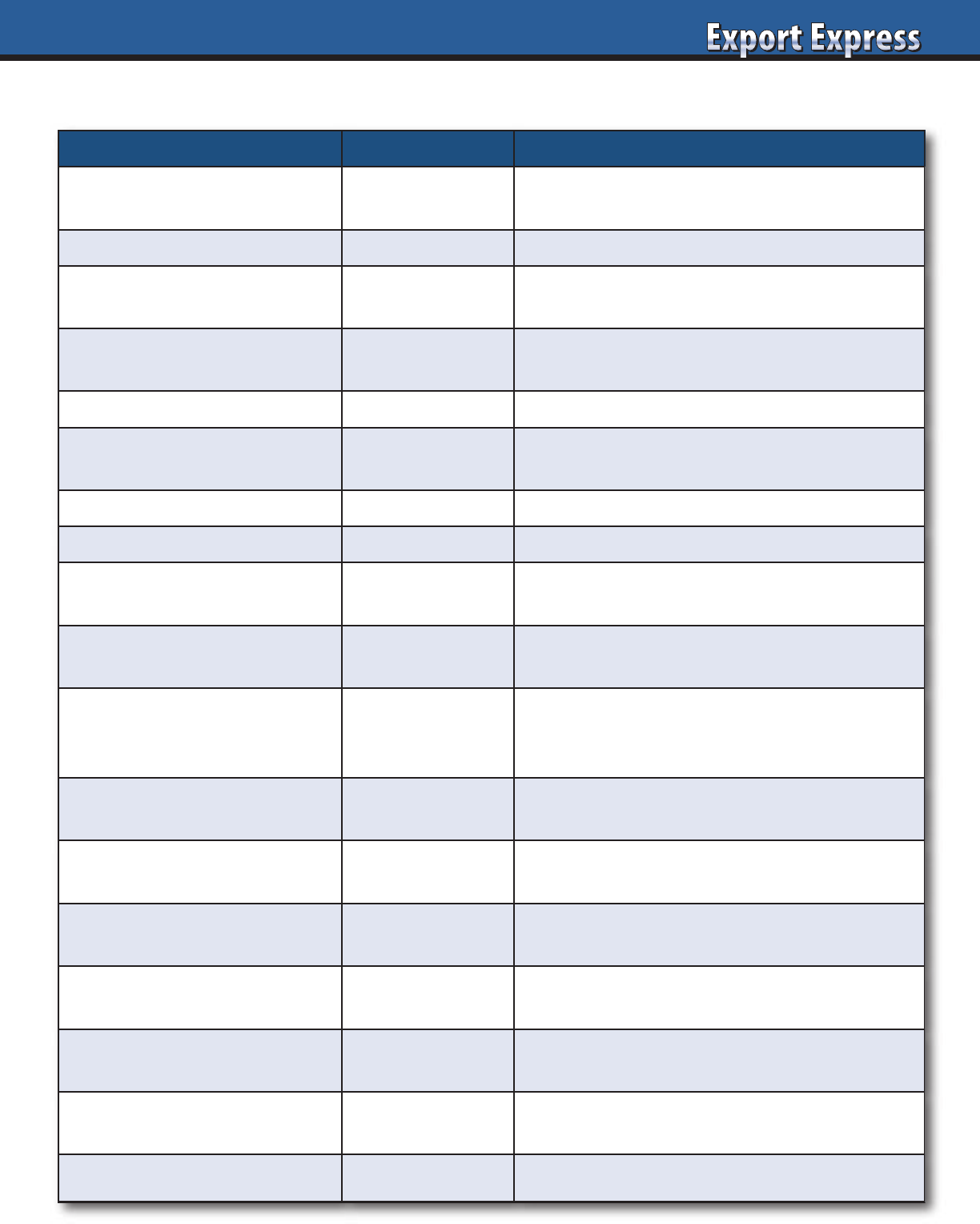

Activity Bad Practice Best Practice

Distributor Profile No portfolio synergies.

Representing similar size,

premium brands from your

aisle/country.

Candidate Model

Agent or third party not based

in destination country.

Distributor of international,

third party brands.

Web Site None! Watch out.

Modern/informative site.

Lists current companies

handled.

Candidate Selection Evaluate one candidate only.

Consider 3-5 candidates,

depending on complexity.

First Contact

Random solicitation by

unknown company.

Trade show or formal phone

meeting with respected

distributor.

Market Visit

Start partnership without

market visit.

Local assessment: office

meeting, warehouse inspection.

Store Check

No store check to validate

distributor capabilities.

Full day store check to measure

results for existing brands.

Reference Check

No financial or commercial

checks.

Check current principals plus

financial institutions (D & B).

Year I Plan No plan. “Buy and ReSell.”

Logical plan with targets,

activities, timelines, costs.

Price Calculation

Sell at dead net price.

Arbitrary mark-up.

Transparent price calculation

from factory to store shelf.

7

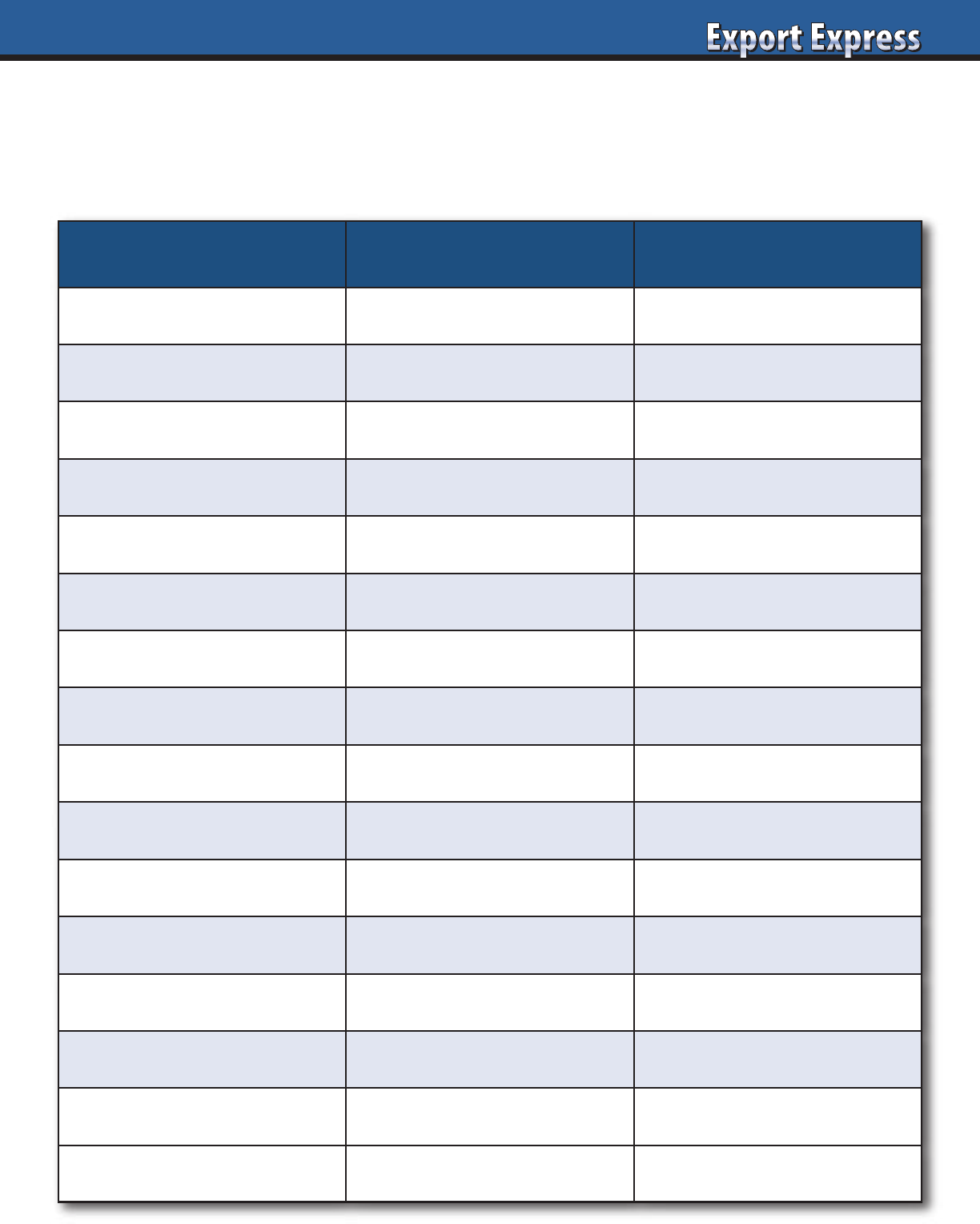

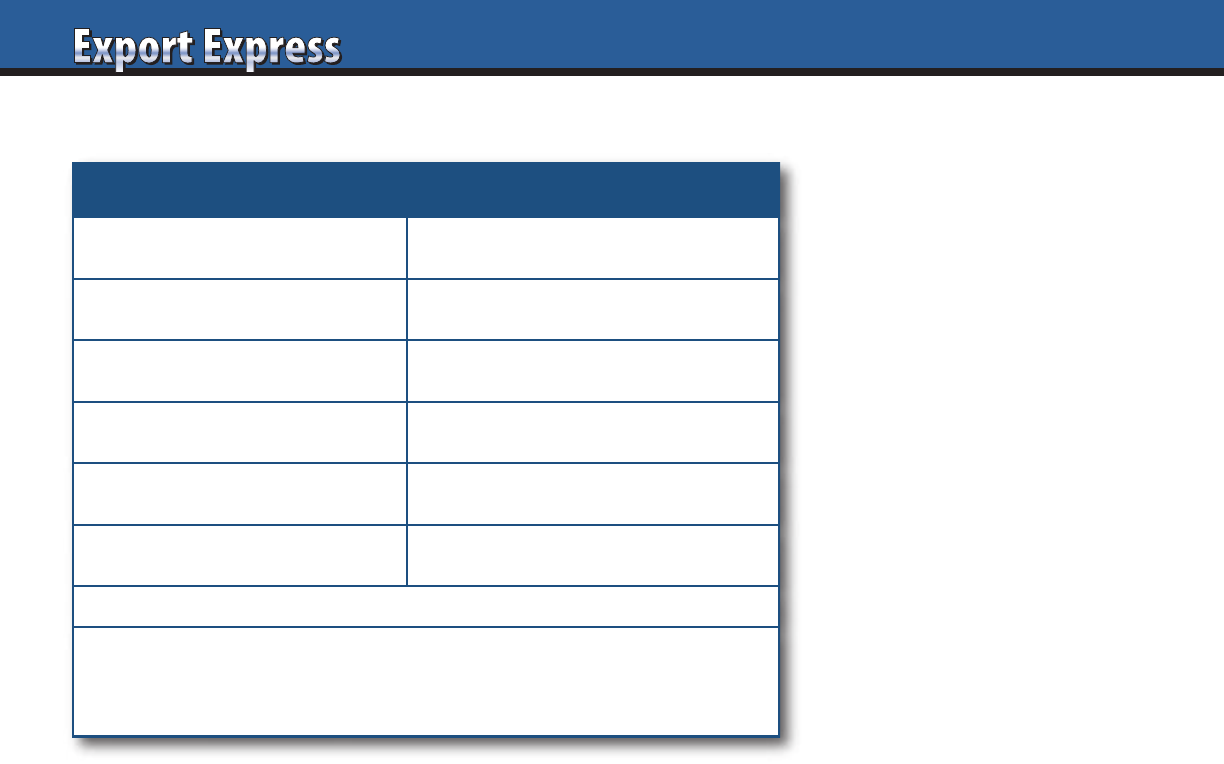

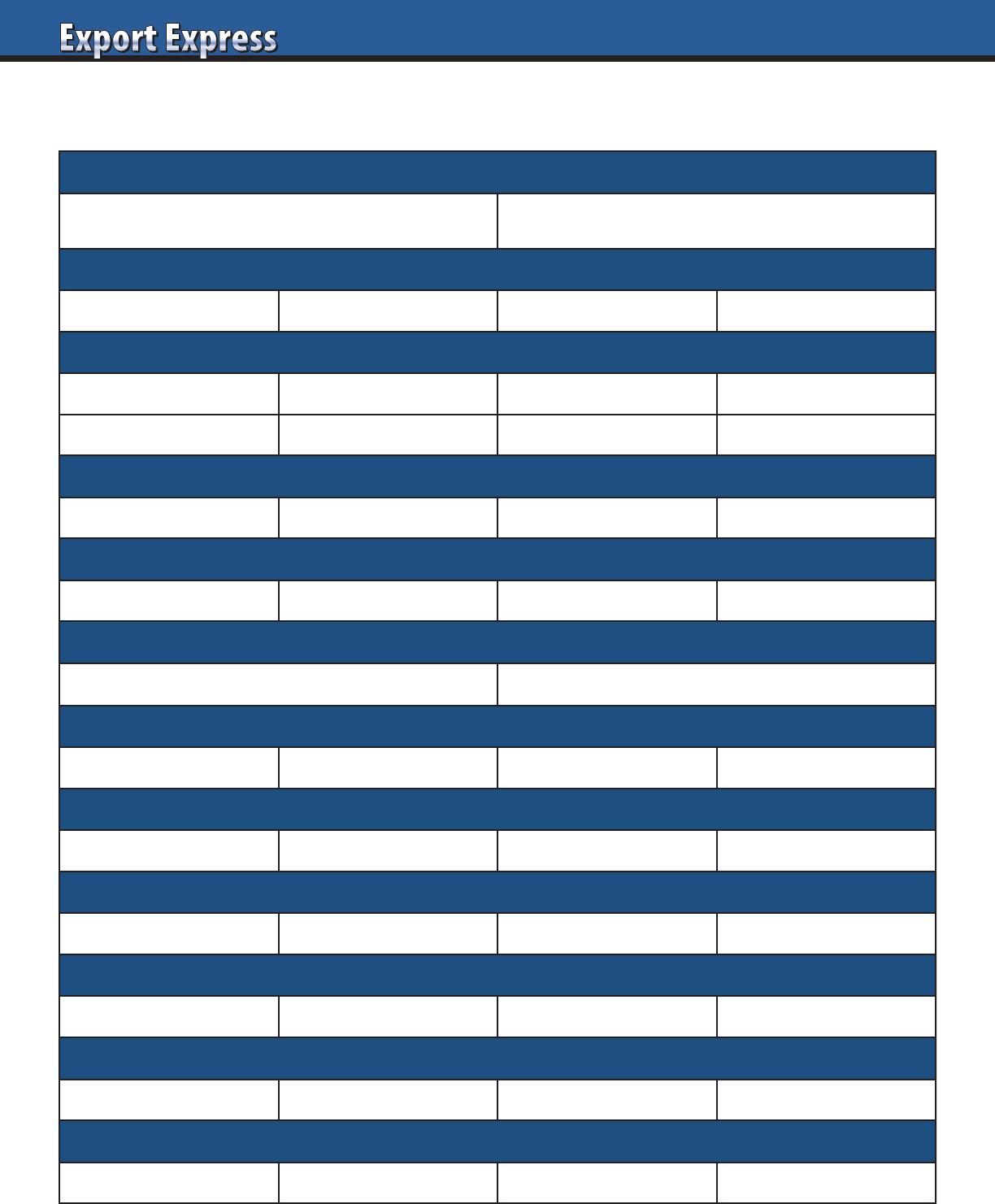

Exporter Data Sheet

What Distributors want to Know about Your Company

Key Contact: Telephone:

Web Site: Email:

Founding Date: Ownership:

Annual Sales: Total Employees:

0-$50 million $50 million - $250 million $250 million- $1 billion $1 billion +

% Sales International:

0-10% 10-25% 26-50% 50% +

Exporter Classification/Description:_________________________ (#1-10, based upon Export Solutions’ scale)

Core Product Range:

Unique Selling Point:

Market Share:

Home Country: Country A: Country B: Country C:

Current Business in Distributor’s Country: Yes/No: Size $:

Current Customers (Distributor’s Country):

Investment Model: Listing Fees*: Yes/No *average $35 per item,per store

Trade Promotion Budget: Dead net price: 10% of sales: Mass:

Marketing: Digital: Sampling: 360 degree:

Ambition/Size of Prize: Sales: Market Share:

Year 1

Year 2

Year 3

Exporter Data Sheet

What Distributors want to Know about Your Company

New Business Opportunity: _____________________________________

(Company Name/Country)

8

Big Brand Distributors

Large distributors supply an economical

alternative for leading brand manu-

facturers versus operating their own

subsidiary. Normally, they handle

multiple categories and offer critical

mass. A potential issue is the struggle

for attention among brands all vying

for focus from one sales team.

Category Expert

Buyers value partners that serve as

category experts who can share insights

and innovation for the sector. Distributors

dedicated to one sector provide logistics

efficiencies and capability to share best

practices from complimentary products.

Managing product conflicts is a frequent

problem with distributors concentrated

on only one category.

Channel Expert

Many distributors built their business

platform centered on servicing the

supermarket channel. Incremental growth

today is dependent on penetrating under-

served channels such as foodservice,

small shops, or pharmacy. In larger

countries, it’s possible to maintain one

organizational approach for supermarkets

and then appoint a specialist for a

different channel. Alternate channels

normally feature smaller store footprints

which can provide a barrier to entry for

all but the leading brands.

Country Expert

Some distributors have created viable

businesses as the source for brands from

one country. These distributors supply

brands to consumers “homesick” for

their favorite brands at a premium

price. A benefit with this option is

the distributor who can consolidate

shipments from one country and

is connected with the retailers and

consumers for this “expat” segment. This

approach works well for niche products

or brands focused on availability without

marketing investment.

Fine Food Importer

Food enthusiasts everywhere are

passionate about the gourmet experience.

Fine dining restaurants are dependent on

unique products and ingredients from

around the world. The classic fine food

importer fulfills this role. Fine Food

importers seek brands of the highest

quality, with unique attributes and

reputation. Not an option for

commodities or “me-too” type products.

Niche Entrepreneur

Pioneering a brand with no existing

sales is tough in any country. While many

brands would prefer partnering with a

prestigious specialist, the reality is that

a smaller distributor may be your best

option to start. Niche entrepreneurs are

hungry and flexible to work without

significant resources supplied by the

brand. It is important to calibrate your

expectations when working with a niche

entrepreneur and conduct due diligence

on their financial situation.

Evaluate Your Current Distributor Mix

A valuable exercise is to evaluate your

current roster of distributors “by type.”

Which models are delivering superior

results? Which models are lagging

behind? Are there any universal

conclusions which may apply when you

expand to new markets or considering a

distributor change? One type does not fit

all scenarios. However, it is important to

segment your partners and understand

the inherent strengths and issues with

different types of distributor partners.

All distributors are not created equally! Most exporters recognize obvious differences based upon the size of distributor and breadth

of service offering. Export Solutions has identified six common types of distributor business models. Global brands maintain a mix of

distributor relationships. Some partnerships are new while others have evolved for thirty years or more. With time, requirements for

servicing our industry have changed. While some distributors have remained generalists, handling many brands and channels. Others

elected to focus against a specific market segment. Which model delivers the best result for your brand?

Distributor Types: Different Experts for Different Situations

Distributor Types: Different Experts for Different Situations

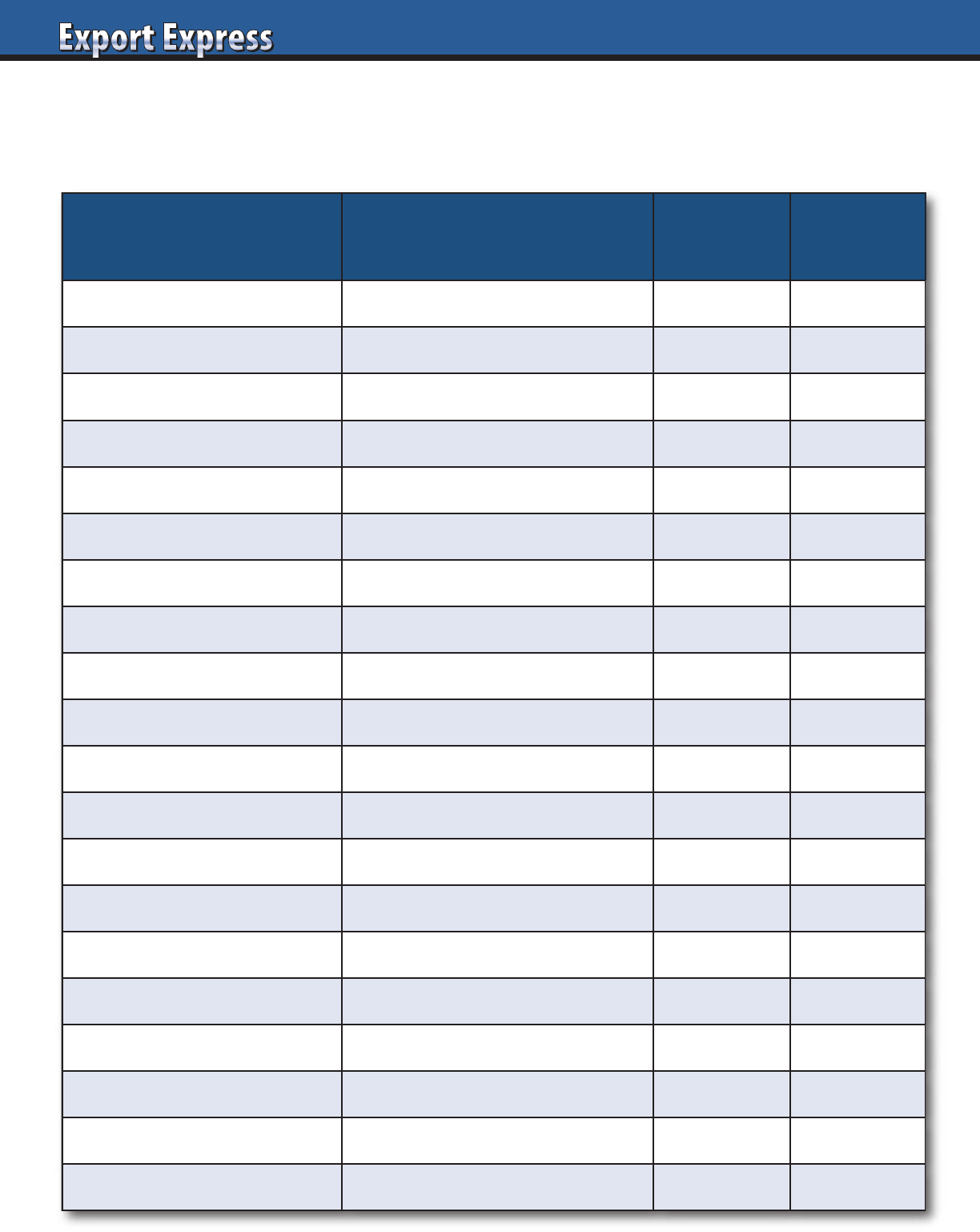

Distributor Type Model Application

Big Brand Distributor

Large Distributors.

Handles # 1 or # 2 brands.

Multiple categories/channels.

Outsourcing solution. Option for

Latin America, Middle East, Asia,

Europe (excluding large countries)

Category Expert Dedicated to one category

Specialists for Confectionery, Frozen, OTC,

Beverages, Natural Foods, Dairy, Beauty

Channel Expert Dedicated to one channel

Specialists for Foodservice, “small shops”,

or Pharmacy channels

Country Expert

Represents brands exclusively

from one country/region

Specialist for Brands from USA, UK, Germany,

Asia, Italy, or Spain

Fine Food Importer

Represents leading international

gourmet/niche brands.

Handles brands like Tabasco, Maille, Bonne

Maman, Twinings, Bahlsen, Ryvita

Niche Entrepreneur

Small distributor.

Willing to pioneer new brands

with limited marketing support

Option for small brands or countries where

brand does not want to invest.

Export Passport

Strategic Export

Development Program

9

Strategic Export

Development Program

Export Passport

Export Passport

10

Distributor Search Challenge

• Some distributors are too big…

• Other distributors are too small!

3

Export Passport identifies

Prime Prospect distributors

that represent the Right Fit

11

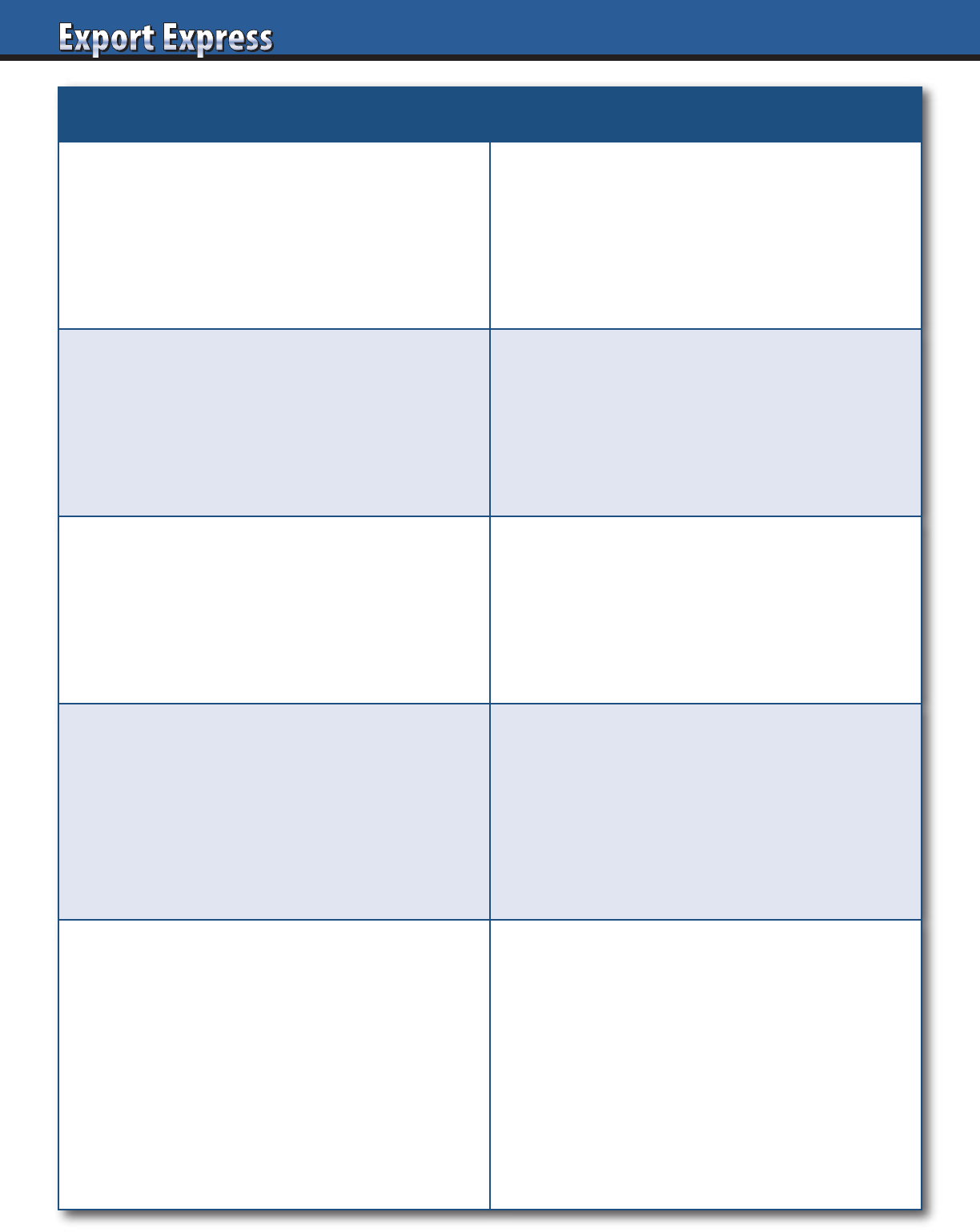

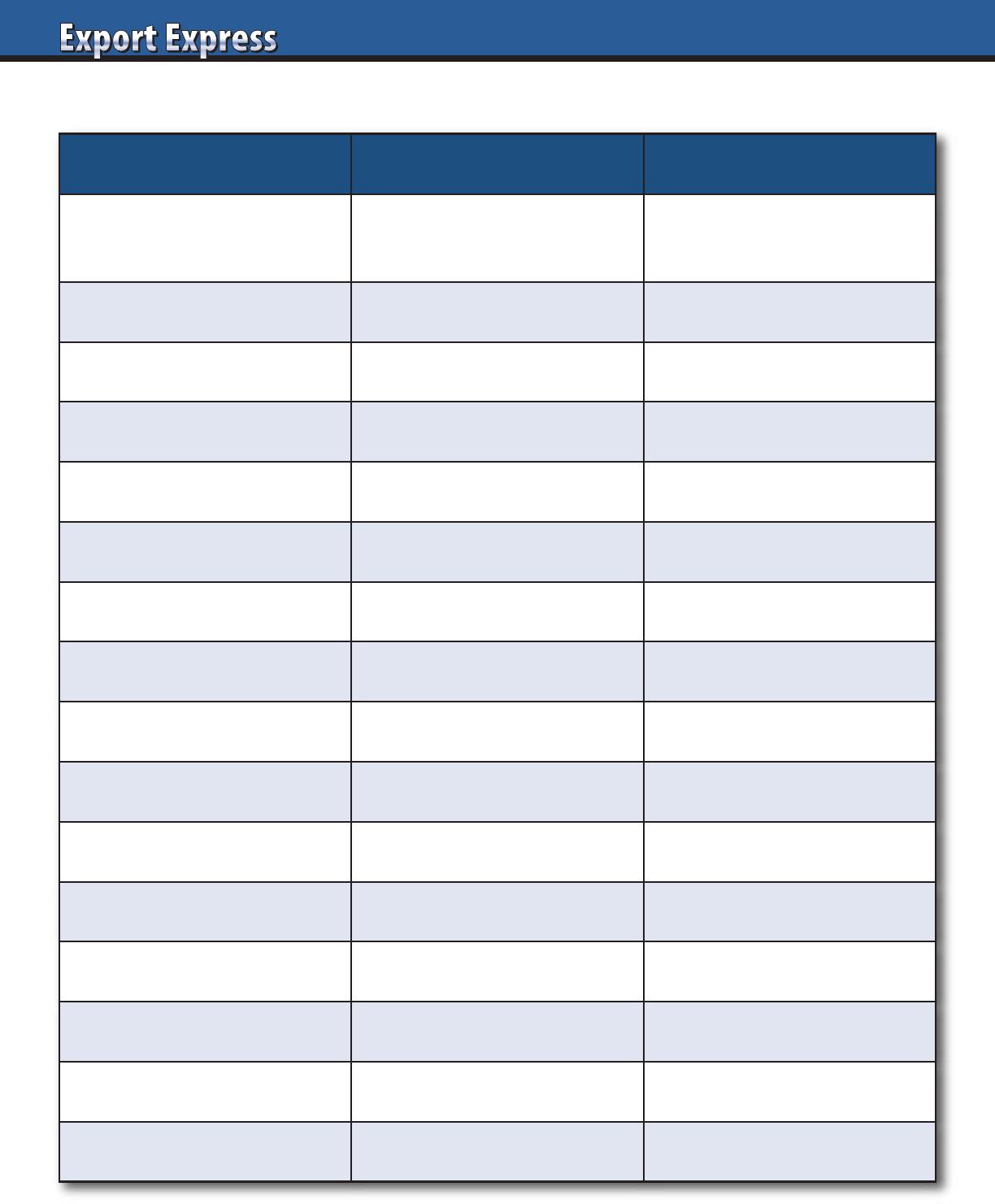

Exporter Classification*

Type Description

Export Profile

10 Multinational Strong market share everywhere across multiple categories.

9 Global Multinational. Mix of leading countries and niche participation.

8 Category Champion One core mass category. Strong performance globally.

7 Icon Well known, niche leader. Global availability. Example: Tabasco.

6 Regional Leader Strong share across one continent/region. Some export success.

5 National Hero National treasure, #1 brand. Exports to homesick expats, tourists.

4 Player Respectable share in home country. Opportunistic exports.

3 Participant “Me too” product. Opportunistic exports. “Trader”/private label.

2 Challenger Innovator. Some listings in home country. New to export.

1 Start-up Trying to get traction in home country. Export “dreamer.”

*Export Solutions’ classification system

12

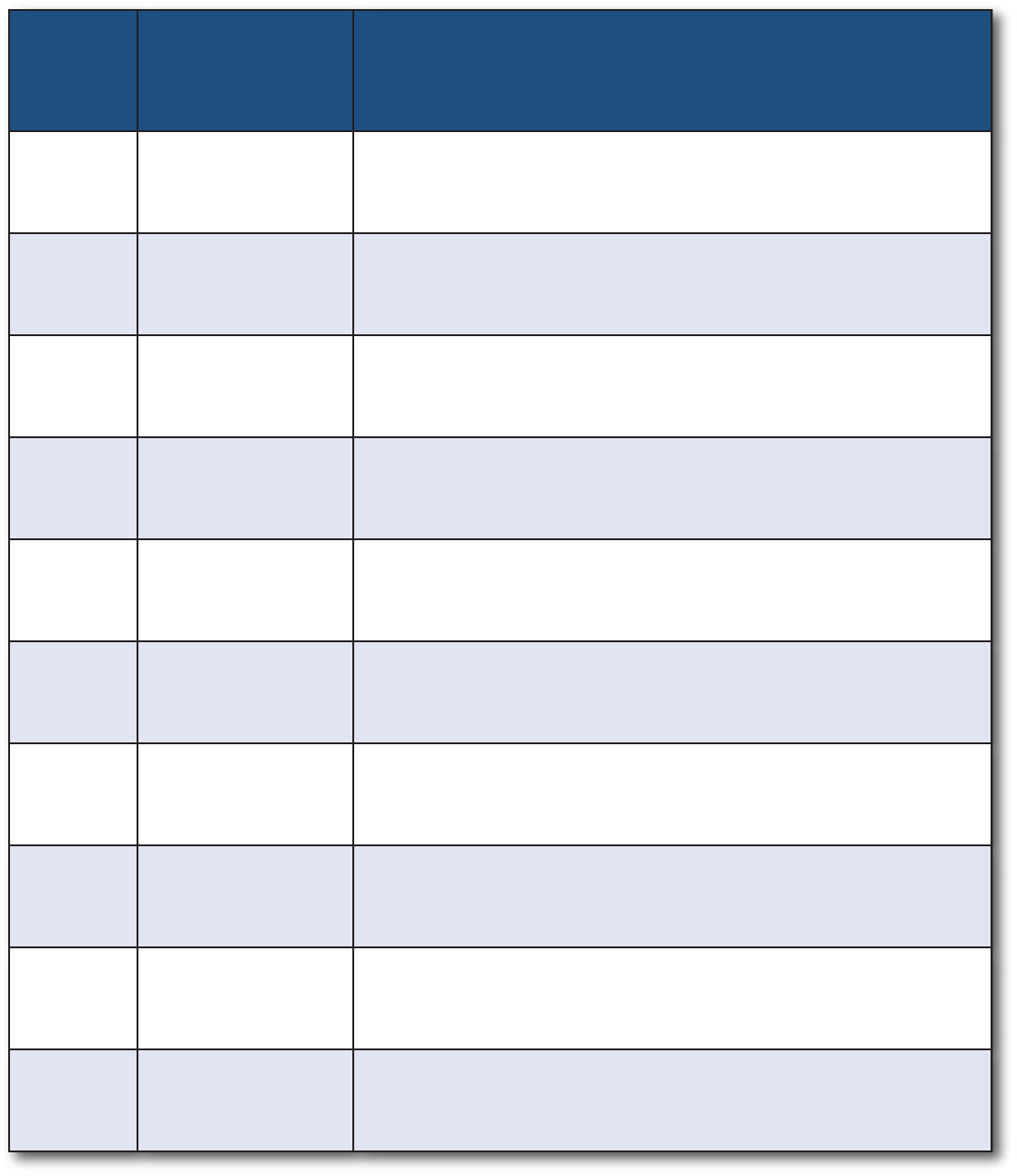

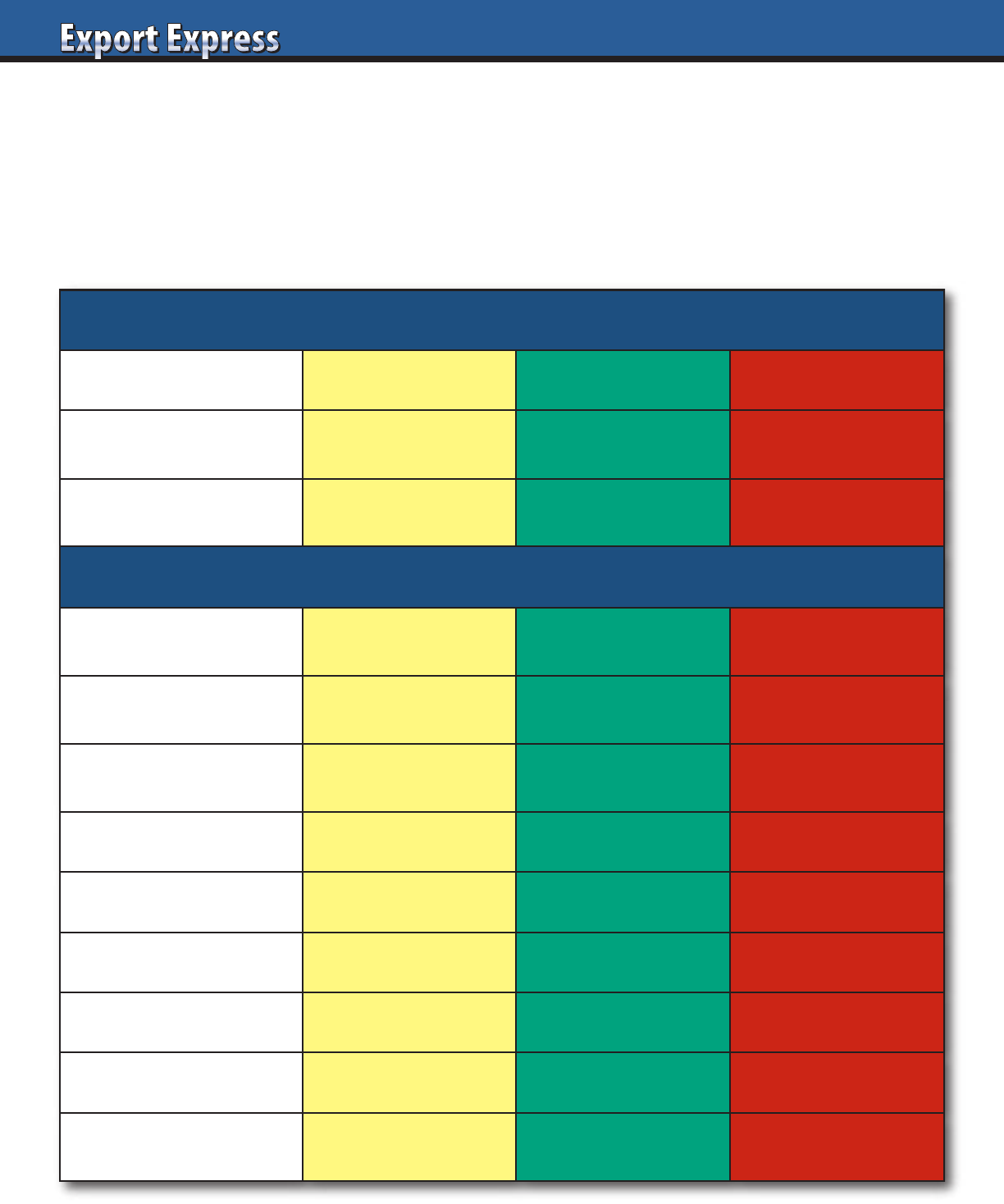

Distributor Classification*

Stars Title Description Prime Prospects

HHHHH

Champion

Massive distributor.

Handles multinational/#1

brands across many

categories.

Brand leaders.

$$$ marketing budgets.

Exporter types: 6-10

HHHH

Captain

Category Captain.

Handles leading brands in

one segment.

Category

innovators/leaders.

$$ marketing budgets.

Exporter types: 5-9

HHH

Player

Mid-size distributor.

Handles #2/3 brands or

niche leaders across many

categories.

Differentiated,

premium brands.

$-$$ marketing budgets.

Exporter types: 4-7

HH

Participant

Respected local.

Diversified product

portfolio.

Results equal to investment.

Flexible, challenger brands.

$ marketing budget.

Exporter types: 2-4

H

Pioneer

Small distributor.

Entrepreneurial, open to

innovative new companies.

Start-up brands.

“Pay as you go” marketing.

Exporter types: 1-3

Need more information? Visit www.exportsolutions.com.

*Export Solutions’ classification system

13

Distributor Search Helper for:

Your

Logo

Here

Can We Help You?

Recent Distributor Search Projects

Asia Europe Middle East Latin America

Australia Germany Israel Argentina

China Ireland Kuwait Brazil

Indonesia Netherlands Qatar Colombia

Japan Nordics Saudi Arabia Costa Rica

Malaysia Spain UAE Ecuador

Philippines United Kingdom North America Mexico

Singapore Africa Canada Panama

South Korea South Africa United States Peru

Call the Export Accelerator!

Contact Greg Seminara at greg@exportsolutions.com

to discuss your business development project.

www.exportsolutions.com

14

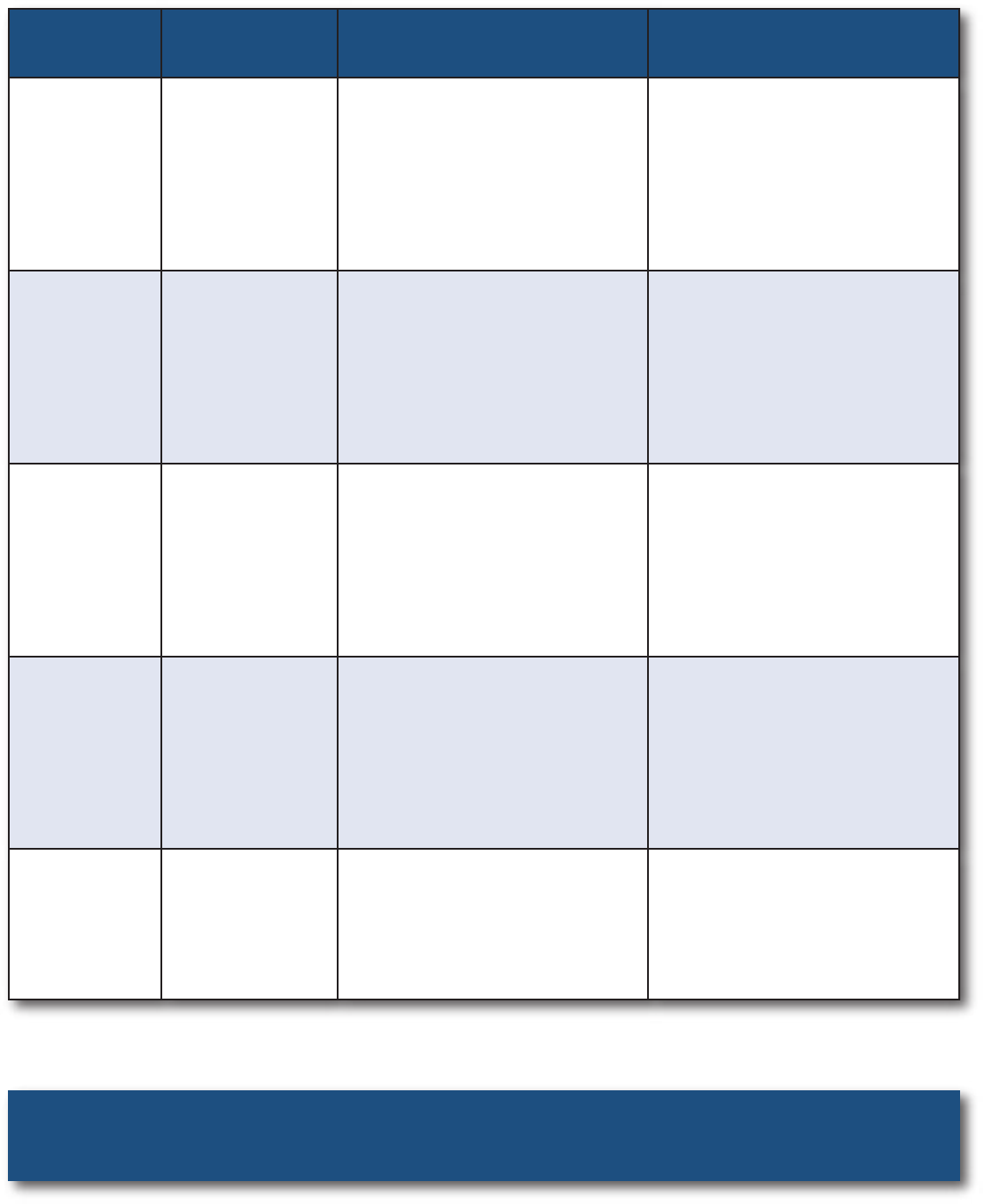

Distributor Selection Road Map

Export Solutions Performs Distributor Search in 96 Countries

Most companies maintain diverse distributor networks: A mix of large and small distributors, category

specialists, and those focusing on brands from your home country. Export Solutions recommends performing

a distributor model analysis of your current distributors to determine which type of distributor is delivering

“Best in Class” results. An important consideration is your brand ambition and investment level for a country

when evaluating distributor performance. The results of your distributor model assessment can be used to

guide new distributor selection or upgrade your current distributor network. Export Solutions can help!

Brand Ambition

Country Importance Strategic Priority Opportunistic

Brand Market Share

Objective

Leader Player Niche

Brand Investment Model Mass Marketing 10% of Sales Dead Net Price

Distributor Selection Criteria

Preferred Distributor

Size

Large Medium Small

Channel Specialization Supermarkets Foodservice Pharmacy

Category Specialization All Food

Confectionery

& Snack

Beverage

Gourmet Natural Food Health & Beauty

Ethnic Food Frozen/Chilled Household/Non Food

Country Specialization USA France Germany

Italy Spain United Kingdom

Asia Latin America Middle East

Benchmark Brands

(examples)

Pringles Barilla Tabasco

15

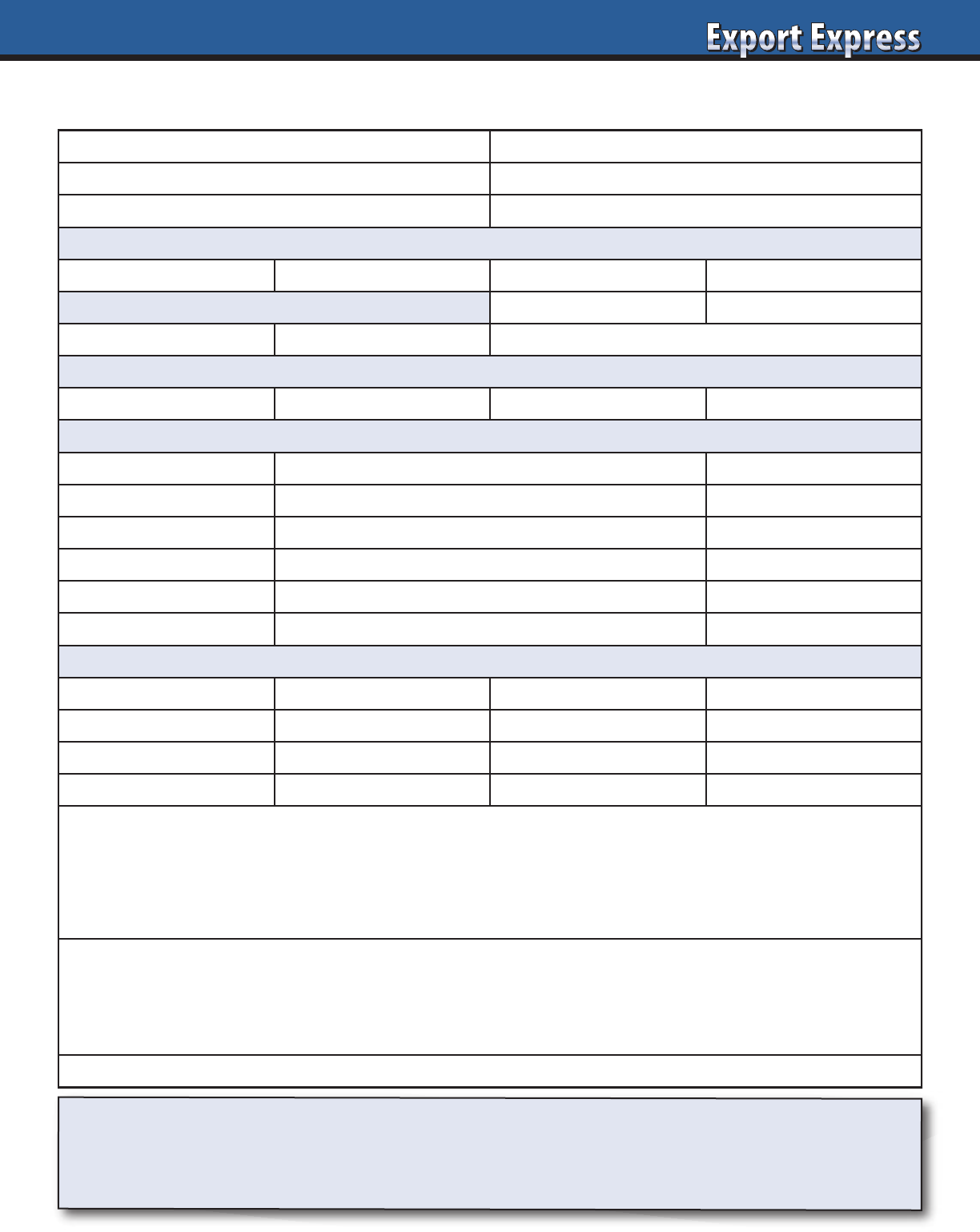

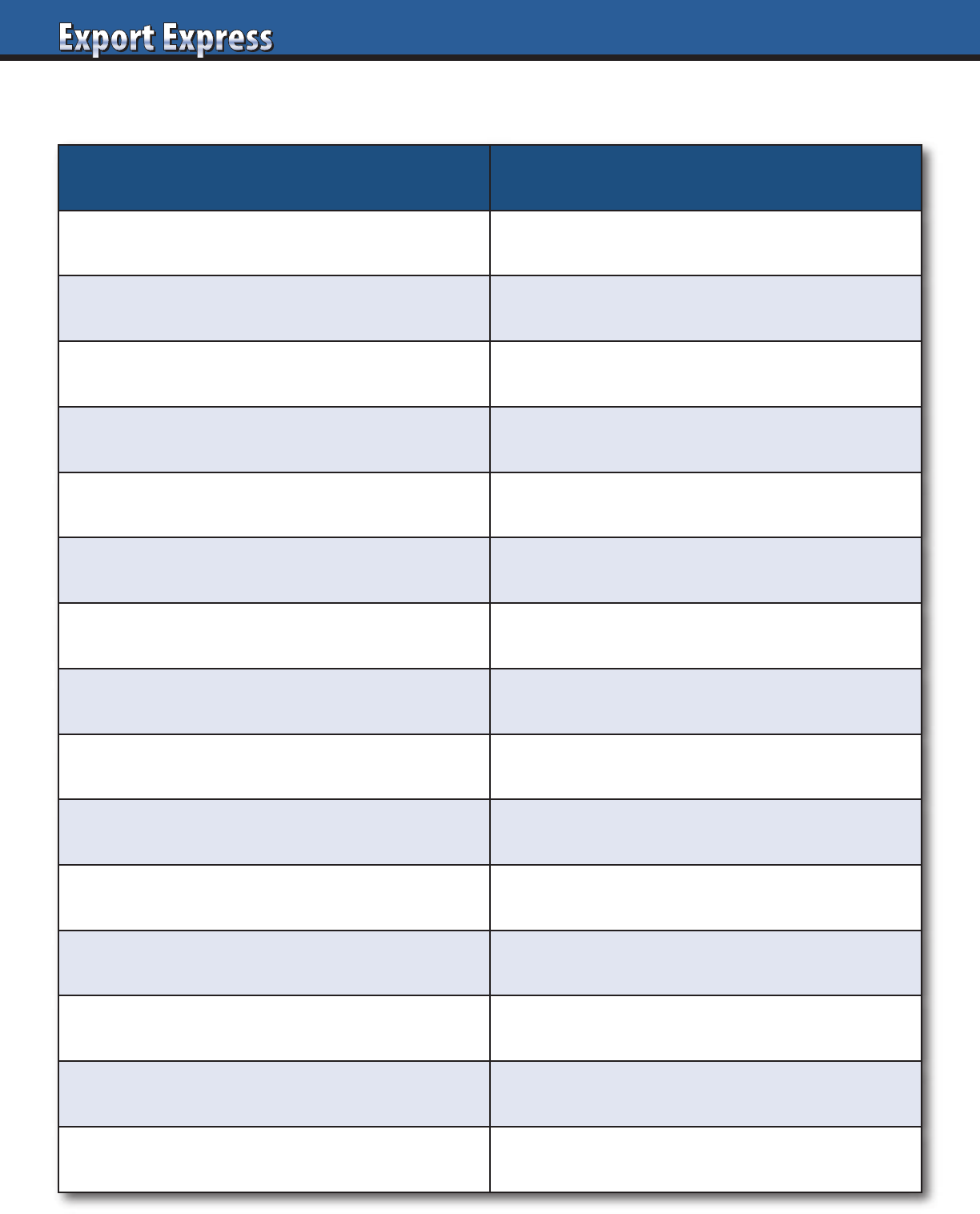

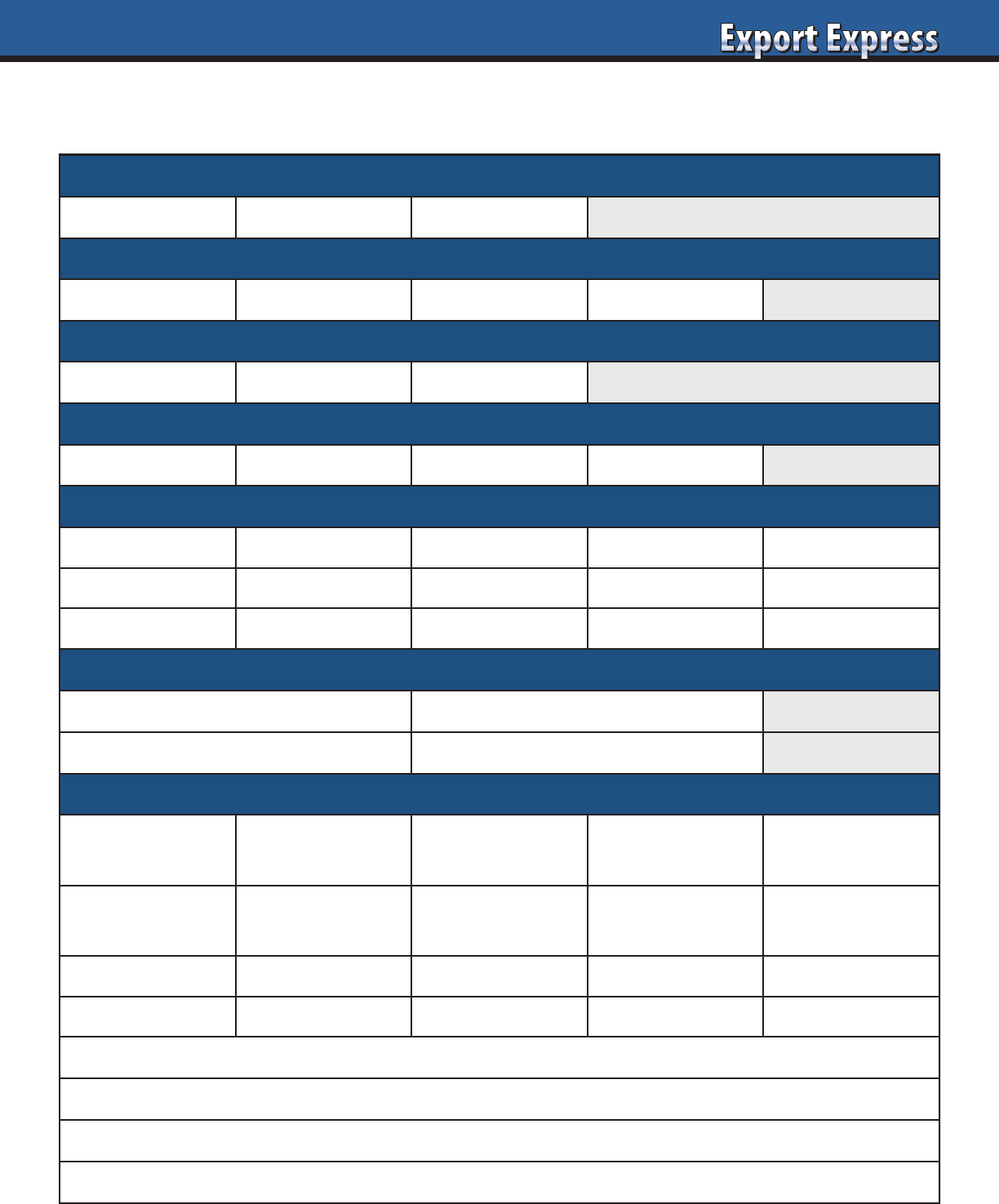

Export Solutions recommends creating your own one page Export Distributor fact sheet template. Insist that all candidates

complete the template 100 percent prior to a phone interview or trade show meeting. Pay particular attention to the annual

sales number, brands represented and manufacturer references. Qualified candidates will enthusiastically complete these

sections. “Pretenders” or time wasters will leave these sections blank or disappear saving you time and money!

Export Distributor Data Sheet:___________________________________

Key Contact: Telephone:

Web Site: Email:

Annual Sales: Total Employees:

Employees, by Function:

Key Account Sales Logistics Marketing Merchandising

Company Owned Warehouse: Yes No

If Yes Warehouse Size: Location:

Channel Coverage (percent sales by channel):

Supermarket Convenience Foodservice E-commerce

Top Five Manufacturer Clients:

Company Name Brands Represented Years Service

1

2

3

4

5

Manufacturer references:

Company Name Contact Name Contact Telephone Contact Email

1

2

3

Why are you interested in distributing our brand?

Why is your company the best candidate to represent our brand in the market?

Feel free to attach your company credentials presentation.

(Distributor Name)

Coverage: 96 countries and 9,200 distributors

Confectionery & Snack

Gourmet/Ethnic Foods

Beverage (Ambient & Hot)

USA, German, UK, Italian Food

Health & Beauty

Tracking Distributors for more than 300

of the world’s most famous brands.

Example 1: Who are Beverage Distributors

in Germany?

Example 2: Who is the Pringles Distributor

in Saudi Arabia?

NEW!

ORDER NOW!

Distributor Search Made Simple

16

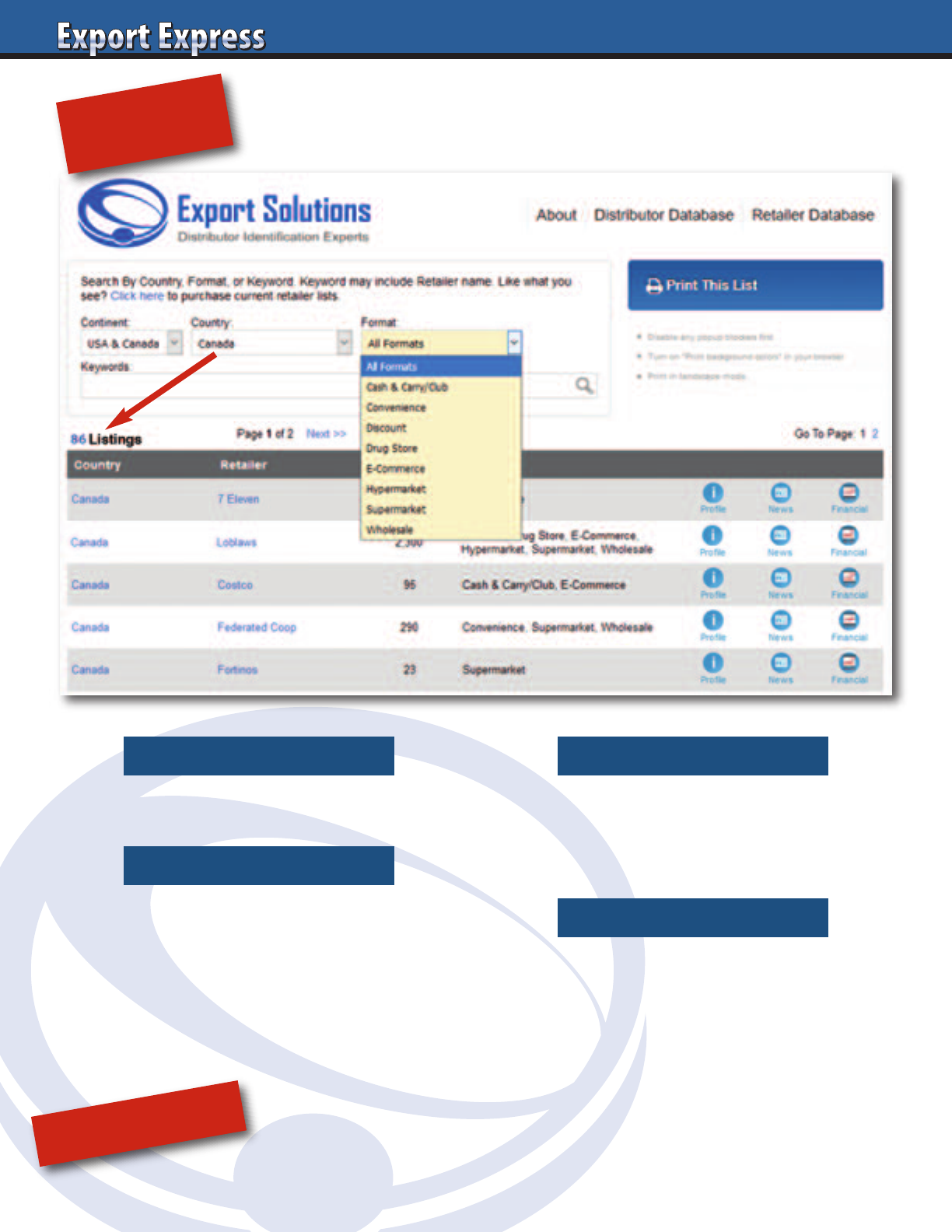

Search by Brand NameSearch by Country

Search By Category

Combo Search

www.exportsolutions.com

17

Why did you create the distributor database?

Export Managers dedicate a lot of time to

networking, always searching for good

distributor recommendations. We waste

precious time at trade shows speaking to

“pretenders” with no hope of adequately

representing our brands. I thought that

the supermarket industry could benefit

from a global distributor database to

instantly find the leading distributors

in any country.

How did you compile the distributor database?

Export Solutions sources distributor

candidates using six specific strategies.

This includes having access to the global

distributor lists of more than 300 brands

and store checks in at least 25 countries

per year.

How accurate is the contact data?

Export Solutions’ distributor database is

updated every day! Distributor company

names, web sites, and specialization rarely

change. This makes the database 98%

accurate at the company level. The

distributors’ key contact for new product

inquiries and their email addresses may

change as a result of job moves. Email

address accuracy ranges from 80-90

percent depending on the country. We

employ three separate mechanisms to

keep up to date with changes.

What’s new?

Our database has expanded to 96 countries

and 9,200 distributors. It’s now searchable,

supplying country and category filter

inputs or brand names! (see details on

page 16). We also offer 90 day access if you

purchase a country or category list. This

allows you to work online and enjoy “one

click access” to distributors’ web sites.

Naturally, we prefer that you purchase an

annual subscription with unlimited access

to the entire database for one year.

What is the difference between

Export Solutions’ distributor database

and other “lists?”

1. Created by industry export

professionals, not directory aggregators

or other online companies with no

relevant food/consumer goods

industry experience.

2. Each distributor is personally validated

by Greg Seminara. Distributors can not

self register or pay to be in our database.

We know the difference between a “best in

class” distributor and a “one man show.”

3. Our distributor database is designed

for manufacturers of branded products

normally sold through supermarkets,

pharmacies, and food service channels.

We do not include distributors of

commodities or ingredients.

4. Call us! Our specialization is

distributor search, with 300+ projects

completed. Contact us for a free copy

of our 84 page Distributor Search Guide.

5. Our database is searchable by country,

category specialization, brand name, or

combination of all three filters.

Which type of companies use our database?

Database clients range from small start-

ups to the largest companies in food

and consumer goods. Export Solutions’

database has had more than 3,000 clients

including brand owners from all over

the world. Leading government trade

organizations from USA, Italy, Germany,

and Brasil also develop special

agreements to gain access.

What product categories are covered?

Distributors include specialists for

branded food products, confectionery

& snacks, beverage, natural foods,

gourmet products, ethnic food, health

and beauty care products, household

products, and general merchandise.

We offer oustanding coverage of Italian

Food distributors. Many distributors can

handle any product that is normally sold

through Supermarkets, Convenience,

Foodservice/Catering, or Pharmacy

trade channels.

What are best practices in getting the most

productivity from the database?

Successful companies use the database

to screen companies to develop a top 5

list of high potential candidates. They

send a short introductory email with

a web link to their company site. Then,

the export manager follows up with

a phone call within 48 hours. The

database is an excellent tool to invite

potential candidates to an international

trade show like Sial, Anuga, ISM or

Sweets and Snacks. Note: mass mailing

distributors usually generates less than

desirable results.

Does Export Solutions provide any

additional information on the distributors?

Export Solutions knows many of the

distributors in our database. Clients

of our Premium Subscription or Talk

to An Export Expert Services can gain

access to our insights via phone on the

best distributor candidates in any of

the 96 countries we cover.

How do I access the distributor database?

Visit www.exportsolutions.com and

click the distributor database page.

You can place a subscription or country

or category access into a shopping cart.

Register and check out via credit card.

The process takes two minutes and we

automatically send you an invoice.

FAQ’s – Distributor Database

18

Every export manger has performed

the time consuming function of reaching

out to potential distributor candidates

in a new country. The process is usually

successful, but requires patience and

perseverance. Top distributors are

overwhelmed with new representation

inquiries. These requests must compete

for attention with the hundreds of emails

in the distributors inbox from his existing

brands. Export Solutions has worked on

more than 300 distributor search projects

across 96 countries. Below are our Best

Practices for contacting new distributors.

Email Plus Phone Call

Email candidates a short, fact based, note.

You may receive an immediate response

from a few hungry and motivated

candidates. More likely scenario is the

need for an immediate phone follow-up.

Work with the contact’s assistant to

schedule a phone meeting or ask to speak

with the person in charge of “important

new business” projects. Periodically, I will

also contact a distributor through

LinkedIn, as that often routes through a

different email address. Lack of response

after several attempts means that the

distributor is not interested. On the other

hand, you must persevere as frequently

the boss may be busy or not glued to

email like the rest of us.

Avoid Mass Mailing

Distributors recognize an email blast from

miles away, guaranteeing a low response

rate. Better to send a personal email,

mentioning the contact’s name, how you

found him and your rationale for contact,

i.e., “we are looking for a partner with a

strong track record building other USA

brands.” Target distributors which may

be a good fit based upon your investment

level and brand ambitions. For example,

large power distributors prefer brands

with strong marketing plans, while

smaller distributors appear more open

to pioneering promising new products

without giant spending budgets.

Company Credentials Information

Do not bombard a candidate with

attachments and PDFs of lovely

brochures prepared by an ad agency.

First, many people automatically delete

emails with attachments from people

they don’t know. Send PowerPoints

and project details only after you have

established contact.

What Distributors Want to Know

Distributors want to know who you

are: what is the size of your company,

brand USP (why are you different?)

international success, and plans

(investment strategy) for their market.

Distributors’ mindset is to quickly

calculate how much money they can

make representing your brand and how

tough will it be to sell to their customers!

Market Visit

Distributor response will be improved

if you request an introductory meeting

at their office. This demonstrates that

you are serious about the project and

interested in brand building, not just

selling a few containers. Try to visit at

least three distributors on your trip, more

if it is a large country or you anticipate a

“tough sell.” Schedule your visit at least

6-8 weeks in advance to guarantee

distributor availability.

Distributor Search Guide – Export Solutions

Export Solutions’ web site contains a free

84 page Distributor Search Guide. This

guide is jammed with strategies, ideas,

and templates to guide each step of the

distributor search process. Export

Solutions completes distributor search

projects for leading brands worldwide.

Contacting New Distributor Candidates – Best Practices

Sample Introductory Email

Subject: New Business Opportunity – CerealCo* – USA

Dear Alexander:

CerealCo is a popular cereal brand from the USA.

Founded in 1960, 2022 sales will exceed $300 million

dollars. Our point of difference is that CerealCo offers

high quality gluten-free and organic cereals popular

with many modern consumers. CerealCo exports to

25 countries, including several in Asia.

We are now beginning the process of considering

partners for Indonesia. I understand that you have a

successful track record building other well known USA

grocery brands. Can we arrange an introductory web

meeting for Wednesday at 900 am? I am based in

Atlanta, Georgia, -12 hours versus Jakarta.

For more information, visit our web site at

www.cerealco.com

Kind regards,

Greg Seminara

Export Manager

(001)-404-255-8387

*Note: CerealCo is a fictitious company. Any resemblance to an

actual cereal company is coincidental.

19

Annual Sales:

$300 million US dollars in 2022

History:

CerealCo founded in 1960…62 years old

Core Product Portfolio:

Breakfast Cereals – “Leader in Organic/Gluten-Free Cereals”

Web Site:

www.cerealco.com

International Overview:

Direct sales to 25+ countries. Indirect sales to 50+ countries.

2021 International sales + 25%!

Southeast Asia Status:

CerealCo products available across Asia through a hybrid model

of partnerships, distributors and indirect sales through USA

consolidators. Current net sales of roughly $2 million dollars

in Asia Pacific.

CerealCo Objective:

Align with a distributor with strong brand building capabilities.

Develop a collaborative plan to grow business to comparable

levels to of our successful business in other Asia Pacific countries.

August Market Visit

CerealCo will visit Jakarta the week of August 1.

We will visit stores and meet potential partners to discuss

CerealCo plans.

*Note: CerealCo is a fictitious company. Any resemblance to an actual

cereal company is coincidental.

Company Fact Sheet (add your logo)

CerealCo* Summary – Indonesia Example

Best Practices – Contacting New Distributors

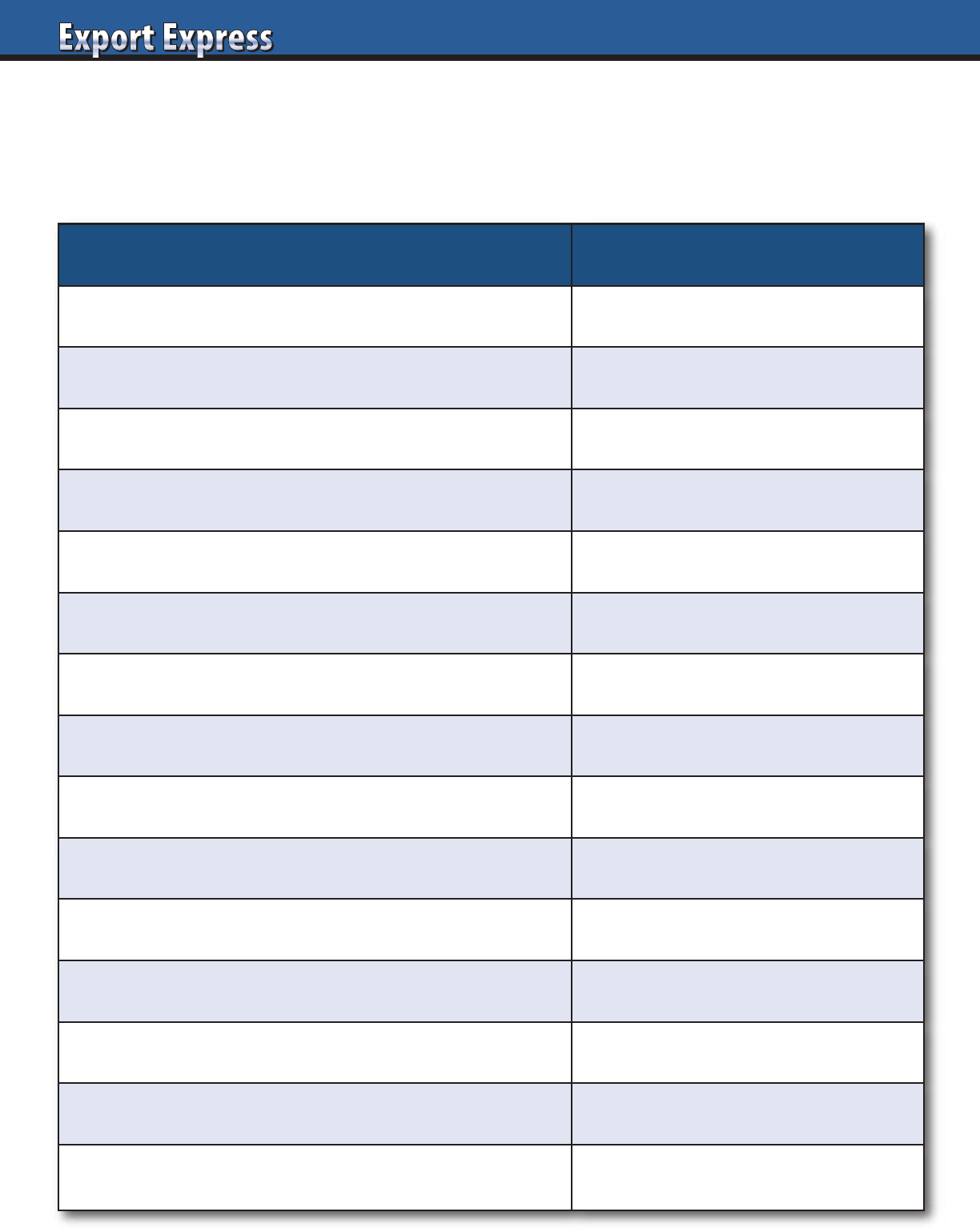

Do Don’t

Email Content

Short introductory email.

Company facts plus web link.

Lengthy email with

generic claims on

“why your brand is the best”

Email Delivery

Send on Monday.

Distributor has week to review

Send on Friday.

Email lost over the weekend.

Email Timing

Should arrive to distributor

at 2:00 pm his time.

After the “morning rush.”

8:00 am/9:00 am emails are

reviewed quickly and deleted

Phone Contact

Start calling 24 hours

after initial email.

Wait a week to call.

Attachments

No attachments on first email.

Web link only.

Send PowerPoints or

pricing on first email

Follow-Up

Constantly, if you believe

it’s a good candidate.

Wait for distributor to

contact you

In Country Meeting

Best opportunity to review

your brand proposition.

Create relationship without

market visit.

2020

Breakthrough – Contacting New Distributors

Looking for Good Distributors?

Export Solutions’ database covers

9,200 distributors in 96 countries.

www.exportsolutions.com

Strong distributors are inundated with lengthy emails from brands searching for a qualified

partner. Distributors check their emails every ten minutes just like the rest of us. Brand owners

are frustrated by the lack of response to their generic, mass emails. Export Solutions works on

around 35 distributor search projects per year. This requires us to be experts at breaking through

the clutter to reach the distributor owner or manager in charge of new business projects.

Breakthrough Techniques

• Call immediately after email. Before 9:00 AM and after 4:00 PM are prime time.

• Receive an introduction from one of distributor’s existing suppliers.

• Request your local government trade officer make an introduction.

• Connect with distributor team members through LinkedIn.

• Stimulating subject line: New Business Opportunity – Leading XYZ Brand.

• Try mobile phone, WhatsApp, Skype, or better yet…a FedExed Letter!

• Work through managing director’s assistant to facilitate contact.

• Initiate contact through a distributor’s junior level team member.

• Hire local to handle contacts: Russia, China, Japan.

• Follow up: use at least 3 of the above tactics.

If no response after 3 days, this signals a clear lack of interest.

21

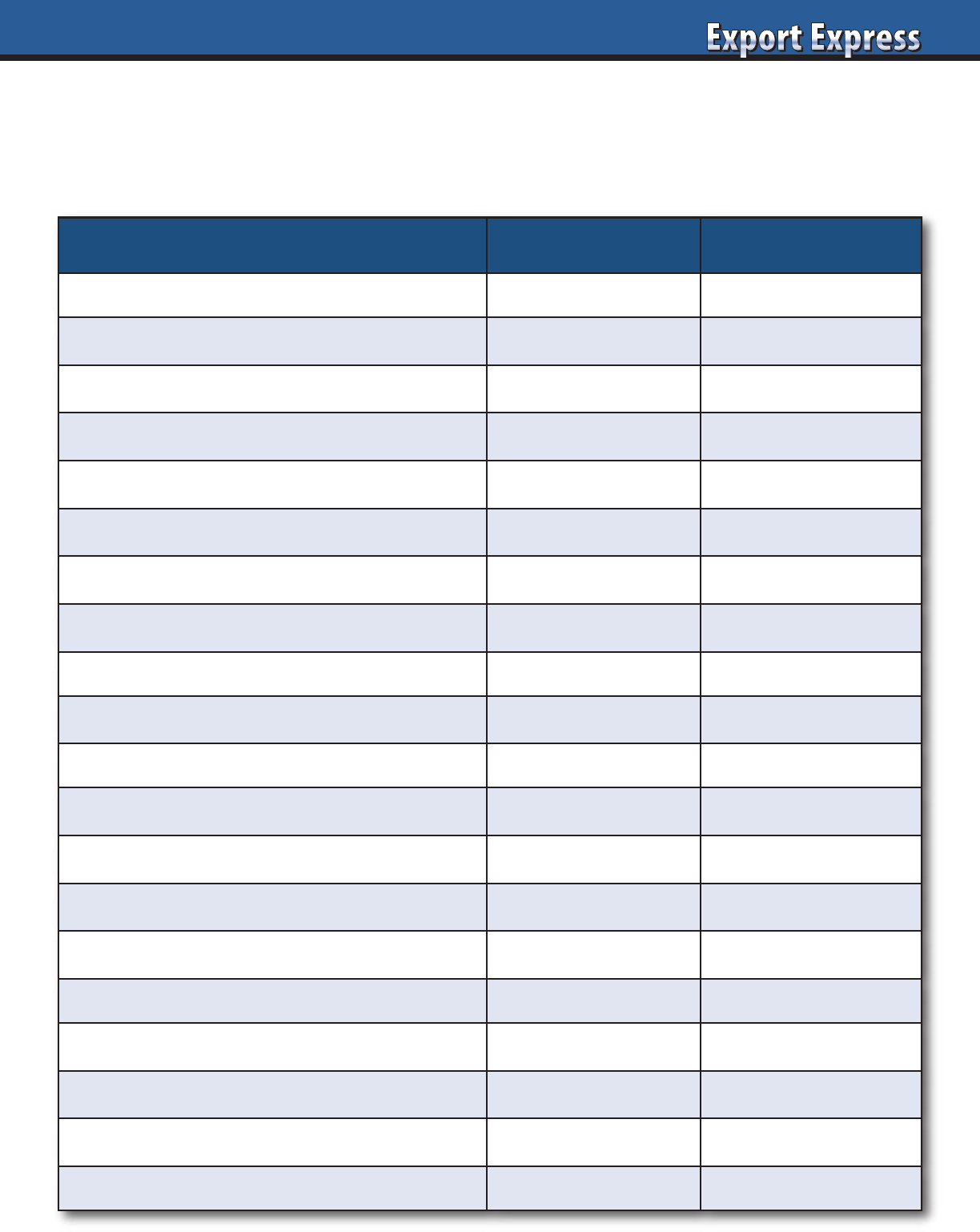

Are Distributors Interested in Your Brand?

High Interest Low Interest

Email Response

Immediate reply Delayed or no reply

CEO Engagement

Active participation Delegated to middle management

Scheduling Meeting

Flexible and easy Difficult. Conflicts.

Airport/Hotel Pick-Up

Offers to pick you up Take a taxi!

Meeting Presentation

Tailored. Prepared for you. Standard presentation

Category Research

Obtains data None

Competitive Review

Shares photos: store sets Informal comments

Store Visits

Organized/led by CEO Office meeting only

Samples

Obtains and tries samples Waits for you

Team Participation

3-6 people at meeting One person

Cell Phone

Shares private number Email address only

Questions

Addresses key issues No questions

Timeline

Meets due dates Delays

Post Meeting Follow-up

Immediate and frequent None

Proposed Plan

Detailed and fact based Brief topline

Results Winner Second place?

I have conducted hundreds of distributor interviews for multinational companies: P&G, Nestle, General Mills, Duracell, Lindt, Tabasco,

Barilla, J&J, etc. Distributor candidates all claim enthusiasm and high interest in your brand. See Export Solutions’ checklist of clues to

measure true distributor interest level.

22

Introducing

America’s Favorite Brands

Executive Board

Export Solutions Smucker’s Tabasco

Greg Seminara, CEO Danny Berrios, President Megan Lopez, Vice-President

General Mills Sun-Maid

Eric Saint-Marc Carsten Tietjen

Advisory Board

Bazooka Candy Blue Diamond Bob’s Red Mill

Santiago Ricaurte Dale Tipple Jan Chernus

Bush Beans Campbells Church & Dwight

Dave Bauman Julio Gomez Arun Hiranandani

Ferarra Candy Heartland Idahoan

Daniel Michelena Tom Theobald Ryan Ellis

Johnsonville Sausage Kao USA Keurig Dr. Pepper

Cory Bouck Julie Toole Billy Menendez

Mizkan Reynolds Welch’s

Noel David Chris Corey Marc Rosen

19 Companies | 200+ Top Brands | $80 Billion Combined

View our activities for export managers – www.usafoodexport.com

What Distributors Want to Know ?

Strong distributors are overwhelmed by calls from brand owners looking for new partners. Distributors assess each opportunity

carefully, as any new brand must add incremental sales and profits and not distract from priorities from existing brands handled.

What is the “size of the prize” for the distributor?

Assessment Criteria Facts Rating (10 = Best)

Your company: size/reputation

Existing business: sales in distributors country?

If zero “current sales,” what is realistic expectation?

Brand’s USP…your point of difference/innovation?

Size of investment plan: Marketing and Trade?

Potential distributor revenues?margin?

How does the product taste? (or peform)

How attractive/compliant is the packaging?

Pricing relative to category?

Brand success story in an adjacent country?

Competition intensity in category?

Brand range complexity?Product shelf life?

Local market research? Syndicated data?

Will brand invest in marketing and social media?

Will this be a tough product to launch?

Can we grow with the brand owner?

Your brand: core distributor category or adjacency?

Will the export manager be good to work with?

Will we be proud/excited to represent this brand?

What is the “size of the prize?”

23

24

Distributor interviews can be compared to a first

date. There is no second date after a bad first date,

even if both parties are interested in each other.

On the other hand, a good distributor first

interview can lead to a lifelong relationship.

Listed below are Export Solutions’ ten tips on

enhancing the productivity of your distributor

interview process.

1. Schedule Interview With Four to Six Weeks Lead Time

This allows you to program several candiate

interviews on your preferred timeline. Long lead

times enhance the chance of distributor senior

management availability and provide sufficient

time for motivated distributors to research

your category.

2. Meeting Agenda

Send a meeting agenda three weeks in advance

of meeting. Typical discussion topics include

Distributor credentials, organization model,

coverage by channel, success stories, category

insights, and distributor margin philosophy.

3. Store Visits – Pre-Interview

Export Solutions always conducts independent

store visits prior to our distributor interviews. This supplies

a snapshot of distributor’s performance for other international

brands. It also permits us to quickly become familiar with local

category dynamics, competitive activity, and pricing.

4. Distributor Assessment Grid/Questions

Prepare an assessment grid template highlighting and

weighting core assessment areas prior to your first interview.

Create a list of potential questions to be asked during the

meetings. Export Solutions provides free sample Distributor

Assessment grids and “10 Questions for Every Distributor

Interview” on our web site.

5. Distributor Presentation: Template or Tailored?

A key indicator of distributor enthusiasm is whether they

created a personal, tailored presentation for your meeting

or swapped brand logos and provided their “standard pitch.”

Best in class presentations allocate equal time for Distributor’s

CEO, functional heads, and your proposed first point of contact.

6. Your Company Presentation

Be prepared to share a 10-15 page presentation on your

company credentials. Stick to the key facts: company metrics,

product point of difference, export success stories, and plans

for the market. Bring plenty of samples for everyone to try.

Note that the distributor will ask for your presentation, so keep

it brief as you do not want a lengthy strategic presentation in

the hands of a distributor that is not selected.

7. Tour Distributor’s Office and Warehouse

Would you buy a house without visiting it? Distributor offices

and warehouses offer valuable clues to distributor activity,

head count, size, and professionalism. Your quick inspection

will validate that the distributor’s activities match claims from

their presentation.

8. What’s Their Plan?

A core question in a positive interview is “What would the

distributor’s plan be if we awarded them the business starting

next Monday?” This provides insights on their plans, timelines,

and process for transitioning and building new brands.

9. What Do You Like About Us?

A good way to measure distributor interest is to ask their

feedback on your opportunity towards the end of the meeting.

Framing the question from a positive point of view allows the

distributor to express interest or concerns.

10. Provide Homework Assignment

Conclude each positive meeting with a request for distributor

to provide a deeper category assessment and a suggested entry

or transition plan. Distributors should supply references for five

of their existing clients. An important insight will be the quality

and response time for completing the “homework.”

Ten Tips: Distributor Interview Preparation and Insights

Need more information? Visit www.exportsolutions.com.

25

Agenda: New Distributor Interview

1. Distributor Capability

History, organizational model, coverage,

Companies represented.

2. Category Insights

Distributor observations and analysis

of your category? Category sales data?

Store check photos?

Gaps? Recommendations?

3. Success Story

Request example using a brand of similar

size to your brand. Success story could be

“Pioneering a New Brand” or “Taking an

Existing Brand” to a higher level of sales.

4. Distributor Cost to Serve

General model of financial cost to serve

the market. Retailer costs for listing fees,

trade promotion plus everyday category

margin. Distributor margin estimate and

services included in margin.

5. Warehouse Visit

Check companies represented and

inventory, by brand, for accurate view.

6. Year 1 Action Plan

If distributor hired, what would be their

Year 1 action plan?

Note: More relevant for existing brand

looking to grow.

7. Brand Owners:

Company Credentials Presentation

Company History, product portfolio,

point of difference.

Share product samples.

8. Brand Owners:

Status/Plans for Country

Brand Ambition for the country.

Current distribution levels and pricing.

Planned investment level.

9. Next Steps

Determine mutual interest level.

Establish timeline, point person for

distributor and brand owner.

Prepare category review, year I plan,

and price calculation model.

Looking for Good Distributors?

Export Solutions’ database covers

9,200 distributors in 96 countries.

www.exportsolutions.com

26

10 Questions for Every Distributor Interview

1.Company History

How long have you been in business? Who are the owners?

How many direct, “payrolled” employees do you have?

Approximate annual sales volume?

2. Company Brand Portfolio

What are your top 10 companies/brands represented?

For which channels do you represent each brand?

How long have you represented each brand?

Can you provide senior level references at each “brand owner”?

3. Key Account Buyers

Who is the buyer for our category at the largest retailers

in your market? What other brands do you sell to our buyer?

How frequently do you visit each major customer?

4. New Product Launch Success Story

Provide a recent example of a new brand launch success story.

Key retailer acceptance? Cost of entry? How long did it take?

Key elements of the success strategy?

5. Creative Selling

Provide an example where you took an assigned

marketing/brand support budget and created a successful

local program. How do you measure success?

6. Retail Servicing

How many full time employees do you have visiting retail

stores? Are they located countrywide or just in the capital city?

How do you measure a “good store” in terms of brand presence

versus a “bad store”? Describe your retail reporting system.

7. People

Who would be our point of first contact? Would our contact also

“sell” our brands to major accounts? What other brands is our

contact responsible for? How do we insure that we get our fair

share of attention from your sales force?

8. Business Planning Model

What would your action plan be if we made an agreement to

start with your company? First steps? 90 Day Plan? Reporting?

9. Cost to Serve

How do you model your distributor margin? Range of margin

for our brands? Are you open to promotional spending

split (50/50)?

10. Enthusiasm for our Company

Why is our brand a good match for your company?

Why are you the best partner in the market for our brand?

What commitment are you willing to make?

Talk to an Expert

• International Strategy Road Map

• Fix Problem Markets

• Entry Plans

• Find Distributors in 96 Countries

• Export Workshops

• Motivational Meeting Speaker

Contact Greg Seminara at (001)-404-255-8387 to discuss your business development project.

www.exportsolutions.com

27

Distributor Search Made Simple – 96 Countries

Contact Greg Seminara at (001)-404-255-8387

to discuss your distributor search project.

“Spend time Selling to Distributors versus Searching for Distributors”

www.exportsolutions.com

Recent Distributor Search Projects for Export Solutions

• Global distributor search across 26 countries supporting sale of 1 billion dollar food brand

• USA entry strategies and importer/broker search for 70 million dollar European ethnic food brand

• Indonesia, Malaysia, Philippines & Singapore distributor search for global snack brand

• Global strategic assessment: Europe, Asia, Middle East and Latin America for leading USA food company

• Brazil: “next level” business development for famous global food brand

• Europe and Latin America distributor search supporting spinoff of leading non-food brand

• Peru & Ecuador distributor search for 6 billion dollar food company

• Mexico distributor search for global biscuit brand

Export Solutions serves as a phone consultant on more than 50 distributor search projects every year.

Why use Export Solutions as a distributor identification consultant?

Export Solutions has the unique ability to leverage our proprietary database of 9,200 distributors in

96 countries. Distributors everywhere respect Export Solutions as a valuable source of new business leads.

Our nine step distributor selection process is a proven system to identify and hire the best candidate to build

your brand. You provide us the brief and we facilitate the rest within 60 days!

28

Strong consumer goods distributors are

deluged with representation inquiries

from around the world. The emails

are usually supplemented by a product

catalog and promise to mail a price list! In

a best case scenario, this type of approach

may lead to a request for more informa-

tion from a good distributor. More likely,

the distributor will skip your inquiry

and move on to the next opportunity

in his mailbox. Listed below are Export

Solutions tips for “breaking through the

clutter” and providing the right informa-

tion to generate excitement and interest

from the distributor community.

1. What is your Brand USP

(Unique Selling Proposition)?

USP defines your competitive edge

versus all other brands battling for the

same shelf space. The USP can revolve

around quality, value, assortment, or

packaging. However, you need to

validate your claims. For example, a

statement such as “tastes better than

competitors A & B” should be supported

by market research of consumers or blind

tests of a sufficient panel group that backs

your quality claim. Similarly, a retail price

review can demonstrate a “better value”

position. Your USP must also pass the

litmus test: Is your USP relevant to the

purchaser and consumer? For example,

you might offer the only coffee with

orange and lemon flavors, but is anyone

really looking for this product?

2. Have you done your homework

on my market?

The food/consumer goods industry is

relatively transparent. Typically, brand

owners simply need to visit the leading

supermarket chains to obtain a “snap-

shot”of local category assortment, pricing

and merchandising practices. The assort-

ment and shelf space allocation will

provide clues regarding consumer

preferences from a taste/usage stand-

point and potential gaps in the market.

Syndicated data providers such as

Nielsen and Euromonitor supply reams

of data tracking category sales and trends.

New brand representation offers to dis-

tributors that demonstrate a degree of

understanding of local category market

conditions will always receive an

appreciative response.

3. What will the brand owner invest?

The most important consideration after

the USP definition! A distributor believes

that he needs the right financial spend

levels to aid him in achieving the results

that he is capable of. The correct spend

level usually reflects an appropriate

mix of trade development funds (listing

fees/shelf space/flier participation)

and consumer awareness activities

(sampling/pr etc.) The brand owner

must acknowledge that there are fixed

fees to enter virtually every market.

Some distributors are willing to split

these fees. It’s usually not enough to case

rate spending unless you have a very

strong proposition. Bottom line: If you are

unwilling to invest in your brand…why

should the distributor invest his time and

resources building your brand?

4. Where has your brand been successful?

Your track record at building brands

counts! Share your record proudly,

particularly if the target country or

retailer are well known or reside in an

adjacent country. On the other hand, a

“Made in the USA” success story may

not be impactful if you don’t intend to

duplicate the conditions that brought

you success such as local production

and measurable marketing investments.

5. How tough is the job to launch your brand?

Are you attempting to enter a competitive

category dominated by heavy spending

multi-nationals? Or are you aiming at an

attractive niche? What are the brand

owners expectations in terms of product

availability and sales volume?

6. Can the distributor make money

with your brand?

Distributors seek to obtain a fair profit

for their activities to support your brand.

Profit must be measured in dollars

contributed versus percent of sales.

Distributors rarely make money during

year one of an introduction as they

allocate a disproportionate share of their

resources to launch a brand. On the other

hand, new brands in current categories

for the distributor can bring new profits

with minimal incremental effort. Globally

recognized brands bring prestige to a

distributor’s portfolio and may serve as

a magnet to attract other brands. Brand

owners must present a convincing case to

the distributor on the incremental profits

that your company can deliver to the

distributor’s bottom line.

Brand Owners: What Every Distributor Wants to Know

29

Distributors are flooded with requests

for representation of brands from

around the world. Normally, these

presentations are jammed with pretty

photos and long stories about the

company’s history. Brands will receive

better response with a fact based,

company credentials presentation

focused on “what distributors and

buyers really want to know.” Export

Solutions recommends that brands

create two versions of your credentials

presentation: a ten page detailed

presentation and a one page summary.

Recapped below are our ten tips

on developing a strong company

credentials presentation to attract

interest from distributors and

buyers anywhere.

1. Just the Facts:

Page 1 should include basic company

facts. Annual sales, ownership, number

of employees, and key categories

and brands.

2. History

Tell the story of when and how the

company was founded. This is your

chance to seduce the audience with a

captivating story. Learn to tell the story

in one page with no company videos

or DVDs (boring!). Provide a longer

version of your history and milestones

on your company web site for those

who want more information.

3. Brand USP

This is the place for pretty pictures

of your brand and the opportunity to

demonstrate your category expertise.

Why is your brand different? How do

you compare with current category

assortment? List any awards or

recognition for your company.

4. Current Export Markets

Share countries where your brand is

currently available. Segment between

core markets where your brand is

strong and others where you maintain

niche status. What is the rationale for

entering the distributor’s country?

5. Distributor and Retailer Partners

Highlight well known distributors

currently serving as your partners. List

retailers who currently sell your brand.

Logos work well.

6. Success Stories

Focus on recent examples of your brand

building results. Mention specific retailers

or distributors if examples are well

known retailers or in adjacent countries.

7. Investment Strategy

Distributors and buyers demand

critical information on how you plan

to generate consumer awareness, trial,

and repeat purchase of your product.

Their interest will match your level

of financial commitment.

8. Team Resources

Publish photos of your export team.

This includes marketing, finance,

customer service, and logistics experts.

List years of service for each team

member to demonstrate that you have

a strong support organization to build

the business.

9. Sync With Web Site

Your credentials presentation should sync

with information on your web site. In

reality, your web site is the first place that

a potential distributor will visit. Modern

web sites, with crisp graphics, minimal

text, and no music will receive attention.

Do you have a page dedicated to

international export? When was the

last time you updated your web site?

10. Why is your Company a Good Partner?

This represents a one page summary of

your company credentials. What value

does your company bring to the

partnership? What is the “size of the

prize?” How will your brand make more

money for the distributor or buyer?

Export Solutions can help!

Export Solutions has participated in more

than 300 distributor identification projects

and reviewed web sites of more than

10,000 distributors and brand owners.

We are available to review your company

presentation or web site to provide timely

ideas and suggestions to improve your

visibility. Contact us in the USA at

(001)-404-255-8387 for more information.

Ten Tips: Your Company Credentials Presentation

Need more information? Visit www.exportsolutions.com.

30

All your distributors express enthusiasm

and commitment for your brand. True

passion for your partnership is measured

by what distributors do, not by what they

say. Listed below are ten tips to consider

when measuring distributor enthusiasm

for your brand.

1. CEO Commitment and Involvement

The CEO steers the distributor ship

and sets the tone for your business

relationship. Best in Class distributor

CEO’s reach out via phone to touch base

periodically and spend time with you

when you are in town. They keep up to

date on your priorities and key issues

and ensure that his team is delivering

good service and results.

2. Responsiveness to Problems

Urgent situations erupt in every market.

Currency devaluations, product recalls,

or missed budget numbers require

immediate attention. What is the distributor

response time? Does the distributor share

your sense of urgency? How long does it

take to get problems fixed?

3. Customer Introductions

Most distributors maintain good

relationships with leading retailers.

Enthusiastic distributors are happy to

introduce you to the leadership of their

customers. These distributors will use

their personal relationships and “favors”

to benefit your brand.

4. Best People Assigned to Your Brand

The distributor functions as a team.

Every team has superstars and

developing players. How does the

distributor allocate “talent”? Are the

stars working on your business?

5. Web Site Prominence

A distributor’s web site offers important

clues to distributor professionalism,

services, and core brands. How

prominently is your brand featured on

the distributors web site? Is a case study

using your brand results mentioned?

Is your brand logo listed at the top of

the page or buried at the bottom?

6. Distributor Visits to Your Headquarters

How often does the distributor travel to

your headquarters or factory? Does the

distributor have a relationship with your

CEO, vice president of international,

or other leaders? Many distributors are

interested in visiting companies based

in San Francisco or London, but true

enthusiasm accompanies meetings in

Chicago or Hamburg during the winter!

7. Creative Ideas

Distributors can be magicians at

developing “new ways to solve old

problems.” Good distributors bring

innovative ideas to adapt your plan

and funding budget to the local market.

How often does your distributor apply

their brilliant new idea to your brand?

8. Distributor Awards and References

Successful distributors proudly display

their awards in conference rooms and

lobbies. Is your award visible? I always ask

distributors for references from other brand

owners. Does the distributor use your

name as a reference or request a testimonial

from you on their performance?

9. Love Your Brand

I have written an entire article on

getting a distributor to love your brand.

There are many ways to feel the love.

Does the distributor sales team wear the

shirts with your brand logo or use the

pens that you handed out at the last

sales meeting? Is the distributor able to

secure a customer meeting for you on

one week lead time? Are they happy to

see you arrive or just to see you depart?

10. Exceed Expectations Everyday

The most enthusiastic distributors

exceed your expectations everyday.

This includes shipment results in excess

of overall market growth and total

organizational support behind your

new product introductions. Enthusiasm

is not measured in words and weeks,

but in actions carried out over many

years by a Best in Class partner.

Ten Tips: Measuring Distributor Enthusiasm for Your Brand

Need a hand? Visit www.exportsolutions.com.

31

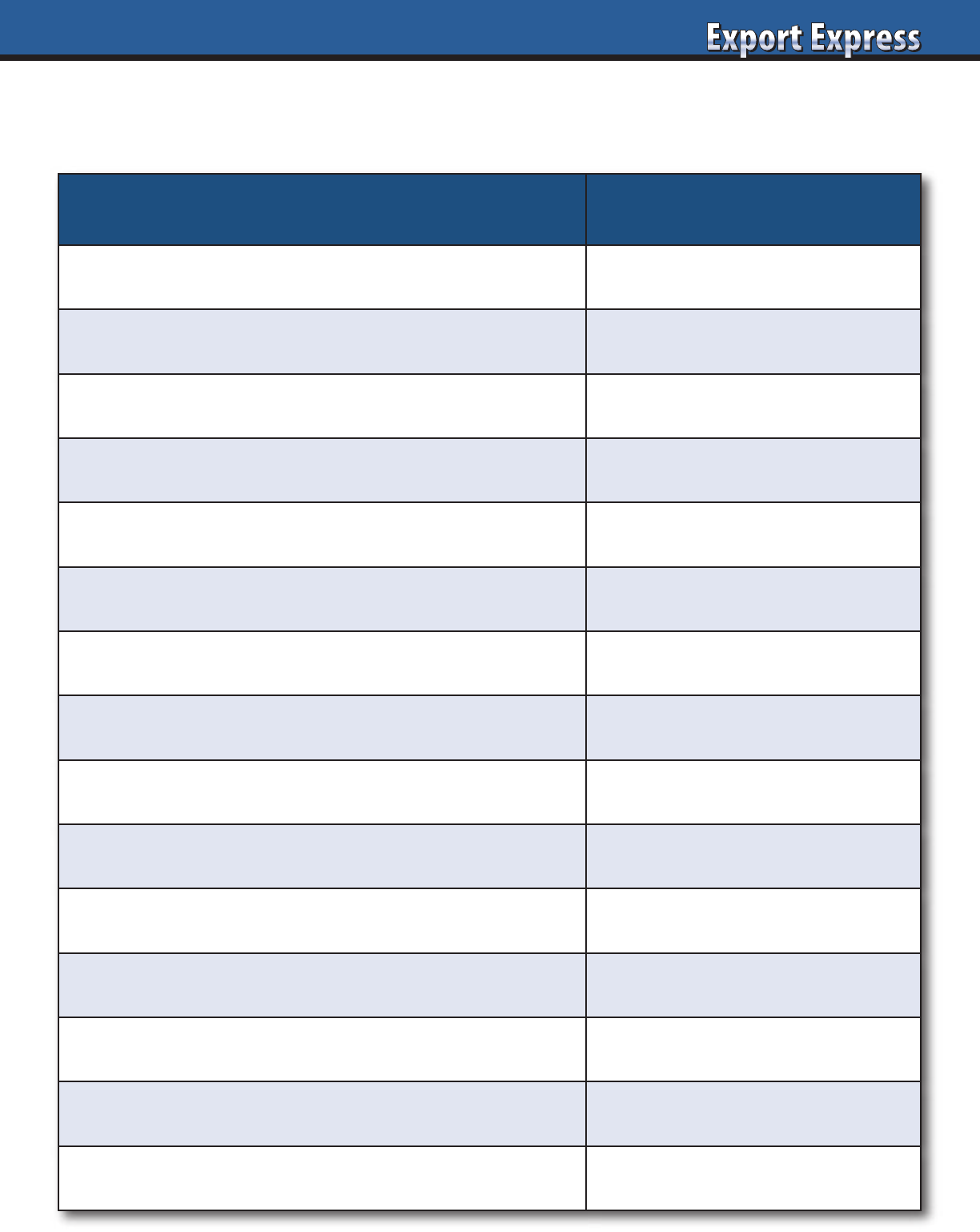

Criteria (weighting)

Rating Evaluation Factors

Corporate Credentials 30%

Size, sales force, logistics, # employees.

Reputation (reference check existing brands).

National coverage.

Multi-channel coverage.

Category Expertise 20%

Sells brands in my category.

Shelf space for existing brands.

Current brands selling to target retailer.

Category analysis and insights.

Brand Building 15%

Ideas to build or launch my brand?

Marketing plan, cost, timing.

Success stories.

Cost to Serve 15%

Fair, transparent model relative to size

of business, brand investment, and

work required.

Enthusiasm for

My Brand 20%

Advance preparation, CEO involvement.

Follow-up on commitments.

Alignment with your vision.

X Factors: People, Admin.,

Professionalism, etc.

+/-

CPG/FMCG background for leaders.

Efficiency of scheduling meeting.

Office environment.

Do you enjoy the people?

Rating System

Rating Score

Excellent 5

Very Good 4

Average 3

Fair 2

Poor 1

Contact Greg Seminara at (001)-404-255-8387 to discuss your distributor search project.

www.exportsolutions.com

Export Solutions Distributor Assessment Grid

32

I admit it: I like big distributors.

They feature more critical mass which

allows them to invest in people and

technology. Retailers and large

distributors are “co-dependent,” leveling

the playing field. Also, big distributors

get paid first during financial crisis

and usually offer better multi-channel

coverage and retail services. However,

many small/mid-size brands feel lost at

a big distributors, securing mediocre

results and failing to access the massive

distributor’s resources. Listed below are

Export Solutions’ Ten Tips for “Getting

Better Results with Big Distributors.”

1. Develop a Personal Relationship

With Your Distributor’s CEO

Call him a few times per year. Invite him

to dinner or a high profile sporting event

when you are in town. Send him a good

business book. Stay top of mind.

2. Focus on 2-3 Priorities

Provide a limited number of specific,

measurable objectives that are critical

to the delivery of your annual business

plan. Many companies bombard their

partners with a myriad of priorities,

forms, and requests diluting focus.

Instead position communication,

reporting, and activities in context

of the 2-3 tasks that must happen.

3. Invest in Distributor Sponsored Events

Large distributors offer the possibility

of co-promotion with their other brands.

Frequently, a mid-size brand may be

able to gain promotional activity at a

reduced cost due to the scale of their

distributor partner.

4.Evaluate Your Distributor Brand Manager

Your distributor brand manager is your

primary point of contact. If your business

is not growing, this could signal a need

for a change in brand manager. Two

scenarios exist. In some cases, you

may have a senior brand manager with

too many brands and no time for you.

In these cases, it may be better to shift

to a junior brand manager with more

bandwidth. In other cases, your contact

may be too junior, with limited

organizational clout to get things done.

In this example, you may fare better

by changing to a more veteran

brand manager.

5. Spend Time With

the Field Representatives

I am an advocate of escaping distributor

conference rooms for the hustle of the

stores. Spend time with the sales

representatives visiting their customers

and stores. The field team is frequently

ignored by export managers, but serves

as the engine of the distributor. Take

them to lunch, listen to their problems,

understand their business, give them

a gift with your company logo and they

will be your dedicated warriors for life.

6. CEO Market Visit

Invite your CEO or other senior

executives to visit the market. Distributor

CEO’s love to “rub elbows” and solve

the world’s problems together. You’d be

surprised at the number of market issues

that will disappear in advance of your

CEO visit. It’s also a good idea to invite

your technical experts in information

technology or supply chain to visit. Big

distributors love to learn best practices

from their overseas suppliers.

7. Create a Distributor Advisory Council

Invite a select group of large distributor

CEO’s to advise your company on

international development. Meet twice

per year a year, with at least one event at

a resort location. This allows your large

distributors to build relationships with

your senior team in an intimate setting.

All members of your Distributor

Advisory Council will achieve their

annual objectives!

8. Sales Contest

Create some excitement with a sales

contest for the entire distributor

team.Make it fun and structure it to

maximize winners. Find a way to include

all the “non-sales” people if you can.

9. VIP Visit to Corporate Headquarters

Treat your distributor as a VIP at your

corporate office. This trip creates a

memorable bonding experience and a

chance for you to serve as a good host.