Insights to Accelerate International Expansion

Distributor Management Guide

Our Mission: Help Manufacturers “Spend time Selling to Distributors versus Searching for Distributors”

In This Issue

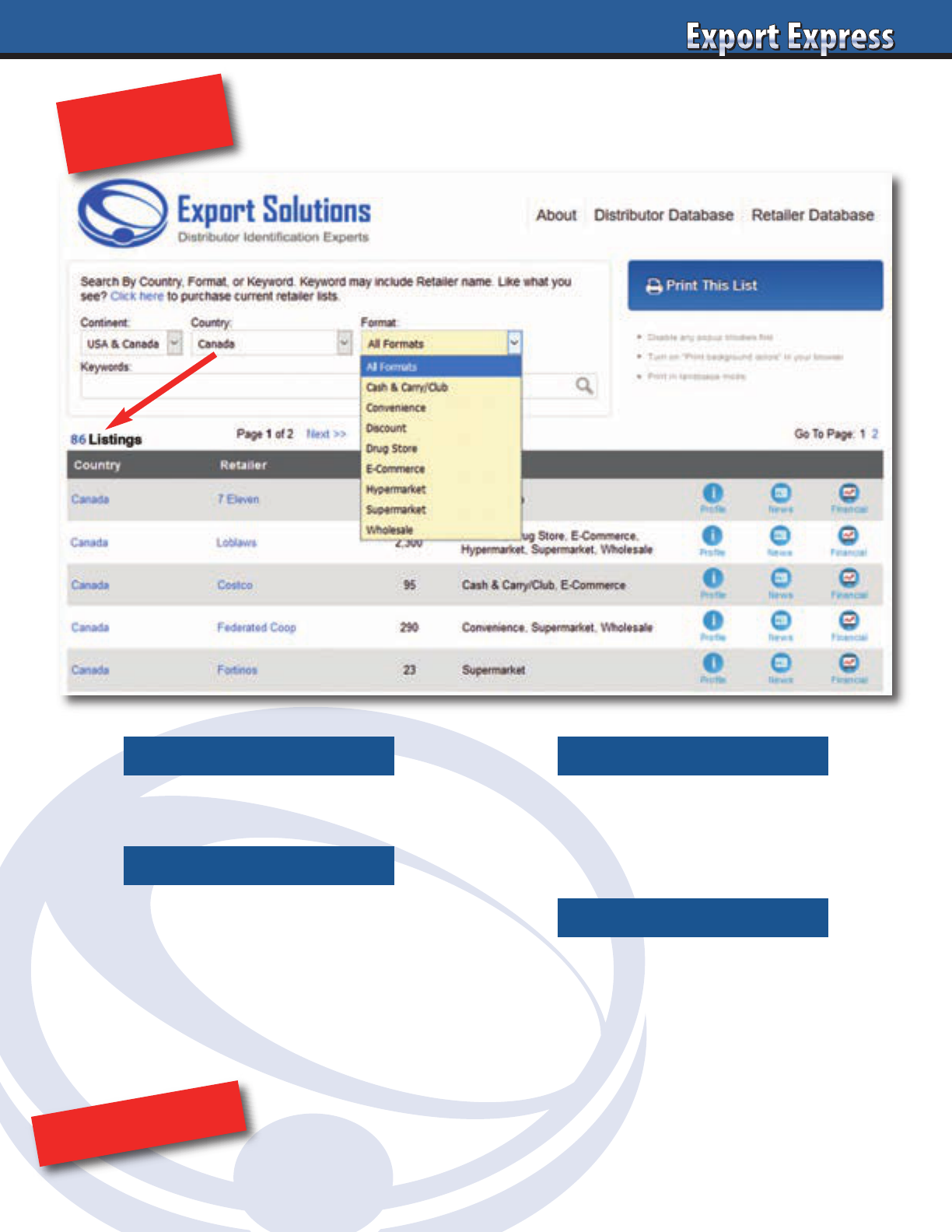

Sell to 96 Countries

Looking for new customers and

distributors in international markets?

Export Solutions’ distributor database

covers more than 9,200 distributors

in 96 countries. Our database features

extensive coverage of leading food,

confectionery, and beverage distributors.

New! Export Solutions’ retailer database

now tracks 2,700 retailers in 96 countries.

Order now at www.exportsolutions.com.

Page 3

Distributor Performance: Recognize the

Leaders, Push the Laggards

Page 17

Ten Tips: Measuring Distributor

Enthusiasm for Your Brand!

Page 25

10 C’s – Cooperation Model

Page 36

How to Win 2022 – Ten Tips

Page 43

Currency Exchange – Tough Tactics

for Tumultuous Times

Page 50

Retailer Annual Business Review

Page 58

“Best in Class” Distributor Standards

Page 80

Contacting New Distributor Candidates –

Best Practices

Export managers spend

our lives working with our

international distributor

networks. Our days are

filled with meetings, emails

and phone calls discussing

shipments, new items, and

promotional activity. There

is a definitely a “science” to

our methods for partnering

with distributors.

Export Solutions’ Distributor

Management Guide seeks

to capture strategies,

techniques, and templates that we use to

build international businesses. Much of

the material will be familiar, if not

forgotten for many export managers.

Our Distributor Management Guide serves

as a reference tool for all export

managers and a gentle reminder of good

ideas that work.

These insights represent Best Practices

from some of the 400 projects I've

completed across Europe, Asia,

Middle East, and the Americas. Export

Solutions’ newsletters and handbooks

represent the collective thinking of

more than 9,900 export managers and

government trade groups that form my

network. I try to learn something new

from every company that I work with

and every distributor that I meet. Like

our ideas? Contact us to take your

international business to the next level.

3 “Distributor Respects what the Brand Owner Inspects.”

3 “What's Measured is Treasured.”

3 Judge distributor success by in-store visibility for your brand,

not only containers purchased.

3 Visit stores independently without your distributor to observe

realistic market conditions.

3 How much money does a distributor make for servicing your brand?

3 Track the number of countries where you have the #1, #2, or #3 brand,

not the total countries you sell to. No one is impressed if you sell to

70 countries, but your volume totals 1-2 small shipments per year in

most of them.

Greg's Guidance: Distributor Management

Distributor Management Guide

How can you take your business to the next level? Export is not

easy and managers are constantly challenged to create miracles.

Game-changing results demonstrated by sales increases of

20 percent, 50 percent or more require aggressive strategies,

not just a repetition of last year’s promotion program.

Read Export Solutions’ 12 tips (20 percent more than 10 tips!)

for driving exceptional results.

1. Big Bet – Focus Country

Pick one mid-size country where you have a decent business,

but significant potential to grow. Test a “heavy-up” marketing

investment program. Invite the distributor to visit your

headquarters to meet senior management and secure

commitment for delivering the “stretch” plan.

2. Dedicated Brand Manager at Distributor

Fund a dedicated brand manager “in house” at your distributor.

This person should maintain a dual reporting relationship to the

distributor and you. Your exclusive manager will immediately

identify issues (and solutions) and supply laser focus against

priorities. Allocating a budget for a “junior” brand manager

may pay out.

3. Mergers and Acquisition

Consider buying a local category competitor. This may increase

your scale and provide access to resources such as factory or a

direct sales team. “If you can’t beat them, buy them.”

4. E-Commerce Focus

E-commerce represents a different sales channel. We’ve viewed

cases where a brand is a “sales hero” in e-commerce, but not

available through conventional supermarkets or pharmacies.

E-commerce sales may be highly incremental.

5. Costco Global Deal

Costco ranks as a global retailer, with 2022 sales expected to

reach around $150 billion. Costco operates 770 stores, including

245 high volume outlets outside the USA. Costco loves exclusive,

“mega pack” offers and can purchase large quantities centrally

for the USA or certain international regions.

6. Celebrity Endorsement

Millennials are glued to their phones, waiting for the latest

news to cross their Instagram feed. Hire a local agency to snare

celebrity endorsements or mentions from popular bloggers.

7. Drop Your Price

How much incremental volume would you generate with

a 20 percent price drop? 30 percent? In some cases, your

distributor will share or co-fund a meaningful price reduction.

The incremental sales and fatter market share may represent

a good return on investment.

8. Co-Promotion

Link with a famous local brand in an adjacent category.

Challenge your distributor to offer a group promotion with

several of his brands. I have observed promotions where you buy

one brand with a higher price point and another brand (could be

yours) is given away free and the other manufacturer reimburses

you for your wholesale cost.

9. Sales Contest

Everyone loves a sales contest! Feature an expensive prize like

a trip to a resort destination or a big screen television and watch

your reps sell like crazy.

10. Local Co-Packer

In-country production may translate to more competitive prices

by avoiding duties and dealing with local cost inputs. In other

cases, consider shipping in bulk and packing finished goods

on site.

11. LTO – Limited Time Offer Pack

Create a special pack with vintage labeling or celebrating a local

sports event. I thought that the “Share a Coke” campaign with

personalized bottles was outstanding.

12. Monthly Market Visit

Most export managers rely on periodic visits to measure

distributor progress. This prevents a “deep dive” into the issues

and familiarity with your brands performance outside the capital

city. Select a country like Saudi Arabia, Peru, Philippines or

Malaysia where visit frequency can impact results. “A distributor

respects what the brand owner inspects.”

Twelve Tips: Generating Game-Changing Results

Looking for Good Distributors?

Export Solutions’ database covers

9,200 distributors in 96 countries.

www.exportsolutions.com

2

3

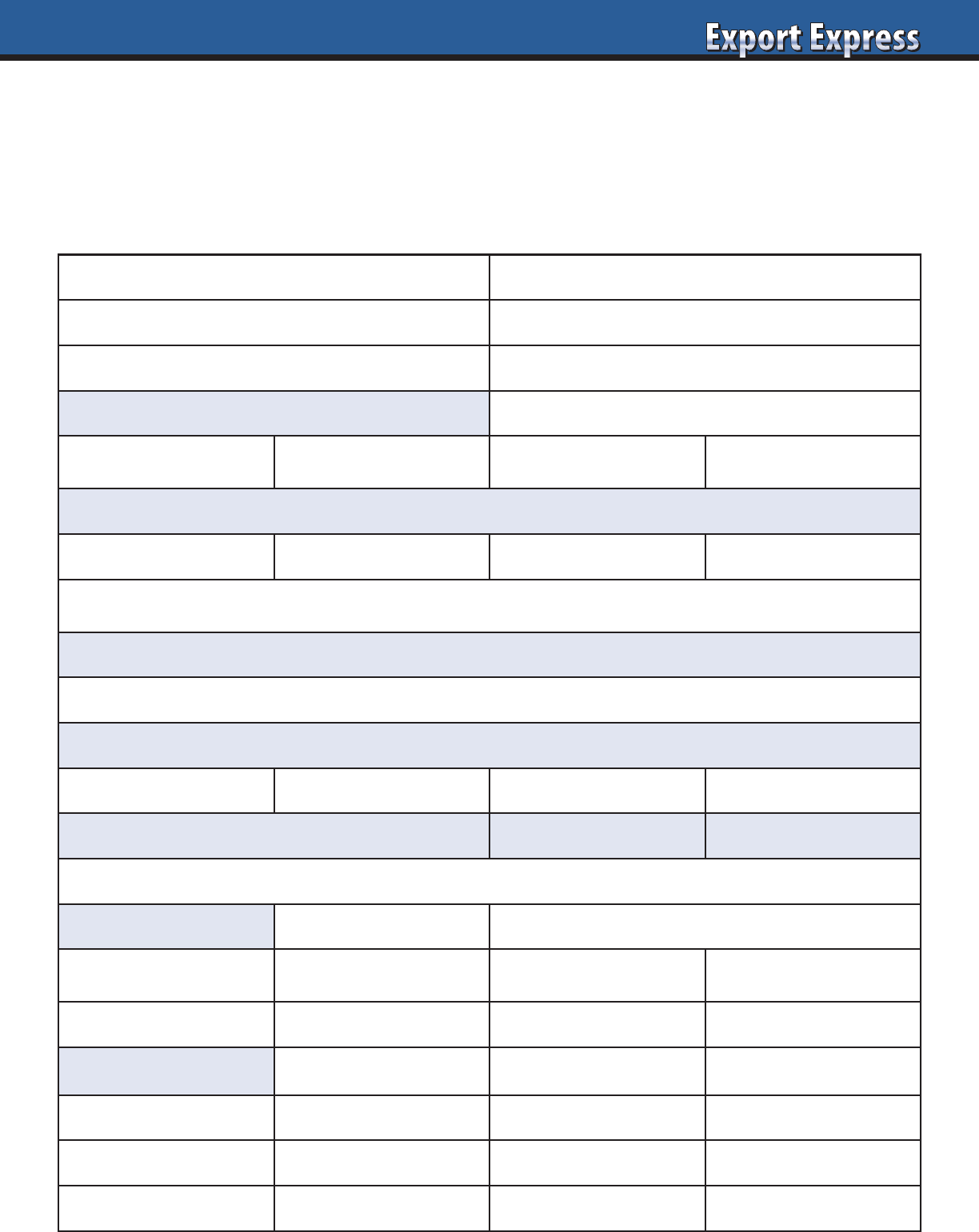

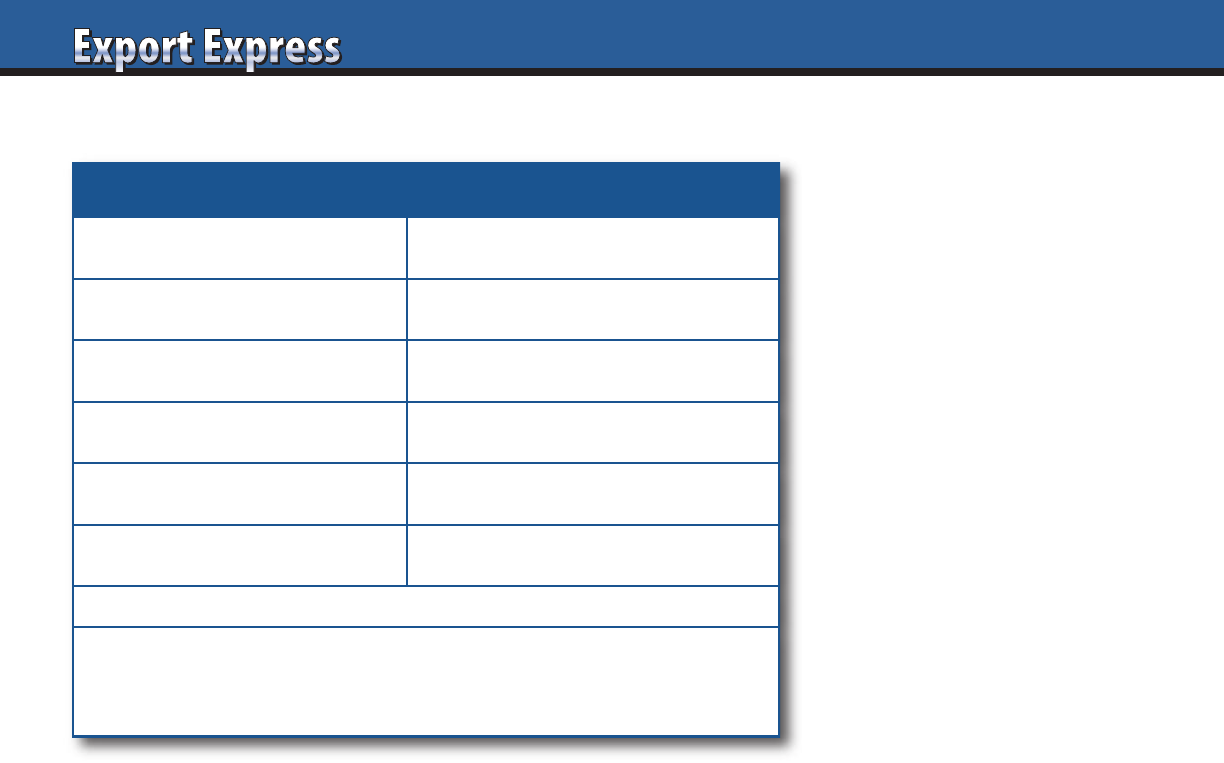

Distributor Performance: Recognize the Leaders, Push the Laggards

The start of a new year is an appropriate time to review distributor performance. This process starts with the evaluation of the usual

metrics such as shipment results, market share, and success delivering new item placement. Normally, distributor performance ranges

across the spectrum from outstanding results delivered by top distributors to under-achievers who fail to meet their shipment budget.

Each scenario warrants a different approach in terms of managing for the future.

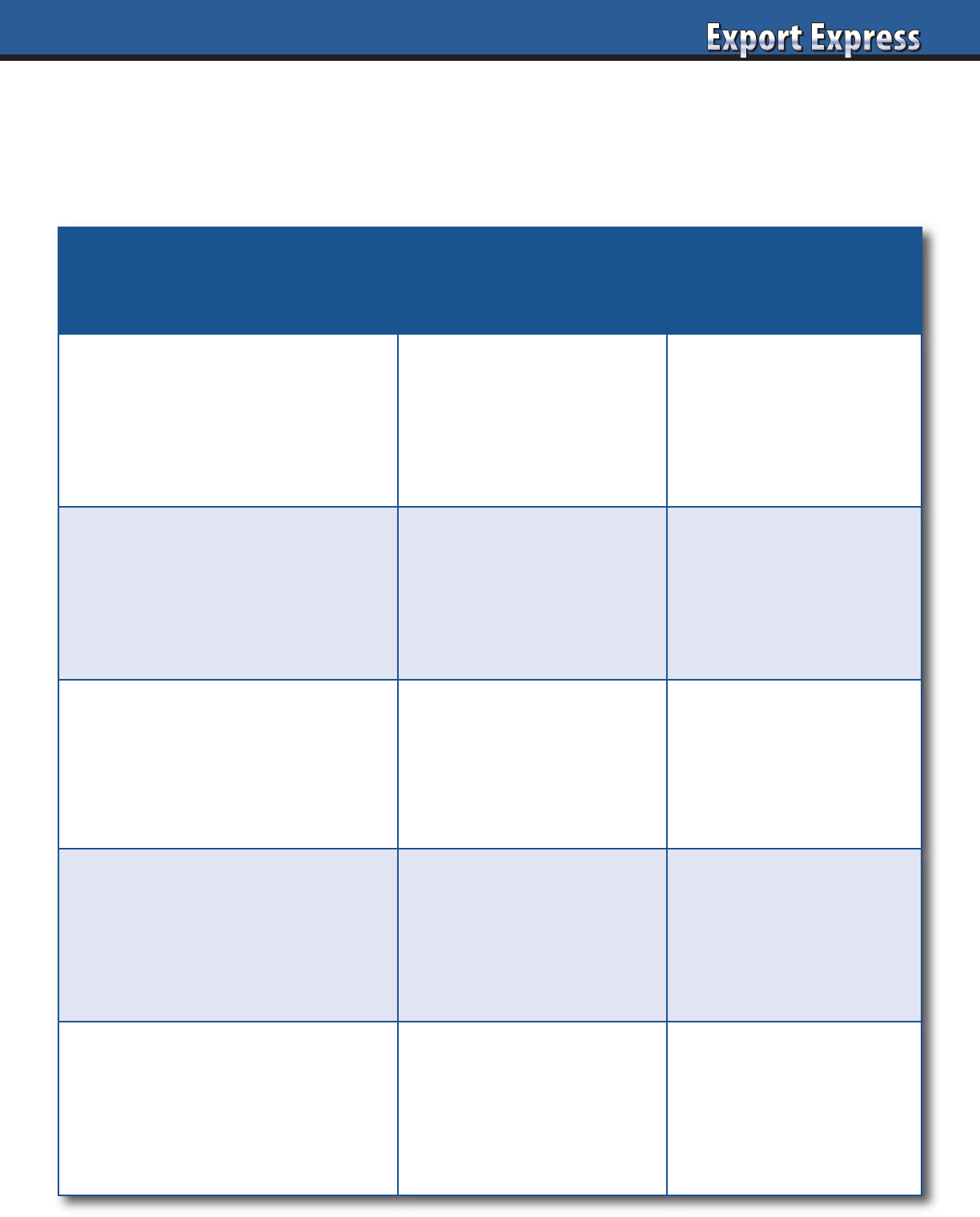

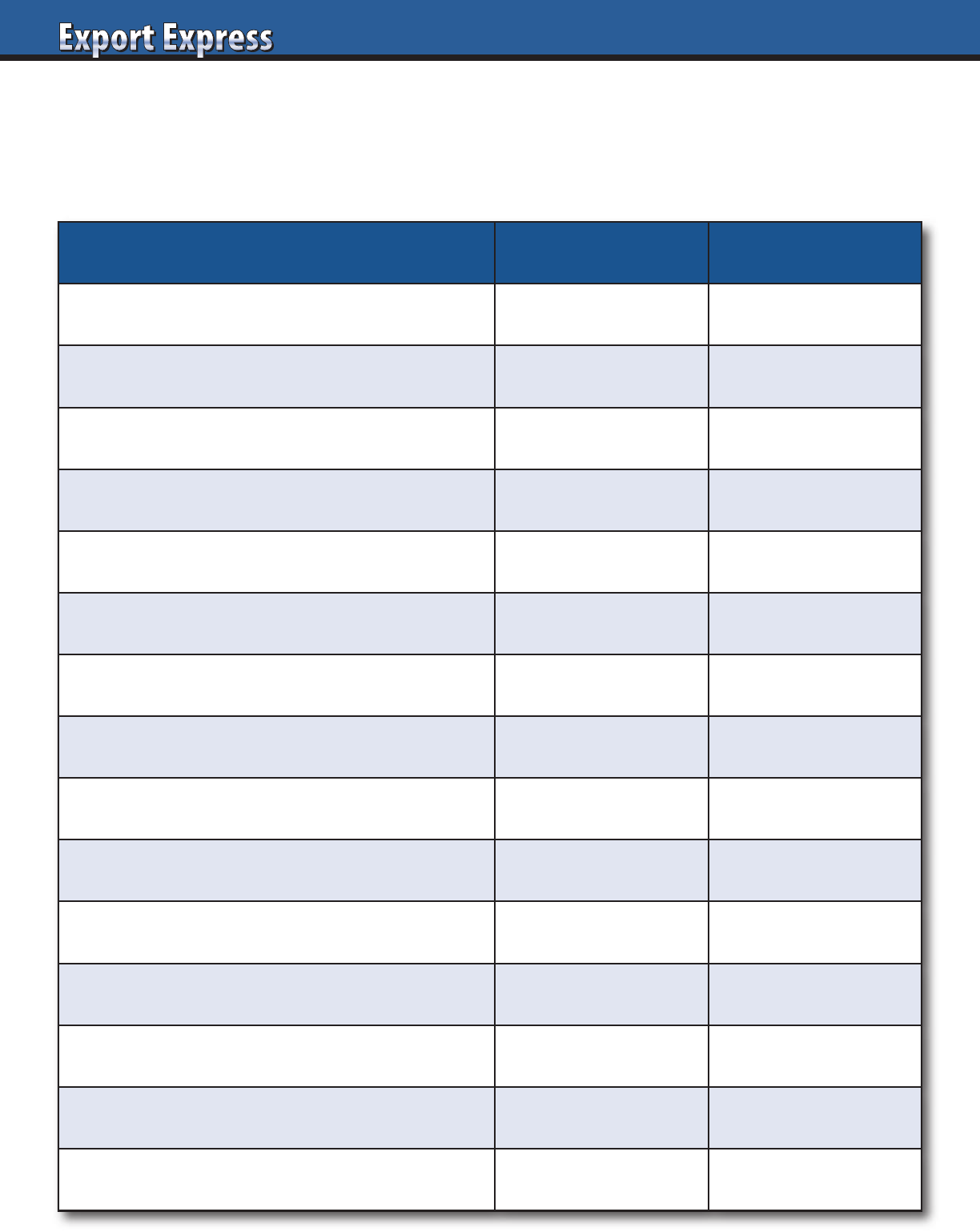

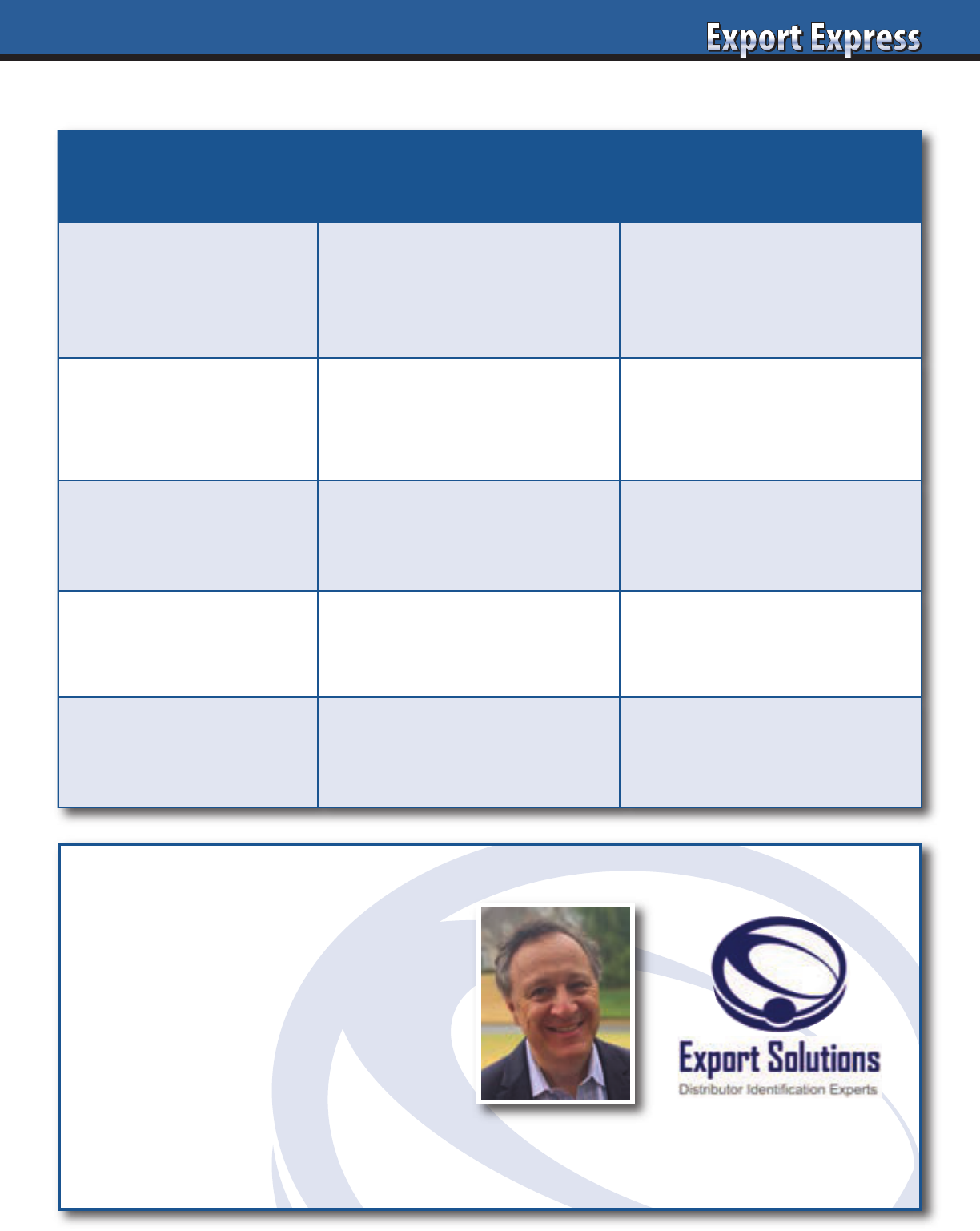

Distributor Segmentation Analysis

A valuable exercise is to segment your existing distributors into

the three groups: Leaders, Performers, and Laggards. Look at

the organizational models of your “Leaders” and Laggards.”

Are there consistent threads between the business specialization

of your distributor network? For example, do you find that your

“Leaders” are all Large Distributors (versus small), Big Brand

Distributors (vs. niche), Category/Ethnic specialists (vs. all types

of Food), technologically savvy versus “old school?” A similar

analysis should cover your “Laggard” distributors. Are under

performers small organizations that fail to meet your

requirements? Or alternatively, large distributors where your

brand is too small to gain sufficient attention? Your analysis

may reveal that one type of model works well for large or

adjacent countries while another approach works best for

smaller or remote countries. Look for the trends!

Lessons Learned

Completing the distributor segmentation exercise described

above should yield some important conclusions on the best

partner models to pursue for your brand. For example, an Italian

manufacturer of candy may confirm that his best performing

distributors are international confectionery experts, versus

distributors specializing only in Italian products. On the other

hand, an ethnic Asian food producer may find that the best

candidates to represent his brand are Asian channel specialists

versus distributors that represent all types of fine food categories

such as Tea & Olive Oil.

Next Steps

Honor your leaders and drive them to higher levels. Recognition

such as Distributor of the Year, visits with your company CEO,

or requests to deliver a presentation on their “success story” are

inexpensive motivators. “Laggards” impact our own ability to

achieve our personal objectives. We often like the people who

work at “Laggards”, but at times, you must act to protect the

long term interests of your company and pursue a change in

distributors. It is important to recognize that all companies have

distributors that are “Leaders” and “Laggards.” Proactive attention

to fix the “Laggards” will only improve your results versus

suffering through another year with a poor performing partner.

Export Solutions Can Help

Our industry leading database has been used by more than

3,000 brands to locate partners in 96 countries. This includes an

average of 85 unique distributors per country. There are always

many alternatives to consider in every country when you have

access to the Export Solutions database.

Export Solutions serves as a consultant to European and

American brands of all sizes. Our work includes analysis

of distributor networks and development of strategies for

motivating, measuring, and rewarding distributors. Export

Solutions has helped companies identify, interview, and sign

distributors on every continent. Contact Greg Seminara at

[email protected] to discuss your project.

Our motto is “Spend time Selling to Distributors vs. Searching

for Distributors.”

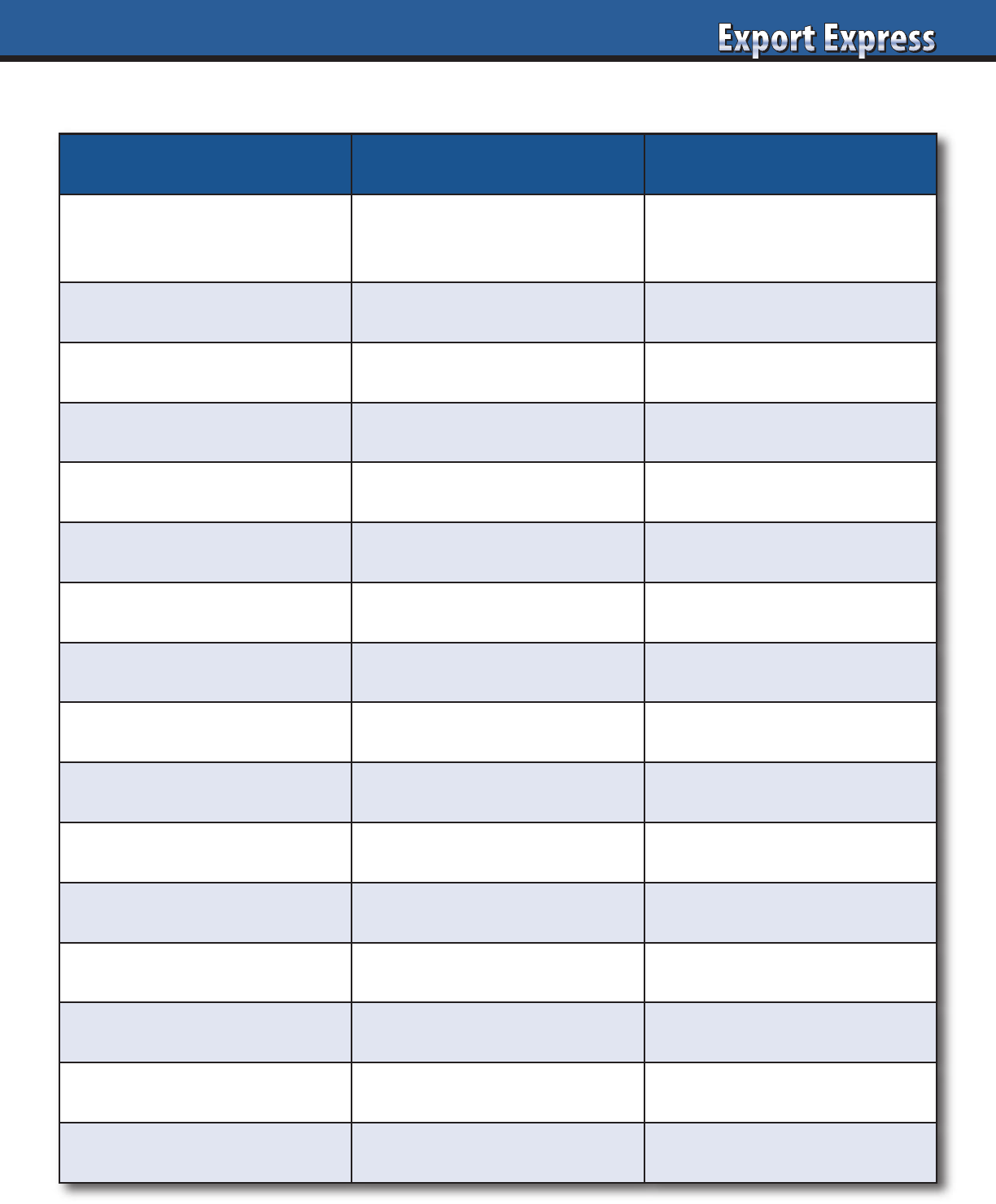

Distributor Segmentation

Results Next Steps

Leaders

20% of total

Shipment increase of 10% or more.

Growing Market Share.

Innovative Strategies.

Recognition: Public & Financial.

Invest in team generated ideas.

Share learning with other markets.

Performers

60% of total

Shipments + 5% and in-line with

overall market growth.

Consistent results over many years.

Support current growth trajectory.

Challenge to reach “Leader” status.

Laggards

20% of total

Flat/declining shipments.

Poor results for 2+ years.

Low energy/innovation.

Probation status for existing partner.

Evaluate different representation options.

All markets have alternatives!

4

I admit it: I like big distributors.

They feature more critical mass which

allows them to invest in people and

technology. Retailers and large

distributors are “co-dependent,” leveling

the playing field. Also, big distributors

get paid first during financial crisis

and usually offer better multi-channel

coverage and retail services. However,

many small/mid-size brands feel lost at

a big distributors, securing mediocre

results and failing to access the massive

distributor’s resources. Listed below are

Export Solutions Ten Tips for “Getting

Better Results with Big Distributors.”

1. Develop a Personal Relationship

With Your Distributor’s CEO

Call him a few times per year. Invite him

to dinner or a high profile sporting event

when you are in town. Send him a good

business book. Stay top of mind.

2. Focus on 2-3 Priorities

Provide a limited number of specific,

measurable objectives that are critical

to the delivery of your annual business

plan. Many companies bombard their

partners with a myriad of priorities,

forms, and requests diluting focus.

Instead position communication,

reporting, and activities in context

of the 2-3 tasks that must happen.

3. Invest in Distributor Sponsored Events

Large distributors offer the possibility

of co-promotion with their other brands.

Frequently, a mid-size brand may be

able to gain promotional activity at a

reduced cost due to the scale of their

distributor partner.

4.Evaluate Your Distributor Brand Manager

Your distributor brand manager is your

primary point of contact. If your business

is not growing, this could signal a need

for a change in brand manager. Two

scenarios exist. In some cases, you may

have a senior brand manager with too

many brands and no time for you. In

these cases, it may be better to shift to

a junior brand manager with more

bandwidth. In other cases, your contact

may be too junior, with limited

organizational clout to get things

done. In this example, you may fare

better by changing to a more veteran

brand manager.

5. Spend Time With

the Field Representatives

I am an advocate of escaping distributor

conference rooms for the hustle of the

stores. Spend time with the sales

representatives visiting their customers

and stores. The field team is frequently

ignored by export managers, but serves

as the engine of the distributor. Take

them to lunch, listen to their problems,

understand their business, give them a

gift with your company logo and they

will be your dedicated warriors for life.

6. CEO Market Visit

Invite your CEO or other senior

executives to visit the market. Distributor

CEO’s love to “rub elbows” and solve

the world’s problems together. You’d be

surprised at the number of market issues

that will disappear in advance of your

CEO visit. It’s also a good idea to invite

your technical experts in information

technology or supply chain to visit.

Big distributors love to learn best

practices from their overseas suppliers.

7. Create a Distributor Advisory Council

Invite a select group of large distributor

CEO’s to advise your company on

international development. Meet twice

per year a year, with at least one event at

a resort location. This allows your large

distributors to build relationships with

your senior team in an intimate setting.

All members of your Distributor

Advisory Council will achieve their

annual objectives!

8. Sales Contest

Create some excitement with a sales

contest for the entire distributor

team.Make it fun and structure it to

maximize winners. Find a way to include

all the “non-sales” people if you can.

9. VIP Visit to Corporate Headquarters

Treat your distributor as a VIP at

your corporate office. This trip creates

a memorable bonding experience and

a chance for you to serve as a good host.

Take the distributor to a new product

development laboratory and organize

a meal with your CEO or executive

officers. Make him feel like a member

of the family.

10. Distributor Awards

Recognize your high performing

distributors with an award. This could

be Distributor of the Year or for achieving

$1 million in sales or for 15 years of

partnership. Some companies sponsor

smaller awards for key account manager

of the year in each market and retail

representative of the year. Publicize the

event by awarding a plaque, hold an

awards luncheon, take photos and share

a press release of the celebration.

In most cases, large distributors have

achieved scale through years of hard

work and success. Most suppliers

maintain a mix of large and smaller

distributors. Veteran export managers

will confirm that good results are possible

with distributor organizations of any

size. The key is to align yourself with a

committed partner who loves your brand

and is delivering shipment growth

consistent with overall market trends.

Ten Tips: Getting Better Results with Big Distributors

5

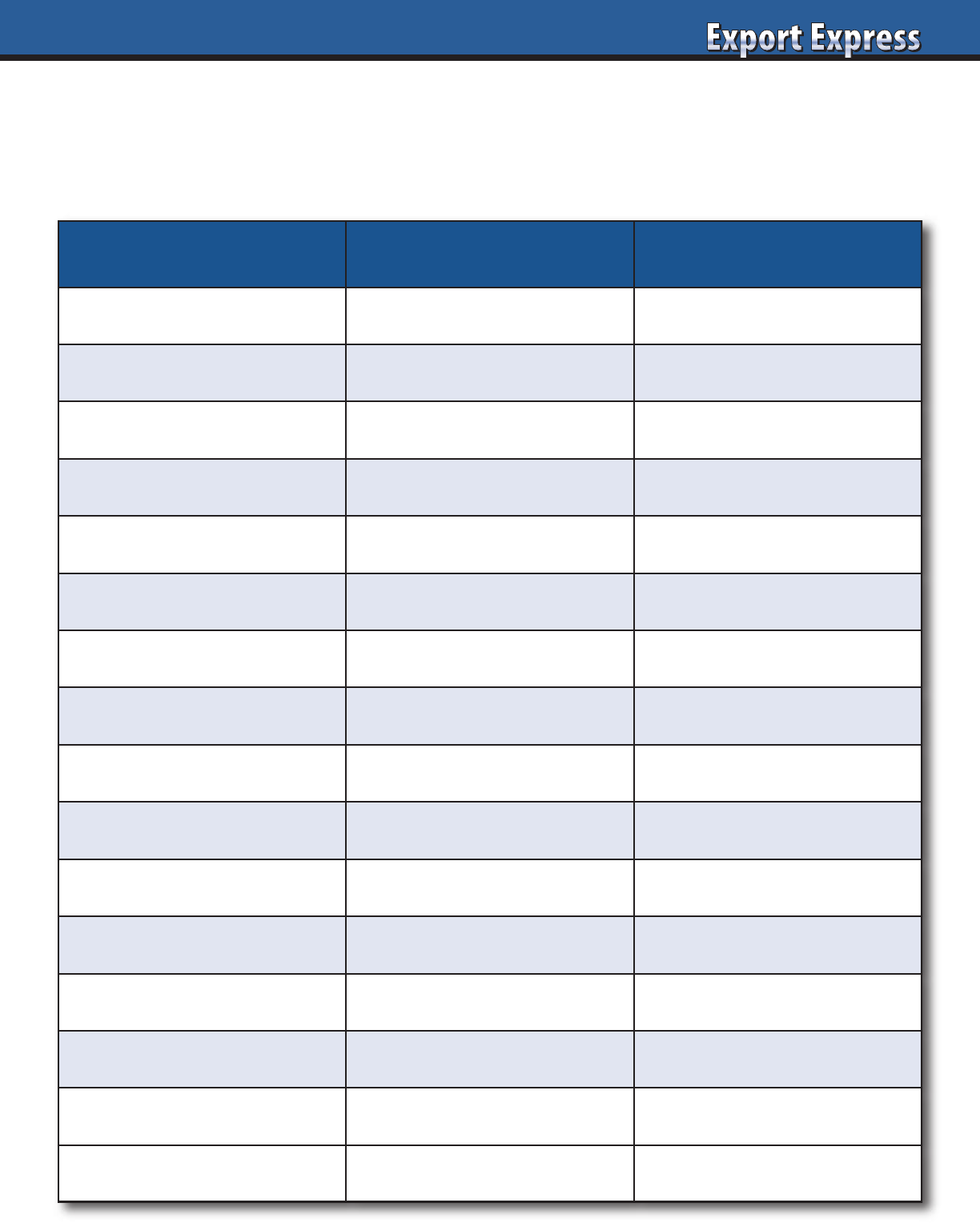

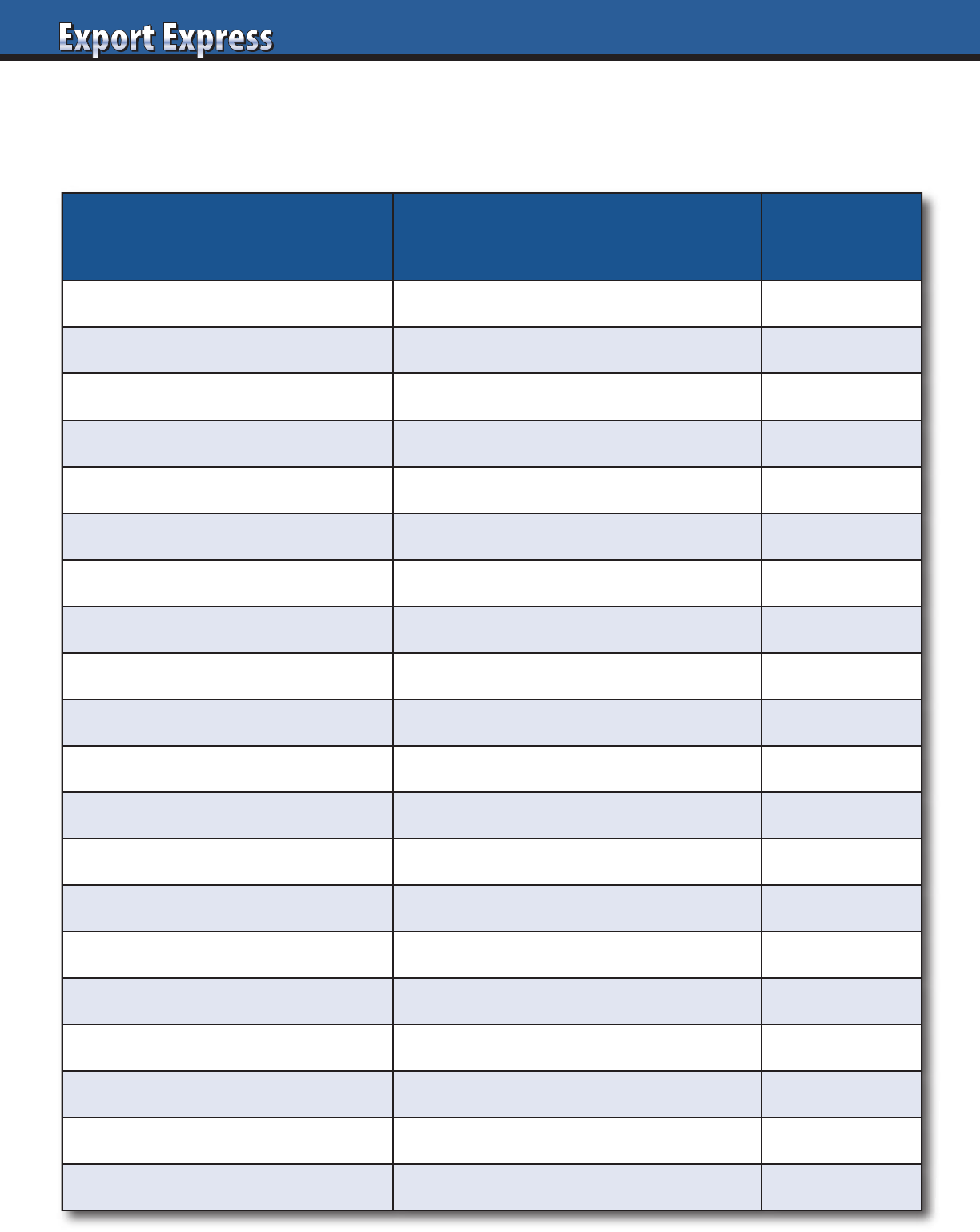

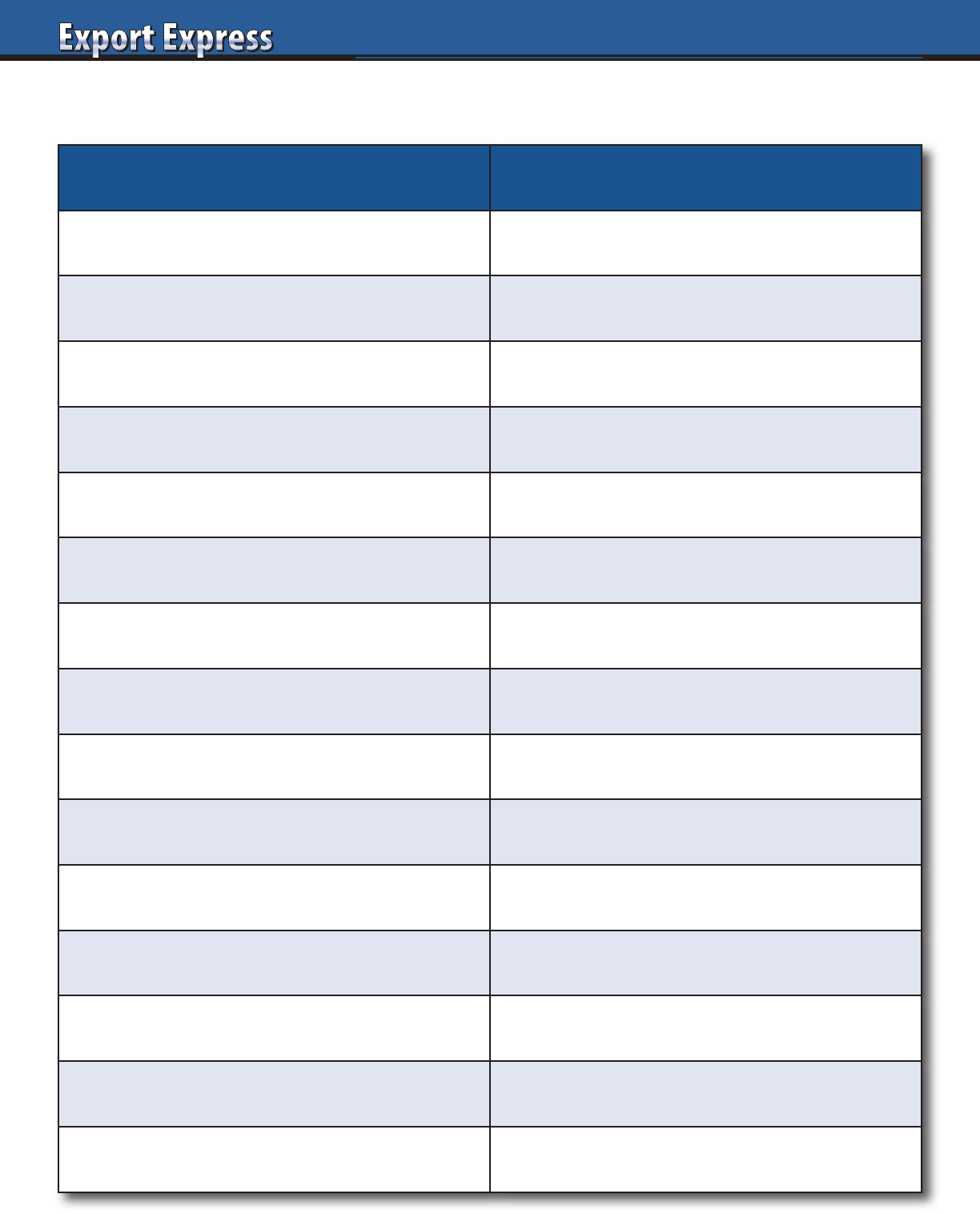

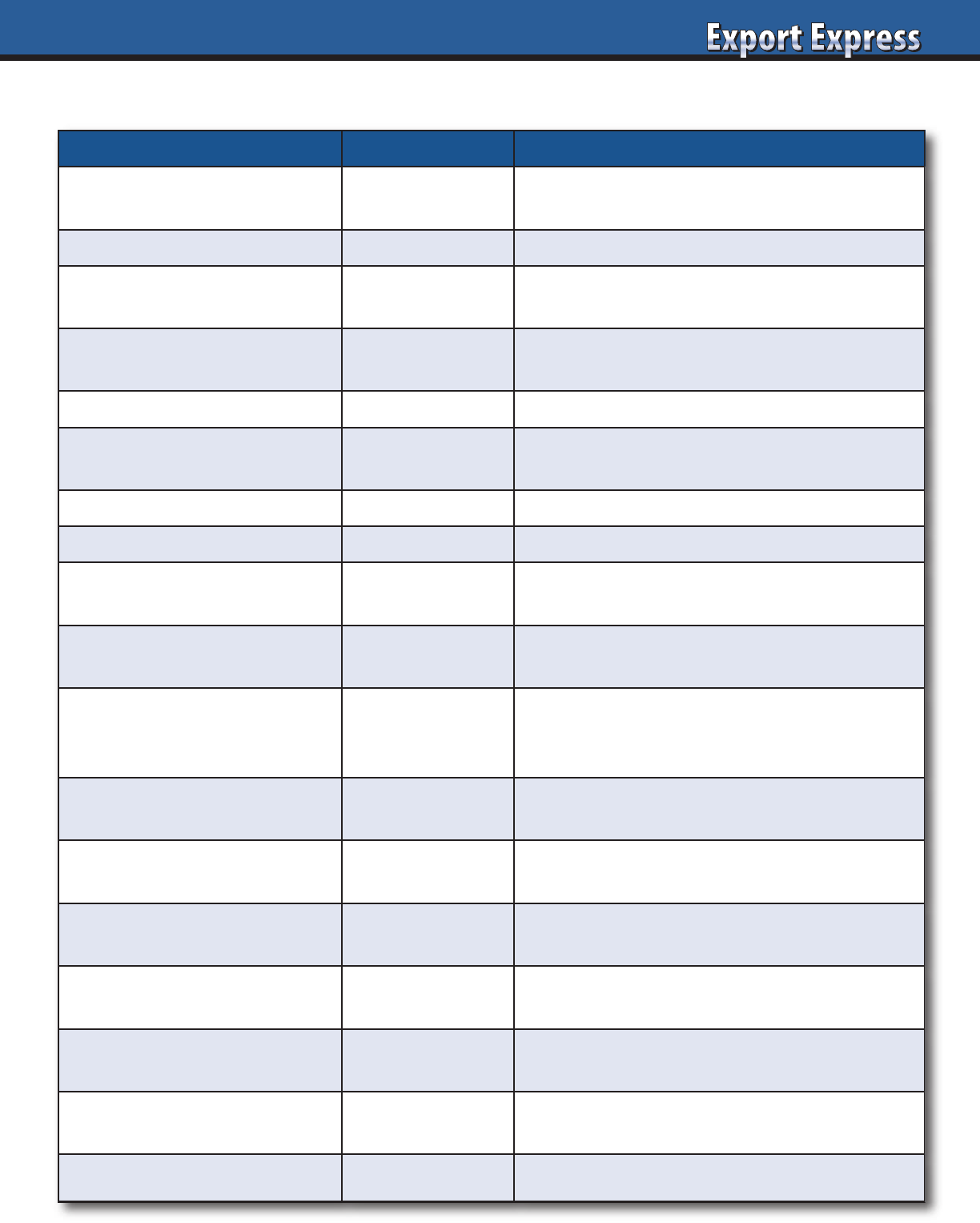

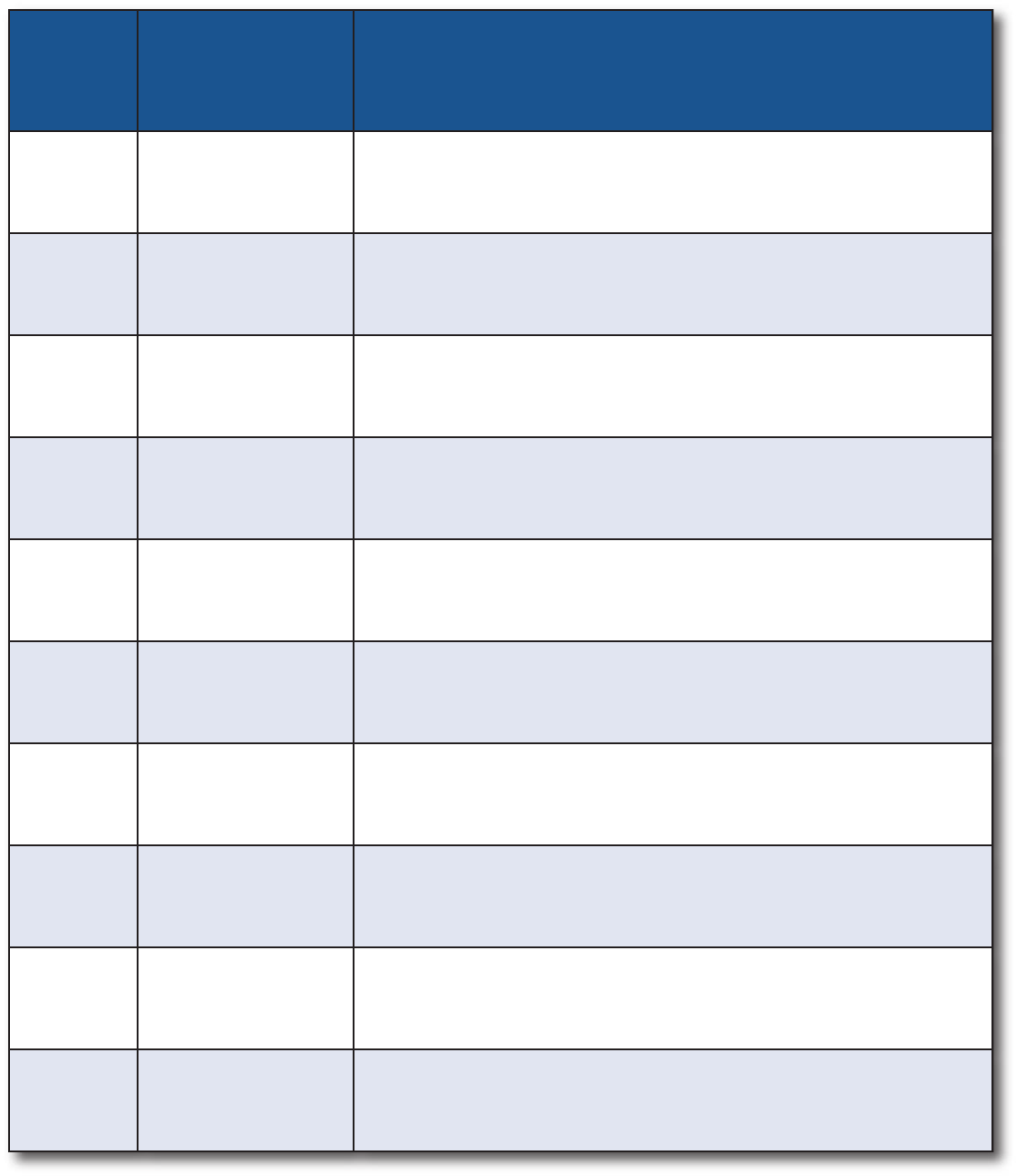

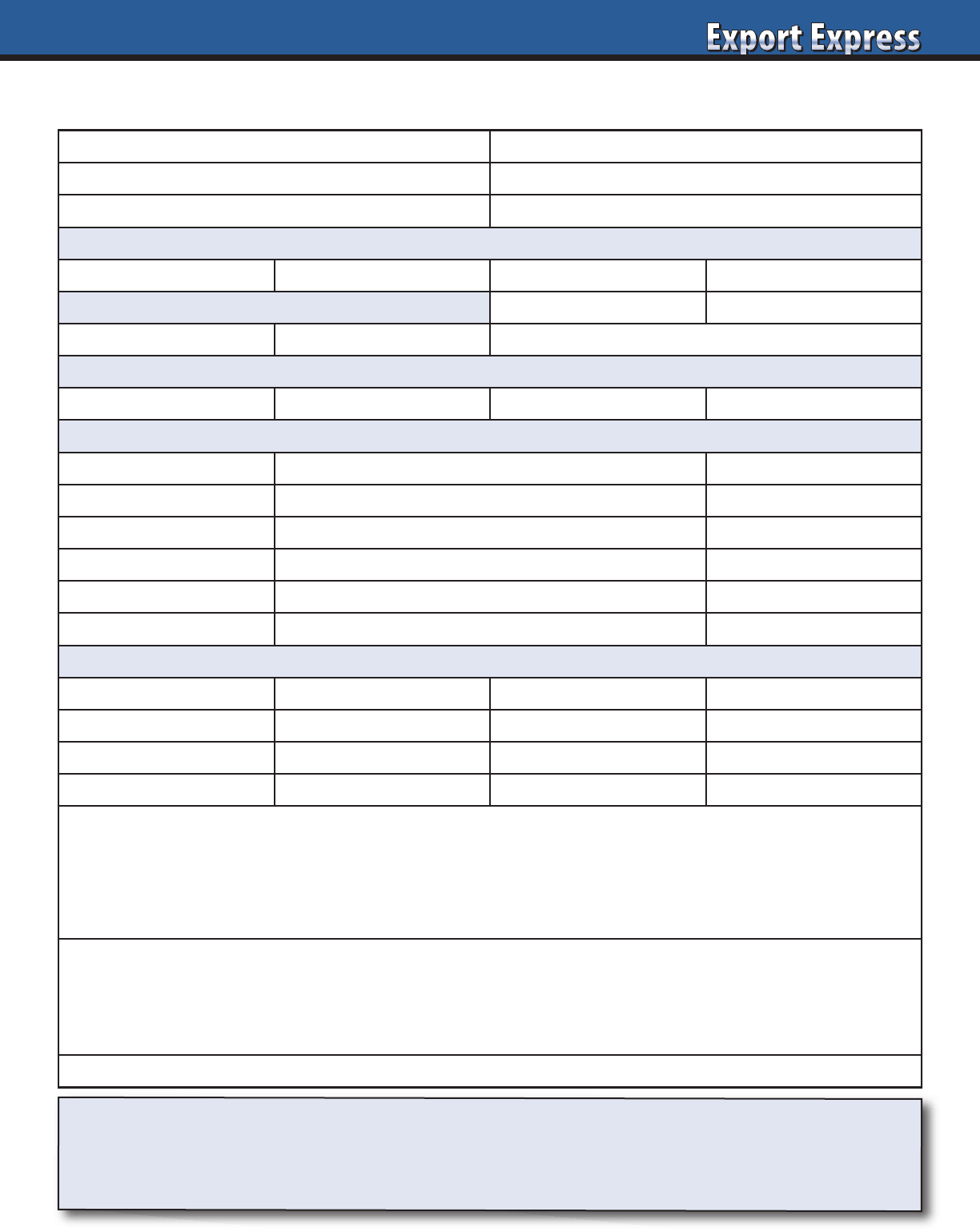

Are Distributors Interested in Your Brand?

High Interest Low Interest

Email Response

Immediate reply Delayed or no reply

CEO Engagement

Active participation Delegated to middle management

Scheduling Meeting

Flexible and easy Difficult. Conflicts.

Airport/Hotel Pick-Up

Offers to pick you up Take a taxi!

Meeting Presentation

Tailored. Prepared for you. Standard presentation

Category Research

Obtains data None

Competitive Review

Shares photos: store sets Informal comments

Store Visits

Organized/led by CEO Office meeting only

Samples

Obtains and tries samples Waits for you

Team Participation

3-6 people at meeting One person

Cell Phone

Shares private number Email address only

Questions

Addresses key issues No questions

Timeline

Meets due dates Delays

Post Meeting Follow-up

Immediate and frequent None

Proposed Plan

Detailed and fact based Brief topline

Results Winner Second place?

I have conducted hundreds of distributor interviews for multinational companies: P&G, Nestle, General Mills, Duracell, Lindt, Tabasco,

Barilla, J&J, etc. Distributor candidates all claim enthusiasm and high interest in your brand. See Export Solutions’ checklist of clues to

measure true distributor interest level.

6

30 Ideas to Help your Distributors

1. Trade Promotion

Share Best Practice Trade Promotion concepts

16. Innovation

Launch new items with successful track record

2. Celebrate Success

Distributor of the Year Awards

17. Sales Contest

Fund contest to incent and motivate distributor team

3. Category Expert

Provide fact based trend updates

18. Thank You Letter

Letter of recognition for team to distributor CEO

4. Logistics Service Level

Target 98% on time, complete orders

19. Event Sponsorship

Support distributor events, especially retailers’ charities

5. Store Check

Periodic visits to understand “retail reality”

20. Distributor Workload

Work proportional to distributor income

6. Billback Reimbursement

Prompt (30 days?) payment of distributor invoices

21. Price Increase

Provide fair lead time for price increases

7. Distributor CEO

Regular (quarterly?) checkpoint web meetings

22. Reference

Write testimonial or volunteer to serve as reference

8. Response Time

Earn reputation as “quick responder”

23. Training

Create Zoom training session for sales team

9. Marketing

Support distributor’s ideas. Invests in creative programs.

24. Portal

Create Portal with presentations, brand facts, digital tools

10. Customers

Do not deal directly with distributor’s customers

25. Social Media

Corporate experts available to help/share content

11. Reports

Stick to basics: sales, forecast, inventory, listing maps

26. VIP Trip Your Headquarters

Introduce distributor to your senior executives

12. Market Visits

Visit, but not too often

27. Samples

Support large sampling programs

13. Team Building

Create team relationship: finance, logistics, administration

28. Corporate Functional Experts

Provide distributor access to your corporate experts

14. Distributor Profit

Respect that a profitable distributor is a healthy distributor

29. Consumer Research

Conduct local research for consumer insights

15. Syndicated Data

Invest in Nielsen data

30. Create Culture of Success

Achieve joint business targets

7

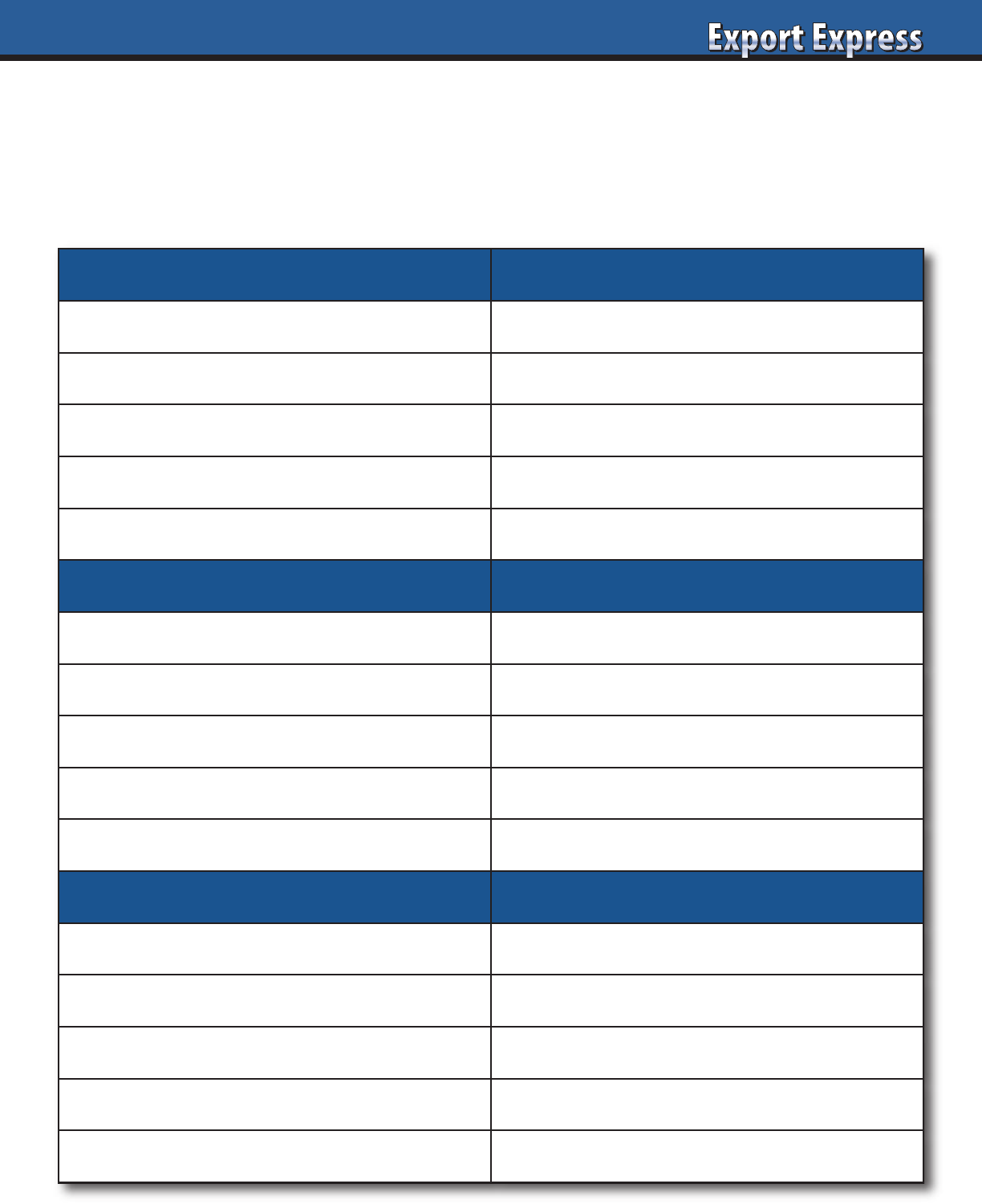

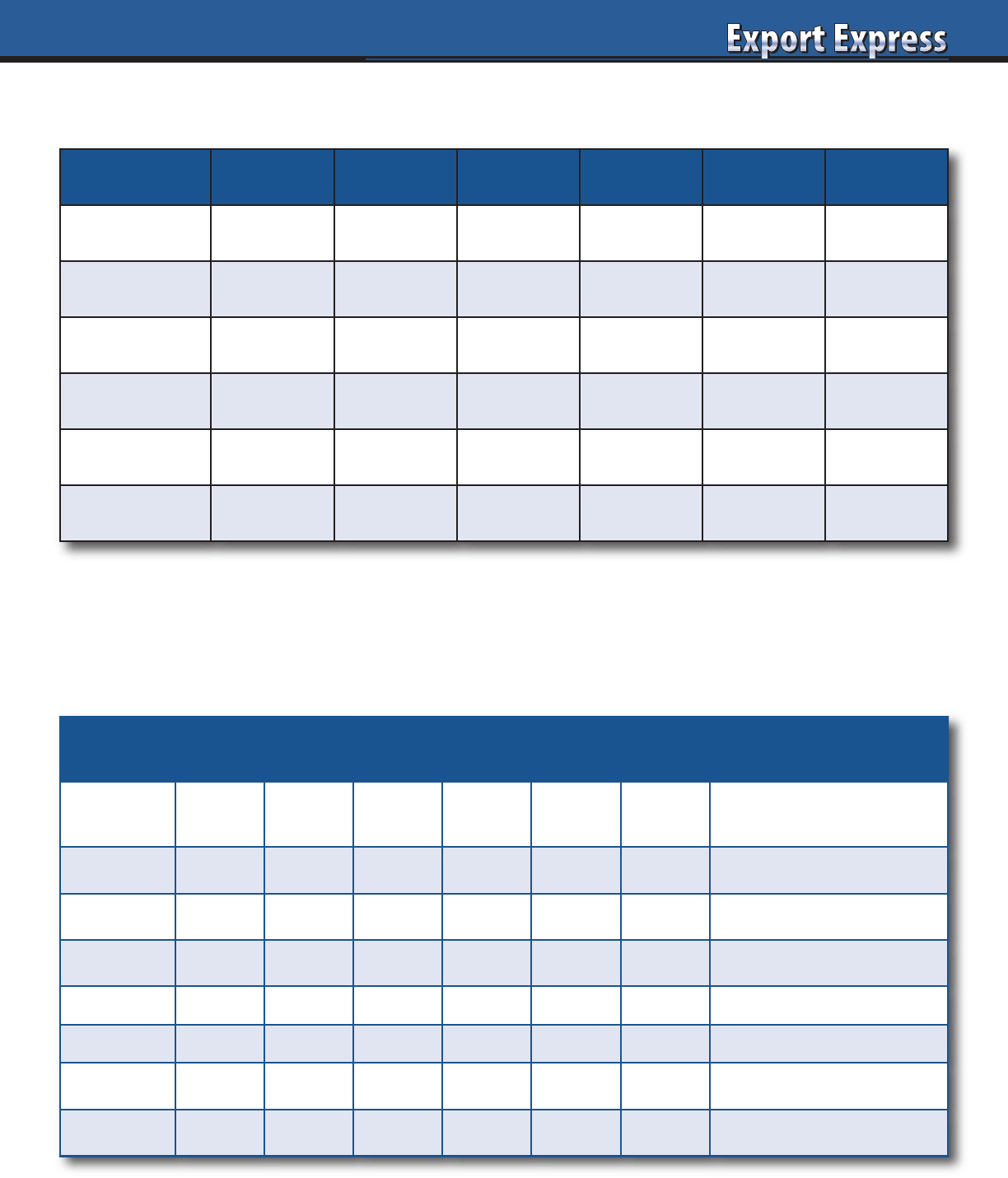

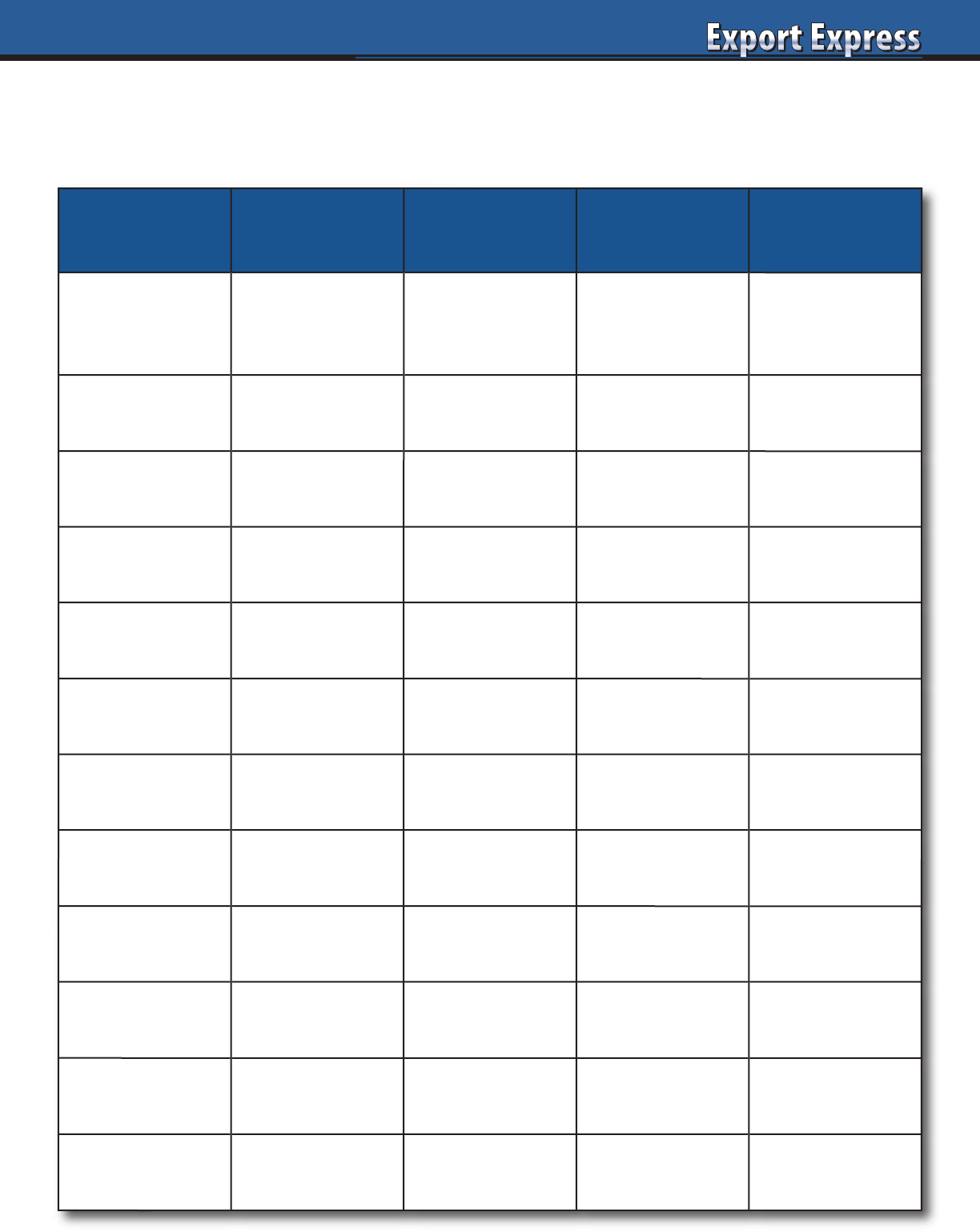

Distributor 2022: New Skills for New Times

Priority Comments

E-Commerce

Treat as major channel, not niche.

Social Media

Hire digital marketing team, link with local influencers.

CEO Engagement

Regular Zoom calls with overseas brand owners.

Culture

Promote young, energetic spirit. Embrace change and new channels.

Category Specialization

Laser focus on core categories vs. products in every aisle of the store.

Training

Use Zoom tools for regular training events with brand owners.

Team

Hire under 30's for social media and e-commerce sales roles.

IT Investment

Upgrade platform: E-commerce, retail reporting, sell out data.

Cost to Serve

Measure profitability by brand and customer.

Realign based upon 2022 reality.

Market Your Distributor Brand

Promote your distributor brand to leading

companies in your core categories. Export Solutions can help!

Sampling

Aggressive investment in this A+ tool. Explore new sampling vehicles.

Brandscaping

Invest in a “Best in Class” web site. Create modern company profile.

Scorecard

Incorporate e-commerce metrics: Page 1 results, consumer feedback, etc.

Brand Managers

Reward creativity and marketing excellence, not paperwork completed.

Recipe

Promote meal solutions, not just brands.

Optimism

Be positive. Think, “why not?”

Results Exceed expectations everyday.

8

Export Manager 2022: New Skills for New Times

Priority Comments

E-Commerce

Treat as major channel, not niche.

Social Media

Create content library for distributors to “plug and play.”

Management Engagement

Zoom with distributor leadership team: CEO, CFO, VP Sales, etc.

Culture

Promote young, energetic spirit. Embrace change and new channels.

Category Specialization

Share category trends. Deliver product innovation, not “me too.”

Training

Use Zoom tools for regular distributor training events.

Team

Make your corporate functional experts available to your distributor team.

IT Investment

Upgrade platform: Brand portal, syndicated data, shipment status.

Cost to Serve

Measure contribution to distributor profit.

Look at pricing and margin vs. agreement.

Marketing Your Brand

Invest to adapt your global marketing plan to local conditions.

Sampling

Aggressive investment in this A+ tool. Explore new sampling vehicles.

Brandscaping

Invest in a “Best in Class” web site. Robust export resource page.

Scorecard

Monitor pricing/assortment at retailer web shops.

Incorporate e-commerce metrics in your distributor scorecard.

Brand Managers

Demand young digitally savvy brand managers.

Recipe

Promote meal solutions, not just brands. Look for co-promotion partners.

Optimism

Be positive. Think, “why not?”

Results Exceed expectations everyday.

9

Introducing

America’s Favorite Brands

Executive Board

Export Solutions Smucker’s Tabasco

Greg Seminara, CEO Danny Berrios, President Megan Lopez, Vice-President

General Mills Sun-Maid

Eric Saint-Marc Carsten Tietjen

Advisory Board

Bazooka Candy Blue Diamond Bob’s Red Mill

Santiago Ricaurte Dale Tipple Jan Chernus

Bush Beans Campbells Church & Dwight

Dave Bauman Julio Gomez Arun Hiranandani

Ferarra Candy Heartland Idahoan

Daniel Michelena Tom Theobald Ryan Ellis

Johnsonville Sausage Kao USA Keurig Dr. Pepper

Cory Bouck Julie Toole Billy Menendez

Mizkan Reynolds Welch’s

Noel David Chris Corey Marc Rosen

19 Companies | 200+ Top Brands | $80 Billion Combined

View our activities for export managers – www.usafoodexport.com

10

Distributor Supplier Relations

Managing the New Normal

Actitivity Old School New School

Customers Mass Supermarkets Omni Channel

Mom: Whats for? Dinner Breakfast, Lunch

Sales Team Over 50’s Under 30’s

E-Commerce Channel Niche Mass

Assortment Limited (supermarkets) Unlimited (e-com.)

Retail Conditions Store visits Web shop checks

Business Management Sales targets Profit targets

Distributor Expertise Generalists Specialists Category, Channel

Business Manager Brand Manager Idea Generator

Check Point Conferences Telephone calls Teams/Zoom

Overseas Supplier Visits Monthly/Quarterly Quarterly/Annually

Brand Presence Shelf Visibility Page 1 results (e-com.)

Distributor Logistics Delivery by case Delivery by unit (e-com.)

Recipe Ideas Your brand only Total meal solutions

Training Annual meeting Webinar (anytime)

Consumer Marketing Mass via multi media Targeted and digital

Brand Information Email to distributors Online portal

Pricing: Distributor Calculation “Closed Book” “Open Book”

Trade Shows Visit in person Hybrid:Virtual and in person

Foodservice Restaurants Home Delivery

Forecasts/Reports Monthly “Live,” real time

Results-Expectations Achieve your Objective Achieve your Objective

11

“The shelf doesn’t lie!” Why are you

surprised when a distributor misses their

sales numbers and you perform a few

random retail checks and the stores look

awful? Or your “star” distributor proudly

brings you to supermarkets where your

brand’s presence looks better than the

sample display you built in your

headquarter office?

A classic question is “how do you

determine a good store from a bad store?”

Some multinational leaders feature well defined shelf guidelines for positioning and

placement and the pursuit of a “perfect store.” A more common practice is for an export

manager to share a pretty photo of a sample shelf layout, created by the marketing

department. A few general objectives are supplied, but no formal training, sales rationale

or KPI measures.

“Is the Store a 10?” is a tailored program from Export Solutions that succeeds in

providing simple shelf standards and a methodology so that every member of a

distributor organization will be crystal clear on store level performance expectations.

Basically, each store is graded with points awarded for assortment, shelf space, shelf

positioning, pricing, and off-shelf display.

Listed below are key elements of developing a “Is the Store a Ten?” program for your

distributor teams.

1. Develop Clear Standards

Award points based upon a “physical count” of authorized items or shelf facings

or answers to a “yes or no” question. Example: Is there a secondary display?

Create a simple 10 point scale, where a “1” is poor and a “10” is the best.

2. Align With Key Account and Retail Sales Teams

This initiative is best explained to key influencers in the distributor organization in-store.

Meet with them at a supermarket and discuss program execution for their customer or

market. The program will fail if you only discuss it with a brand manager or distributor

CEO at the office.

3. Conduct Training Session

Share the program with the entire retail team. Provide a rationale and sales facts for our

objectives. Provide FAQs on common questions or issues. Role play. Launch a “Is the

Store a 10?” shelf drive with prizes. Establish clear KPIs.

4. Measure Improvement: Today a “5”…Tomorrow?

It is likely that early scores may be closer to a 5 than a perfect 10. This is okay

in most cases. The goal is to incorporate a cultural shift in evaluating stores and

capture improvement

5. Planogram Serves as the Official Record

I love the distributors that flood us with photos of great store layouts. I swear

that sometimes the image is the same display taken from several different angles.

Validate performance with a copy of the approved planogram or schematic.

A 2022 objective for all is to escape the boredom of hot conference rooms to spend more

time witnessing retail reality. Export managers are paid on container sales, but this

represents only warehouse inventory. A store shelf is where export dreams are translated

to retail revenues. Contact me to discuss implementing “Is the Store a 10?” for your

company.

www.exportsolutions.com

Greg Seminara

404-255-8387

“Spend Time Selling to Distributors versus Searching for Distributors”

Is the Store a 10?

Strategic Services

Contact Us for

Export Solutions

1. Identify Best in Class

Distributors: 96 Countries

2. Best Practices

Export Strategy

3. Distributor Management

Workshops

4. Export 101:

Let’s Get Started

5. New Market

Prioritization

and Launch Plan

6. Personal Distributor

Introductions:

96 Countries

7. Walmart International

8. Distributor Contracts,

Margins, and Fees

9. Meeting Speaker

10. International

Strategy Expert

Strategic Services

Contact Us for

Export Solutions

1. Identify Best in Class

Distributors: 96 Countries

2. Best Practices

Export Strategy

3. Distributor Management

Workshops

4. Export 101:

Let’s Get Started

5. New Market

Prioritization

and Launch Plan

6. Personal Distributor

Introductions:

96 Countries

7. Walmart International

8. Distributor Contracts,

Margins, and Fees

9. Meeting Speaker

10. International

Strategy Expert

12

Brand owners demonstrate significant due diligence in selecting

a new distributor. This includes lengthy negotiations with the

distributor’s owner and development of a marketing plan with

their senior management. Typically, you sign a contract and then

they introduce you to “John” (example), a 30 year old Brand

Manager who will be your first point of contact. In reality, most

brands are in daily contact with “John,” but do little up front to

evaluate, select, or define “John’s” role in building your business.

Role Definition

Normally, the title of Brand Manager is assigned to your primary

point of contact at the distributor. This person serves as the

central switchboard of all elements regarding your brand’s

business at the distributor. Problem solving, logistics issues,

promotion planning, and chasing payments are just a few of

the everyday tasks assigned to the Brand Manager.

Can your Brand Manager “Move the Organization?”

A key issue is the seniority of the person assigned to your

brand. Are you working with a top manager who has a close

relationship with the CEO? Or are you working with a junior

person who works hard, but basically maintains the flow of

paper? In most cases, I look for a person that commands the

respect of the distributor organization. Many distributors have

multiple brand managers, all lobbying for share of voice from

the team. “Best in Class” Brand Mangers possess the tenacity

to motivate the sales organization to achieve the results and

priorities required for your brand.

Workload

Brand Manager workload is always a key issue. A Brand

Manager may be shared by 3-5 brands. This approach may be

acceptable if you are a niche brand and you are achieving desired

results. On the other hand, it is frequently preferable to secure

a dedicated Brand Manager who spends 100% of their time

working on your business. Exporters need to recognize that

Brand Managers cost money, so your contact’s workload is

directly proportional to the income generated by your brand.

Marketing Versus Sales Background

Brand Managers typically come equipped with a marketing

degree. This background is helpful if your brand requires a

“classic marketer,” combining creativity with deep focus on

the consumer. In other situations, Brand Managers with sales

expertise prove to be adept at participating at key account sales

calls and understanding the best methods for working with the

sales force.

Compatibility

Do you like your Brand Manager? Most companies spend

extensive time working with their distributor Brand Manager

contact. You must be aligned and develop a healthy working

rhythm. This can be difficult, as you share common objectives,

but report to separate bosses and perhaps different incentives.

In many cases, a brand owner develops a strong personal

relationship with their brand manager. This can be unhealthy

if they like their contact, but let this relationship continue even

if results are poor.

People Power: Next Steps

A strong Brand Manager serves as your “Brand Advocate” at

the distributor. Export managers need to include assessment of

their potential Brand Manager as part of the Distributor selection

process. Ask “Who will be my day to day contact? Why? Other

choices?” Avoid “paper pushers” that are nice people and can

complete forms but offer few new ideas, complain about being

overworked and fail to capture the attention of the sales force.

Winning Brand Managers bring energy, new ideas, and results

to your brand. Recognize Brand Managers who maintain the

skill set to take your annual plan, add creative ideas appropriate

for their market, and drive the sales organization to deliver

the results!

People Power: Distributor Brand Managers

Greg’s Guidance: Export Strategy 2025

3 What are your Lessons Learned?

3 What are your Core Competencies?

3 Which countries offer exceptional growth for your category?

3 How much is your company willing to invest? Marketing, People, Promotion

3 What will our organization need to do differently?

3 What are realistic measures and benchmarks?

13

Every exporter has countries where

their brand performance lags far behind

expectations and market potential. This

appears as a serious issue when the poor

results are in a large strategic country like

the USA or China. The first step to fixing

the situation is to admit that you have

a problem. Too many times, export

managers loyally cling to their plan and

existing distributor with hope that “next

year will be better.” The likelihood is that

sub-par trends will continue without

intervention. Remember, it’s your quota

and job that suffer due to lackluster

results in a country. Listed below are

Export Solutions’ 10 Tips on action steps

for under performing countries.

1. Look in the Mirror

Chances are that your current brand

proposition is wrong for the country.

Your product sales are a reflection on

buyer and consumer response to your

product range. An underqualified partner

does not help, but is usually just part of

the problem.

2. Research Consumer Habits

Conduct category research to understand

why consumers in a foreign country do

not appreciate your brand like they do

“back home.” Category habits and

development vary widely, particularly

around food products. Recently, I

confirmed several examples where Asian

consumers demonstrated little interest in

certain Western style foods (although

everyone loves candy and snacks!).

3. Investment Level

Many poor performers suffer the classic

issue of insufficient funds to invest in

marketing and trade programs. There is

a cost of doing business everywhere and

the investment requirements can be huge

in a place like China or the USA. Best bet

is to break down the country into smaller

areas and focus on targeted investments

with high potential, regional retailers

where your brand has a higher probability

of success. Avoid the attraction of large,

national retailers where you realistically

cannot support the business. Don’t expect

miracles without basic investments in

marketing and trade promotion.

4. Establish and Track In Store KPI’s

Many exporters focus primarily on

monthly shipment numbers. Shipments

represent the ultimate scorecard, but we

strongly advocate the implementation of

in-store metrics. This process starts with

major account

listing maps,

tracking your SKU

level authorizations

for major customers.

The second step

is to launch and

measure in-store

presence guidelines.

How do you judge

a good store from

a bad store?

Ultimately,

shipments are

a reflection

of consumer

purchases, not

inventory sitting in a distributor’s

warehouse. “What’s measured

is treasured.”

5. Spend a Day at Retail With

Your Distributor Executives

We all spend too much time in comfy

meeting rooms sharing PowerPoint

presentations with optimistic plans.

Dedicate time for retail with the

distributor executive team. Visit stores

at random, picking an area on the other

side of town from the distributor’s office.

Create a store check sheet to capture

observations such as shelf space,

promotions, and competitive activity.

Speak to aisle clerks and store managers

to get “street smart” on your product

and category performance.

6. Secure Direct Buyer Feedback

Every distributor should maintain

excellent trade relations with at least one

of his key accounts (if not all!). Schedule

an appointment or a lunch with a friendly

buyer to secure his point of view. Try to

keep the conversation focused around

category dynamics and trends versus just

a request for more trade spending. Buyers

love to serve as “experts” and may

support you if you follow their advice.

7. Distributor Brand Manager

The Distributor Brand Manager serves

as our everyday contact and the conduit

to distributor resources. Problems may

relate to having an experienced brand

manager handling too many companies

or a junior brand manager, lacking the

clout to get things done with the busy

sales team. We all like our Brand

Managers, as they take our calls

and rescue us periodically, However,

sometimes it’s just not working and

you need a change.

8. Share Best Practices – Adjacent Countries

Every distributor will be quick to point

out “How different their country is.” The

reality is that there are more similarities

between countries than differences.

Look at an adjacent country or one

with common retailers and share lessons

learned. This may represent a category

review, presentation approach or special

sales contest. Invite the brand manager

to visit a successful country or attend a

meeting where best practices are shared.

9. FaceTime in the Trenches

Distributors appreciate export managers

willing to contribute to joint resolution

of problems. Consider sending a company

employee to work for 3-6 months on

assignment at the distributor. Visit

quarterly or more frequently. Schedule

bi-weekly update calls. Better to focus

attention on fixing a high potential country

than regular visits to small countries

achieving their objectives. “Distributor

respects what the principal inspects.”

10. Partner Change

A distributor change is the last resort,

but sometimes partners outgrow each

other and are no longer a “fit.” Export

Solutions’ database tracks an average of

85 distributors per country, so you always

maintain options. Transition to a new

distributor involves business disruption

and even a temporary decline in

shipments. The good news is that

your new distributor will be motivated,

committed and anxious to make a

positive impression with a fast start.

The key is to manage the process with

dignity and open communication, so that

the terminated distributor is not surprised

by your actions.

Ten Tips: Action Steps for Poor Performing Countries

14

Distributor Search Helper for:

Your

Logo

Here

Can We Help You?

Recent Distributor Search Projects

Asia Europe Middle East Latin America

Australia Germany Israel Argentina

China Ireland Kuwait Brazil

Indonesia Netherlands Qatar Colombia

Japan Nordics Saudi Arabia Costa Rica

Malaysia Spain UAE Ecuador

Philippines United Kingdom North America Mexico

Singapore Africa Canada Panama

South Korea South Africa United States Peru

Call the Export Accelerator!

Contact Greg Seminara at greg@exportsolutions.com

to discuss your business development project.

www.exportsolutions.com

A client asked me a good question.

This Export Manager stated that he

always achieved his shipment objectives,

sold his brand across all countries, and

maintained a pretty good group of strong

distributors. What strategies could be

implemented to drive his business to the

next level? My immediate response was

that this company needed to adopt the

rigor and discipline employed in hitting

their sales quota and apply this approach

to metrics around the causal factors that

drove in-store purchases. At Export

Solutions we call this methodology

“Next Level Business Management.”

Factory Sales = Warehouse Inventory

We are all focused on surpassing our

shipment objectives. In many cases,

we meet these expectations by shipping

inventory to our distributor or a

customer’s warehouse. True sales are

achieved when a consumer purchases our

product and the retailer needs to reorder

to replace store inventory.

Supermarket Shelves – Product Showroom

Supermarkets and other retailers serve

as the showrooms for our brands.

An attractive showroom, with well

displayed products and an invitation to

buy, encourages purchases. How do your

store showrooms look? How do you

measure a good store versus a bad store?

Introducing MAPS Metrics

MAPS is an acronym for Merchandising,

Assortment, Pricing and Shelf

Management. The basic concept of

Next Level Business Management is

to establish clear objectives, focus,

and tracking methodology around

the fundamental drivers of in store

performance. The theory is that by

improving MAPS performance, you will

improve in store sales turnover and force

sales replenishment throughout the

supply chain.

Assortment – First Priority

In-store presence can not be tracked until

an item has been authorized for sale at a

retailer. Our first tool and step is normally

centered on managing a one page listing

map. This allows you to track your all

items’ penetration at leading retailers.

You can establish a customer weighting,

by size, and a listing percentage reflecting

total market coverage. It is important to

understand what percent of a retailer’s

stores where you are authorized. I

remember the famous story of a British

brand whose partner claimed distribution

at Walmart USA. Further investigation

revealed them selling to only 45 of 3,570

Walmart Supercenters.

Shelf Management & Pricing

What does an ideal shelf set look like for

your brand? How much space do you

have relative to your category market

share? Are you on the eye level shelf?

Are you placed next to your prime

competitor if this is desirable? Is your

brand priced at parity versus a similarly

priced competitor? Is the price gap versus

private label within the targeted range?

Has the retailer applied an equal margin

across all of your line extensions?

These are all tangible measures that may

be tracked via a numeric response or

“yes” or “no” answer.

Quality Merchandising

Incremental sales are driven by special

investments in promotional activity.

Next Level Business Management

quantifies quality merchandising drivers

and assigns measures. Did feature ad

meet targeted price point? Was there a

display? How many cases were on the

display? Was the feature ad a “major ad”

or a small line mention? What percent

of your allowance or discount did the

retailer reinvest in a lower price? Was

there a secondary display or location in

the store? These are all critical elements

that can be tracked and evaluated.

“What’s Measured is Treasured”

“The distributor respects what the brand

owner inspects.” “What gets measured

gets done.” These are all famous slogans

with the same basic message: track

something and a distributor will try to

meet expectations. The basic idea is to

measure a distributor based upon more

than just shipment numbers. In general,

begin with metrics around Assortment,

and then move to other areas such as

Shelf Management, Pricing, and Quality

Merchandising where the distributor may

have opportunities. Do not inundate the

distributor with new metrics around

every aspect of their business.

Next Steps

Export Solutions has expertise

at deploying Next Level Business

Management programs with leading

international brands. We have the

experience of designing metrics for your

brands and sharing techniques for rolling

this program out to your sales force and

distributor teams. Contact us for help in

applying our Next Level system to your

export business.

Next Level Business Management

15

16

20 Tips to Accelerate a Mature Business

Activity Strategy

Creative Promotions

Retailer specific events. Offer fresh ideas.

Distributor Brand Manager

Upgrade talent. Secure “A” players on your business.

Pricing

More profit through higher volume at lower price?

Country Manager

Hire local manager or assign HQ person for 3-6 months.

Local Production or Copacker

Lower cost structure with added complexity.

Brand Ambassadors

Hire team with “brand uniform” to sample at local events.

White Space – Distribution

Fill voids on retailer listing map: Top 10 customers.

Social Media

Partner with influencers. Targeted local investments.

New KPIs

New measures: Listing maps, shelf placement, etc.

E-commerce Development

Invest to lead in this emerging channel.

In-Store Visibility

Educate and measure team on in-store presence goals.

Sampling, Sampling, Sampling

Aggressive distribution of free sample size.

Distributor Team Linkage

Zoom/Teams contact with Key Account Managers, etc.

Launch NPD Innovation

Excite team to launch innovation “The Right Way.”

Distributor CEO

Treat CEO as VIP. Create special relationship.

Sponsorship

Support local events and retailer charities.

Sales Contest

Excite and motivate retail sales team.

Alternate Channel Focus

Small shops, foodservice, duty free, drug stores.

High Spend Test

Will heavy up marketing or trade discounts drive sales?

Distributor Change

Motivated new team, high energy to solve old problems.

17

All your distributors express enthusiasm

and commitment for your brand. True

passion for your partnership is measured

by what distributors do, not by what they

say. Listed below are ten tips to consider

when measuring Distributor enthusiasm

for your brand.

1. CEO Commitment and Involvement

The CEO steers the distributor ship

and sets the tone for your business

relationship. Best in Class Distributor

CEO’s reach out via phone to touch base

periodically and spend time with you

when you are in town. They keep up to

date on your priorities and key issues and

ensure that his team is delivering good

service and results.

2. Responsiveness to Problems

Urgent situations erupt in every market.

Currency devaluations, product recalls,

or missed budget numbers require

immediate attention. What is the distributor

response time? Does the distributor share

your sense of urgency? How long does it

take to get problems fixed?

3. Customer Introductions

Most distributors maintain good

relationships with leading retailers.

Enthusiastic distributors are happy to

introduce you to the leadership of their

customers. These distributors will use

their personal relationships and “favors”

to benefit your brand.

4. Best People Assigned to Your Brand

The distributor functions as a team.

Every team has superstars and

developing players. How does the

distributor allocate “talent?” Are the

stars working on your business?

5. Web Site Prominence

A Distributor’s web site offers important

clues to distributor professionalism,

services, and core brands. How

prominently is your brand featured on

the distributors web site? Is a case study

using your brand results mentioned?

Is your brand logo listed at the top of

the page or buried at the bottom?

6. Distributor Visits to Your Headquarters

How often does the distributor travel to

your headquarters or factory? Does the

distributor have a relationship with your

CEO, vice president of international, or

other leaders? Many distributors are

interested in visiting companies based

in San Francisco or London, but true

enthusiasm accompanies meetings in

Chicago or Hamburg during the winter!

7. Creative Ideas

Distributors can be magicians at

developing “new ways to solve old

problems.” Good distributors bring

innovative ideas to adapt your plan

and funding budget to the local market.

How often does your distributor apply

their brilliant new idea to your brand?

8. Distributor Awards and References

Successful distributors proudly display

their awards in conference rooms and

lobbies. Is your award visible? I always

ask distributors for references from other

brand owners. Does the distributor use

your name as a reference or request a

testimonial from you on their performance?

9. Love Your Brand

I have written an entire article on getting

a Distributor to Love your Brand. There

are many ways to feel the love. Does the

distributor sales team wear the shirts with

your brand logo or use the pens that you

handed out at the last sales meeting? Is

the distributor able to secure a customer

meeting for you on one week lead time?

Are they happy to see you arrive or just

to see you depart?

10. Exceed Expectations Everyday

The most enthusiastic distributors exceed

your expectations everyday. This includes

shipment results in excess of overall

market growth and total organizational

support behind your new product

introductions. Enthusiasm is not

measured in words and weeks, but

in actions carried out over many years

by a Best in Class partner.

Ten Tips: Measuring Distributor Enthusiasm for Your Brand

Need a hand? Visit www.exportsolutions.com.

18

The classic industry question is: “How do you maintain

distributor focus on your company priorities once you leave

the market?” There is no easy answer, but a solution is to

encourage a distributor to “fall in love” with your brand and

company. Falling in love is based upon an attraction to a person

and enjoyment of spending time with them. The same feelings

can apply to a brand. I regularly witness super human efforts

by distributors for small and medium sized brands just because

of “Brand Love.” Listed below are Ten Tips to romance your

distributors to superior results.

1. Master Chef Endorsement

The first step is convince the distributor team to be passionate

consumers of your product and enthusiastic brand ambassadors.

For food products, invite all of the group to lunch at a popular

local restaurant. Pay a well-known chef to prepare a meal

featuring your products. Or cook lunch for them yourself.

For candy and snack brands, provide samples to share with

the distributor’s children’s sports clubs. Provide frequent

and generous samples to all of the distributor team.

2. Fun Sales Meetings

Every distributor has sales meetings for their entire company.

These are usually a repetitive drone of Powerpoint slides.

Why not hire an agency to create a fun presentation module

which may include audience participation, games, or costumes?

Or sponsor a local motivational speaker or training workshop

using your products as the case studies. Break the mold of

boring meetings!

3. Provide Great Customer Service

Respond to requests quickly. Ship complete containers to keep

the pipeline filled. Pay all bill-backs promptly.

4. Distributor Awards

Recognize your high performing distributors with an award.

This could be Distributor of the Year or for $1 million in sales

or for 15 years of partnership. Some companies sponsor smaller

awards for key account manager of the year in each market and

retail representative of the year. Publicize the event by awarding

a plaque, hold an awards luncheon, take photos and share a press

release of the celebration.

5. VIP Visit to Corporate Headquarters

Treat your distributors as VIPs at your corporate office.

This trip creates a memorable bonding experience and a chance

for you to serve as a good host. Take the distributor to a product

development lab and organize a meal with your CEO or

executive officers. Make him feel like part of the family.

6. Support Local Events and Charities

Creative distributors drive incremental sales through local

marketing events. Display a willingness to support their ideas

and invest in new programs. Events that sync with the

distributors (or retailers) special charity build substantial

goodwill and appreciation.

7. Annual Incentive Trip

Many companies sponsor trips for distributor executives who

attain their annual sales quota. Mid-size brands source added

focus by sharing the benefits of a good year by inviting achievers

(and spouses?) to trips in resort locations like Hawaii or

international cities such as Rome. Everyone works hard

to qualify and vow to return “year after year.”

8. Holiday Baskets

Send baskets or gift packs to distributor employees that include

your product and other adjacent holiday items. The idea is to

extend your brand’s relationship to your partner’s homes.

9. Distributor Advisory Council

Form a small elite group of distributors to advise your company

on international development. Meet twice a year with access to

your companies senior management. All members of the

Distributor Advisory Council will meet their sales target.

10. Treat Distributors as Your Best Customers

Be nice. Say “thank you” frequently. Send handwritten notes to

people to recognize a nice display or a fixed problem. Have fun

while you work.

Distributors may work with twenty brands or more, each

shouting for attention. Distributors support all their brands, but

there is no magic science to allocate time equally. Naturally, we

all spend more time and effort for the brands and people we like.

What can you do to make your distributors “Fall in Love?”

Ten Tips: Getting a Distributor to Love Your Brand

Need more information? Visit www.exportsolutions.com.

1919

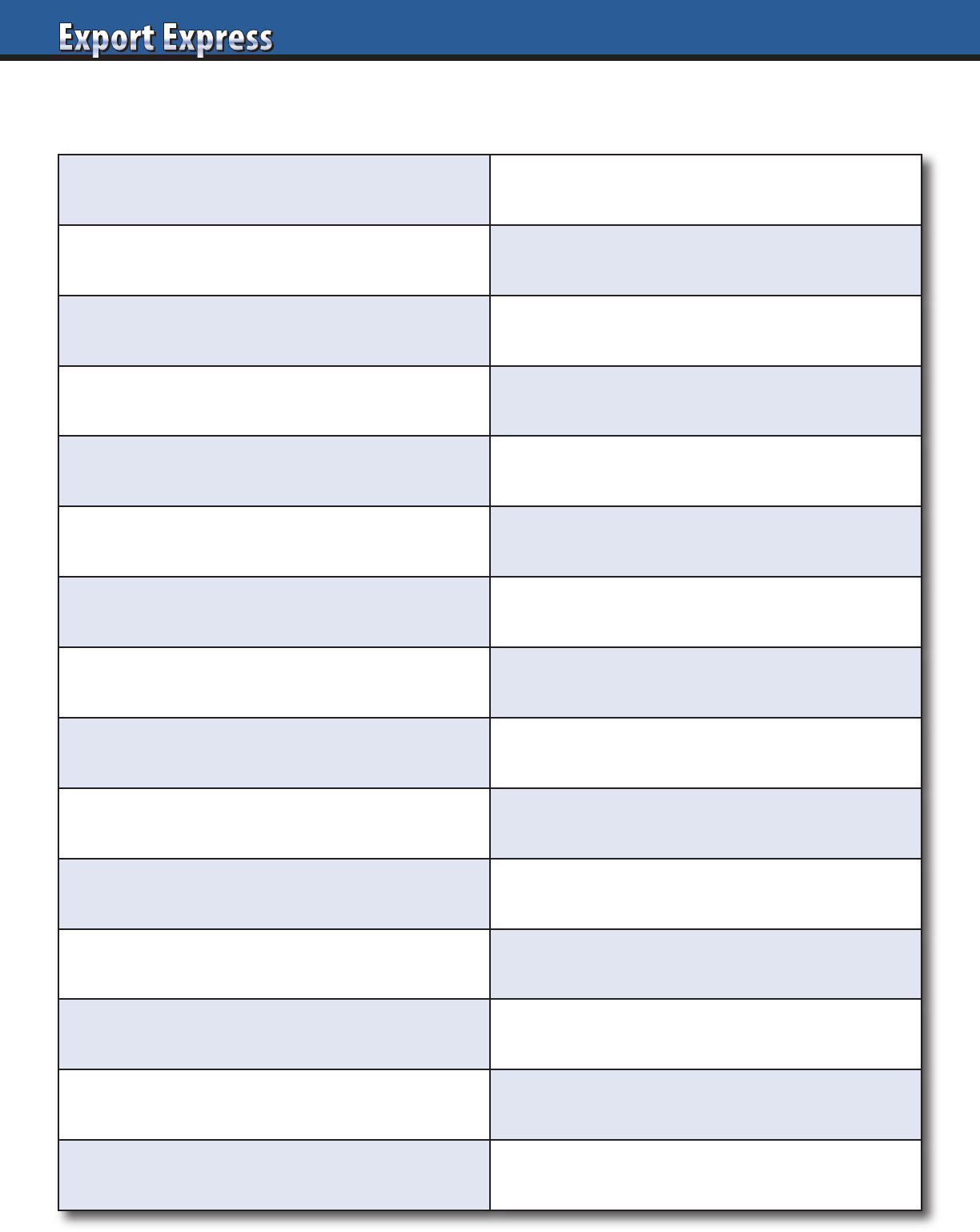

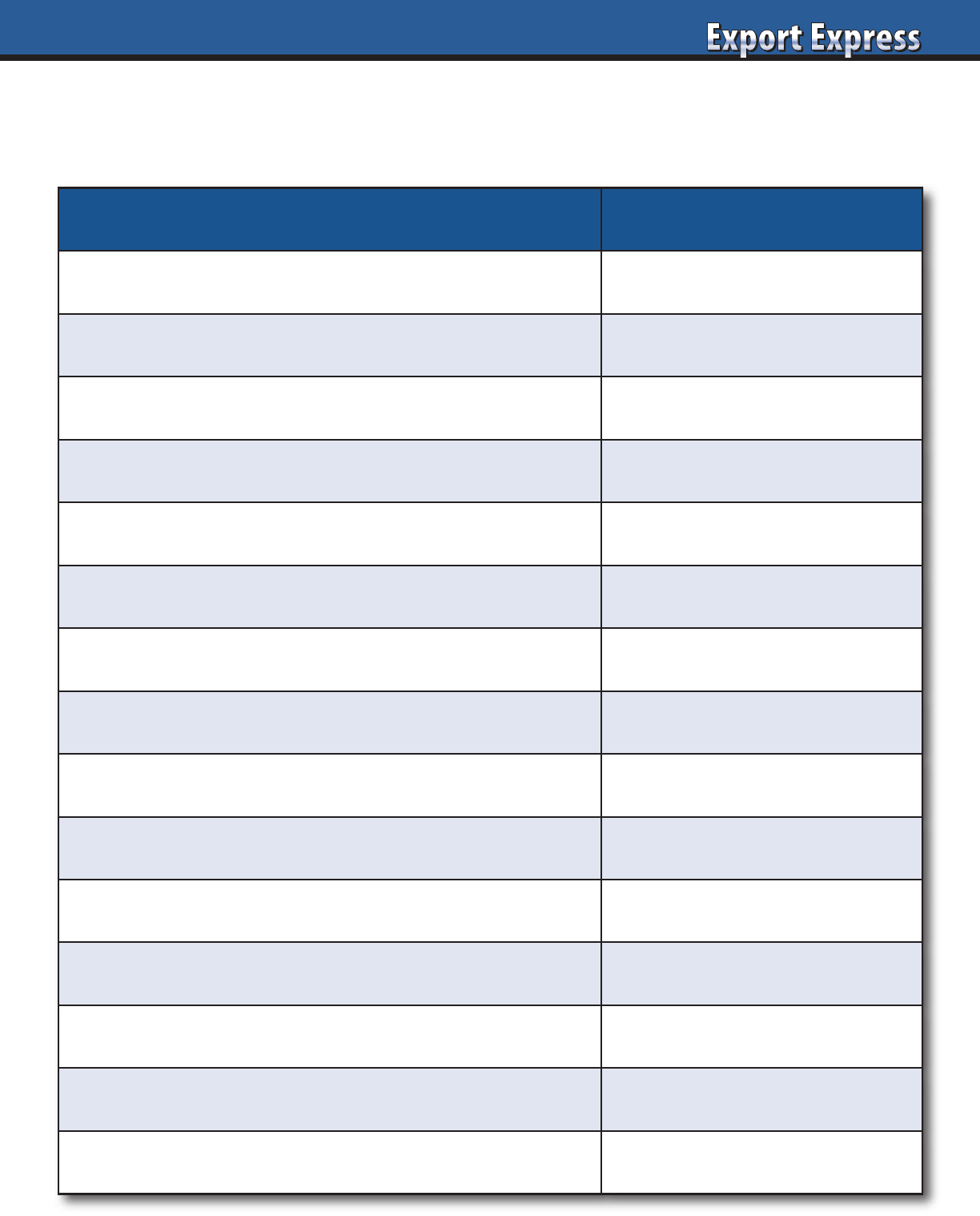

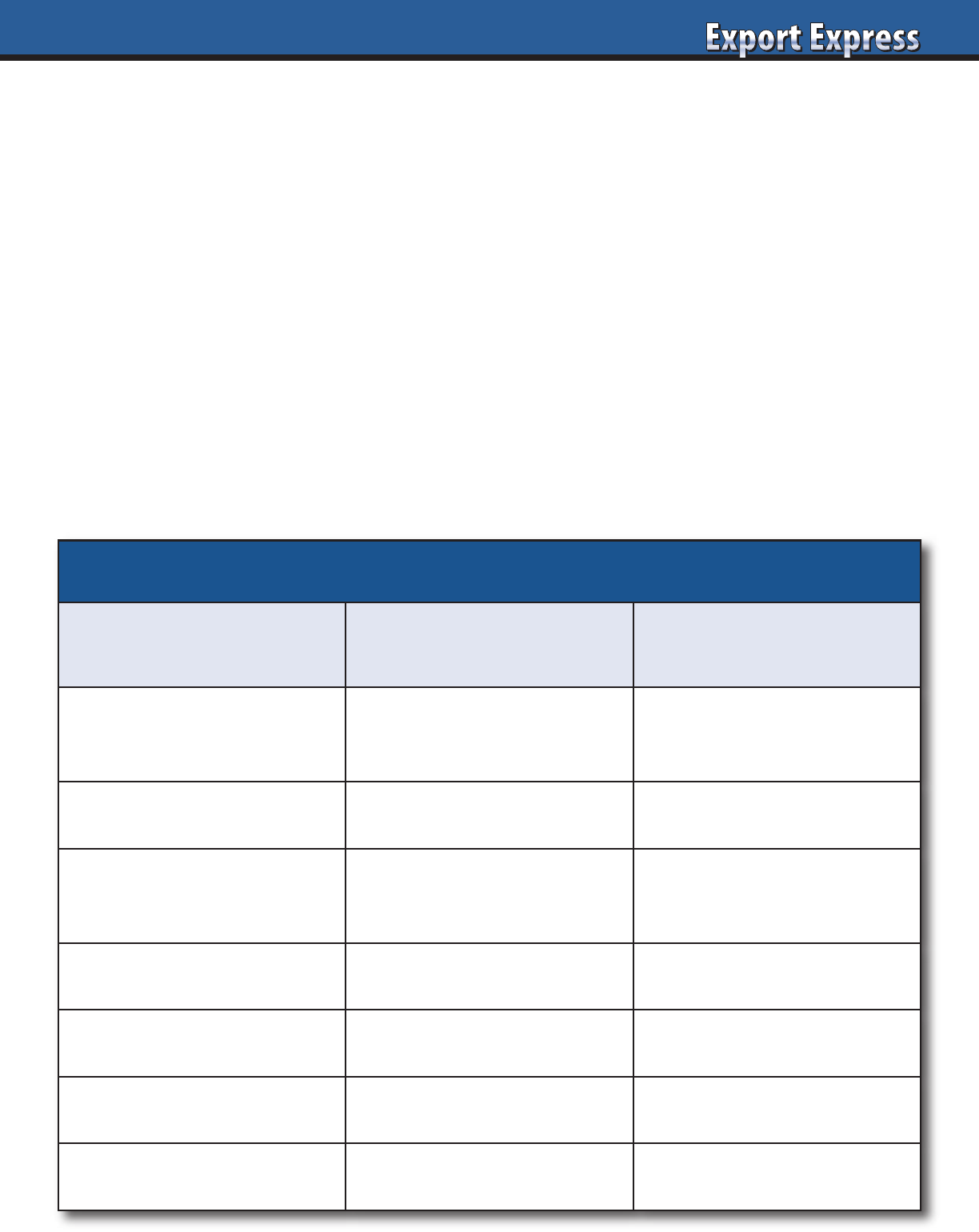

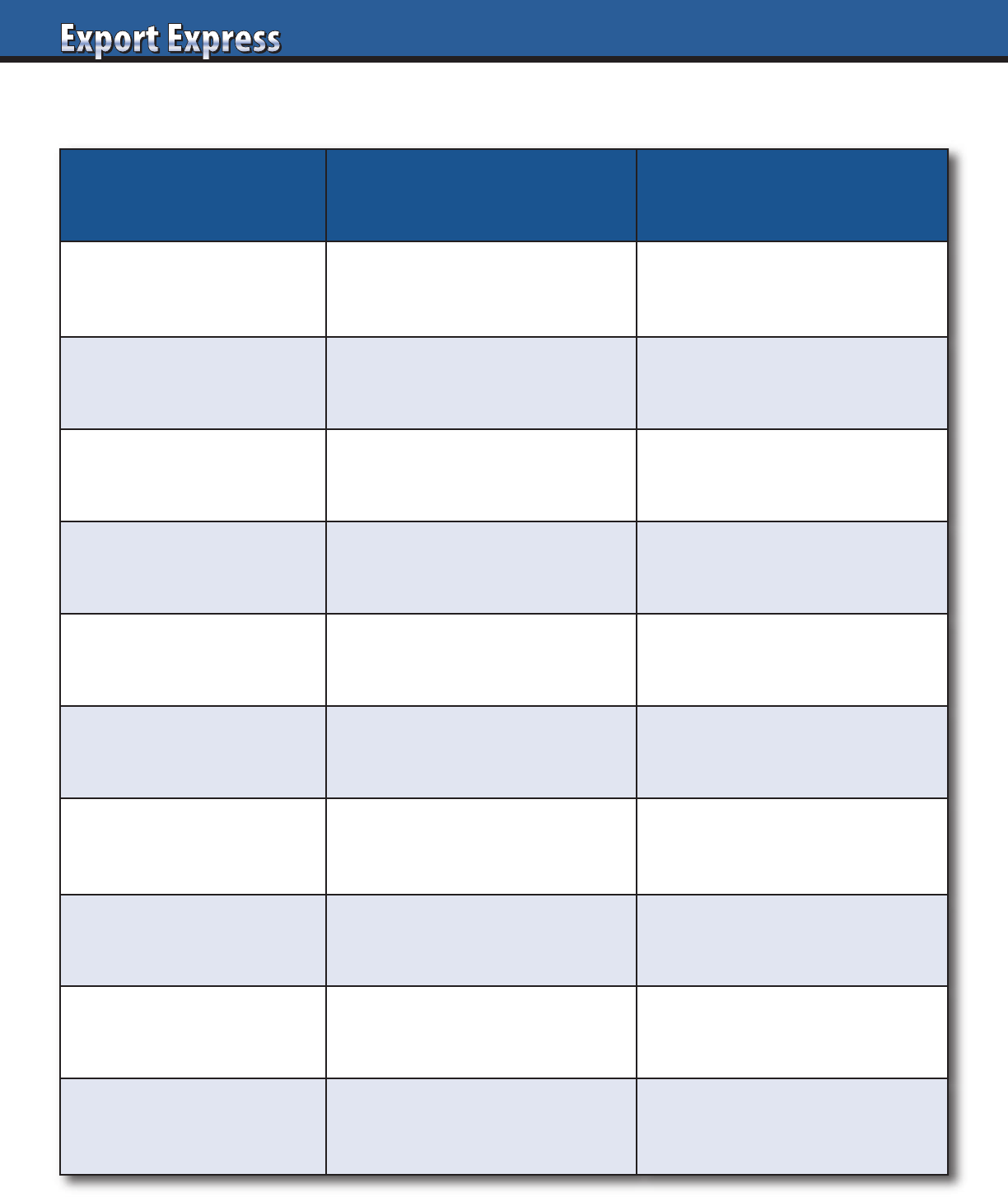

Export Lessons Learned Template

Why are Countries Leading or Lagging?

(Complete based upon your company performance)

Leading

Countries

Lagging

Countries

Country Performance:

Measure: sales per capita

Brand Development:

Measure: market share

Biggest Opportunity

Countries:

Measure: category size/growth

Promotion Effectiveness:

Tactics creating incremental sales

Distributor Performance:

Measure: sales increase,

commitment

2020

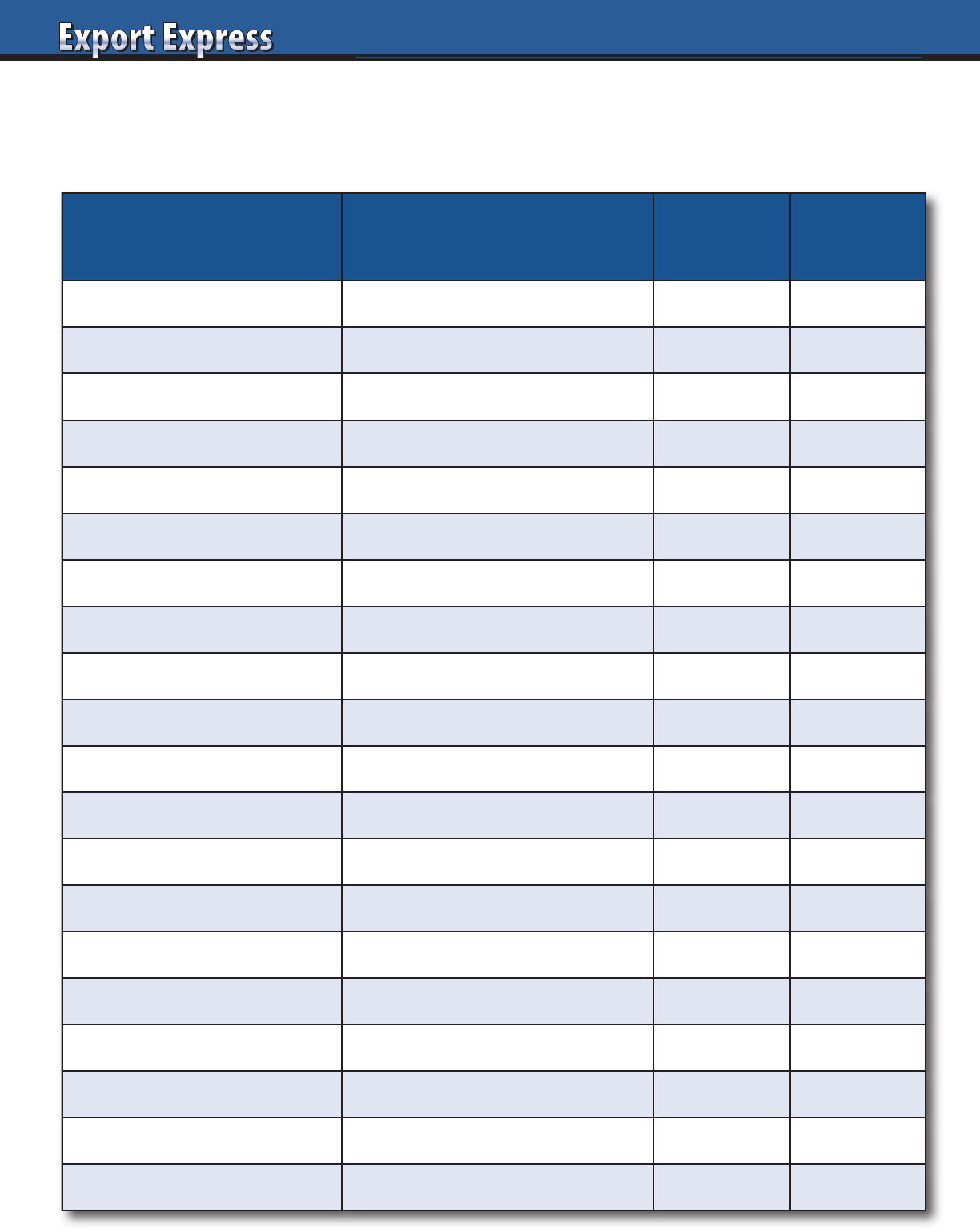

How to be Distributor of the Year

Assessment Criteria Considerations

Rating:

(10 = Best)

Results vs Plan, Market, Category • Reliable, 5 to 10% + growth

Retail Store Conditions • Brand presence exceeds market share

Brand Manager • “A” player, dedicated resource

Cost to Serve • Fair margin, based upon size, complexity

Omni Channel • Channel teams, e-commerce focus

Fun • Do you enjoy the people, country?

Financial • Prompt payments, accurate billbacks

Problem Solving – Response Time • Same day service, sense of urgency

CEO • Loves your brand, engaged

Pioneers New Business • From concept to cases

Supply Chain Management & Forecasting • Accurate, efficient

Customer Relations • Senior access at top retailers

Category Knowledge • Viewed as expert by buyers

Profitable Partner • Sells profitable cases

Analytical Skills: Shipments, Nielsen • Trends, opportunities, plan

Team (Finance, IT, Logistics) • Cross functional expertise

Digital Savvy • Social Media team, pioneers new tools

Reporting • On time, complete, accurate

Best Practices • Creative idea source for other markets

Cultural Alignment • Perfect fit with brand owner’s vision

2121

Distributor Capability Assessment

Export Solutions established 15 assessment criteria to identify “Best in Class” performers as well as “under

achievers.” Many distributor relationships extend 10 years or more. Is your distributor network still a “good fit”

for your current business requirements? Template can also be used as New Distributor Reference Check form

.

Assessment Criteria Rating: (10 = Best)

Category Expertise/Critical Mass

Focus/Time Dedicated to your Business

Joint Business Plan Development, Execution, Delivery

Alignment with Brand Owners Vision. Relationship.

Cost to Serve (fair margin, extra costs)

Assortment/Shelf Space

Promotion Creativity, Effectiveness, and Efficiency

Key Account Relations (Senior level, buyer)

Leadership/Owner (engaged & committed to us?)

Brand Manager (seniority, clout,creativity)

Multi Channel, Multi Regional Coverage

Financial Stability, Payment Record

Supply Chain Management & Forecasting

Problem Solving: rapid response?

Sales Results versus Budget, Market, Category (CY, PY, 3 Years)

2222

Does Your Distributor Network Need A Check Up?

Export Solutions Can Help!

• Distributor Network Assessments

• Motivational Speeches

• International Strategy

• Find Distributors in 96 Countries

Contact Greg Seminara at [email protected] or (001)-404-255-8387.

www.exportsolutions.com

Exporters manage distributor networks extending to 20, 50, 70 countries or more!

Every company has a few distributors that under perform.

“Under achievers” prevent us from attaining our personal objectives.

Distributor Network Check Up

• Independent assessment from Export Solutions

• Establish methodology for ranking Best in Class distributors and “Laggards”

• Supply strategies for recognizing top distributors

and upgrading the bottom performers

• Benchmark external brands from your category

• Practical and “action oriented” approach

2323

Slotting allowances, listing fees or as the Irish say “Hello” money

are all real estate rental fees charged in advance by retailers for

access to their limited shelf space. Many retailers assign their

buyers “budgets” for this type of incremental fee income. Store

owners seek to obtain maximum productivity from each shelf

facing and fixed entry fees are a tactic to gain immediate income

from new products without an established sales history. At the

end of the day, it’s a cost of doing business. Our objective is to

allocate as little money as possible to listing fees to redirect

our investments to consumer awareness and trial generating

activities. Recapped below are Export Solutions’ Ten Tips on

minimizing listing fee payments.

1. Exclusivity

Some large retailers will waive listing fees in order to achieve

first in the market status with an exclusivity arrangement.

Normally, this extends for three to six months. Beware, you

may upset other customers who become “locked out” during

the exclusivity period.

2. Pay Fees Over One Year

This approach reduces your initial outlay and also increases the

likelihood that the retailer will keep your product on the shelf

for at least one year. This may also allow you to structure the

payment as a percent of case cost versus a “lump sum” payment.

3. Free Goods

Our net cost of “Free Goods” may range from 30-50% of a

product’s retail price to the consumer. The retailer recoups his

listing fee when the product is sold. Some retailers are hesitant to

accept this option, as a slow moving brand may force him to wait

to receive his money.

4. Approach “Non-Slotting” Fee Retailers First

Every country includes retailers and channels that do not

demand slotting fees. Create a success story with these customers

first. Your track record may validate the larger investment in

paying the fees at a bigger account or success may help you

negotiate more favorable terms.

5. Create “All Inclusive” Annual Plan

Ultimately, the retailer has many “profit centers” to reach their

internal financial targets. Customers respect a solid, year one

plan, with investments in their other programs like advertising,

sampling, shelf rental and display. You may secure your product

listings as part of your annual agreement.

6. Negotiate Reductions – Multiple Items

My experience is that many retailers have published standard

prices for listing fees. However, net payment often depends on

your distributor’s clout. Big distributors, representing

multinational’s and a wide variety of brands know the difference

between what is requested and what is really paid on high profile

brand launches where the retailer needs the new brand to be

competitive. The most frequent “discount” is receiving a reduced

fee for multiple items: example, paying a full listing fee on first

two items and receiving authorization for two extra items as part

of a group listing.

7. Retailer Entertainment

Most countries still permit buyers to socialize with suppliers.

The cost of a few tickets to a high profile sporting event is far less

than most listing fees. A VIP plane trip to view your factory or

your category in a “resort” country is another way to gain access

to the shelves without writing a big check.

8. Higher Everyday Margin

Total category margin is a key assessment metric for most buyers.

Some may consider a lower listing fee, if your brand delivers a

margin higher than the category average.

9. Distributor Contribution

Some “hungry” distributors may cover or co-fund listing fees.

There are options to “case rate” fixed fees into the distributor

margin calculation. Ultimately, distributors benefit from

increased sales and margin contribution from a new product

listing. However, many are reluctant due to short term contracts.

Most maintain policies related to brand owners retaining

100 percent responsibility for listing fees and consumer

marketing activities.

10. Beg! Claim Poverty

Buyers are human and realists too. They may “bend” in their

demands if they like your brand and know that you represent

a small company. Long term distributors can request the

occasional “favor” from a friendly buyer. Most retailers have

programs to provide “low cost” chances to entrepreneurial

new or local suppliers.

Ten Tips: How to Minimize Listing Fee Payments

Create Your Own

Export Library

All Guides available free at

www.exportsolutions.com

in the Export Tips section.

Distributor Search Guide

Export Handbook

Selling to USA Handbook

Distributor Management Guide

Finance & Logistics

Export Treasure Chest

My Favorite Templates & Forms

People Power

Strong Teams Build Great Brands

2424

Customer Relationship Assessment

All distributors claim strong relationships with their biggest customers. Below is Export Solutions’ template

for evaluating distributor key account relationships. Best way to evaluate distributor relationships? Your

company’s market share and volume growth at the customer versus the balance of the market!

Assessment Criteria Rating: (10 = Best)

Distributor viewed as an important supplier to the retailer/buyer

Open to bringing brand owner to customer meetings.

Ability to schedule buyer/CEO meetings outside the office.

Can negotiate standard listing fees and other program costs.

Pricing: access to price coordinator. Ability to make changes.

Shelf: access to decision maker. Space in excess of market share.

Merchandising Flier/Catalog: Ability to get prime feature space.

Relationship/access to retailer owners, senior executives.

Problem solving: rapid response? Emergency orders etc.

Payment terms.

Access to retailer movement data.

Category captain or “advisor” for my category.

Vendor awards?

Knowledge of retailers systems. “How to get things done.”

Sales results versus overall market and retailers internal growth.

2525

1. Case

Manufacturer supplies a business case

confirming brand “aspirations” for the

country: Key items in portfolio, estimated

base pricing, volume/market share

expectations, and investment model.

2. Category Review

Distributor supplies a local review

of category competitors, pricing,

and merchandising practices.

3. Capabilities

Distributor shares detailed organizational

capability and customer coverage.

Could include references from existing

suppliers represented. An important step

when there are two or more candidates

under consideration.

4. Commitment and Costs

What is the Year 1 Plan and Forecast?

Targeted listings, marketing activities,

launch budget and volume estimate

associated with the spending plan.

5. Calculation – Value Chain

Line by line, build up from port to retail

store shelf. Include currency assumptions.

6. Compliance

Highlight product registration and

label requirements. Typical timelines

for compliance?

7. Captain of Team

Who will be our day-to-day brand manager or

first point of contact? Which senior executive

will serve as our “Brand Champion?”

8. Contract

Options include formal contract, letter

of understanding, or handshake deal.

Begin this process early!

9. Consumer Marketing

What are planned activities to generate

consumer trial and repeat purchases?

Trade marketing, consumer marketing,

social media, etc.

10.Calendar /Close

Distributor supplies a detailed timeline

of all activities. When can we expect first

order and delivery to support launch?

Frequent checkpoint calls or meetings.

10 C’s – Cooperation Model

Looking for Good Distributors?

Export Solutions’ database covers

9,200 distributors in 96 countries.

www.exportsolutions.com

26

Export Accelerator

Contact Us for Distributor Search Help in 96 Countries

Greg Seminara • greg@exportsolutions.com

“Spend time Selling to Distributors versus

Searching for Distributors”

26

Why have Barilla, Pringles, Nature Valley, Starbucks, Duracell,

Nestlé, Tabasco, Pepperidge Farm, and other leaders used

Export Solutions as a distributor search consultant?

• Powerful distributor network: owner of industry database

9,200 distributors – 96 countries

• Professional 10 step due diligence process

• Results! We make Export Managers’ lives easier!

2727

Your new product launch is a big deal, comparable to the birth of

a child. The first days are critical if you want to raise a “healthy

brand.” Listed below are Export Solutions’ ten tips for launching

your company for the first time to a new distributor or

expanding through a new product introduction.

Firm Calendar

Distributor and brand owner should align on a “firm calendar.”

This includes dates for sales materials development, launch

meeting and key account calls. All dates are dependent on arrival

and customs clearance of the first order. No product, no meeting!

Get Ready

Allow adequate time for printing of point of sale materials

and development of key account presentation. In some cases,

translation or local adaptation of brand owner supplied tools

may be required.

Memorable Meetings

I still remember motivational meetings with themes around

boxing and magic. Create new memories with a special theme or

an external speaker. Off-site meetings contribute to making your

launch special, with an added sense of commitment. Have fun!

Mandatory Attendance

The distributor CEO, brand manager, and export manager must

all attend and have speaking roles. Best is to have one meeting

with sales and merchandising teams together. However, in some

cases, a follow up meeting may be required. Invite logistics,

finance, and customer service people to make it a “team effort.”

In-Store Objectives

Establish clear measures for in-store presence. This includes

shelf positioning, space allocation, pricing, and off-shelf

merchandising. Share a photo. What qualifies as a “good store”

versus a “bad store?”

Frequently Asked Questions

Prepare a list of potential questions and logical responses. Role

play with the team. Share a printed one pager with sample

answers to tough questions.

Samples, Samples, Samples

Provide generous quantities of samples for all distributor

employees to enjoy and take home. Prepare recipes if your

brand is a food product. Samples are your best advertisement.

Personal Goals

Each team member should have personal goals for your launch.

For a key account sales person, this could be acceptance of the

core product lineup. A retail merchandiser could be assigned a

target of a specific number of stores with displays or eye level

shelf placement. For the launch, focus on implementation goals

versus case shipments.

Key Account Calls

In many countries, large supermarket chains dominate sales.

Develop a personal strategy for each key account. What are the

buyers internal goals? How do we fit with the chains consumer

base and plans? Which chain “push” programs can we

participate in? Schedule a “lead call” with an easier key account

to get feedback that will help you with a tougher buyer. Invite

the export manager or distributor MD to participate in the sales

call if it will help.

Audit

Schedule a retail audit of stores to coincide with the expected

retail availability of product. Bring other people from the brand

owner’s company and have 2-3 teams auditing the market

against a specific set of goals. Visit secondary cities, not just the

stores around the distributor’s office. Recognize that conditions

will not be perfect and celebrate progress to date.

New Product Launch: Ready, Set, Grow – Ten Tips

Need more information? Visit www.exportsolutions.com.

2828

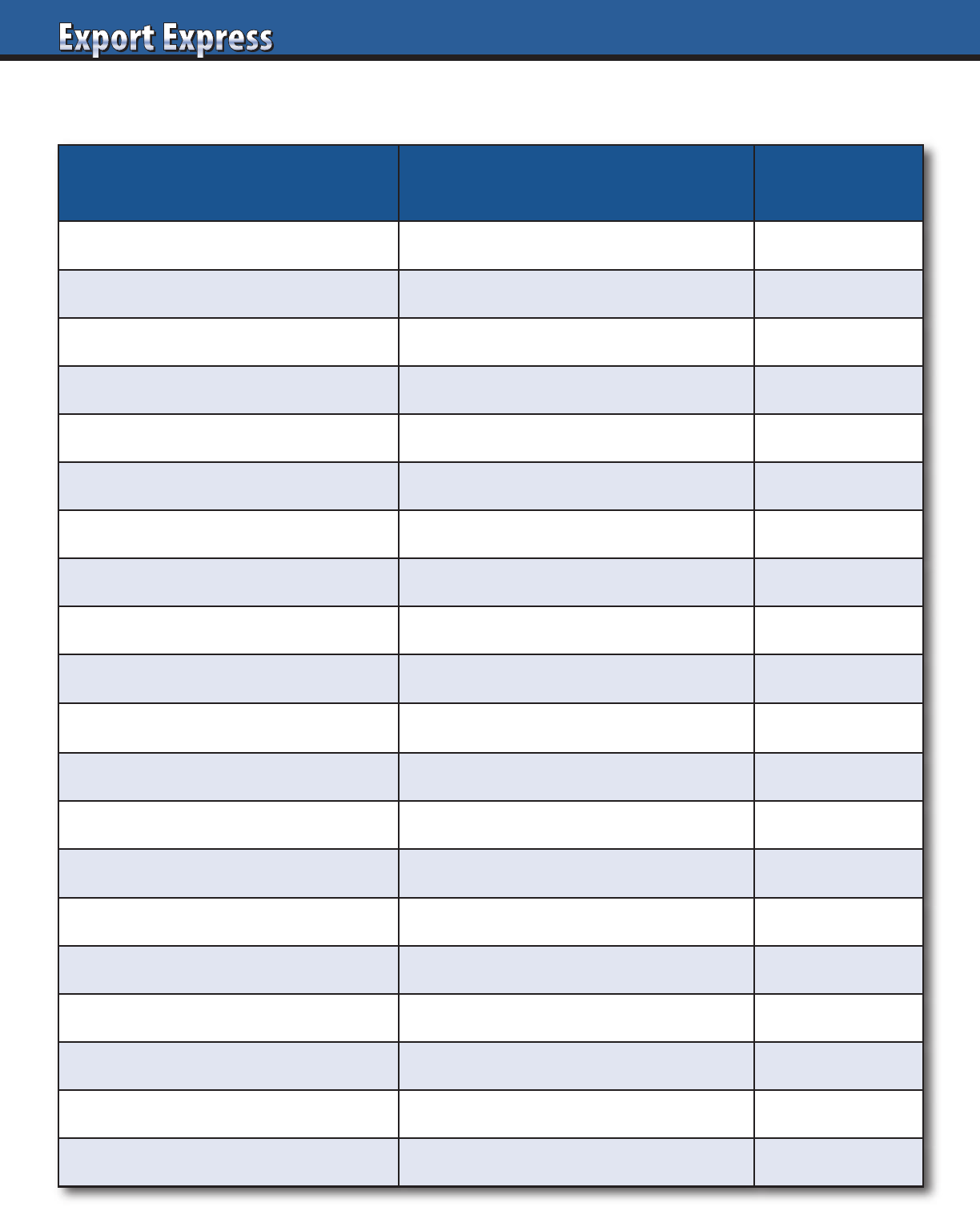

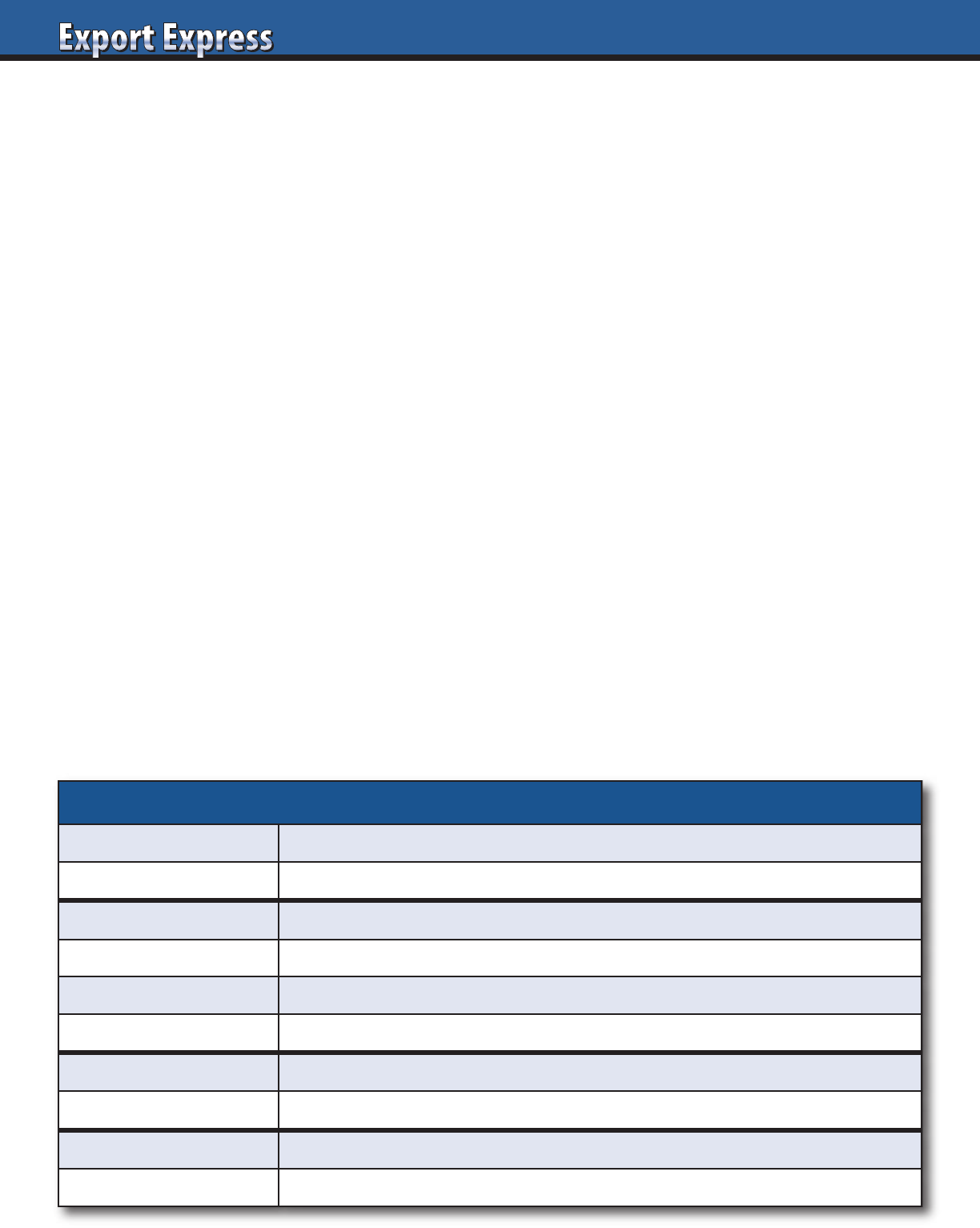

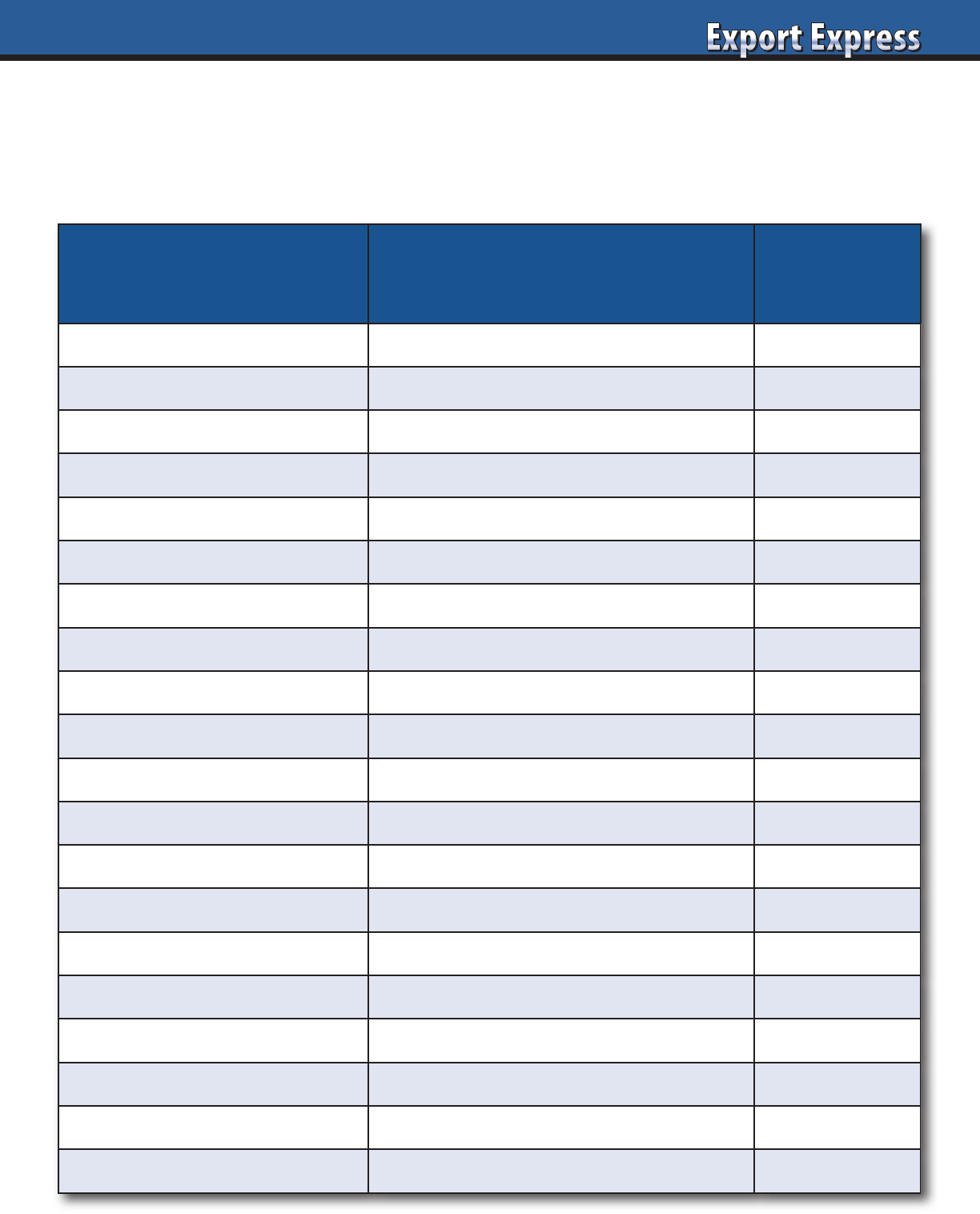

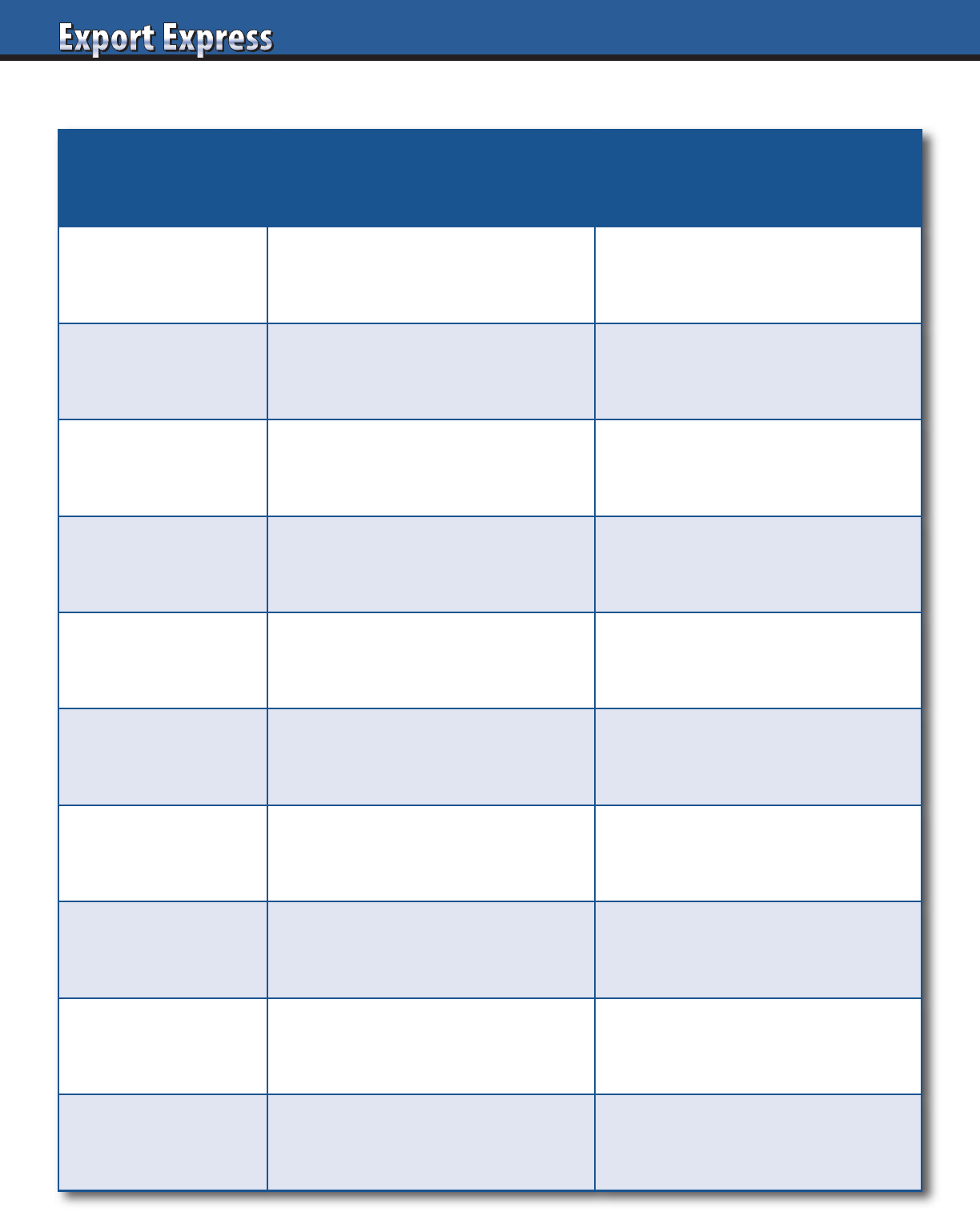

Year One Scorecard Example

Brand owners and distributors enter new relationships with great expectations.

Most partnerships succeed, but some under deliver leaving both parties disappointed.

Export Solutions Year One scorecard helps both parties align on KPI’s.

Objective Goal Results

Shipments to Distributor

Distributor Sales to Customers

Top 5 Customers

Region: Sales Split by Area

Channel: Sales Split by Channel

Market Share

Listings: Top 5 Customers

Retail Pricing

Shelf Positioning

Shelf Space

Sampling

Social Media

Displays

Manufacturer Investment

Brand Manager Performance

2929

“The Right Way” – New Country Launch

Retail buyers and distributors are receptive to brand launches from multinationals. Why?

Multinationals succeed, as they introduce new products “The Right Way.” Export Solutions recaps

30 components of launching “The Right Way.” Exporters create magic with limited budgets!

Winners check as many boxes as possible on “The Right Way” scorecard.

Product Retailer

o Meaningful innovation – not “me too” o Boost category sales, margin, and profit

o Consumer market research insights o Syndicated data (Nielsen) – category facts

o Technical confirmation of product differentiation o Invest in retailer “push” programs

o Reasonable retail price – premium (not sky high) o 4-6 high value promotional events per year

o Test market results – similar country or retailer o Retailer VP, distributor CEO at intro call

Marketing Excitement

o 360 marketing plan: TV, in-store, social, PR o Launch party – memorable location

o Sampling o PR, social media, trade press

o Social media o Celebrity endorsement

o Displays: end of aisle and shelf blocks o Distributor sales contest

o Special offers – retailer fliers o Donation to local charity

Team Scorecard

o Distributor – best in class, category expert o Year 1: invest; year 2: break even; year 3: profit

o Local manager – launch oversight o Sales volume (retail sell-out)

o Marketing, social media, PR agencies o Market share

o Brand/technical resource from headquarters o Retail availability (weighted distribution)

o Total distributor engagement: reps. to CEO o Year 2 commitment and enthusiasm

30

Export Solutions conducts over 100 distributor

interviews/meetings per year. Many distributors ask…

What are these big brands looking for? How do we prepare

a standout presentation? What will it take to win the business?

See our fifteen tips below.

1. Professional Communications: Frequent email communication

in advance. Send re-confirmations. Offer to help with hotel

reservation or pickup. Share mobile contact for emergencies.

2. Creative Welcome: Raise flag from visitor’s country or a banner

with brand name on it. Serve food paired with their brand.

Create immediate “wow!” Skip, if confidential interview.

3. Purchase Product Samples: Potential new brand and

competitors. Supply price for each item.

4. Participants: Owner/MD, sales, marketing, and potential

brand manager. All should have speaking roles.

5. Presentation – Page 1 Company facts: Founding date, sales

revenue, # employees, # field sales, warehouse size, key

categories and principals.

6. Category Sales Data: Try to obtain category sales data from