1

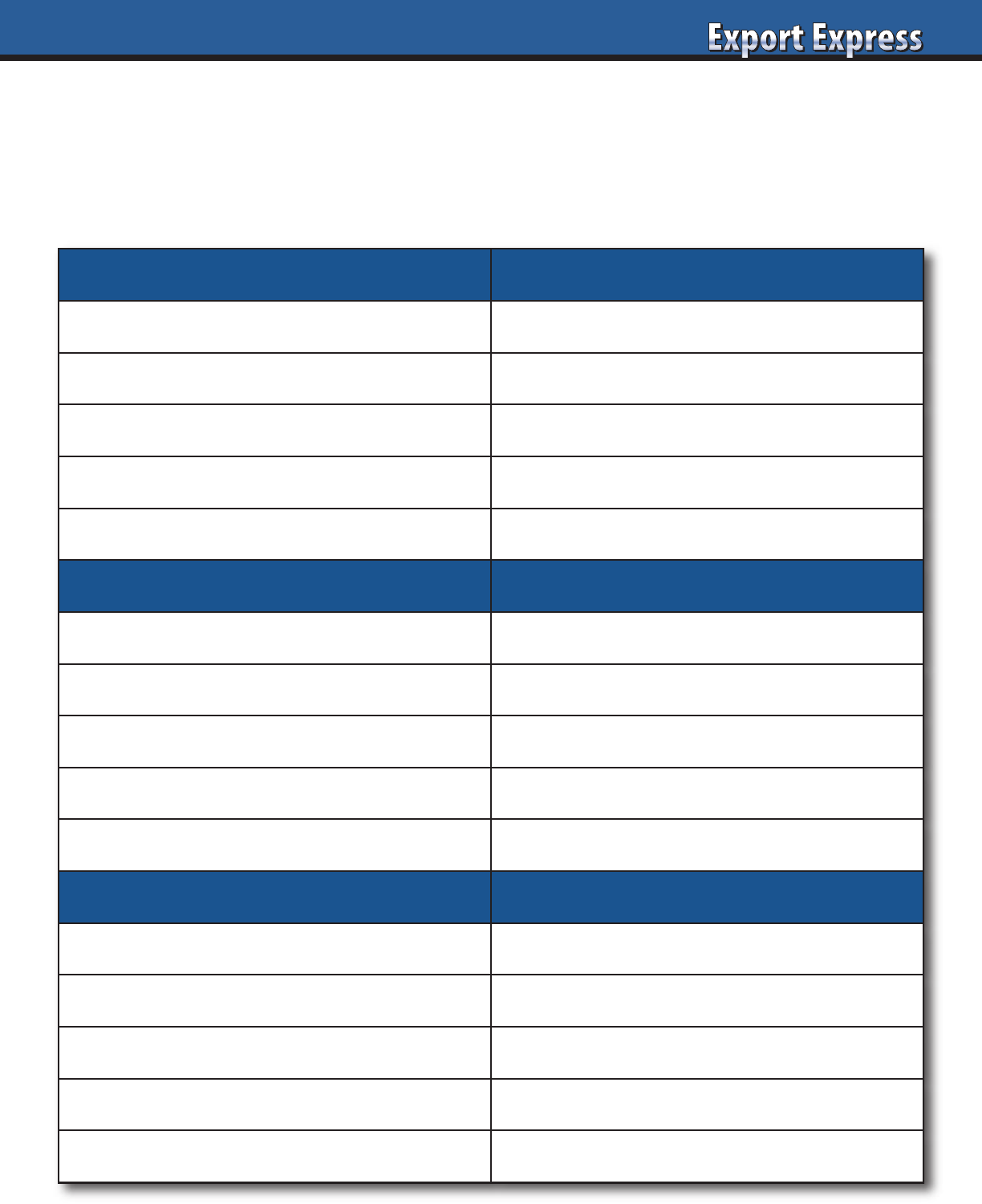

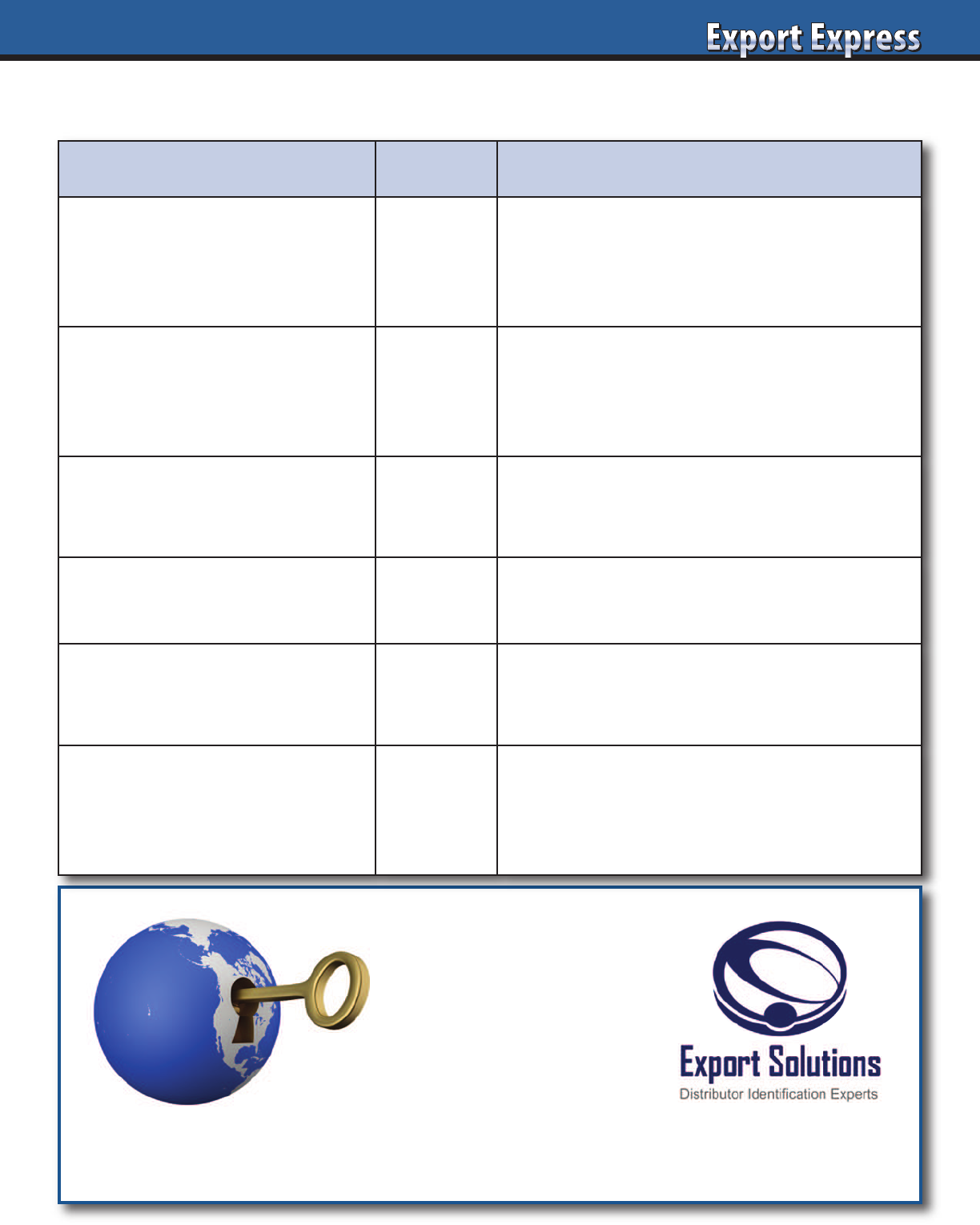

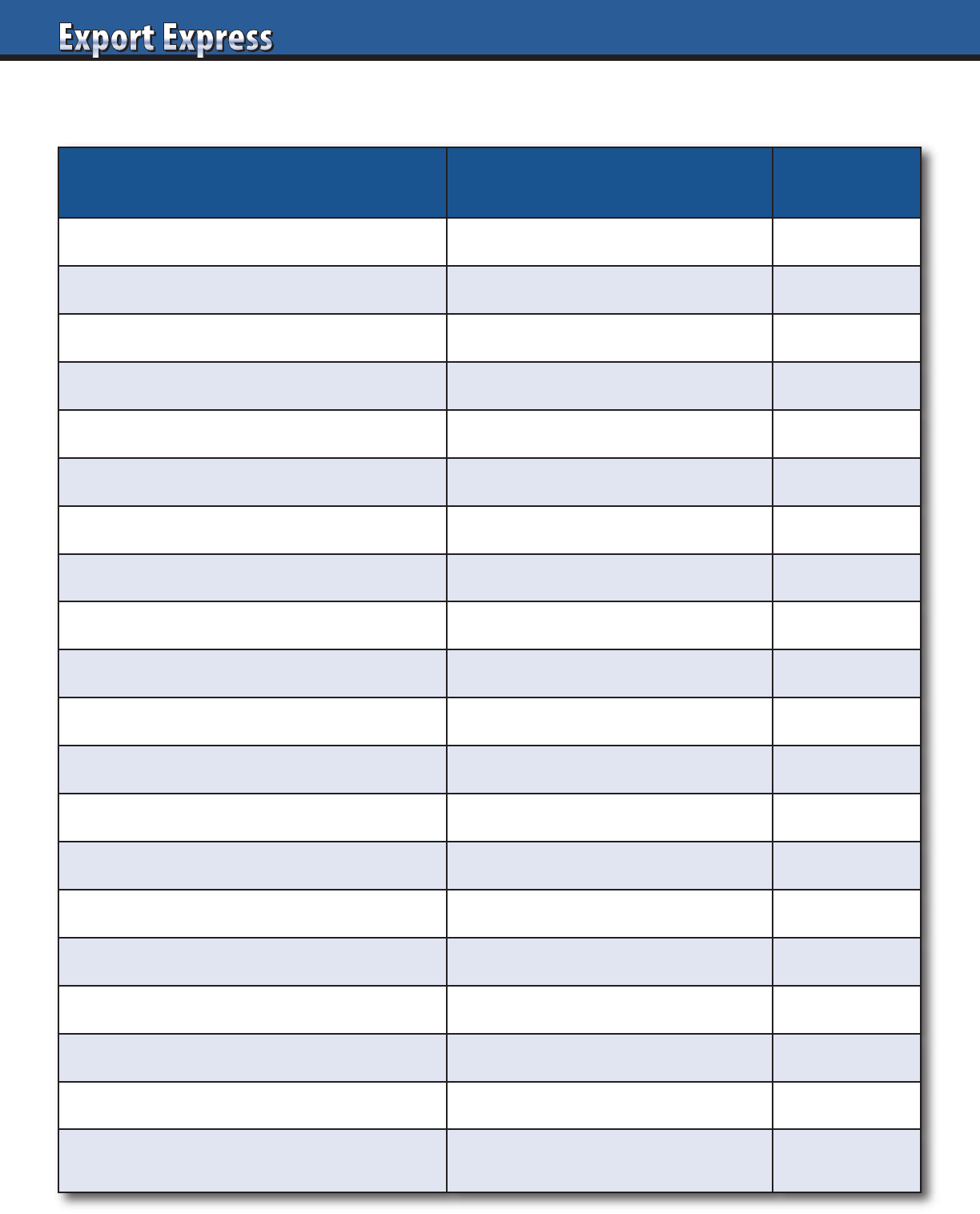

“The Right Way” – New Country Launch

Retail buyers and distributors are receptive to brand launches from multinationals. Why?

Multinationals succeed, as they introduce new products “The Right Way.” Export Solutions recaps

30 components of launching “The Right Way.” Exporters create magic with limited budgets!

Winners check as many boxes as possible on “The Right Way” scorecard.

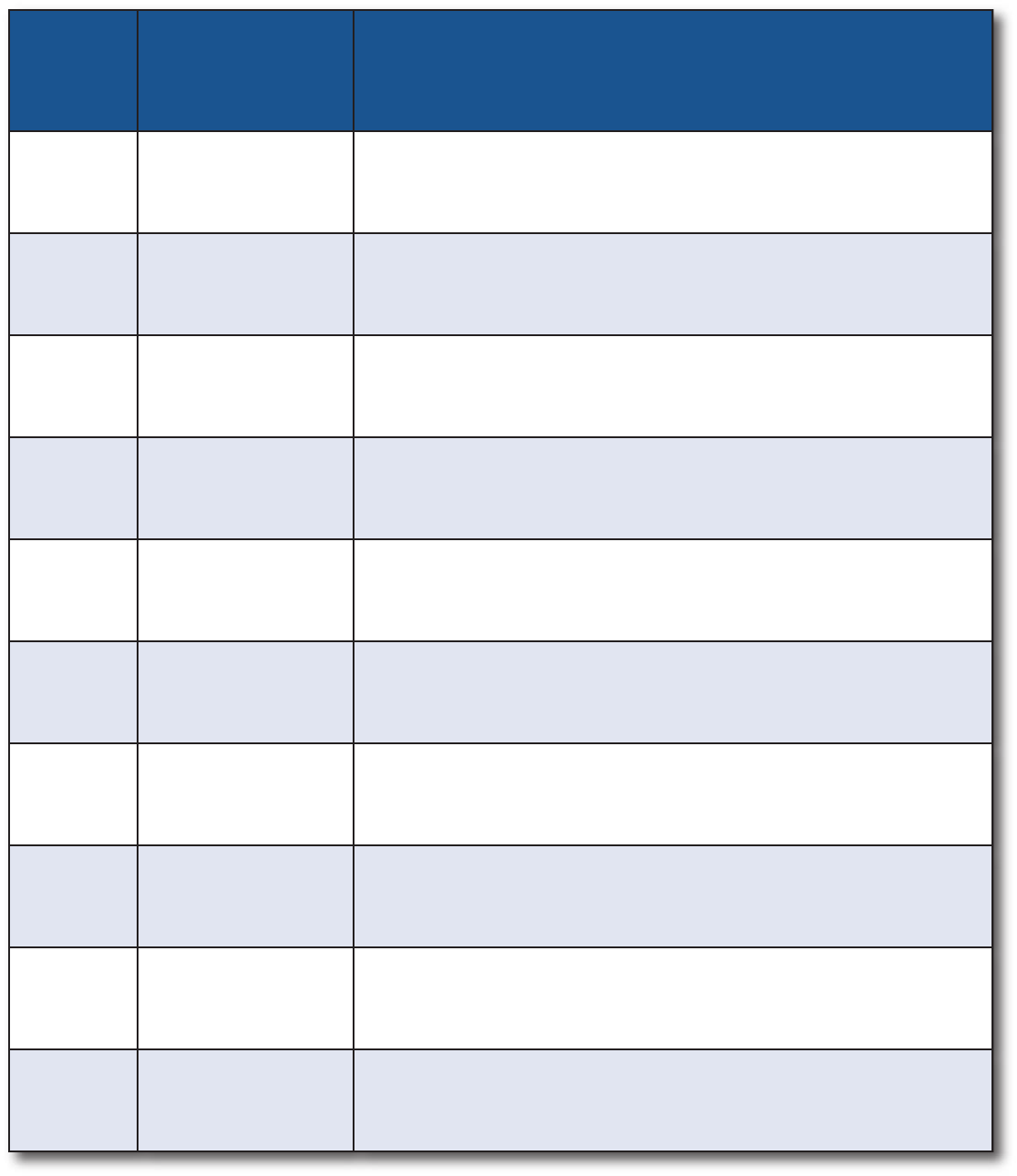

Product Retailer

o Meaningful innovation – not “me too” o Boost category sales, margin, and profit

o Consumer market research insights o Syndicated data (Nielsen) – category facts

o Technical confirmation of product differentiation o Invest in retailer “push” programs

o Reasonable retail price – premium (not sky high) o 4-6 high value promotional events per year

o Test market results – similar country or retailer o Retailer VP, distributor CEO at intro call

Marketing Excitement

o 360 marketing plan: TV, in-store, social, PR o Launch party – memorable location

o Sampling o PR, social media, trade press

o Social media o Celebrity endorsement

o Displays: end of aisle and shelf blocks o Distributor sales contest

o Special offers – retailer fliers o Donation to local charity

Team Scorecard

o Distributor – best in class, category expert o Year 1: invest; year 2: break even; year 3: profit

o Local manager – launch oversight o Sales volume (retail sell-out)

o Marketing, social media, PR agencies o Market share

o Brand/technical resource from headquarters o Retail availability (weighted distribution)

o Total distributor engagement: reps. to CEO o Year 2 commitment and enthusiasm

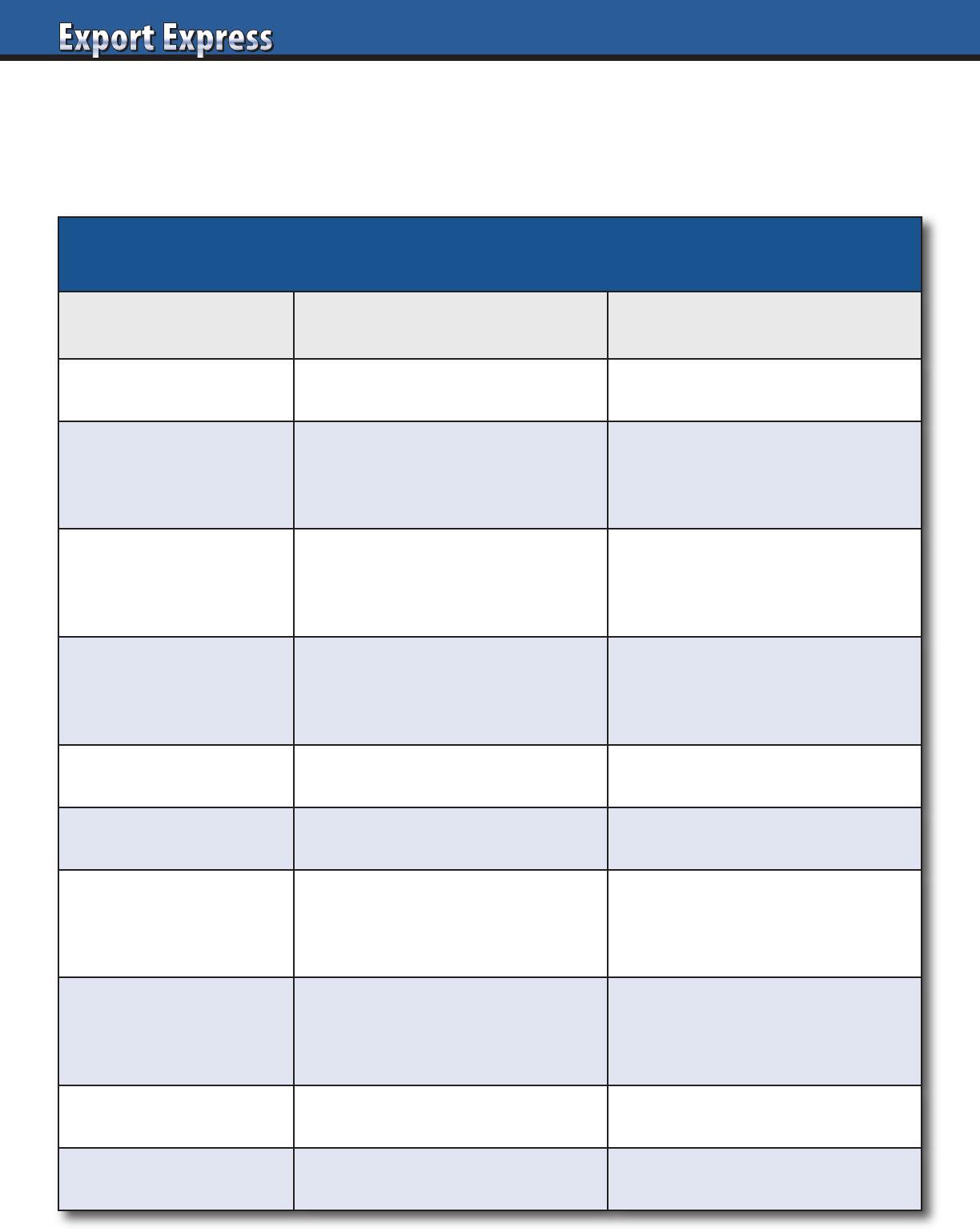

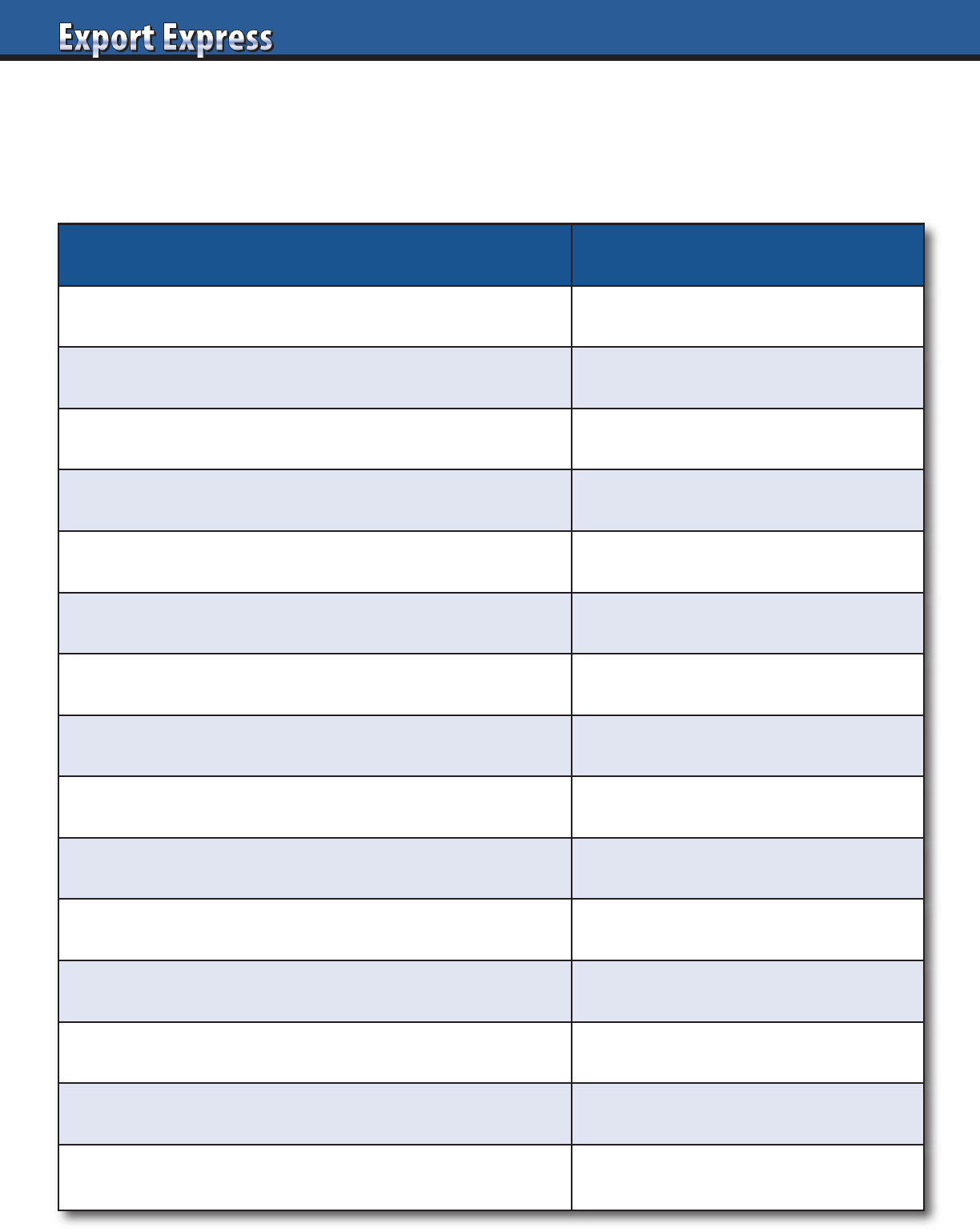

2

Retail buyers are challenged to maximize profits and sales from every available inch of shelf space. Every new item accepted must

improve on the performance of the brand currently occupying that space. Buyers are overwhelmed by new product offerings, all

with ambitious promises. Improve your chances of success by incorporating Export Solutions’ 10 point check list on how to excite

your category buyer about your new product.

How to Excite Buyers – New Product Checklist

Buyers: New Product Assessment

High Interest Low Interest

Category Opportunity Large or high growth Declining or niche

Brand Owner

Multinational or proven local.

Category expert

New foreign supplier

or start-up

Innovation

Something new, supported

by consumer research

“Me too” product

Profit Margin

Enhance current

category margin

Equal to or less than

current category margin

Sales Generates incremental sales Cannibalizes existing sales

Marketing Investment Sampling, social media, PR None

Trade Programs Invests in retailer “push” programs Periodic discounts/rebates

Brand Track Record Successful at other local retailers Unproven in the country

Terms/Conditions Attractive deal structure Typical terms/conditions

Representation Dependable local distributor Small, niche entrepreneur

3

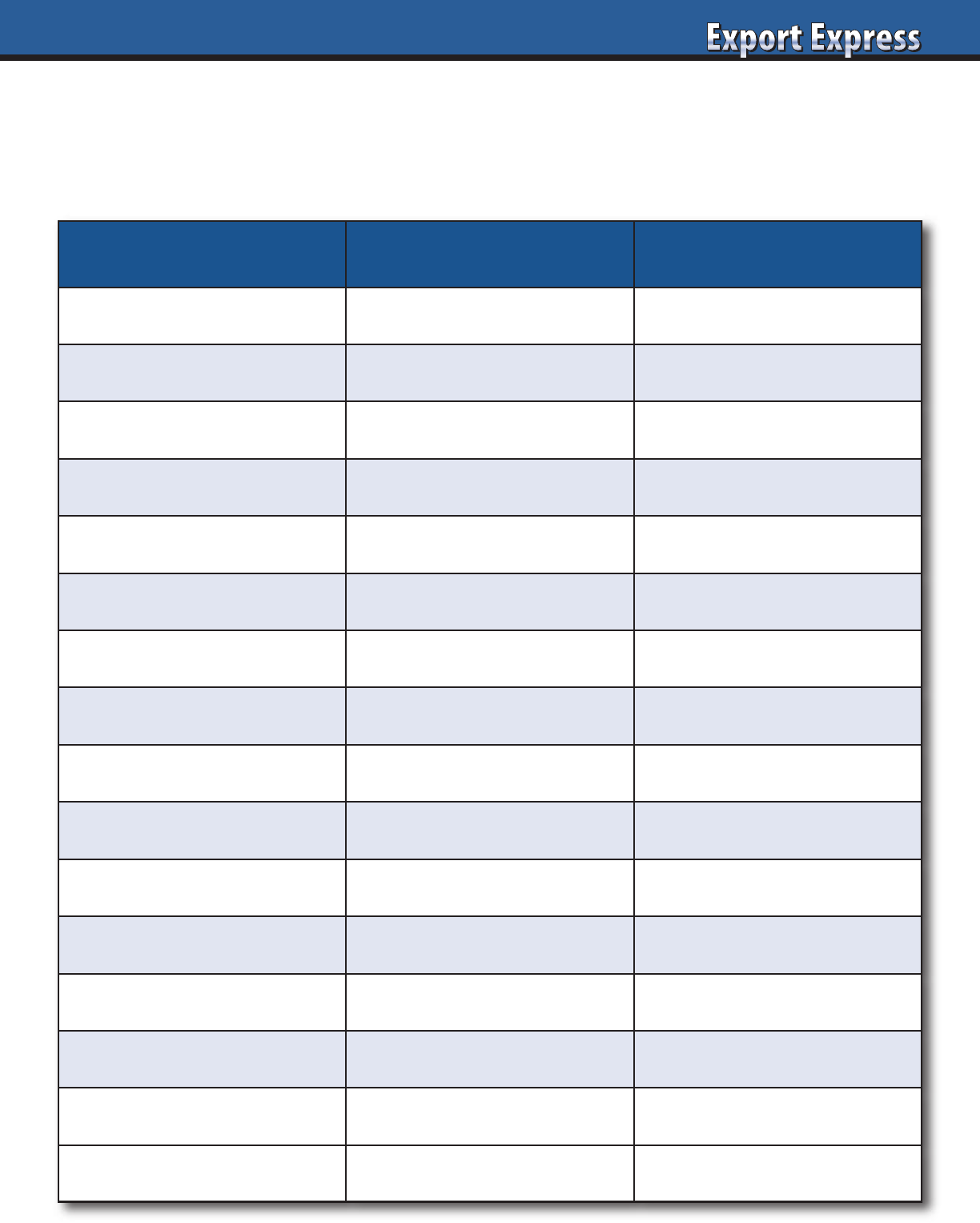

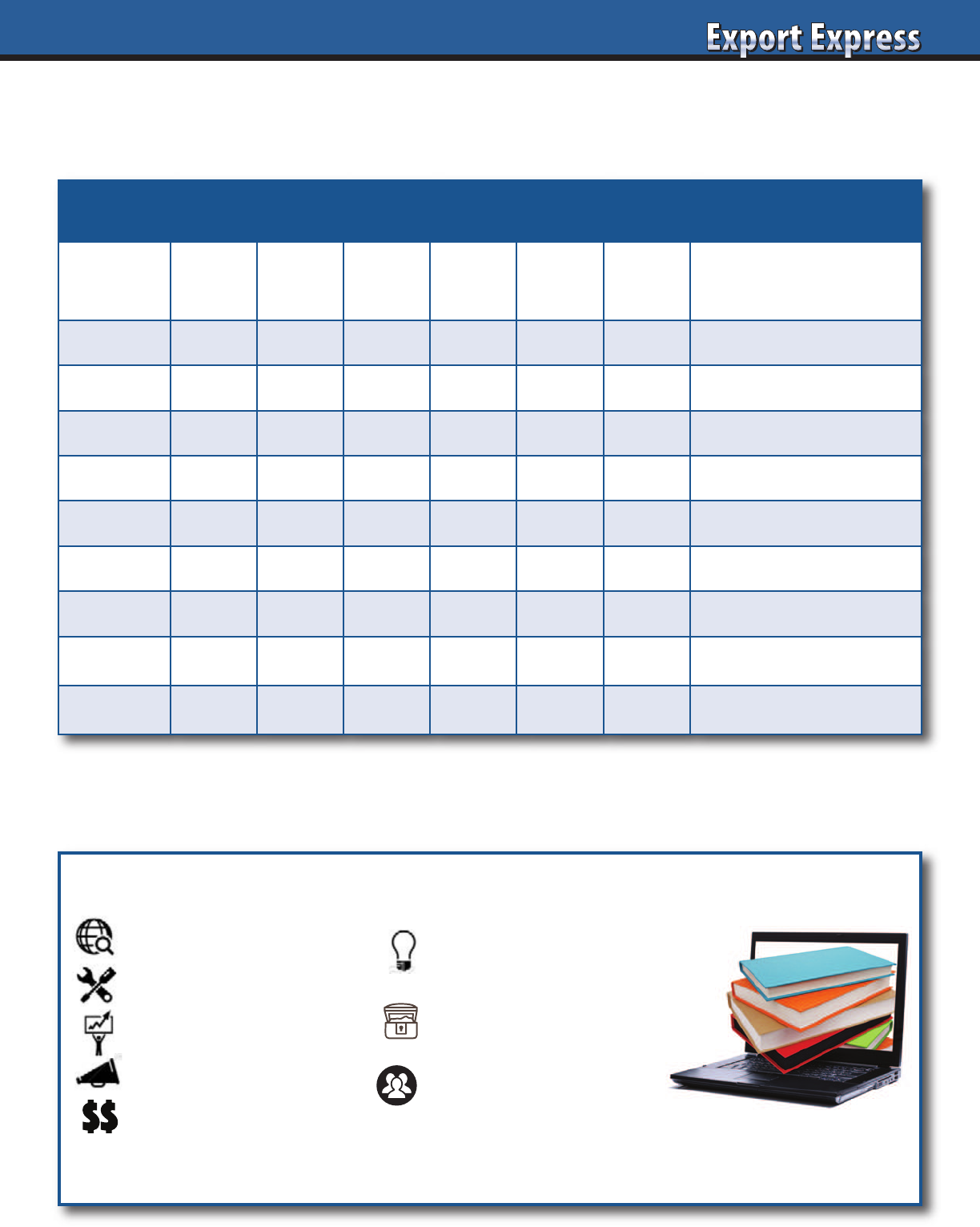

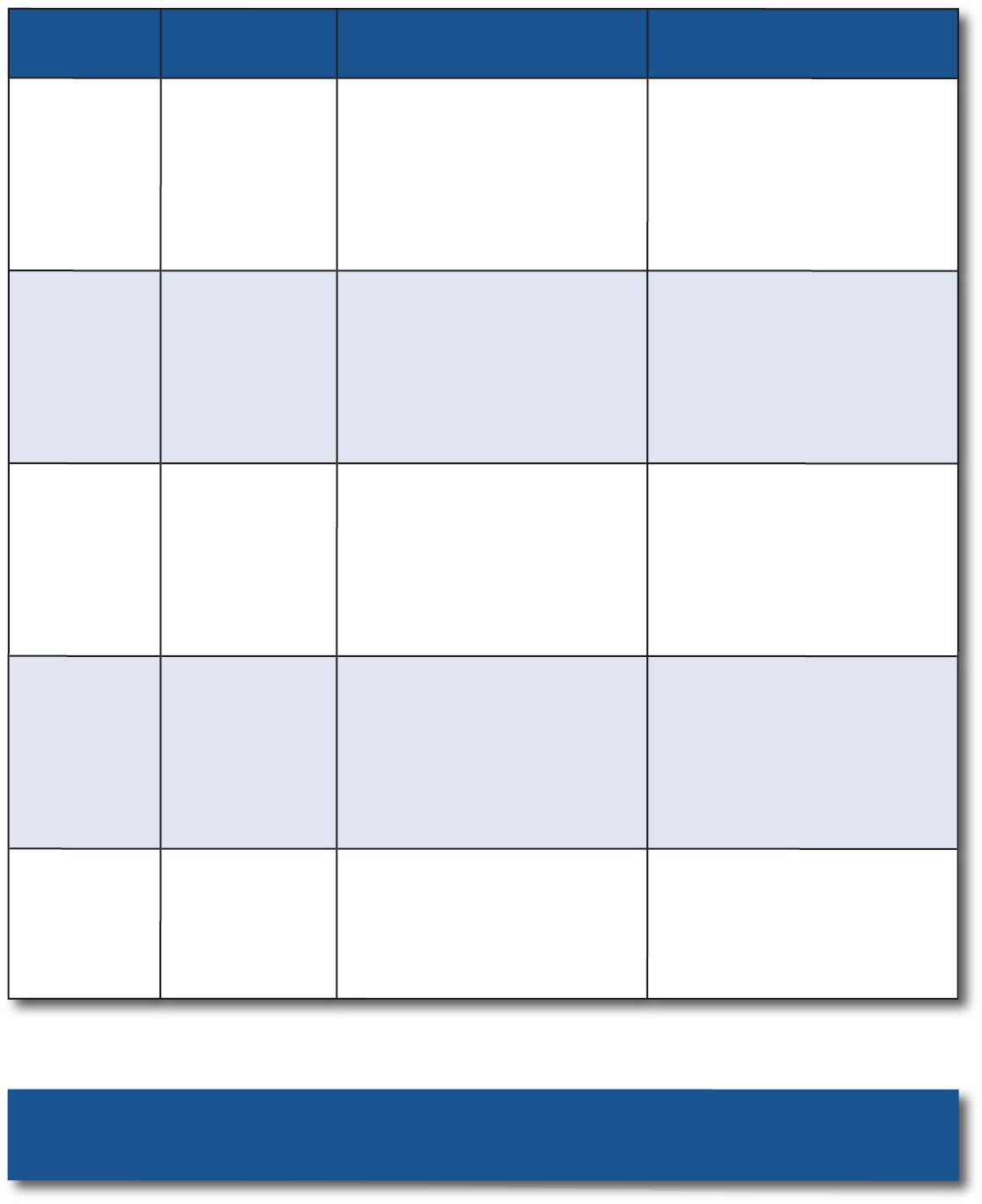

Are Distributors Interested in Your Brand?

High Interest Low Interest

Email Response

Immediate reply Delayed or no reply

CEO Engagement

Active participation Delegated to middle management

Scheduling Meeting

Flexible and easy Difficult. Conflicts.

Airport/Hotel Pick-Up

Offers to pick you up Take a taxi!

Meeting Presentation

Tailored. Prepared for you. Standard presentation

Category Research

Obtains data None

Competitive Review

Shares photos: store sets Informal comments

Store Visits

Organized/led by CEO Office meeting only

Samples

Obtains and tries samples Waits for you

Team Participation

3-6 people at meeting One person

Cell Phone

Shares private number Email address only

Questions

Addresses key issues No questions

Timeline

Meets due dates Delays

Post Meeting Follow-up

Immediate and frequent None

Proposed Plan

Detailed and fact based Brief topline

Results Winner Second place?

I have conducted hundreds of distributor interviews for multinational companies: P&G, Nestle, General Mills, Duracell, Lindt, Tabasco,

Barilla, J&J, etc. Distributor candidates all claim enthusiasm and high interest in your brand. See Export Solutions’ checklist of clues to

measure true distributor interest level.

4

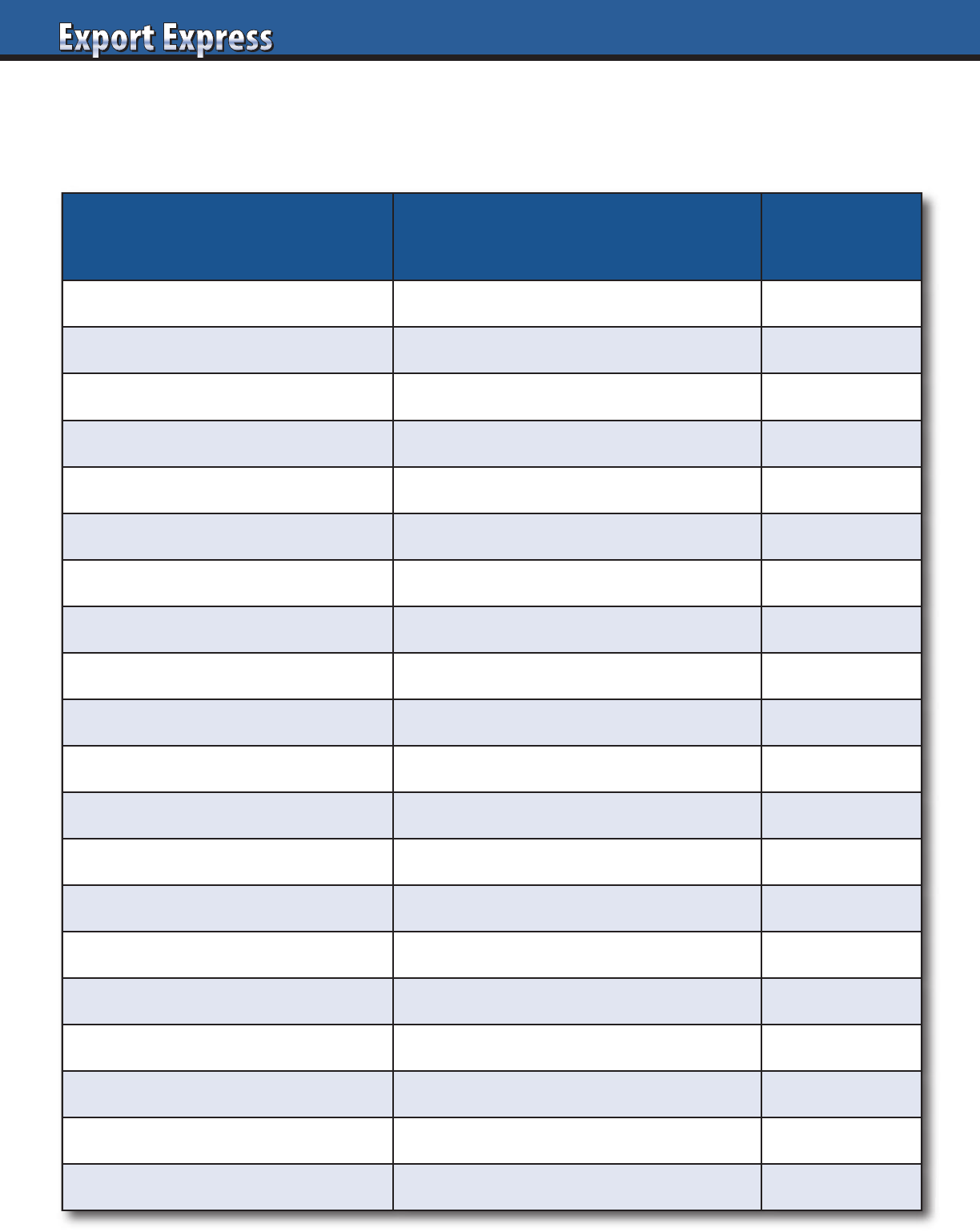

What Distributors Want to Know?

Strong distributors are overwhelmed by calls from brand owners looking for new partners. Distributors assess

each opportunity carefully, as any new brand must add incremental sales and profits and not distract from

priorities from existing brands handled. What is the “size of the prize” for the distributor?

Assessment Criteria Facts Rating (10 = Best)

Your company: size/ reputation

Existing business: sales in distributors country?

If zero “current sales,” what is realistic expectation?

Brand’s USP…your point of difference/innovation?

Size of investment plan: Marketing and Trade?

Potential distributor revenues?margin?

How does the product taste? (or peform)

How attractive/compliant is the packaging?

Pricing relative to category?

Brand success story in an adjacent country?

Competition intensity in category?

Brand range complexity?Product shelf life?

Local market research? Syndicated data?

Will brand invest in marketing and social media?

Will this be a tough product to launch?

Can we grow with the brand owner?

Your brand: core distributor category or adjacency?

Will the export manager be good to work with?

Will we be proud/excited to represent this brand?

What is the “size of the prize?”

Rating System

Rating Score

Excellent 5

Very Good 4

Average 3

Fair 2

Poor 1

Contact Greg Seminara at (001)-404-255-8387 to discuss your distributor search project.

www.exportsolutions.com

5

Criteria (weighting) Rating Evaluation Factors

Corporate Credentials 30%

Size, sales force, logistics, # employees.

Reputation (reference check existing brands).

National coverage.

Multi-channel coverage.

Category Expertise 20%

Sells brands in my category.

Shelf space for existing brands.

Current brands selling to target retailer.

Category analysis and insights.

Brand Building 15%

Ideas to build or launch my brand?

Marketing plan, cost, timing.

Success stories.

Cost to Serve 15%

Fair, transparent model relative to size

of business, brand investment, and

work required.

Enthusiasm for

My Brand 20%

Advance preparation, CEO involvement.

Follow-up on commitments.

Alignment with your vision.

X Factors: People, Admin.,

Professionalism, etc.

+/-

CPG/FMCG background for leaders.

Efficiency of scheduling meeting.

Office environment.

Do you enjoy the people?

New Distributor Assessment Grid

6

Distributor Capability Assessment

Export Solutions established 15 assessment criteria to identify “Best in Class” performers as well as “under

achievers.” Many distributor relationships extend 10 years or more. Is your distributor network still a “good fit”

for your current business requirements? Template can also be used as New Distributor Reference Check form

.

Assessment Criteria Rating: (10 = Best)

Category Expertise/Critical Mass

Focus/Time Dedicated to your Business

Joint Business Plan Development, Execution, Delivery

Alignment with Brand Owners Vision. Relationship.

Cost to Serve (fair margin, extra costs)

Assortment/Shelf Space

Promotion Creativity, Effectiveness, and Efficiency

Key Account Relations (Senior level, buyer)

Leadership/Owner (engaged & committed to us?)

Brand Manager (seniority, clout,creativity)

Multi Channel, Multi Regional Coverage

Financial Stability, Payment Record

Supply Chain Management & Forecasting

Problem Solving: rapid response?

Sales Results versus Budget, Market, Category (CY, PY, 3 Years)

7

Does Your Distributor Network Need A Check Up?

Export Solutions Can Help!

• Distributor Network Assessments

• Motivational Speeches

• International Strategy

• Find Distributors in 96 Countries

Contact Greg Seminara at [email protected] or (001)-404-255-8387.

www.exportsolutions.com

Exporters manage distributor networks extending to 20, 50, 70 countries or more!

Every company has a few distributors that under perform.

“Under achievers” prevent us from attaining our personal objectives.

Distributor Network Check Up

• Independent assessment from Export Solutions

• Establish methodology for ranking Best in Class distributors and “Laggards”

• Supply strategies for recognizing top distributors

and upgrading the bottom performers

• Benchmark external brands from your category

• Practical and “action oriented” approach

8

Segmentation Factors

Segmentation analytics will vary by company. Absolute

population is just one factor warranting consideration. Other

criteria include size of the category, proximity to your producing

plant, as well as per capita spending power. For example, most

USA based exporters sell far more to Puerto Rico, an island with

3.3 million people, than they do to China or Brasil. As a result,

some USA brand owners place a strategic focus on the Caribbean

Basin countries adjacent to the USA and process only occasional

opportunistic shipments to complex countries such as China.

Mix of Countries

Most companies can dedicate focus on a strategic launch into

only one or two “strategic” countries at a time. It’s appropriate

to create a growth plan aimed at a mix of Strategic, Priority, and

Opportunistic countries.

Market Share Expectations

Your export road map should also be adjusted based upon your

market share expectations for a select market. Generally, there

are three scenarios for a brand to pursue.

Leader: Brand investment and innovation to become

#1 in the category.

Player: Brand plans to compete effectively, obtaining a market

share of 5%-20%.

Participant: Niche. Brand objective is incremental shipments

with little/no investment.

Lessons Learned

Calibrate expectations to investments in brand support and

management oversight. Everyone wants to be a category leader

or player. To achieve this lofty status, you need to conduct local

market research, innovate, maintain competitive pricing, invest

in marketing, and align with a strong sales team just as you do in

your home market. Projects fail as certain brands want category

leadership but invest only to “niche” levels.

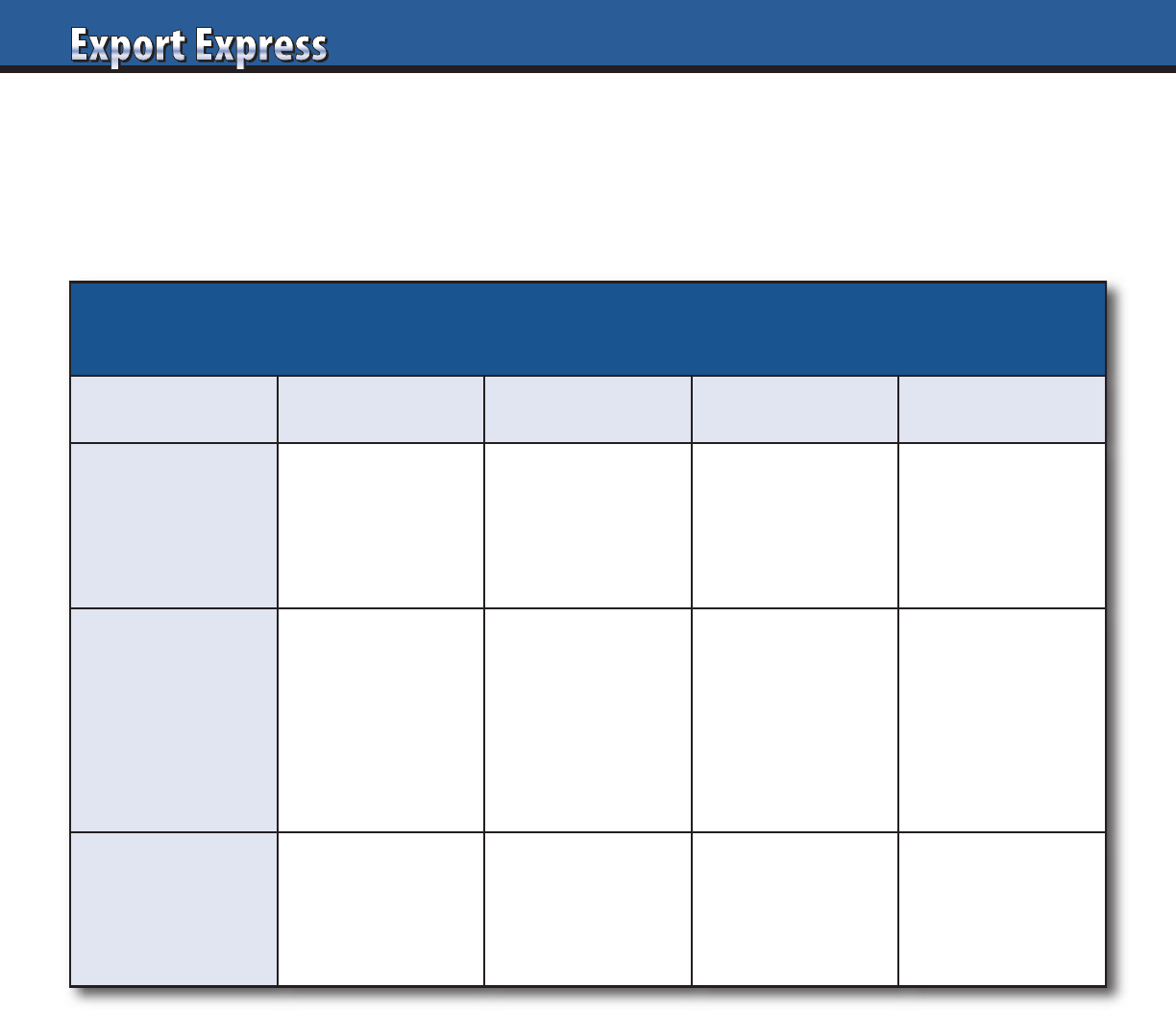

Strategic segmentation of export opportunities is “Job One” for export managers. Export Solutions divides countries into three groups:

Strategic, Priority, and Opportunistic. This approach filters countries by “size of the prize” and investments required to win. The basic

rationale is that a company should allocate different resources to develop a large country like Brasil, compared to a medium size

country like Belgium versus the Bahamas or Bermuda. Too frequently, we see companies handcuff all markets to one export program,

with common strategy, pricing, and investment models for all countries.

Country Segmentation – One Size Does Not Fit All

Country Segmentation

Country Profile Investment Required Business Model Examples

Strategic

(Focus)

Large Country

(pop. 50mm +)

High GDP

High Category BDI

Global Retailers

High Complexity

Significant Investment

in Brand support. Mar-

ket Research Manage-

ment Visibility

Local Office or Distribu-

tor or

Joint Venture

Mexico

China

Brasil

Turkey

USA

Priority

(Manage)

Mid size Country

(pop. 10 mm+)

High GDP

High Category BDI

Mid Complexity

Moderate investment

in brand support. Man-

aged by Export Manager

Distributor

Chile

Australia

Canada

S. Korea/Thailand

South Africa

Spain

Saudi Arabia

Japan

Opportunistic

(Profit)

Profitable Opportuni-

ties.

Low GDP Countries

Low Complexity

Minimal/no investment

in brand support

Distributor or

Direct to Retailer

Caribbean

Central America

Middle East

Africa

9

Distributor Market Review

Greg’s Ten Tips

1. Good news travels fast and bad news

travels slowly

2. If you want to know what’s really going

on, spend a day visiting stores

3. Pick up the phone and call a friend or business

partner versus email

4. Be positive. Think, “why not?”

5. Results are directly proportionate to your

investment: Marketing, People, Focus, Time

6. A distributor (or Broker) “respects” what the

Brand owner “inspects”

7. Shipment numbers rarely lie

8. Put it in writing

9. If two people agree on the principle of a deal,

you can usually work out the financial terms

10. There is more in common with industry

practices across the globe than differences.

Brand owners everywhere desire more shelf

presence and retailers demand more discounts.

Recognize the differences, but focus on the

universal requirement for superior products,

marketed at a fair price.

Criteria Rating Evaluation Factors

Shipment Results

Overall growth for our industry in your market?

Distributor company wide sales performance (all

brands)?

Distributor sales results for my brand?

Change vs. benchmarks?

Brand Performance

Key brand performance versus overall category.

Shipment growth, market share, weighted distribution.

New item success.

Key Account Results

Results at top 3-5 accounts (or channels).

Improvements: new items, shelf presence,

merchandising.

Are we getting “fair share” of retailers growth?

What Worked?

Strategies or performance that achieved results.

Ideas that delivered incremental sales.

Key Issues?

Problems or barriers to achieving results.

Pricing, investment, competition.

People

Performance by key people touching our business.

Organizational changes? Who made a difference?

Financial

Distributor’s financial health. Planned investments.

Efficiency opportunities in Partnership.

2022 Requirements

Resources required to achieve 2022 shipment expectations.

Critical activities, timelines, changes to structure/plan.

10

Export Manager Report Card

Assessment Criteria Considerations

Rating:

(10 = Best)

Annual Plan Development, Execution, Delivery • Aligned, reliable, committed

Export Experience – Food/Consumer Products • New to 20 years +

Ability to Influence Distributors • Focus on your priorities

Pioneers New Business • From concept to containers

Work Ethic • Office time vs. overseas trips?

International Citizenship • Language skills, cultural alignment

Category Knowledge • Viewed as expert: buyers, distributors

Business Leadership • Partners with internal functions

Distributor Relationships • From sales reps. to owner

Thought Leadership • Creates and shares best practices

Export Strategy • Logical vision and road map

Profitable, Sustainable, Exports • Sells profitable cases

Retail Store Conditions • Brand presence vs. market share?

Brand Building – Promotions • Creativity, effectiveness, efficiency

Problem Solving – Response Time • Same day to one week?

Customer Relations • Senior access at top retailers

Analytical Skills: Shipments, Nielsen • Trends, opportunities, plan

Digital Savvy • E-commerce, social media

Supply Chain Management & Forecasting • Accuracy and efficiency

Results vs Budget, Market,

Category (CY, PY, 3 Years)

• Flat to 10% +

11

Export Solutions’ New Distributor Checklist

____ Contract/Agreement

____ Price Calculation Model

____ Business Plan: objectives, marketing,

spending, key dates

____ Category Review: Pricing, Shelf,

Assortment, Merchandising

____ Label Compliance

____ Shelf Life

____ Order Lead Time

____ Minimum Order

____ Pick up Point

____ Payment Terms

____ Payment Currency

____ Damage Policy

____ Product Registration

____ Forecast: Year 1

____ Pipeline Order & Inventory

____ Brand Facts

____ Product Samples

____ Appointment Letter

____ Brand Specifications in System:

Distributor & Customers

____ Training: Key Account Managers,

Retail, Administrative Staff, Warehouse

____ In Store Standards: Pricing, Shelf

Management, Merchandising

____ FAQ’s/Handling Common Objections

____ Key Account Presentation

____ Customer Appointment Dates

____ Category/Business Review:

Tailored to Each Key Account

____ Retail Sales Contest

____ Checkpoint Calls

____ Market Audit Date

____ Reporting: Track Distribution, Pricing,

Shelf Positioning, Merchandising, etc.

Talk to an Expert

• Find Distributors in 96 Countries

• International Strategy Road Map

• Fix Problem Markets

• Entry Plans

• Export Workshops

• Motivational Meeting Speaker

Contact Greg Seminara at (001)-404-255-8387 to discuss your business development project.

www.exportsolutions.com

12

Distributor Search Helper for:

Your

Logo

Here

Can We Help You?

Recent Distributor Search Projects

Asia Europe Middle East Latin America

Australia Germany Israel Argentina

China Ireland Kuwait Brazil

Indonesia Netherlands Qatar Colombia

Japan Nordics Saudi Arabia Costa Rica

Malaysia Spain UAE Ecuador

Philippines United Kingdom North America Mexico

Singapore Africa Canada Panama

South Korea South Africa United States Peru

Call the Export Accelerator!

Contact Greg Seminara at greg@exportsolutions.com

to discuss your business development project.

www.exportsolutions.com

Country Listing Map – USA Example*

“Required Template for Every Country”

13

Create Your Own Export Library

Distributor Search Guide

Export Handbook

Selling to USA Handbook

Distributor Management Guide

Finance & Logistics

All guides available free at www.exportsolutions.com in the Export Tips section.

Idea Guide:

New World – New Business

Export Treasure Chest

My Favorite Templates & Forms

People Power

Strong Teams Build Great Brands

Retailer Stores SKU 1 SKU 2 SKU 3 SKU 4 SKU 5 Comments/Plans

Walmart SC 3,571 x x x

SKU 1, 2, 3 stocked at only

2,000 Supercenters

Costco 575 x Special SKU 5 for Costco

Kroger 2,726 x x x x Category Review March

Albertsons 2,278 x x x New shelf set

Publix 1,300 x x x BOGO Ad November

Ahold-FL 2,050 x x x x New SKU 4 listing

HEB - USA 355 x x x Category Review March

Meijer 260 x x x x Holiday Display Program

Shop Rite 361 x x x x New SKU 4 listing

Giant Eagle 216 x x x SKU 4 delisted

*Instructions: List top 10 customers for every country. List all your key SKUs (items).

“X” indicates item stocked at customer. Blank space represents a distribution void.

14

Preferred Supplier Scorecard

Distributors deliver their best results for their favorite principals. How do you rank?

Supplier Assessment Considerations

Rating:

(10 = Best)

Annual Sales Revenue • Percent of total distributor sales

Annual Profit Generated ($)

• Net sales times gross margin

Years of Service • New to 20 years or more

Compound Annual Growth Rate

• Flat to 10% or more

Supplier Investment Level • Zero to 25% of sales

Celebrates Success

• Awards, dinner, thank you notes

Shares Best Practices

• Serves as category expert

Logistics Service Level

• Target 98% on time, complete orders

Visits Retail Stores

• Never to full day every visit

Reimbursement of Billbacks • 2 weeks to 3 months

Senior Management Relationship • None to long term partners

Export Manager Experience • New hire to 10 years or more

Response Time • Same day to one month

Supports Distributor’s Ideas

• Invests in local ideas

Good on Customer Calls

• Avoids calls to customer favorite

Admin Requirements • Orders only to multiple reports

Supplier Visit Frequency • Never to weekly

Relationship: Entire Team • Finance, logistics, administration

Respects Fair Profit for Distributor • Healthy distributor is profitable

Achieves Joint Business Targets • Creates culture of success

15

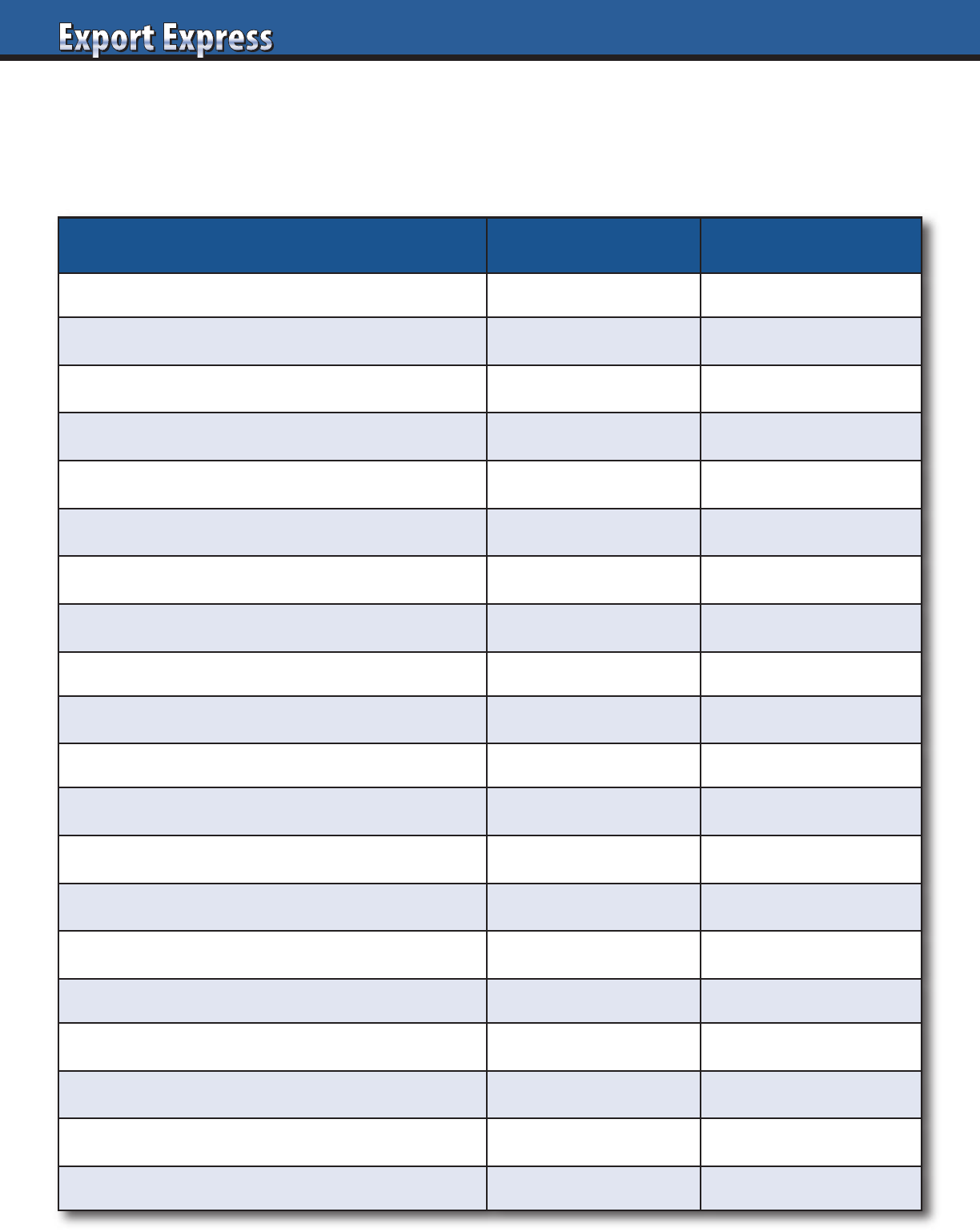

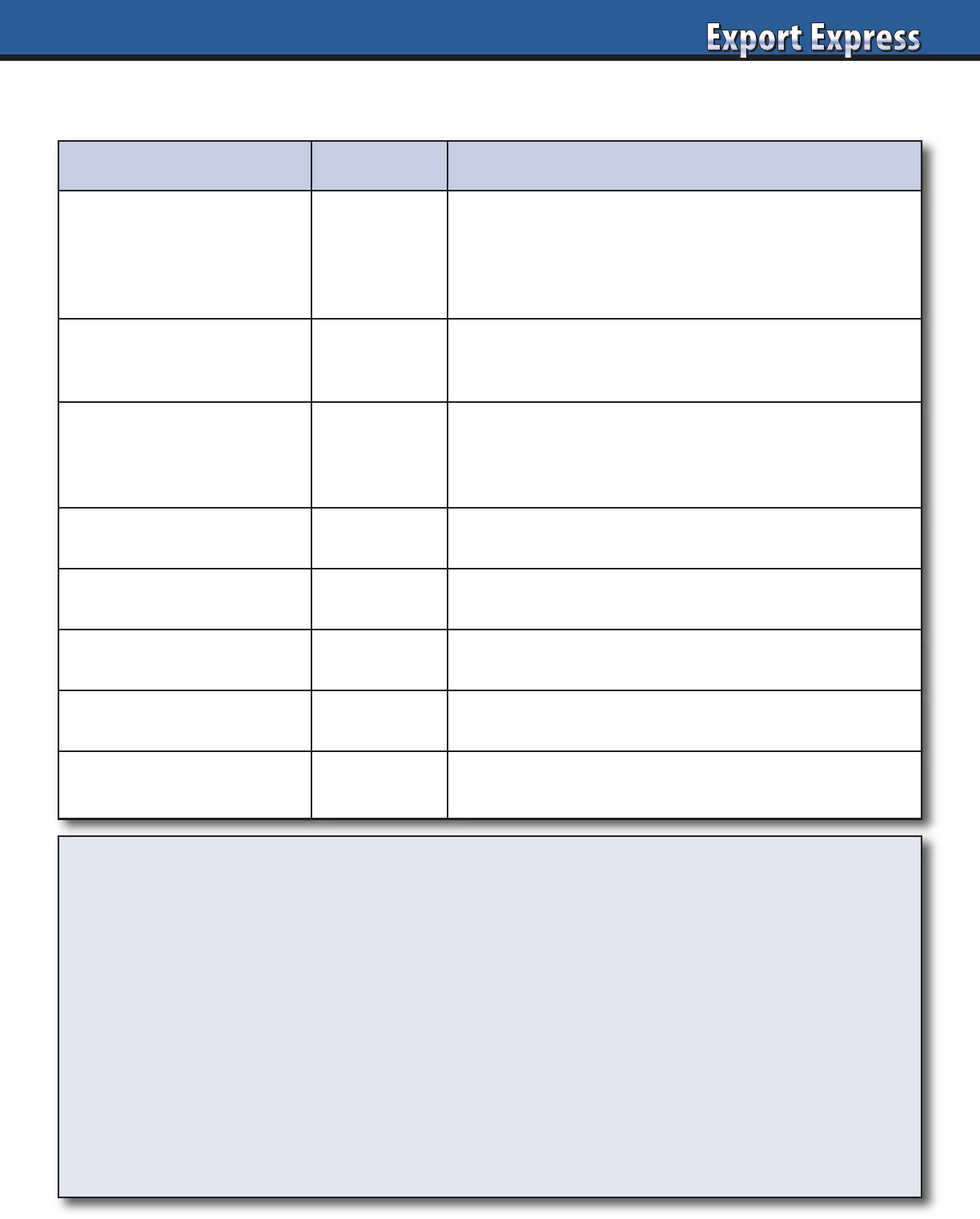

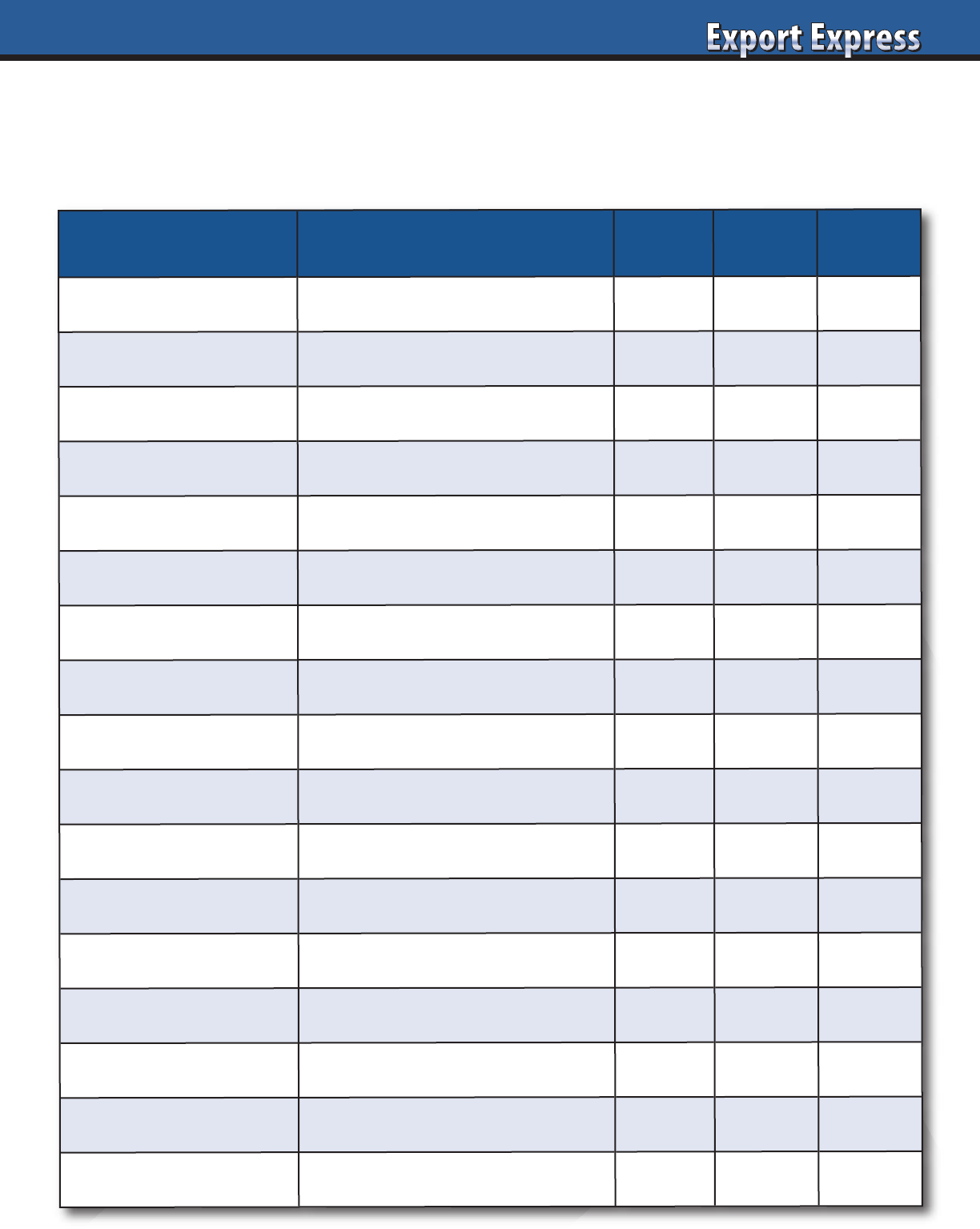

Export Reports: Format and Frequency

Every exporter requires certain reports to manage the business.

Productivity is enhanced when distributor focuses on selling activities versus compiling a stack of reports.

Everything functions better when reports are filed on a regular schedule.

Report

Description

Monthly

Quarterly

Annually

Distributor “Sell Out”

Distributor sales to customers

x

Sales Forecast

Rolling 90-180 days

x

Distributor Inventory

Weeks supply on hand, by sku

x

Sales Versus Budget

Progress vs. annual objective

x

KPI Dashboard

Coverage, Displays, Distribution, etc.

x

Listing Map/Plans

Brand/sku authorization, by customer

x

Promotion Tracking

Calendar, budget, payments, lift

x

New Product Launch Status

Acceptance by key customer

x

Category Review (Nielsen ?)

Category trends

x

Retail Price Survey

Top 10 customers

x

Competitive Activty

New launches, innovation

x

Distributor Credentials

Distributor “standard” presentation

x

Credit Report

Financial update

x

Distributor Value Chain

Factory gate to store shelf

x

Annual Business Plan

Agreed road map to achieve objectives

x

Retailer Business Review

Top 5 retailers

x

List of Top 10 Customers

Plus your buyers name

x

Strategic Export

Development Program

Export Passport

Export Passport

16

Distributor Search Challenge

• Some distributors are too big…

• Other distributors are too small!

3

Export Passport identifies

Prime Prospect distributors

that represent the Right Fit

17

18

Exporter Classification*

Type Description

Export Profile

10 Multinational Strong market share everywhere across multiple categories.

9 Global Multinational. Mix of leading countries and niche participation.

8 Category Champion One core mass category. Strong performance globally.

7 Icon Well known, niche leader. Global availability. Example: Tabasco.

6 Regional Leader Strong share across one continent/region. Some export success.

5 National Hero National treasure, #1 brand. Exports to homesick expats, tourists.

4 Player Respectable share in home country. Opportunistic exports.

3 Participant “Me too” product. Opportunistic exports. “Trader”/private label.

2 Challenger Innovator. Some listings in home country. New to export.

1 Start-up Trying to get traction in home country. Export “dreamer.”

*Export Solutions’ classification system

19

Distributor Classification*

Stars

Title

Description

Prime Prospects

HHHHH

Champion

Massive distributor.

Handles multinational/#1

brands across many

categories.

Brand leaders.

$$$ marketing budgets.

Exporter types: 6-10

HHHH

Captain

Category Captain.

Handles leading brands in

one segment.

Category

innovators/leaders.

$$ marketing budgets.

Exporter types: 5-9

HHH

Player

Mid-size distributor.

Handles #2/3 brands or

niche leaders across many

categories.

Differentiated,

premium brands.

$-$$ marketing budgets.

Exporter types: 4-7

HH

Participant

Respected local.

Diversified product

portfolio.

Results equal to investment.

Flexible, challenger brands.

$ marketing budget.

Exporter types: 2-4

H

Pioneer

Small distributor.

Entrepreneurial, open to

innovative new companies.

Start-up brands.

“Pay as you go” marketing.

Exporter types: 1-3

Need more information? Visit www.exportsolutions.com.

*Export Solutions’ classification system

Searching for New Distributors?

Export Solutions makes life a little easier for more than 3,000 export managers.

Our time saving distributor database serves as a “helper” for identifying more

than 9,200 qualified, local brand builders in 96 countries.

“Select Your Distributors,

Do Not Let Your Distributors Select You”

www.exportsolutions.com

Search by Country, Category, or Country of Origin

20

Local Experts

Distributor Coverage

Asia: 2,030

Europe: 3,139

Latin America: 1,574

Middle East: 937

USA/Canada: 1,464

Category Experts

Distributor Coverage

Beverage: 1,691

Candy/Snack: 2,713

International Food: 3,276

Health & Beauty: 1,800

Natural Food: 837

Country Experts

Distributor Coverage

German Brands: 648

Italian Brands: 1,397

UK Brands: 682

USA Brands: 1,189