Insights to Accelerate International Expansion

Scorecard Guide

Our Mission: Help Manufacturers “Spend time Selling to Distributors versus Searching for Distributors”

In This Issue

Sell to 96 Countries

Looking for new customers and

distributors in international markets?

Export Solutions’ distributor database

covers more than 9,200 distributors

in 96 countries. Our database features

extensive coverage of leading food,

confectionery, and beverage distributors.

New! Export Solutions’ retailer database

now tracks 2,700 retailers in 96 countries.

Order now at www.exportsolutions.com.

Export development has evolved from

opportunistic shipments to foreign

countries to strategic brand building.

This requires a new level of business

management for companies desiring to

take their international business to the

next level. The distributor community

experienced radical changes, with

a big gap between “Best in Class”

performers and old school traders who

just buy and resell. Export Solutions’

new guide provides valuable

scorecards and templates to calibrate

performance by your distributor teams.

Each distributor includes functional

experts responsible for key account

sales, brand management, logistics,

and merchandising. Export Solutions’

scorecards supply assessment templates

analyzing performance across a

minimum of fifteen key attributes

required for succeeding in each area.

All distributors claim good relationships

with their largest customers. Our

scorecard provides metrics to calibrate

distributor effectiveness at translating

buyer contacts into tangible results.

Establishing a network of strong

distributors is “job one” for most export

managers. Our scorecards provide a

practical methodology to recognize your

top distributor performers as well as

underachievers who impact your ability

to achieve your own personal targets.

This guide shares detailed criteria for

evaluating potential new distributors .

A listing map is the one form required

for each country. This chart captures

authorized listings by sku at the top 8-10

customers in each country. Companies

record sales at the moment they secure

in-store placement. Listing maps focus

and track this essential element in the

store coverage cycle. Coming soon:

Export Solutions’ Retailer Database

tracking 2,700 retailers in 96 countries,

including store counts by customer.

3 Distributor respects what the principal inspects.

3 KPI’s separate boardroom promises from retail reality.

3 Listing map: critical one page road map for every country.

3 Good news travels fast. Bad news travels sloooooowly.

3 The shelf doesn’t lie!

Greg's Guidance

Page 2

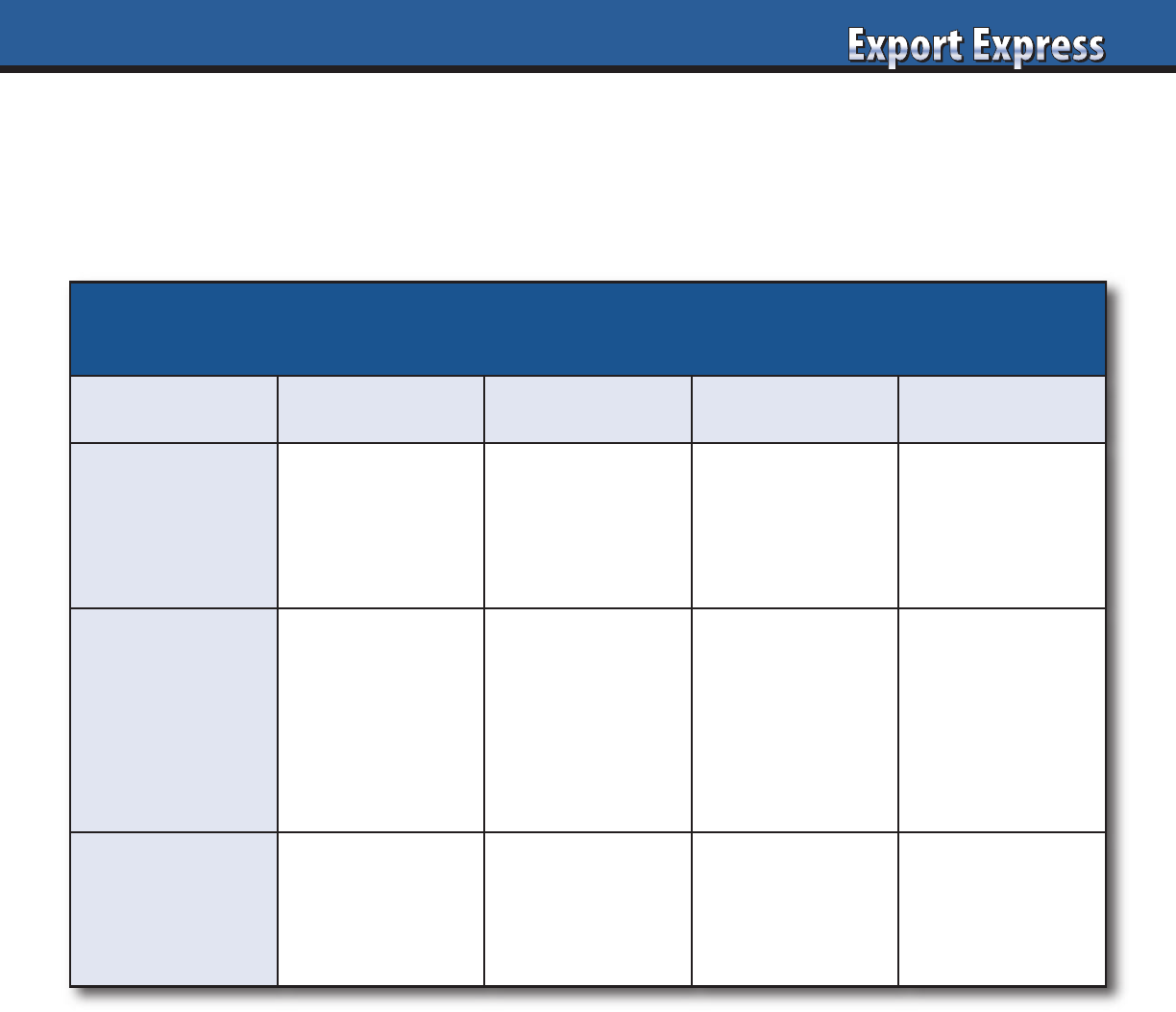

Distributor Market Review

Page 3

Distributor Capability Assessment

Page 10

Customer Relationship Assessment

Page 19

Ten Questions:

Developing your Cooperation Model

Page 23

Field Sales

– Capability Assessment

Page 31

FAQ’s – Retailer Database

Page 36

Cost Calculation Assessment

Page 38

Preferred Supplier Scorecard

Page 48

Introduction to Export Catalyst

Scorecard: What’s Measured is Treasured!

2

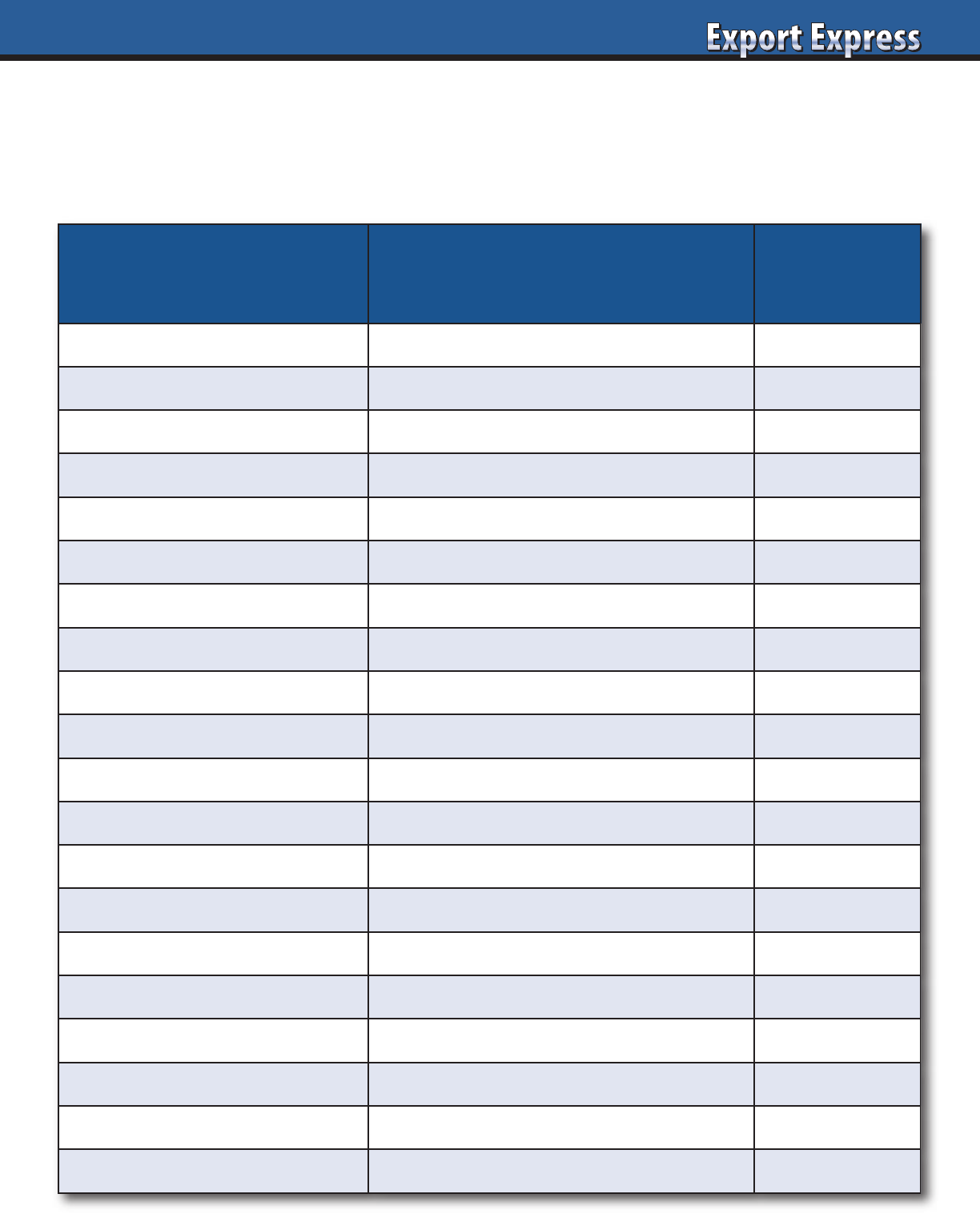

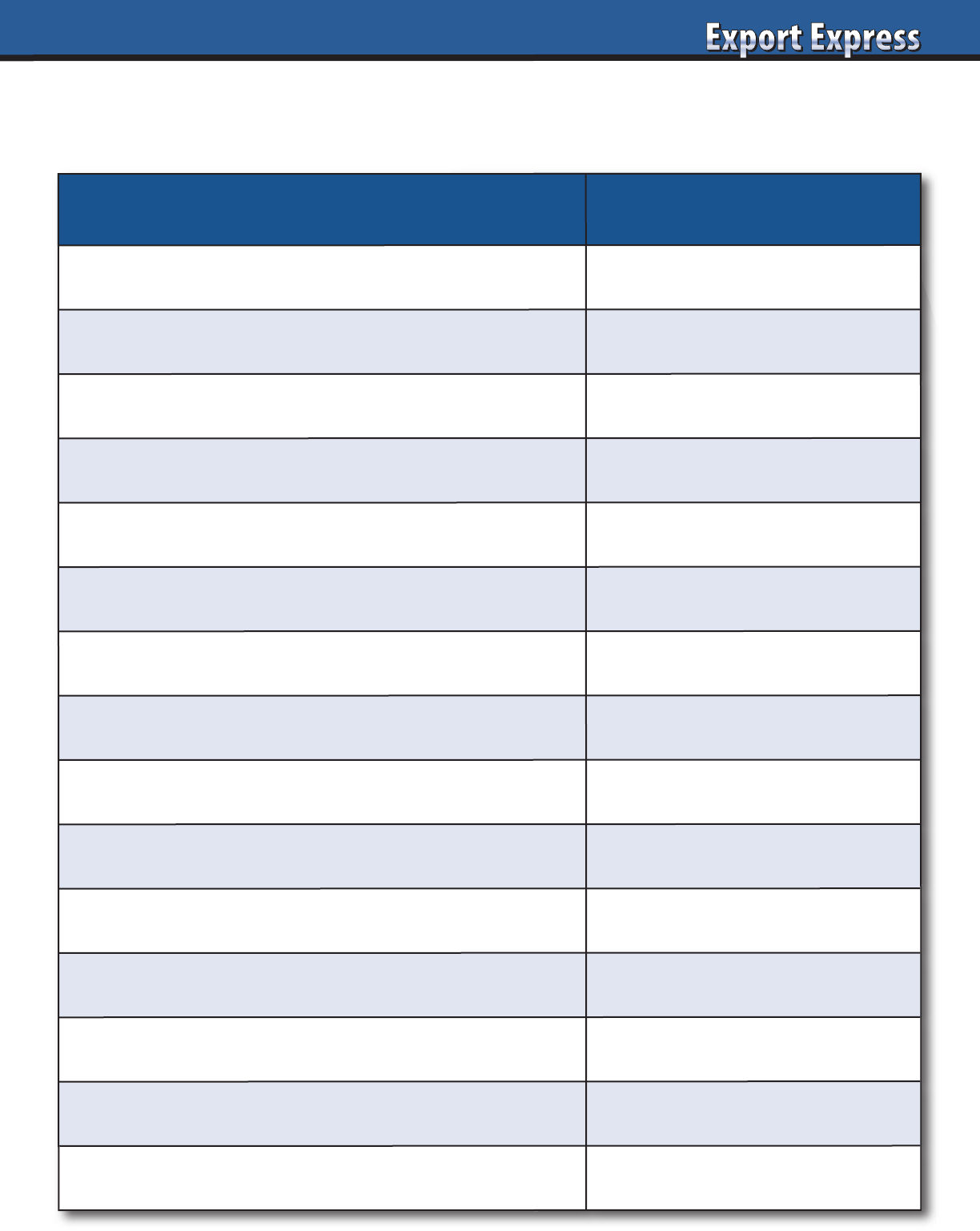

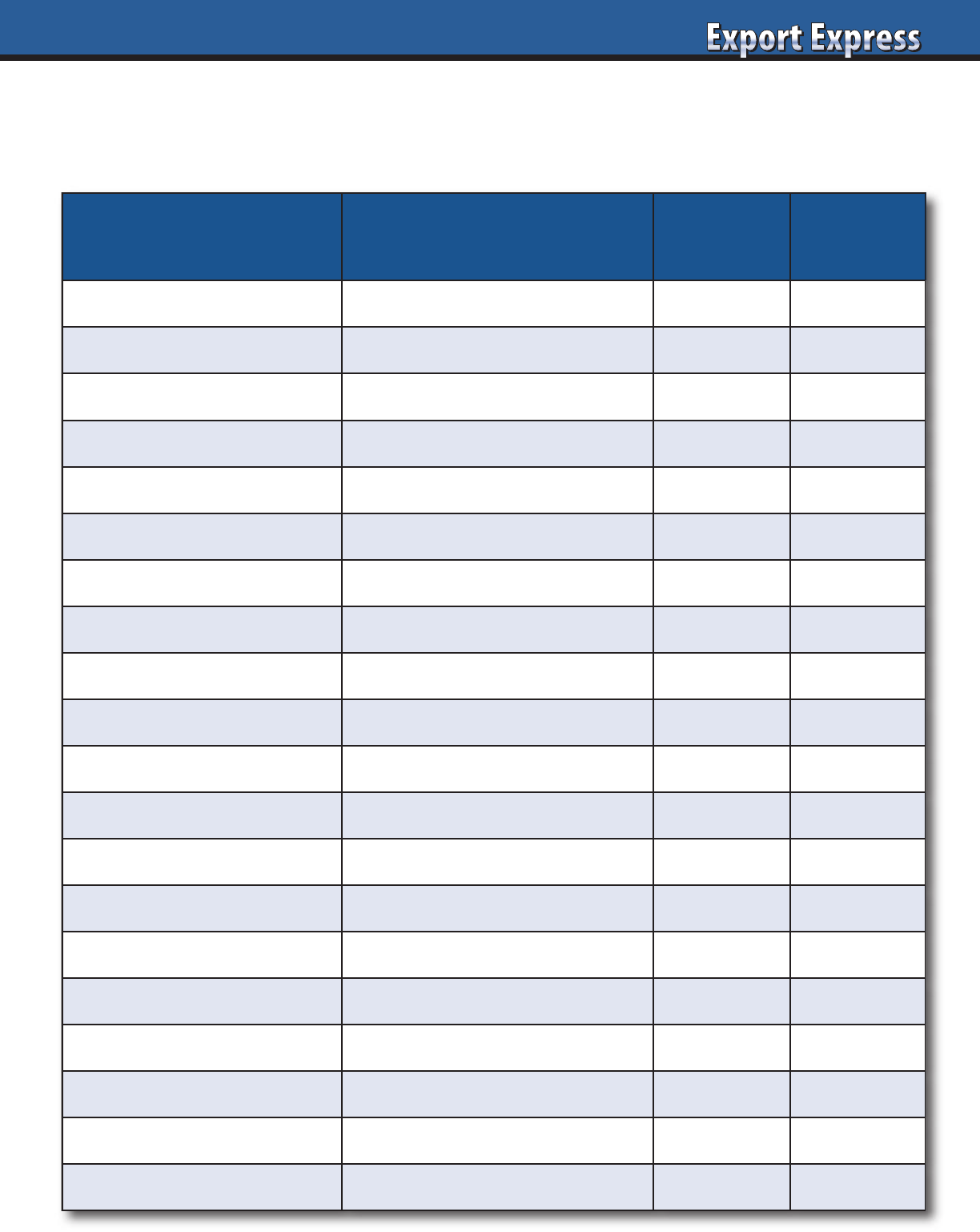

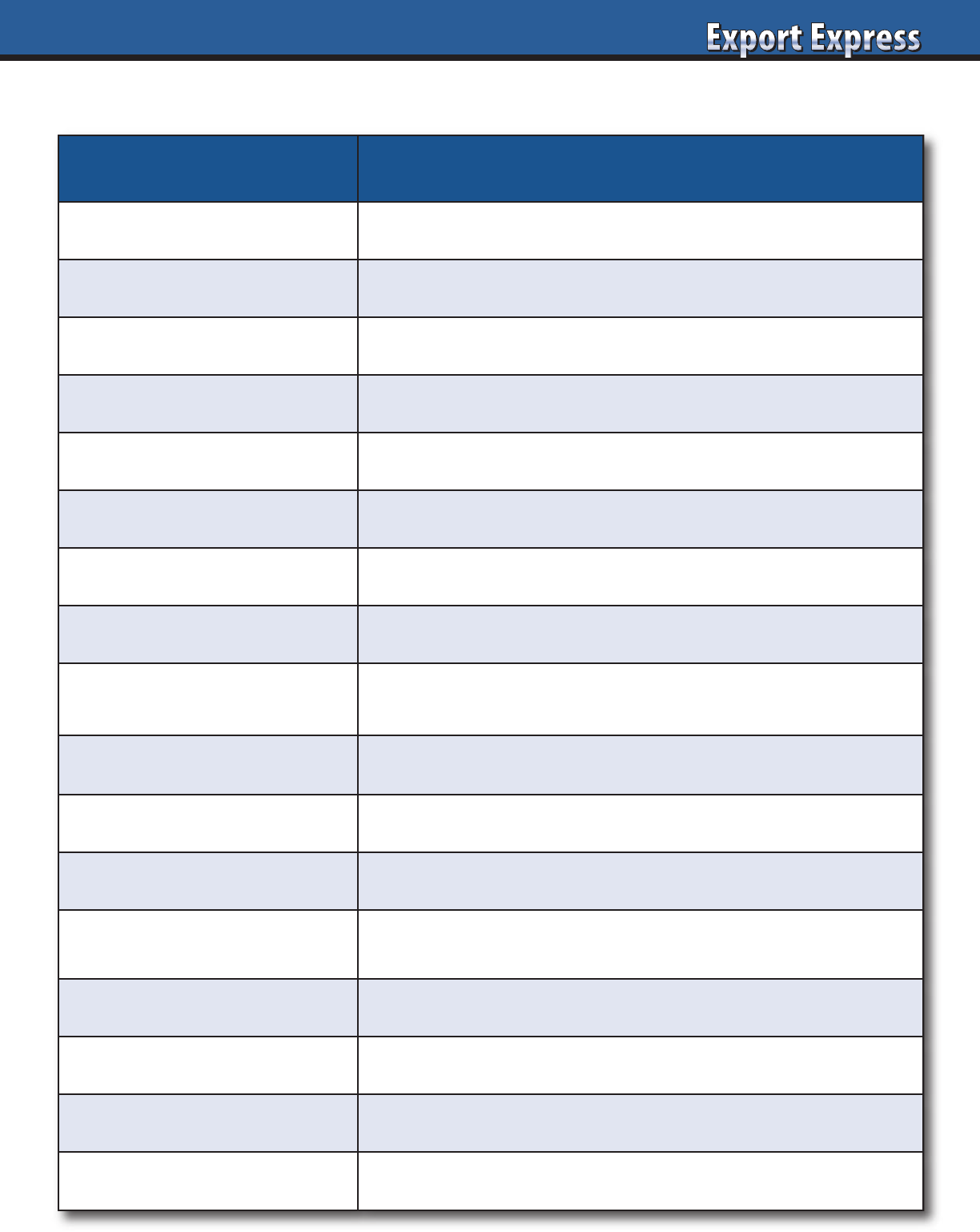

Criteria Rating Evaluation Factors

Shipment Results

Overall growth for our industry in your market?

Distributor company wide sales performance (all

brands)?

Distributor sales results for my brand?

Change vs. benchmarks?

Brand Performance

Key brand performance versus overall category.

Shipment growth, market share, weighted distribution.

New item success.

Key Account Results

Results at top 3-5 accounts (or channels).

Improvements: new items, shelf presence,

merchandising.

Are we getting “fair share” of retailers growth?

What Worked?

Strategies or performance that achieved results.

Ideas that delivered incremental sales.

Key Issues?

Problems or barriers to achieving results.

Pricing, investment, competition.

People

Performance by key people touching our business.

Organizational changes? Who made a difference?

Financial

Distributor’s financial health. Planned investments.

Efficiency opportunities in Partnership.

2022 Requirements

Resources required to achieve 2022 shipment expectations.

Critical activities, timelines, changes to structure/plan.

Distributor Market Review

Greg’s Ten Tips

1. Good news travels fast and bad news

travels slowly

2. If you want to know what’s really going

on, spend a day visiting stores

3. Pick up the phone and call a friend or business

partner versus email

4. Be positive. Think, “why not?”

5. Results are directly proportionate to your

investment: Marketing, People, Focus, Time

6. A distributor (or Broker) “respects” what the

Brand owner “inspects”

7. Shipment numbers rarely lie

8. Put it in writing

9. If two people agree on the principle of a deal,

you can usually work out the financial terms

10. There is more in common with industry

practices across the globe than differences.

Brand owners everywhere desire more shelf

presence and retailers demand more discounts.

Recognize the differences, but focus on the

universal requirement for superior products,

marketed at a fair price.

3

Distributor Capability Assessment

Export Solutions established 15 assessment criteria to identify “Best in Class” performers as well as “under

achievers.” Many distributor relationships extend 10 years or more. Is your distributor network still a “good fit”

for your current business requirements? Template can also be used as New Distributor Reference Check form

.

Assessment Criteria Rating: (10 = Best)

Category Expertise/Critical Mass

Focus/Time Dedicated to your Business

Joint Business Plan Development, Execution, Delivery

Alignment with Brand Owners Vision. Relationship.

Cost to Serve (fair margin, extra costs)

Assortment/Shelf Space

Promotion Creativity, Effectiveness, and Efficiency

Key Account Relations (Senior level, buyer)

Leadership/Owner (engaged & committed to us?)

Brand Manager (seniority, clout,creativity)

Multi Channel, Multi Regional Coverage

Financial Stability, Payment Record

Supply Chain Management & Forecasting

Problem Solving: rapid response?

Sales Results versus Budget, Market, Category (CY, PY, 3 Years)

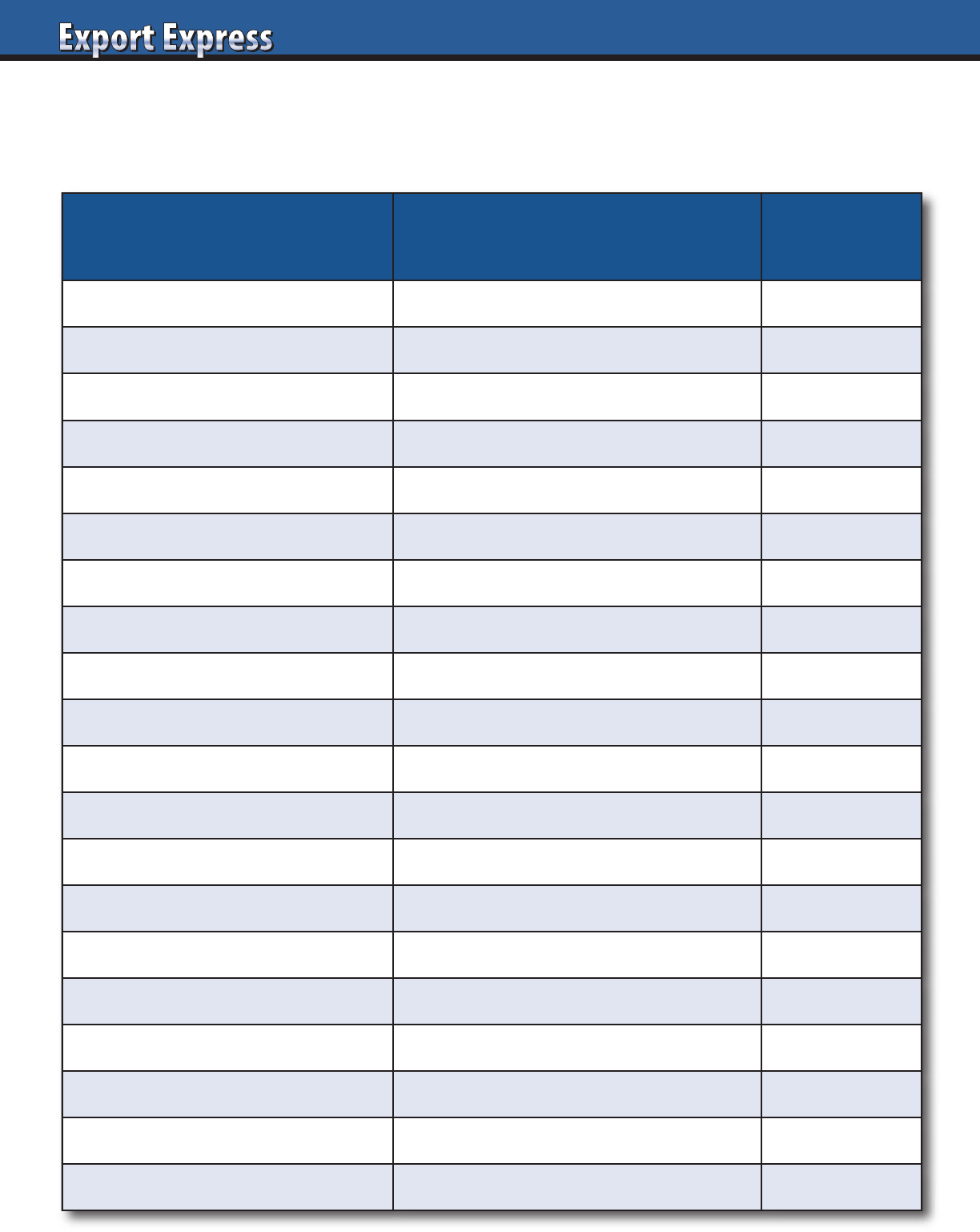

Criteria (weighting) Rating Evaluation Factors

Corporate Credentials 30%

Size, sales force, logistics, # employees.

Reputation (reference check existing brands).

National coverage.

Multi-channel coverage.

Category Expertise 20%

Sells brands in my category.

Shelf space for existing brands.

Current brands selling to target retailer.

Category analysis and insights.

Brand Building 15%

Ideas to build or launch my brand?

Marketing plan, cost, timing.

Success stories.

Cost to Serve 15%

Fair, transparent model relative to size

of business, brand investment, and

work required.

Enthusiasm for

My Brand 20%

Advance preparation, CEO involvement.

Follow-up on commitments.

Alignment with your vision.

X Factors: People, Admin.,

Professionalism, etc.

+/-

CPG/FMCG background for leaders.

Efficiency of scheduling meeting.

Office environment.

Do you enjoy the people?

Rating System

Rating Score

Excellent 5

Very Good 4

Average 3

Fair 2

Poor 1

Contact Greg Seminara at (001)-404-255-8387 to discuss your distributor search project.

www.exportsolutions.com

Export Solutions Distributor Assessment Grid

4

5

How to be Distributor of the Year

Assessment Criteria Considerations

Rating:

(10 = Best)

Results vs Plan, Market, Category • Reliable, 5 to 10% + growth

Retail Store Conditions • Brand presence exceeds market share

Brand Manager • “A” player, dedicated resource

Cost to Serve • Fair margin, based upon size, complexity

Omni Channel • Channel teams, e-commerce focus

Fun • Do you enjoy the people, country?

Financial • Prompt payments, accurate billbacks

Problem Solving – Response Time • Same day service, sense of urgency

CEO • Loves your brand, engaged

Pioneers New Business • From concept to cases

Supply Chain Management & Forecasting • Accurate, efficient

Customer Relations • Senior access at top retailers

Category Knowledge • Viewed as expert by buyers

Profitable Partner • Sells profitable cases

Analytical Skills: Shipments, Nielsen • Trends, opportunities, plan

Team (Finance, IT, Logistics) • Cross functional expertise

Digital Savvy • Social Media team, pioneers new tools

Reporting • On time, complete, accurate

Best Practices • Creative idea source for other markets

Cultural Alignment • Perfect fit with brand owner’s vision

6

Export Manager Report Card

Assessment Criteria Considerations

Rating:

(10 = Best)

Annual Plan Development, Execution, Delivery • Aligned, reliable, committed

Export Experience – Food/Consumer Products • New to 20 years +

Ability to Influence Distributors • Focus on your priorities

Pioneers New Business • From concept to containers

Work Ethic • Office time vs. overseas trips?

International Citizenship • Language skills, cultural alignment

Category Knowledge • Viewed as expert: buyers, distributors

Business Leadership • Partners with internal functions

Distributor Relationships • From sales reps. to owner

Thought Leadership • Creates and shares best practices

Export Strategy • Logical vision and road map

Profitable, Sustainable, Exports • Sells profitable cases

Retail Store Conditions • Brand presence vs. market share?

Brand Building – Promotions • Creativity, effectiveness, efficiency

Problem Solving – Response Time • Same day to one week?

Customer Relations • Senior access at top retailers

Analytical Skills: Shipments, Nielsen • Trends, opportunities, plan

Digital Savvy • E-commerce, social media

Supply Chain Management & Forecasting • Accuracy and efficiency

Results vs Budget, Market,

Category (CY, PY, 3 Years)

• Flat to 10% +

7

“The Right Way” – New Country Launch

Retail buyers and distributors are receptive to brand launches from multinationals. Why?

Multinationals succeed, as they introduce new products “The Right Way.” Export Solutions recaps

30 components of launching “The Right Way.” Exporters create magic with limited budgets!

Winners check as many boxes as possible on “The Right Way” scorecard.

Product Retailer

o Meaningful innovation – not “me too” o Boost category sales, margin, and profit

o Consumer market research insights o Syndicated data (Nielsen) – category facts

o Technical confirmation of product differentiation o Invest in retailer “push” programs

o Reasonable retail price – premium (not sky high) o 4-6 high value promotional events per year

o Test market results – similar country or retailer o Retailer VP, distributor CEO at intro call

Marketing Excitement

o 360 marketing plan: TV, in-store, social, PR o Launch party – memorable location

o Sampling o PR, social media, trade press

o Social media o Celebrity endorsement

o Displays: end of aisle and shelf blocks o Distributor sales contest

o Special offers – retailer fliers o Donation to local charity

Team Scorecard

o Distributor – best in class, category expert o Year 1: invest; year 2: break even; year 3: profit

o Local manager – launch oversight o Sales volume (retail sell-out)

o Marketing, social media, PR agencies o Market share

o Brand/technical resource from headquarters o Retail availability (weighted distribution)

o Total distributor engagement: reps. to CEO o Year 2 commitment and enthusiasm

Searching for New Distributors?

Export Solutions makes life a little easier for more than 3,000 export managers.

Our time saving distributor database serves as a “helper” for identifying more

than 9,200 qualified, local brand builders in 96 countries.

“Select Your Distributors,

Do Not Let Your Distributors Select You”

www.exportsolutions.com

Search by Country, Category, or Country of Origin

8

Local Experts

Distributor Coverage

Asia: 2,030

Europe: 3,139

Latin America: 1,574

Middle East: 937

USA/Canada: 1,464

Category Experts

Distributor Coverage

Beverage: 1,691

Candy/Snack: 2,713

International Food: 3,276

Health & Beauty: 1,800

Natural Food: 837

Country Experts

Distributor Coverage

German Brands: 648

Italian Brands: 1,397

UK Brands: 682

USA Brands: 1,189

Distributor E-Commerce Scorecard

Assessment Criteria Considerations

Rating:

(10 = Best)

Distributor CEO Commitment • Investment, engagement, and patience

E-Commerce as Percent Total Sales • How big is e-commerce for distributor?

E-Commerce 2021 Growth Rate • Results: 2022 trends? 3 year CAGR?

2022 E-Commerce Growth Objective • Benchmark versus overall country growth

E-Commerce Team • Dedicated? Experience? “A Players?”

E-Commerce Analysts • Dedicated or shared?

Digital Marketing Manager • Experience? Budget? Examples?

Logistics: Fulfillment Capability • Solution to deliver by unit?

Top E-Commerce Customers • Coverage, penetration?

Amazon: Treated as Key Account? • 2021 sales, trends, items listed

# Items Sold: Your Brand • Listed items at major retailer like Amazon

# Items on Page 1 or 2: Your Brand • Listed items on page 1 or page 2?

Your Brand Share: Page 1 or 2 • Category share of items on page 1 or page 2?

Category Sales Ranking: Your Brand • Sales rank for key items

# Customer Reviews: Your Brand • Total number of reviews for your brand

# Positive Reviews: Your Brand • Number/percent of 4 and 5 star reviews

Reputation Management • Responsiveness to consumer feedback

Percent Third Party Sales: Your Brand • Sales trends through 3rd party merchants

Special Packs • Capability to create e-commerce packs

Pricing: E-Commerce vs. Retail • Pricing equilibrium: retail and e-commerce

E-commerce development and digital marketing expertise is a top priority.

International distributors must establish a plan and demonstrate patience.

Are your distributors e-commerce leaders, performers, or laggards?

9

10

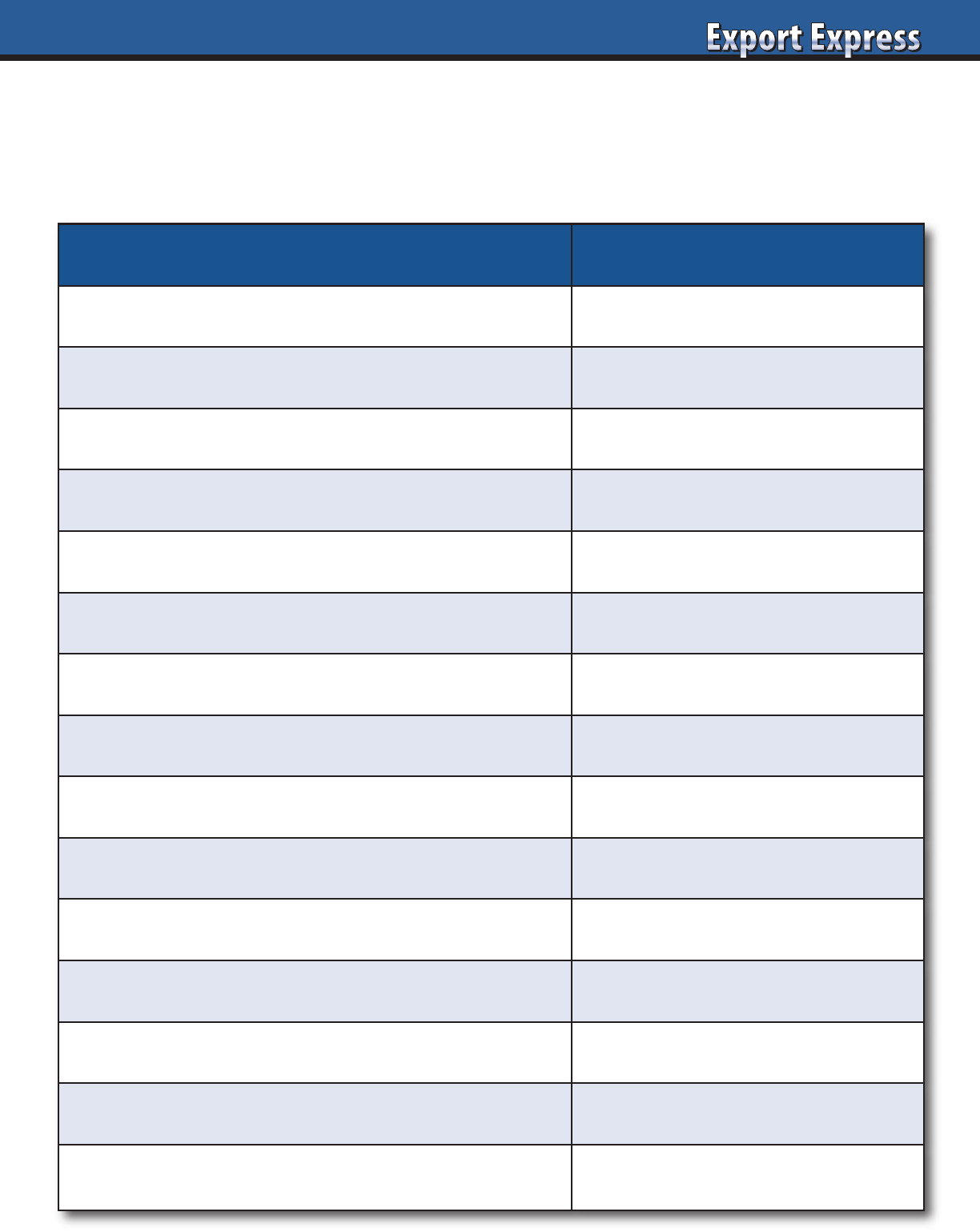

Customer Relationship Assessment

All distributors claim strong relationships with their biggest customers. Below is Export Solutions’ template

for evaluating distributor key account relationships. Best way to evaluate distributor relationships? Your

company’s market share and volume growth at the customer versus the balance of the market!

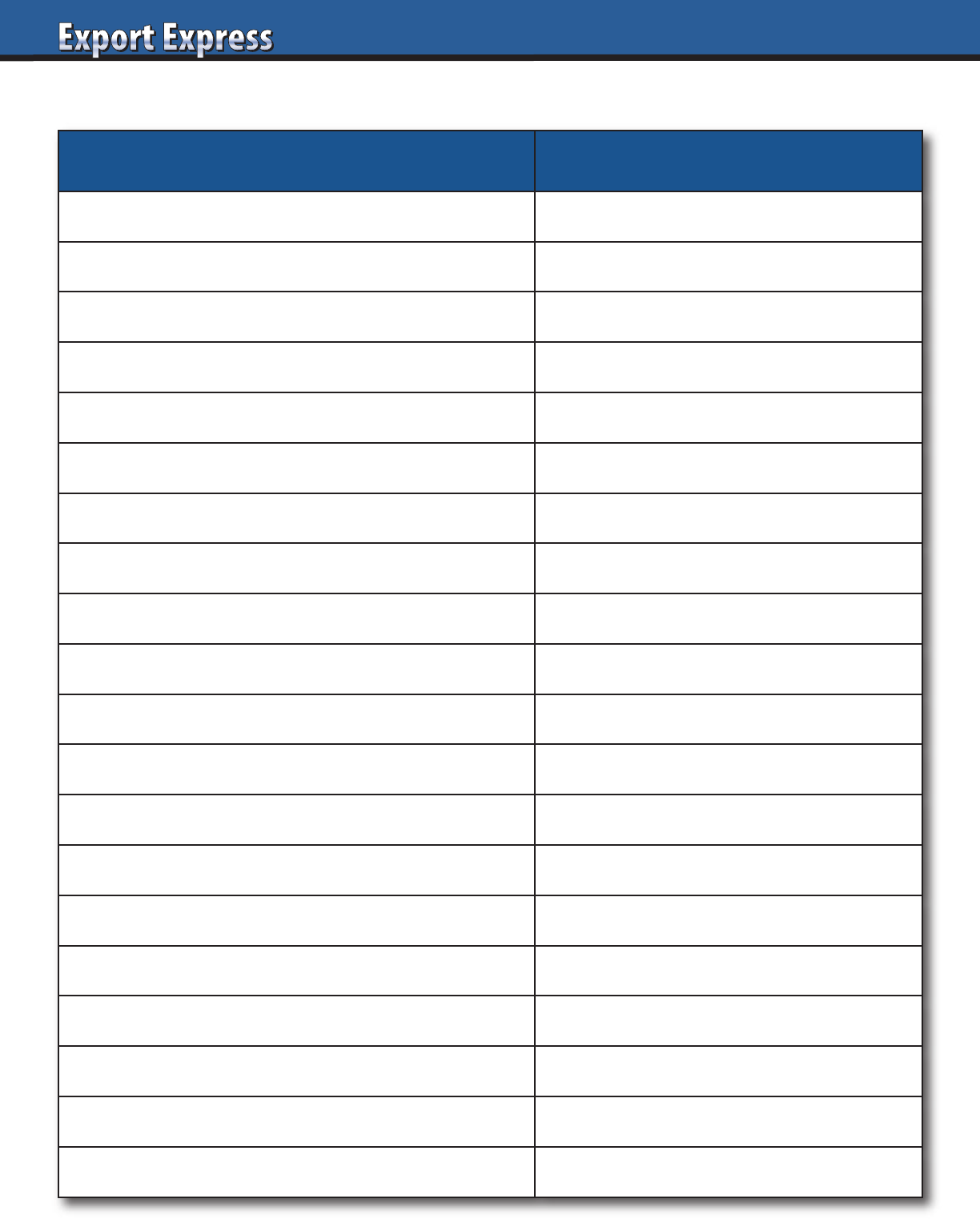

Assessment Criteria Rating: (10 = Best)

Distributor viewed as an important supplier to the retailer/buyer

Open to bringing brand owner to customer meetings.

Ability to schedule buyer meetings outside the office.

Can negotiate discounted listing fees and other program costs.

Pricing: access to price coordinator. Ability to make changes.

Shelf: access to decision maker. Space in excess of market share.

Merchandising Flier/Catalog: Ability to get prime feature space.

Relationship/access to retailer owners, senior executives.

Problem solving: rapid response? Emergency orders etc.

Payment terms.

Access to retailer movement data.

Category captain or “advisor” for my category.

Vendor awards?

Knowledge of retailers systems. “How to get things done.”

Sales results versus overall market and retailers internal growth.

11

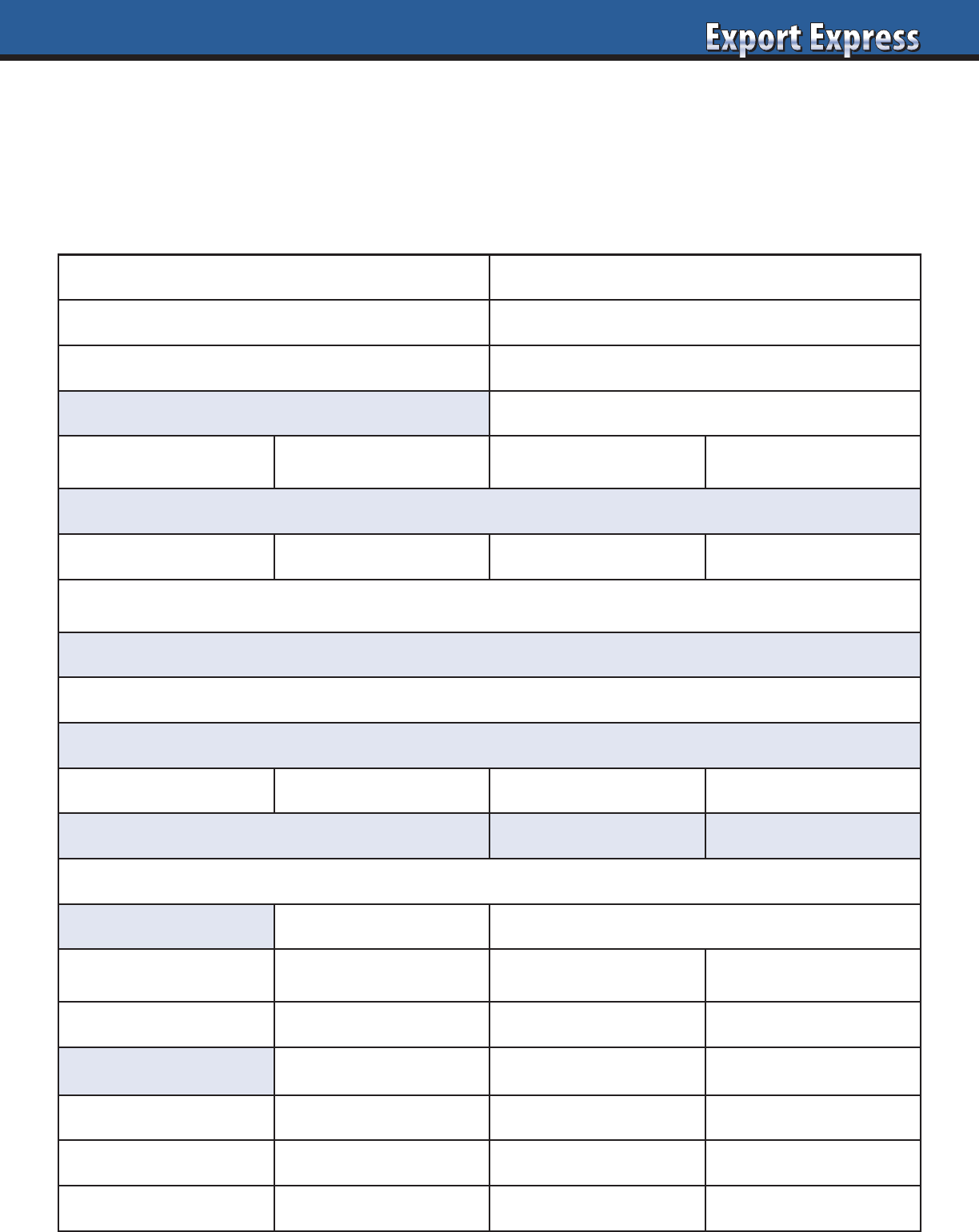

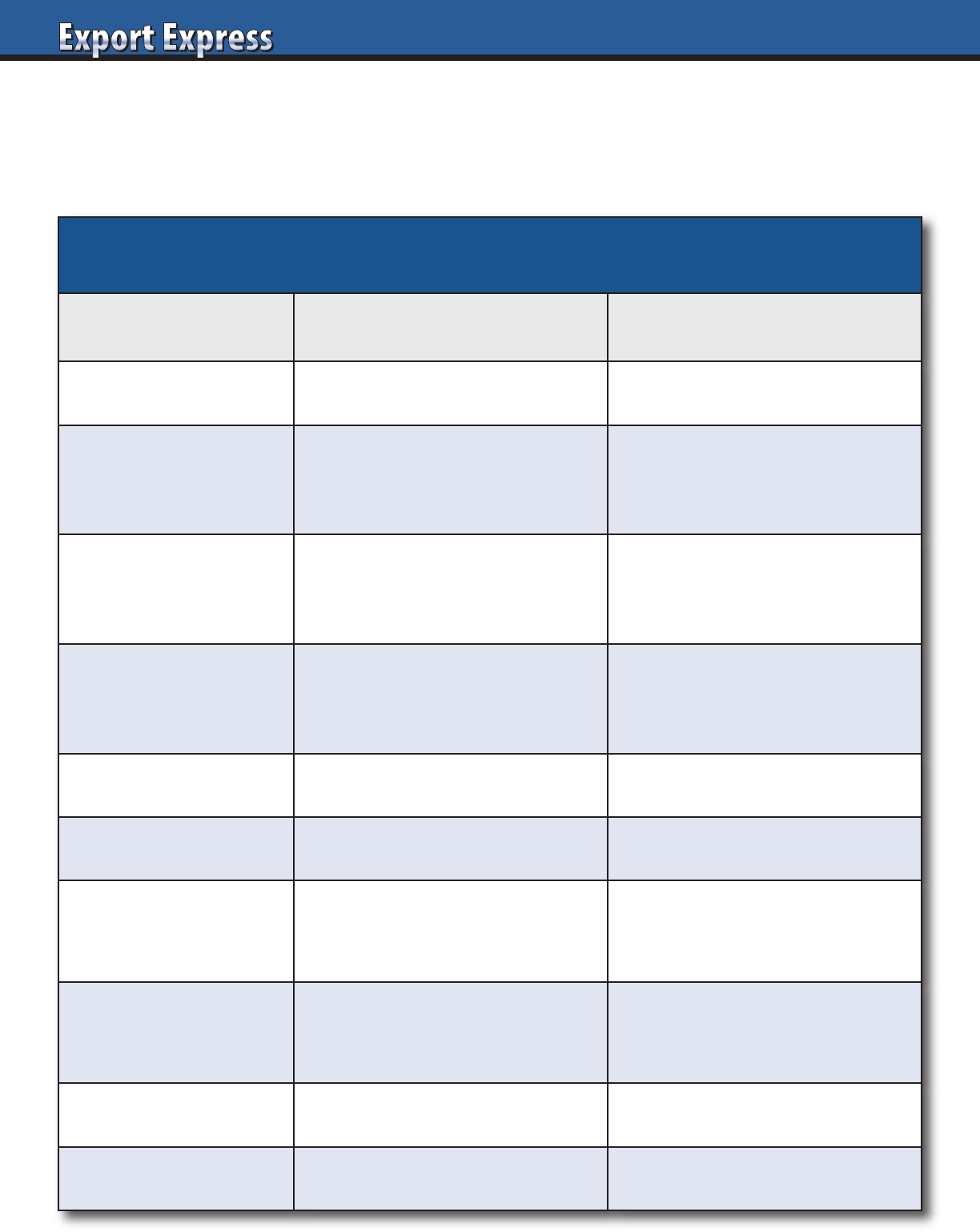

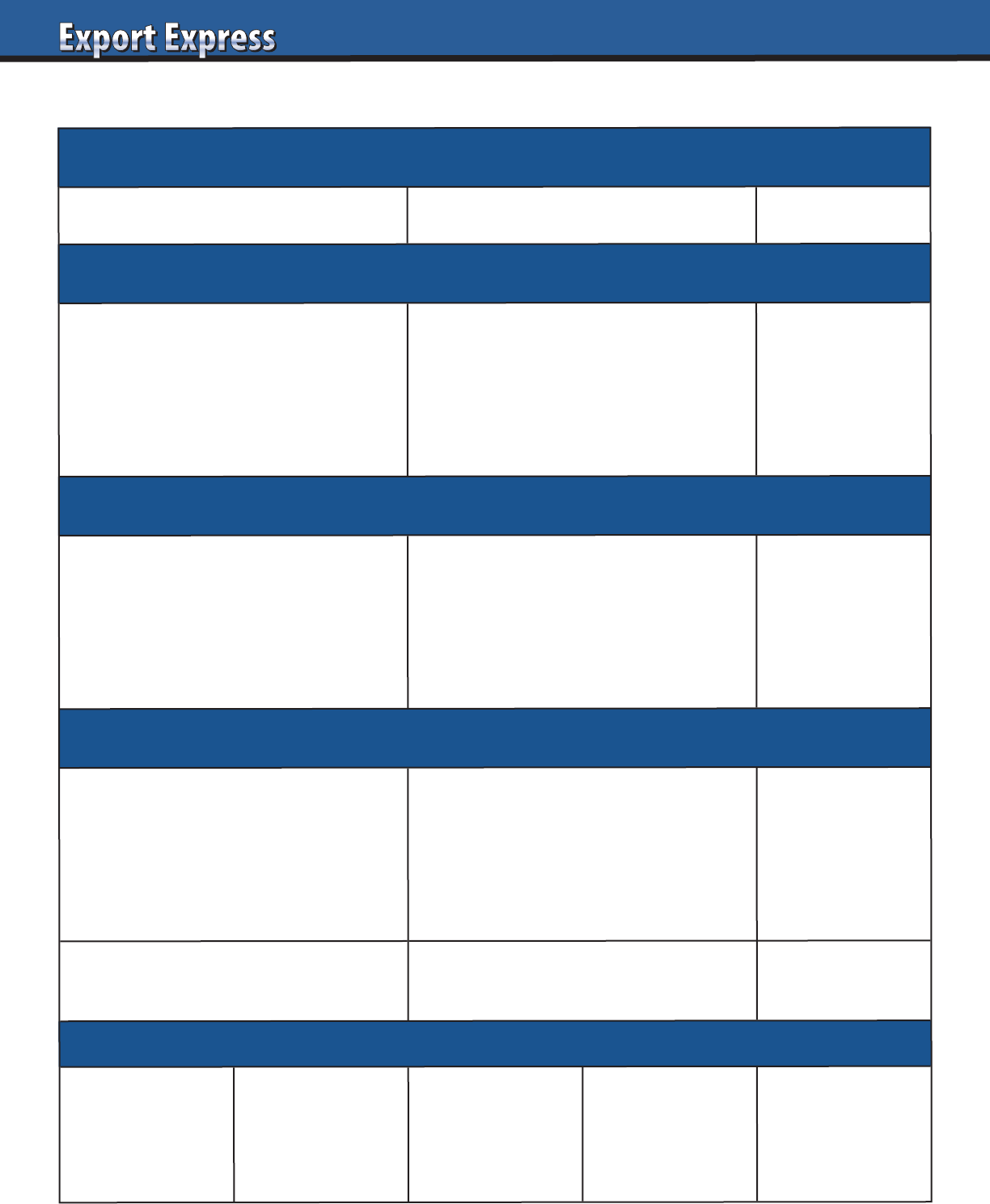

Exporter Data Sheet

What Distributors want to Know about Your Company

Key Contact: Telephone:

Web Site: Email:

Founding Date: Ownership:

Annual Sales: Total Employees:

0-$50 million $50 million - $250 million $250 million- $1 billion $1 billion +

% Sales International:

0-10% 10-25% 26-50% 50% +

Exporter Classification/Description:_________________________ (#1-10, based upon Export Solutions’ scale)

Core Product Range:

Unique Selling Point:

Market Share:

Home Country: Country A: Country B: Country C:

Current Business in Distributor’s Country: Yes/No: Size $:

Current Customers (Distributor’s Country):

Investment Model: Listing Fees*: Yes/No *average $35 per item,per store

Trade Promotion Budget: Dead net price: 10% of sales: Mass:

Marketing: Digital: Sampling: 360 degree:

Ambition/Size of Prize: Sales: Market Share:

Year 1

Year 2

Year 3

New Business Opportunity: _____________________________________

(Company Name/Country)

12

Export Solutions recommends creating your own one page Export Distributor fact sheet template. Insist that all candidates

complete the template 100 percent prior to a phone interview or trade show meeting. Pay particular attention to the annual

sales number, brands represented and manufacturer references. Qualified candidates will enthusiastically complete these

sections. “Pretenders” or time wasters will leave these sections blank or disappear saving you time and money!

Export Distributor Data Sheet:___________________________________

Key Contact: Telephone:

Web Site: Email:

Annual Sales: Total Employees:

Employees, by Function:

Key Account Sales Logistics Marketing Merchandising

Company Owned Warehouse: Yes No

If Yes Warehouse Size: Location:

Channel Coverage (percent sales by channel):

Supermarket Convenience Foodservice Other

Top Five Manufacturer Clients:

Company Name Brands Represented Years Service

1

2

3

4

5

Manufacturer references:

Company Name Contact Name Contact Telephone Contact Email

1

2

3

Why are you interested in distributing our brand?

Why is your company the best candidate to represent our brand in the market?

Feel free to attach your company credentials presentation.

(Distributor Name)

13

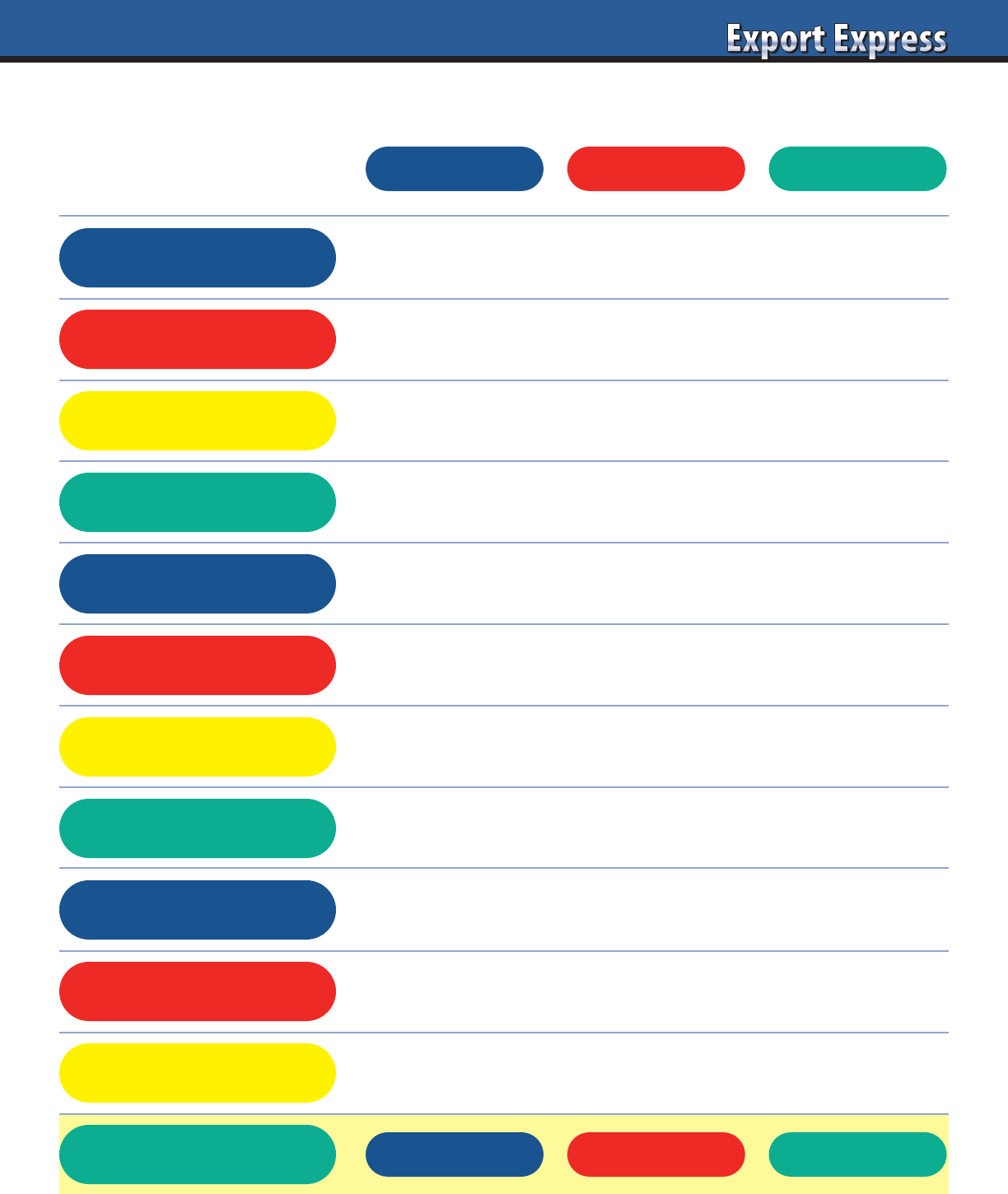

Are Distributors Interested in Your Brand?

High Interest

Low Interest

Email Response

Immediate reply

Delayed or no reply

CEO Engagement

Active participation

Delegated to middle management

Scheduling Meeting

Flexible and easy

Difficult. Conflicts.

Airport/Hotel Pick-Up

Offers to pick you up

Take a taxi!

Meeting Presentation

Tailored. Prepared for you.

Standard presentation

Category Research

Obtains data

None

Competitive Review

Shares photos: store sets

Informal comments

Store Visits

Organized/led by CEO

Office meeting only

Samples

Obtains and tries samples

Waits for you

Team Participation

3-6 people at meeting

One person

Cell Phone

Shares private number

Email address only

Questions

Addresses key issues

No questions

Timeline

Meets due dates

Delays

Post Meeting Follow-up

Immediate and frequent

None

Proposed Plan

Detailed and fact based Brief topline

Results

Winner

Second place?

I have conducted hundreds of distributor interviews for multinational companies: P&G, Nestle, General Mills,

Duracell, Lindt, Tabasco, Barilla, J&J, etc. Distributor candidates all claim enthusiasm and high interest in your

brand. See Export Solutions’ checklist of clues to measure true distributor interest level.

14

Introducing

America’s Favorite Brands

Executive Board

Export Solutions Smucker’s Tabasco

Greg Seminara, CEO Danny Berrios, President Megan Lopez, Vice-President

General Mills Sun-Maid

Eric Saint-Marc Carsten Tietjen

Advisory Board

Bazooka Candy Blue Diamond Bob’s Red Mill

Santiago Ricaurte Dale Tipple Jan Chernus

Bush Beans Campbells Church & Dwight

Dave Bauman Julio Gomez Arun Hiranandani

Ferarra Candy Heartland Idahoan

Daniel Michelena Tom Theobald Ryan Ellis

Johnsonville Sausage Kao USA Keurig Dr. Pepper

Cory Bouck Julie Toole Billy Menendez

Mizkan Reynolds Welch’s

Noel David Chris Corey Marc Rosen

19 Companies | 200+ Top Brands | $80 Billion Combined

View our activities for export managers – www.usafoodexport.com

15

Distributor Search Helper for:

Your

Logo

Here

Can We Help You?

Recent Distributor Search Projects

Asia Europe Middle East Latin America

Australia Germany Israel Argentina

China Ireland Kuwait Brazil

Indonesia Netherlands Qatar Colombia

Japan Nordics Saudi Arabia Costa Rica

Malaysia Spain UAE Ecuador

Philippines United Kingdom North America Mexico

Singapore Africa Canada Panama

South Korea South Africa United States Peru

Call the Export Accelerator!

Contact Greg Seminara at greg@exportsolutions.com

to discuss your business development project.

www.exportsolutions.com

What Makes a Great Distributor CEO?

CEO Assessment Considerations

Rating:

(10 = Best)

Achieves Joint Business Targets • Committed and dependable.

Dedication to Your Business • Knows details. Visits your HQ.

Willing to Invest

• People, technology, brand building.

Strong Customer Relations

• Senior contacts at top retailers.

Relationship With Brand Owners

• From export manager to CEO.

Response Time

• Same day to one week?

Thinks Like A Marketer • Creative, brand building ideas.

Frequent Visits: Retail Stores

• Good grasp of retail conditions.

Problem Solving

• “Hands on,” responsive.

Compound Annual Growth Rate • Flat to 10% or more.

Cost to Serve Transparency

• Detailed understanding of costs.

Celebrates Team Success

• Awards, promotions, raises.

CPG/FMCG Background • Senior level external experience.

Years of Service

• New to 20 years or more.

Local Industry Leader • High profile in community.

Work Ethic

• Office time vs. overseas trips?

Information Technology (IT)

• Invests in “best in class” IT.

Ethical and Trustworthy • Principled, respected partner.

Respects Manufacturer’s P & L • Sells profitable cases.

Relationship: Entire Team

• Finance, logistics, adminstration.

16

17

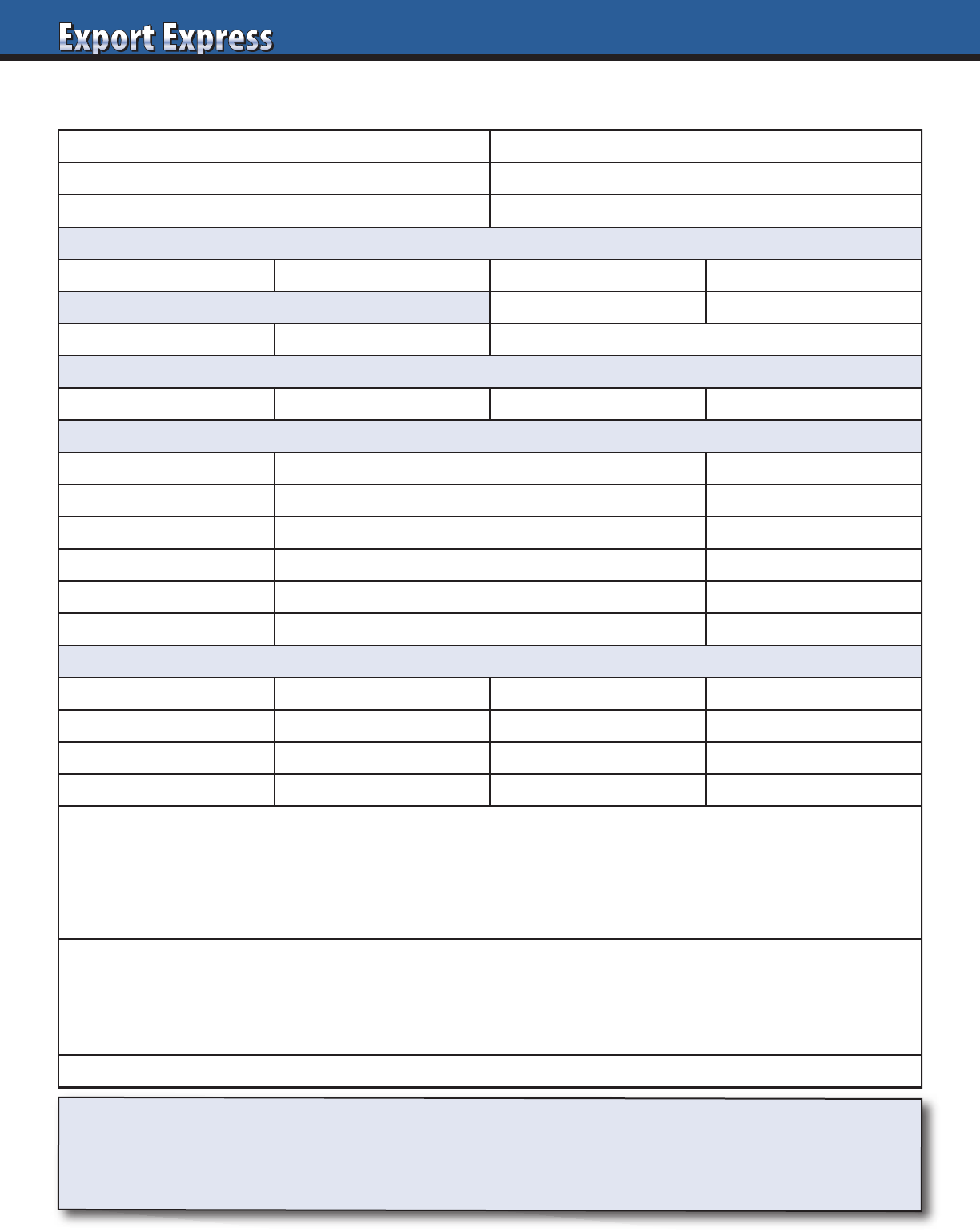

Year One Scorecard Example

Brand owners and distributors enter new relationships with great expectations.

Most partnerships succeed, but some under deliver leaving both parties disappointed.

Export Solutions Year One scorecard helps both parties align on KPI’s.

Objective Goal Results

Shipments to Distributor

Distributor Sales to Customers

Top 5 Customers

Region: Sales Split by Area

Channel: Sales Split by Channel

Market Share

Listings: Top 5 Customers

Retail Pricing

Shelf Positioning

Shelf Space

Sampling

Social Media

Displays

Manufacturer Investment

Brand Manager Performance

Export Accelerator

Contact Us for Distributor Search Help in 96 Countries

Greg Seminara • greg@exportsolutions.com

“Spend time Selling to Distributors versus

Searching for Distributors”

18

Why have Barilla, Pringles, Nature Valley, Starbucks, Duracell,

Nestlé, Tabasco, Pepperidge Farm, and other leaders used

Export Solutions as a distributor search consultant?

• Powerful distributor network: owner of industry database

9,200 distributors – 96 countries

• Professional 10 step due diligence process

• Results! We make Export Managers’ lives easier!

19

Ten Questions: Developing your Cooperation Model

1. Size of the Prize

What are the distributor’s year one and year three

volume estimates? How big is the category? Is the

category growing?

2. Key Account Listings

What listings can we achieve in year one? Who will

be our biggest customers? Will there be differences

in retailer acceptance by region or channel?

3. Trade Reaction

What will retailers like about our brand? Any potential

barriers? Which retailers will be most challenging?

4. Brand Manager

Who will be our primary point of contact?

Experience level? Workload?

5. Marketing Investment

What budget is requested to achieve our mutual

shipment objectives? Who pays for marketing costs?

Which costs are split?

6. Currency Fluctuation

What assumptions are made in your price calculation?

What happens if the currency fluctuates more than

5 percent in either direction? How do you handle

price increases?

7. Distributor Margin

What is your distributor margin? What services are included?

Any other fees or regular costs if we work together?

8. Trial and Repeat

What strategies are required to generate consumer trial

and repeat purchase? What works? How do you conduct

post-promotion analysis and measure payout and success?

9.Focus

Where will our company rank in terms of volume contribution

to your overall business? How will we secure share of mind

during our critical first year?

10. Issues

What are the biggest issues we will face? Barriers to success?

What must happen to win?

Talk to an Expert

• International Strategy Road Map

• Fix Problem Markets

• Entry Plans

• Find Distributors in 96 Countries

• Export Workshops

• Motivational Meeting Speaker

Contact Greg Seminara at (001)-404-255-8387 to discuss your business development project.

www.exportsolutions.com

20

What Distributors Want to Know ?

Strong distributors are overwhelmed by calls from brand owners looking for new partners. Distributors assess

each opportunity carefully, as any new brand must add incremental sales and profits and not distract from

priorities from existing brands handled. What is the “size of the prize” for the distributor?

Assessment Criteria Facts Rating (10 = Best)

Your company: size/ reputation

Existing business: sales in distributors country?

If zero “current sales,” what is realistic expectation?

Brand’s USP…your point of difference/innovation?

Size of investment plan: Marketing and Trade?

Potential distributor revenues?margin?

How does the product taste? (or peform)

How attractive/compliant is the packaging?

Pricing relative to category?

Brand success story in an adjacent country?

Competition intensity in category?

Brand range complexity?Product shelf life?

Local market research? Syndicated data?

Will brand invest in marketing and social media?

Will this be a tough product to launch?

Can we grow with the brand owner?

Your brand: core distributor category or adjacency?

Will the export manager be good to work with?

Will we be proud/excited to represent this brand?

What is the “size of the prize?”

21

Brand Manager Assessment

Your distributor Brand Manager represents your key day to day contact. Successful Brand Managers are good

partners and deliver results, not excuses. Is your Brand Manager an experienced veteran or new hire (rookie)?

Assessment Criteria Rating: (10 = Best)

Years industry/distributor experience

Years sales/commercial experience

Reports to owner or senior leadership team

Workload: dedicated or shared with many brands

Responsiveness: gets things done quickly!

Category knowledge: technical, competition

Analytical skills: shipment trends, Nielsen data

Problem solving

Develops creative promotions

Reports: accurate and on time

Enthusiasm for your company and the business

Participation on customer calls, store checks

Forecast accuracy

Influence distributor team: focus on your priorities

Delivers/exceeds shipment objectives

22

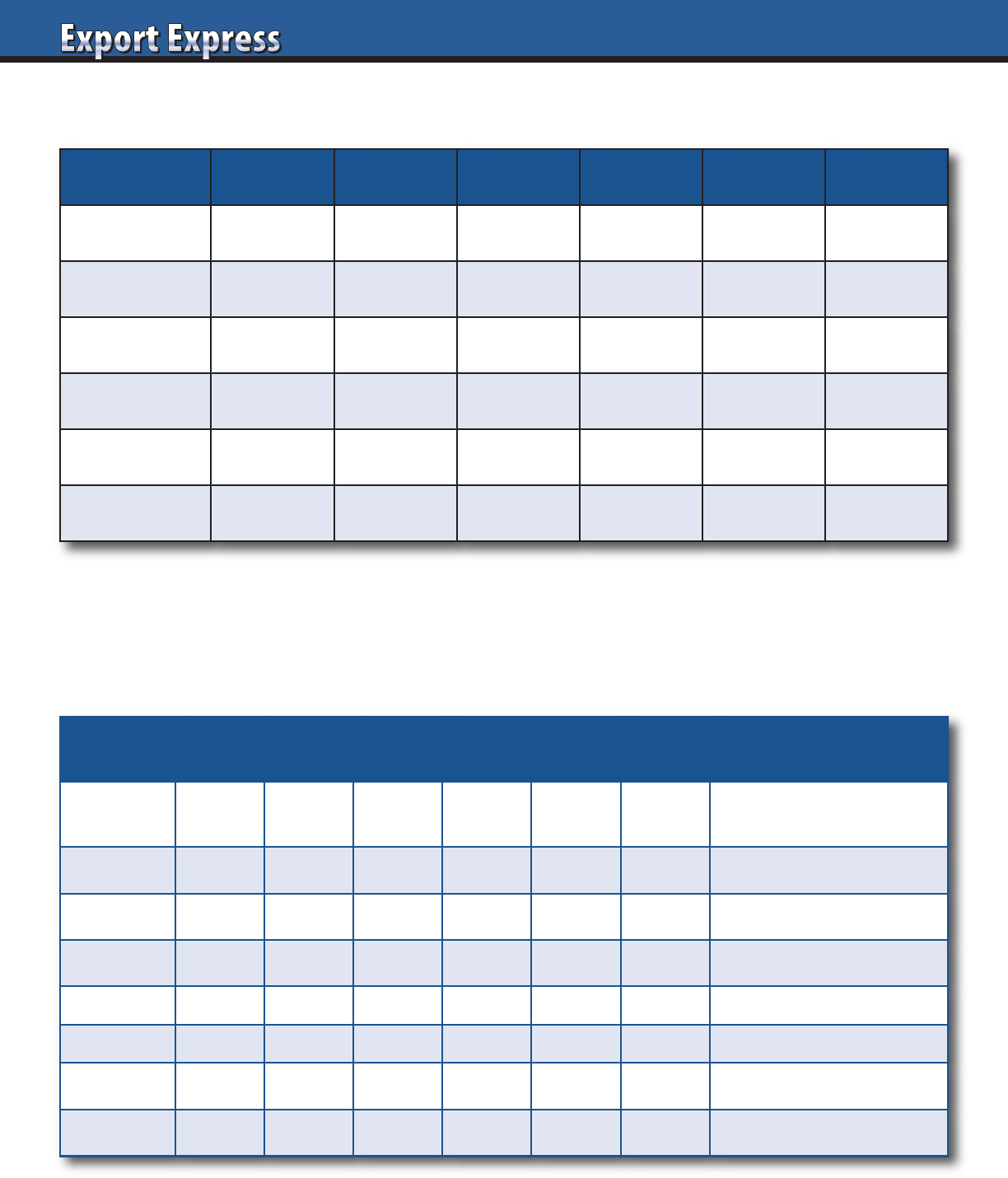

Field Sales – Coverage Frequency Template

Retailer #/Stores Daily Weekly Bi-Weekly Monthly Never

Sample Chain 200 0 50 100 40 10

Country Listing Map – USA Example*

“Required Template for Every Country”

*Instructions: List top 10 customers for every country. List all your key SKUs (items).

“X” indicates item stocked at customer. Blank space represents a distribution void.

Retailer Stores Sku 1 Sku 2 Sku 3 Sku 4 Sku 5 Comments/Plans

Walmart SC 3,571 x x x

Sku 1, 2, 3 stocked at only

2,000 Supercenters

Costco 575 x Special sku 5 for Costco

Kroger 2,726 x x x x Category Review March

Albertsons 2,278 x x x New shelf set

Publix 1,300 x x x BOGO Ad November

Ahold-FL 2,050 x x x x New sku 4 listing

HEB 355 x x x Category Review March

Meijer 260 x x x x Holiday Display Program

23

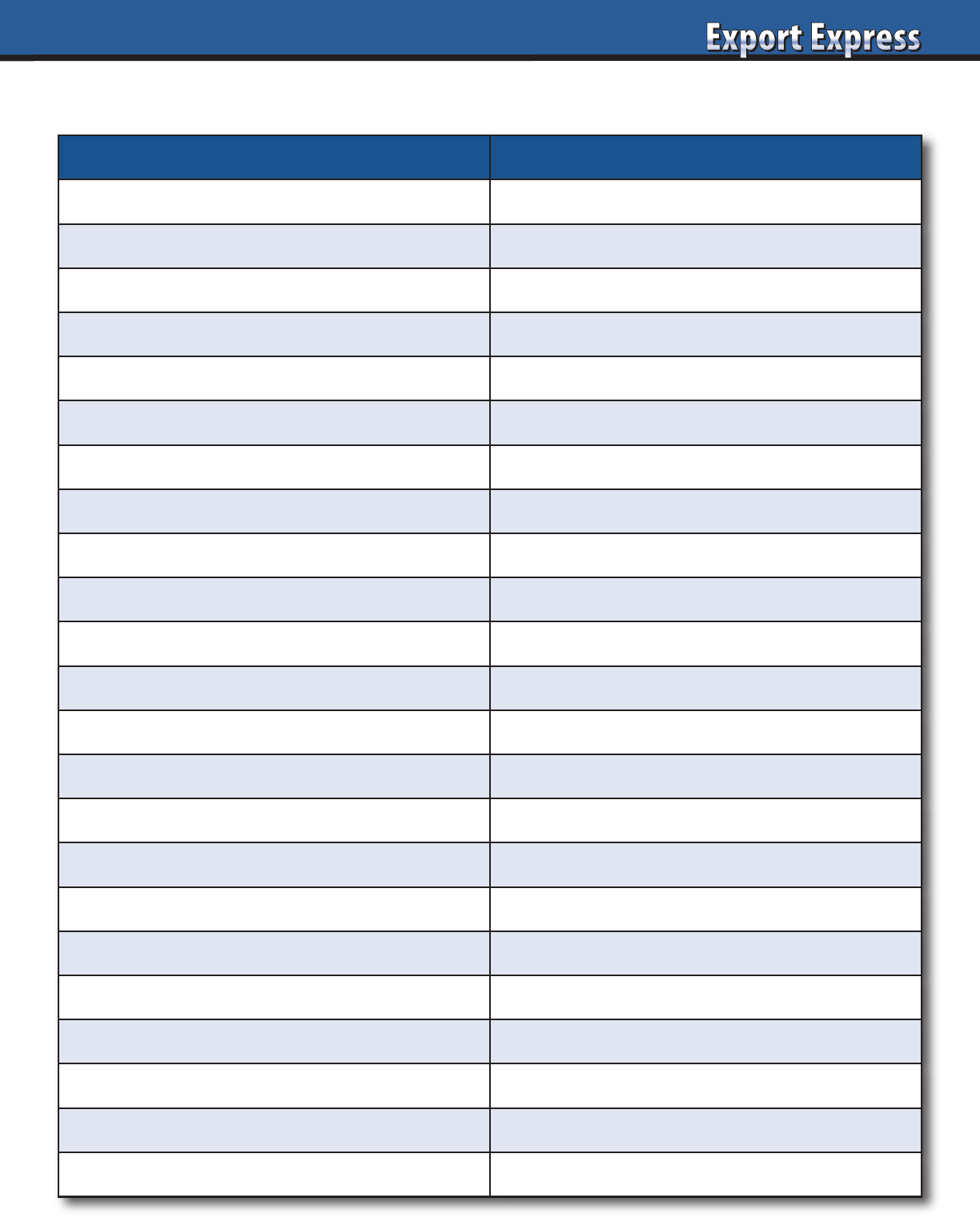

Field Sales – Capability Assessment

Number of sales offices (list locations)

Total field sales representatives (or merchandisers)

Number of sales reps outside capital area

Number of field sales supervisors

# Full time representatives vs. # part time

Average years of service: representatives

Average stores per representative

# stores visited per day

Average time spent per store, per day

Do you have multiple reps visiting each store?

# SKUs handled per sales rep

# priorities per store visit

# sales reps with laptop or tablet

# sales reps with phone with reporting capability

Compensation: percent fixed vs. variable?

24

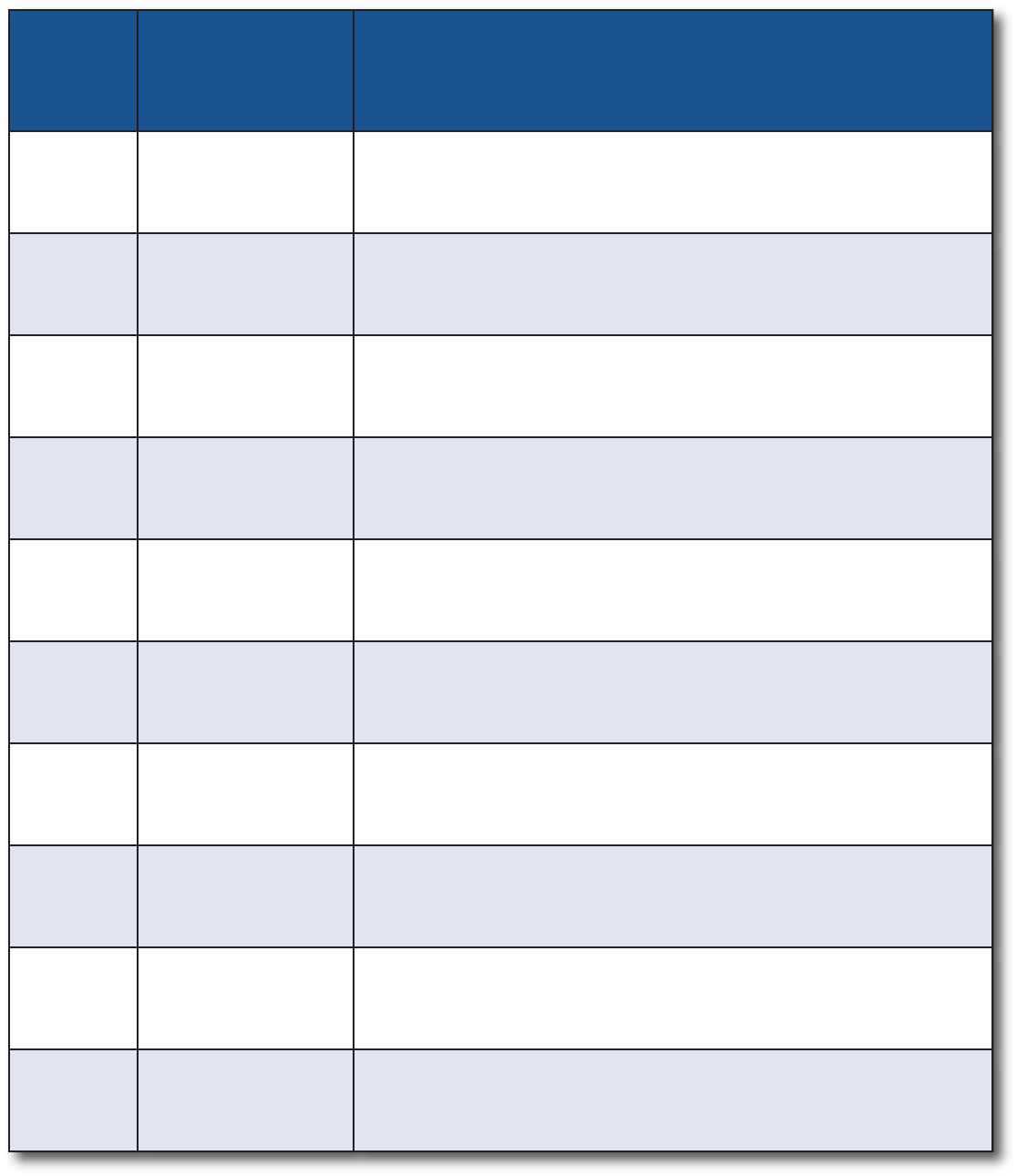

Who Is My Team?

Big distributors feature large teams with strong capabilities.

Manufacturers want to know who is their functional contact and how much time do they dedicate to my business?

Function

Distributor

Contact

Title

Email

Phone

(Mobile)

Senior

Management

(Owner/MD)

Marketing

Manager

Sales Manager

Brand Manager

Field Sales

Manager

Digital Marketing

Finance

Supply Chain

Purchasing

(order placement)

Accounts Payable

Compliance/

Registration

Customer

Service Manager

Logistics-Distributor Capability Scorecard

Many retailers supply their distributors with service level scorecards. Our distributor’s performance demonstrates their reputation as

a reliable supplier to important customers. Benchmark results vary by country, reflecting unique requirements to serve local customers.

Assessment Criteria Capability – Results

Warehouse: Distributor owned or outsourced to third party?

Trucks/vans: Distributor owned? How many, by type?

Warehouses: Locations, size, pallet positions,temp.controlled?

Special pack services: Stickering, promo packs, repack?

Average stock on hand: number weeks supply, by SKU

Annual inventory turns

Order lead time: capital city, rural regions

Minimum order size: cases, value, avg. order size

Perfect order rate, case fill rate, SKU fill rate

On time delivery rate

Monthly orders handled? Unique customers?

Damaged goods: Percent of sales

Vendor Managed Inventory (VMI) customers

Can distributor ship less than case quantities?

Logistic cost: percent of net invoiced cost

25

Small Shops (Traditional Trade)

– Capability Assessment

Assessment Criteria Capability – Results

Traditional trade: percent of total distributor sales

Dedicated traditional trade team? Structure?

Top 5 principals: traditional trade

# Vans and DSD trucks? Owned?

# Traditional trade reps. Exclusive or shared?

Sales rep. compensation (fixed/variable/bonus)

Customer coverage, segmentation, frequency

# Customers invoiced monthly

Average order size

# items sold per order

# calls per day

How do you establish call priorities?

Measures/KPI’s

Retail reporting capabilities

How do you drive traditional trade volume?

Creative trade marketing ideas?

Sub-distributors or wholesalers used?

Cost to serve?

New item launch process

Traditional trade growth versus market?

26

Foodservice/HORECA Capability Assessment

Assessment Criteria Capability – Results

Foodservice: Percent of total distributor sales

Dedicated Foodservice Team? Structure?

Foodservice Channel Principals (list):

Refrigerated/Frozen Warehouse/Delivery

Chef on staff?

# of Operator Calls (monthly)

# Foodservice Sales reps. Chef background?

Foodservice: Percent sales by segment:

Hotels

Restaurants: “High End”

Restaurants: “Quick Serve”

Catering, Canteens

Institutions: Hospitals, Schools, Prisons

Theaters, Stadiums, Theme Parks

Airlines, Cruise Ships

Bars, Pubs, Nightclubs

Foodservice: Top 3 customers

Trade Show Participation

Creative Marketing: Menu Ideas?

Tabletop/“Front of House” presence

Foodservice Sub-Distributor Partners:

Nutritionist, Food Technologist?

Foodservice annual sales growth vs. overall market

27

Buyer Performance Appraisal

When is the last time you considered how your category buyer was evaluated? Buyers defintely maintain

a strict set of KPIs from their bosses. How is your new product pitch “Good for the Buyer?”

Buyer Assessment Criteria Objective

Category Sales Increase category sales at higher rate than retailer growth: 3-5%?

Category Sales per Square Foot

Increase category sales per square foot to higher level than

store average.

Category Profit

Increase category profits at higher rate than overall retailer profit

growth: 5-10%?

Category Profit Margin

Increase category margin to a level higher than total department

profit margin.

Category Share vs. Competitors

Higher share of total market category sales than retailer’s share

of overall market.

Service Level to Stores 98% minimum service level. Out of stock level: 1% or less.

Inventory Turns Exceed industry average of 18.5 turns per year.

Retail Prices

Maintain competitive retail prices, in line with chain’s

overall pricing position.

Private Label Sales

Increase private label percentage of category sales. Increase private

label sales at a higher level than overall category sales.

Listing Fee Funding

Achieve assigned budget for incremental supplier payments

including listing fees or equivalent.

Trade Promotion Funding

Increase total category margin dollars through back margin,

rebates etc.

Retailer Marketing Programs Supplier support behind retailer sponsored marketing programs.

Performance of Ad/Display Features Sales results of buyer allocated ad flier and display space.

Assortment and Innovation Offer variety versus duplication, while optimizing category sales.

Terms Improvement Improve terms and conditions: annual negotiations.

Cost of Goods: Price Increases Obtain best cost of goods. Fight price increases.

Industry Leadership Participate (or lead) external committees on industry development.

Supplier Relations Maintain positive relations with suppliers, particularly top 10.

Community Relations Build positive impressions for retailer through community support.

Category Expert

Understand trends, product attributes, performance, and

innovation for the category

28

29

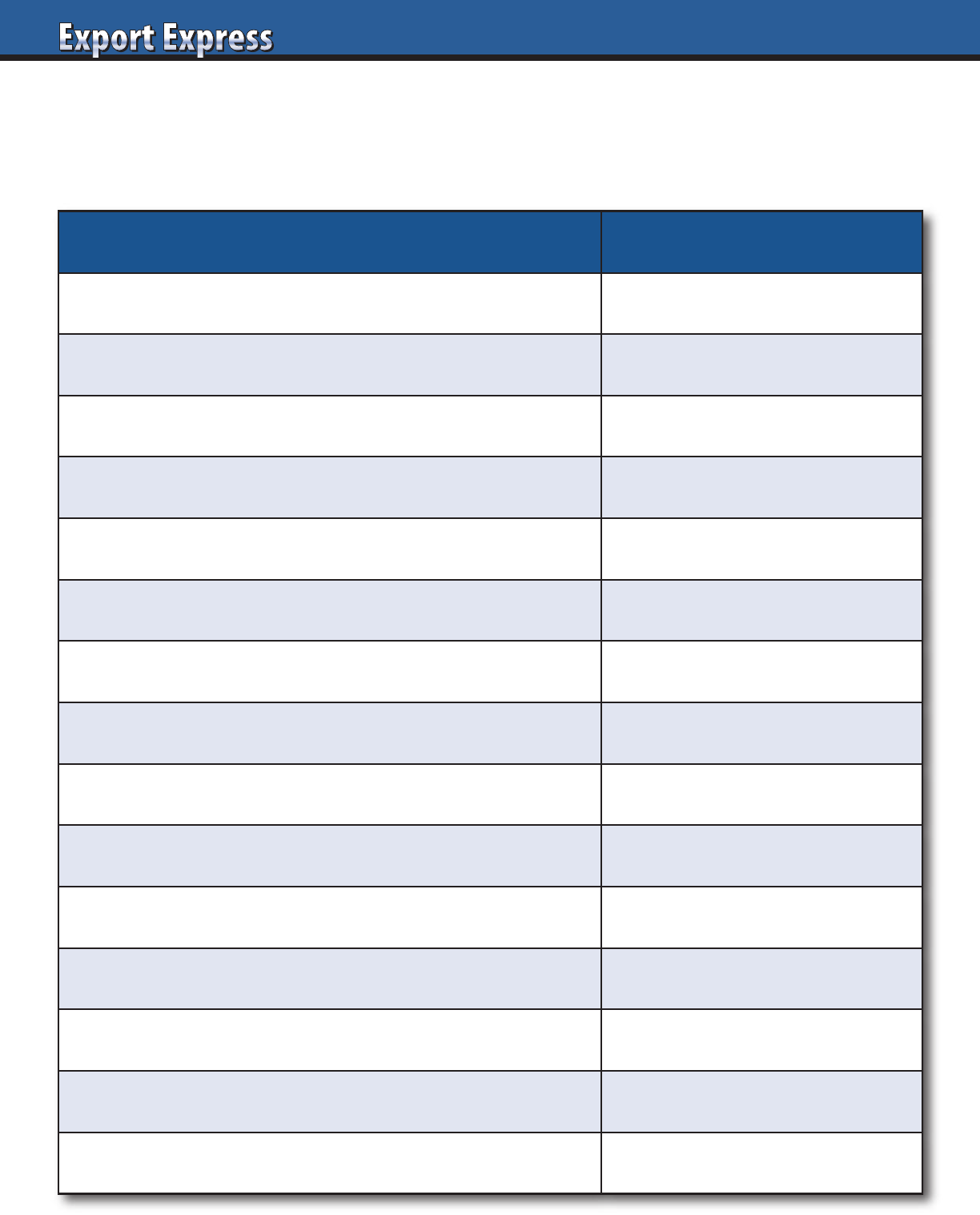

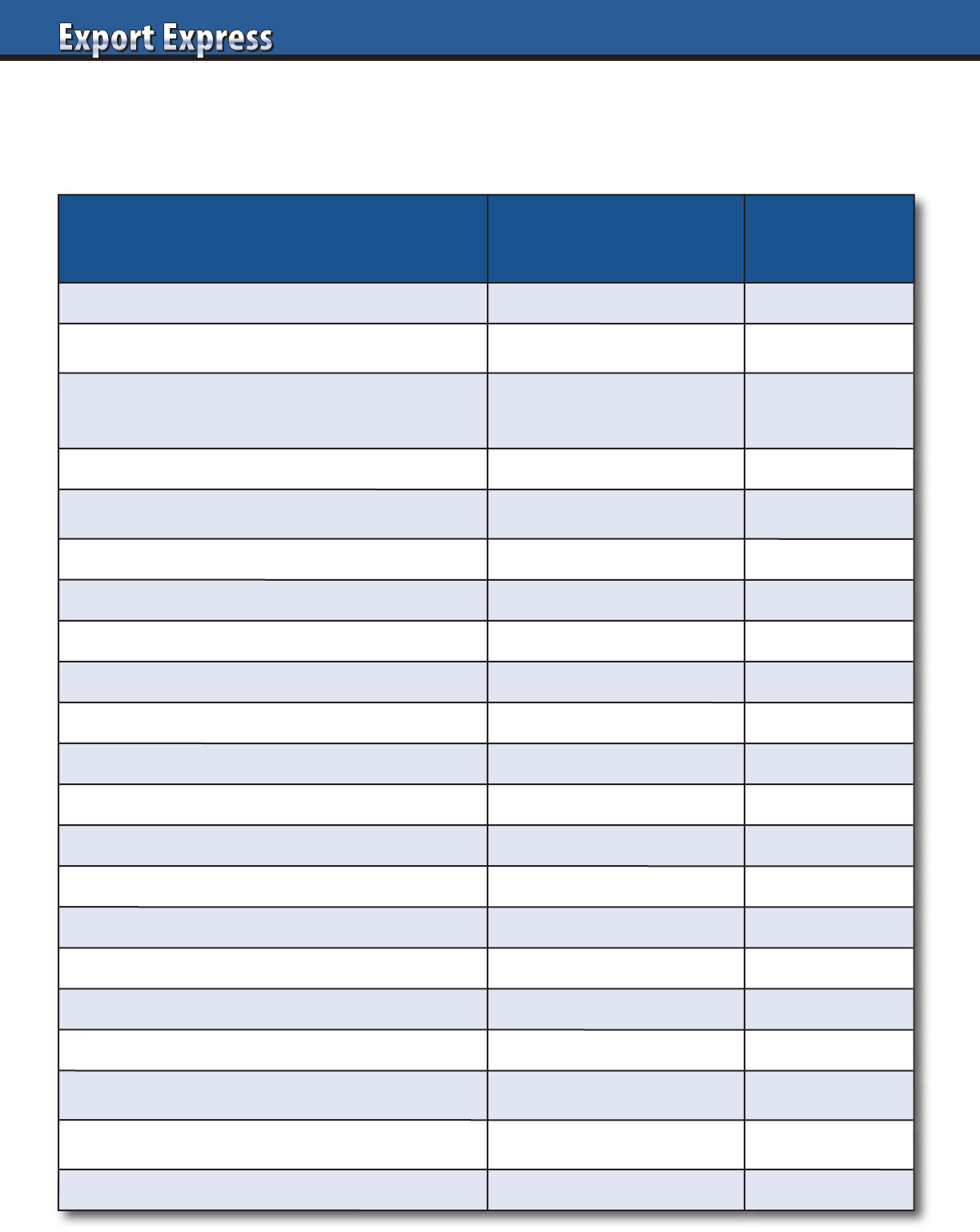

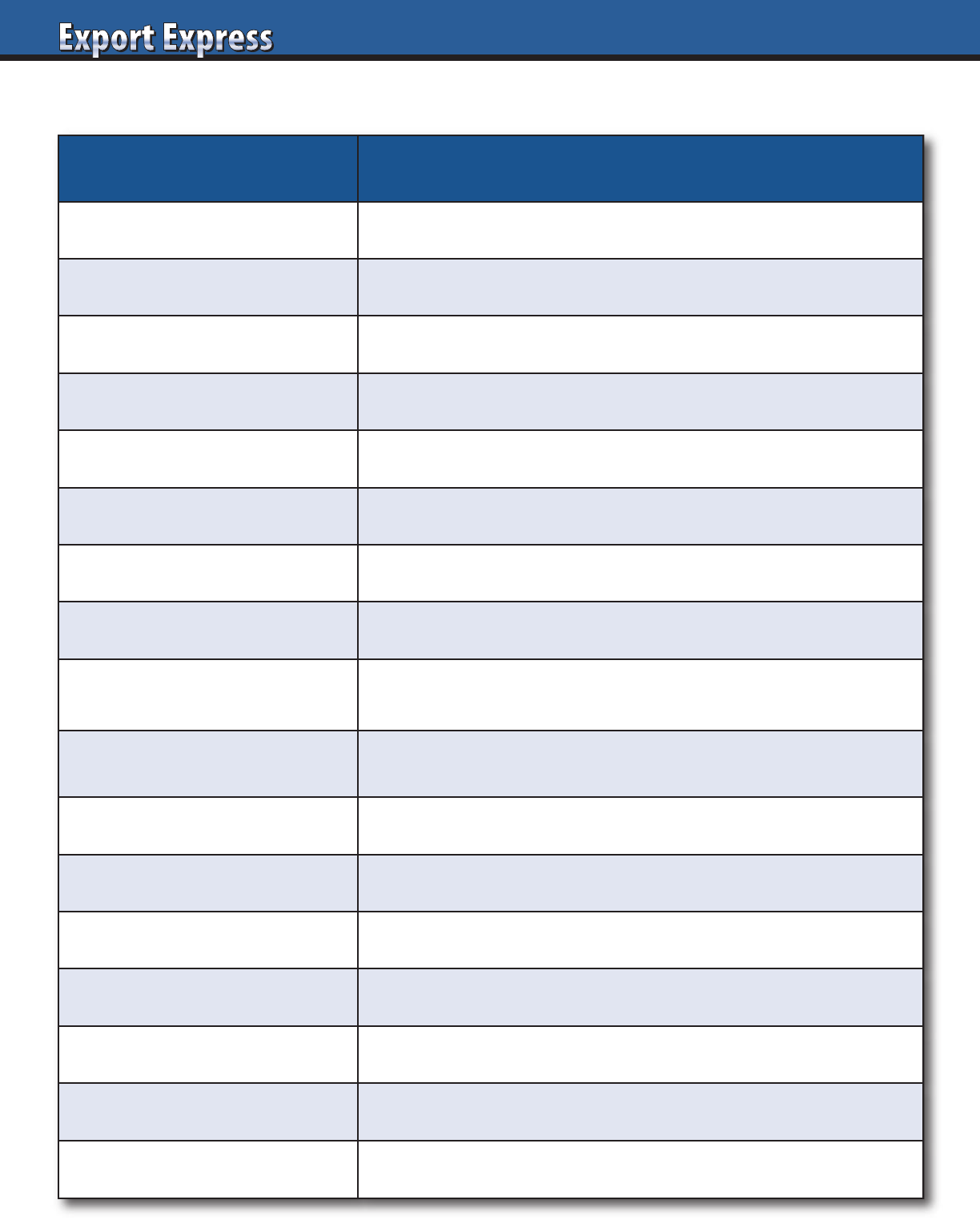

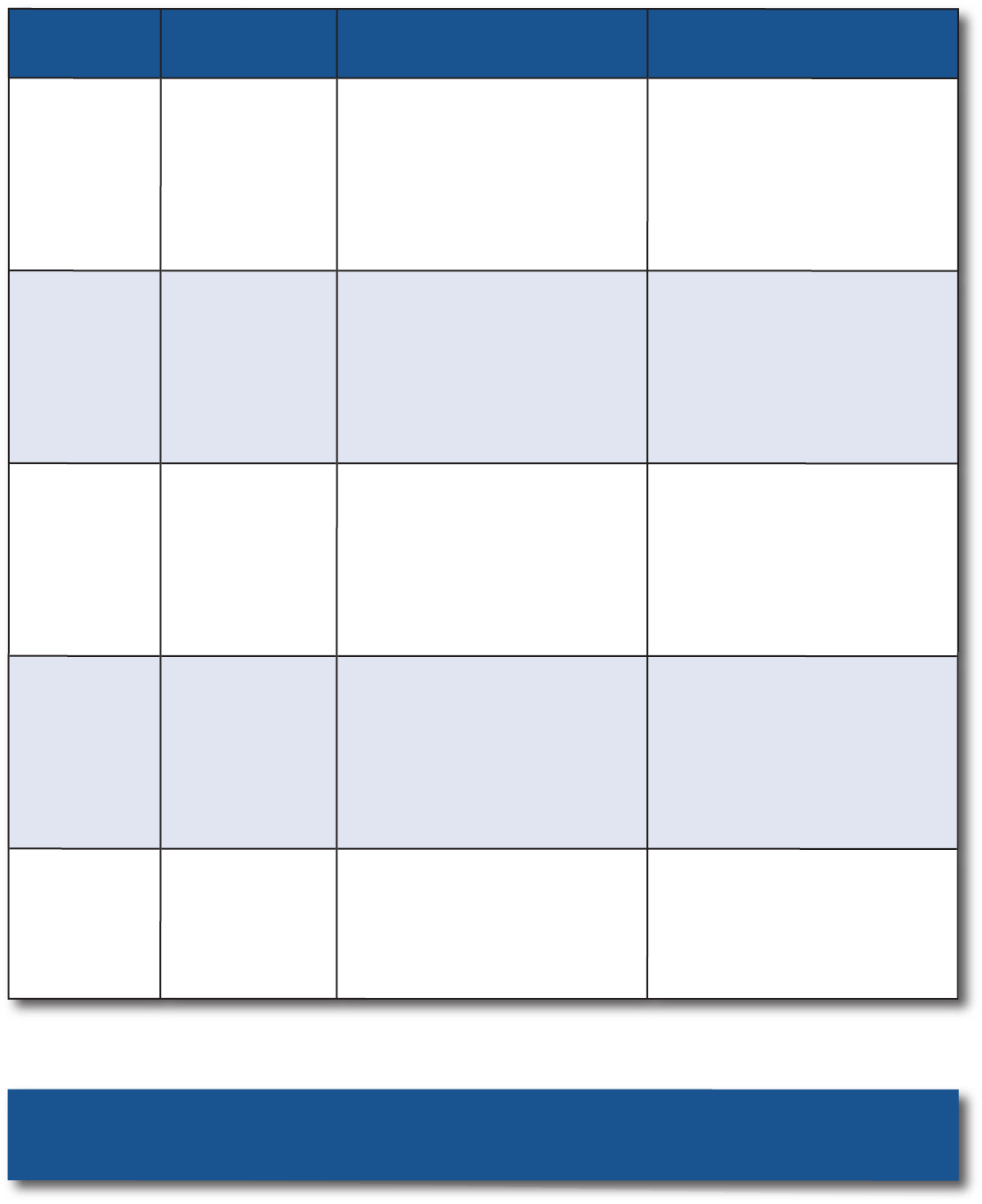

Export Reports: Format and Frequency

Every exporter requires certain reports to manage the business.

Productivity is enhanced when distributor focuses on selling activities versus compiling a stack of reports.

Everything functions better when reports are filed on a regular schedule.

Report

Description

Monthly

Quarterly

Annually

Distributor “Sell Out”

Distributor sales to customers

x

Sales Forecast

Rolling 90-180 days

x

Distributor Inventory

Weeks supply on hand, by sku

x

Sales Versus Budget

Progress vs. annual objective

x

KPI Dashboard

Coverage, Displays, Distribution, etc.

x

Listing Map/Plans

Brand/sku authorization,by customer

x

Sales Promotion Calendar

Capture adjustments, and payout

x

New Product Launch Status

Acceptance by key customer

x

Category Review (Nielsen ?)

Category trends

x

Retail Price Survey

Top 10 customers

x

Competitive Activty

New launches, innovation

x

Distributor Credentials

Distributor "standard" presentation

x

Credit Report

Financial update

x

Distributor Value Chain

Factory gate to store shelf

x

Annual Business Plan

Agreed road map to achieve objectives

x

Retailer Business Review

Top 5 retailers

x

List of Top 10 Customers

Plus your buyers name

x

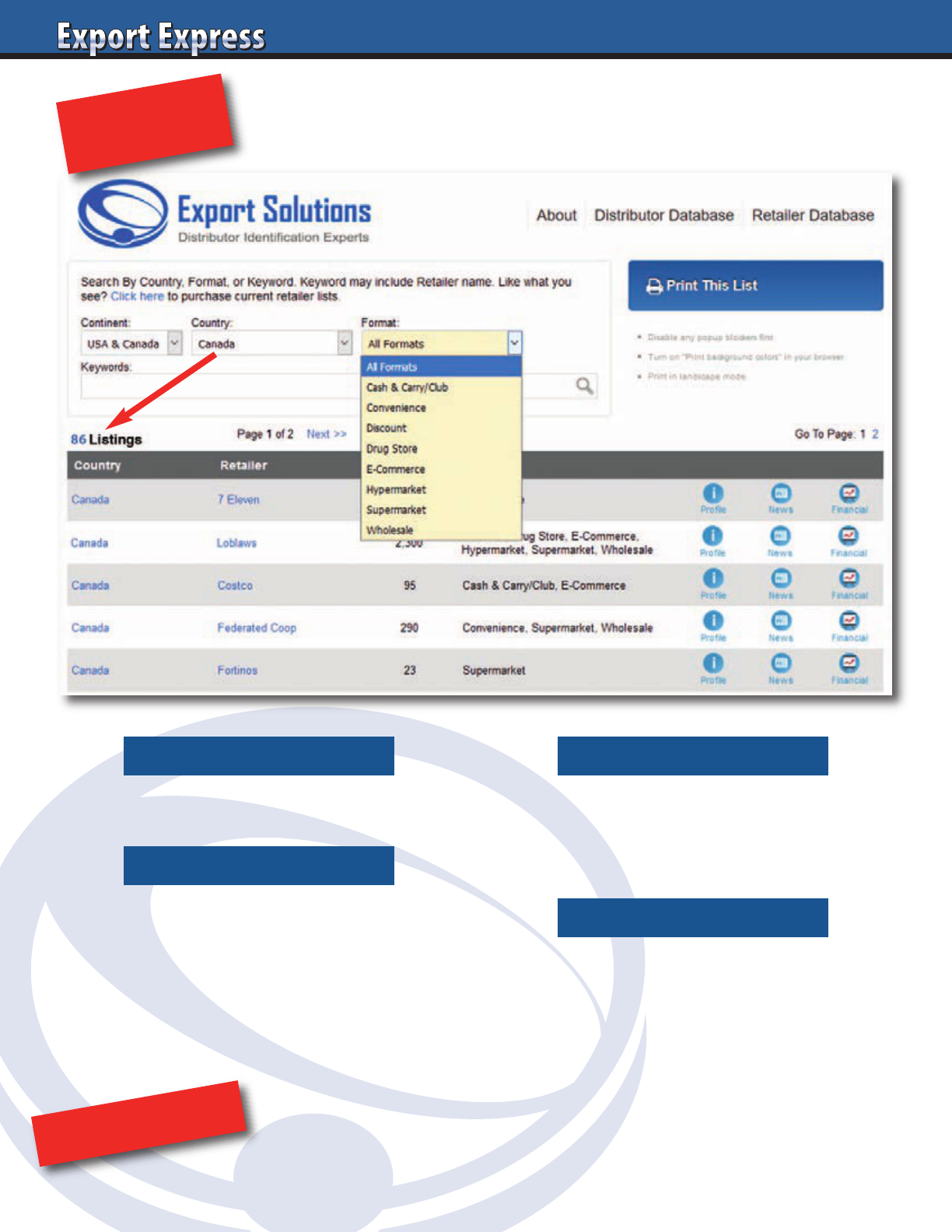

Coverage: 96 countries and 2,700 retailers

Supermarket

Convenience

Drug Store

Natural Food

Club, Cash & Carry

Supplying profiles, store counts, formats,

news and info for Top 100 international

retailers plus all overseas branches

Example 1: Who are supermarket

retailers in Canada?

Example 2: How many stores does Loblaws

operate by banner, in Canada?

NEW!

ORDER NOW!

30

Search by Retailer NameSearch by Country

Combo Search

www.exportsolutions.com

Search By Format

Retailer Search Made Simple

Canada Example

31

Why did you create the retailer database?

Export managers dedicate a lot of time

to researching countries, retailers and

preparing business plans. A standard

KPI measure is tracking product listings

for key customers. I believe that our

industry could benefit from a global

retailer database to instantly locate

retailers and their store counts in

96 countries. The retailer database

is a logical extension of our leading

distributor database which has helped

more than 3,000 companies build export

sales during the last 10 years.

What is your geographic coverage?

96 of top 100 GDP countries worldwide.

This includes most Asian, Middle Eastern,

and European countries. Our database

covers every country in the Americas.

In Africa, we cover South Africa.

What is your format coverage?

Excellent coverage of chain supermarkets,

hypermarkets, clubs, cash and carry,

and convenience formats. Solid initial

coverage of drug stores, natural food

stores, and e-commerce channels.

Our database does not cover

DIY/hardware, toy, office, liquor,

or sporting goods channels.

Retailer database: featured info

Profile – Retailers profile and link to their

internet home page.

Formats – Retailer’s stores segmented

by format and banner.

We track supermarkets, hypermarkets,

cash and carry, convenience stores,

discounters, drug stores, natural food

stores, and e-commerce retailers.

News – Latest retailers’ news. In some

cases (Asia), we substitute a link to the

retailer’s latest promotional flyer.

Financial – Many leading retailers are

publicly traded. A link is provided to

their latest financial results. We do not

offer estimated financial information for

privately held or family owned retailers.

How is your coverage of global retailers?

We offer total coverage for top 100 global

retailers. This includes all of their

branches and banners. Searchable!

Use filters to research Walmart, Costco,

Carrefour, Tesco, Metro, Casino presence

by country. Database covers retailer’s

total store outlets as well as a breakout

by banner and format.

What can I use the retailer database info for?

• Obtain an instant snapshot of an

average of 24 retailers per country

for 96 countries.

• Track presence of global retailers like

Walmart, Carrefour, and Metro AG.

• Create country specific listing maps

where distributors measure brand

authorization by retailer.

• Conduct home office based

international category reviews and price

checks from retailers’ e-commerce sites

(not all retailers).

• Prepare annual reviews and reports

with up-to-date information on leading

retailers and channels.

Searchable

The database offers filters allowing you to

search by country, format, or retailer name.

You can also use a combination of filters for

your research.

Can I get a free sample of the retailer database?

Sure! Check www.exportsolutions.com for a

complete profile of United Kingdom retailers.

Do you provide retailer’s annual sales

or market share information?

Accurate annual sales information is

available through the financial link for

publicly traded companies. We do not

provide estimated financial information for

privately held and family owned retailers.

Channel blurring occurs between

supermarket, convenience, e-commerce,

and even natural food operators. We do not

provide market share due to difficulty to

accurately isolate and define channel

market share information, particularly with

so many privately held retailers.

How accurate is the retailer data?

Export Solutions’ retailer database is

updated weekly, so information is highly

accurate. Retailer names, web sites, and

formats rarely change. This makes the

database 99% accurate at the company

level. New stores open every day,

resulting in store counts that may be

95% accurate. We intend to update store

counts on a regular basis.

How much does retailer database access cost?

An annual subscription to the retailer

database is $975. This supplies one year,

unlimited access to more than 2,700

retailers in 96 countries. Special offers

available for our distributor database

customers. Note: special pricing for

government trade organizations.

How do I access the retailer database?

Visit www.exportsolutions.com and click

the retailer database page. You can place

a subscription or individual continent

(i.e., Europe) into a shopping cart.

Register and check out via credit card.

The process takes two minutes and we

automatically send you an invoice.

About Export Solutions

Export Solutions was founded in 2004

and is based in Atlanta, Georgia in the

USA. Export Solutions serves as a leading

provider of business intelligence to the

food and consumer goods industries.

Our distributor database covers 9,200

distributors in 96 countries and has

been used by more than 3,000 clients.

Our Export Express newsletter has a

circulation of 9,900 and is viewed as an

important source of insights, strategies,

and templates for international

development. www.exportsolutions.com.

FAQ’s – Retailer Database

32

Export Lessons Learned Template

Why are Countries Leading or Lagging?

(Complete based upon your company performance)

Leading

Countries

Lagging

Countries

Country Performance:

Measure: sales per capita

Brand Development:

Measure: market share

Biggest Opportunity

Countries:

Measure: category size/growth

Promotion Effectiveness:

Tactics creating incremental sales

Distributor Performance:

Measure: sales increase,

commitment

33

Segmentation Factors

Segmentation analytics will vary by company. Absolute

population is just one factor warranting consideration. Other

criteria include size of the category, proximity to your producing

plant, as well as per capita spending power. For example, most

USA based exporters sell far more to Puerto Rico, an island with

3.1 million people, than they do to China or Brasil. As a result,

some USA brand owners place a strategic focus on the Caribbean

Basin countries adjacent to the USA and process only occasional

opportunistic shipments to complex countries such as China.

Mix of Countries

Most companies can dedicate focus on a strategic launch into

only one or two “strategic” countries at a time. It’s appropriate

to create a growth plan aimed at a mix of Strategic, Priority, and

Opportunistic countries.

Market Share Expectations

Your export road map should also be adjusted based upon your

market share expectations for a select market. Generally, there

are three scenarios for a brand to pursue.

Leader: Brand investment and innovation to become #1

in the category.

Player: Brand plans to compete effectively, obtaining a market

share of 5% -20%.

Participant: Niche. Brand objective is incremental shipments

with little/no investment.

Lessons Learned

Calibrate expectations to investments in brand support and

management oversight. Everyone wants to be a category leader

or player. To achieve this lofty status, you need to conduct local

market research, innovate, maintain competitive pricing, invest

in marketing, and align with a strong sales team just as you do in

your home market. Projects fail as certain brands want category

leadership but invest only to “niche” levels.

Strategic segmentation of export opportunities is “Job One” for export managers. Export Solutions divides countries into three groups:

Strategic, Priority, and Opportunistic. This approach filters countries by “size of the prize” and investments required to win. The basic

rationale is that a company should allocate different resources to develop a large country like Brasil, compared to a medium size

country like Belgium versus the Bahamas or Bermuda. Too frequently, we see companies handcuff all markets to one export program,

with common strategy, pricing, and investment models for all countries.

Country Segmentation – One Size Does Not Fit All

Country Segmentation

Country Profile Investment Required Business Model Examples

Strategic

(Focus)

Large Country

(pop. 50mm +)

High GDP

High Category BDI

Global Retailers

High Complexity

Significant Investment

in Brand support.

Market Research

Management Visibility

Local Office or

Distributor or

Joint Venture

Mexico

China

Brasil

United Kingdom

USA

Priority

(Manage)

Mid size Country

(pop. 10 mm+)

High GDP

High Category BDI

Mid Complexity

Moderate investment

in brand support.

Managed by

Export Manager

Distributor

Chile

Australia

Canada

S. Korea/Thailand

South Africa

Spain

Saudi Arabia

Opportunistic

(Profit)

Profitable

Opportunities.

Low GDP Countries

Low Complexity

Minimal/no investment

in brand support

Distributor or

Direct to Retailer

Caribbean

Central America

Middle East

Africa

34

Retail buyers are challenged to maximize profits and sales from every available inch of shelf space. Every new item accepted must

improve on the performance of the brand currently occupying that space. Buyers are overwhelmed by new product offerings, all with

ambitious promises. Improve your chances of success by incorporating Export Solutions’ 10 point check list on how to excite your

category buyer about your new product.

How to Excite Buyers – New Product Checklist

Buyers: New Product Assessment

High Interest Low Interest

Category Opportunity Large or high growth Declining or niche

Brand Owner

Multinational or proven local.

Category expert

New foreign supplier

or start-up

Innovation

Something new, supported

by consumer research

“Me too” product

Profit Margin

Enhance current

category margin

Equal to or less than

current category margin

Sales Generates incremental sales Cannibalizes existing sales

Marketing Investment Sampling, social media, PR None

Trade Programs Invests in retailer “push” programs Periodic discounts/rebates

Brand Track Record

Successful at other

local retailers

Unproven in the country

Terms/Conditions Attractive deal structure Typical terms/conditions

Representation Dependable local distributor Small, niche entrepreneur

35

Export Strategy Road Map Template

Countries Brands Partners

Strategic Priority Opportunistic

Mission

Lessons Learned

20/20 Analysis

Core Competencies

Big Opportunities

Low Hanging Fruit

Investment

Strategic Options

Strategic Plan

Tactics

Measures

Markets

Strategy questions? Contact Greg Seminara at Export Solutions (001)-404-255-8387

What are your business ambitions for the time period?

What factors have contributed to export success?

What situations have led to export disappointments?

What countries represent your top 20% performers? Why?

What countries represent your bottom 20% performers? Why?

What is your competitive advantage?

Why is your brand unique versus international competitors?

What are the biggest export opportunities for your company?

What represent high percentage, profitable opportunities?

What is your investment model? Marketing, Promotion, People.

What alternatives are available?

One page plan defining Objectives, Goals, Strategy, Measures

What activities are required to achieve desired results?

What are realistic measures and benchmarks?

36

Cost Calculation Assessment*

*Ambient grocery example: Higher margins – Chilled and Health & Beauty products

Assessment Criteria

Global

Benchmark

Actual

Retailer: Everyday margin

20-35%

Retailer: Back margin (rebates,discounts)

0-10%

Retailer: Other margin

(Damage, merchandising, central warehouse)

0-5%

Total Retailer Gross Margin

25-40%

Trade Promotion (Manufacturer)

5-20% of net sales

Total Distributor Margin

15-35%

Warehouse/Stickering

2-4%

Delivery

2-5%

Total Distributor Logistics

3-7%

Key Account Sales

1-3%

Brand Management

1-2%

Merchandisers/Field Force

0-4%

Total Distributor Sales Team

4-6%

Administration

1-2%

Finance and Collections

2-5%

Overheads (office, IT, corporate)

2-5%

Distributor Promotion Investment

0-10%

Distributor Net Profit

2-5%

37

Analyze: Your Contribution to Distributor Profit

Export Solutions: 20 Factors Driving Distributor Profitability

Assessment Criteria

Considerations

Result

Rating:

(10 = Best)

Annual Sales Revenue • Percent total distributor sales

Annual Margin Generated ($) • Net sales times gross margin

Distributor Percent Margin

• 10 percent to 50 percent

Brand Owner Investment Level

• Percent of distributor purchases

Distributor Margin Re-Investment

• Distributor promotion spending

Category Adjacency • Distributor portfolio synergies

Brand Market Share

• Niche versus market leader

Payment Terms

• Pre-pay versus 120 day terms

Safety Stock Requirements • Two weeks to four months

Typical Customer Order • One case to full truck

Shelf Life • Two weeks to five years

Case Cube/Case Cost • “Low cube, high case cost best”

# Brands/Items in Range

• “High sales, fewer items valued”

Logistics/Storage: Temp?

• Ambient versus chilled

Damage/Expired Goods • None to 20% of sales

Category Competition

• Niche to highly competitive

Labor: Battle for Shelf Space

• None to intense fight

Brand Manager

• Shared or dedicated

Admin Requirements • Orders only to multiple reports

Manufacturer Visit Frequency

• Never to weekly

38

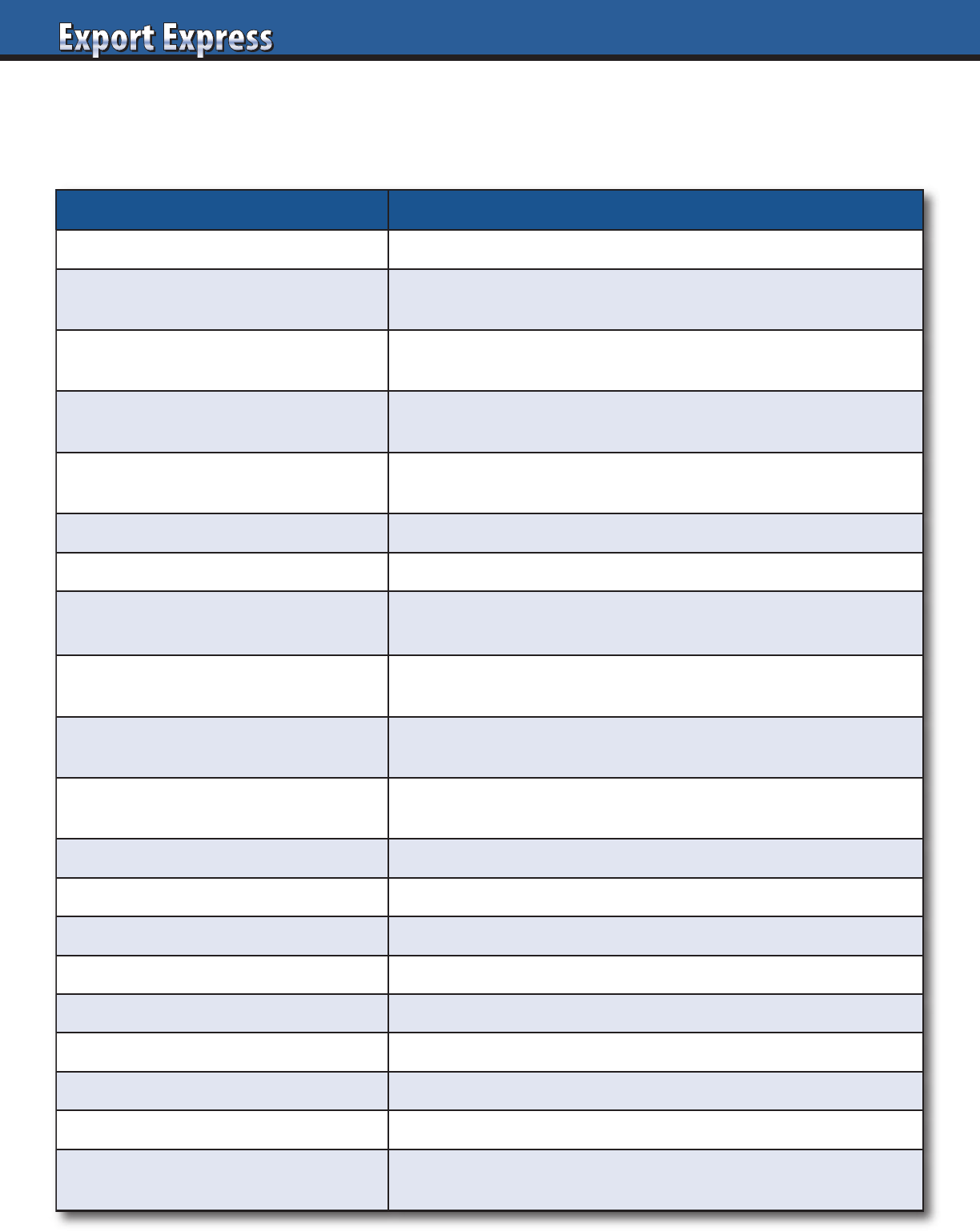

Preferred Supplier Scorecard

Distributors deliver their best results for their favorite principals. How do you rank?

Supplier Assessment Considerations

Rating:

(10 = Best)

Annual Sales Revenue • Percent of total distributor sales

Annual Profit Generated ($)

• Net sales times gross margin

Years of Service • New to 20 years or more

Compound Annual Growth Rate

• Flat to 10% or more

Supplier Investment Level • Zero to 25% of sales

Celebrates Success

• Awards, dinner, thank you notes

Shares Best Practices

• Serves as category expert

Logistics Service Level

• Target 98% on time, complete orders

Visits Retail Stores

• Never to full day every visit

Reimbursement of Billbacks • 2 weeks to 3 months

Senior Management Relationship • None to long term partners

Export Manager Experience • New hire to 10 years or more

Response Time • Same day to one month

Supports Distributor’s Ideas

• Invests in local ideas

Good on Customer Calls

• Avoids calls to customer favorite

Admin Requirements • Orders only to multiple reports

Supplier Visit Frequency • Never to weekly

Relationship: Entire Team • Finance, logistics, administration

Respects Fair Profit for Distributor • Healthy distributor is profitable

Achieves Joint Business Targets • Creates culture of success

39

Does Your Distributor Network Need A Check Up?

Export Solutions Can Help!

• Distributor Network Assessments

• Motivational Speeches

• International Strategy

• Find Distributors in 96 Countries

Contact Greg Seminara at [email protected] or (001)-404-255-8387.

www.exportsolutions.com

Exporters manage distributor networks extending to 20, 50, 70 countries or more!

Every company has a few distributors that under perform.

“Under achievers” prevent us from attaining our personal objectives.

Distributor Network Check Up

• Independent assessment from Export Solutions

• Establish methodology for ranking Best in Class distributors and “Laggards”

• Supply strategies for recognizing top distributors

and upgrading the bottom performers

• Benchmark external brands from your category

• Practical and “action oriented” approach

40

Distributor 2022: New Skills for New Times

Priority Comments

E-Commerce

Treat as major channel, not niche.

Social Media

Hire digital marketing team, link with local influencers.

CEO Engagement

Regular Zoom calls with overseas brand owners.

Culture

Promote young, energetic spirit. Embrace change and new channels.

Category Specialization

Laser focus on core categories vs. products in every aisle of the store.

Training

Use Zoom tools for regular training events with brand owners.

Team

Hire under 30's for social media and e-commerce sales roles.

IT Investment

Upgrade platform: E-commerce, retail reporting, sell out data.

Cost to Serve

Measure profitability by brand and customer.

Realign based upon 2022 reality.

Market Your Distributor Brand

Promote your distributor brand to leading

companies in your core categories. Export Solutions can help!

Sampling

Aggressive investment in this A+ tool. Explore new sampling vehicles.

Brandscaping

Invest in a “Best in Class” web site. Create modern company profile.

Scorecard

Incorporate e-commerce metrics: Page 1 results, consumer feedback, etc.

Brand Managers

Reward creativity and marketing excellence, not paperwork completed.

Recipe

Promote meal solutions, not just brands.

Optimism

Be positive. Think, “why not?”

Results Exceed expectations everyday.

41

Export Manager 2022: New Skills for New Times

Priority Comments

E-Commerce

Treat as major channel, not niche.

Social Media

Create content library for distributors to “plug and play.”

Management Engagement

Zoom with distributor leadership team: CEO, CFO, VP Sales, etc.

Culture

Promote young, energetic spirit. Embrace change and new channels.

Category Specialization

Share category trends. Deliver product innovation, not “me too.”

Training

Use Zoom tools for regular distributor training events.

Team

Make your corporate functional experts available to your distributor team.

IT Investment

Upgrade platform: Brand portal, syndicated data, shipment status.

Cost to Serve

Measure contribution to distributor profit.

Look at pricing and margin vs. agreement.

Marketing Your Brand

Invest to adapt your global marketing plan to local conditions.

Sampling

Aggressive investment in this A+ tool. Explore new sampling vehicles.

Brandscaping

Invest in a “Best in Class” web site. Robust export resource page.

Scorecard

Monitor pricing/assortment at retailer web shops.

Incorporate e-commerce metrics in your distributor scorecard.

Brand Managers

Demand young digitally savvy brand managers.

Recipe

Promote meal solutions, not just brands. Look for co-promotion partners.

Optimism

Be positive. Think, “why not?”

Results Exceed expectations everyday.

42

Launch Plan Proposal – Year One*

Brand Objective

Volume: _______________ Wtd. Distribution: _______________

Share: ________

Consumer Marketing Activities

Activity

1.

2.

3.

Rationale Cost

Trade Marketing Activities

Activity

1.

2

3.

Volume

Cost

Listing Fees

Customer

1.

2.

3.

# SKUs, Space, Promotion Support Cost

Total Year One Volume Total Year One Cost

Wtd. Distribution

Distribution Achieved with Above Spend Level

Customer

1.

2.

3.

Stores

% Country

# SKUs

Volume (annual)

*Feel free to attach other pages to support your recommended launch plan.

Strategic Export

Development Program

Export Passport

Export Passport

43

Distributor Search Challenge

• Some distributors are too big…

• Other distributors are too small!

3

Export Passport identifies

Prime Prospect distributors

that represent the Right Fit

44

45

Exporter Classification*

Type Description

Export Profile

10 Multinational Strong market share everywhere across multiple categories.

9 Global Multinational. Mix of leading countries and niche participation.

8 Category Champion One core mass category. Strong performance globally.

7 Icon Well known, niche leader. Global availability. Example: Tabasco.

6 Regional Leader Strong share across one continent/region. Some export success.

5 National Hero National treasure, #1 brand. Exports to homesick expats, tourists.

4 Player Respectable share in home country. Opportunistic exports.

3 Participant “Me too” product. Opportunistic exports. “Trader”/private label.

2 Challenger Innovator. Some listings in home country. New to export.

1 Start-up Trying to get traction in home country. Export “dreamer.”

*Export Solutions’ classification system

46

Distributor Classification*

Stars

Title

Description

Prime Prospects

HHHHH

Champion

Massive distributor.

Handles multinational/#1

brands across many

categories.

Brand leaders.

$$$ marketing budgets.

Exporter types: 6-10

HHHH

Captain

Category Captain.

Handles leading brands in

one segment.

Category

innovators/leaders.

$$ marketing budgets.

Exporter types: 5-9

HHH

Player

Mid-size distributor.

Handles #2/3 brands or

niche leaders across many

categories.

Differentiated,

premium brands.

$-$$ marketing budgets.

Exporter types: 4-7

HH

Participant

Respected local.

Diversified product

portfolio.

Results equal to investment.

Flexible, challenger brands.

$ marketing budget.

Exporter types: 2-4

H

Pioneer

Small distributor.

Entrepreneurial, open to

innovative new companies.

Start-up brands.

“Pay as you go” marketing.

Exporter types: 1-3

Need more information? Visit www.exportsolutions.com.

*Export Solutions’ classification system

47

Create Your Own Export Library

Looking for a fresh point of view for your

next event or training workshop?

Contact Greg Seminara at

greg@exportsolutions.com

All guides available free at www.exportsolutions.com.

Export Strategy Guide

Distributor Search Guide

Export Handbook

Selling to USA Handbook

Distributor Management Guide

Finance & Logistics

300 Tips for

Export Managers

Idea Guide:

New World – New Business

Export Treasure Chest

My Favorite Templates & Forms

People Power

Strong Teams Build Great Brands

New Distributor

Cooperation Model

48

Overview

Four Core Program Pillars

1. Distributor Segmentation: “Capabilities and Alignment”

2. More in the Store

3. People Power

4. Distributor Economics

Introduction

to Export Catalyst

• Your company has export footprint in most key countries

• Current distributors are adequate, but growth has slowed

• Good export team, but too much repetition of old strategies and inefficient promotions

Team requires new ideas to propel existing business to next level

Export Catalyst

stimulates new sales through innovative strategies

for your current distributor network

Challenge:

Solution:

Options

• Organize as a Work Session or Training Workshop

• Flexible Program: 1 day and 2 day options

• Additional modules: Strategic Export Development, Finding Best in Class Distributors,

Selling to the USA, and 25 Export Problems (& Solutions!)

Looking for new sales from old markets?

Contact Greg Seminara to schedule Export Catalyst

Looking for new sales from old markets?

Contact Greg Seminara to schedule Export Catalyst

49

Export Catalyst

Best Practices

Topic

Core Themes

Distributor Segmentation

•

Distributor capability

and specialization assessment

• Segmenting distributors:

“leaders, performers, laggards”

• Motivating different classes of partners

• Distributor change management

More in the Store

• Defining a good store versus a bad store

• Trade promotion effectiveness:

creativity, KPI’s

• Culture change:

managing in-store merchandising metrics

• Tool kit: listing maps, perfect shelf, etc.

People Power

• Distributor CEO/MD

engagement in your business

• Distributor brand manager:

veteran or trainee?

• Gaining support of total distributor team

• Your role: doctor, coach or babysitter?

• Creating brand champions

Distributor Economics

• How distributors make money

• Calculation Diagnostic:

from factory to store shelf

• Analyzing your profit contribution

to distributor organization

• Distributor profit centers

50

We’ve Got You Covered!

Distributor Database Coverage

9,200 distributors – 96 Countries

Subscribe now at www.exportsolutions.com

“Spend time Selling to Distributors versus Searching for Distributors”

Confectionery & Snack:

2,713 Distributors

Ambient Beverage:

1,691 Distributors

Gourmet & Ethnic Foods

3,276 Distributors

Asia

2,030 Distributors

17 Countries

Middle East

937 Distributors

12 Countries

Europe

3,139 Distributors

Latin America

1,574 Distributors

USA Importer/Distributor

:

598 Distributors