Insights to Accelerate International Expansion

Idea Guide

Our Mission: Help Manufacturers “Spend time Selling to Distributors versus Searching for Distributors”

In This Issue

Sell to 96 Countries

Looking for new customers and

distributors in international markets?

Export Solutions’ distributor database

covers more than 9,200 distributors

in 96 countries. Our database features

extensive coverage of leading food,

confectionery, and beverage distributors.

New! Export Solutions’ retailer database

now tracks 2,700 retailers in 96 countries.

Order now at www.exportsolutions.com.

10 years ago, few exporters would have

predicted that Walmart would be

number one outside the USA too,

with $100 billion in sales beyond USA

borders. In 2012, who would have

guessed that Amazon would be viewed

as Walmart’s biggest competitor, with

2022 product sales of $400 billion? Or

that today, the Chinese grocery market is

larger than the USA’s, with a compound

growth rate of 5 percent since 2010. Our

job is not to predict the future, but to

discover new ideas to sell more product.

Today, it is possible to share new

business ideas and Best Practices

from around the world instantly

via the internet. Export Solutions’

Idea Guide represents a compilation

(and update) of my Export Express

newsletter columns. These comments

are personal reflections on ideas and

strategies to build an international

business, not just sell a few containers.

I must share credit for these ideas with

my network of more than 9,800 export

manager and distributor friends from

around the world.

Export Solutions’ role is to provide

tools and insights to facilitate the

international expansion plans for our

industry. We must remain committed to

discovering and pursuing new ways to

achieve our ambitious targets. This Idea

Guide seeks to share New Ideas to create

New Business in this ever expanding

world of 7.9 billion people.

3 What is your strategy to optimize e-commerce (Amazon) sales?

3 How do you share Best Practices in Selling to Walmart, Carrefour,

and Metro between your teams operating in different countries?

3 When was the your last offsite meeting dedicated to brainstorming

new ideas?

3 What was the most creative promotion you saw last year? Why?

3 How much time do you spend looking at the entire supermarket,

looking for new ideas, not just focused on your own category?

3 When was the last time that you hired an external consultant to take

an independent look at your export strategy?

Greg's Guidance: New Ideas – New Business

New Ideas – New Business

Page 4

What Will You Do Differently in 2022?

Page 8

What If and Why Not?

Page 28

Fire a Customer!

Page 31

What I Learned in 2021

Page 38

Treat Distributors as your Best Customers

Page 41

Half Time Report: An Exporter at 50

Page 44

Buyer for a Day?

Page 45

2022: New Year, New Business Ideas

Page 50

Distributor Intelligence

2

I learned a lot in 2021 through projects completed in

31 countries on five continents. One of the important

issues revealed is human resource allocation in the world

of export. Our function appears anchored to the title of

regional export manager. This export manager is expected

to achieve their assigned objectives through a combination

of managing existing businesses and expansion into new

countries. In many cases, there is one export manager

assigned to handle a huge geography like Asia or Latin

America. My observation is that most export managers dedicate the majority of their time

“babysitting” existing businesses that deliver their annual sales quota. This shortchanges

time available to “making babies,” the process of new market development.

Our feature article “The World in 2025” unveils a snapshot of the world in 3 years. Most

exporters jam their annual plans with futuristic projections for dynamic business potential

of China, Brazil, or the USA (European Brands). How can we ever expect to take these

businesses to the next level with one person allocated per region, perhaps even located in

corporate headquarters, thousands of miles away from the “action?”

Listed below are Export Solutions ideas for “Making More Babies” in 2022.

1. Shift Team From Mature Markets to Developing Markets

Most companies feature sizable sales teams managing, large, mature businesses growing

at 5 percent or less. Then, they’ll have one person managing Asia’s 4 billion people and one

person allocated to Latin America’s almost 600 million people. The result is usually tiny niche

businesses growing by high percentages, but miniscule in terms of scale. There is a delicate

balance, but in general the shifting of some head count from the base business to international

can pay out plus supply a meaningful new career opportunity for your team members.

2. Create New Country Development Role

This business incubation position could focus on business start-up in a small number of

priority countries. The person should have access to corporate functional resources and work

closely with the area export managers. I know several companies that use this model with

exceptional results.

3. Redefine Export Manager Work Allocation

Split workload to provide more time for Making Babies versus Babysitting. Don’t worry,

markets like Puerto Rico, Belgium, UAE, and Singapore will be fine if you spend more time

in Colombia, Poland, Saudi Arabia, and Indonesia.

4. David Against Goliath Won’t Work in Top 5 Countries

A one person team working with a distributor will not allow you to optimize your business

in enormous, complex countries like China, Mexico, or the USA (Europeans). Game changing

results can be obtained through a three-five year plan including local production, multi-

functional teams, regional activities, and serious investments in trade activities and marketing

support. Consider acquisition of a local brand in your core category.

5. Boots On the Ground

Brands with regional employees based in foreign countries are gaining more than their fair

share of distributor time and focus. These managers are closer to market conditions and

distributor sales teams than export managers based in distant USA or European headquarters.

Consider offices in Shanghai, Sao Paolo, Mexico City, Jakarta and Jeddah to make a difference.

Other choices include Singapore, Panama, and Dubai. USA managers are typically centrally

located in Chicago, Atlanta, or Dallas, close to major customers and airports.

We are the “Brand Parents.” Making Babies and creating new businesses will provide a solid

home base for the future. Time is always required for babysitting and brand development in

existing markets. However, need to spend more time on activities to “expand the family.”

www.exportsolutions.com

“Spend Time Selling to Distributors versus Searching for Distributors”

Greg Seminara

404-255-8387

Strategic Services

International Strategy Expert

Export Solutions has written the

Export Strategy Guide. This handbook

is a valuable industry resource.

Our strategic services adapts the

concepts from our Export Strategy

Guide to meet the needs of your

business. Expertise covers global

market prioritization and criteria

to identify Best in Class distributors

from average players.

Contact Us for Export Solutions

Making Babies Versus Babysitting

3

KLIM milk powder is a Nestlé product popular when

I lived in Saudi Arabia. Try spelling Klim right to left

(backwards) and you will discover a great brand name

for an instant milk product. Apply the same principle

to YTIVITAERC and you will discover the theme of

today’s column.

I am bored with the majority of today’s brand

promotional programs. It appears that many companies review last year’s plan, update

and repeat! Don’t mistake me for a sentimental old timer, but in store merchandising still

creates excitement and builds business. I remember when as a young P & G salesman, I

would encourage my stores to display dishwashers from a local appliance store

surrounded by a pallet of Cascade in order to sell more dishwasher detergent.

Today, I love the story of Rio Mare, Europe’s leading tuna fish brand. Tuna is a tough

category, driven by price promotions. Rio Mare is also a premium brand, with superior

ingredients and processing. Still, Rio Mare enjoys double digit growth in many emerging

markets. How do they do it? I recently visited Dubai and Qatar where I counted massive

displays everywhere featuring a promotion where the shopper received a free casserole

dish with the purchase of Rio Mare. In Dubai, you can discover taxis painted in

Rio Mare’s distinctive salmon,blue and orange colors.

How do we inject Creativity and new ideas into our promotional programs?

1. Creativity Workshop – Schedule a day long brainstorming session outside the office.

Search for an inspirational site, such as an art museum, historical monument or even

a sports arena. Hire a motivational speaker from outside the industry to stimulate

discussion. Encourage each team member to generate two good ideas for the event.

Leave all cell phones and laptops in the car to avoid distraction.

2. Co-Marketing Activity – Every food brand “shares the plate” with other related

products. Non-food products such as household cleaners and laundry aids are

combined to present consumer solutions. Approach related, “adjacent” brands to

create co-marketing promotions. Costs can be shared and you may discover a friendly

“non-competitor” to benchmark best practices.

3. Distributor Events – Entrepreneurial distributors serve as magicians at designing

unique programs. Their extensive rolodex allows them to sync with a retailer’s

favorite cause or leverage the popularity of local sports teams. A successful strategy

is to encourage a distributor to run a group promotion for all their brands with a

charitable overlay.

4. Online Insights – Look to the internet and social media for learning on breakthrough

new ideas. How are giants such as Amazon and Ocado pairing your products for their

online customers? What topics are hot with supermarket bloggers? How do we translate

these insights into a meaningful promotional campaign?

5. Sales Contest – Everyone loves the excitement of a sales contest. Why not reward your

distributor brand managers for the best creative event measured by incremental volume?

First prize could be a “Design your Dream Trip of a Lifetime” where the top prize is

$10,000 to go anywhere in the world.

Leading companies are devoted to a spirit of innovation and creativity.

Ultimately a recipe of traditional price promotions and coupons dulls the consumer

response. YTIVITAERC! Sometimes you just need to address promotions from a

different point of view.

YTIVITAERC

www.exportsolutions.com

“Spend Time Selling to Distributors versus Searching for Distributors”

Greg Seminara

404-255-8387

Strategic Services

Identify Best in Class

Distributors: 96 Countries

Export Solutions maintains the

unique ability to leverage the power

of our proprietary database for our

clients. Distributors everywhere know

Export Solutions, providing our clients

with access to senior distributor

management and special

consideration for their projects.

Contact Us for Export Solutions

4

It’s far from business as usual in the export world.

Most companies struggled to a decent 2021 finish

through a combination of emerging market growth

offsetting tough conditions in the home market.

2022 looks tougher, with a smaller increases projected

for Asia and Latin America and a continued squeeze

in Europe. Austerity protests, “fiscal cliffs,” Carrefour divestitures and the surge

in Internet shopping create an uncertain outlook for our “old school” export

development plans. Listed below are ideas to define your new game plan for

achieving your 2022 targets.

1. Focus on Fewer, Bigger Opportunities

All markets are not created equally and many of us spend too much time on small or

mature markets. Pick 1-2 high potential markets in your area. Visit frequently and invest

at a higher level in local programs. The USA market opportunity is “Bigger than BRIC”

for most European exporters.

2. More In the Store

Dedicate 2022 to improved retail conditions for your brand. Publish an in-store presence

handbook. Sponsor a sales contest to encourage better shelf positioning. Spend a half

day on each trip visiting stores. The supermarket is where inventory is translated to

actual sales.

3. Create a Listing Map for Each Country

Each market should maintain a brand availability listing map. This template should

track your brands availability by size (variant) and by retailer. Create a methodology

to track new or lost distribution.

4. Online Retailer Sales Strategy

Establish a project to assess internet retail implications for your brand. What are the

opportunities? How will this change your marketing approach? How can you provide

tools and resources to help your distributors attack local Ecommerce sales opportunities?

The future is now!

5. Call or Visit to Each Distributor CEO

Get an early pulse on the market. Make personal calls to leaders regarding 2022

expectations, planned investments, and insights from large retailers. Reinforce your

key priorities and secure commitment for “no surprises.”

6. Upgrade Your Web Site

Your web site is the gateway to your company’s global reputation. Refresh your Export

page with success stories, brand availability maps, and new graphics. Export Solutions

will follow our own advice with a new web site in 2022!

The new year represents an excellent time to set aside time to identify industry trends

and develop your personal plan for making a difference in 2022. Send a message to

senior management that you are focused on the future. Good luck!

What Will You Do

Differently in 2022?

www.exportsolutions.com

“Spend Time Selling to Distributors versus Searching for Distributors”

Greg Seminara

404-255-8387

Strategic Services

Meeting Speaker

Looking for a motivaional speaker

to challenge your audience to take

your business to the next step?

Greg Seminara serves as keynote

speaker for distributor, company,

and government sponsored events.

Topics cover any of the 100 subjects

written about in our

Export Express Newsletters.

Contact Us for Export Solutions

5

Export Managers proudly salute the flags on

their country coverage map as part of their export

credentials. This flag filled map is important, but

sales volumes per capita trends serve as a more

accurate measure of export progress. Many brands

claim a footprint in many countries, but only a few

brands such as Barilla, Pringles, and Tabasco sell to more than 100 countries

and are successful virtually everywhere.

This month, a well known European company approached me for help to fill in

“white spaces” in their export coverage map. This brand claimed distributors in about

70 countries, including all of the important high growth regions of Asia and the Americas.

Normally, I conduct distributor assessment projects in at least 20 countries per year.

I knew that this good brand enjoyed acceptable presence in about 20 markets.

However, a situation existed in at least 30 countries in their coverage universe where

they “planted flags” through partnership with a distributor, but registered minimal sales.

My response to this company is that their strategy and my involvement would generate

better results through focus on a handful of countries where their brand was underdeveloped,

versus stretching their export map to new countries to fill in coverage gaps.

Listed below are a few ideas to build sales in existing markets.

1. Conduct a 20/20 Analysis

Which export markets rank as your top 20% in terms of sales per capita?

Which rank as the lowest 20%? Why? What are the lessons learned that should

be applied to your export strategy?

2. Segment Countries

Export Solutions segments countries as “Strategic,” “Priority,” and “Opportunistic.”

Which strategic countries are in your bottom 20% of performance?

3. Focus on 1-2 Strategic Countries

Look at your gaps and focus on one country. Change your model, hire a local manager, and

test a higher investment plan. Visit frequently. If you have a big team, concentrate on two

countries, but the basic message is to align your energy on a big country, even though it’s

tough versus dividing your time and resources equally among a lot of countries.

4.USA is Bigger than BRIC’s

All companies claim sales to the USA, but per capita sales levels are usually quite

modest. The USA is a growing country, with 333 million relatively affluent consumers.

Invest in marketing and people to build your brand in the USA. The size of the prize

and return on investment from the USA will be higher than all the BRIC’s combined.

5. Change Distributors or Exit Markets

Selling one container a year to a large market is not worth the complexity and energy

required just to claim another “flag on the map.” If you partner with a strong distributor,

provide them with more tools and investment. Change your distributor if they are small

and underperforming in a large country. You do more long term damage to your brand

with an unqualified partner versus the benefits of a few extra shipments. You’ll find this

out when you try to enter the same country later and you are rejected by the retailers as

your brand has “been here before and failed.”

For many companies, there is more incremental business available through optimizing

existing international businesses versus chasing new flags for the map.

Too Many Flags,

Not Enough Sales!

www.exportsolutions.com

“Spend Time Selling to Distributors versus Searching for Distributors”

Greg Seminara

404-255-8387

Strategic Services

Walmart International

Walmart International began with a

joint venture in Mexico in 1991. Today,

Walmart’s international sales total

$120 billion dollars, exceeding 24% of

total Walmart sales. Export Solutions

has been there since the beginning,

with knowledge of Walmart

operating units in Mexico,

United Kingdom, China, India, etc.

Contact Us for Export Solutions

6

Every successful manager has a special person in their

career that mentored them and promoted their potential

to the big bosses at headquarters. In my case, this

was Bill Doyle. Bill was a crafty veteran, my division

manager at Clorox. Bill Doyle defined “old school,”

having honed his skills on the rough and tumble streets

of New York for Procter and Gamble and Phillip Morris.

USA brokers fearfully called him the “Doctor” because

he usually showed up when the business was sick.

Bill Doyle passed up several opportunities to move up the corporate ladder. He threw

all his energy into discovering exceptional young talent and developing them. Doyle led

by example and created an unprecedented record of advancing his people to the upper

levels of management. Bill Doyle taught me most of what I know about the fine art

of store checks. “What’s measured is treasured.” I guess I impressed him when he

challenged me to focus on a broker’s in-store performance. I quickly produced analysis

based upon checking 300 of the broker’s 400 stores within a six week period.

In the world of export, we are frequently asked to create miracles with limited budgets

and stretched resources. We can not do it all alone. One of Bill Doyle’s many lessons was

to focus on people development and spending time in the trenches. A well written letter

or a timely phone call from Bill could inspire the troops to achieve the desired results.

There are two questions to think about.

What are you doing to promote and develop young talent at your company?

Big companies like Nestlé, Coke, and General Mills sponsor structured mentoring

programs. Smaller companies are more informal, but still committed. Structured or

unstructured, the greatest gift an executive can share is his time. Examples include

participation in a week long market visit to a quarterly checkpoint lunch or an invitation

for a young talent to sit in on a senior management meeting. We all thrive from positive

written communication. I still have “attaboy” letters from my early days at Procter and

Gamble. One of my popular bosses, who later became a CEO, maintained a large stack

of index card notes on his desk. Each day, he dedicated time to draft handwritten notes

to team members, customers, and contacts with a few short sentences of encouragement

or recognition.

What is your export training program?

International development and distributor management is a science. Senior managers

rely on years of experience. Newer people to export are frequently sourced from the

home market organization, with strong industry fundamentals, but are quickly lost

when they step off the plane on a new continent. Each year, I conduct 1-2 day training

workshops for companies focused on export expansion as well as government trade

associations. The sessions are always highly interactive and a form of team building.

Typically, everyone participates from the international leader to the customer service

representatives. Looking back, I always reflect on the positive group spirit and sense

of shared purpose at the companies that invest in formal export training. Will your

legacy be based upon your own accomplishments or a that of a strong pipeline of

future leaders?

I have been fortunate enough to work on export projects from Mexico to Mongolia and

Italy to India thanks to the support of Bill Doyle and others at Clorox (Rich, Joe, Tom,

Glynn) who took an interest in my career. Today, I took Bill Doyle out for lunch to say

thank you. Who is the Bill Doyle who made a difference in your life? Give them a call

today to express your appreciation and update them on your activities to develop your

own team.

www.exportsolutions.com

“Spend Time Selling to Distributors versus Searching for Distributors”

Greg Seminara

404-255-8387

Strategic Services

International Strategy Expert

Export Solutions has written the

Export Strategy Guide. This handbook

is a valuable industry resource.

Our strategic services adapts the

concepts from our Export Strategy

Guide to meet the needs of your

business. Expertise covers global

market prioritization and criteria

to identify Best in Class distributors

from average players.

Contact Us for Export Solutions

Who is Bill Doyle?

7

Recently I celebrated 26 years of marriage to my wife Frances.

As the story goes, I met my Irish bride at a wine tasting party in

Jeddah, Saudi Arabia. We were married in Dublin by no fewer than

four Irish priests and began our journey together in Buenos Aires,

where I worked for Clorox. Twenty five years have flown by,

including surviving the turbulent teens of our three beautiful

and “spirited” daughters. My wife claims that she is not technically

completing 26 years of marriage, as I’ve been travelling about half

the time. As usual, your wife is always right.

Similar to all couples, our lives reflect a mix of fun and tears,

laughter and arguments. Days without talking to each other blurred

by escapes to a Caribbean beach. Frances and I are still together

because of a shared sense of purpose and values. Over the years,

we’ve evolved and adjusted, and even become more flexible and

tolerant, particularly of my stubborn habits. At the end of the day, our marriage has

succeeded though a strong commitment and the fact that we still enjoy each other’s

company. It works!

Some may wonder why I share this personal story? As I became absorbed in planning

details for our 26th wedding anniversary celebration, my private life and business world

of “distributor search” collided. For the last 16 years, I spent at least half of my life

visiting countries and helping great brands find new partners. I was reminded that

distributor and supplier partnerships are like marriages, linked together by commitment

and common objectives. Great global brands like Barilla and Tabasco point to some

distributor relationships extending 25 years or more. Yet, as with marriages, distributor

relationships don’t always work out. Despite “liking each other,” we need to take the

painful step of moving on.

At the risk of sounding like a distributor “marriage counsellor,” I share these thoughts.

1. Brands and distributors: mix of good years and disappointments.

Continuity requires more good years than bad. Do you both possess the ability

to proceed with renewed passion beyond trouble spots?

2. Partners must remain important to each other.

Distributors are genuinely excited to take on a new brand. They invest their own money

and resources because of a strong belief in your company and vision. As years progress,

is that spark still there?

3. Sometimes you need a getaway.

PowerPoints, spreadsheets, and meeting rooms stifle creativity and team building.

When was the last time that you spent a day together outside the office checking stores

or for a brainstorming session at an offsite location? A better idea is to invite your

distributor to your company headquarters for a VIP experience.

4. Celebrate your anniversary!

Some companies do a great job at recognizing distributors for 1, 5, 10, or 25 years

of partnership. My wife appreciates a nice dinner out and jewelry to mark a special

anniversary. Distributors proudly display plaques and recognitions from their suppliers.

Most couples commemorate their anniversary every year. Why not adopt a similar

approach with your distributor network?

I am hoping that my wife Frances signs another 26 year contract. It won’t be easy,

with lots of hard work in a changing environment. We are not so young anymore, but

maintain plenty of energy and a good outlook. We marked our 25th anniversary with

a big party at the Finnstown House near Dublin, the same venue from our wedding

reception all those years ago. A fun part of life is celebrating good days and important

milestones. Good luck!

Celebrate Your Anniversary

www.exportsolutions.com

“Spend Time Selling to Distributors versus Searching for Distributors”

Greg Seminara

404-255-8387

Strategic Services

Identify Best in Class

Distributors: 96 Countries

Export Solutions maintains the

unique ability to leverage the power

of our proprietary database for our

clients. Distributors everywhere know

Export Solutions, providing our clients

with access to senior distributor

management and special

consideration for their projects.

Contact Us for Export Solutions

8

This is the time of year that many of us are buried in the planning process for 2022.

Some companies speak of disruptor strategies, but the reality is that most remained

glued to repeating the old playbook: same brands, same trade promotions, same

distributor all with the dream of struggling to a five percent growth target. Brands

compete in a new world, with emerging markets and e-commerce as primary growth

engines. Winners must “Say No to Status Quo.”

Business transformation requires us to ask two fundamental questions:

What if and why not?

What if you could…?

1. Double your international business in three years?

2. Create a major new business in a prime prospect country like Mexico or Japan?

3. Become a category leader in e-commerce?

4. Convince management to produce offshore or a substantial investment

in social media?

5. Reduce your prices, but deliver higher profit through increased turnover?

One recipe for success is to “think like an exporter, but act like a multinational.” Pick

one or two high potential countries and test a high impact plan, including more boots

on the ground.

I recall my first business trip to Denmark in 1999. Denmark is not an easy country to

enter for USA exports. My meeting was with Hugo Rosendahl, the managing director

of Consiva (now Conaxess), the largest distributor. After sharing my enthusiastic

presentation, Hugo responded favorably “Why not?” He mentioned that he always

carefully considered each opportunity, looking at the potential benefits not the barriers.

After lunch, the team delivered little green bottles of Underberg to each guest.

To an unknowing American, the Underberg bottle appeared like a local version of

Tabasco. Imagine my surprise when Hugo raised the Underberg and invited us all

to chug the bottle. Skal! For years, a bottle of Underberg digestif alcohol has remained

on my desk to symbolize “Why not?”

Why not? Anything is possible, with the right plan, partner, and focus. During a

recent project across seven Middle East countries, I saw several brands that achieved

impressive presence in their categories. These brands were “Made in the USA,” but

I had never seen them on the shelves of a USA supermarket before. In other words,

entrepreneurial companies transformed their business and succeeded in the global

marketplace despite a small platform in their home country.

Sports teams approach each season optimistically, with new players and a hope to

win the championship. In our competitive world, some brands cling to “old school”

distributor teams. These under-capitalized distributors have not invested in omni-

channel coverage, digital marketing or, e-commerce. Without “A” players to manage

your business, how can you grow?

2022 may represent a game changing year for your company and your global ambitions.

Why Not?

What If and Why Not?

www.exportsolutions.com

“Spend Time Selling to Distributors versus Searching for Distributors”

Greg Seminara

404-255-8387

Strategic Services

Best Practices Export Strategy

Export Solutions has participated

in more than 300 projects across

5 continents. Our work extends across

most supermarket categories. This

provides us with us with a broad base

of benchmarking contacts and lessons

learned to incorporate into your

export strategy.

Contact Us for Export Solutions

9

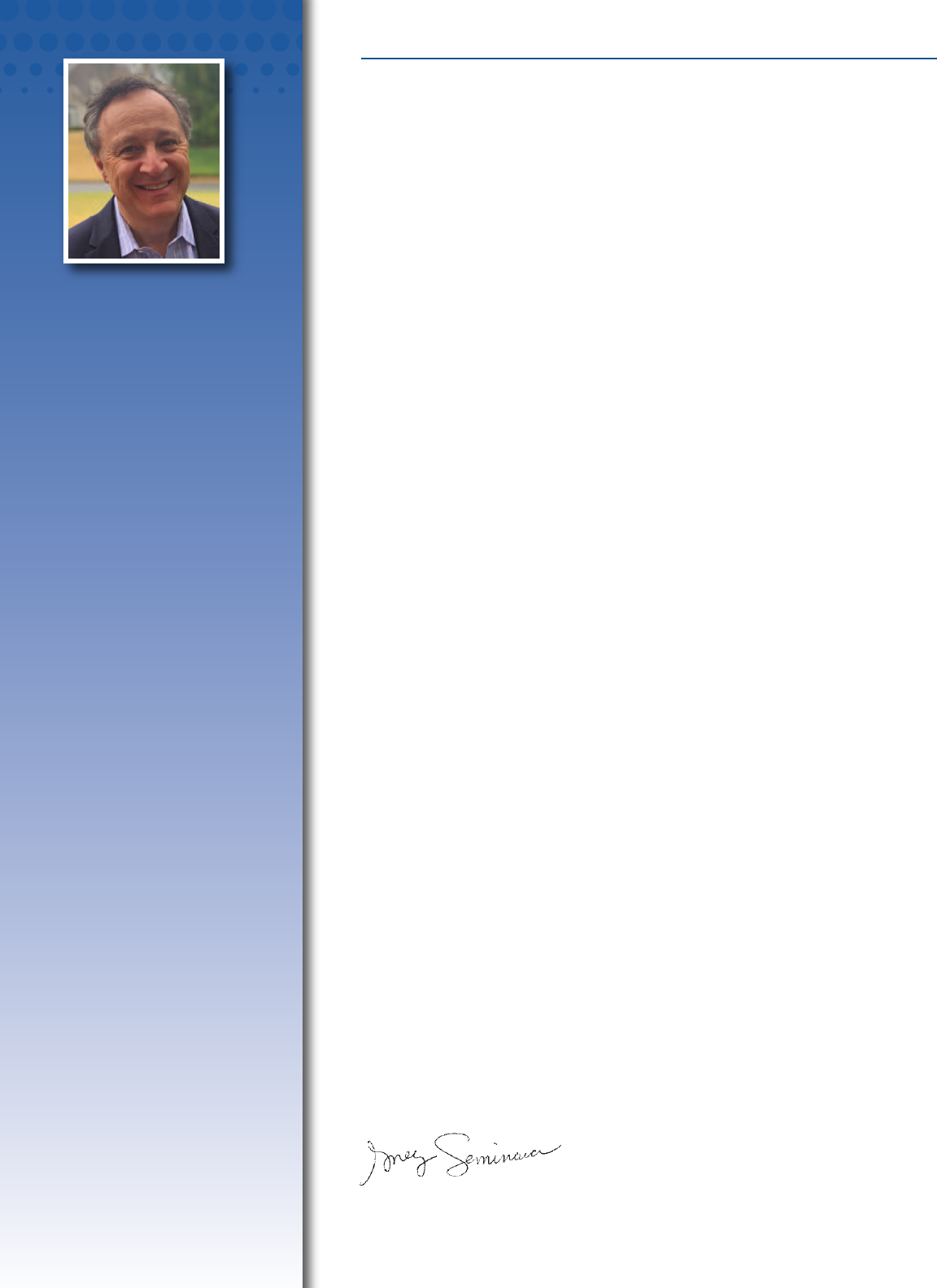

Distributor Search Helper for:

Your

Logo

Here

Can We Help You?

Recent Distributor Search Projects

Asia Europe Middle East Latin America

Australia Germany Israel Argentina

China Ireland Kuwait Brazil

Indonesia Netherlands Qatar Colombia

Japan Nordics Saudi Arabia Costa Rica

Malaysia Spain UAE Ecuador

Philippines United Kingdom North America Mexico

Singapore Africa Canada Panama

South Korea South Africa United States Peru

Call the Export Accelerator!

Contact Greg Seminara at greg@exportsolutions.com

to discuss your business development project.

www.exportsolutions.com

10

Picking the right distributor is not an exact science.

I know that each of us experiences moments of

frustration when we question, “why did we ever pick

that distributor?” Believe me, an equal number of

examples exist where a distributor may share the

same emotion about your company! Frequently, a

partnership is christened by a positive distributor

interview or enthusiastic meeting at a trade show.

Everyone is always in a hurry to negotiate prices

and a contract and secure the first order. However, in

many cases the decision to work together is cemented

without a formal business plan where expectations, road map, and KPI’s are established.

Unfortunately, one year later both parties may find themselves pointing fingers at each

other due to disappointing results.

I recently completed a distributor search project in the Middle East. We interviewed a

number of good candidates and identified two with high potential. Last month, I was

notified by the export manager that he selected one of the candidates. I supported his

decision, but questioned how the plan proposals for the two distributors compared?

The vague response confirmed no plans, just that he liked one distributor better.

This year, another project brought me to a country where a new distributor had been

appointed less than one year earlier. Initial results were severely below expectations.

The first question I asked the brand owner related to the reconciliation versus the

original one-year business plan. What happened? In this case, there was general

understanding about the direction of the partnership, but never alignment around

a one-page scorecard with KPIs and a logical road map.

Launching a new distributor relationship is like the birth of a child. A mother rarely

leaves the side of a baby, providing comfort, safety, and nutrition until the infant is

healthy and able to survive without constant oversight. The same philosophy must

apply to a distributor partnership. During the first few months, there must be frequent

communication, care and visibility from the supplier with the new “brand parents.”

This approach results in a healthy brand. Too many times, I see a new distributor

appointed without anyone from the manufacturer committed to visit the country

for the sales launch meeting or conduct a retail sales audit within the first sixty days.

Parents bring their newborn to the doctor frequently for checkups.

Listed below are Export Solutions’ tips on creating a clear annual plan for each country

and distributor partner.

1. Select new distributors based upon the quality of their year one plan:

targeted listings, volume forecast, and retail penetration.

What is their written commitment and timeline for achievement?

2. Current distributors should also have a confirmed one page plan.

Merchandising events, new listing targets, spending, and shipment targets.

Many brand owners treat distributors as good customers which is a smart approach.

The distributor is paying your invoice, not a retailer. Successful distributor partnerships

thrive when both parties are aligned and committed to a simple, one-page plan.

Looking for a sample format? I’ve prepared a one-page business plan template that

is freely available in the Export Tips section of my web site or simply email me.

What is your annual plan for each country?

www.exportsolutions.com

Greg Seminara

404-255-8387

“Spend Time Selling to Distributors versus Searching for Distributors”

Strategic Services

Export 101: Let’s Get Started

Export Solutions provides practical

advice on creating your export

strategy. We’ve helped 100’s of

small-mid size companies gain new

sales from overseas markets.

Our added value is our sales oriented

approach and extensive contacts

with international distributors.

Contact Us for Export Solutions

What is the Plan?

11

Most international managers work

for companies with impressive market

shares in their home countries. This

creates a proud company culture based

upon critical mass, deep resources, and

a strong commitment to marketing and

innovation. This scaled model appears in

direct conflict with the export department which is tasked with creating

miracles with a small team and limited investment. The result may be

challenging when a big company attains a disappointing niche status

in strategic international markets.

How can we leverage our home office strengths to accelerate our growth trajectory

in tough to penetrate countries?

1. No More Copy Paste

Too many export departments repeat the same boring behavior every year: identical

price promotions, similar annual priorities and the same discussions year after year.

Inspire your distributor team. Reward creativity and new thinking to solve old

problems. Test something new!

2. Think Like Marketers, Act Like Start-ups

Export frequently resembles a trading souk focused on price and promotion.

Return to your marketing roots, with conversations around your unique product

benefits and strategies to reach your target consumer. Deploy cost effective, guerilla

marketing techniques to break through the clutter. Find creative ways to get samples

into the hands of a broad audience.

3. Build the “A” Team

Everyone wants to work on the international business. Seek the brightest young people

at headquarters and lure them to your team. They will require training, but their high

energy will be rewarded. Access functional experts, even if it’s on a shared or dotted

line basis.

4. Is Your Price Right?

At home, our brands represent category leaders, usually appearing in the middle of the

price spectrum. Overseas, the added costs through the supply chain result in our brands

being priced at premium or super premium levels versus local players. In many cases,

export pricing is heavily burdened with corporate overheads that are duplicated

overseas through your distributor’s cost structure. Pursue efficiencies “line by line”

to sync your pricing to be more competitive with local price thresholds.

5. Big, Big, Big Strategy

In export, it is easy to be distracted by complexity. Some export managers falsely rest on

the claim that “they sell to 50 countries.” Winning the big prize requires a narrow focus:

Big Brands at Big Customers in Big Countries.

Your company has demonstrated its brand building success in your competitive home

market. Capture, borrow, and adapt that formula to fight tough battles overseas.

Good luck!

Strategic Services

Contact Us for

Export Solutions

1. Identify Best in Class

Distributors: 96 Countries

2. Best Practices

Export Strategy

3. Distributor Management

Workshops

4. Export 101:

Let’s Get Started

5. New Market

Prioritization

& Launch Plan

6. Personal Distributor

Introductions:

96 Countries

7. Walmart International

8. Distributor Contracts,

Margins, & Fees

9. Meeting Speaker

10. International

Strategy Expert

Strategic Services

Contact Us for

Export Solutions

1. Identify Best in Class

Distributors: 96 Countries

2. Best Practices

Export Strategy

3. Distributor Management

Workshops

4. Export 101:

Let’s Get Started

5. New Market

Prioritization

& Launch Plan

6. Personal Distributor

Introductions:

96 Countries

7. Walmart International

8. Distributor Contracts,

Margins, & Fees

9. Meeting Speaker

10. International

Strategy Expert

www.exportsolutions.com

Greg Seminara

“Spend Time Selling to Distributors versus Searching for Distributors”

When Big is Small

12

Do you speak the same language as your

distributors? I am not talking about

English, Italian, Arabic, or Chinese

linguistic skills. I am speaking the

language of money. Most export

managers discuss business with their

distributors in terms of cases and

containers. Many distributors are

entrepreneurs that measure their business in terms of profit contribution and

cash flow, just like your company CFO. Understanding distributor economics

can position you and your company as preferred suppliers.

1. Distributors deserve a reasonable profit for their efforts.

Many achieve a net profit margin of only 3-5 percent plus various owner benefits.

A financially stable partner invests in people and technology to advance your mutual

business. A solid balance sheet allows the distributor to weather the storm in a political

or financial crisis.

2. What is the “salary” you pay your distributors?

Calculate cash flow generated by your company by analyzing distributor net sales

to customers multiplied by the distributor margin excluding any promotional bill

backs. Margin is one metric, but cash generated pays the bills. How does the distributor

salary compare to the work required to service your business or the cost of maintaining

a local subsidiary?

3. New Business = Bonus

Distributors are constantly searching for new brands. The next piece of new business

entering a distributor generates incremental sales while better utilizing fixed assets like

the sales team and warehouse. Brands with existing sales in a country are very attractive

as they contribute immediately to the distributor, even if they require a lot of effort

during the initial transition.

4. Pioneering is tough!

Would you work for a company for one year without salary? That is the scenario when

a distributor is challenged to pioneer a brand in a country for the first time. The cycle

of distributor selection, business plan, new product launch, marketing activation and

customer repayment may take one year or more before the distributor receives his first

“paycheck” for his efforts for your company. Of course, there is a long term pay out

for the distributor when the brand works. This is one of the primary reasons that

distributors are reluctant to start to represent a new company without a strong USP

and investment program.

5. What is the “size of the prize?”

Distributors appreciate export managers that frame their partnership in terms of mutual

profit development. Brand owners that understand the intricacies of distributor cost to

serve will be rewarded. Measure your profit contribution to a distributor and request

that a fair share of their resources be invested in your brand development. A profitable

distributor is a healthy distributor!

Good luck!

www.exportsolutions.com

Greg Seminara

“Spend Time Selling to Distributors versus Searching for Distributors”

Distributor Economics

Strategic Services

Contact Us for

Export Solutions

1. Identify Best in Class

Distributors: 96 Countries

2. Best Practices

Export Strategy

3. Distributor Management

Workshops

4. Export 101:

Let’s Get Started

5. New Market

Prioritization

& Launch Plan

6. Personal Distributor

Introductions:

96 Countries

7. Walmart International

8. Distributor Contracts,

Margins, & Fees

9. Meeting Speaker

10. International

Strategy Expert

Strategic Services

Contact Us for

Export Solutions

1. Identify Best in Class

Distributors: 96 Countries

2. Best Practices

Export Strategy

3. Distributor Management

Workshops

4. Export 101:

Let’s Get Started

5. New Market

Prioritization

& Launch Plan

6. Personal Distributor

Introductions:

96 Countries

7. Walmart International

8. Distributor Contracts,

Margins, & Fees

9. Meeting Speaker

10. International

Strategy Expert

13

For many exporters, eighty percent or

more of their distributor interaction filters

through a distributor brand manager.

If you are lucky, this energetic university

graduate completes your reports and

serves as a capable advocate with the

distributor sales team. Brand owners

frequently demonstrate excessive loyalty

to their brand managers as local heroes

that rescue the export manager from periodic emergencies. In reality,

the distributor brand manager is a “middle man,” communicating with

the generals that deliver the results at key account and store level.

International brand building is a team sport. Winners are companies that form strong

relationships with all functional leaders in a distributor organization. Web meeting tools

like Zoom and Teams facilitate easier direct linkage with key distributor personnel.

Discussed below are Export Solutions’ tips for moving “Beyond the Brand Manager”

to accelerate your business to the next level.

1. Key Account Managers (KAMs) Are the Power Players

KAMs are the major account experts and own the buyer relationships. Direct feedback

from them provides valuable, realistic insights. Most distributors have weekly KAM

meetings that are worthwhile to join to discuss a key priority. Roll up your sleeves

and become visible with the sales people “carrying the bag.”

2. Field Sales Teams Control the In-Store Show Room

Typically, a distributor’s store-level merchandising team reports to the sales director, a

few “hand-offs” away from the brand manager. Retail stores represent the place where

export dreams are translated to cash in the register. Field managers juggle a large basket

of priorities for their sales army. Fund a sales contest and you will build loyalty.

3. Follow the Money to the CFO

How well do you know the CFO at your distributors? The finance department is the

cash hub, approving orders, handling payments, and guiding the distributor’s financial

health. Establish a relationship with the CFO when all is well, as it will pay dividends

when a financial crisis erupts.

4. Meet the Digital Team

E-commerce development represents a growth initiative everywhere. Many distributors

hire a small, young team. Create “First One in Benefits” by partnering with this group at

this early stage of team evolution.

5. Treat Distributor CEO as a VIP

CEOs are busy, stretched by brand owners, customers, employees, and shareholders.

Find ways to engage the distributor CEO in your business. Consider quarterly Zoom

dates and extend an offer to join your distributor advisory board. Invite him to visit

your company headquarters for a first-class experience and a meeting with your CEO.

A favorite part of any market visit is “management by walking around.” I love to visit

every department. Smile to everyone, handing out a small gift with your company logo,

and say thanks for your help. Today’s travel guidelines limit these trips, but challenge

us to adapt this practice in a virtual way.

We appreciate our brand managers, but must remember that our partnership service

agreement is with the entire distributor, not just one person.

Good luck!

Strategic Services

Contact Us for

Export Solutions

1. Identify Best in Class

Distributors: 96 Countries

2. Best Practices

Export Strategy

3. Distributor Management

Workshops

4. Export 101:

Let’s Get Started

5. New Market

Prioritization

and Launch Plan

6. Personal Distributor

Introductions:

96 Countries

7. Walmart International

8. Distributor Contracts,

Margins, and Fees

9. Meeting Speaker

10. International

Strategy Expert

Strategic Services

Contact Us for

Export Solutions

1. Identify Best in Class

Distributors: 96 Countries

2. Best Practices

Export Strategy

3. Distributor Management

Workshops

4. Export 101:

Let’s Get Started

5. New Market

Prioritization

and Launch Plan

6. Personal Distributor

Introductions:

96 Countries

7. Walmart International

8. Distributor Contracts,

Margins, and Fees

9. Meeting Speaker

10. International

Strategy Expert

www.exportsolutions.com

Greg Seminara

“Spend Time Selling to Distributors versus Searching for Distributors”

Beyond the Brand Manager

14

Introducing

America’s Favorite Brands

Executive Board

Export Solutions Smucker’s Tabasco

Greg Seminara, CEO Danny Berrios, President Megan Lopez, Vice-President

General Mills Sun-Maid

Eric Saint-Marc Carsten Tietjen

Advisory Board

Bazooka Candy Blue Diamond Bob’s Red Mill

Santiago Ricaurte Dale Tipple Jan Chernus

Bush Beans Campbells Church & Dwight

Dave Bauman Julio Gomez Arun Hiranandani

Ferarra Candy Heartland Idahoan

Daniel Michelena Tom Theobald Ryan Ellis

Johnsonville Sausage Kao USA Keurig Dr. Pepper

Cory Bouck Julie Toole Billy Menendez

Mizkan Reynolds Welch’s

Noel David Chris Corey Marc Rosen

19 Companies | 200+ Top Brands | $80 Billion Combined

View our activities for export managers – www.usafoodexport.com

15

“The shelf doesn’t lie!” Why are you surprised when

a distributor misses their sales numbers and you

perform a few random retail checks and the stores look

awful? Or your “star” distributor proudly brings you

to supermarkets where your brand’s presence looks

better than the sample display you built in your

headquarter office?

A classic question is “how do you determine a good

store from a bad store?” Some multinational leaders

feature well defined shelf guidelines for positioning

and placement and the pursuit of a “perfect store.”

A more common practice is for an export manager to share a pretty photo of a sample

shelf layout, created by the marketing department. A few general objectives are

supplied, but no formal training, sales rationale or KPI measures.

“Is the Store a 10?” is a tailored program from Export Solutions that succeeds in

providing simple shelf standards and a methodology so that every member of a

distributor organization will be crystal clear on store level performance expectations.

Basically, each store is graded with points awarded for assortment, shelf space, shelf

positioning, pricing, and off-shelf display.

Listed below are key elements of developing a “Is the Store a Ten?” program for your

distributor teams.

1. Develop Clear Standards

Award points based upon a “physical count” of authorized items or shelf facings

or answers to a “yes or no” question. Example: Is there a secondary display?

Create a simple 10 point scale, where a “1” is poor and a “10” is the best.

2. Align With Key Account and Retail Sales Teams

This initiative is best explained to key influencers in the distributor organization in-store.

Meet with them at a supermarket and discuss program execution for their customer or

market. The program will fail if you only discuss it with a brand manager or distributor

CEO at the office.

3. Conduct Training Session

Share the program with the entire retail team. Provide a rationale and sales facts for our

objectives. Provide FAQs on common questions or issues. Role play. Launch a “Is the

Store a 10?” shelf drive with prizes. Establish clear KPIs.

4. Measure Improvement: Today a “5”…Tomorrow?

It is likely that early scores may be closer to a 5 than a perfect 10. This is okay

in most cases. The goal is to incorporate a cultural shift in evaluating stores and

capture improvement

5. Planogram Serves as the Official Record

I love the distributors that flood us with photos of great store layouts. I swear

that sometimes the image is the same display taken from several different angles.

Validate performance with a copy of the approved planogram or schematic.

A 2022 objective for all is to escape the boredom of hot conference rooms to spend

more time witnessing retail reality. Export managers are paid on container sales, but

this represents only warehouse inventory. A store shelf is where export dreams are

translated to retail revenues. Contact me to discuss implementing “Is the Store a 10?”

for your company.

www.exportsolutions.com

Greg Seminara

404-255-8387

“Spend Time Selling to Distributors versus Searching for Distributors”

Is the Store a 10?

Strategic Services

New Market Prioritization

& Launch Plan

Our extensive market segmentation

work helps clients quickly identify the

best markets based upon their brand

profile and investment approach.

Normally, we can quickly help brands

segment markets into three groups:

Strategic, Priority, and Opportunistic.

Contact Us for Export Solutions

16

A few years ago, I described a multinational’s “Big, Big,

Big” strategy. This company focused on Big Brands,

Big Countries, and Big Customers. This approach may

function well for billion dollar giants, capable of

building local factories, hiring large teams, and

investing millions in brand support. However, many

exporters have been disappointed the last five years

when “BRIC dreams turned into Export nightmares.”

Exporters: consider a “Small, Small, Small” strategy

as a route to profitable growth.

Small Channels – E-commerce, Gourmet, Ethnic

Small Countries – South Korea, Chile, Saudi Arabia, Spain, etc.

Small Investments – Trade/marketing costs everywhere, but total spend is lower

in emerging channels and small/mid-size countries.

Listed below are considerations for developing your “Small, Small, Small” strategy.

1. Massive Supermarket Chains: Demanding & Declining

Traditional supermarket chains are losing share. To sell to them today, you “spend more

to sell less!” Smaller chains and channels may be more open to innovation and feature

lower cost of participation.

2. Limited Local Production: Small/Mid-Size Countries

Big countries feature well established local producers, guarding their shelf space.

Smaller countries frequently do not contain many local manufacturers and remain

dependent on adjacent countries or USA, UK, Germany, Italy, etc. for many of their

brands. Examples include USA companies selling far more to Puerto Rico than they

do to Brazil. UK companies export more to Ireland than to Russia or Italy.

3. Lower Investment Levels

Brand investments are relatively proportional to country population and per capita

income. A $10,000 – $100,000 investment drives significant presence and funds solid

marketing activities in many small/mid-size countries. This allows your brand to

capture market share versus serving as a niche player in a large country.

4. Distributor Capability: Inversely Proportional to Country Size

Some of the world’s best distributors are based in Panama, Norway, UAE, or Singapore.

Why? In these countries, even multinationals like P & G, Kellogg’s, and Barilla may

partner with national distributors. In large countries like the USA, China, India,

distributors usually handle only niche brands, regional coverage, or small shops.

5. Make Multi-Channel Bets

There is incremental business available through attacking new trade channel opportunities.

This may require distributors to expand coverage and “attack something new.”

Manufacturers should conduct a “Lessons Learned” exercise. What countries are

delivering superior growth and highest market shares? Which new channels and

customers are recording double digit sales increases? What are channel success stories

from other countries? Which markets do not demand mandatory listing fees and deliver

superior results for your investment? What is your global e-commerce strategy?

In many cases you can deliver “big” increases from thinking “small.” Good luck!

www.exportsolutions.com

Greg Seminara

404-255-8387

“Spend Time Selling to Distributors versus Searching for Distributors”

Small, Small, Small Strategy

Strategic Services

Personal Distributor

Introductions: 96 Countries

Export Solutions’ database tracks

9,200 distributors. After 300 projects

and 20 years in export…I am proud

to have personal relationships with

hundreds of the best distributors in

the world. My clients will confirm that

distributors are happy to see me,

because I am a vital link to the world’s

best brands.

Contact Us for Export Solutions

17

Does your distributor network require a tune up?

I have lost count of the times I’ve heard a vice president

of international claim that their company has the best

group of distributors in the world. Or trade show

meetings when a global export manager states that

his company sells to 60 countries and is not looking

for any new distributors. These are the same executives

that struggle every December to achieve their annual

sales budget.

Every year, I am asked to analyze the global distributor network of at least ten

manufacturers for independent feedback. The good news is that my conclusions

are generally positive. Most companies maintain a solid network of international

distributors, committed and capable of serving as good partners. However,

the 1/3, 1/3, 1/3 rule always applies. Every company maintains a mix of distributors.

1/3 Leaders Best in class brand builders, delivering outstanding results

1/3 Performers Reliable and capable, normally meet expectations

1/3 Laggards Small, unsophisticated, players…sometimes diverters

The first step to transformational success is to admit that not all your distributors are

a good fit. Management recognizes that you’ve created a strong overall team and will

support your efforts to upgrade underperforming distributors. Some companies cling

to laggards due to history or personal relationships. This loyalty is nice, but ultimately

underachievers deprive you of your ability to reach your own personal business goals.

Each cluster of distributors requires a different level of engagement and support.

Leaders: Love them, reward them and recognize them. What characteristics of your

leaders allow them to deliver superior results? Are your leaders all big or mid-sized?

Category specialists or channel experts? Share best practices from your leaders with

other markets. The best advice with leaders is to support them and deliver outstanding

customer service so that your company is viewed as a preferred supplier.

Performers: Strong contributors to growth. Challenge them to become leaders. With

some companies, a majority of their distributors are viewed as performers which is a

positive indication.

Laggards: These distributors exist with every company and remain easy to identify.

Clue: small shipments to a big country. Or in the case of diverters, big shipments to a

small country. Shipment trends are one clear metric. Other scorecards include authorized

distribution and shelf presence at major accounts, merchandising ideas, and new item

launch success.

A strategic requirement for 2022 is to upgrade the bottom 1/3 (laggards) of your

distributor network. A core responsibility is to secure top talent in every country.

Export Solutions’ distributor database tracks an average of 85 distributors per country,

so plenty of options exist for strong brands. Who are your leaders? Who are your

laggards? What will you do differently in 2022?

1/3, 1/3, 1/3

1/3, 1/3, 1/3

www.exportsolutions.com

“Spend Time Selling to Distributors versus Searching for Distributors”

Greg Seminara

404-255-8387

Strategic Services

Distributor Management

Workshops

Looking to get better results

from your Distributor network?

Export Solutions has conducted

Distributor management workshops

for Barilla and Rio Mare.

Topics include Best in Class Distributor

Performance Metrics, Getting More

Than your Fair Share of Distributors

Time, and Distributor Economics.

Contact Us for Export Solutions

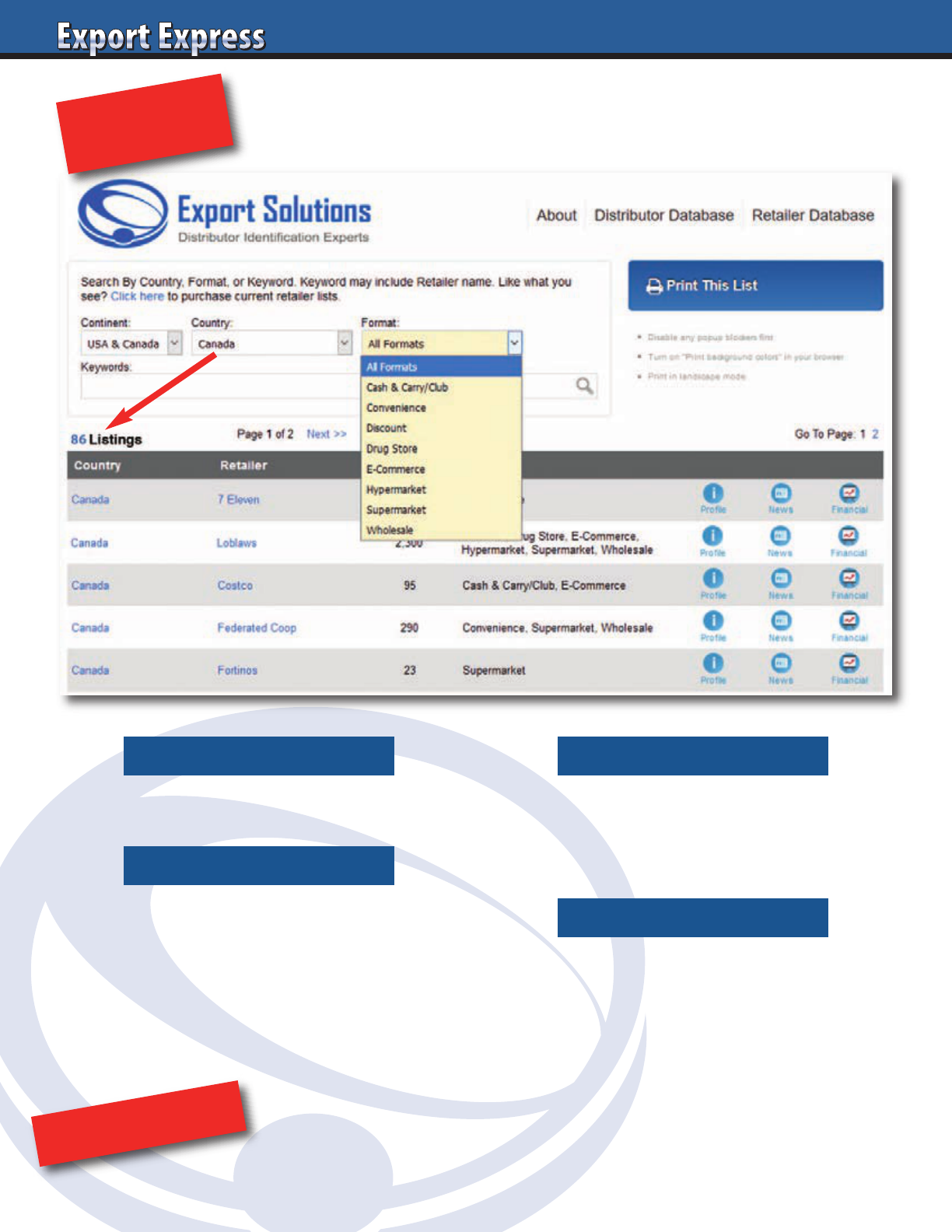

Coverage: 96 countries and 2,700 retailers

Supermarket

Convenience

Drug Store

Natural Food

Club, Cash & Carry

Supplying profiles, store counts, formats,

news and info for Top 100 international

retailers plus all overseas branches

Example 1: Who are supermarket

retailers in Canada?

Example 2: How many stores does Loblaws

operate by banner, in Canada?

NEW!

ORDER NOW!

18

Search by Retailer NameSearch by Country

Combo Search

www.exportsolutions.com

Search By Format

Retailer Search Made Simple

Canada Example

19

Why did you create the retailer database?

Export managers dedicate a lot of time

to researching countries, retailers and

preparing business plans. A standard

KPI measure is tracking product listings

for key customers. I believe that our

industry could benefit from a global

retailer database to instantly locate

retailers and their store counts in

96 countries. The retailer database

is a logical extension of our leading

distributor database which has helped

more than 3,000 companies build export

sales during the last 10 years.

What is your geographic coverage?

96 of top 100 GDP countries worldwide.

This includes most Asian, Middle Eastern,

and European countries. Our database

covers every country in the Americas.

In Africa, we cover South Africa.

What is your format coverage?

Excellent coverage of chain supermarkets,

hypermarkets, clubs, cash and carry,

and convenience formats. Solid initial

coverage of drug stores, natural food

stores, and e-commerce channels.

Our database does not cover

DIY/hardware, toy, office, liquor,

or sporting goods channels.

Retailer database: featured info

Profile – Retailers profile and link to their

internet home page.

Formats – Retailer’s stores segmented

by format and banner.

We track supermarkets, hypermarkets,

cash and carry, convenience stores,

discounters, drug stores, natural food

stores, and e-commerce retailers.

News – Latest retailers’ news. In some

cases (Asia), we substitute a link to the

retailer’s latest promotional flyer.

Financial – Many leading retailers are

publicly traded. A link is provided to

their latest financial results. We do not

offer estimated financial information for

privately held or family owned retailers.

How is your coverage of global retailers?

We offer total coverage for top 100 global

retailers. This includes all of their

branches and banners. Searchable!

Use filters to research Walmart, Costco,

Carrefour, Tesco, Metro, Casino presence

by country. Database covers retailer’s

total store outlets as well as a breakout

by banner and format.

What can I use the retailer database info for?

• Obtain an instant snapshot of an

average of 24 retailers per country

for 96 countries.

• Track presence of global retailers like

Walmart, Carrefour, and Metro AG.

• Create country specific listing maps

where distributors measure brand

authorization by retailer.

• Conduct home office based

international category reviews and price

checks from retailers’ e-commerce sites

(not all retailers).

• Prepare annual reviews and reports

with up-to-date information on leading

retailers and channels.

Searchable

The database offers filters allowing you to

search by country, format, or retailer name.

You can also use a combination of filters for

your research.

Can I get a free sample of the retailer database?

Sure! Check www.exportsolutions.com for a

complete profile of United Kingdom retailers.

Do you provide retailer’s annual sales

or market share information?

Accurate annual sales information is

available through the financial link for

publicly traded companies. We do not

provide estimated financial information for

privately held and family owned retailers.

Channel blurring occurs between

supermarket, convenience, e-commerce,

and even natural food operators. We do

not provide market share due to difficulty

to accurately isolate and define channel

market share information, particularly with

so many privately held retailers.

How accurate is the retailer data?

Export Solutions’ retailer database is

updated weekly, so information is highly

accurate. Retailer names, web sites, and

formats rarely change. This makes the

database 99% accurate at the company

level. New stores open every day,

resulting in store counts that may be

95% accurate. We intend to update store

counts on a regular basis.

How much does retailer database access cost?

An annual subscription to the retailer

database is $975. This supplies one year,

unlimited access to more than 2,700

retailers in 96 countries. Special offers

available for our distributor database

customers. Note: special pricing for

government trade organizations.

How do I access the retailer database?

Visit www.exportsolutions.com and click

the retailer database page. You can place

a subscription or individual continent

(i.e., Europe) into a shopping cart.

Register and check out via credit card.

The process takes two minutes and we

automatically send you an invoice.

About Export Solutions

Export Solutions was founded in 2004

and is based in Atlanta, Georgia in the

USA. Export Solutions serves as a leading

provider of business intelligence to the

food and consumer goods industries.

Our distributor database covers 9,200

distributors in 96 countries and has

been used by more than 3,000 clients.

Our Export Express newsletter has a

circulation of 9,900 and is viewed as an

important source of insights, strategies,

and templates for international

development. www.exportsolutions.com.

FAQ’s – Retailer Database

20

This is the time of year when suppliers are engaged in

2023 planning. A common approach is to dust off 2023

plans, assess results to date and update the numbers to

reflect a three to five percent sales increase. In today’s

crowded global marketplace, it appears tougher every

year to exceed management expectations. More

companies join the battle for coveted shelf space in

emerging markets. Repetitive plans without creativity are

likely to fall in the category where you are required to “spend more to sell less.”

Breakthrough results are possible by testing something new. Skipping conventional

promotional strategies may allow us to explore “new ways to sell old brands.” The basic

concept is to establish an innovative market test, measure results, and strive for a winning

idea to reapply. The success may emerge in the form of new insights or closer distributor

relationship versus case payout alone. This method involves some element of risk. It is

okay for a test to fail, as long you as you “fail fast” (and inexpensively).

Listed below are Export Solutions’ five ideas for stimulating your 2023 test.

1. Brainstorm Out of Office

Dedicate time where the sole objective is to generate new ideas. Escape from the

distractions of the office or a hot conference room. Commit to a specific time on your

calendar. Work alone or as part of a team. Encourage group ownership by circulating test

concepts and seeking feedback. This exercise may apply to your headquarter export unit

or an individual distributor.

2. Blockbuster Event to Digital Marketing

A myriad of options exist for your test. Consider one enormous 360 Marketing event versus

several small promotions. Another alternative is to place heavy emphasis on digital

marketing to reach consumers in an original way. Companies may pursue a high spend test

or a low spend test. Another possibility relates to frequency and depth of your market visits.

3. One Focus Country

Every export manager can identify a country with strong potential with capability

for exponential growth. Select a mid-size country. Vow to visit more frequently. Travel

to secondary cities and participate in distributor sponsored sales training events.

Champion a retail sales contest and support your partners market level ideas.

4. Product

Many companies feature a broad portfolio of products marketed in their home country.

Usually, a narrower range is targeted for export. Why not look at trying a new product

or size or pack in a different country? Is it possible to manage a market test of something

new from your research lab that is not available in your core market?

5. Measures

A sales manager’s reaction is to “just do it.” I admire that spirit and determination to

translate “boardroom promises into retail reality.” However, a test is not a test without

a grade. Establish clear parameters and a timeline for evaluating performance.

What if? Successful companies maintain a passion for leading not copying. Each year,

I attend five or six trade shows and check hundreds of stores. So many brands, so little

shelf space. Most exporters could quickly list of ten or more snack, pasta, or condiment

brands. I am always impressed with new promotional events and innovative ideas from

iconic brands like Pringles, Barilla, and Tabasco. These brands are marketed to more

than 100 countries and still tackle each year with a fresh approach and hot ideas to

reach picky consumers.

What will you do differently in 2023?

Greg Seminara

404-255-8387

“Spend Time Selling to Distributors versus Searching for Distributors”

Test Something…Please!

www.exportsolutions.com

Strategic Services

New Market Prioritization

& Launch Plan

Our extensive market segmentation

work helps clients quickly identify the

best markets based upon their brand

profile and investment approach.

Normally, we can quickly help brands

segment markets into three groups:

Strategic, Priority, and Opportunistic.

Contact Us for Export Solutions

Export Accelerator

Contact Us for Distributor Search Help in 96 Countries

Greg Seminara • greg@exportsolutions.com

“Spend time Selling to Distributors versus

Searching for Distributors”

21

Why have Barilla, Pringles, Nature Valley, Starbucks, Duracell,

Nestlé, Tabasco, Pepperidge Farm, and other leaders used

Export Solutions as a distributor search consultant?

• Powerful distributor network: owner of industry database

9,200 distributors – 96 countries

• Professional 10 step due diligence process

• Results! We make Export Managers’ lives easier!

22

MAPS is the fundamental equation to drive incremental

sales. The export manager job description serves as

logistics, finance, and customer service manager all

rolled up into one person. Our “quality time” with

the distributor gets highjacked by routine reports and

distractions. Stop! The core responsibility of an export

manager is new business development. This includes

optimizing sales through your existing distributor

network as well as expansion into new countries.

What is MAPS? MAPS is an acronym for Merchandising, Assortment (Distribution),

Pricing, and Shelf Management, the essential elements for creating in-store visibility

and sales. The supermarket (and now cyberspace) is our product showroom. MAPS

structures the path for creating an attractive showcase for consumers to buy our brands.

Distribution Listing Maps: #1 Tool

It’s impossible to sell when you don’t have distribution. A customer specific listing map

serves as a valuable helper to measure progress in each country. This one page template

highlights major retailers and your authorized assortment by item. This report should

be updated monthly and include plans, by customer, to expand distribution.

Pricing: Too High or I Don’t Know?

As a shopper evaluates category options, pricing is a critical factor in determining

product selection. Many imported brands are priced too high, a significant premium

to category norms. In other cases, the manufacturer just sells without consideration of

local price points. Exporters should establish a pricing strategy for each country. Track

cost centers from factory gate to store shelf and conduct regular price surveys. Would

the brand owner make more money with a lower price point, with everyone sacrificing

a few margin points in the value chain?

Shelf: Good Store Versus Bad Store?

Many manufacturers fail to provide realistic standards to their distributors on in-store

presence expectations. Leaders provide clear guidelines that allow each member of the

sales team to define a good store versus a bad store. Export Solutions “Is the Store a 10?”

program helps manufacturers structure and launch a shelf improvement initiative.

Merchandising Best Practices

Each brand and retailer maintain best vehicles for stimulating incremental sales. For

some, this may represent secondary locations or mass displays. Other manufacturers

focus on periodic, deep discount promotions. The key is to establish metrics for

merchandising, just as you would shipments. Frequently, if a distributor achieves

merchandising KPIs, he will reach his annual shipment budget.

Sales = Sell Out not Buy In

This is the time of the year, when some exporters will suffer from a fourth quarter

surprise. Apologetic distributors will report that they have heavy inventory and

are unable to meet their annual commitment. Ouch. Monthly tracking of distributor

“sell out” and stock by item reduces the risk of this unpleasant news. Deliveries to

distributors are just shifting inventory from your warehouse to theirs. Scanner recorded

sales reflect a more accurate picture on the state of the business.

Laser focus on MAPS principles is a key factor for export success. This requires us to

recalibrate our supplier/distributor relationships to fit within the MAPS framework.

How are MAPS metrics guiding your distributor network?

Greg Seminara

404-255-8387

“Spend Time Selling to Distributors versus Searching for Distributors”

MAPS = More Sales

www.exportsolutions.com

Strategic Services

Walmart International

Walmart International began with a

joint venture in Mexico in 1991. Today,

Walmart’s international sales total

$120 billion dollars, exceeding 24%

of total Walmart sales. Export

Solutions has been there since

the beginning, with knowledge of

Walmart operating units in Mexico,

United Kingdom, China, India, etc.

Contact Us for Export Solutions

23

Like the new photo? I lost 22 pounds (10 kilos) in the

last eight months. My export friends at trade shows

and clients are constantly asking “How did I do it?” In

the past, I always said “never trust a thin man in the food

business.” However, my Doctor thought I was eating too

many samples of my clients’ products (thanks Daniel!).

He advised me that I needed to lose weight.

I immediately heard the message and committed to lose

15 pounds (7 kilos) in the next year. Reflecting on my weight loss success, there are some

lessons learned for the world of export.

1. Realistic Commitment

I set my goal to lose 15 pounds, about eight percent of my previous weight. This was

not easy, but not an impossible mission. My Doctor and I are friendly and have worked

together for fifteen years. I was confident that I would meet the challenge because I