Insights to Accelerate International Expansion

Distributor Search Guide for

Export Solutions Customers

Our Mission: Help Manufacturers “Spend time Selling to Distributors versus Searching for Distributors”

In This Issue

Sell to 96 Countries

Looking for new customers and

distributors in international markets?

Export Solutions’ distributor database

covers more than 9,200 distributors

in 96 countries. Our database features

extensive coverage of leading food,

confectionery, and beverage distributors.

New! Export Solutions’ retailer database

now tracks 2,700 retailers in 96 countries.

Order now at www.exportsolutions.com.

Locating a strong local partner to

sell your brand is never easy. Export

Solutions has worked on more than

300 distributor identification projects

in 96 countries. We share every brand

owner’s frustration on the lack of

responsiveness to email and phone

inquiries. The reality is that pioneering

a new brand today is difficult for the

distributor too. As a result, distributors

are searching for unique brands,

supported by investment in marketing

and trade development activities. Your

professional first approach to a potential

distributor makes a big difference in a

creating a positive environment to

conduct business.

The objective of the Essentials of

Distributor Search is to share practical

tips for international distributor

identification projects. Export Solutions

desires to add more value to your

company than simply providing you

the lists of distributors for each country

or category. Export Solutions’ goal is to

share strategies, ideas, and best practices

that have helped other brands succeed

in building export sales. Ultimately, the

potential of your brand must attract the

distributor. Our Essentials of Distributor

Search Guide helps brand owners “Spend

Time Selling to Distributors, versus

Searching for Distributors.”

Distributor Search Tips from Export Solutions

3 History of Success pioneering other

international brands

3 Strong retail presence for current brands handled

3 Logical launch plan, category analysis,

and cost structure

3 Positive references from existing brands

and Dun & Bradstreet

3 Enthusiastic about your brand and the business

Greg's Guidance:

Distributor Assessment Criteria

Page 2

Distributor Search 2022

Page 3

10 Step Distributor Search Process

Page 5

Distributor Types:

Different Experts for Different Situations

Page 6

Contacting New Distributor Candidates –

Best Practices

Page 10

Export Distributor Data Sheet

Page 12

Export Solutions Distributor

Assessment Grid

Page 15

What Distributors Want to Know?

Page 17

Ten Tips: Converting Promising Leads

to New Partnerships

2

2022 marks the fifteen year anniversary of

the launch of Export Solutions’ distributor

database. Many of my friends from export

will recall the story behind the birth. I was

faced with the challenge of identifying

distributor candidates in Italy for a large

multinational. I attacked the project the

“old way”: sorting through business cards,

checking the Embassy, calling colleagues, searching the internet, and after one

month finding five acceptable distributor candidates. Frustrated by the process,

I took six months off and pioneered the first industry database created from the

standpoint of an export manager. Today, brand owners locate names, web sites,

brands represented, and contact information for 105 distributors in Italy and

9,200 distributors across 96 countries in about 10 seconds on my web site.

Below are some important “lessons learned” about finding distributors.

1. 85 Distributors Per Country

Each country offers more distributor options than you think. Every government trade

officer and export manager knows the names of 3-5 distributors per country. Often, we

stick with an underperforming distributor because of the misconception that “there are

no other choices” in a market. Our country lists track an average of 85 distributors of all

sizes and specialties per country. The revelation is that you can instantly find several

qualified distributor options in every country by using our database.

2. Consider Small/Mid Size Distributors

Mega distributors representing 20 or more brands are not usually interested in

pioneering new brands with zero sales. These large distributors are excellent, but are

busy enough with their current portfolio. Many new brands focus their energies on these

“name brand” distributors, but are frustrated with the lack of response. Better approach

is to pursue small to mid size distributors that are hungrier and more entrepreneurial to

launch a new brand. Big distributors are a good choice when you are outsourcing sales

of a brand with measurable existing business.

3. Email Plus Telephone Call

No one speaks these days. We email 100 messages a day and wonder about the lack of

response. Email is a great to tool to communicate news. However, when you need action,

pick up the phone and call. Executives still return phone calls, but will frequently ignore

or delete email messages just to clear the inbox.

4. Rethink Your Trade Show Strategy

Trade shows like Sial, Anuga, Cibus, and ISM are outstanding places to gain visibility for your

brand and contacts with potential new distributors. However, too many brands use the “Hope

and Wait” approach at their booth. Unfortunately, many of the spontaneous visitors at a trade

show are from “time wasters”, incapable of building your brand. Some of our best success

stories come from companies who leverage Export Solutions’ database to create productive

meetings at trade shows. Basically, they pre-screen candidates from the database in advance

of a trade show and invite the most promising ones to scheduled meetings at the show.

5. Avoid Disappointment – Visit Each Market At Least Once

There are too many disappointments in the world of export. Frequently, I’ll witness a

distributor meeting a brand owner for the first time at a trade show. Within five minutes

they are discussing pricing, followed by exaggerated projections of market potential. Our

business is fairly straight forward to figure out. Visit each market at least one time. Meet

your distributor candidates at their office. Visit a few stores. Then create your plan. Export

is tough, but you increase your chances for success when you complete fundamental in

market due diligence.

www.exportsolutions.com

Distributor Search 2022

Greg Seminara

404-255-8387

“Spend Time Selling to Distributors versus Searching for Distributors”

Strategic Services

Contact Us for

Export Solutions

1. Identify Best in Class

Distributors: 96 Countries

2. Best Practices

Export Strategy

3. Distributor Management

Workshops

4. Export 101:

Let’s Get Started

5. New Market

Prioritization

and Launch Plan

6. Personal Distributor

Introductions:

96 Countries

7. Walmart International

8. Distributor Contracts,

Margins, and Fees

9. Meeting Speaker

10. International

Strategy Expert

Strategic Services

Contact Us for

Export Solutions

1. Identify Best in Class

Distributors: 96 Countries

2. Best Practices

Export Strategy

3. Distributor Management

Workshops

4. Export 101:

Let’s Get Started

5. New Market

Prioritization

and Launch Plan

6. Personal Distributor

Introductions:

96 Countries

7. Walmart International

8. Distributor Contracts,

Margins, and Fees

9. Meeting Speaker

10. International

Strategy Expert

1. Determine Brand Ambition for Country

Will your brand be a category leader,

player, or niche participant?

2. Establish Distributor Selection Criteria

Big brand distributor, category specialist, or

smaller entrepreneur?

3. Create a Pool of Candidates

Export Solutions’ database tracks 9,200

distributors in 96 countries.

4. Determine Candidate’s Preliminary

Interest Level

Send introductory email, followed by

phone call within 48 hours.

5. Introductory Web Interview

One hour meeting to share credentials

and confirm interest.

6. Local Interview at Distributor’s Office

4-6 weeks lead time. 2 hour meetings.

Send advance agenda and samples.

7. Independent Store Checks

Provides category insights and real distributor

performance for current brands handled.

8. Interview Preparation: Scorecard, Samples,

Your Presentation, Key Questions

Export Solutions’ templates: Assessment

Scorecard & Ten Questions for Every Interview

9. Distributor Interviews – Target 3 Candidates

Review capabilities, warehouse and interest

in your brand.

10. Cooperation Model

What is the plan? Year one plan, pricing

calculation, and timeline.

10 Step Distributor Search Process

Looking for Good Distributors?

Export Solutions’ database covers

9,200 distributors in 96 countries.

www.exportsolutions.com

3

4

Export Solutions’ New Distributor Checklist

____ Contract/Agreement

____ Price Calculation Model

____ Business Plan: objectives, marketing,

spending, key dates

____ Category Review: Pricing, Shelf,

Assortment, Merchandising

____ Label Compliance

____ Shelf Life

____ Order Lead Time

____ Minimum Order

____ Pick up Point

____ Payment Terms

____ Payment Currency

____ Damage Policy

____ Product Registration

____ Forecast: Year 1

____ Pipeline Order & Inventory

____ Brand Facts

____ Product Samples

____ Appointment Letter

____ Brand Specifications in System:

Distributor & Customers

____ Training: Key Account Managers,

Retail, Administrative Staff, Warehouse

____ In Store Standards: Pricing, Shelf

Management, Merchandising

____ FAQ’s/Handling Common Objections

____ Key Account Presentation

____ Customer Appointment Dates

____ Category/Business Review:

Tailored to Each Key Account

____ Retail Sales Contest

____ Checkpoint Calls

____ Market Audit Date

____ Reporting: Track Distribution, Pricing,

Shelf Positioning, Merchandising, etc.

Talk to an Expert

• Find Distributors in 96 Countries

• International Strategy Road Map

• Fix Problem Markets

• Entry Plans

• Export Workshops

• Motivational Meeting Speaker

Contact Greg Seminara at (001)-404-255-8387 to discuss your business development project.

www.exportsolutions.com

5

Big Brand Distributors

Large distributors supply an economical

alternative for leading brand manu-

facturers versus operating their own

subsidiary. Normally, they handle

multiple categories and offer critical

mass. A potential issue is the struggle

for attention among brands all vying

for focus from one sales team.

Category Expert

Buyers value partners that serve as

category experts who can share insights

and innovation for the sector. Distributors

dedicated to one sector provide logistics

efficiencies and capability to share best

practices from complimentary products.

Managing product conflicts is a frequent

problem with distributors concentrated

on only one category.

Channel Expert

Many distributors built their business

platform centered on servicing the

supermarket channel. Incremental growth

today is dependent on penetrating under-

served channels such as foodservice,

small shops, or pharmacy. In larger

countries, it’s possible to maintain one

organizational approach for supermarkets

and then appoint a specialist for a

different channel. Alternate channels

normally feature smaller store footprints

which can provide a barrier to entry for

all but the leading brands.

Country Expert

Some distributors have created viable

businesses as the source for brands from

one country. These distributors supply

brands to consumers “homesick” for

their favorite brands at a premium

price. A benefit with this option is

the distributor who can consolidate

shipments from one country and

is connected with the retailers and

consumers for this “expat” segment. This

approach works well for niche products

or brands focused on availability without

marketing investment.

Fine Food Importer

Food enthusiasts everywhere are

passionate about the gourmet experience.

Fine dining restaurants are dependent on

unique products and ingredients from

around the world. The classic fine food

importer fulfills this role. Fine Food

importers seek brands of the highest

quality, with unique attributes and

reputation. Not an option for

commodities or “me-too” type products.

Niche Entrepreneur

Pioneering a brand with no existing

sales is tough in any country. While many

brands would prefer partnering with a

prestigious specialist, the reality is that

a smaller distributor may be your best

option to start. Niche entrepreneurs are

hungry and flexible to work without

significant resources supplied by the

brand. It is important to calibrate your

expectations when working with a niche

entrepreneur and conduct due diligence

on their financial situation.

Evaluate Your Current Distributor Mix

A valuable exercise is to evaluate your

current roster of distributors “by type.”

Which models are delivering superior

results? Which models are lagging

behind? Are there any universal

conclusions which may apply when you

expand to new markets or considering a

distributor change? One type does not fit

all scenarios. However, it is important to

segment your partners and understand

the inherent strengths and issues with

different types of distributor partners.

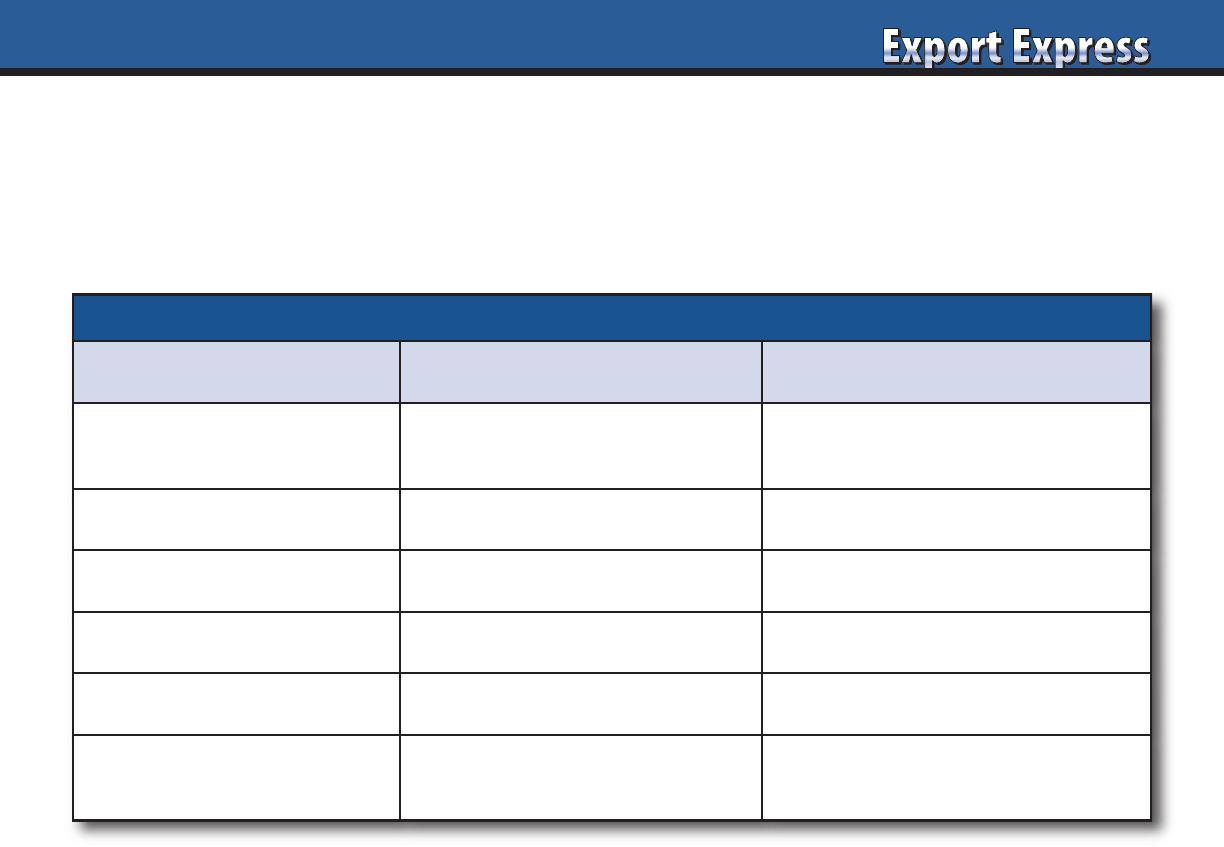

All distributors are not created equally! Most exporters recognize obvious differences based upon the size of distributor and br

eadth

of service offering. Export Solutions has identified six common types of distributor business models. Global brands maintain a mix of

distributor relationships. Some partnerships are new while others have evolved for thirty years or more. With time, requirements for

servicing our industry have changed. While some distributors have remained generalists, handling many brands and channels. Others

elected to focus against a specific market segment. Which model delivers the best result for your brand?

Distributor Types: Different Experts for Different Situations

Distributor Types: Different Experts for Different Situations

Distributor Type Model Application

Big Brand Distributor

Large Distributors.

Handles # 1 or # 2 brands.

Multiple categories/channels.

Outsourcing solution. Option for

Latin America, Middle East, Asia,

Europe (excluding large countries)

Category Expert Dedicated to one category

Specialists for Confectionery, Frozen, OTC,

Beverages, Natural Foods, Dairy, Beauty

Channel Expert Dedicated to one channel

Specialists for Foodservice, “small shops”,

or Pharmacy channels

Country Expert

Represents brands exclusively

from one country/region

Specialist for Brands from USA, UK, Germany,

Asia, Italy, or Spain

Fine Food Importer

Represents leading international

gourmet/niche brands.

Handles brands like Tabasco, Maille, Bonne

Maman, Twinings, Bahlsen, Ryvita

Niche Entrepreneur

Small distributor.

Willing to pioneer new brands

with limited marketing support

Option for small brands or countries where

brand does not want to invest.

66

Every export manger has performed

the time consuming function of reaching

out to potential distributor candidates

in a new country. The process is usually

successful, but requires patience and

perseverance. Top distributors are

overwhelmed with new representation

inquiries. These requests must compete

for attention with the hundreds of emails

in the distributors inbox from his existing

brands. Export Solutions has worked on

more than 300 distributor search projects

across 96 countries. Below are our Best

Practices for contacting new distributors.

Email Plus Phone Call

Email candidates a short, fact based, note.

You may receive an immediate response

from a few hungry and motivated

candidates. More likely scenario is the

need for an immediate phone follow-up.

Work with the contact’s assistant to

schedule a phone meeting or ask to speak

with the person in charge of “important

new business” projects. Periodically, I will

also contact a distributor through

LinkedIn, as that often routes through a

different email address. Lack of response

after several attempts means that the

distributor is not interested. On the other

hand, you must persevere as frequently

the boss may be busy or not glued to

email like the rest of us.

Avoid Mass Mailing

Distributors recognize an email blast from

miles away, guaranteeing a low response

rate. Better to send a personal email,

mentioning the contact’s name, how you

found him and your rationale for contact,

i.e., “we are looking for a partner with a

strong track record building other USA

brands.” Target distributors which may

be a good fit based upon your investment

level and brand ambitions. For example,

large power distributors prefer brands

with strong marketing plans, while

smaller distributors appear more open

to pioneering promising new products

without giant spending budgets.

Company Credentials Information

Do not bombard a candidate with

attachments and PDFs of lovely

brochures prepared by an ad agency.

First, many people automatically delete

emails with attachments from people

they don’t know. Send PowerPoints

and project details only after you have

established contact.

What Distributors Want to Know

Distributors want to know who you

are: what is the size of your company,

brand USP (why are you different?)

international success, and plans

(investment strategy) for their market.

Distributors’ mindset is to quickly

calculate how much money they can

make representing your brand and how

tough will it be to sell to their customers!

Market Visit

Distributor response will be improved

if you request an introductory meeting

at their office. This demonstrates that

you are serious about the project and

interested in brand building, not just

selling a few containers. Try to visit at

least three distributors on your trip, more

if it is a large country or you anticipate a

“tough sell.” Schedule your visit at least

6-8 weeks in advance to guarantee

distributor availability.

Distributor Search Guide – Export Solutions

Export Solutions’ web site contains a free

84 Distributor Search Guide. This guide is

jammed with strategies, ideas, and

templates to guide each step of the

distributor search process. Export

Solutions completes distributor search

projects for leading brands worldwide.

Contacting New Distributor Candidates – Best Practices

Sample Introductory Email

Subject: New Business Opportunity – CerealCo* – USA

Dear Alexander:

CerealCo is a popular cereal brand from the USA.

Founded in 1960, 2022 sales will exceed $300 million

dollars. Our point of difference is that CerealCo offers

high quality gluten-free and organic cereals popular

with many modern consumers. CerealCo exports to

25 countries, including several in Asia.

We are now beginning the process of considering

partners for Indonesia. I understand that you have a

successful track record building other well known USA

grocery brands. Can we arrange an introductory web

meeting for Wednesday at 900 am? I am based in

Atlanta, Georgia, -12 hours versus Jakarta.

For more information, visit our web site at

www.cerealco.com

Kind regards,

Greg Seminara

Export Manager

(001)-404-255-8387

*Note: CerealCo is a fictitious company. Any resemblance to an

actual cereal company is coincidental.

77

Annual Sales:

$300 million US dollars in 2022

History:

CerealCo founded in 1960…62 years old

Core Product Portfolio:

Breakfast Cereals – “Leader in Organic/Gluten-Free Cereals”

Web Site:

www.cerealco.com

International Overview:

Direct sales to 25+ countries. Indirect sales to 50+ countries.

2021 International sales + 25%!

Southeast Asia Status:

CerealCo products available across Asia through a hybrid model

of partnerships, distributors and indirect sales through USA

consolidators. Current net sales of roughly $2 million dollars

in Asia Pacific.

CerealCo Objective:

Align with a distributor with strong brand building capabilities.

Develop a collaborative plan to grow business to comparable

levels to of our successful business in other Asia Pacific countries.

August Market Visit

CerealCo will visit Jakarta the week of August 1.

We will visit stores and meet potential partners to discuss

CerealCo plans.

*Note: CerealCo is a fictitious company. Any resemblance to an actual

cereal company is coincidental.

Company Fact Sheet (add your logo)

CerealCo* Summary – Indonesia Example

Best Practices – Contacting New Distributors

Do Don’t

Email Content

Short introductory email.

Company facts plus web link.

Lengthy email with

generic claims on

“why your brand is the best”

Email Delivery

Send on Monday.

Distributor has week to review

Send on Friday.

Email lost over the weekend.

Email Timing

Should arrive to distributor

at 2:00 pm his time.

After the “morning rush.”

8:00 am/9:00 am emails are

reviewed quickly and deleted

Phone Contact

Start calling 24 hours

after initial email.

Wait a week to call.

Attachments

No attachments on first email.

Web link only.

Send PowerPoints or

pricing on first email

Follow-Up

Constantly, if you believe

it’s a good candidate.

Wait for distributor to

contact you

In Country Meeting

Best opportunity to review

your brand proposition.

Create relationship without

market visit.

Export Accelerator

Contact Us for Distributor Search Help in 96 Countries

Greg Seminara • greg@exportsolutions.com

“Spend time Selling to Distributors versus

Searching for Distributors”

8

Why have Barilla, Pringles, Nature Valley, Starbucks, Duracell,

Nestlé, Tabasco, Pepperidge Farm, and other leaders used

Export Solutions as a distributor search consultant?

• Powerful distributor network: owner of industry database

9,200 distributors – 96 countries

• Professional 10 step due diligence process

• Results! We make Export Managers’ lives easier!

99

Breakthrough – Contacting New Distributors

Looking for Good Distributors?

Export Solutions’ database covers

9,200 distributors in 96 countries.

www.exportsolutions.com

Strong distributors are inundated with lengthy emails from brands searching for a qualified

partner. Distributors check their emails every ten minutes just like the rest of us. Brand owners

are frustrated by the lack of response to their generic, mass emails. Export Solutions works on

around 35 distributor search projects per year. This requires us to be experts at breaking through

the clutter to reach the distributor owner or manager in charge of new business projects.

Breakthrough Techniques

• Call immediately after email. Before 9:00 AM and after 4:00 PM are prime time.

• Receive an introduction from one of distributor’s existing suppliers.

• Request your local government trade officer make an introduction.

• Connect with distributor team members through LinkedIn.

• Stimulating subject line: New Business Opportunity – Leading XYZ Brand.

• Try mobile phone, WhatsApp, Skype, or better yet…a FedExed Letter!

• Work through managing director’s assistant to facilitate contact.

• Initiate contact through a distributor’s junior level team member.

• Hire local to handle contacts: Russia, China, Japan.

• Follow up: use at least 3 of the above tactics.

If no response after 3 days, this signals a clear lack of interest.

1010

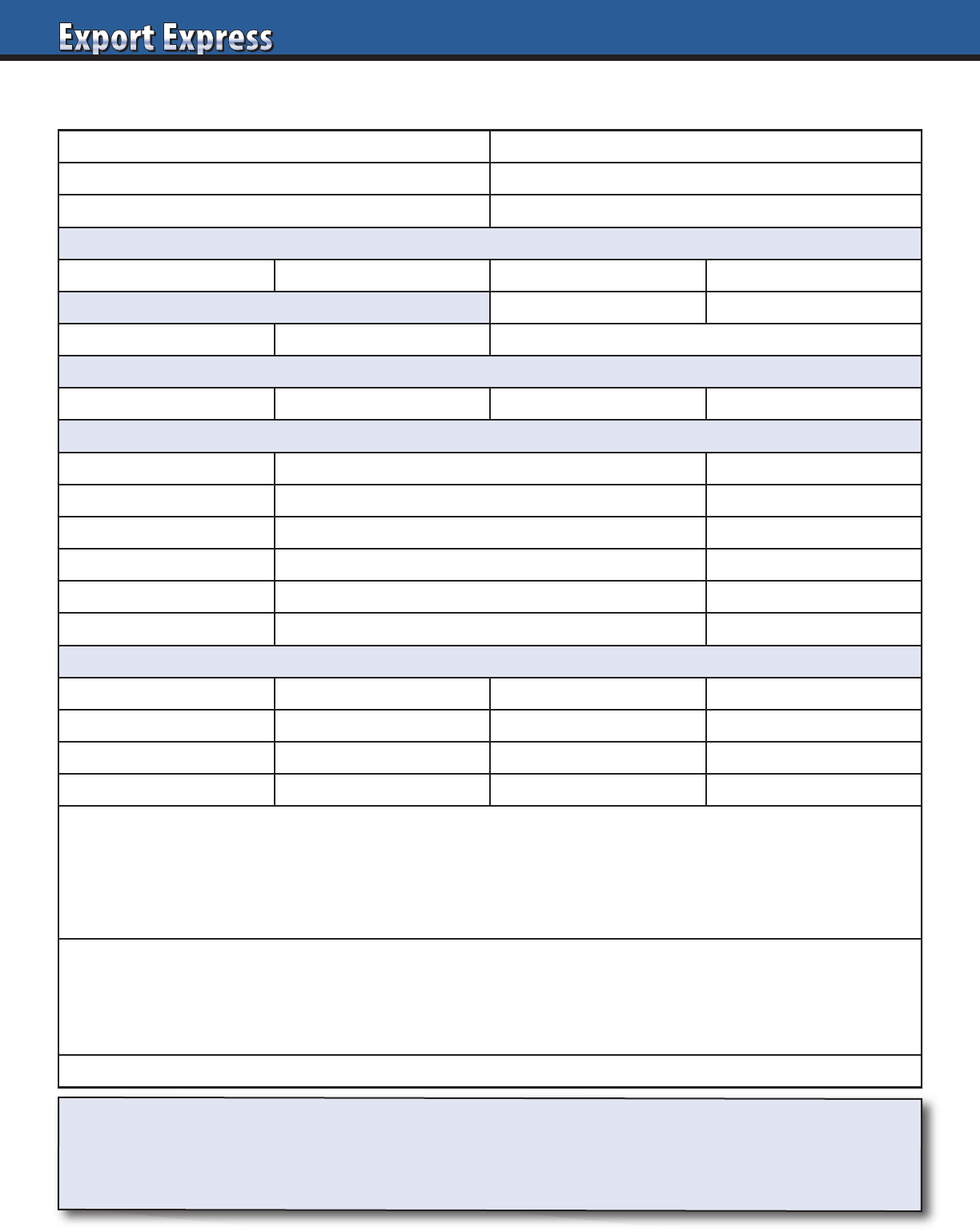

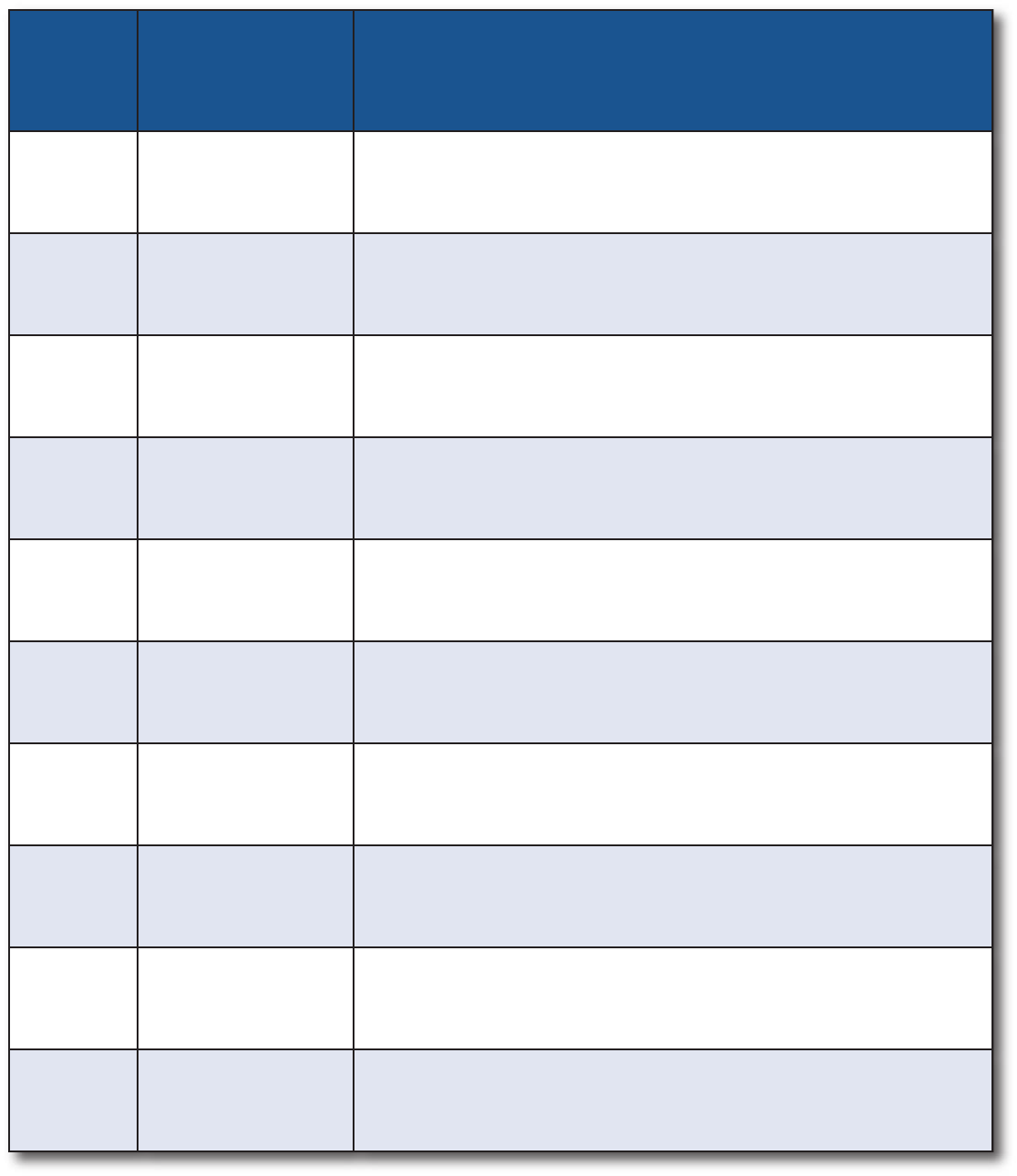

Export Solutions recommends creating your own one page Export Distributor fact sheet template. Insist that all candidates

complete the template 100 percent prior to a phone interview or trade show meeting. Pay particular attention to the annual

sales number, brands represented and manufacturer references. Qualified candidates will enthusiastically complete these

sections. “Pretenders” or time wasters will leave these sections blank or disappear saving you time and money!

Export Distributor Data Sheet:___________________________________

Key Contact: Telephone:

Web Site: Email:

Annual Sales: Total Employees:

Employees, by Function:

Key Account Sales Logistics Marketing Merchandising

Company Owned Warehouse: Yes No

If Yes Warehouse Size: Location:

Channel Coverage (percent sales by channel):

Supermarket Convenience Foodservice Other

Top Five Manufacturer Clients:

Company Name Brands Represented Years Service

1

2

3

4

5

Manufacturer references:

Company Name Contact Name Contact Telephone Contact Email

1

2

3

Why are you interested in distributing our brand?

Why is your company the best candidate to represent our brand in the market?

Feel free to attach your company credentials presentation.

(Distributor Name)

1111

Distributor Search Helper for:

Your

Logo

Here

Can We Help You?

Recent Distributor Search Projects

Asia Europe Middle East Latin America

Australia Germany Israel Argentina

China Ireland Kuwait Brazil

Indonesia Netherlands Qatar Colombia

Japan Nordics Saudi Arabia Costa Rica

Malaysia Spain UAE Ecuador

Philippines United Kingdom North America Mexico

Singapore Africa Canada Panama

South Korea South Africa United States Peru

Call the Export Accelerator!

Contact Greg Seminara at greg@exportsolutions.com

to discuss your business development project.

www.exportsolutions.com

12

Rating System

Rating Score

Excellent 5

Very Good 4

Average 3

Fair 2

Poor 1

Contact Greg Seminara at (001)-404-255-8387 to discuss your distributor search project.

www.exportsolutions.com

Export Solutions Distributor Assessment Grid

Criteria (weighting)

Rating Evaluation Factors

Corporate Credentials 30%

Size, sales force, logistics, # employees.

Reputation (reference check existing brands).

National coverage.

Multi-channel coverage.

Category Expertise 20%

Sells brands in my category.

Shelf space for existing brands.

Current brands selling to target retailer.

Category analysis and insights.

Brand Building 15%

Ideas to build or launch my brand?

Marketing plan, cost, timing.

Success stories.

Cost to Serve 15%

Fair, transparent model relative to size

of business, brand investment, and

work required.

Enthusiasm for

My Brand 20%

Advance preparation, CEO involvement.

Follow-up on commitments.

Alignment with your vision.

X Factors: People, Admin.,

Professionalism, etc.

+/-

CPG/FMCG background for leaders.

Efficiency of scheduling meeting.

Office environment.

Do you enjoy the people?

13

10 C’s

1. Case

Manufacturer supplies a business case

confirming brand “aspirations” for the

country: Key items in portfolio, estimated

base pricing, volume/market share

expectations, and investment model.

2. Category Review

Distributor supplies a local review

of category competitors, pricing,

and merchandising practices.

3. Capabilities

Distributor shares detailed organizational

capability and customer coverage.

Could include references from existing

suppliers represented. An important step

when there are two or more candidates

under consideration.

4. Commitment and Costs

What is the Year 1 Plan and Forecast?

Targeted listings, marketing activities,

launch budget and volume estimate

associated with the spending plan.

5. Calculation – Value Chain

Line by line, build up from port to retail

store shelf. Include currency assumptions.

6. Compliance

Highlight product registration and

label requirements. Typical timelines

for compliance?

7. Captain of Team

Who will be our day-to-day brand manager or

first point of contact? Which senior executive

will serve as our “Brand Champion?”

8. Contract

Options include formal contract, letter

of understanding, or handshake deal.

Begin this process early!

9. Consumer Marketing

What are planned activities to generate

consumer trial and repeat purchases?

Trade marketing, consumer marketing,

social media, etc.

10.Calendar /Close

Distributor supplies a detailed timeline

of all activities. When can we expect first

order and delivery to support launch?

Frequent checkpoint calls or meetings.

From First Meeting to First Order – Cooperation Model

Export Solutions answers the question, “where do we go from here?”

Cooperation Model describes the follow up process from positive initial meeting to launch plan strategy.

Contact Greg Seminara at greg@exportsolutions.com

for a free copy of our Distributor Cooperation Model Guide.

14

Business Case Template – Brand Owner

Request for Information – New Distributor

Activity

Comments

Brand Owner Profile

• Founding date, headquarter location

• Annual sales

• Category, point of difference,

international sales

Opportunity

• Anticipated Year 1, Year 3,

Year 5 revenues

• Market share aspirations

Product Portfolio

• Core items from product portfolio

Retail Price Range

• Estimated retail price or premium

vs. current category items

Channels/Customers

•

Target trade channels, customers

Marketing Budget

• Spending range or percent of sales

• Any contingencies

Marketing Activities

• Consumer promotion, sampling, media

• Trade promotion, listing fees

• Social media, community engagement

Launch Timing

•

Launch date

• Retail availability date

Information Required

• Category Review, Year 1 Business Plan

• Value Chain, Team Members

• Timeline

15

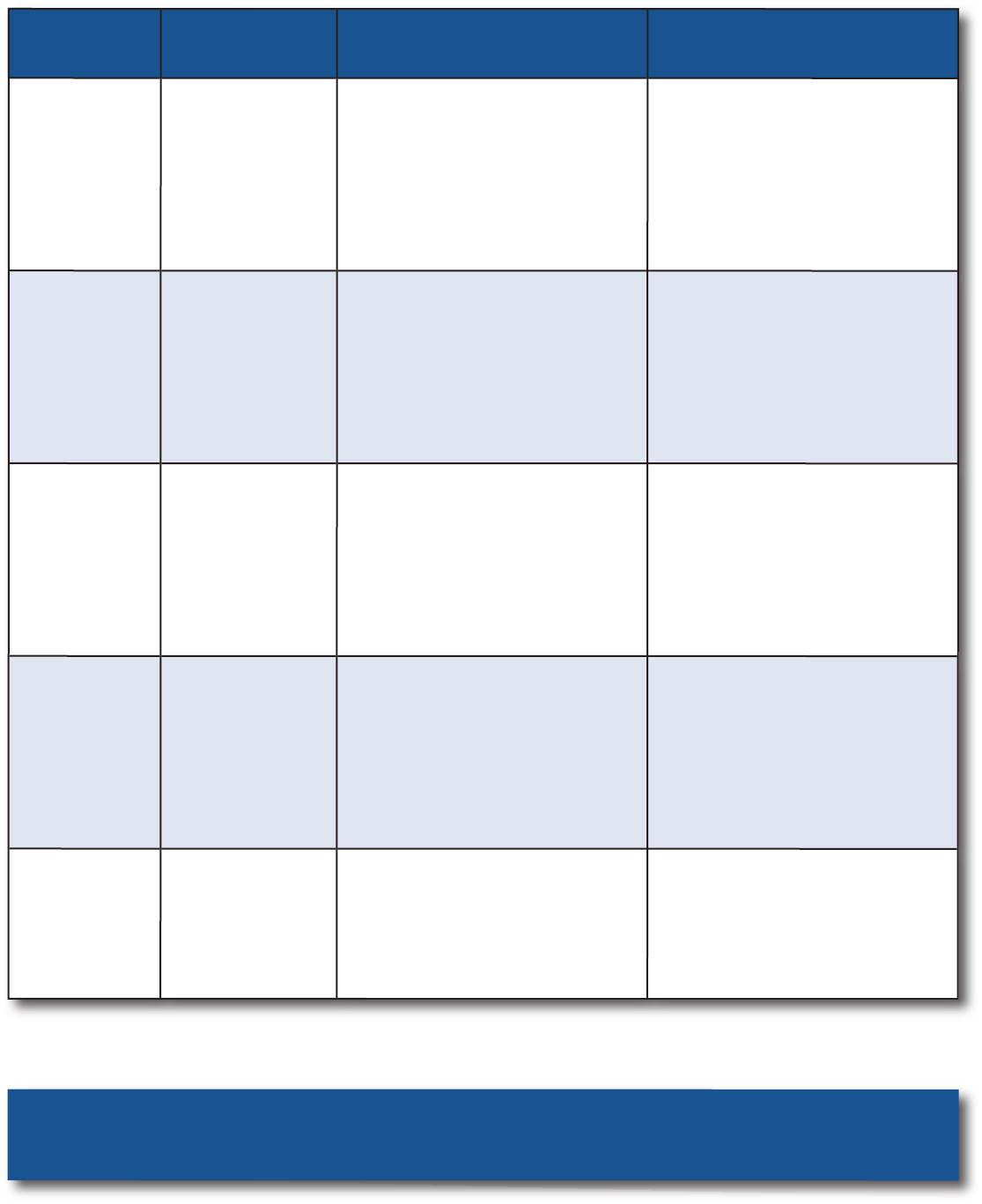

What Distributors Want to Know?

Strong distributors are overwhelmed by calls from brand owners looking for new partners. Distributors assess each opportunity

carefully, as any new brand must add incremental sales and profits and not distract from priorities from existing brands handled.

What is the “size of the prize” for the distributor?

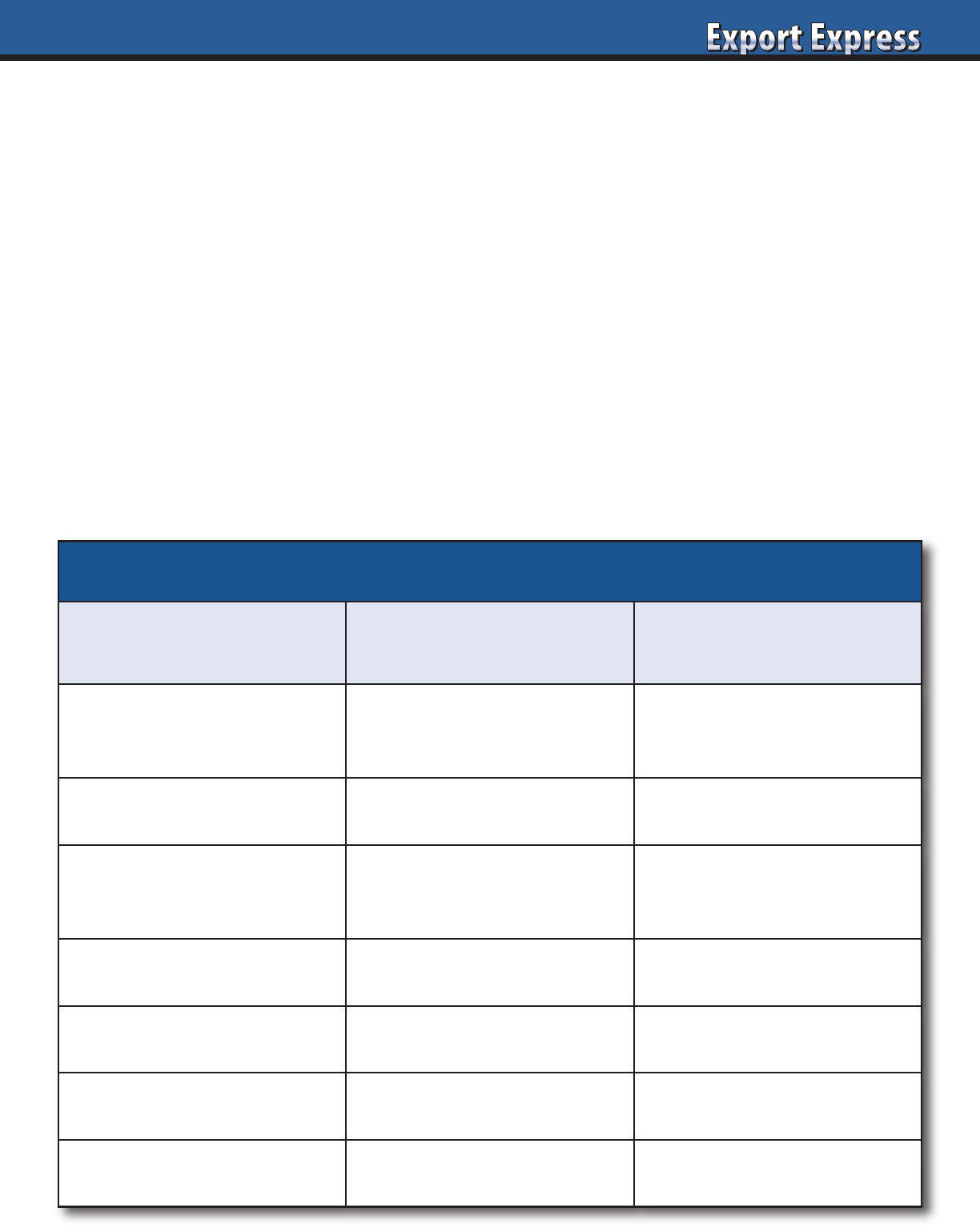

Assessment Criteria Facts Rating (10 = Best)

Your company: size/ reputation

Existing business: sales in distributors country?

If zero “current sales,” what is realistic expectation?

Brand’s USP…your point of difference/innovation?

Size of investment plan: Marketing and Trade?

Potential distributor revenues?margin?

How does the product taste? (or peform)

How attractive/compliant is the packaging?

Pricing relative to category?

Brand success story in an adjacent country?

Competition intensity in category?

Brand range complexity?Product shelf life?

Local market research? Syndicated data?

Will brand invest in marketing and social media?

Will this be a tough product to launch?

Can we grow with the brand owner?

Your brand: core distributor category or adjacency?

Will the export manager be good to work with?

Will we be proud/excited to represent this brand?

What is the “size of the prize?”

16

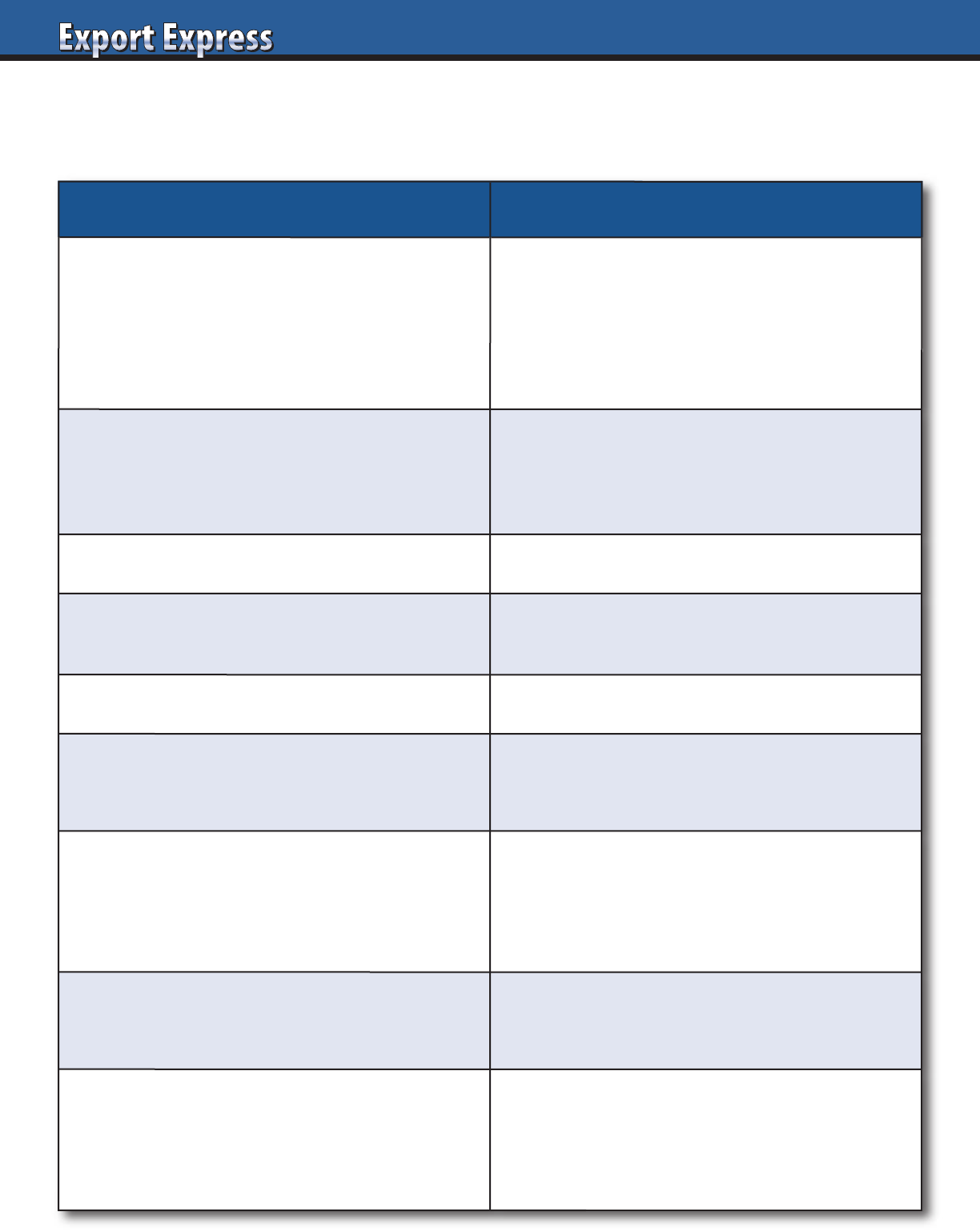

Distributor Search Best Practices

Activity Bad Practice Best Practice

Distributor Profile No portfolio synergies.

Representing similar size,

premium brands from your

aisle/country.

Candidate Model

Agent or third party not based

in destination country.

Distributor of international,

third party brands.

Web Site None! Watch out.

Modern/informative site.

Lists current companies

handled.

Candidate Selection Evaluate one candidate only.

Consider 3-5 candidates,

depending on complexity.

First Contact

Random solicitation by

unknown company.

Trade show or formal phone

meeting with respected

distributor.

Market Visit

Start partnership without

market visit.

Local assessment: office

meeting, warehouse inspection.

Store Check

No store check to validate

distributor capabilities.

Full day store check to measure

results for existing brands.

Reference Check

No financial or commercial

checks.

Check current principals plus

financial institutions (D & B).

Year I Plan No plan. “Buy and ReSell.”

Logical plan with targets,

activities, timelines, costs.

Price Calculation

Sell at dead net price.

Arbitrary mark-up.

Transparent price calculation

from factory to store shelf.

1717

Have you ever experienced an incredible

first meeting with a distributor? Strong

alignment, good fit, everyone smiling,

timelines agreed. Then, nothing happens!

The export manager may take up to six

months to translate his outlook from

“done deal” to “dead deal.” There are

two reasons why this occurs.

First, distributors are positive,

competitive athletes, always striving

to win new business. However, in some

cases, the distributors wake up after time

to reflect and decide they really weren’t

that interested in the brand after all.

Failure also results when a strong

first personal meeting at a trade show

or distributors office is followed by

a relationship buried in email

communication, with no personal touch.

Below are Export Solutions’ Ten Tips on

converting promising new business leads

into tangible business partnerships.

1. Zoom/Teams – Don’t Depend on Email

Motivated distributors still return phone

calls, but frequently receive up to 200

emails a day, many from existing brand

partners. Top distributors’ business days

are captured by a continuous flow of

meetings with customers, principals,

and their own employees. Best bet is to

call a potential partner or set up Zoom

meetings. Email is okay for routine

correspondence, but too easy to ignore

or delete.

2. Follow Up Immediately & Frequently

Time slips away, as Export Managers

focus on existing businesses and

“problems of the day.” One tip is to

put regular follow up reminders on

your computer calendar.

3. Focus on 10 C’s: Category Review,

Calculation, Cost of Plan, Compliance,

Contract, etc.

Described below are critical elements to

translate a “lead” into shipments.

Category Review: How does your

category look in target country? Category

size, competition,pricing,margins, and

merchandising activity.

Calculation: What is the distributor’s

proposed calculation from your factory

gate to the store shelf? What are standard

costs like duties and taxes? What are

flexible or negotiable like trade discounts

and distributor margin?

Cost of Plan: Each brand needs a plan

to gain market entry. This includes key

account “sell in,”

followed by consumer

and trade promotion

activities. Look at the

distributor’s proposed

plan, as well as several

options with different

price tags.

Compliance: Many

countries feature a

product registration

process and labeling

requirements. In some

countries, this step is

easy with automatic

compliance for a USA

or European brand. Or a

simple solution with a small distributor

applied sticker. In other countries like

Japan or Indonesia, plan on one year or

more to navigate the complex process.

Contract: “Ready, Set, Go” can be delayed

by 3-6 months due to contract negotiations.

Company lawyers demand 20 page

agreements in English that even the

Brits can’t understand. Distributors

prefer two page letters of understanding

or a handshake deal. Do what is right

for your business, but expect delays

and frustration.

4. Request References

A good idea is to quickly request

distributor references from other brands

they handle. Motivated distributors will

send impressive references right away.

Also, have your credit department run

a Dun and Bradstreet or Equifax report

as soon as possible. Many trade show

meetings are with “pretenders” who state

exaggerated claims and are ultimately too

small to handle your brand. Better to

discover this sooner versus later.

5. Move Beyond the Distributor Owner/MD

The distributor owner “writes the

checks,” but frequently serves as a

“bottleneck.” The key is to quickly get

your brand assigned to a “worker” whose

task is to move your project through the

system and produce an order!

6. Establish Realistic Timelines

Sync with category review dates and avoid

holiday periods. Update timelines

frequently. New distributor relationships

always take longer. Plan on six months

from first meeting to first shipment. Be

pleasantly surprised if things move quicker.

7. Distributor Response Time

Signals Interest Level

How often do you check your emails?

Probably every hour. When I work

on distributor search projects for well

known brands like Pringles, Tabasco,

or Barilla, distributor response is

lightening fast. Motivated distributors

will chase you if they are interested

because they are anxious to start selling

your brand!

8. Establish Regular Checkpoint Calls

I suggest every two weeks at a

minimum. Use a common document of

priorities, action steps, and due dates.

9. Visit the Distributor

It’s amazing the amount of progress

that will be made during a meeting

at the distributor’s office. Also, the

distributor will work hard in advance of

your visit as your project moves up the

priority list and they want to guarantee

a favorable impression. A visit to the

distributor’s market signals your

commitment. Beware if the distributor

is reluctant to schedule your visit. Either

he has changed his mind about a

partnership or his office and capabilities

do not match the bold promises made at

the initial trade show meeting.

10. Parallel Path Two Candidates per Country

A favorable first meeting represents an

excellent start. However, there are still

many steps (think 10 C’s in point 3)

before you sign a contract and receive

your first order. Always keep two

candidates in the process, in case your

top choice disappoints. This can be

tough, but represents a better option

than needing to start the entire process

over again.

Ten Tips: Converting Promising Leads to New Partnerships

18

Exporter Classification*

Type Description

Export Profile

10 Multinational Strong market share everywhere across multiple categories.

9 Global Multinational. Mix of leading countries and niche participation.

8 Category Champion One core mass category. Strong performance globally.

7 Icon Well known, niche leader. Global availability. Example: Tabasco.

6 Regional Leader Strong share across one continent/region. Some export success.

5 National Hero National treasure, #1 brand. Exports to homesick expats, tourists.

4 Player Respectable share in home country. Opportunistic exports.

3 Participant “Me too” product. Opportunistic exports. “Trader”/private label.

2 Challenger Innovator. Some listings in home country. New to export.

1 Start-up Trying to get traction in home country. Export “dreamer.”

*Export Solutions’ classification system

19

Distributor Classification*

Stars

Title

Description

Prime Prospects

HHHHH

Champion

Massive distributor.

Handles multinational/#1

brands across many

categories.

Brand leaders.

$$$ marketing budgets.

Exporter types: 6-10

HHHH

Captain

Category Captain.

Handles leading brands in

one segment.

Category

innovators/leaders.

$$ marketing budgets.

Exporter types: 5-9

HHH

Player

Mid-size distributor.

Handles #2/3 brands or

niche leaders across many

categories.

Differentiated,

premium brands.

$-$$ marketing budgets.

Exporter types: 4-7

HH

Participant

Respected local.

Diversified product

portfolio.

Results equal to investment.

Flexible, challenger brands.

$ marketing budget.

Exporter types: 2-4

H

Pioneer

Small distributor.

Entrepreneurial, open to

innovative new companies.

Start-up brands.

“Pay as you go” marketing.

Exporter types: 1-3

Need more information? Visit www.exportsolutions.com.

*Export Solutions’ classification system

20

Where Do You Want to Grow?

Asia/Africa/Middle East

Europe Americas

Use Export Solutions Database

to fill in the Gaps in your

Export Coverage Map

Australia – 274 Distributors

China – 160 Distributors

Hong Kong – 177 Distributors

India – 109 Distributors

Indonesia – 78 Distributors

Japan – 176 Distributors

Korea – 146 Distributors

Malaysia – 128 Distributors

Philippines – 109 Distributors

Singapore – 163 Distributors

Thailand – 94 Distributors

Vietnam – 49 Distributors

Israel – 61 Distributors

Saudi Arabia – 115 Distributors

U.A.E. – 195 Distributors

South Africa – 106 Distributors

Plus 14 more countries

Austria – 68 Distributors

Belgium – 85 Distributors

Croatia – 78 Distributors

France – 125 Distributors

Germany – 188 Distributors

Greece – 90 Distributors

Hungary – 68 Distributors

Italy – 105 Distributors

Netherlands – 155 Distributors

Poland – 90 Distributors

Russia – 108 Distributors

Spain – 157 Distributors

Sweden – 103 Distributors

Switzerland – 100 Distributors

Turkey – 82 Distributors

U.K. – 274 Distributors

Plus 19 more countries

Argentina – 61 Distributors

Bolivia – 52 Distributors

Brazil – 135 Distributors

Canada – 205 Distributors

Chile – 92 Distributors

Colombia – 82 Distributors

Costa Rica – 73 Distributors

Ecuador – 55 Distributors

Guatemala – 61 Distributors

Mexico – 193 Distributors

Panama – 63 Distributors

Paraguay – 57 Distributors

Peru – 82 Distributors

Uruguay – 52 Distributors

USA – 598 Distributors

Venezuela – 38 Distributors

Plus 14 more countries